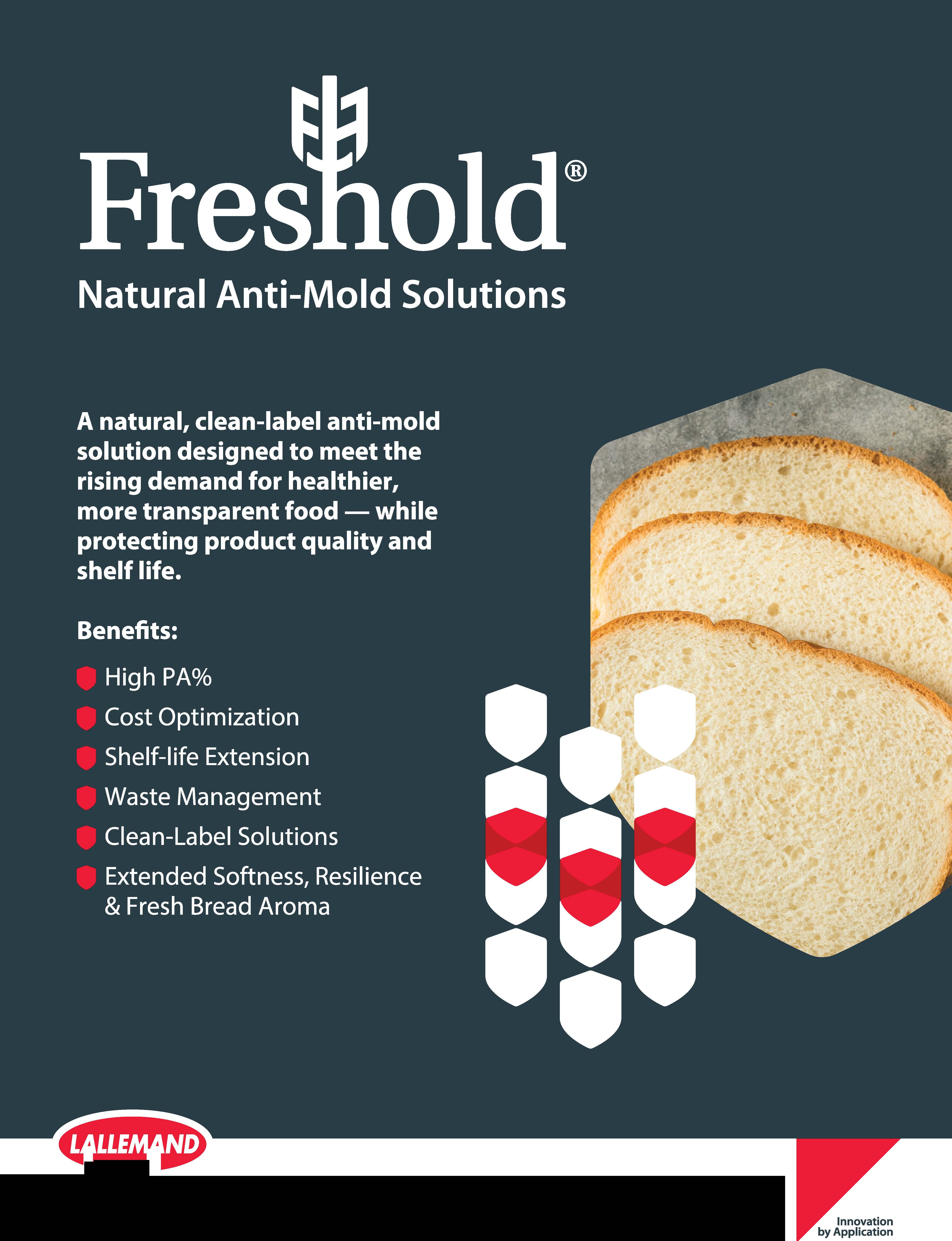

No tricks. Just Clean Label ingredients that keep all your baked goods fresh, naturally. Leading bakery innovation with the only Natural Verified mold inhibitors.

Visit our website to learn more!

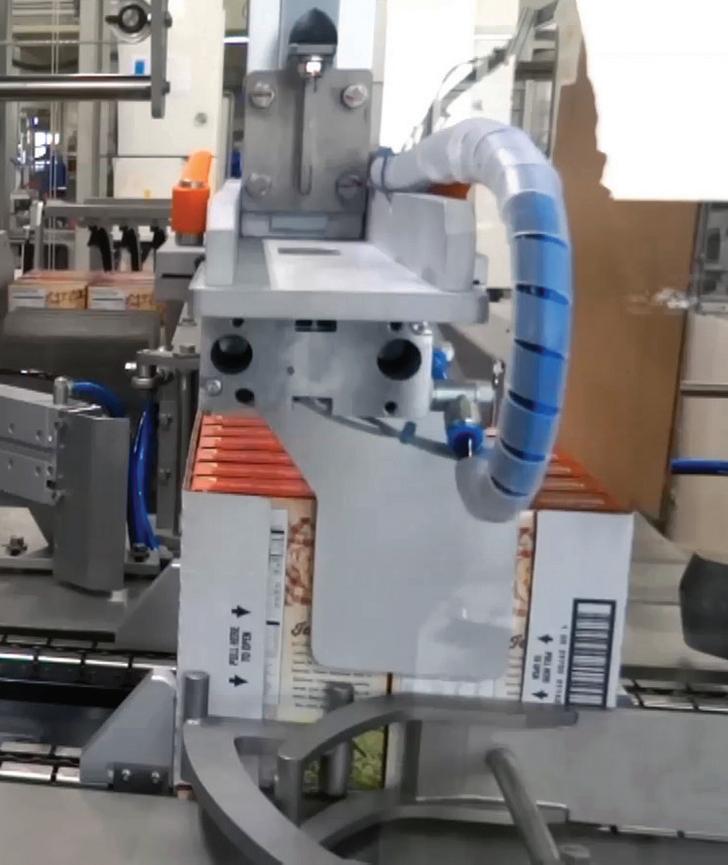

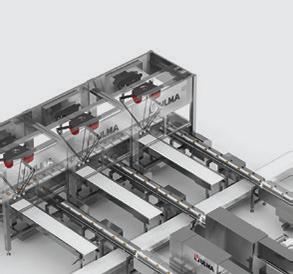

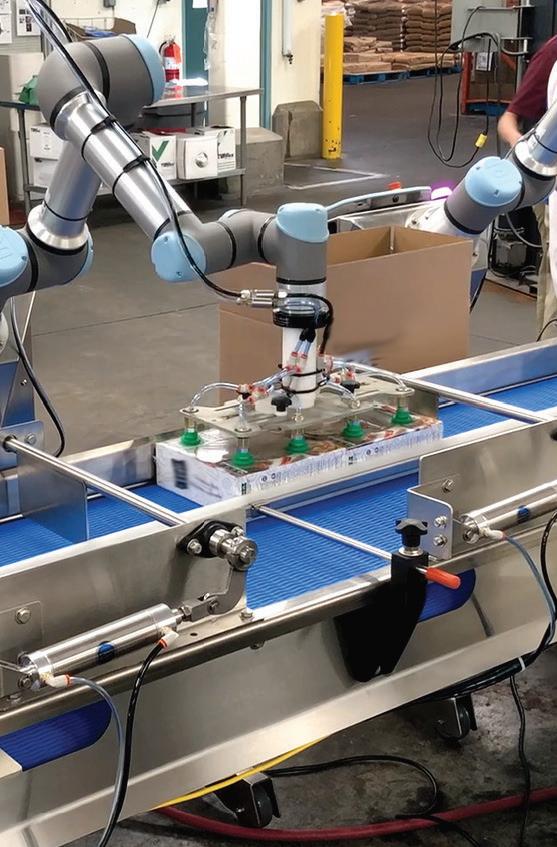

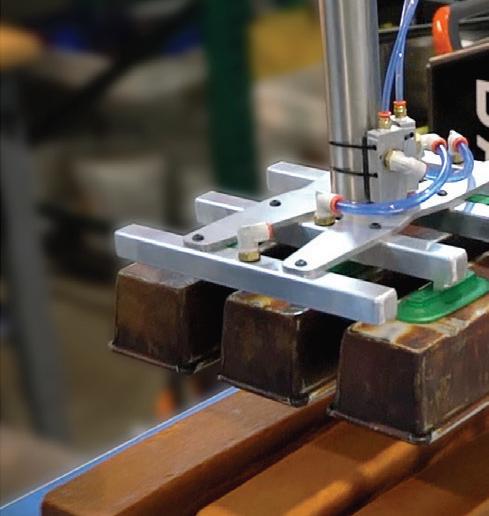

Solve your toughest secondary packaging challenges with our automated solutions

You make it. We pack it. End-of-line packaging solutions for the bakery, snack and tortilla industries. BPA loads your packaged and naked products into cases and various secondary containers including your hffs machines, wrapper chain in-feeds and indexing thermoform machines. We ASK. We LISTEN. We PARTNER.

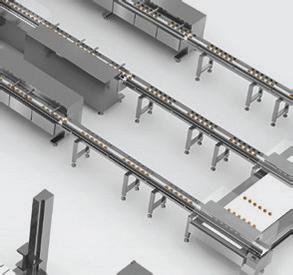

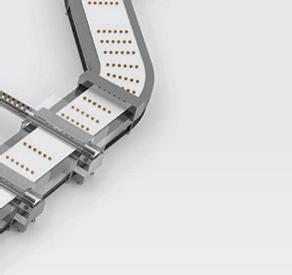

www.intralox.com

Intralox’s new Active Integrated Motion (AIM) Glide™ is a gentle, hygienic automation solution. It eliminates unscheduled downtime and jams while requiring 75% less maintenance and 50% less cleaning time than metal slat switches.

Gentle product handling while maintaining orientation

75% less maintenance

Reliable zero-jam automation

50% less cleaning time

Zero lubrication required

Paul Lattan

President - Principal

Steve Berne

Executive Vice President - Principal

Joanie Spencer

Vice President - Partner

Paul Lattan

Publisher | paul@avantfoodmedia.com

816.585.5030

Steve Berne

Director of Sales | steve@avantfoodmedia.com

816.605.5037

Erin Zielsdorf

Account Executive | erin@avantfoodmedia.com

937.418.5557

Joanie Spencer

Editor-in-Chief | joanie@avantfoodmedia.com

913.777.8874

Mari Rydings

Editorial Director | mari@avantfoodmedia.com

Jordan Winter

Creative Director | jordan@avantfoodmedia.com

Olivia Siddall

Multimedia Director | olivia@avantfoodmedia.com

Annie Hollon

Digital Editor | annie@avantfoodmedia.com

Maddie Lambert

Associate Editor | maddie@avantfoodmedia.com

Lily Cota

Associate Editor | lily@avantfoodmedia.com

Beth Day | Maggie Glisan

Contributors | info@commercialbaking.com

Commercial Baking is published by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Commercial Baking considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur. Consequently, readers using this information do so at their own risk. Commercial Baking is distributed with the understanding that the publisher is not liable for errors and omissions. Although persons and companies mentioned herein are believed to be reputable, neither Avant Food Media nor any of its employees accept any responsibility whatsoever for their activities. Commercial Baking magazine is printed in the USA and all rights are reserved.

No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher. All contributed content and advertiser supplied information will be treated as unconditionally assigned for publication, copyright purposes and use in any publication or digital product and are subject to Commercial Baking ’s right to edit.

Commercial Baking ISSN 2767-5319, / USPS Publication Number: 25350 is published in February, April, June, July, August, October and December, in print and digital formats by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Periodicals Postage Paid at Kansas City, MO, POSTMASTER: Send address changes to Commercial Baking, c/o Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108.

Circulation is tightly controlled, with print issues sent only to hand-verified industry decision makers and influencers. To apply for a free subscription, please visit www.commercialbaking.com/subscription

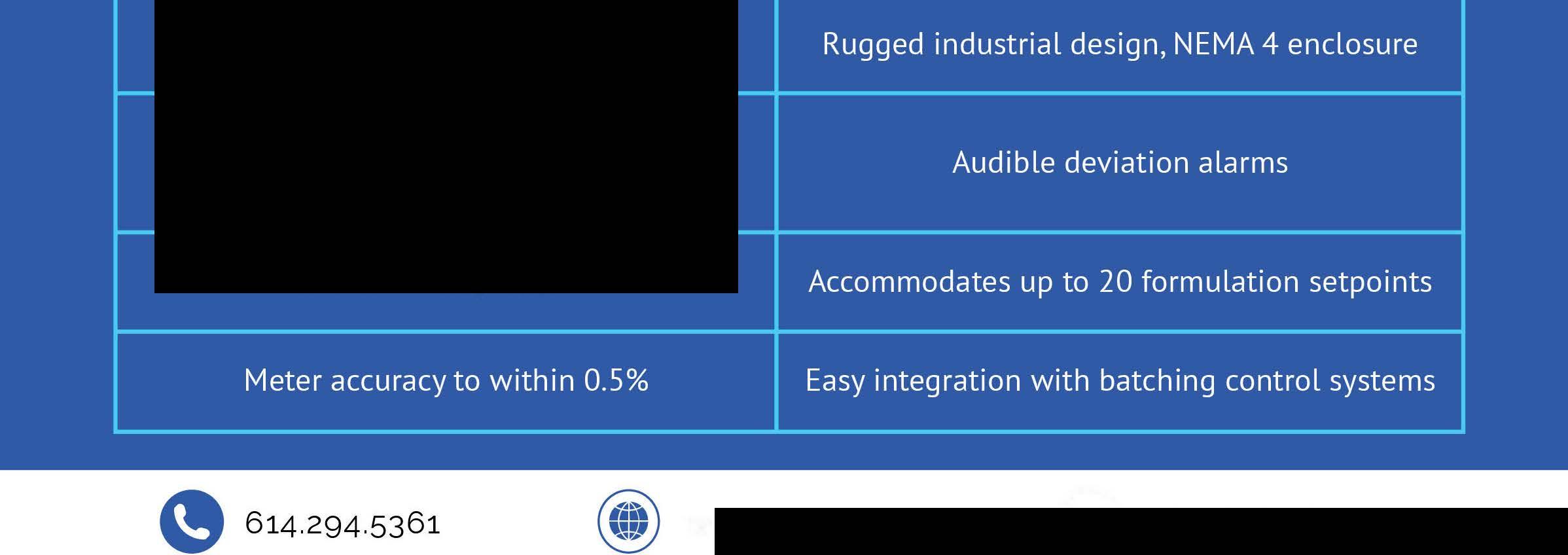

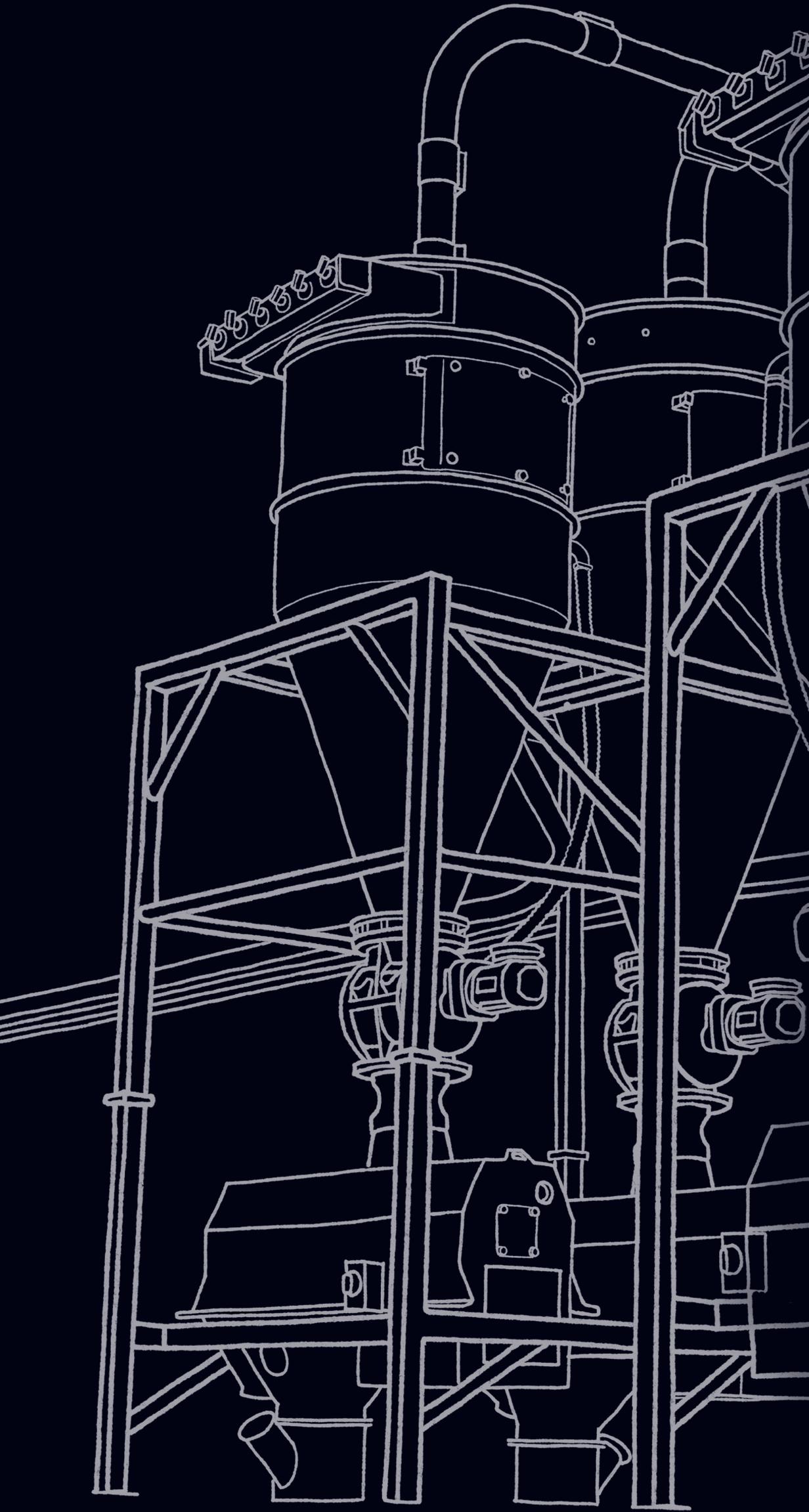

Pfening's new generation Enviroblender (EBM 7) brings unmatched precision and sustainability to your process. With a true plug-and-play design, this rugged system ensures accurate water metering, consistent temperature blending, and zero waste operation, saving resources and streamlining production.

For accurate water metering with Zero Waste, the EBM 7 is the smart choice.

Look for QR codes that contain exclusive digital content throughout the issue.

Ditsch USA: A Twist on the Twist

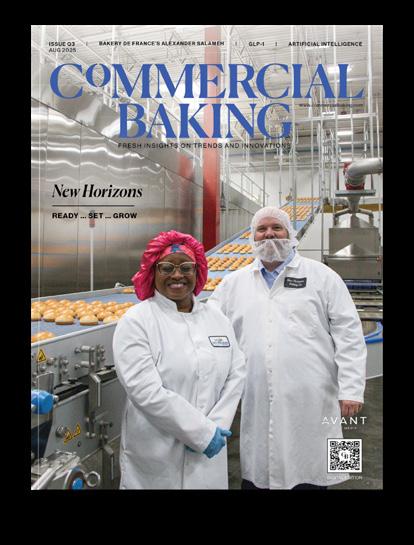

Cover: Ditsch USA, the US division of the 100-year-old German company, is poised to disrupt the pretzel category with all-new takes on this beloved German staple. Read more on page 20.

Sarah Testa: Tailor-Made Trailblazing

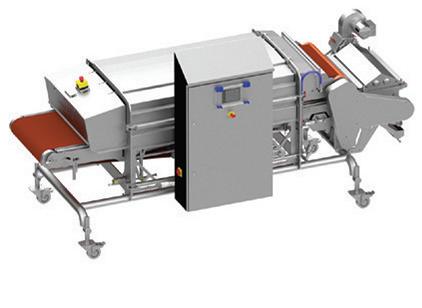

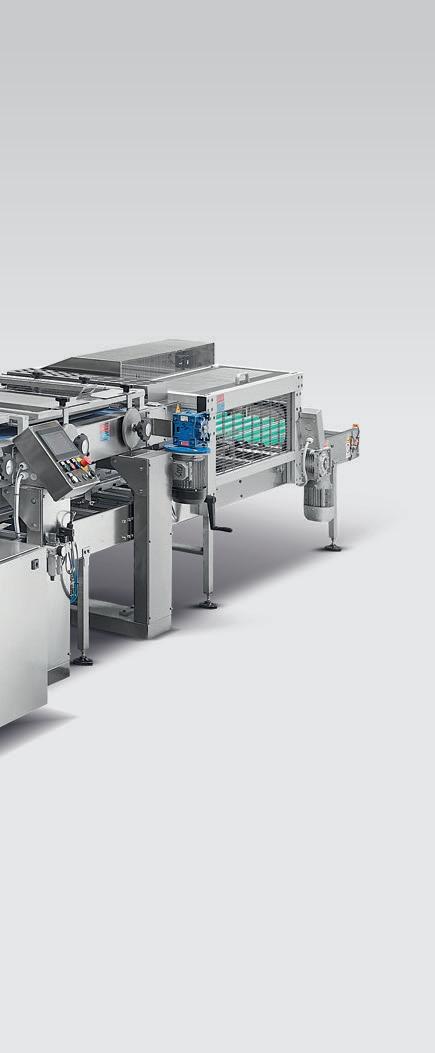

Fully automated and efficient baking solutions featuring key modular components that minimize manual input while maximizing throughput. Designed for specific product and space requirements, these systems optimize costefficiency and accelerate return on investment, delivering greater consistency and repeatability in both quality and appearance.

Liner or Greaser

Depositing

High Capacity Serpentine Solution for all Bakery Categories

Washing / Sanitizing & Drying

Dough Mixing Specialists

Managing Product Climate Clean Rooms

Complete Cake & Sweet Goods Processing Lines

WELCOME OKA AND FRIGOMECCANICA TO

Oka is recognized for its precision engineering in extrusion, molding, depositing, and cutting technologies for industrial bakery and confectionery production.

Frigomeccanica is a global leader in drying, defrosting, fermentation, refrigeration, and preservation systems that extend product shelf life while maintaining premium food quality.

Together, these additions strengthen our full-line solutions, expand our capabilities in bakery and protein processing, and reinforce our commitment to supporting food producers worldwide with advanced, customer-driven technologies.

JOANIE SPENCER Editor-in-Chief | joanie@avantfoodmedia.com

WATCH NOW:

Joanie Spencer reflects on IBIE and looks forward to the innovation ahead. Sponsored by Bundy Baking Solutions.

If you’re anything like me, you’ve returned from IBIE equal parts exhausted and energized. As an industry, we spent a week in Las Vegas making new connections, visiting with old friends and identifying where we go from here.

During the show, there was a lot of discussion around the changing consumer landscape, especially in terms of how people are balancing health concerns with the desire for unique food experiences. That’s driving much of the product innovation in our industry, and it’s only the start.

Identifying what needs must be filled is Step 1 … understanding how to fill them is where the work begins. Between record-breaking educational content and countless supplier innovations on the show floor, IBIE provided the tools bakers need to get that work done. This issue is dedicated to not only insight from the Baking Expo but also from bakers using technology in all-new ways to develop products that serve specific need states and the hottest new retail channels.

Our October issue not only marks the entry into the fourth quarter of an undeniably turbulent year, but it’s also Commercial Baking ’s 20th regular issue since launching in the midst of the COVID19 pandemic. Through all the ups and downs the industry has experienced in recent years, our team is proud to have shared this ride with you.

Then again, the ride isn’t over. Remember, the work has, in many ways, only just begun.

“Every time we gather at IBIE, the world looks a little different, but the spirit of this industry remains the same: resilient, innovative and always moving forward.”

“This

is the culture I want to create: A workplace and company where it’s not just about individual jobs … it’s about every team member being an integral part of a wider culture of care, growth, empowerment and celebration.”

“Social media has truly emerged from a critical marketing tool to a selling channel. More than 60 percent of consumers are influenced to buy sweet bakery items based on something they saw on social media.”

“Younger generations are looking for that purpose-driven job. They’re not just looking to go clock in from 9-5.”

Eric Dell | president and CEO | American Bakers Association (ABA) On the next generation of bakers, during ABA’s Bake to the Future podcast

Photo

of BEMA

•FDA,

•BRC

“No

one has it figured out; you never stop needing support. Be vulnerable with your team because we’re all human, and sometimes we need reassurance that our leaders are people just like us.”

“Food science is far more complicated than an inaccurate, one-size-fits-all ‘junk food’ label. It fills nutrient gaps, reduces food insecurity and increases food affordability.”

Edward Hoffman | head of communications | Upcycled Foods Inc. LinkedIn post on ultra-processed foods

“If you’re crafting a novel food or beverage, you want to put it alongside something a little more familiar. Right now, consumers want new foods, but they don’t want off-the-cuff fusion that they don’t recognize at all.”

Suzy Badaracco | president | Culinary Tides Inc. On evolving flavor preferences

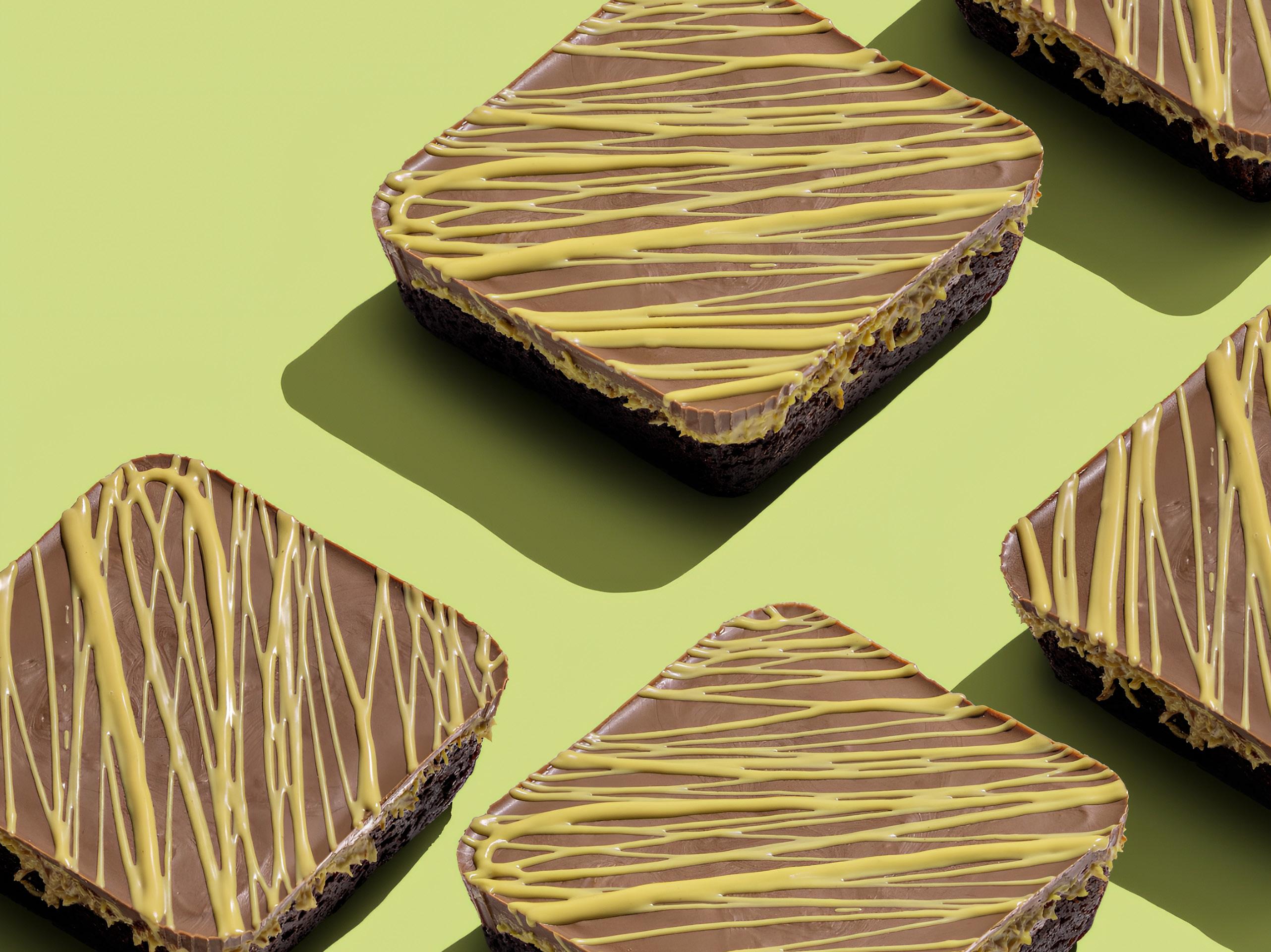

With a new facility and technology upgrades, Ditsch USA is redefining what’s possible for pretzels while staying true to its core.

BY JOANIE SPENCER

When a century-old company is known for a centuries-old product, is there room for innovation? Absolutely. That is, so long as the foundation is not forgotten. For Cincinnati-based Ditsch USA — the US division of the German company — innovation can only happen by sticking to the time-honored process of pretzel making.

While Ditsch has been making pretzels in Germany and around the world since 1919, it officially entered the US market in the early 2000s.

Pretzel Baron, founded in Cincinnati in 2014 by a certified master baker and well-known “pretzel expert,” caught the global producer’s eye. In 2017, Valora Group, Ditsch’s parent company, acquired Pretzel Baron with its 85,000-square-foot facility, launching Ditsch USA.

In just over five years, Ditsch USA outgrew the original bakery, and set out to open a 175,000-square-foot facility less than two miles down the road from its flagship. With the new plant — and equipment additions and upgrades to the original — the company is poised to not only provide consumers with an authentic pretzel experience but also disrupt the entire category with all-new takes on this beloved German staple.

“In Europe, pretzel products are breakfast or lunch items,” said Thorsten Schroeder, CEO of Ditsch USA. “In the US, it’s a snack, appetizer or dinner item. The use case is very different, and that gives us opportunities. But it also makes us different in terms of how it’s perceived and consumed.”

Compared to European countries like Germany, pretzels are just hitting their stride in the US.

“The soft pretzel has really just broken the ice in the US,” said John Stefanik, VP of sales and marketing for Ditsch USA. “That’s been a big part of the strategy behind our expansion, so we’re ready for significant projected growth in an already mature category.”

Innovating while maintaining authenticity for a traditional product requires staying true to how each iteration of it is used.

Just as with another German staple — beer — American consumers typically like their pretzels a little less stout. That’s for a couple of reasons. While a pretzel in Germany is darker, heavier and a bit more bitter, US consumers prefer a lighter pretzel that’s meant for dipping. Both styles are perfectly designed for their intended use: experiential enjoyment in Germany vs. multi-tasking in American markets such as at the ballpark or in a sports bar.

“Our pretzels are made to meet the needs of the US market,” Schroeder said. “It’s

a perfectly made pretzel from a classic recipe, but the taste profile and softness are designed to meet those preferences.”

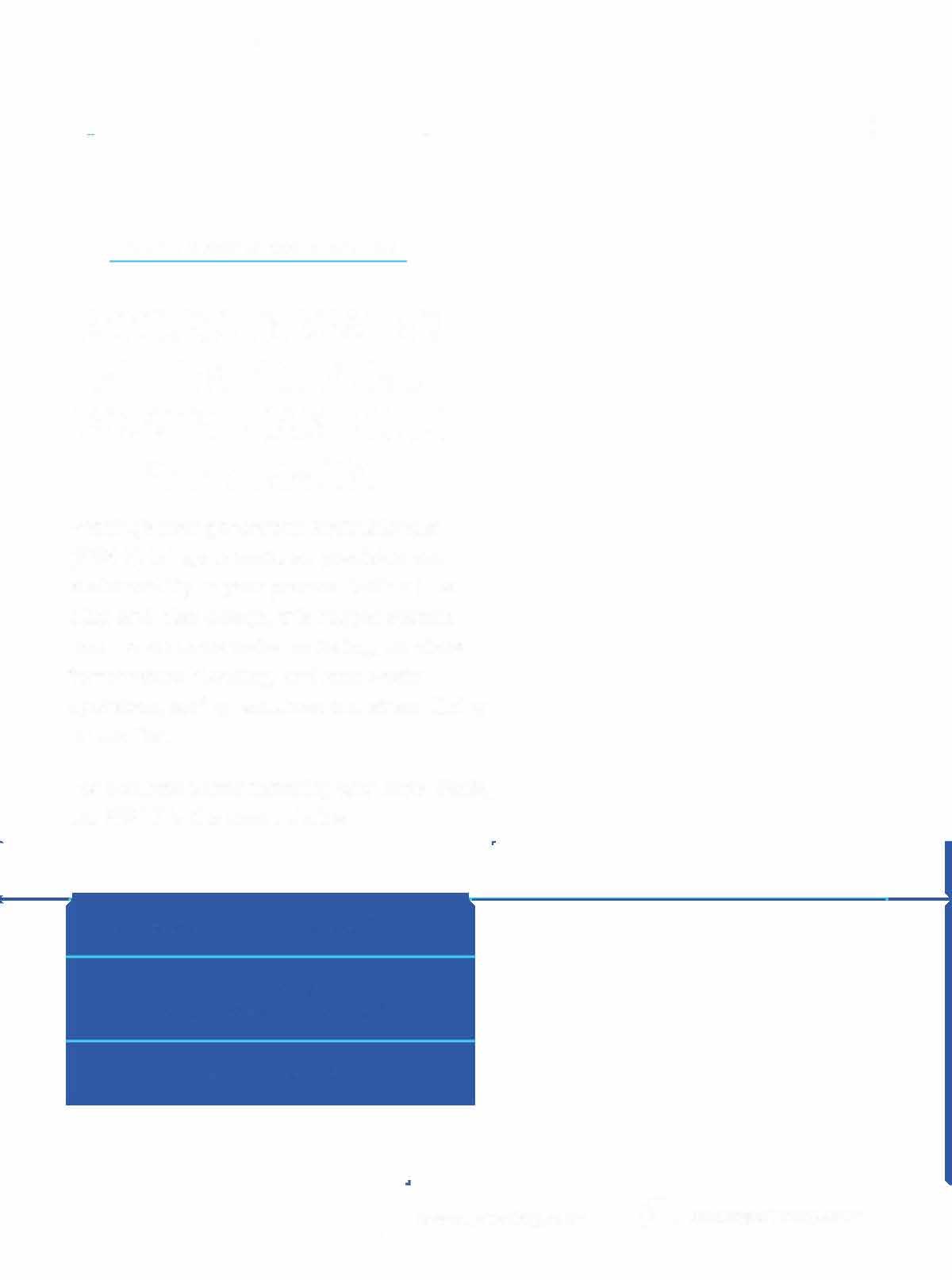

Ditsch USA first disrupted the US market in 2019 with its pretzel bites, marking the brand’s first unique spinoff. Deviating from the typical extruded-style pretzel, the company created a bite that married flavor and function.

“It made a significant impact on the market when a broader range of co nsumers realized how a pretzel can be an indulgence or a carrier,” Schroeder said. “We showed the consumer that pretzels can be more than just a snack, and they can be just as delicious — if not better than — the dip.”

That can’t happen in a vacuum; it requires a deep understanding of the consumer trends that are driving demand.

“We have to look at what the trends are in terms of what people look for and why

they’re going after it,” said Jason Walley, head of product and innovation for Ditsch USA. “That can range from flavors to health concerns. But we also have to stay in tune with where the next opportunities are as well.”

One area of focus is menu development and looking for ways to introduce pretzels into untapped eating occasions, and the R&D team is exploring how the product might support menus in other ways.

“The way we form our bites makes them really fluffy and delicious,” Walley said. “That prompted us to wonder, ‘Can we use that same method to go for a bun that’s used for sandwiches?’ And from there, we looked at all kinds of forms like the swirl and panini. It’s not only opening up new use cases, but it’s also expanding the types of markets we serve.”

During the International Dairy Deli Bakery Association (IDDBA)’s annual conference and expo, held earlier

INTRODUCING SINGLE- AND DOUBLE-ARM SIGMA MIXERS FOR MAXIMUM FLEXIBILITY

Engineered to the highest hygienic standards, the multi-purpose SNAX Single Sigma and Double Sigma Arm Mixers offer reliable, heavy-duty mixing for a wide range of snack foods, including wire-cut cookies, energy bars, pie doughs, granola, pretzels and other specialty snacks up to 3,300 lbs (1,497 kg). Simplified, mechanical dual-tilt mechanisms ease the loading of minor ingredients and seamlessly integrate with dough handling systems.AMFFusionmixerscomeequippedwithoptionalDough Guardian Plus technology combining AMF’s mix-to-energy data analysis with a live video feed from inside the mixer to fine-tune your mixing process.

60 YEARS OF PROVEN MIXER PERFORMANCE

ADVANCED DOUGH MONITORING THROUGH DOUGH GUARDIAN PLUS

SANITARY, TUBULAR FRAME DESIGNS

SINGLE END BELT DRIVE FOR OPTIMAL DURABILITY

SCAN TO

this year in New Orleans, Ditsch USA launched two new items — panini- and swirl-style pretzels — presented with new flavor varieties and suggested uses and pairings.

As AI tools become more prevalent in product development, Ditsch USA has tapped into technology that uses scientific analysis to discover new use cases and create menu ideas based on the flavor profiles or product formula.

Jason Walley explains why product development must stay true to the core of the brand.

“We’re able to use that to showcase what our customers can do with our products,” Walley said. “It’s not just, ‘Here’s a new shape or flavor, go do something fun with it.’ We can realistically demonstrate distinct, innovative things that can be done with an item that’s already on a menu but might not be associated with a pretzel yet. It also empowers chefs and restaurateurs to think more creatively about the pretzel and how it can be presented.”

Also on display at IDDBA were high-fiber items that play into trending consumer health needs. With the surge in health awareness and pharmaceutical weightloss strategies, Ditsch USA keeps specific needs on the radar, including interest in protein and fiber.

The first step is focusing on the basic makeup of a classic pretzel: flour, water, salt, yeast and fat. By understanding how these elements work together, formulators can create new iterations that

play into modern health needs without sacrificing quality or taste.

“We don’t just rely on [customers] to say, ‘This is what I need.’ We collaborate with them directly.”

John Stefanik | VP of sales and marketing | Ditsch USA

“When we look at the wheat and fat, we can see opportunities,” Walley said. “We have to consider the wheat in terms of where and how it’s grown, as well as the blend of the wheat. We can do the same with the fat. This creates opportunities for higher fiber. Protein is super popular right now, but without the right amount of fiber paired with it, it’s more or less useless. It’s got to have the right nutrients. You can’t have protein for the sake of being ‘high protein.’ It has to actually provide the nutrition that’s needed to support a high-protein diet.”

No, this level of innovation doesn’t happen in a vacuum, especially when regulations and consumer demands can change on a dime. These days, speedto-market often hinges on collaboration.

On one hand, Ditsch USA is collaborating with its customers to create new flavors, formats and uses.

“We’re walking side by side with our customers,” Stefanik explained. “We don’t just rely on them to say, ‘This is what we need.’ We col laborate with our customers directly, and we have a specialized segment and sales team with close connections, so we’re always ready to help them.”

On the other hand, the team has to first collaborate internally and with supplier partners to understand what’s functionally possible. For that, resources such as Puratos’ Taste Tomorrow research become valuable tools.

“We see Puratos as knowledge partners,” Schroeder said. “The knowledge they bring to the table is absolutely powerful, and it’s an incredible collaboration.”

Once products are developed, testing is critical to bring them to fruition.

“It’s easy to be at the bench and make something look great, but what happens when you bring it on the production line?” Schroeder said. “That’s a key point in the development process. Before we can present a finished product, we have to know we can make it in an industrial scenario and keep the quality while giving it momentum. It doesn’t make sense to create a shape we can’t replicate with our current equipment or innovative modifications.”

While the first line in the original bakery will eventually become an in-house test line, Ditsch USA has tapped into the new Puratos Pilot Bakery, powered by AMF Bakery Systems, to test new product iterations on a fully functional industrial line without disrupting daily operations at either of its own facilities.

“The equipment at the Pilot Bakery is more or less ‘cut in,’ Stefanik said. “We can roll pieces in or out or reconfigure the line, depending on how we need to replicate one of our lines and the technology we have in each facility.”

Collaborating with OEM partners eased pressure as Ditsch USA settled into operating two plants, with the new facility having started up in late 2024. Today, both bakeries have a total of five lines, and any product can be made on any line in either location.

“We’ve designed the bakeries to have the flexibility and speed to react to almost any customer demands,” Schroeder said. “We can achieve that by not limiting specific items to one site, so our equipment is set up to make nearly all products at both sites.”

Capacity was the primary objective for opening the second bakery, but adding flexibility also allows for redundancies that create a backup scenario.

“Redundancy equals security for our customers,” Stefanik said. “It’s like we’re our own secondary supplier, just 10 minutes down the street. As COVID exposed, supply chain is key, so there was a lot of thought put into how we designed and mirrored the facilities.”

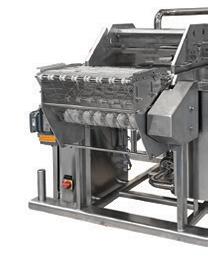

The flagship bakery originally had one production line with a MULTIVAC/ FRITSCH Multi Twist, and today the bakery houses three lines with several Multi Twists working in tandem.

“Our twisters are a great example of how we approach innovation,” said plant manager Robert Cramer. “Yes, this is a machine that twists a pretzel, but there are several other things it can do in terms of forming other items. We can make adjustments depending on how we prepare and manage the dough.”

This “small but mighty” space is producing exponentially more than the original operation, in terms of not only output but also the creativity that goes into new product iterations. For example, the robotic scoring machine from ABI Ltd., scores with the utmost precision, enabling a customized score on practically any product.

“We could write your name on a pretzel with this machine,” Cramer said. “It’s that precise.”

Meanwhile, at the new facility, two AMF lines could produce bites, paninis, swirls and other items. The modularity of the mirror-image lines enables production of either one large run or multiple variations.

Bellarise$ BellaSOFT Ever Fresh bakes the best softness, resilience, and bite into all of your breads and buns.

Oh, and it's all-natural and clean label, too.

All-new Bellarise BellaSOFT Ever Fresh:

• Maximizes value by yielding the best softness for the longest time

• Protects your breads when stacked by offering top-notch resilience

• Creates a perfect bite that always reveals all the best In your breads

Our master bakers put their best into Bellarise* BellaSOFT Ever Fresh to help make your breads unforgettable. After all, you work hard at the bakery every single day, so we work hard to make sure all your efforts count.

Please contact us and order your sample today!

“One line may be doing bites while the other is doing something a little different,” Cramer said. “They’re versatile enough that we can plug and play into the central areas and alter the process enough to enable a specific innovation.”

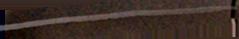

Ditsch USA’s process might not be new to baking, but it is outside the norm for pretzel making. How the dough is nurtured and developed — starting with the Sancassiano mixers and through makeup and forming — results in a texture that’s arguably unmatched in the market, and it leads to further innovation.

“That’s how the magic happens,” Cramer said.

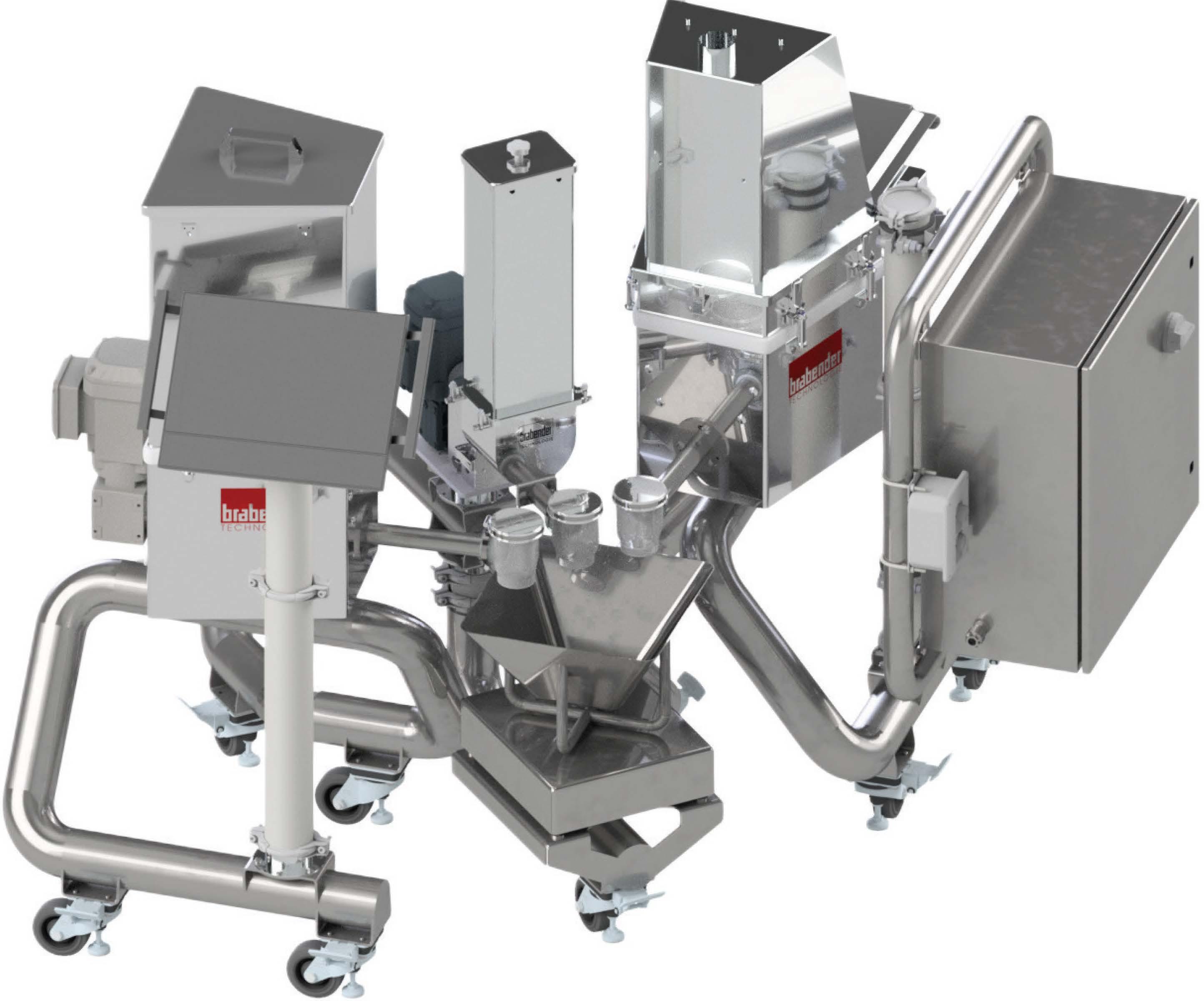

Tried-and-true equipment such as the mixers and the Spiromatic ingredient handling in both bakeries allow efficiency in producing this six-ingredient artisan product at scale. Of those six ingredients, three are handled through the Spiromatic system while the rest are hand-fed into the mixers.

And of course, soft, fluffy pretzels require a perfect bake; the makeup lines feed AMF tunnel ovens to deliver just that.

Then again, some innovation at the new bakery is changing the game in a totally different way. An all-CO2-driven freezer system supports the warehouse freezer and the one in production. It’s not only environmentally friendly but also eases total cost of ownership for freezing.

“The system is set up to handle cooling for the whole plant,” Cramer said. “We don’t have to add anything to it. That’s where bottlenecks happen, when we have to think, ‘How am I going to cool all of this? How much more ammonia do I need to add?’ But it’s all CO2, so it’s also environmentally friendly.”

As the brand rides a wave of “Americanized” pretzel innovation in the US, the company is expanding its reach throughout all of North America … and beyond. Many food trends in the US are spinoffs of European originals, but that doesn’t mean they can’t make their way back across the pond, gaining attention of their own.

“The global market has come to really want Americanized things,” Stefanik said. “There are many people overseas who are intrigued by what we’re doing with our pretzel bites.”

That intrigue is converting to sales as Ditsch USA begins exporting orders overseas.

“But it only works when we stay true to our roots,” he added.

With all that’s happening, this isn’t the “Wild West” for pretzel making. The company’s stage-gate process ensures product development is done with intention, regardless of the speed. Creativity doesn’t mean the team simply lets imagination run wild. Even while stretching the limits of pretzel innovation,

SMAR T AUTOMATION FOR SUSTAINABLE PRODUCTION

More than 60 of experience years

it must maintain Ditsch’s brand integrity and always stay true to the original formula.

“Do we want to bend to the left or right a little?” Schroeder observed. “Yes, we do. That’s important. But long-term, we must stay consistent, and development has to meet those standards.”

With room in the new bakery to add at least four more lines, as well as create space for dedicated distribution and on-site R&D, growth will come at the pace demand dictates.

“We’ve created a ‘plug and play’ situation,” Stefanik said. “With it, there’s no challenge we can’t face.”

The USA team has struck a balance between honoring a century of Ditsch’s expertise — and even more history of its product — with adopting new technology and adapting to modern American tastes. The result is a group of “pretzel ambassadors” presenting this product like never before.

“New” for the sake of being new doesn’t work here. No matter how innovative the products or technology are, Ditsch USA will stay true to its core, ensuring every product fits the time-honored process and quality standards of the brand.

“We don’t call them ‘bites of happiness and pretzel love’ for no reason,” Stefanik said. “We love every aspect of that dough, from start to finish.” CB

Less than 10 years after starting up operations in Cincinnati, Ditsch USA has upgraded its original 85,000-square-foot bakery and opened a new, 175,000-square-foot facility less than two miles down the street. Ditsch USA is disrupting the pretzel market with new flavors, formats and styles. Below is a list of supplier innovations that can be found in both bakeries.

ABI Ltd. lye bath, scoring

AMF Bakery Systems makeup, proofing, oven

BOSCH packaging

DSI Dantech cooling

IJ White cooling tower

IMA Ilapak flowwrapping, bagging MULTIVAC/FRITSCH twister

Pattyn packaging

Sancassiano mixers

Spiromatic silos, ingredient automation

IMA Ilapak combines over five decades of bakery expertise with thousands of packaging systems installed worldwide.

Our portfolio offers cutting-edge solutions for feeding, weighing, counting, and packaging, engineered to handle an extensive range of bakery products from bread, pretzels, pizza, and tortillas to cakes, pastries, and frozen baked goods.

We are proud of our partnership with Ditsch USA LLC, providing innovative packaging solutions that evolve with their needs and fuel their continued success.

marketing ilapak@ima.it

Coperion unites the leading technology brands in food manufacturing to deliver innovative system solutions for your bakery.

Technology for: Systems & Ingredient Automation

Pre-Dough, Mixing, Forming & Dividing

Depositing, Decorating & Cutting

� baker perkins b bakon � diosna �operion

@ peerless $ shaffer � shick esteve

Scan the QR code to find out more

kemutec

unifiller •4 vmi

Sarah Testa has done it all, and as chief growth officer, she’s leveraging that experience to take Roskam Foods to new heights.

BY ANNIE HOLLON

There’s more to the food and beverage industry than meets the eye. From segment to segment, specialized business areas work in harmony to keep products rolling out on store shelves and beyond. Understanding how all the moving parts work is a task on its own, but using this insight to propel a business forward requires a jack-of-all-trades background.

A leader with vast industry experience and a willingness to learn is often a rarity. But Sarah Testa, Grand Rapids, MI-based Roskam Foods’ first chief growth officer, is just that. In a little less than three years, her work has been vital to taking the centuryold company into its new era.

While the majority of Testa’s professional experience has been in the food and beverage industry, it wasn’t her intended field. She started out in management consulting at Deloitte, spending a few years there working for retail, healthcare and financial clients before brand management piqued her interest.

“I find it fascinating,” Testa said. “There’s always something to learn, a new challenge. With brand management, you’re really a general manager as well; you’re

running a business and also building a brand.”

The decision to pursue this field steered her to Stanford University’s MBA program, and it eventually served as Testa’s entry point into food.

“The food industry is ever-evolving, and, for me, that keeps things interesting,” she said. “As a strategist, I’m constantly adapting to new trends and the information around them, and being able to pivot and come up with winning strategies in this environment is a great fit for me.”

Testa’s tenure in the food space began at Conagra Brands, formerly known as Conagra Foods, in 2005. She supported an array of storied brands and also got her first taste of the private label sector, managing the snack division’s bar and cereal business. After a brief pivot to Target, lending her CPG insights to the retail sector, she joined Minneapolisbased private label snack manufacturer Flagstone Foods as part of its new management team.

“It was a chance to build a marketing team and processes from scratch and be part of this company from the ground up,” Testa said. “The role was a pivotal change in my career, where my trajectory started to shift a little bit away from traditional brand management and general management roles to a much broader scope of responsibility.”

Her 11-year tenure at Flagstone — which was acquired and later spun out of TreeHouse Foods — allowed her to work in different aspects of the business, ranging from product development to commercialization. It also gave her direct insight into scaling a company and adjusting through integrations, acquisitions, divestitures and more.

“Even when you’ve had a 20-year stretch in the food industry, there’s always something new to learn.”

Sarah Testa | chief growth officer | Roskam Foods

With an arsenal of know-how, Testa was equipped for her latest venture as chief growth officer of Roskam Foods, which she joined in 2023. The new role played to Testa’s strengths and experience.

“I was brought into this newly created role and was responsible for building and executing the growth strategy for the next phase of the company,” she said. “My role then expanded to leading all aspects of product development, commercialization and sustainability.”

Having approached the industry from a variety of different angles, Testa’s wellrounded understanding helped shape Roskam’s growth trajectory as well as its new strategy.

“I’m back working with brands again, which is where I started my career,” she said. ”Having that insight of being a brand manager really helps me understand who we’re selling to and how we can partner with them to add the most value.”

Known for being one of the country’s premier contract manufacturers, and for having substantial ingredient business, Roskam has a large baking customer base. Testa has learned a new channel, its complexities and the role the company plays in supporting its customers.

“Even when you’ve had a 20-year stretch in the food industry, there’s always something new to learn,” she said. “Understanding everything we have under Roskam’s umbrella, as well as the broader co-manufacturing space, has been the new challenge for me.”

The ability to understand three key elements — the market, the consumer and the competitive landscape — has helped propel Testa and the organizations she’s worked for to the next level.

“Making sense of all that, being able to identify those growth pockets and opportunities — before your competition — has been key to my success,” she said, “regardless of where I have been in the food industry.”

Developing Roskam’s strategy proved to be a rigorous process, with the c-suite taking time to make sure it knew its customers, the market and trends. For Testa, learning all she could about co-manufacturing and Roskam’s unique history was essential to building upon that foundation.

“It was a very collaborative process that involved probably 30 to 40 of our top leaders; a combination of people who were tenured and had a long-time history with the company, and others who were coming in newer with a fresh perspective,” she said. “Having both perspectives in the mix was really important.”

These collective insights proved instrumental during Testa’s first year with the business as she helped lead the charge for the company’s rebrand. This included a name change from Roskam Baking Co. to Roskam Foods to reflect the company’s growing capabilities. Beyond the name, the introduction of the blue multiplier logo served as a symbol of the company’s commitment to increasing opportunities for employees, customers, the community and shareholders.

The change, Testa shared, has been transformational.

Identifying growth opportunities for the company requires Testa and her team to monitor what is trending, and why and how to adapt.

“When you think about co-manufacturing and ingredients, it’s all about matching your capabilities with the market need,” she said. “We’ve got to make sure we’re playing in the right spaces to be successful.”

On the baking side of the business, she’s noticed a common theme of disruptors that enter a dormant segment and shake things up with innovations such as better-for-you reiterations of nostalgic classics or a new take on products, including frozen dough.

Enter strategic bets, an approach that, with support from the company’s private equity owners, helps Roskam fund these investments and capabilities to spur growth opportunities. In Testa’s eyes, taking these calculated risks early on gives businesses an edge over competitors.

When it comes to producing consistently great cookies, innovation is the key ingredient. Our GenesisPRO Series offers the most advanced, efficient and reliable equipment on the market. For cookies, biscuits, bars and filled products, RBS has the technology and experience you need to bake your best products each and every day. Call (01) 610-693-5816 or visit readingbakery.com for more information.

“This is a very capital-intensive business, so if you don’t have the assets and you don’t have the equipment to make that reinvented product, you’re going to miss out on that opportunity,” Testa said. “That’s where we talk about these strategic bets and build the capability with an eye toward all the opportunities we want to go after. So far, we’ve been really successful with that strategy.”

Locking in on those opportunities early on has been at the core of Testa’s business philosophy throughout every phase of her career. From role to role, looking beyond the now has proved valuable.

“I’ve been in businesses where you make short-term decisions to hit the budget,” she said, “but you’re probably not making the right choices for the long-term health of the business.”

Testa has kept the needs of both customers and team members in focus throughout her career. Tending to both groups keeps business on track. On a similar note, fostering an environment in which people want to work starts at the top. Akin to the adage, “Be the change you want to see in the world,” Testa works to create a collaborative and positive environment for her team.

NOW:

Sarah Testa shares why empowerment has become a core part of her leadership philosophy.

“How you do your work and accomplish the goal matters a lot,” she said. “You’ve got to bring the right skill set and approach and then model those for your employees, not

“How you do your work and accomplish the goal matters. You’ve got to bring the right skill set and approach and model that for your employees.”

Sarah Testa | chief growth officer | Roskam Foods

asking them to do anything you wouldn’t do yourself or that you don’t demonstrate on a day-to-day basis.”

As a leader, Testa’s approach has remained steady, driven by transparency, leading by example and empowering team members. For her, setting the strategic vision and then giving employees the support, room and resources needed yields positive results for everyone.

“People want to be part of a winning team, part of something bigger,” Testa said. “Everybody wants to feel that sense of ownership and that they’re contributing to the goal.”

The business landscape has changed in many ways, and with it, what leadership looks like. Beyond the diverse

backgrounds often represented in the top rungs of company ladders, there are more leaders supporting companies at different levels. Identifying these changemakers on the production floor and beyond strengthens the business as a whole.

“They are people who are eager to grow, learn and take on new ch allenges,” Testa said. “Those are the people you want to identify and give them more and more opportunities.”

Backed by rich experiences across the industry, a killer instinct for trends and growth opportunities — and a talent for fostering a forward-thinking work environment — Testa is well-suited to help Roskam Foods bloom while blazing a trail for future industry leaders. CB

From fresh-baked sourdough bread to artisan, single-serve grilled cheese sandwiches, A Friendly Bread is redefining what’s possible in CPG.

BY LILY COTA

Most people probably think they know all there is to know about grilled cheese sandwiches. It’s just bread and cheese, after all.

But what if that grilled cheese was made with pre-toasted, artisan sourdough bread? What if it was packaged in an individually wrapped format, ready for a toaster oven, combining home-cooked flair and modern-day convenience?

With its heat-and-eat frozen grilled cheese and steadfast commitment to authenticity, Baltimore-based A Friendly Bread is changing the way consumers perceive CPG baked goods.

But the brand’s journey didn’t start with this vision in mind. In fact, it’s amazing it even started at all, considering founder and CEO Lane Levine didn’t like bread growing up … that is, with the exception of sourdough.

“I always thought sandwiches were just too wet and soggy,” Levine said. “But I came across sourdough here and there and always remembered that it was a chewier or crustier bread that seemed to hold up better.”

That distinct fondness, coupled with the impending burnout of 12 years in non-profit work, led Levine through a budding baker’s rite of passage as he

began casually experimenting with sourdough. This newfound passion ignited curiosity, and A Friendly Bread was born with scrappy beginnings and swelling potential.

“Before building this business, I never had the experience of participating actively with a product … a physical thing somebody could buy from me,” Levine said. “The intangible nature of non-profit work really wore on me, and suddenly I was making something that I felt could be my first engagement in the goods economy, so I went with it.”

Levine’s bread was a hit at farmers markets and among a growing core of home delivery customers, with a local following that grew every day. So much so that customers were sending him pictures of their DIY grilled cheese sandwich innovations, opting for two slices of A Friendly Bread’s sourdough as the base. Suddenly, a light bulb flickered, and the brand started doing pop-up Grilled Cheese Nights at luxury apartments. The response was overwhelming … and enlightening.

The grand grilled cheese idea was hatched, and A Friendly Bread restructured its ascent as a premium, par-baked CPG sandwich brand. But things are never that simple, and the path to success isn’t always linear.

A brand can’t truly consider itself established without experiencing its share of R&D and distribution detours.

In the beginning, A Friendly Bread manufactured its products by hand in a co-working production space. To make things easier on the bakers and increase production, the team took a leap with upgraded automation — and a bit of practical frugality.

“I set a rule for any kind of large equipment investment — whether it’s production or packaging — that nothing we purchase can only be used for one thing,” he said. “We needed to buy an industrialsized slicer to efficiently slice the bread for the sandwiches, but I realized it could also be used to slice the cheese.”

As the brand began experimenting with grilled cheese at scale, the process wasn’t always cut-and-dried. Initially, the product was fully browned and cooked by the time the consumer received it. But during the reheating step, the sourdough developed a rubbery texture, and the cheese fully absorbed into the bread.

“Then you’re left with two wet pieces of bread, which is not a grilled cheese sandwich,” Levine said. “We decided to par-bake the sandwich so the bread and cheese would slightly melt together but not get overcooked. For the end user, the melt needed to happen in a reasonable amount of time without the bread burning.”

Enter the diagonal slash.

In the R&D phase, when checking the bake time required for a full melt, Levine’s team found that cutting the sandwich in half gave a good look at the progress. But that diagonal cut also expedited the heat-up time. That discovery led to what is now its signature break-and-bake format.

“It’s still one cohesive product, but it’s basically perforated,” Levine explained. “You take it out of the freezer, crack it open, and then the heat gets to the inside much faster, making it even more convenient for consumers.”

Flavor development was broached strategically, yet simplistically. Sticking to four classic but sophisticated profiles, the brand paid homage to its flagship product’s top-selling flavors: Simple Country with Cheddar, Cinnamon Raisin with Brie, Challah with Swiss and Ja lapeño with Gruyere.

“I learned through the Grilled Cheese Nights that you can be extremely clever with your flavor profiles and people might still not be interested,” Levine said. “The

vast majority of people who eat potato chips go for the plain olive oil and sea salt. So, you have to lead with the plain flavors, but innovative flavors — while they may never be best sellers — serve a function of creating a little cult following or allegiance to the company because we might be the only ones making that variety.”

Marketing went hand-in-hand with the R&D process. In the early stages, when customers ordered their loaf of bread for the week, Levine included a complimentary grilled cheese sandwich if they agreed to review the product or provide feedback via an R&D survey.

Through this, A Friendly Bread lived up to its name, integrating itself into the local community, slowly but surely building connections and, in turn, its brand.

“I had relationships with some small local retailers who were selling my bread,” Levine shared. “I pitched the grilled cheese product to them, and they saw the spot it could fill in the marketplace. That opened the door for us to do demos and marketing in the local area and really helped develop that direct customer marketing.”

Through this stage of trial and error, the brand discovered that the grocery

retail market was not an ideal distribution channel. However, foodservice outlets where the product is heated and served directly to the customer — specifically coffee shops, college cafes and quick-serve venues — turned out to be a perfect fit. The brand now supplies a range of clients with A Friendly Bread grilled cheese to elevate their menus and stock their grab-and-go shelves.

While many emerging brands dream of building a brand on nothing more than passion, it’s the financials that gets things off the ground. Small-business loans, among other avenues, can make the road less bumpy, but they can’t always cover it all. In the scrappy pursuit of a successful future, A Friendly Bread has benefited from a few entrepreneurial hacks.

This small team of three does all the baking and distribution, which is emerging as an area of potential growth beyond the core product. Not only does the brand save on early-stage costs by manufacturing its products out of a co-working production space, but it’s also setting the scene for a future home.

By renting a warehouse with ample freezer space, A Friendly Bread operates as a local cold storage and basic cross-docking service provider for small to medium shipping customers. This alliance helps the brand cover its expenses while it works toward purchasing the warehouse as its full production space, all while helping other small businesses grow their own distribution.

Today, A Friendly Bread finds itself facing the age-old question: Where to go next? The destination may not be set in stone, but it’s the journey — as well as the handprepped, elevated yet classic, artisan grilled cheese baked along the way — that counts. CB

Bringing industry-changing innovations to North American bakers for over 40 years

Some of the technologies

Allied has introduced to our industry

Thermal Oil Oven technologytransforming the Artisan Bread sector

Carousel, Robot, and Continuous Systems to automate the mixing room

Large-scale, twin-tool, closed-bowl, self-scraping Planetary Mixing

Fully C.I.P. multi-piston batter depositors

Truly stress-free (no extrusion) large volume make-up lines for highly hydrated doughs

Revolutionary Vertical Dough Mixing technologies - beyond the spiral

High-speed injection equipment with an accuracy of +/- 0.25 grams

BY MAGGIE GLISAN

For bakers today, growth often means looking beyond traditional retail shelves. Shifting purchasing habits and an increasingly competitive landscape are pushing brands to explore new ways to get their products into consumers’ hands, whether through vending machines and micro-markets, c-stores and gas stations, catering programs, or even subscription models. These channels open the door to fresh revenue streams and new audiences, but they also come with operational challenges. With a number of things to consider — packaging formats, shelf life, logistics and brand consistency — bakers must balance opportunity with complexity. The question isn’t just where to sell, but also how to make each channel work.

C-stores are no longer just a spot to snag a bag of Cheetos while topping off the tank; they’re evolving into full-fledged gourmet pit stops. According to National Association of Convenience Stores data, in 2024 food ser vice accounted for nearly 28% of in-store sales and almost 40% of gross-margin dollars at US c-stores, with prepared food driving 68% of that growth. Bakery alone generated nearly $19 billion in sales, underscoring the strong demand for grab-and-go cookies, muffins and pastries. That combination of consistent consumer traffic and appetite for pac kaged baked goods makes c-stores a compelling growth channel.

The rise of micro-markets and vending reflects broader shifts in consumer behavior. The National Automatic Merchandising Association (NAMA)’s 2023 Industry Census shows that micro-market installations have grown from 2% of the industry in 2014 to 20% in 2023, with manufacturing, hospitality and college locations leading opportunities for growth.

“Micro-markets and vending have both diversified significantly in part due to changing consumer demands wanting access to products whenever and wherever they are,” said Kat Snodgrass, senior director of communications and marketing at NAMA.

But success in these channels requires more than just placement.

“There’s no universal answer,” Snodgrass said. “What works depends entirely on an operator’s location, consumer base and timing. For example, third-shift manufacturing workers might grab coffee or baked goods at 2 a.m., while day-shift hospital employees purchase the same items at 8 a.m., and they may take extra home for family breakfast.”

Research from the 2024 International Food Information Council’s Food & Health Survey supports this, finding that nearly three in four Americans snack at least once a day, with 56% replacing meals with snacks.

Operators also face unique operational challenges.

“Convenience services require strategic thinking beyond traditional food distribution, and underestimating that complexity can be a pitfall,” Snodgrass said. “Unlike wholesale distribution to stores, convenience services involve automated dispensing systems, packaging that withstands temperature variations and shelf-life management without human handling. Products that remain visually appealing in unmanned environments while fitting planogram dimensions and inventory turnover patterns create competitive advantages.”

For wholesale bakers, mastering these operational nuances and tailoring products to meet consumer demand can open doors to new revenue streams while supporting strategic objectives such as workplace well -

ness, guest satisfaction and employee engagement.

That balance between spontaneity and quality is something San Leandro, CA-based Otis Spunkmeyer knows well.

“Unlike traditional retail markets, where purchases are usually planned, vending and micro-markets thrive on impulse and convenience,” said Paul Stippich, senior director of marketing for Otis Spunkmeyer, an Aspire Bakeries brand.

To succeed in those environments, the brand has leaned into individually wrapped, larger-portion formats designed to maintain freshness and visual appeal in unattended spaces. It recently introduced Caddy Packs, which are delivered frozen and include 12 individually wrapped loaf cakes, cookies and brownies, giving operators an easy way to stock, store and display the baked goods. This type of packaging innovation has been central to ensuring products travel well through distribution and stand out once they’re stocked.

“Our packaging must act as a silent salesperson,” Stippich explained.

“In micro-markets, airports and workplace catering, people often browse visually before selecting baked treats,” he said. “We’ve focused on tamper-evident, grab-and-go solutions that meet operator needs for safety and convenience while maintaining our premium brand presentation.”

Catering has also become an essential avenue for bakeries looking to diversify revenue beyond retail. In 2023, the US catering market reached $72 billion, with corporate events, holiday parties and special occasions driving consistent demand. For bakers, offering catered platters, pastries and custom desserts not only expands brand visibility but also encourages repeat business, since a single event can introduce dozens of new customers. With flexibility and creativity, catering can provide a high-impact way to scale sales while building lasting relationships.

Milwaukee-based Milwaukee Pretzel Co., known for its Bavarian-style pretzels, formalized a catering program after fielding growing requests from local businesses and events.

“We recognized there was demand in southeast Wisconsin for a high-quality, easy-to-order catering option that also had a fun brand component,” said co-owner and COO Matt Wessel.

To meet those needs, the company invested in specialized packaging designed to hold pretzels and dips, which not only streamlined production but also ensured brand visibility at events. While catering remains a smaller slice of the company’s business, Wessel said it has opened the door to new customer segments — from corporate events to weddings — proving that with the right packaging, logistics and delivery strategy, even a niche product can scale into a high-impact channel.

That potential is something ezCater, a nationwide workplace food platform, is also seeing firsthand.

“We’re witnessing a significant rise in ‘treat culture’ in the workplace,” said Cindy Klein Roche, chief growth officer of ezCater. “Our data shows a 26 percent year-over-year increase in dessert orders, with cookies, brownies and cupcakes topping the list. Employees now expect a pick-me-up snack during the workday, especially in the afternoon.”

But Roche emphasized that success in catering requires more than a great product. It also means creating catering-specific menus, investing in sturdy packaging and clearly labeling for ingredients and allergens.

“We recognized there was demand in southeast Wisconsin for a high-quality, easy-to-order catering option that also had a fun brand component.”

Matt Wessel | co-owner and COO | Milwaukee Pretzel Co.

•Palletizing

•

Management

•

Other

“The real challenge is ensuring consistency and quality at scale, making sure the hundredth meal is just as perfect as the first, and that they all arrive reliably on time,” she said. “You’re selling a business-grade experience, not just a product.”

Catering is also increasingly moving beyond big, occasional events.

“The most significant shift we’re seeing is the rise of the everyday occasion,” Roche said. “Orders for daily or weekly employee meals are up 32 percent yearover-year, and 62 percent of employees enjoy a treat during the mid-afternoon slump. This creates a massive opportunity for bakeries that can deliver smaller, more frequent moments of joy.”

That shift can be a marketing opportunity as much as sales. Roche noted that 70% of employees who first try a restaurant through a workplace meal go on to personally order from that brand.

“That tray of sandwiches and cookies feeding 25 people at lunch isn’t just one order,” she said. “It’s potentially 25 new customers.”

While catering multiplies a brand’s reach through single events, subscription boxes provide a steady, predictable way to engage consumers directly and build long-term loyalty. Since its launch in 2020, Wildgrain, a bake-from-frozen artisan bread and pasta delivery service, has scaled to more than 80,000 active subscribers by partnering with more than 45 local bakeries for fulfillment.

Members can choose from box sizes of 4, 6 or 12 items, with options such as Italian, gluten-free, plant-based, or variety assortments that include breads, pastries, pastas, sauces and more. A

monthly subscription typically ranges from $69 to $189 per box with free shipping, and customers can skip, pause or adjust shipment frequency whenever they want — features that help build retention.

Subscription boxes are part of a broader trend toward direct-to-consumer food sales, which grew more than 20% year-over-year in 2023. For bakeries, these models not only provide recurring income but also valuable consumer data, offering insights into purchase frequency, preferred products and flavor trends. This information can inform broader marketing, menu development and even new product launches. In addition, subscription models allow brands to experiment with limited-edition items, seasonal offerings or curated pairings, creating a sense of excitement and

exclusivity that drives engagement. For wholesale bakers, subscription models offer recurring income, direct consumer relationships and a scalable way to expand reach beyond traditional shelves.

The baking landscape is only getting more dynamic, and that creates opportunity. New channels from vending to catering to c-stores are more than just a chance to expand distribution; they’re touch points to build stronger connections with today’s consumers. Bakers who embrace this shift with creativity and agility can do more than keep pace — they can set the tone for how the industry evolves. By rethinking packaging, formats and experiences, the next wave of category leaders won’t just be adapting to change, they’ll be defining what’s next. CB

Bakery is your business and you know how tough it is. So do we. Our team of dedicated professionals earned their experience on the bakery floor so we know what works and what doesn’t. Partnering with Rademaker Systems Integration gives your business the competitive advantage of:

• 30+ YEARS OF OPERATION AND ENGINEERING EXPERIENCE

• LAYOUT AND PROCESS CONSULTATION

• TOP TIER EQUIPMENT MANUFACTURING PARTNERS – FROM RAW MATERIAL THROUGH PACKAGING

• PROFESSIONAL, ON SITE PROJECT MANAGEMENT

• INSTALLATION, COMMISSIONING, TRAINING SUPPORT

Make your bakery the best it can be with Rademaker Systems Integration!

Whether planned in advance or happening on the fly, the reformulation of a product requires foresight and collaboration.

BY MADDIE LAMBERT

Remember back in 2014, when Vani Hari, known around the blogosphere as “Food Babe,” sent the commercial baking industry into upheaval with her petition against Subway?

Hari called for the sandwich chain to remove the dough conditioner azodicarbonamide (ADA) from its bread, noting the chemical was also used in the manufacturing of yoga mats and shoe rubber. Even though ADA had GRAS status from the FDA, the petition still sent shock waves through the industry, causing bread suppliers — not only for Subway but in channels everywhere — to drop everything and reformulate.

In an ideal world, a clear set of initiatives is outlined in advance of the reformulation process and its several stages. Before R&D teams can roll up their sleeves and get to work, they must understand what’s driving the reformulation. Whether the need is related to nutritional targets, cost considerations or consumer perception, it’s crucial to identify potential ingredients that contribute to the end goal without sacrificing the quality of the finished product.

“That involves looking into technical data, regulatory status, functional properties and perhaps consulting with supplier partners to review market benchmarks and consider consumer perception areas,” said Kendall Howie, principal food scientist at the Middleby Bakery Innovation Center. “It’s not just about finding an ingredient that ‘works.’ It’s also about finding one that aligns with the product, brand identity and production realities.”

Once the process moves to benchtop trials, the abstract formulation comes to life on a smaller scale to assess feasibility in a controlled setting. From there, qualitative assessment becomes a crucial step for spotting early red flags in terms of appearance, flavor, aroma and texture. Raising those flags early provides time to screen different ingredient levels before testing at scale and completing full production trials.

In the case of the ADA disruption, the truncated timeline and quick-turn decisions risked missteps at any part of such a nuanced process.

“It takes time to rebuild because you have to understand the matrix you’re putting the product into,” said Sherrill Cropper, PhD, new product development lab manager for Lesaffre North America. “We have to understand exactly what parameters can and cannot be changed, and as we start trying to hit the specific formulation change that’s required, we have to keep the product’s integrity.”

Fast-forward a decade, and the court of consumer opinion still has significant sway over product development.

Today, consumers are pushing for fewer synthetic additives for foods with cleaner labels. They’re also paying closer attention to the legacy ingredients used in traditional snacks and asking deeper questions about whether they’re safe and how they’re processed … and manufacturers should take heed.

“We’re seeing a push to prioritize natural and sustainable ingredients, and that often necessitates the removal of artificial flavors, colors, preservatives and additives of that nature,” Howie said. “But it’s not as simple as just swapping one ingredient for another. It’s more about rethinking the structure, function and relationship of those ingredients.”

While the push is at the forefront of product development now, the trend has been gaining momentum for several years.

For instance, Houston-based The Sola Co. reformulated its breads, buns and

bagels in 2023 to become keto-certified and free of saturated fats, artificial flavors, colors and preservatives. Sola relies on an all-natural preservative system to maintain taste while naturally extending shelf life. Reformulating allowed the bread manufacturer to expand into natural and organic channels.

Label cleanup is the name of the game right now. Baking companies are seeking resources to do so, whether it’s replacements for DATEM, L-cysteine, mono- and diglycerides, or label-friendly alternatives to sodium stearoyl lactylate.

There’s one word consumers will surely recognize — and accept — in their foods: fermentation.

According to Precedence Research, the global fermented foods market size accounted for $247 billion in 2024 and is expected to increase to almost $395 billion by 2034, with the fermented

confectionery and bakery products segment expected to grow at the fastest rate during this forecast period.

For bakers, this means there’s white space to experiment with recipes and integrate fermented ingredients into their portfolios. And, with consumer demand for clean labels reaching a near fever pitch, there’s room for the use of these ingredients beyond bread. Pastries, fillings and doughs can also serve as vessels for experimentation, and brands can introduce new flavors and packaging formats to make fermented foods even more accessible and appealing to a wider range of shoppers.

“It helps that consumers know yeast, they know fermentation, and they know some of those aspects up front,” Dr. Cropper said. “It’s not as big a challenge to overcome when the ingredients on the package appear friendly to the consumer.”

Hand-in-hand with fermentation are enzyme technologies, and, according to Jason Tucker, Industrial Pilot Bakery supervisor for Puratos USA, they’re the future.

“As bakers clean up their ingredient lists, enzymes are going to become the heavy hitter from a formulation standpoint,” he said. “Whether it’s from the shelf-life perspective or the dough-strengthening perspective, enzymes can do almost anything bakers need them to do in a formula.”

Puratos recently launched its Industrial Pilot Bakery, powered by AMF Bakery Systems, to accelerate product development from concept to commercialization. The facility combines AMF’s bakery equipment and integrated automation solutions with Puratos’ ingredient knowhow and recipe formulation for quicker speed-to-market.

After all, time isn’t on the baker’s side when changing up the ingredient deck in today’s regulatory uncertainty, especially when a reformulation isn’t necessarily by choice. Bakers have been reading the tea leaves on red dye, but legislation these days seems to be changing faster than consumers change their minds.

Take the FDA’s recent regulation on food coloring and synthetic dyes, for example. That may have left some R&D teams in a scramble. In either the worst- or best-case scenario, success comes down to having a playbook that outlines ingredient analysis in advance. This enables R&D to complete easier and quicker replacements that build on past projects for future applications.

“Stay close to your procurement department so you’re constantly forward-looking about new technologies,” said Jeff Gholson, senior VP of procurement at Minneapolis-based Rise Baking Co., during the International Dairy Deli Bakery Association’s Quarterly Bakery Commodities Update, August 2025 webinar. “Have a complete look at the supply chain, and not just in North America or around your own manufacturing plants, but the full supply chain. Talk to vendors — past, current or even new ones — and have those conversations well ahead of time and don’t wait until it’s the eleventh hour.”

Supply chain shifts and the subsequent rising costs are another driver for reformulation. There was some relief from the post-COVID supply chain disruption, but with avian flu outbreaks and continued inflationary pressures, prices of eggs and cocoa have soared, and this volatility has led commercial bakers on a prompt hunt for a solution.

“The easier choice would be to adjust the consumer price higher, but there will be resistance from a producer to do so, and this is where our R&D teams are involved,” said Karim Houssenbhay, R&D director of sweet goods for Puratos. “We’re constantly scouting for alternative solutions to replace eggs. We often need to be very inventive, finding other functional replacements like enzymes or proteins to reduce or replace the very costly ingredient.”

Of course, a viable reformulation requires cross-functionality at every level. Changing a formula is about more than just ingredients and how they work together. It’s also about how a reformulated product runs through the machines as well. Testing at scale is a necessity that’s not always feasible in the reality of a bakery’s operation.

“Oftentimes at the plant level — especially when you’re looking at large bread and bun manufacturers — they’re mixing 1,000 to 1,500 pounds of flour at a time,” Tucker said. “The mixer we have in this space mixes 100 pounds, at minimum. That means we can run 15 test doughs before generating the same amount of product as a standard industrial mixer. Being flexible with small batches gives us more room to test, fail and optimize in the same amount of time and consumption that you’d have in a single mix at a plant level.”

At the end of the day, the mark of success is entirely dependent on the consumer.

“The true test of reformulation is whether the consumer still accepts it — not just at first bite but also long term,” Howie said. “This is where consumer perception and brand equity come into play, and food scientists need to close the gap between what’s

“Have a complete look at the supply chain ... Talk to vendors — past, current or even new ones — and have those conversations well ahead of time and don’t wait until it’s the eleventh hour.”

Jeff Gholson | senior VP of procurement | Rise Baking Co.

technically acceptable and what’s emotionally satisfying to the consumer. In this industry, we’re creating products that don’t just function but also resonate. That gives us a seat at the strategic table and allows us to assist in driving long-term brand loyalty.”

Reformulation today isn’t just a technical task. It sits at the crossroads of changing legislation, supply chain shifts, consumer trends and brand identity, and the future of baking relies on collaboration across the board. By crafting an ingredient playbook, defining proactive and clear goals, and maintaining consistent communication between all parties, the product reformulation waters are ready for smooth sailing. CB

IBIE 2025 hit home for a changing industry.

BY JOANIE SPENCER

It’s the largest, most comprehensive bakery tradeshow in the Western Hemisphere: the triennial International Baking Industry Exposition (IBIE). And Sept. 13-17 at the Las Vegas Convention Center, IBIE lived up to that reputation.

After a successful post-COVID show in 2022, the event had big shoes to fill, not to mention economic and geopolitical headwinds to face. But, in terms of exhibitor space, education programming and overall excitement, IBIE 2025 not only filled those shoes, but it also exceeded the previous show cycle’s recordsetting exhibition and IBIEducate lineup. From 451,000 square feet of sold-out exhibit space ho using more than 1,000 exhibitors (including 486 new) to more than 250 education sessions and hands-on demos, the Baking Expo provided a well-rounded experience for bakers, suppliers and industry allieds.

“When I was talking to our members, the sentiment was the same,” said Kerwin Brown, president and CEO of BEMA, which co-owns IBIE with the American Bakers Association (ABA). “The size and breadth of the show — from the smallest companies to the biggest global entities — brought an energy that felt like this was the Super Bowl for our industry. I’ve been to IBIE 10 times, and this year it was more evident than ever that the Baking Expo is the place to be. The energy, excitement and variety of attendees at IBIE always attracts, serves — and paves the way forward for — every segment of our industry.”

IBIEducate reached new heights by not only expanding the number of sessions but also diversifying its accessibility. Education was available in classrooms throughout the convention center, as well as areas throughout the North and West Halls. Additionally, IBIE introduced Wordly, a downloadable real-time translation service accessible via QR code that offered 64 language choices.

96 countries were represented at IBIE, including 27 official delegations.

Source: IBIE

“This year’s IBIEducate was by far the most comprehensive and curated program we’ve ever had,” Brown said. “It was available in classrooms, on stages, in demo spaces … we took it to where the people were. We put in more work than ever before, and the result was value for everyone who participated.”

From the global perspective, IBIE welcomed attendees from 96 countries, including 27 official delegations and a concentration of international buyers from the Americas, led by Mexico, Canada, Brazil, Guatemala, Colombia and Peru. Additionally, IBIE emphasized global needs that the North American baking industry serves.

Corbion celebrated the 10th anniversary of The Women’s Bakery, a social enterprise bakery in East Africa formed to help women build professional skills and earn stable incomes by creating bread and other baked goods for local customers and schoolchildren. In the past few years, The Women’s Bakery also launched the One Bread Project, the school snack program developed to reduce malnutrition among students in areas the bakery serves. In 2024, The Women’s Bakery partnered with 65 schools, resulting in an 86% decline in dropout rates. Corbion has been a corporate sponsor of The Women’s Bakery for nearly a decade.

Plus, an ABA-sponsored presentation about food security solutions showcased the partnership between Lesaffre/Red Star Yeast and So They Can, a global organization dedicated to ending ch ildhood poverty in Africa through increased education for chi ldren. During the show, Emily Whitehouse, So They Can pa rtnerships manager, was also present in the Le saffre booth to help IBIE attendees learn more about the

group’s mission and how it’s working with Lesaffre/Red Star Yeast.

Baking competitions also had a global spotlight at the show, with the World Bread Awards USA returning to IBIE, along with the Coupe du Monde de la Boulangerie – Americas Selection, for which Team Canada and Team USA took first and second place, respectively. A newcomer to the Baking Expo, the Americas selection of the Panettone World Cup named winners from USA and Canada in the traditional category, as well as competitors from Ecuador and USA taking top honors in the chocolate category.

Meanwhile, the 20th edition of the Pillsbury Creative Cake Decorating Competition hosted six teams that competed across four categories — Wedding Cake, Rolled Fondant, Sculpted Cake and Buttercream — in the North Hall.

Also in the North Hall, the Retail Bakers of America (RBA) — supporting partner of IBIE — showcased the RBA Bakers Center with live demos, competitions and inspiring stories from leading bakers, pastry chefs and cake artists.

“The camaraderie, passion and knowledge-sharing at the show were truly palpable,” said Amie Smith, IBIE committee member and RBA president. “The event fosters generosity in sharing expertise and creating lasting connections. At its core, IBIE sets the gold standard for education and top-notch talent presenting at the RBA Retail Bakers Center.”

Despite a year full of economic and political uncertainty, IBIE proved to be impactful for all who entered its halls. Although individual registration took a

91%

of IBIE attendees identified as purchasing decisionmakers or influential in the process.

Source: IBIE

slight dip — down 8% from the 2022 show — the number of baking companies represented was 5% higher than pre-pandemic show cycles.

“Experiencing my first IBIE was truly remarkable,” said Eric Dell, ABA president and CEO, who joined the association in 2023. “IBIE is much more than a tradeshow. It’s the premier forum where innovation, education and global collaboration come together to shape the future of baking. IBIE reaffirmed ABA’s vital role in advocating on behalf of baking manufacturing. I was especially glad to see our supplier and baker members connect in meaningful ways, strengthening the partnerships that move our industry forward. The energy throughout the show demonstrated why IBIE is essential to inspiring innovation and advancing the baking sector.” CB

For the full suite of written and multi media coverage from the Baking Expo, visit www.commercialbaking.com/ibie

COMMITTED PARTNER

BY BETH DAY

While bagels remain a breakfast favorite, they have also evolved into a customizable snack or anytime meal.

The overall bagel category reported more than $2 billion in sales, according to Circana sales figures for the latest 52 weeks ending July 13, 2025. Producers are expanding offerings to include artisanal styles, enhanced flavors and healthy ingredient claims to satisfy diverse consumer preferences.

“Bagel manufacturers are introducing more profiles that emulate some of the more popular flavors across other bakery categories,” said Dawn Aho, principal of client insights, bakery vertical at Circana.

“Additionally, Circana’s National Eating Trends has shown that bagels are one of the bread types to increase their share of sandwich carrier frequency over the past four years.”

Center store bagels posted more than $1.6 billion in sales, a -1.5% decline vs. the same period a year ago, according to Circana. Unit sales are stagnant, reporting a 0.4% uptick. Despite dips, Aho observed some growth among top brands, potentially fueled by the inclusion of functional claims.

“Top performers for center store bagels with increased dollar sales feature products with health claims that may be driving growth,” Aho said. “These brands highlight use of real ingredients and functional attributes, such as organic, low carb, high protein and whole grain.”

Total US - Multi Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military and Select

Beauty & Online Retailers) | Latest 52 Weeks Ending July 13, 2025

&

Source: Circana Omnimarket Integrated Fresh, a Chicago-based Market Research Firm (@WeAreCircana)

Among the top five brands, Aho noted that sales of Horsham, PA-based Bimbo Bakeries USA (BBU)’s Thomas’ Bagels brand were the highest by more than twice the next brand. Private label bagels and those from Thomasville, GA-based Flowers Foods’ Dave’s Killer Bread showed both dollar and unit growth. Both Thomas’ and Dave’s Killer Bread offer bagels with healthy ingredient claims.

“Thomas’ Bagels recently introduced two high-protein, 4-count products, inc luding plain and everything profiles,” Aho said. “Dave’s Killer Bread bagels are all organic, made with no high fructose corn syrup, artificial ingredients or preservatives, and feature protein and whole grain claims on the label.”

Other center-store brands among the top 10 that feature functional bagels and that are showing growth include Denver-based Einstein Bros. and Houston-based The Sola Co. Einstein Bros. offers an ancient grain bagel made with quinoa and chia seeds to boost protein and fiber. Similarly, The Sola Co. leverages functional trends, not only with added protein and fiber but by also touting low-carb and low-glycemic traits.

“These product attributes are becoming more important to consumers as they look for specific ingredients, functional benefits and products with pac kaging that identifies all of the above,” Aho added.

Bagel producers must keep pace with evolving tastes and preferences. Relative to perimeter offerings, center store bagels provide more variety for consumers across a spectrum of attributes. Mixing it up with seasonal flavor profiles is a potential growth strategy.

“Center store bagel manufacturers that introduced seasonal flavors like cranberry and pumpkin spice or expanded portfolios to include additional flavors such as the everything spices, blueberry and cheese varieties, have reported sales increases on a UPC level versus a year ago,” Aho said. “Mini bagels and bagel thins also have devoted fans, and many producers leverage mini bagel offerings, including kid-friendly flavors like chocolate chip.”

Featuring different pack sizes resonates with consumers with varying needs. Aho pointed out that some producers have downsized from five or six bagels per package to four or five bagels, which allows for potential manufacturing savings while holding prices fairly steady.

Perimeter bagels not only hold a small market share but also aren’t showing much growth. They include both fixed weight and random weight items. The random weight or bulk bin choices in perimeter appeal to boomers, as they allow them to purchase just the right amount for their needs.

“Perimeter bagels have fewer flavor choices and no mini bagel options,” Aho said. “Additionally, there are no products highlighting those health attributes like organic, low carb or clean ingredients, which are driving growth in center store.”

When grocery budgets are challenged, many consumers trade down to save money by purchasing private label products. Over the last year, Circana shared thought leadership that has shown many categories, including bakery and center store bagels, are experiencing a bifurcation of consumer purchase behavior, where both private label and premium brands are winning at the expense of mainstream brands.

Center Store vs. Perimeter Bagels % Change vs. a Year Ago

It’s where we began. For the past century, Brolite has created a variety of naturally fermented cultured flavors. Designed to give bakers a handcrafted taste in no time, these flavors are a great addition to any formula.

Our sours range from strong and pungent to sublte and delicate flavors giving the baker an exact flavor profile needed. Brolite ferments various flours for specific amounts of time, then dehydrates the custom flavor before it is finally milled into a fine, easily handled, free-flowing powder.

Unique artisan flavors made easy for any baker and any baking application.

“Private label and some premium quality and priced brands, including Dave’s Killer Bread and The Sola Co. are showing growth at the expense of Thomas’, Sara Lee, Pepperidge Farm and Franz,” Aho explained. “Private label bagels in center store represent a little over 21 percent of dollar sales and have gained over a share point versus a year ago, which could indicate consumers are balancing their bagel purchases with private label, mainstream and perceived premium options over time.”