In a dynamic global marketplace, perspective is critical to success. Baird offers industry-leading investment research on over 750 stocks and across 40 industry verticals. We also provide access to award-winning macroeconomic and government policy analysis. All to ensure you have the insights you need to make informed decisions.

4 Leading Edge

4 NOW BY THE NUMBERS

5 BIZ LUNCH – FITZY’S CAFE

6 JUMP START - LOTZA

7 PUBLIC RECORD BIZ TRACKER

8 WISCONSIN 275 – Sheldon Lubar

9 FRESH DIGS –Annex Wealth Management

11 WHO’S ON THE BOARD? –Enerpac Tool Group BIZ POLL

12 Biz News

24 M&A: Big Deals

Coverage includes a recap of the largest mergers and acquisitions deals in southeastern Wisconsin during the past year, a report on how buyers and sellers can get a deal done in the current economic environment, and a preview of BizTimes Media’s annual M&A Forum

12 SHOP TALK – Training Within Industry

14 ThriveOn King project nearing completion

16 Real Estate

58 Meet the Notable Commercial Banking Leaders

64 Strategies

64 M&A - Mike Malatesta

65 TECHNOLOGY - Nicole Schmidt

66 MANAGEMENT - Susan Wehrley

67 TIP SHEET

69 Biz Connections

69 PAY IT FORWARD – Jim Wozniak, RBC Wealth Management

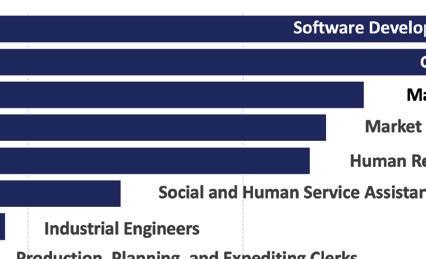

32 Workforce and Professional Development

70 GLANCE AT YESTERYEAR COMMENTARY

Coverage includes a report about how upskilling programs are attracting business and tech professionals as employers seek job candidates with AI and communication skills; and a look at recent efforts to strengthen the hospitality talent pipeline in Milwaukee.

71 5 MINUTES WITH…Gregory León, Amilinda chef and owner

Enerpac Tool Group, a global manufacturer currently based in Menomonee Falls, is planning to move its corporate headquarters to downtown Milwaukee.

The company will occupy 56,000 square feet of office space on the fourth floor of the ASQ Center building at 648 N. Plank-

inton Ave. As part of the deal, the building will be renamed the Enerpac Center.

About 130 employees will be making the move to Enerpac’s downtown Milwaukee headquarters, according to a company spokesperson. The company plans to make the move in late 2024 or

early 2025, after the buildout of its space is complete.

“We are incredibly excited about this move, as the new space will better accommodate our local workforce and enable Enerpac to better retain and attract top local talent,” said Paul Sternlieb, president and chief executive officer of Enerpac, in a press release. “Our new global headquarters will offer a dynamic and inspiring workplace to spur strong collaboration and drive innovation.”

Founded in 1910, Enerpac is a manufacturer of industrial tools, producing more than 50,000 products, including cylinders/jacks, pumps, bolting tools, presses, pullers and heavy lifting technology. The company had nearly $600 million in net sales and $53.6 million in net earnings in its 2023 fiscal year.

Enerpac employs about 2,100 people globally, with 28 facilities in 22 countries, according to its website. Approximately 130 of the company’s employees are based in the greater Milwaukee area and work in company management, engineering, finance, information technology, human resources and other roles supporting its global industrial tools and services business.

Enerpac’s headquarters is currently located in an 81,500-squarefoot office building at N86 W12500 Westbrook Crossing in

Menomonee Falls. That building was built by Wauwatosa-based Irgens Partners in 2011 for Enerpac, then called Actuant Corp. Irgens, which was also involved in the redevelopment of the ASQ Center, sold the Menomonee Falls Actuant building in 2014. Actuant rebranded as Enerpac in 2019.

Enerpac joins a growing number of companies that have moved to or added office locations in or near downtown Milwaukee in recent years, including Fiserv, Milwaukee Tool, Rite-Hite, Twin Disc, Regal Rexnord and Church Mutual.

Earlier this year, Charlotte, North Carolina-based Allspring Global Investments announced that it will move 300 employees from Menomonee Falls to the Historic Third Ward, just south of downtown Milwaukee.

Also, Northwestern Mutual is in the middle of a 540,000-squarefoot, $500 million renovation of one of its existing downtown office buildings and will close its Franklin campus, moving those employees downtown.

“Milwaukee continues to be an attractive place for growing companies with our amenities, our activities, and our concentration of vibrant businesses,” Milwaukee Mayor Cavalier Johnson said in a news release. “My administration looks forward to working with all companies looking to relocate here.”

ADDRESS:

424 E. Silver Spring Drive, Whitefish Bay

WEBSITE:

fitzyscafe.com

CUISINE:

Bistro-style cafe

CHEF:

Kay Dieterman

MOOD:

Modernized luncheonette with a warm, friendly atmosphere

PRICING: $11-19

Modern taste meets local tradition at the new Fitzy’s Cafe on metro Milwaukee’s North Shore.

The craft coffee bar and bistro-style eatery opened late last year within the historic Fitzgerald Pharmacy, featuring a chef-curated, all-day menu of made-to-order salads, sandwiches and lighter fare made with locally sourced and organic ingredients.

Fitzy’s – named after the endearment given to the original pharmacy, which closed in 2019 after 65 years in business and was revived by new ownership shortly thereafter – leans into the nostalgia of a mid-century drugstore luncheonette while appealing to the ever-evolving expectations of modern-day consumers, whether they’re shopping for the latest health and wellness product or looking for a place to meet over lunch.

“We really felt the responsibility to bring this back to the community. Not just bring it back, but bring it back better than it’s ever been,” said Tamir Kaloti, president of Milwaukee-based Hayat Pharmacy, which purchased and reopened Fitzgerald Pharmacy in fall 2022.

3

1 2 3

Fitzy’s is set in a bright, airy space where diners can sit at the counter or at a table – or take their order to go.

LOCATION:

Menomonee Falls

FOUNDERS:

Laura Markz

FOUNDED:

2023

SERVICE:

Beverage manufacturer

WEBSITE:

getlotza.com

EMPLOYEES:

1

GOAL:

Achieve $400 million in sales within five years

EXPERIENCE:

Digital marketing and consulting

AS THE POPULARITY of non-alcoholic and low-ABV beverage options continues to rise, Menomonee Falls-based startup Lotza is looking to carve out its own space within the alternative beverage market.

Company founder Laura Markz has created what she believes to be the world’s first “goodfor-you” drink mixer that not only protects the body against the negative effects of alcohol, but also provides additional health benefits.

Designed to be mixed as a cocktail or consumed on its own as a mocktail, Lotza contains mood-boosting adaptogens and plant-based nutrients to support liver health and next-day recovery. The carbonated beverage is currently

available in three flavors: lemon hibiscus, watermelon cucumber and wild berry mint.

“The whole goal as a business for Lotza, my ‘why’ behind everything, is to help protect people from the damaging effects of alcohol,” said Markz, who launched the startup in February 2023.

Markz is a Marquette University graduate who began her professional journey at advertising agency Laughlin Constable. She quickly climbed the ladder to become vice president of digital strategy but ended up leaving the corporate world after suffering from a severe medical emergency during childbirth. After a stint as a consultant and later working for a colleague’s air purification business, which ended up shutting down, Markz made the decision to start her own company.

The idea of creating a beverage that can be enjoyed in social settings by drinkers of all preferences had always been a half-formed concept in the back of Markz’s head.

“Being with your friends and having a beverage that can be enjoyed equally by people who consume alcohol and people who don’t was really important to me,” she said.

Lotza has a two-pronged approach to how it can help protect consumers from the damaging effects of alcohol. Working with a medical advisory team, Markz perfected a formula that includes vitamins, antioxidants and adaptogens, such as holy basil and rhodiola, which have been shown to naturally lower stress levels and increase energy.

“The adaptogens can either be a supplement to alcohol or a replacement to alcohol, to give you that fun feeling without actually being intoxicated,” said Markz.

The second piece of Lotza’s health-centric approach is DHM, a plant-derived supplement that can help counteract the effects of alcohol. It also has antioxidant and anti-inflammatory properties.

“A lot of the big brands think if you consume alcohol, you must not care about your health,” said Markz. “I think that’s a total farce.”

The goal is to achieve $400 million in sales within the first five years of business and Markz has laid out an aggressive growth strategy to reach that milestone. Lotza was recently named a semifinalist in the annual Governor’s Business Plan Contest.

The latest area economic data.

A total of 439,354 passengers used Milwaukee Mitchell International Airport in January, a 5.5% increase year-over-year.

Wisconsin’s seasonally adjusted unemployment rate is 3.2%.

Home sales in the four-county metro Milwaukee area rose 4.3%

in January, year-over-year, to 848, but the average home sale price fell 2.2% to $328,745.

Statewide, single-family homebuilding activity

rose 2.9% in 2023 with a total of 11,657 permits pulled.

Wisconsin businesses exported $29.9 billion in goods in 2023, a 2.6% increase

from 2022. The state imported $39.3 billion in goods in 2023, a decrease of 4.4% from the prior year.

On April 2, Milwaukee Public Schools will ask voters to approve a referendum allowing the district to exceed revenue limits by $252 million on a recurring basis.

MPS is not alone in Wisconsin in asking voters to support more funding. According to the state Department of Public Instruction, between the February and April elections there are:

• 21 other recurring revenue referendums totaling more than $85 million. If approved, districts are able to increase the base of their tax levy moving forward.

• 42 non-recurring revenue referendums totaling $331 million. If approved, districts can increase their tax levy for specified years.

• 30 debt issuance referendums totaling $800 million. These referendums often relate to specific building expansion or renovation projects.

In placing the question on the ballot, MPS pointed to the lack of inflation adjustments in revenue limits. The district estimated that if limits kept pace with inflation, MPS would have access to $210 million in additional funding per year.

Without the additional funding, the district says it would need to consider eliminating positions, freezing salaries, increasing the employee share of benefit cots, consolidating schools, eliminating specialty programs, reducing mental health supports and reducing funding to schools. The district’s financial estimates project a cumulative budget shortfall of $252 million by its 2028 fiscal year.

The biggest drivers of the shortfall are forecasted increases in salary and benefit costs of 4.3% and 5.3%, respectively, on average annually and an average decrease in overall revenues of around 1.2% per year.

Critics, including the Metropolitan Milwaukee Association of Commerce and Northwestern Mutual chairman and chief executive officer John Schlifske, have argued there is not a clear plan of how additional funding for MPS will translate to improved student achievement while also pushing property taxes higher.

MPS estimates the referendum would increase its tax rate by around $2.16 per $1,000 of equalized value for the next budget year, pushing the district’s property tax rate to around $10.10 per $1,000.

District officials also pointed out a growing number of Wisconsin school districts are turning to referendums for help with their finances. More than 20 recurring referendum questions have been on the ballot in every even year election cycle since 2016 in the state.

Here’s a look at the number of recurring revenue referendums in the state per year since 2009, along with the amount of funding approved or rejected:

Chairman and founder Lubar & Co. MILWAUKEE

This Q&A is an extended profile from Wisconsin 275, a special publication from BizTimes Media highlighting the most influential business leaders in the state. Visit: biztimes.com/wisconsin275 for more.

Education:

Bachelor’s and J.D., UW-Madison

What was your first job and what did you learn from it?

“Marine National Exchange Bank. I learned everything about banking: estate planning, lending, investing and management.”

What piece of advice has had the most significant impact on your career?

“Don’t let go of one trapeze until you have a firm hand on the other.”

If you could have dinner with any two business leaders, who would you choose and why?

“Warren Buffet, he is the best investor in America. David Rubenstein, he says he knows who the best investors in America are.”

What are some of your favorite destinations or places to visit?

“Aspen, Colorado; Switzerland; our home in River Hills.”

What is one book you think everyone should read and why?

“’Jews, God and History,’ by Max I. Dimont. Because of the importance of understanding the broadest sector of the world’s population.”

Lubar is founder and chairman of Lubar & Co., a family-owned, Milwaukee-based private investment and wealth management office. He was chairman and chief executive officer of the Christiana Companies Inc. until its merger with Weatherford International in 1999 and chairman of Total Logistics Inc. until its acquisition in 2005 by SuperValu Inc. He has held federal governmental appointments under presidents Carter, Nixon and Ford, and served as president of the University of Wisconsin System Board of Regents. His $10 million gift to the University of Wisconsin-Milwaukee established the Lubar School for Entrepreneurship, and its home, the Lubar Entrepreneurship Center. He also co-founded and served as president of the Wisconsin Policy Research Institute.

What’s your hobby or passion?

“Sports: swimming, skiing (formerly), mountain climbing, and now reading.”

What is your favorite Wisconsin restaurant and what do you order there?

“I don’t like restaurants. I prefer my wife’s cooking. Second choice, Milwaukee Country Club.”

What would people be surprised to learn about you? “Nothing. I am an open book that sometimes does the unexpected.”

What was your first car?

“The Ford my wife drove when we were married.”

If you could take a one-year sabbatical, what would you do?

“We already did it. Our family (four children, Marianne and me) moved to Switzerland for one year and traveled the world.”

What’s the toughest business challenge you’ve had to overcome?

“Financing my first acquisition.”

What advice would you give to a young professional?

“1. Buy a home and, with your spouse, fill it with children. 2. Always tell the truth. 3. Money is no objective. All you need is enough.”

What would make Wisconsin better?

“Very low college tuition.”

As you enter your office, what would you choose to be your walk-up or theme song and why?

“’On Wisconsin’ because it is the best in most respects.” Is there a nonprofit cause that has special meaning to you?

“Education. Knowledge is the pathway to success and a better life.”

What is the biggest risk you have ever taken?

“My first acquisition that I did on my own.”

Top of your bucket list:

“Living past 100.”

What has you most excited about the future?

“Everything.”

OWNER: Sentinel Real Estate Corp.

ARCHITECT: GROTH Design Group

CONTRACTOR: Venture Construction Group

COSTS: Undisclosed

COMPLETED: January 2024

ANNEX WEALTH MANAGEMENT in January moved into its new Brookfield headquarters along I-94 at 17950 W. Corporate Drive. Although it wasn’t a long-distance move — about four miles from its former Elm Grove office — the major differences are in the physical space.

At 45,000 square feet, the firm’s new office is significantly larger than its old one and has room for the company to grow as Annex plans to double in size by 2026, according to chief growth officer Mark Beck.

The new headquarters has more meeting rooms for client reviews and more working space for its growing team. The space includes a variety of meeting spaces including a cafe and couches for in-

formal meetings and private rooms with enhanced AV capabilities to accommodate remote partners.

For a client-facing company, the office is split between client space and workspace.

“Employees know when they’re entering the client zone: it’s a professional demeanor, you’re going to interact with clients,” Beck said.

Annex’s new headquarters also features expanded content creation spaces for the company’s five talk radio shows among other creative endeavors.

“Our guests come in and they love seeing the radio room and production, so we made sure to have windows there so everyone can see how that workflow happens,” said events manager Bonnie Hittman.

$7,500,000 Equipment Financing

Experienced. Capable. Responsive. All things you expect from your banking partner when navigating complex tranactions in a rapidly changing marketplace. Ixonia Bank provides an elevated banking experience with tailored and innovative financing solutions that will exceed your expectations.

$6,600,000 Refinance Working Capital for Growth

$4,000,000 Working Capital and Equipment Financing

$3,400,000 Acquisition Financing for Industrial Buildings

$2,000,000 Working Capital Financing

$1,300,000 Real Estate Construction

$1,300,000 Acquisition Financing

$1,200,000 Acquisition of Medical Facility

$700,000 Equipment Financing

$350,000 Working Capital Financing

$720,000 Industrial Real Estate Financing for Growth

Dennis

• Paul Sternlieb, president and CEO of Enerpac Tool Group

• Jim Ferland, retired chairman and CEO of Babcock & Wilcox Enterprises Inc.

• Alfredo Altavilla, former executive chairman of ITA Airways

• Judy Altmaier, former president of Exmark Manufacturing Co.

• Palmer Clarkson, former president and CEO of Bridgestone HosePower LLC

• Danny Cunningham, retired partner and former chief risk officer of Deloitte & Touche LLP

• Colleen Healy, former chief financial officer and principal accounting officer of SailPoint Technologies Holdings Inc.

• Richard Holder, president and CEO of HZO Inc.

• Lynn Minella, former executive vice president and chief human resources officer of Johnson Controls

• Sidney Simmons, attorney and founder of Sidney Simmons Law

GOOD WORKERS are hard to find. They’re even harder to train when they are new on the job. Factor in the influx of Baby Boomers continuing to retire from the workforce over the next several years, and you’re left with a growing knowledge gap on the shop floor.

That’s where “Training Within Industry” programs enter the picture. Often described as a hands-on method of training and coaching for supervisors, team leaders and workers, TWI was first introduced by the United States Department of War in 1940 to meet the high demand for wartime materials from a less experienced workforce. The training method gained traction in Japan after being introduced at the end of World War II and was most notably embraced by Toyota, becoming a cornerstone of the company’s team leader training that’s still used today.

In the U.S., TWI has seen a resurgence in popularity that started about a decade ago, according to Jay Jochman, a certified TWI trainer and consultant with Madison-based WMEP Manufacturing Solutions.

“Most people just don’t have any type of training or skills related to teaching others,” said Jochman. “So, (TWI) gives them an approach that they can take to fill that gap.”

A TWI program is typically broken into four training modules:

job instruction, job relations, improving methods, and improving safety. Most manufacturers opt to start with either the job instruction module, which standardizes a method for instructing employees, or the job relation module, which deals with building company culture and how to treat employees.

Regardless of what module a company starts with, what makes TWI successful is the standardization of the process, said Jochman. For example, if a company wants to train a new employee on a CNC machine, they will follow stepby-step instructions outlined on what’s known as a job breakdown sheet. In addition to key steps, the sheet explains why a job is done a certain way and provides trainers with steps for putting their trainees at ease during the process.

“(TWI is) really focused on coming up with a standard process, sticking to that process, and by doing that, business owners reduce variation within their organizations,” said Jochman.

For Mark Sarder, chief executive officer of Delavan-based MicroPrecision, the decision to begin implementing a TWI program came after the company welcomed a new chief operating officer who was already familiar with the training method. Before that, the company “fumbled along” with its training process.

“It was more like you hand a document to a trainee, say ‘here are your work instructions’ and

‘good luck,’” Sarder said.

After hiring a consultant last June, MicroPrecision began the TWI training process by first bringing in managers to familiarize themselves with the method. Then, company leadership needed to identify which employees would be the best fit to take on a role as a trainer. It’s key to make sure these positions are completely voluntary, said Sarder. Three employees eventually volunteered for the first round of training and later hosted a town hall to showcase the TWI method to their peers.

“They just did a simple training instruction, and it was very impactful,” said Sarder. “I think on the other side of it, we had a lot more people wishing they volunteered.”

Introducing a TWI program can also encourage positive employee relations between departments that might not typically interact with one another. Groups of MicroPrecision employees that might not have known each other at one point in time were suddenly working in training sessions together.

“It just creates this overall bonding within the whole organization,” said Sarder. “It’s this idea that … the whole business owns the program.”

While it’s too soon to tell if MicroPrecision’s employee retention rates have improved following the introduction of its TWI program last June, Sarder said some of the initial feedback he’s received from

• Start with a commitment from company leadership to complete the training.

• When looking to identify potential trainers within the company, select employees who willingly volunteer. This will create a sense of goodwill and commitment.

• Show your employees you’re fully dedicated to the TWI learning process. Perhaps consider slowing down, or even shutting down operations temporarily to showcase what the TWI training method looks like.

• Job breakdown sheets aren’t set in stone. As workers discover better ways to do things, sheets should be adjusted accordingly.

employees has been promising. Typically, companies can expect to dedicate between 40 and 60 hours of time for initial TWI training.

“We’re still in the early stages of this, but we believe it’s working just because of the response we’re getting and the interactions that we’re getting between employees, which I think are all positive,” said Sarder.

Presents: APRIL 17, 2024

Brookfield Conference Center

Agenda:

2:00 PM - 2:30 PM - Networking & Registration

2:30 PM - 3:45 PM - Introductions & Program, Speaker Presentations, Q&A

4:00 PM - 4:45 PM - Breakout Sessions

4:45 PM - 6:15 PM - Networking Reception

Plan to join BizTimes Media and business leaders from around the county and region on April 17th for a closer look at how Waukesha County will evolve in the coming decades in areas like housing, commercial development, workforce training, manufacturing and much more.

Each speaker will share their vision for what Waukesha County will look like in 2050 through the lens of their industry. Each will also address the steps they see as necessary for the county to realize that vision and be a leading county in southeastern Wisconsin and the Midwest.

Panelists:

• Matt Neumann, CEO, Neumann Companies (1)

• Rachel Bahr, President, Xiogenix (2)

• Bill Berrien, CEO/Founder, Pindel Global Precision (3)

• Paul Farrow, Waukesha County Executive (4)

Breakout sessions to follow presentations. The program concludes with a networking reception.

Sponsor: Partner:

Offices for Medical College of Wisconsin, Greater Milwaukee Foundation nearly ready for staff, community spaces to open in May

By Cara Spoto, staff writertraining area will be on view for prospective job seekers.

“Another benefit to having this visible is also reducing the fear and stigma about blood, organ and tissue donation in communities of color. So, this is why it’s very intentionally visible,” said Cydney Key, senior director of guest experience and strategic partnerships for ThriveOn. Key will work on the main floor of the campus to assist partners and members of the public. Walking around that space, she pointed to other areas that will serve the neighborhood, including a future wellness lab.

“We’ll be programming the space with community partners. So, sometimes it might be yoga, meditation, or life skills training,” Key said. “There’s definitely an intentional focus on youth because that was something the community said they needed during visioning sessions. There’s nowhere in the community where they can just focus on their wellness and de-stress.”

IT’S BEEN MORE than 50 years since the former Gimbels and Schuster’s department store building at Garfield Avenue and Dr. Martin Luther King Jr. Drive in Milwaukee has been open to the public, but in just a few months the former neighborhood mainstay will once again become a gathering space.

The ThriveOn King project – a collaboration among Royal Capital Group, the Greater Milwaukee Foundation and the Medical College of Wisconsin – has been in the works for the better part of six years. As renovations wrap up on the commercial side of the 470,000-square-foot redevelopment, representatives say they expect the public-facing spaces, including a 20,000-square-foot gathering area and café on the first floor, to open in May.

The GMF and MCW will begin moving their staff into the building this month. GMF is moving its 70

employees and headquarters from Schlitz Park. MCW will maintain offices for 159 employees at ThriveOn King on a permanent basis and another 135 employees on a temporary basis. GMF will also have public meeting rooms that nonprofits will be able to use on the fourth floor, expanding on a practice the foundation has maintained at Schlitz Park.

Organizations on the first floor – Malaika Early Learning Center, Versiti, and JobsWork MKE – will likely start moving in around the end of April and beginning of May.

In addition, 90 mixed-income apartments being constructed inside the 1917 portion of the former department store are slated to open in late December, said Kevin Newell, president and chief executive officer of Milwaukee-based development firm Royal Capital Group.

The renovation project was designed by Engberg Anderson

Architects and is being constructed by CG Schmidt and JCP Construction.

On a recent afternoon, some of the first-floor spaces were beginning to take shape. A spacious room where shoppers once stood in line to make their purchases or get their picture taken in a photo studio is now subdivided to accommodate its new purposes.

In the back, where Malaika’s will soon open its second childcare location, new changing tables and other nursery items remain covered in plastic to protect them from construction dust.

Nearby, an interior wall cutout indicates where Versiti will hold its training program. The nonprofit blood center and research institution plans to operate a community resource and permanent blood donation center at ThriveOn. As part of the effort, its phlebotomist

While looking out the floorto-ceiling window displays along King Drive and Garfield Avenue, Key discussed the paintings and art installations that are being commissioned for spaces that had up until recently been hidden from the neighborhood’s view. Helping foster a community-focused reuse of the former department store has been rewarding, she said.

“People will say, ‘Oh, I got my first heels from (Schuster’s),’ or ‘I remember shopping there with my mom during the holidays,’” Key said. “I just did a presentation about three weeks ago, and an audience member shared that when they were kids, they would get dropped off on the mezzanine area near where (Malaika will be located). It’s just really cool to hear.”

A $120 million investment, the ThriveOn Collaborative began as a shared effort by GMF, MCW and Royal Capital to catalyze economic development in the Brewers Hill, Halyard Park and Harambee neighborhoods, while also work-

ing to improve social determinants of health, a term used to describe factors like social cohesion, access to healthy food, quality affordable housing, economic opportunity and early childhood education.

The project has been part of a sea change along King Drive that has included new developments such as Pete’s Fruit Market and the Dohmen Company Foundation’s Food for Health program. Dr. Howard Fuller Collegiate Academy’s new high school, which is under construction across the street from ThriveOn, is slated to welcome students this fall. Royal Capital is also the developer of that project.

The GMF’s new Halyard Park headquarters will position the foundation in a neighborhood it seeks to serve, said Ken Robertson, executive vice president and chief financial officer of GMF.

“While we’re not far from this

location currently, there’s something to be said for a community foundation that’s actually in the community – for the community to actually inform how we do the work,” Robertson said.

For MCW, which will be dedicating space at the ThriveOn campus to nine of its community-focused health programs, having a home base in the city’s Bronzeville district will put the medical college in closer proximity to the populations it seeks to serve. The programs include MCW’s Advancing a Healthier Wisconsin, Center for AIDS Intervention Research, the Institute for Health & Equity (Epidemiology), Community Engagement, Cancer Center Outreach, the Comprehensive Injury Center, Center for Advancing Population Science, the Maternal Health Research Center of Excellence and the Health Equity Scholars Program (HESP).

“Being closer to the community allows us to not just identify the opportunity but to begin creative intervention work that allows us to have a different conversation about the disparities,” said Greg Wesley, a co-chair of the ThriveOn Collaboration and senior vice president of strategic alliances and business development for MCW.

Wesley added that co-locating the community-focused programs at ThriveOn will also encourage greater collaboration among those programs. Additionally, MCW students enrolled in the Health Equity Scholars Program – a four-year health equity training track – will have an opportunity to live in the ThriveOn apartments.

Newell, whose company Royal Capital owns the ThriveOn campus, is heartened to see the project near completion,

especially when he considers the difficult economic conditions it has weathered.

“The vision has definitely developed and grown, and we couldn’t be prouder of that, but it also came along with some significant challenges, be it that we were walking right into COVID and then all of the volatility in the financial markets,” Newell said. “So, this is what we call a true labor of love.”

Financing for the apartment project – which will include affordable housing units for families and people 55 and older, as well as market-rate apartments and units dedicated for medical students in HESP – was finalized in February, marking another milestone for the project.

“We’re excited,” Newell said. “Hopefully this is going to be a demonstration of what collaboration can do inside of this community of ours.”

More historic Milwaukee VA buildings to be rehabbed

A MONTH BEFORE his assassination in 1865, President Abraham Lincoln signed legislation to create a national system of homes for disabled veterans. The Milwaukee VA Soldiers Home opened in 1867 as one of the three original homes for wounded veterans in the nation.

The sprawling 90-acre campus on the far west side of Milwaukee has several historic buildings dating back to the 19th century and was designed to be a self-contained village.

As those buildings fell into disrepair, the campus was considered one of the 11 most endangered historic properties in the country in 2011, according to the National Trust for Historic Preservation.

Today, some of the buildings have been restored to serve their original purpose: the service of veterans. That is the result of redevelopments led by The Alexander Co., a Madison-based development firm specializing in historic preservation and urban revitalization. In 2021, the company completed a rehabilitation of six historic buildings on the campus, including the iconic Old Main building.

Now, the firm is tackling rehabilitation of three more buildings on the campus, with a $25 million plan.

Planning and design work is underway to restore the Governor’s Residence, built in 1868 and in service up until recently; the Ward Memorial Theater, built in 1881 and empty for about 40 years; and the Soldiers Home Chapel, built in 1889 and empty for about 30 years.

Under the current proposal, the Ward Memorial Theater building will host community theater and musical groups and offer a destination venue for conferences and lectures for VA Medical Center staff. The Soldiers Home Chapel will become a nondenominational worship space and conference space for training and mental health sessions. The Governor’s Residence will hold offices for supportive services providers and a technological training center to provide computer literacy training.

The Alexander Co. is planning to start construction in April of 2025 to complete all three buildings by late 2026.

That phase of the project will build off the $40 million project of Old Main and five other buildings, which created 101 supportive-housing units for veterans and their families who are homeless or at risk of homelessness. Even before work wrapped up on that project in 2021, there was a waitlist for units, according to Jonathan Beck, development project manager at The Alexander Co.

“And there continues to be a waitlist of veterans wishing to live there,” Beck said. “I remember the first public hearing when the VA announced the first phase at Old Main, a lot of folks showed up and there were questions about what if one day there aren’t any veterans that need this space. The VA said, ‘Unfortunately, that day is never going to come.’”

The Alexander Co. is partnering with the VA on the project. The VA said the second phase will help extend the continuum of care for veterans living on the campus and in the greater Milwaukee area.

“It’s almost difficult to put it into words what this means to us,” said Kendra Bishop, director of business development at The

Alexander Co. “The very nature of our work is preserving history and making sure these buildings are returned to the communities they’re originally built for.”

This work is funded by complicated, and fortuitous, financing packages. Both phases of the Milwaukee VA Soldiers Home redevelopment rely on state and federal historic tax credit programs that came into effect in the early 2010s. For the first phase, developers were able to seize on a 2017 tax reform to create a unique structure of federal low-income housing tax credits. The second phase will also use a significant amount of funding from the PACT Act, which passed in 2022 and provided an influx of funding to the VA.

“Through all these various state and federal programs, we’ve seemed to be in the right place at the right time,” Beck said.

In 2011, the campus became one of 42 national historic landmarks in Wisconsin. Before it secured that protection, ideas had been floated to replace some of the historic buildings, resulting in protests and a multi-year effort led by the Milwaukee Preservation Alliance to save the buildings.

“We know what these buildings mean to the veteran community, and they’ve been waiting for decades to see them come back to life,” Beck said.

A delayed project to build 40 “tiny homes” for homeless veterans and their families on Milwaukee’s northwest side is moving forward again.

Kansas City-based Veterans Community Project Inc. is planning to begin construction this year. The development’s homes would range from 240 to 340 square feet, provided rent-free. A village center would provide social activities as well as case management services. The goal is to help residents become stable and find jobs and new housing.

A Racine-based organization had planned to start work on a similar project on the site in 2021, but those plans didn’t move forward. Veterans Community Project picked up the project in 2022.

SIZE: 40 homes

COST: $11.7 million

ADDRESS: 6767 N. 60th St., Milwaukee

HUNTER TURPIN

HUNTER TURPIN

Reporter

P / 414-336-7121

E / hunter.turpin@biztimes.com

T / @HunterDTurpin

BY ASHLEY SMART, staff writer

BY ASHLEY SMART, staff writer

Growth can be a double-edged sword. Businesses strive to grow and make the most profit possible, but the path to achieving that growth can make intangibles like culture and communication more difficult to successfully maintain.

This is the balancing act Johnson Controls International has been trying to achieve over the past eight years, following its transformative merger with Tyco International in 2016.

Based in Cork, Ireland – with its primary North American operations headquartered in Glendale – the public company designs and produces fire, HVAC and security equipment and digital solutions for buildings across the globe and, 140 years since its founding, remains one of the largest employers in southeastern Wisconsin with nearly 2,000 local employees as of 2022.

On a continuous journey to improve profitability and streamline its portfolio, Johnson Controls is in the midst of a head-to-toe revamp. Some changes, including the recent rollout of a new sales incentive plan, have been met with skepticism – and mounting legal challenges.

“We’ve lost all faith and trust in the company right now,” one longtime sales rep told BizTimes in January, speaking under condition of anonymity, on the detrimental impact of the new sales incentive plan on his personal income. “Our core values are out the window.”

The company’s origins trace back to 1885, when entrepreneur Warren Johnson moved from Whitewater – where he grew up in poverty as the son of farmers – to Milwaukee, in search of financing to build his invention of the earliest version of the electric thermostat. Today, Johnson Controls is an international company with $26.8 billion in annual revenue and more than 100,000 employees in 150 countries.

At the core of Johnson Controls’ ongoing transformation is the evolution of its hardwired, mechanical systems – the products that have long-defined the Johnson Controls name – to a technology-driven approach to maintaining the infrastructure and improving the sustainability of commercial buildings, while helping customers reduce their carbon footprints. The company is on a so-called “digital journey” as it expands its suite of building solutions under its new OpenBlue software platform. Launched in July 2020, OpenBlue stores data from a building’s operating system, including

HVAC, security, fire, power and electrical, and then uses analytics and artificial intelligence to provide facilities managers operational insights into the building’s sustainability and productivity. Currently, less than 10% of Johnson Controls’ services are digital but the company plans to turn that percentage on its head as it works to connect all of its “assets” – a massive footprint of installed equipment and controls – to the OpenBlue platform. The software service is projected to reach a value of $150 million to $200 million, George Oliver, chief executive officer of Johnson Controls, told investors at Citi’s 2024 Global Industrial Tech and Mobility Conference in February.

Through a spokesperson, Johnson Controls declined to speak on the record for this story. Strategic insight referenced throughout this piece was gleaned from Oliver’s remarks at the Citi event, background information provided by the company, earnings call transcripts and SEC filings.

In conjunction with Johnson Controls’ merger with Tyco, the company redomiciled its headquarters to Cork, Ireland, where Tyco was headquartered even though its operational base was in New Jersey. That move saved Johnson Controls $150 million a year in taxes. Johnson Controls has continually made business decisions in support of its long-term goals of evolving into a company focused solely on being a pure building solutions provider. Those decisions have ranged from cost and workforce reductions to several segment divestitures and leadership changes.

When Morningstar analyst Brian Bernard first began covering Johnson Controls nearly eight years ago, he described it as “more of an auto supplier manufacturer.”

“They’re streamlining the business so that its core competency is in the commercial space,” he said. It wasn’t until 2016 that JCI began its transition to a “pure-play building technologies company.”

Adient, an automotive seating business, was spun off in 2016, followed by Scott Safety in 2017 and Johnson Controls’ power solutions business in 2019. Today, that company is known as Clarios, a manufacturer of car batteries.

Getting rid of these business segments and adding Tyco’s fire and security portfolio were instrumental in simplifying Johnson Control’s business proposition for customers.

“It’s more of a holistic product portfolio,” said Bernard. “Sort of a one-stop-shop for decision makers (in the fields of) HVAC and fire and security.”

Simplifying the company’s portfolio is an ongoing process. During the company’s first quarter earnings call in January, Oliver confirmed that Johnson Controls is actively pursuing “strategic alternatives” for some of its non-commercial product lines. And then, a January Bloomberg story broke the news that Johnson Controls is considering the George Oliver

sale of some of its HVAC assets for $5 billion.

“When you look at the non-commercial product lines, they’re excellent businesses, but are they consistent with our strategy over the longer term? That’s why we’re now pursuing the alternatives,” said Oliver. “These are good businesses and there’s an opportunity to be able to create more value for our shareholders.”

Divestitures aren’t the only way Johnson Controls is streamlining operations. Over the past several years, there have been ongoing cost-saving efforts aimed at delivering above-market growth and strong returns to shareholders.

At the time of the merger with Tyco, Oliver, who was previously the CEO of Tyco, said the company was confident it would be able to achieve $650 million in synergies – or the added value generated by an M&A transaction – within three years.

“In addition to the commercial benefits at the customer level, there is also significant value created for both Tyco and Johnson Controls shareholders, through the $650 million of synergies, and the stronger financial profile of the combined compa-

ny,” he said in a May 2016 earnings call.

Of that $650 million projection, $150 million was attributed to tax synergies, $150 million to eliminating corporate headquarters costs and $350 million to operational synergies across both companies.

All told, Johnson Controls achieved more than a billion dollars in synergies from the merger, according to an analyst.

Prior to Tyco, Oliver spent 20 years at General Electric, serving as CEO of several different divisions. Going back to Jack Welch’s time as CEO from 1981-2001, GE has a long track record of cutting both operating costs and headcount. Nate Manning, Johnson Controls’ chief operations officer, global field operations, also spent time at GE before joining the company.

Similar to GE, Johnson Controls has emphasized the importance of cutting operating expenses and adjusting its workforce numbers.

In 2021, the company announced projections of $300 million in savings over the next three years, mostly through consolidation efforts. By then, Johnson Controls had already eliminated roughly 11,500 positions as part of restructuring plans

aimed at accelerating growth and expanding margins in the years immediately following its merger with Tyco.

Johnson Controls is often compared to larger competitors like Honeywell International – which boasts “world-class results and margins,” said Bernard – but has always fallen behind in several key performance metrics.

“These companies are trading at premium multiples and Johnson Controls has lagged behind,” he said. “I think it’s an opportunity.”

Johnson Controls is tapping into the smart building market, which has an estimated value of $150 billion, according to a 2023 Forbes article.

While smart buildings generally focus on balancing cost, efficiency and emissions, Johnson Controls believes the smart buildings of the future will also prioritize improved outcomes and experiences for occupants.

Today’s buildings account for nearly 40% of global greenhouse gas emissions, according to a Johnson Controls report on smart buildings. This means businesses are under increasing pressure to meet net zero goals while improving profits. Rising energy costs and changes to building occupancy patterns due to hybrid work trends are also accelerating the popularity of smart buildings.

Smart building technology can measure energy usage and determine how to balance sustainability with the comfort and wellness of its occupants. This might mean reducing ventilation and heating supplied to vacant or lightly used spaces, and increasing delivery to areas where there are more people.

When a building uses smart technology, it also can identify opportunities to replace fossil fuel-powered equipment with electrically powered equipment, reducing certain emissions.

“As technology evolves, future smart buildings will employ more advanced AI, seamless integration with personal devices, and even digital twins to offer more personalized, secure, and efficient ex-

• September 2016: Johnson Controls and Tyco International complete merger.

• October 2016: Johnson Controls spins off its automotive seating business, Adient.

• June 2017: Johnson Controls opens new China HQ.

• September 2017: Former CEO Alex Molinaroli retires from Johnson Controls 18 months ahead of schedule.

• September 2017: George Oliver is named new CEO of Johnson Controls

• October 2017: Johnson Controls sells its Scott Safety business.

• April 2018: Nancy Berce is named chief information officer after John Repko leaves to pursue other opportunities.

• May 2019: Johnson Controls sells its power solutions business, now known as Clarios.

periences,” according to the report.

A digital twin is a virtual representation of a physical asset, system, or process that can be used to simulate, monitor, and optimize its performance.

The OpenBlue platform allows businesses to do everything from tracking live activity happening within a building to giving employees a way to prebook workspaces virtually. OpenBlue can also intelligently adapt temperature and air quality levels within buildings based on occupancy levels. The platform provides several security features as well, including facial recognition technology.

The suite of apps available through OpenBlue’s Enterprise Manager system pulls data from a company’s OT and IT systems, and from external sources like weather forecasts and utilities. Enterprise Manager continuously scans this data and identifies opportunities to cut energy costs, reduce emissions and improve air quality. It also helps businesses optimize the performance and extend the life of their building’s various internal systems.

Johnson Controls has an advantage over its competitors due to its “huge install base” of equipment and controls that spans over 8 million customers, and its over 25,000 channel partners that help install, service and connect that equipment, according to Johnson Controls’ former chief commercial officer Rodney Clark, who was interviewed by Forbes last February. The OpenBlue platform gives customers a one-stop-shop for managing its building’s physical assets.

“Most of the equipment competitors in the segment focus on a single type of equipment or specialized building automation controls,” said Clark.

As an analyst, Bernard sees OpenBlue as Johnson Controls’ next growth platform. The company’s operational headquarters in Glendale includes a 12,000-square-foot OpenBlue Innovation Center, which hosts customers, prospective customers and other visitors interested in learning more about Johnson Controls’ products and services.

Johnson Controls has also been working to significantly decrease its selling, general and administrative expenses and simplify its IT systems now

that the company relies on OpenBlue as its one operating system.

What’s more, the company is completely changing how it does business across all divisions. Among recent changes was a revised sales incentive plan, rolled out globally in November.

The new plan eradicates a system of backlog payments that were previously due to each salesperson under the previous incentive structure, in which salespeople received a portion of their commission when a project was booked and the remainder of their commission as the project hit key milestones.

This created a backlog of commission payments that salespeople say ranged in size from a little more than $1,000 to upwards of $400,000 per salesperson at the time the new system was unveiled. The new sales plan does away with that commission structure not only moving forward, but also on projects booked prior to Oct. 1, 2023, that had not reached required milestones.

To Oliver and the Johnson Controls executive team, shaking up the way salespeople are incentivized simply comes with the territory of “delivering what we believe is a very different value proposi-

Through Johnson Controls’ OpenBlue platform, facility operators can do everything from remotely adjusting air quality levels to monitoring the live activity happening in the building.

tion” as Johnson Controls develops its new building solutions strategy.

“You’re changing the fundamentals of how that’s delivered, that includes updating sales plans,” Oliver said at the Citi conference. “We’re very competitive in how we attract, retain and develop our people across the board, and this would be in line with the enhanced strategy … the ability to incent what ultimately you’re looking to execute and do it consistently across the board.”

But to many of the 3,000-plus North American salespeople impacted by the new plan – some of whom say they expect a significant decrease in anticipated income – the issue is personal.

Several lawsuits have been filed challenging the legality of the sales incentive plan changes, including one in U.S. District Court for the Eastern District of Wisconsin, three in Michigan and two in New York. More than 20 salespeople have joined the class action lawsuit filed in Wisconsin.

Legal documents show millions of dollars in backlog payments are in question. BizTimes Milwaukee spoke to several Johnson Controls salespeople anonymously about the impact of the new sales incentive plan. On top of personal finance concerns, some expressed fears of possible backlash from the company while others questioned what the changes

• July 2020: Johnson Controls launches its OpenBlue software platform.

• August 2020: Olivier Leonetti is named chief financial officer following the retirement of Brian Stief.

• October 2020: Nate Manning is named president of Building Solutions North America.

• August 2021: Francois Mandeville is named corporate development officer.

• October 2021: Marlon Sullivan is named executive vice president and chief human resources officer following the retirement of Lynn Minella.

• November 2022: Lei Schlitz is named president of Global Products business following the retirement of Jeff Williams.

• April 2023: Julie Brandt is named president of Building Solutions North America.

• April 2023: Nate Manning is named vice president and chief operations officer for global field operations.

• August 2023: Marc Vandiepenbeeck is named president of Europe, Middle East, Africa and Latin America business.

• January 2024: Marc Vandiepenbeeck is named executive vice president and chief financial officer after past CFO Olivier Leonetti leaves company for a new job.

signify for the company’s overall culture.

“There’s a huge cultural shift that’s been happening ever since George Oliver became the CEO,” said one sales rep who’s been with Johnson Controls for a decade and had a backlog of $171,000. “The reason I came here was because a regional vice president recruited me. He became like my dad. He was so good to me and the most ethical people I met were at Johnson Controls.”

In a previously released statement on the legal challenges to the incentive plan, Johnson Controls said it routinely assesses its practices to “best support” the growth and achievements of its employees.

“We modified our sales incentive program to better align with our company strategy to deliver smart, healthy and more sustainable environments for our customers,” according to the statement. “We will continue to assist our sales organization to ensure a seamless transition to our revised competitive model.”

While it isn’t uncommon for employees to file lawsuits against their employers stemming from wage and hour issues, the traction this case has gained from disgruntled Johnson Controls salespeople is unique, according to Summer Murshid, an employment discrimination and class action wage lawyer at Glendale-based Hawks Quindel S.C.

“The level of participation and interest that we have seen from (Johnson Controls) salespeople is astounding,” said Murshid, who represents one of the plaintiffs in the original Wisconsin lawsuit. “I think that level of participation reflects just how surprised people were that JCI would do this.”

Typically, a larger class action lawsuit could draw 12 to 15 plaintiffs. As just one of five lawyers representing plaintiffs for the Wisconsin lawsuit, Murshid said she has talked to approximately seven people a week since the lawsuit surfaced in January, and she is still hearing from additional salespeople from across the country who have expressed interest in joining. In speaking with numerous salespeople, Murshid said she has not heard of any incidents of Johnson Controls retali-

ating against plaintiffs.

While it could take several months – or even years – for this legal battle to play out, there may be lessons to be learned from it in the short term.

“I think fundamentally, the principle that resonates with people is when you promise to pay someone a certain way, you can’t retroactively change that,” said Murshid.

In the long run, Johnson Controls could potentially end up paying more money than the total from the original employee backlogs. In Wisconsin, for example, wage payment and collection laws could require employers to pay the total sum of wages owed, plus 50% of each claim of unpaid wages.

Johnson Controls has officially filed a motion to dismiss the class action lawsuit filed in Wisconsin. This essentially leaves the case in a state of limbo until a judge decides whether to take it.

One key issue Johnson Controls is attempting to resolve is the company’s cash flow conversion. Changes to the sales incentive plan could help address this issue, said Bernard.

In 2023, Johnson Controls generated $1.8 billion in free cash flow, which represented a 76% conversion.

“All other kinds of world-class companies and their peers are closer to 100%,” said Bernard. “And they’ve been less than that. This is one of the things that would cause their working capital to not be at 100%. You’re not getting the revenue but you’re paying your employees.”

He believes Johnson Controls has “really strong” growth prospects and the company’s continuous cost saving measures are something any “world-class company” does if it is well managed.

“Sometimes you see this stuff because a company is struggling or not growing,” said Bernard. “That’s not the problem Johnson Controls is having. I think there are things that are misunderstood about the company and in the long term, it’s going

to work out.”

Johnson Controls has managed to increase its profitability over the past several years, even if some of those increases didn’t quite meet analysts’ expectations.

In 2023, Johnson Controls reported gross profit of $8.9 billion, up from $8.3 billion in 2022, and $8.05 billion in 2021. Net income attributed to Johnson Controls in 2023 was $1.8 billion, compared to $1.5 billion the prior year. Full year reported sales were up 6% and increased 8% organically.

As of early March, Johnson Controls’ stock price was at about $60 per share, having recovered from a nearly 50% plunge in mid-2022 from an alltime high of $80.85 at the end of 2021.

Johnson Controls’ core strategy remains focused on “creating growth platforms, driving operational improvements and creating a high-performance culture,” according to the company’s latest 10-K filing.

During the company’s first quarter earnings call in January, Oliver stressed that Johnson Controls has the right operating system and overall strategy in place to create value for shareholders.

“We believe that we’re on the right path now to simplify the portfolio, continue to drive margin expansion and deliver much more consistent cash flow,” he said.

For the year ahead, Johnson Controls expects “well above-market” growth and continued margin expansion in the mid- to high-teens range.

While a decision has yet to be made on Johnson Controls’ non-commercial product lines, the possible sale is drawing mixed reactions from analysts.

“Sales could streamline the portfolio and offer attractive sales valuations for JCI. Conversely, these are assets in high-interest areas of HVAC and sales would lessen JCI’s overall exposure to HVAC itself,” a Baird Equity Research report states.

In addition, the company is continuing its restructuring efforts as it works to reduce SG&A costs. In the first quarter, Johnson Controls paid $39 million in pre-tax restructuring and impairment costs, primarily comprised of severance charges due to ongoing “restructuring actions,” according to an SEC filing.

Oliver acknowledged there’s still work to be done not only in cost saving efforts, but also in the development of the OpenBlue platform as Johnson Controls positions itself as a leader in the autonomous building market.

“We have successfully removed many layers of cost across the organization, but we know there is more work to be done,” said Oliver. “We will continue to simplify and standardize across our portfolio. As we continue to focus on simplifying the company, we’re always assessing opportunities to advance our transformation into a comprehensive solutions provider for commercial buildings.”

presents the 17th annual:

Sponsor Messages:

Tuesday, March 19, 2024

2:00 PM - 2:30 PM | Registration & Networking

2:30 PM - 6:30 PM | Program & Networking Reception

Brookfield Conference Center

Whether you are on the Buy-side or the Sell-side, there are many things to consider. Market cycles, product innovation and employee ownership trends have continued to drive activity in the market.

Old National is now top 30 banking companies headquartered in the US and we the official banking partner of the Big 10. We are proud of our roots as a community bank while excited for our expanded footprint, services and talent to support your business’ goals.

We are excited to bring the Empowerment Small Business Loan Program to Wisconsin, with resources designed for minority- and womenowned businesses.

Our team is based at our downtown Milwaukee Headquarters in the historic Huron Building, where our commercial, corporate, business and wealth segments are under one roof.

We are thrilled to once again be the long-time presenting sponsor of the BizTimes M&A Forum in 2024.

Reinhart is pleased to once again sponsor the BizTimes M&A Forum and contribute our perspectives on the rapidly evolving dynamics of today’s mergers and acquisitions market.

Year after year, we see a consistently high level of middle market deal flow. As a result, our attorneys are attuned to current trends, key players and emerging legal issues. Representing buyers, sellers and financing sources, we are expert at structuring transactions to align with long-term goals, identifying opportunities to enhance deal value, and leading complex transactions under tight timelines. We help our clients identify, quantify and resolve complicated business and legal issues involving multiple parties, who frequently have different and conflicting objectives. Our deep experience, breadth of expertise and staffing approach result in efficient processes. We are delighted to have the opportunity to be part of today’s event.

Partner:

Taureau Group is pleased to sponsor the 2024 BizTimes M&A Forum. Despite levels of uncertainty in the M&A market due to the macro environment, the lower-middle market remains strong. We see potential for increased deal flow throughout 2024 for high-quality and strategic opportunities as the market continues to be driven by available capital along with private equity and corporate buyer motivation.

If considering a company sale or recapitalization, we are here to lead you through the process leveraging our 200+ years of collective M&A experience.

Taureau Group is an independent investment bank providing M&A services to lower-middle market companies. Taureau Group’s team has completed hundreds of successful M&A transactions combining the capabilities of large, bulge-bracket investment banks with the service and responsiveness of a boutique firm.

National clients…global results.

taureaugroup.com | (414) 465-5555

A FEW YEARS AGO, the mergers and acquisitions market was white hot. Low interest rates, a generation of business owners ready to move on and plenty of capital on the sidelines ready to be invested was a recipe for a strong seller’s market.

Today’s market is a little different. Interest rates are higher, although it is possible the Federal Reserve will begin cutting soon. Overall, things are more uncertain. There are geopolitical risks around the world, the U.S. economy could tip into recession, or it could stick a soft landing. And then there’s the 2024 presidential election.

The reality, however, is that no matter the market, a quality business is always in demand. The 2024 BizTimes M&A Forum will help attendees understand how to best prepare a business for sale and to spot opportunities for value as a buyer.

The event takes place from 2 p.m. to 6:30 p.m. on Tuesday, March 19 at the Brookfield Conference Center. The event is sponsored by Old National Bank, Reinhart Boerner Van Deuren s.c. and Taureau Group LLC.

The program starts with a keynote conversation featuring Sharad Chadha, chief executive officer of Sprecher Brewing Co. In a conversation with BizTimes managing editor Arthur Thomas, Chadha will discuss lessons learned from his 2020 acquisition of Sprecher along with four subsequent acquisitions. Their conversation will also address how M&A has evolved as part of Sprecher’s strategy, the financing and structuring of deals, determining brand and culture fit in a short period of time, and ultimately finding common ground between a buyer and seller.

After the keynote, Taureau Group founder and managing director Ann Hanna will moderate a panel discussion with buyers and sellers sharing best practices and lessons learned. The panel features Dan Erschen, founder of Wisconsin Metal Parts; Jacob Erschen, president of Lean Manufacturing Products; David Wage, former CEO and owner of Formrite Companies; Blake Knickelbein, shareholder in the corporate law practice of Reinhart Boerner Van Deuren; and Paul Stewart, co-founder of PS Capital Partners.

The panel will address a range of topics, including market trends, how the market shapes the timing of a decision to sell, evaluating different buyer types, important steps to prepare for a sale, perspectives from a private equity buyer and advice for others with the benefit of 20/20 hindsight. ■

Erschen started Die Concepts Inc. in his basement in 1988. The name was changed to Wisconsin Metal Parts in 2010 and grew to 135 people. The Waukesha-based company, which provides a single source for metal part production serving a wide range of industries, was sold to Solv Metals as of Jan. 1.

Chadha is the primary owner of Glendale-based Sprecher Brewing Co. He led the acquisition of the company in January 2020. Since then, Sprecher’s sales have tripled, distribution has increased by 400% across a 49-state footprint, and the workforce has grown from 50 to 150 employees. His previous experience includes roles at Samsung, GE Healthcare, Electrolux and ABB.

Erschen, the son of Dan Erschen, started Waukesha-based Lean Manufacturing Products Inc. in 2016 after seeing an opportunity to help manufacturing facilities with an efficiency-driven product line. Given the close relationship between Lean and Wisconsin Metal Parts, the two companies were both sold to Solv Metals, and Jacob Erschen stayed on to help continue the company’s growth.

In 2000, Wage purchased the assets of HMF Inc. and formed HMF Innovations, an automation and robotics integration firm. In 2010, he purchased Formrite Companies Inc. in Two Rivers. The automation portion of HMF was merged into Formrite, a fabricator of formed steel tubing. In June 2023, the Formrite family of companies was sold to G3 Industries of Kronenwetter, Wisconsin.

Knickelbein is a shareholder in Reinhart’s corporate law practice, helping clients on a range of matters, including buy- and sell-side transactions, succession planning and transitions to the next generation of key employees, and other corporate matters like contracting, governance, entity formation and issuing equity. He graduated from UW-Madison for both undergraduate and law school.

Stewart co-founded PS Capital Partners in 2001. The private equity firm invests in Upper Midwest manufacturing or process-based companies with annual revenues of $10 million to $50 million. Transactions are typically $5 million to $30 million. Deal types include buyouts, recapitalization, divestiture, sale of a family business, growth capital, and majority or minority ownership.

At Old National, we’re proud to bring valuable business conversations to greater Milwaukee. If you’re thinking of selling your business—or of making an acquisition—you won’t want to miss this.

The M&A Forum: Benefit Your Business

Tuesday, March 19 | Brookfield Conference Center

2pm: Check In and Networking

2:30pm: M&A Forum Begins

Keynote Speaker: Sharad Chadha, CEO of Sprecher Brewing

Panel Discussion with M&A Leaders

Breakout Sessions in Specific Areas of Interest

5pm: Networking Reception

Get all the details and register today at www.biztimes.com/maforum

IN AN IDEAL WORLD, buying or selling a business would be easy.

A business owner meets a willing buyer with plenty of money in the bank. Each proposes a price for the transaction. After a little bit of negotiation, they meet in the middle, shake hands, sign the paperwork and the deal is done.

However, life is not always quite so simple. Buyers and sellers may not see eye-to-eye on price. A bank may not be willing to provide enough financing. In those cases, a deal becomes complicated quickly.

“In today’s market, certain deal structure –broadly defined as deferred or contingent payments – can be a valuable tool to bridge gaps in valuation, plug holes in the capital structure, and ultimately get the best deals to the finish line,” said Robert Jansen, managing director of Milwaukee-based Bridgewood Advisors.

For more than a decade, interest rates were incredibly low, making it relatively inexpensive for buyers to borrow money to finance a deal. That changed with the Federal Reserve hiking rates in 2022 and 2023 to combat inflation.

“As a result of the higher interest rates, the cost of money increases,” said Steve Boylan, a mergers and acquisitions advisor at Valens M&A. “This in turn can decrease the amount of money the bank

is willing to loan and the buyer is willing to pay.”

Cheryl Aschenbrener, national leader and partner in transaction advisory services at Sikich LLP, said most private equity buyers add leverage or borrowing when making a deal to boost the return on investment. Higher rates and an uncertain environment dampened M&A market activity in 2023, she said.

“Most are predicting a return to higher activity as the Fed has signaled rates will be steady to lower,” Aschenbrener said.

Boylan noted that more business owners are beginning to accept that rates will not return to their recent low levels anytime soon.

“Once they accept the reality of the near future cost of money, the decision to bring the business to market is more likely,” he said.

In the event that a gap remains between what a buyer is bringing to the table through cash and financing and what the seller wants, there are a few available options.

For starters, the buyer could increase their upfront investment. Different types of buyers may be better positioned to bring more money to the table. A large strategic or corporate buyer is much more likely to be able to invest more than a group of employees looking to buy the company, for example.

Another option would be for the seller to provide financing to the deal. In that case, the buyer provides the seller with a note to repay debt over a set period of time with interest.

“That’s still pretty good because you have the rights of a creditor,” said John Emory Jr., president of Milwaukee-based investment banking firm Emory & Co. “A note is far better than an earnout. A lot of sellers in their mind tend to lump a seller note together with an earnout, but an earnout is typically far less valuable than a note. A note bears interest and you can enforce it.”

Aschenbrener said buyers opting to include seller financing in a deal is more common in cases challenged by low or inconsistent performance of the business.

Earnouts are arrangements in which the seller receives some portion of the value of the business based on whether the company is able to hit certain metrics over a set period of time. Emory said buyers will typically look to tie the metric to earnings while a seller might opt for revenue. Aschenbrener said earnouts are common with either inconsistent past performance or a future forecast that is high compared to the past.

“This protects the buyer from some risk, and also sometimes enables sellers to receive a higher overall multiple,” she said. “If earnings come in as expected, the buyer is essentially using those earnings in part to pay the seller.”

Aschenbrener noted that earnouts were especially more common in the first year or two after the pandemic as supply chain issues or demand changes injected anomalies into financial performance.

Another option for closing the gap in financing a deal is for the seller to roll over a portion of their equity in the business, maintaining a small ownership stake post-sale.

“Rollover equity is most common when selling to private equity,” Jansen said.

In many cases, private equity firms are looking to grow a business they acquire and then sell it after a handful of years. In the right circumstances, an owner could realize as much value in a subsequent sale from a 20% stake they held onto as they did from the 80% they initially sold.

Whether it’s seller financing, an earnout or rolling over equity, who the buyer is becomes more important as new elements are added to a deal.

“A seller’s confidence in the prospective buyer becomes exponentially important when deal structure is involved,” Jansen said. “Sellers should have high confidence in the buyer’s strategy, vision, ability to execute and ability to make future payments.”

In some cases, it may make sense for a seller to opt for a lower price if it means a simpler and more certain deal, Emory said. ■

We leverage the collective experience, contacts and market insights of our attorneys to locate strategic partners, connect prospective purchasers and sellers, arrange necessary financing and negotiate the most favorable results for our clients.

THE TREND of health care consolidation continued last year as Milwaukee-based Froedtert Health and Neenah-based ThedaCare agreed to merge their two health systems. The combined entity, known as Froedtert ThedaCare Health Inc., launched Jan. 1. Froedtert president and CEO Cathy Jacobson will lead the organization for the first six months before retiring, at which point Dr. Imran Andrabi, president and CEO of ThedaCare, will take over. Jud Snyder, regional president – Midwest for BMO Wealth Management, is board chair of Froedtert ThedaCare Health and Jim Kotek, retired president and CEO of Menasha Corp., is vice chair.

Froedtert also acquired sole ownership in Menasha-based Network Health from Ascension Wisconsin. The two health systems previously each had 50% ownership of the providers of commercial and Medicare health insurance plans.

In another health care-related deal, Milwaukee-based Physicians Realty Trust, a real estate investment trust that invested in medical facilities, merged with Denver-based Healthpeak Properties. The all-stock deal was described as a “merger of equals” and valued the combined entity at $21 billion. Healthpeak shareholders ended up with 77% ownership of the combined company, which kept the Healthpeak name but the Physicians Realty Trust stock ticker “DOC.” The companies also said they would keep an office in Milwaukee.

BizTimes Milwaukee regularly covers M&A deals at biztimes.com. Here’s a look at other notable local transactions from the past year with terms provided if available:

» In May, Minnesota-based nVent Electric completed its $1.1 billion acquisition of New Berlin-based ECM Industries, a manufacturer of electrical products for the construction, maintenance, irrigation and landscape supply, and utility markets.

» Massachusetts-based Watts Water Technologies Inc., a manufacturer of plumbing, heating and water quality products, acquired Menomonee Falls-based Bradley Corp. for $303 million.

» Molson Coors Beverage Co. acquired a 75% equity interest in Kentucky-based bourbon and rye whiskey producer Blue Run, for $77 million.

» Kohler Co. announced plans to spin off its energy business as a separate, independent company with California-based Platinum Equity as the majority investment partner. The deal is expected to close in the first half of 2024.

Kohler also announced plans to acquire German sauna maker KLAFS from its parent company, the Egeria Group, and acquired United Kingdom-based Kast Concrete Basins.

» Johnson Controls International acquired FM:Systems, a digital workplace management and Internet of Things provider for facilities and real estate professionals for $540 million.

» Mayville Engineering Co., which moved its headquarters to Milwaukee from its namesake city, acquired Fond du Lac-based Mid-States Aluminum in July for nearly $96 million.

» Milwaukee-based Rockwell Automation paid $565 million with up to a $50 million contingent consideration to acquire Clearpath Robotics, a Canadian company specializing in autonomous robotics for industrial applications. Rockwell also acquired Verve Industrial Protection, a Chicago-based cybersecurity firm, for $185 million.

» Milwaukee-based A.O. Smith acquired Water Tec of Tucson for almost $17 million in September and then announced the acquisition of Impact Water Solutions this month. Terms of the Impact deal were not disclosed. Since 2016, the company has spent at least $266 million on seven acquisitions for its water treatment business.

» Hartland-based Fathom Digital Manufacturing accepted a proposal from Chicago-based CORE Industrial Partners that will allow CORE to purchase all outstanding shares of Fathom’s class A and class B common stock. CORE, which already owns 62.8% of the stock, initially offered $4.50 a share in November and now plans to pay $4.75 per share. The deal does need shareholder approvals.

» In December, Milwaukee-based sheet music publishing company Hal Leonard “combined” with Cyprus-based music content and creation company Muse Group. Terms of the deal were not disclosed. San Francisco-based investment firm Francisco Partners provided growth investment for the deal.

» Boston-based Exaltare Capital Management, a private investment firm with a focus on franchise and multi-unit investments, acquired Milwaukee-based GF Midwest Inc., one of the largest developers and operators of the Good Feet Store, operating 23 franchises across nine states.