THE PROPERTY ISSUE

BARGAIN HUNTERS DRIVE PROPERTY MARKET REBOUND

PRIVATE EQUITY BETS ON HONG KONG REAL ESTATE

HOW TOKENISATION AND TECH ARE REWRITING HK’S PROPERTY RULES

TIGHTER CYBER LAWS PUT PRESSURE ON INSURANCE COSTS

TOURISTS OUT TO SEE K-POP, MANDOPOP SPEND MORE

Established 1982

Editorial Enquiries:

Charlton Media Group Hong Kong Ltd Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Hong Kong | +852 3972 7166

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

ASSOCIATE PUBLISHER Louis Shek

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR Eleennae Ayson

LEAD JOURNALIST Noreen Jazul

PRODUCTION TEAM Gwyneth Bejer

Diana Dominguez

Frances Gagua

Vincent Mariel Galang

Jilliane Rae Manuel

Marielle Medina

Olivia Tirona Rain Zhao

EDITORIAL RESEARCHER Angelica Rodulfo

GRAPHIC ARTIST Cathlyn De Raya

EDITORIAL ASSISTANT Vienna Verzo

COMMERCIAL MEDIA TEAM Jenelle Samantila Dana Cruz

Danielle Goh

ADVERTISING CONTACTS Louis Shek +852 6099 9768 louis@hongkongbusiness.hk Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez-Difuntorum awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL editorial@hongkongbusiness.hk

SINGAPORE

Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 +65 3158 1386

HONG KONG Room 1006, 10th Floor, 299 QRC, 287-299 Queen's Road Central, Sheung Wan, Hong Kong +852 3972 7166

MIDDLE EAST

FDRK4467, Compass Building, Al Shohada Road, AL Hamra Industrial Zone-FZ, Ras Al Khaimah, United Arab Emirates www.charltonmedia.com

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@hongkongbusiness.hk. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@hongkongbusiness.hk with “Partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com. Hong Kong Business is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Hong Kong Business can accept no responsibility for loss. We will however take the gains.

Sold on newstands

FROM THE EDITOR

Investors are taking advantage of price corrections in Hong Kong’s property market, snapping up properties for their own use—from offices and student housing to luxury homes. Experts add that the city’s commercial property segment is also finding strength in its recovering stock market. Read more in our cover story on page 26.

Hong Kong has seen strong IPO and fundraising activity this year and is expected to welcome more dual listings from the Mainland following recent moves to lower public float requirements. On page 42, experts discuss how these changes could attract more A+H listings to the city.

Building on the momentum of Hong Kong’s stock market, newly appointed ZA Bank CEO Calvin Ng revealed plans to launch a Hong Kong stock trading outlet later this year. Learn more about the digital bank’s initiatives—from wealth management to crypto trading—on page 38.

Blockchain innovation is extending beyond finance—it’s now reshaping property. Real estate agents are advocating for tokenisation of assets to invigorate Hong Kong’s commercial market. Experts say the shift could cut transaction costs by up to 30%. Find out more on page 32.

Beyond the stories of innovation and transformation, this issue also recognises those making remarkable strides in real estate. Meet the 20 most notable real estate agents under 40 on page 28.

HongKongBusiness is a proud media partner and host of the following events and expos:

HongKongBusiness is available at the airport lounges or onboard the following airlines:

Tim Charlton

News from hongkongbusiness.hk

Daily news from Hong Kong

MOST READ

Hong Kong’s salary increase falls in 2025, but will recover in 2026

Hong Kong’s actual salary increase is at 3.7% in 2025, lower than in 2024, according to a report by advisory firm WTW. This is lower than the 4% in 2024, and the 2025 APAC average of 5.1%. Salary increases in the city are projected to rise back to 4% in 2026, according to the Salary Budget Planning Report by WTW.

Singapore-based fintech firm Chocolate Finance enters Hong Kong

Singapore-based fintech firm

Chocolate Finance has raised $117.7m in a Series A+ funding round and received approval to begin operations in Hong Kong. Nikko Asset Management led the funding round, with participation from returning investors Peak XV, Prosus, and Saison Capital, and founder Walter de Oude.

Improved certification scheme helps SMEs to go green

SMEs are taking centre stage in Hong Kong’s green building push, as the Construction Industry Council and the Hong Kong Green Building Council launch Certification Scheme 2.0 to boost sustainable construction practices. With over 1,000 certified green products to date, the majority have come from SMEs.

Tai and CSI Properties unveil "Central Crossing" in Central district

Wing Tai Properties and CSI Properties unveiled Central Crossing, a joint development in the Central district. Located at 118 Wellington Street, the project is set to be completed by mid-2026 and will combine Grade A office spaces, a luxury hotel, a lifestyle hub, and green open areas all whilst preserving heritage.

Hong Kong’s commercial real estate market faced growing pressure in the first quarter of 2025, with rising vacancy rates and cautious investor sentiment weighing on the office and industrial sectors. According to a Colliers report, demand for office space is shifting towards smaller units as rent levels decline.

Most firms miss Scope 3 emission baseline and mature transition plans

A new KPMG China and DBS Bank (Hong Kong) study revealed that just 10% of companies have mature transition plans aligned with the Ambition, Action, and Accountability principles recommended by the Transition Plan Taskforce. The joint research found that over half have yet to begin reporting Scope 3 emissions.

Wing

Hong Kong office demand shifts to smaller units in early 2025: Colliers

Stablecoin bill sharpens oversight and spurs regulated innovation

Hong Kong’s recently passed Stablecoins Bill raises the bar on transparency and compliance, whilst unlocking opportunities for innovation in the digital asset space, analysts said.

“Issuers will need to overhaul treasury transparency, implement robust realtime reserve attestations, and establish clear redemption mechanisms,” Elena Tzvetinova, chief operating officer at Reasoon Ltd., operating as London-based artificial intelligence fintech Eunice, told Hong Kong Business.

Stablecoin issuers should be clear about the reserves backing their tokens and provide mechanisms for users to redeem them for cash. Many, however, may not yet meet the bill’s standards.

“Many lack sufficient internal controls or risk frameworks that meet the bill’s standards,” Tzvetinova said in an exclusive interview.

Eunice recently launched a stablecoin due diligence and monitoring solution for compliance and risk oversight.

Banks are expected to reassess their exposure to stablecoins and review ties with

third-party providers to avoid unintentional noncompliance, she added.

Passed in May 2025, the Stablecoins Bill extends to fiat-referenced stablecoins designed to maintain a stable value against the Hong Kong dollar, whether issued domestically or overseas.

It additionally governs marketing and promotional activities, allowing only licensed issuers to offer or advertise their tokens to retail investors.

According to the Hong Kong Monetary Authority (HKMA), the framework is intended to strengthen investor safeguards and reinforce confidence in the digital asset market.

The measure follows months of industry consultation with banks, fintechs, and crypto associations, reflecting Hong Kong’s wider strategy to cement its role as a leading global hub for virtual assets.

The bill will also require any person or

entity that issues fiat referenced stablecoins— digital tokens pegged to currencies like the US dollar or Hong Kong dollar—to get a licence from the HKMA.

Only licensed issuers can advertise or sell stablecoins to retail investors in Hong Kong. The regime aims to enhance investor protection and public confidence in the digital asset sector, according to the central bank.

According to Tzvetinova, the law could position Hong Kong as a launchpad for bankgrade, interoperable stablecoins and serve as a gateway for regional digital currency initiatives.

Banks are already responding. ZA Bank Ltd.—Hong Kong’s first virtual bank—has been offering stablecoin reserve banking services since 2024 and is in talks with several potential issuers.

“We are prepared to meet diverse development needs as the market evolves,” said Calvin Ng, CEO at ZA Bank.

“The passage of the bill has injected confidence into the market, signalling a clear regulatory direction and paving the way for responsible innovation,” he said. “It has encouraged active engagement and strategic planning amongst industry players.”

Standard Chartered Hong Kong earlier said it plans to launch a Hong Kong dollarbacked stablecoin in partnership with Animoca Brands Corp. Ltd. and Hong Kong Telecommunications Ltd.

Potential and challenges

Tzvetinova sees new product potential for banks—from integrating stablecoins into existing products to partnering on issuance and developing products and platforms.

Cyrus Tong, chief compliance officer at DCS Card Centre Pte. Ltd., said stablecoins could support cross-border payments, programmable wallets, tokenised assets, smart escrow, and loyalty programmes.

“This could streamline settlements, reduce [foreign currency] friction, and attract institutional investors seeking regulated digital alternatives,” he said in a separate interview.

However, Tong warned of key challenges. “Interoperability with other regimes is critical to avoid fragmentation,” he said, adding that emerging risks such as cybersecurity threats and liquidity mismatches need regulatory attention.

Tzvetinova noted that whilst some issuers might exit the market, those who remain will be better positioned. Companies committed to Hong Kong would likely invest in infrastructure and compliance, she added.

The passage of the bill has injected confidence into the market, signalling a clear regulatory direction and paving the way for responsible innovation

The bill requires fiat-referenced stablecoin issuers to get a licence from HKMA

Experts warn fixed ride-hailing caps could hurt mobility

Hong Kong should adopt a “variable quota” system for online ride-hailing vehicles rather than a fixed limit, transport experts told Hong Kong Business, warning that rigid caps could hinder services and reduce mobility.

Ticky Chan, an officer at the Public Transport Think Tank of Hong Kong (PTTTHK), expressed concern over potential restrictions on ride-hailing numbers.

“Such restrictions would not only affect over 30,000 drivers but also significantly impact passenger services, such as longer waiting times

and greater difficulty in booking a ride,” he told the magazine.

Alok Jain, chief executive officer and managing director at TransConsult Ltd., said a vehicle cap is “a very straight-line approach for a very tech-driven operation.”

A flexible quota system that allows more vehicles during peak periods and fewer during off-peak hours is more appropriate, he added, noting that “supply should adjust rather than remain constant.”

The government has not disclosed what the vehicle quota will be.

A PTTTHK survey published on

3 June found that six of 10 Hong Kong citizens see no need for a cap, and if imposed, nine of 10 want it set no lower than the number of ridehailing vehicles.

The vehicle quota is part of a broader plan to regulate online ridehailing and ensure fair competition with heavily regulated taxis.

Chan said the cap is unlikely to boost taxi ridership. “Instead, it could lead citizens to drive themselves or use other transport modes, adding to road congestion. In an era of technological advancement, why suppress this service and hinder citizens’ mobility?”

Lower taxi trips

Data from the Legislative Council Secretariat showed daily taxi trips have fallen 29.4% in the past decade to 682,000 in 2024, whilst taxis’ share of public transport patronage declined to 5.8% from 7.7%.

The reduction was partly due to factors such as competition from ride-hailing and other personalised point-to-point services.

Such restrictions would not only affect over 30,00 drivers but also significantly impact passenger services

Hong Kong has about 18,000 taxis and four ride-hailing platforms— Uber Technologies, DiDi Global, Tada Mobility, and Amap (AutoNavi). However, the number of vehicles deployed by these platforms has not been made public.

Whilst Chan opposes a vehicle cap, he supports other regulatory measures, including a proposal requiring ride-hailing operators to obtain licences for each vehicle.

THE CHARTIST: ADVERTISING TO OUTPACE CONSUMER SPENDING IN MEDIA SECTOR

Hong Kong’s entertainment and media (E&M) industry is tilting towards advertising as a growth driver as businesses cut back on consumer revenue strategies amidst a global push for digitalisation, according to a PwC report.

This is in line with a global trend, in which advertising is expected to surpass consumer revenue by about $2.34t (US$300b) by 2029. Internet ads, over-the-top (OTT) video, and cinema will drive the increase, it said.

“The ongoing shift from traditional to digital media by consumers and advertisers is occurring concurrently with the rising impact of AI (artificial intelligence)-enhanced monetisation strategies by major tech platforms,” Cecilia Yau, PwC Chinese Mainland and Hong Kong media leader, told Hong Kong Business.

“Consequently, internet advertising will play

an increasingly crucial role in driving growth. Given the trajectory of AI and digitalisation, businesses are likely to allocate larger portions of their budgets to internet advertising,” she said.

Hong Kong’s E&M market is projected to grow 2.26% annually to $117b (US$15b) by 2029, with advertising leading, Yau said, citing a PwC report published in August.

“In Hong Kong, advertising revenue is projected to grow at a 4% compound annual growth rate (CAGR), compared with a 1% increase in consumer revenue,” she said.

“Whilst consumers may be more reserved in their spending, businesses are prioritising marketing efforts to capture attention and drive sales,"the media leader continued.

Globally, advertising will grow more than three times faster than consumer spending at 6.1% from 2024 to 2029.

Source: PwC Hong Kong

Alok Jain

HOW MUCH COULD RETAILERS LOSE IGNORING SENIORS?

Retailers who ignore older shoppers may miss out on $700b in spending by Hong Kong seniors by 2046 — double today’s level and as much as five times more than the city’s annual public health expenditure, analysts said.

“By 2046, one-third of Hong Kong’s population is expected to be in the silver age,” Dicky Chow, head of healthcare and social innovation at Our Hong Kong Foundation, told Hong Kong Business. “The challenge is how to truly unlock the potential of the silver economy.”

He said the city’s silver economy by then could be four to five times the size of public health expenditure. “It’s that significant,” he told the magazine.

“Just because older adults have the purchasing power doesn’t mean they’re willing to spend. Many feel there’s a lack of choices, or that products and services simply aren’t designed with their needs in mind,” the head of healthcare continued.

Today’s older adults are living longer, healthier, and more active lives, and their consumption patterns reflect interests that go far beyond basic necessities, said Xue Bai, director of the Research Centre for Gerontology and Family Studies at The Hong Kong Polytechnic University (PolyU).

“The new generation of older adults in Hong Kong has greater consumption potential, and there is a growing demand for age-friendly measures, products, and services,” she said in an exclusive interview.

“The shift is transforming the ‘sunset economy’ into a ‘sunrise industry.’”

Product innovations could include smart home devices with intuitive interfaces, ergonomic kitchenware, and adaptive clothing that combines style with comfort, she pointed out.

In May, the government announced 30 measures to boost the city’s silver economy, including efforts to drive consumption through special shops and e-commerce platforms.

Dual-sided panels to jump-start solar growth

Hong Kong could increase its solar power output by as much as 80% by adopting dual-sided panels—helping the city unlock more of its 8,000-megawatt solar potential, according to an energy expert.

“The gain is around 10% to 80% depending on the installation,”

Vivien Lu, a professor at Hong Kong Polytechnic University’s Department of Building Environment and Energy Engineering, told Hong Kong Business.

Pairing bifacial modules with technologies such as highly reflective, self-cooling paints could further raise energy yields by at least 30%, she said.

Bifacial panels generate power from both the front and back sides. According to an analysis by Market Size and Trends, Hong Kong’s bifacial solar modules market is projected to record a 15% compound annual growth rate over the next five years, thanks to its aggressive renewable energy policies and high urban solar potential.

Industry players are increasingly investing in advanced industry-specific innovations such as high-efficiency bifacial panels, smart monitoring

solutions, and integrated energy storage systems, enhancing energy yield and operational efficiency.

They are already being used in Hong Kong, but their application remains limited.

One such initiative is a joint project by City University of Hong Kong and CLPe Solutions Ltd. to deploy these panels across the university campus.

Solar power capacity in Hong Kong has been flat at 0.33 gigawatts (GW) from 2023 to 2024, according to Our World in Data. In contrast, oil remained the dominant energy source, powering 180.94 terawatt-hours (TWh) of the city's electricity last year.

Total energy consumption for the year stood at 272.87 TWh, with renewable sources accounting for only 1.36 TWh.

Hong Kong’s Climate Action Plan 2050 aims to raise the share of renewable energy in the power mix to 7.5%–10% by 2035, from 0.9% in 2022.

Solar power is expected to contribute about 1% to 2% of electricity demand by that year. But with full deployment, solar energy could provide up to 20% of the city’s electricity needs, Lu said.

Stronger policy support

Beyond bifacial panels, other solar technologies like rooftop and floating solar systems can help close the gap. Lu noted that 29 reservoirs across Hong Kong covering 13.37 square kilometres could support floating solar installations that can produce 689 gigawatt-hours of electricity, covering about 0.42% of Hong Kong’s electricity demand.

New opportunities are emerging as interest grows in commercial rooftop solar and off-grid solutions for remote areas, expanding the market's reach and potential revenue streams, according to Market Size and Trends.

To accelerate adoption, Lu urged stronger policy support. “We can include this in the building energy code for new buildings and even the retrofits for infrastructure projects,” she said. She also said brownfield sites and car parks could be developed into solar parks.

Lu said there are other emerging solar technologies still being developed, which may be integrated with other technologies.

With improved technology and stronger government backing, Hong Kong could significantly scale up its solar energy production and reduce reliance on fossil fuels.

Solar capacity has been flat at 0.33 GW from 2023 to 2024

We can include this in the building energy code for new buildings and even the retrofits

Vivien Lu

ENERGY & OFFSHORE

Source: Tracxn

STARTUP

PEQABOO CREATOR TARGETS 1,000 MERCHANTS BY YEAR-END

Decennium Platforms Ltd. aims to sign up 1,000 merchants by year-end to its Peqaboo app, which connects pet owners with products and services tailored to their animals’ health and medical needs.

“We have just under 100 merchants now, but we’re actively recruiting,” Simon Chan, director at the Hong Kong-based startup, told Hong Kong Business

The app now boasts a community of over 50,000 active users across Hong Kong, Taiwan, Japan, and Thailand, with 12,000 located in Hong Kong alone.

Through Peqaboo, merchants gain access to a subscriptionbased marketplace and targeted advertising, which form the company’s main revenue streams. The company is seeking to raise $7.8m to $23.4m (US$1m–US$3m) to fund its expansion.

“We provide personalised advertising for merchants,” Chan said in an exclusive interview. “Our artificial intelligence (AI) system analyses their sales data and identifies users most likely to become potential customers.”

The app also features BOO AI, an AI-driven chatbot that delivers personalised recommendations based on pet profiles created by owners. These profiles can be enriched with medical records, test histories, and lab results to ensure accuracy.

Howard Chan, a veterinarian and co-founder of Decennium, said the system could recommend products or services specific to a pet’s condition.

“If you are looking for food supplements suitable for dogs with chronic kidney disease, which require a low-phosphate diet, our system will provide you with a list of merchants that can offer these,” he said in the same interview.

Other offerings

Beyond products, merchants offer services such as grooming, pet walking, and pet hotels. The platform also helps pet owners find veterinary clinics suited to their pets’ specific needs.

“If users are looking for a clinic or hospital for a particular operation, we can filter and suggest the right one for them,” Chan told the magazine.“This way, they don’t waste time calling clinics individually or being transferred elsewhere. We want to bridge that gap," he continued.

Whilst direct vet appointment booking is not yet available, Decennium is working with ezyVet, a widely used veterinary system, to integrate this feature. The startup is also working with clinics to allow direct uploading of test results into the app, improving the user experience.

Owners upload lab results themselves, which the app interprets through its Lab Report Analysis feature.

“When you get a blood test, the report usually contains many items that are hard to understand,” Chan said. “Nurses don’t explain each one because it’s too time-consuming."

The Z Label tests AI for Gen Zers

RETAIL

Venture builder The Z Label is testing six to eight artificial intelligence (AI) applications that could unlock new revenue streams from products that target Gen Z consumers.

“We’re building AI tools that are made for specific communities, like fans, creators, and wellness lovers,” Rebecca Leung, co-founder of The Z Label, told Hong Kong Business. “The big goal is to turn a few of these into real products that people love and use every day.”

“Long-term, we want to grow three to five of them into successful ventures or plug them into our existing brands,” she added. The company has two ventures under its portfolio— supplement brand Unik and lifestyle clothing label Dream Temple.

Uncovering early-stage ideas

Leung said the tools and ideas they are testing under their AI Lab initiative include a mix of in-house developments and concepts co-created with external founders, tech experts, builders, analysts, marketers, and researchers. The lab is part of the core projects they plan to pursue after raising $11.4m in funding.

Leung said they also host AI hackathons to uncover promising early-stage ideas that The Z Label could help shape and scale.

Ruby Cheng, co-founder of The Z

Label, said the AI Lab would help The Z Label improve all aspects of their business model based on what she calls the three 3Cs—community, content, and commerce.

Leung said the lab studies insights collected from their events such as hackathons, which bring together programmers and developers to solve a problem or build an app in a short period, typically a day or two.

These insights shape the content they produce and support the development of Gen Z-focused products.

Cheng envisions The Z Label as the Hong Kong counterpart of Atomic Labs, a Miami-based venture builder behind more than 10 startup launches.

The main difference is that The Z Label focuses on building products tailored to the culture and consumption habits of Gen Zers.

Probioverse eyes $78m for gut care rings

HEALTHCARE

Probioverse aims to raise as much as $78m (US$10m) to develop wearable tech and an artificial intelligence (AI) system that will let doctors treat gut problems.

“The gut microbiome affects pretty much every single organ, be it the brain, the heart, the liver, the kidneys, and so forth,” Akin Smith, director at Probioverse, told Hong Kong Business.

Data from the smart ring wearables that they are developing would let them devise a plan to “modulate” the ecosystem of microbes that live in one’s intestines, he added. These will also monitor blood oxygen and sugar, amongst other metrics, to assess organ health and ensure interventions are based on accurate and timely data.

“A doctor having a consistent view throughout the entire day of what a person's blood sugar is like gives him a

much more robust picture of his patient's health,” Smith said. “We want to make that information available to doctors so that they can make more informed treatment decisions.”

Probioverse also aims to partner with probiotic makers that target specific organ health. It has one partner now— Pennsylvania-based Kibow Biotech, Inc., which makes Renadyl.

Peqaboo founders Simon Chan and Howard Chan

Probioverse Director Akin Smith

The Z Label founders Rebecca Leung and Ruby Cheng

Fidelity MPF Your ultimate choice

Fidelity’s global investment expertise and unwavering dedication enable us to offer top-tier retirement solutions and grow your assets. Our commitment has been recognised through numerous industry awards and accolades over the years.

Fidelity MPF

Outstanding investment capabilities

‘The 2025 MPF Awards’ by MPF Ratings Gold Rated Scheme for 13 consecutive years1

Leading and flexible retirement solutions

‘The 2025 MPF Awards’ by MPF Ratings Best MPF Post-Retirement Product for 2 consecutive years2

Fidelity.com.hk/mpf

Fidelity Investor Hotline: 2629 2629

Best-in-class member experience

‘The 2025 MPF Awards’ by MPF Ratings Best Member Experience for 4 times3

Innovative digital customer journey

Hong Kong Business Technology Excellence Awards 2025 Mobile - Financial Services4 and Digital - Financial Services5 for 2 consecutive years

The above awards are for reference only. It is not indicative of the actual performance of the constituent funds. For the award information details, please refer to https://www.fidelity. com.hk/awards.

1 Fidelity has won Gold Rated Scheme from MPF Ratings for 13 consecutive years during the period of 2013 to 2025 - the rating(s) only represent MPF Ratings’ assessment standard (for details, please visit: https://mpfratings.com.hk/zh/scheme-ratings-methodology/).The results are based on the investment choices and performance, fees and charges and qualitative assessment of an MPF scheme as of 31/12/2012, 31/12/2013, 31/12/2014, 31/12/2015, 31/12/2016, 31/12/2017, 31/12/2018, 31/12/2019, 31/12/2020, 31/12/2021, 31/12/2022, 31/12/2023 and 31/12/2024.

2 Fidelity has won Best MPF Post-Retirement Product from MPF Ratings for 2 consecutive years during the period of 2024 and 2025 - the award(s) only represent MPF Ratings’ assessment standard (for details, please visit: https://mpfratings.com.hk/awards-methodology/). The results are based on the assessment on the post-retirement initiatives of an MPF scheme as of 31/12/2023 and 31/12/2024.

3 Fidelity has won Best Member Experience Award from MPF Ratings for 4 times during the period of 2018 and 2025 - the award(s) only represent MPF Ratings’ assessment standard (for details, please visit: https://mpfratings.com.hk/awards-methodology/). The results are based on the assessment across the member servicing and experience criteria of an MPF scheme as of 31/12/2017, 31/12/2021, 31/12/2022 and 31/12/2024.

4 The award only represents Hong Kong Business Magazine's assessment standards (for details, please visit: https://hongkongbusiness.hk/event/hong-kong-business-technologyexcellence-awards). The results are based on the assessment across nominations of financial services industry’s mobile technology category as of 14/06/2024 and 25/06/2025.

5 The award only represents Hong Kong Business Magazine's assessment standards (for details, please visit: https://hongkongbusiness.hk/event/hong-kong-business-technologyexcellence-awards). The results are based on the assessment across nominations of financial services industry’s digital technology category as of 14/06/2024 and 25/06/2025. Investment involves risks. Past performance is not indicative of future performance. Please refer to the Key Scheme Information Document and MPF Scheme Brochure for Fidelity Retirement Master Trust for further information including the risk factors. Fidelity, Fidelity International,

The third party mark appearing in this material is the property of the respective owner and not by Fidelity. This material is issued by FIL Investment Management (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission.

Maritime-inspired hotel debuts in Kowloon

Each room offers sea views of both eastern and western stretches of Victoria Harbour.

Kimpton Tsim Sha Tsui Hong Kong, a hotel inspired by the city’s maritime history has opened, offering guests a blend of heritage and modern luxury.

The V-shaped hotel—the biggest in the Kimpton portfolio—rises above the historic Mariner’s Club, established in 1967, integrating a reconstructed sailors’ lounge with contemporary rooms spanning floors nine to 42.

Every room of the hotel, which is owned by Hong Kongbased Empire Group Holdings Ltd. and operated by UKbased InterContinental Hotels Group Plc, offers sea views of both eastern and western stretches of Victoria Harbour, making it the city’s first property with this feature.

About the hotel

“Our hotel is a one-of-a-kind reflection of Hong Kong itself, combining the city’s maritime history with modern energy,” Mike Robinson, general manager at Kimpton Tsim Sha Tsui, told Hong Kong Business.

Artworks throughout the hotel, including “Whatever Floats Your Boat” by Swiss-born, Hong Kong–raised artist Julie Progin, and wave-patterned ceilings in elevator lobbies reinforce the maritime theme.

The rooftop features a 20-metre infinity pool in nautical style, overlooking Victoria Harbour. The hotel is the first Kimpton property in Hong Kong and the 82nd globally. It has 495 rooms and suites, ranging from 28-square-metre Essential Rooms with East Sea or Sunrise views, 34-square-

metre Premium Rooms overlooking Victoria or Central Harbour, to 68-square-metre Kimpton Harbour Suites, some with private balconies.

Average nightly rates start at about $2,400 for Essential Rooms, $2,700 for Premium Rooms, whilst Harbour Suites nightly rates start at $5,500.

Guests can access Hong Kong’s first 24-hour, 200-squaremetre fitness centre offering HYROX training, which combines running and functional workouts.

A hiking programme allows guests to explore curated trails and green spaces across the city.

Combining luxury and heritage

The hotel has five dining and bar options. Hillside offers allday Cantonese cuisine inspired by traditional open-air food stalls, whilst JĪJĀ, opening later this year, will provide highend dining led by two-Michelin-starred chef Vicky Lau.

Bars Swim Club and High Dive serve cocktails infused with local flavours. Birdsong café hosts a nightly social hour with free snacks and drinks and views of the harbour.

“We position ourselves as an urban resort, serving both tourists and local residents,” Robinson said.

“Our hotel is not only a destination for visitors, but also a place where Hong Kongers can feel at home," he continued.

Kimpton Tsim Sha Tsui aims to combine luxury accommodation, heritage-inspired design, and curated experiences to offer guests a unique living experience.

Mike Robinson

HOTELS & TOURISM

The hotel is the first Kimpton property in Hong Kong and the 82nd globally It has 495 rooms and suites

The hotel has five dining and bar options

The rooftop features a 20-metre infinity pool (Photos from Kimpton)

AXA, originating from France, embodies a rich history and global renown. Providing you with comprehensive protection across every stage of life:

QHMS unveils anxiety-calming clinic

Patient-centred design and preventive care meet in this anxiety-free approach to healthcare.

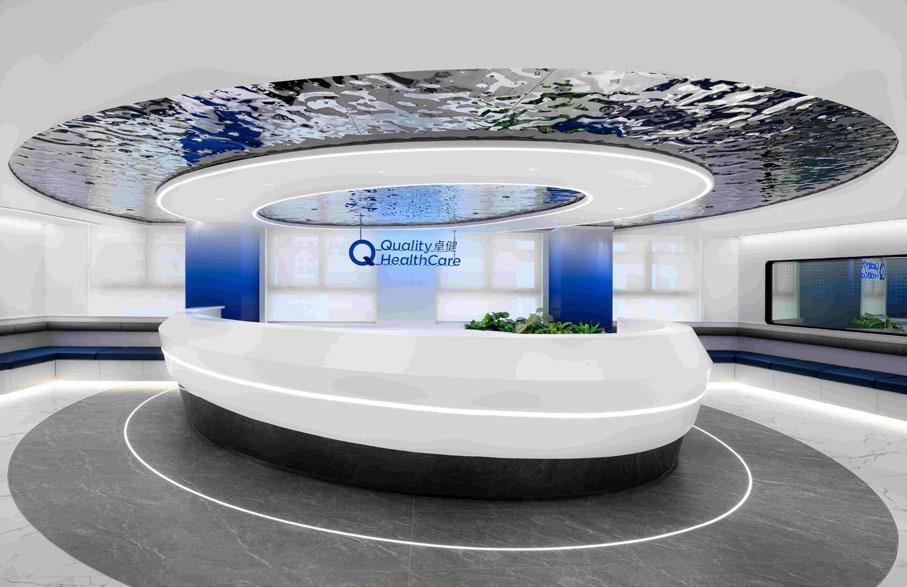

QualityHealthCare Medical Services (QHMS) has opened a flagship clinic in Prince’s Building in Central, positioning it as a benchmark for patientcentred design and preventive care.

The 10,000-square-foot clinic spans six zones, covering family and internal medicine, dermatology, health screening, specialist services, and a day procedure centre for endoscopy. It offers services across 14 medical specialties, aiming to provide both comprehensive and convenient care.

Elaine Chu, general manager of QHMS, said in an exclusive interview that the facility was designed with a focus on emotional comfort as much as clinical solutions.

“Rather than replicating a traditional clinical environment, we’ve created a setting that feels calm, intuitive, and emotionally supportive,” she told Hong Kong Business.

The interiors feature a white-and-blue palette, natural

wood finishes, and greenery to evoke calm and clarity. The layout encourages intuitive movement with clear sightlines and minimal clutter.

QHMS said every element—from lighting to textures— was considered for its anxiety-reducing effect.

The clinic also integrates sensory design. The company partnered with fragrance house Oco Parfum to develop Quies, a bespoke scent blending shiso leaf and passion fruit. The fragrance, described as refreshing and subtly sweet, is diffused throughout the clinic to promote a sense of ease.

The Health Assessment Zone, dedicated to preventive health planning, reflects QHMS’s emphasis on proactive care.

To accommodate fasting patients undergoing check-ups, the area includes a vending machine so they can quickly replenish energy post-assessment—a detail the company described as a gesture of empathetic care.

1 The clinic spans 10,000 sq. ft. with six zones.

2 The interiors feature a white-and-blue palette and natural wood finishes to evoke calm and clarity.

3 The clinic integrates specialty services across 14 specialties supporting prevention, diagnosis, and treatment.

4 The zones include family and internal medicine, dermatology, and a day procedure centre for endoscopy.

5 With a focus on preventive care, the clinic features a health screening zone for early health risk detection and ongoing health management.

6 Quality HealthCare's new Prince's Building flagship clinic features a refreshment corner to enhance comfort for customers.

Elaine Chu

INDUSTRY INSIGHT: MARKETS

Hong Kong’s re-domicile plan draws global insurers

Its re-domiciliation scheme could attract as many as 300 firms in two years.

Aregime that lets companies shift their legal base to Hong Kong without winding up could encourage more insurers and multinationals to register in the city, legal and tax experts said.

“There has been market interest and demand, particularly from the insurance sector, for redomiciliation into Hong Kong,” Simmons & Simmons LLP Partner Claudia Yiu told Hong Kong Business.

She said the programme is expected to boost demand for audit, accounting, and legal services.

“Additionally, it is anticipated that redomiciled companies will bring increased investment and job opportunities, as many are likely to relocate parts of their business operations to Hong Kong,” she said.

Two global insurers have announced plans to move from Bermuda after the scheme was introduced in May, said Yvette Chan, managing director for tax at Alvarez & Marsal Hong Kong.

AXA Hong Kong and Macau

will transfer AXA China Region Insurance Company (Bermuda) Ltd., whilst Manulife (International) Ltd. is expected to complete its transfer in November.

As of 2 September, 95 of the 159 authorised insurers in Hong Kong were locally incorporated, according to the Insurance Authority.

Chan said the regime could attract 50 to 100 companies in its first year, and as many as 300 within two years, depending on promotion and market conditions.

She noted that more than 15,000 companies are operating in the city but incorporated elsewhere. As of 11 July, the Companies Registry had logged 265 enquiries about the scheme, whilst its dedicated webpage recorded more than 22,000 visits and 42,000 downloads.

Firms applying to shift their registration must be financially sound and could pay debts which fall due within the period of 12 months from the application date, according to Grace Tso, a partner

at Baker McKenzie. They must also comply with the rules of their original jurisdiction.

Once the requirements are observed, the company can apply to the Companies Registry for redomiciliation by filing a form together with supporting documents, Tso said. The re-domiciliation takes effect when the Companies Registry issues a certificate confirming the re-domicile. The company must then cancel its original registration.

The Companies Registry may refuse an application if a firm is deemed likely to be used unlawfully or against the public interest. Processing time is about two weeks for complete submissions, Tso said.

Yiu said the registry charges filing fee of $6,050 for online submissions and $6,725 for paper filings. Extra costs cover legal opinions, director certifications, accounting documents, and advisory support. Legal opinions must be issued within 35 days before application.

Once approved, companies receive both a certificate of redomiciliation and a business registration certificate, and must complete cancellation in their former jurisdiction within 120 days.

Gaining market access

Jeckle Chiu, a partner at Johnson Stokes & Master, said companies making the shift will fall under Hong Kong’s profit tax regime. “The government will provide unilateral tax credits to mitigate any resulting double taxation,” he added.

He said companies incorporated in Hong Kong gain market access to Mainland China under the Closer Economic Partnership Arrangement (CEPA), whilst benefiting from simplified rules under the updated Companies Ordinance.

He said the framework strengthens Hong Kong’s role as China’s preferred offshore hub. “It is a true manifestation of ‘One Country, Two Systems’ that will ultimately benefit the city,” he added.

Chan said the scheme improves Hong Kong’s competitiveness against hubs like Singapore, noting that it does not impose economic substance requirements. This allows firms to shift registration without setting up large offices or meeting staffing thresholds.

Two global insurers have announced plans to move from Bermuda after the scheme was introduced in May

Grace Tso

Yvette Chan

Jeckle Chiu INSURANCE

Dual-track scheme bridges care, research

It could also stretch already limited resources in the short run. INDUSTRY INSIGHT:

The government's dualtrack pathway for doctors that lets them split time between treating patients, teaching, and research is expected to bridge looming manpower gaps and boost medical innovation.

The programme seeks to nurture more medical talent and encourage hospitals to integrate clinical work with academic development, Health Secretary Lo Chung-mau told Hong Kong Business.

“A doctor's clinical work is inextricably linked with teaching and research,” he said in an exclusive interview. “More clinical experiences can also be translated into new studies.”

The programme was unveiled late last year and will be supported by public health research funding, including resources earmarked for infectious disease studies. Doctors accepted into the pathway will be given protected time to engage in academic work at the University of Hong Kong or the Chinese University of Hong Kong, whilst continuing their clinical duties at public hospitals.

Phased programme

Whilst the initiative is expected to improve the city’s medical capacity in the long term, experts said it could stretch already limited resources in the short run.

Hong Kong is projected to face a shortage of more than 1,500 doctors by 2030, according to government estimates.

“With doctors required to spend at least 30% of their time on teaching and research, they would need to reduce the time spent in the hospital,” according to Shin Thant Aung, director at management consultancy firm YCP Solidiance.

The director added that hospitals should also prepare for higher salaries and administrative costs during the early years of implementation, before research grants and overseas recruitment can help ease the financial pressure.

To manage the impact, the Hospital Authority will phase in the

programme rather than enrolling all eligible doctors at once. “Scaling up will require a balance between clinical service and academic commitment,” Aung said.

Hospitals may also need to adjust how they allocate staff and assess performance once the dual-track model is in place, according to Dicky Chow, head of healthcare and social innovation at Our Hong Kong Foundation (OHKF).

“They will need to move beyond focusing solely on patient outcomes,” he said. He added that hospitals could get more funding if they link research projects closely to operations, whilst creating dedicated administrative teams to support doctors.

Performance reviews, he said, should reward both clinical and academic contributions.

Chow also cited the need to revise medical curricula to integrate research training more systematically. “Unless a student chooses it, they are not equipped with essential research

skills,” he told the magazine.“A revised curriculum could therefore better support this dual pathway."

Lo said the government would monitor the programme rollout before deciding whether to expand it to more hospitals and specialities.

“We will keep the measure under review,” he told the magazine.

Experts remain cautious about extending the approach to other health professions. Aung said the model might not work as effectively for nurses, whose workloads leave little space for research.

Chow acknowledged workload challenges, noting that whilst doctors can devote 30% of their time to research, this is not yet feasible for allied healthcare professionals.

Even so, the OHKF head said smallscale efforts already exist in nursing and allied health programmes. potential for them to follow a dual track as well,” he said. “By collaborating with universities, they could take it further.”

Hong Kong is projected to face a shortage of over 1,500 doctors by 2030

Dicky Chow

Shin Thant Aung

Lo Chung-mau

INDUSTRY INSIGHT: FINANCIAL SERVICES

Gov't lets banks share fraud data without legal risk

Regulators hope to turn competing banks into crime-fighting partners.

FINANCIAL SERVICES

Hong Kong has amended its banking ordinance to give financial institutions stronger legal backing to share information on suspected scams, money laundering, and terrorist financing—an upgrade regulators say will improve efficiency in tackling financial crime and reduce costly system breakdowns caused by fraud.

The Banking (Amendment) Ordinance 2025 introduces a “safe harbour” that protects authorised institutions when exchanging data aimed at detecting or preventing prohibited conduct. The change is expected to encourage banks to take more action in flagging suspicious accounts and intercepting illicit funds.

“The ordinance also gives authorised institutions a measure of legal protection… whilst also imposing requirements on authorised institutions to maintain confidentiality and safeguard information,” said Raymond Chan, executive director for enforcement and anti-money laundering at the Hong Kong Monetary Authority.

He said the legal cover would let institutions share a broader range of

We want sharing to be more focused, leading to actionable intelligence in

information without fear of liability.

“I very much hope that we will see increases in suspicious accounts identified, illicit funds intercepted and, wherever possible, stolen funds returned to victims,” he said in an exclusive interview.

Stronger sharing could also help the police prosecute criminals exploiting Hong Kong’s banking system, Chan said.

Challenges

The ordinance allows data sharing when banks observe activity indicating involvement in prohibited conduct. “The thresholds are actually a bit higher than just suspicion, which is a fairly low bar,” he said. “We don’t envisage artificial intelligence (AI)-to-AI sharing without suspicion in this context.”

The change builds on the Financial Intelligence Evaluation Sharing Tool, launched in 2023 by Hong Kong’s central bank with the Hong Kong Police Force and Hong Kong Association of Banks. The platform has supported more than 1,200 reports on suspicious corporate accounts. However, Chan noted that

corporate accounts represent only part of the problem. “Around 90% of accounts used in moving and concealing proceeds of crime, so-called mule accounts, are held by individuals rather than corporations,” he said.

The tool is now being upgraded to cover individual accounts, with the rollout planned later this year.

Participation in the expanded system will remain voluntary. Chan warned that making information sharing mandatory could backfire. “It could lead to high volumes of requests and reports, many of which would be of low quality and impose a very high processing workload on the banks,” he said.

He also cited problems with suspicious transaction reports (STR). Because banks face sanctions if they fail to file, many adopt “defensive” reporting whenever there is doubt. “We want sharing to be more focused, leading to actionable intelligence in the form of higherquality STRs. Loading another obligation onto AIs does not seem to be the best way to achieve this.”

Other safeguards

The central bank is also stepping up consumer safeguards. In December 2024, it launched Money Safe, a feature similar to Singapore’s “money lock,” which lets customers ring-fence part of their deposits until banks complete anti-fraud verification.

Other measures include an in-app authentication system that defaults to bound devices instead of SMS one-time passwords; the option to deactivate higher-risk online banking functions; real-time alerts to cancel suspicious payments; and tools to detect deepfakes.

Chan said sector-wide sharing, coupled with these measures, would help banks respond faster to fraud and money laundering.

Globally, banks are also expanding their cybersecurity methods, increasing their cybersecurity spending.

The proportion appointing chief information security officers rose to over seven in 10 of banks of the 228 banks surveyed by Moody’s Ratings.

In Asia, nearly two in five or 37% of cybersecurity leaders report directly to CEOs or CFOs— a “significantly larger proportion than other regions,” according to Moody's.

The HKMA also introduced Money Safe, a feature similar to Singapore's "money lock" in December 2024

the form of higher-quality STRs Raymond Chan

INDUSTRY INSIGHT: ENERGY & OFFSHORE

HK taps mainland for waste-to-energy push

Its first incinerator is only about to be finished in 2025, after eight years.

Hong Kong should tap wasteto-energy facilities across the Greater Bay Area instead of building its own, as it tries to phase out landfills by 2035 and generate more than 900 million kilowatt-hours (kWh) of electricity, analysts said.

“In China, there are a lot of incinerators that don’t have enough waste to burn,” Lawrence Iu, executive director at public policy think tank Civic Exchange, told Hong Kong Business. “We can explore collaboration with Mainland China to utilise idle facilities in the Greater Bay Area, which can ease the pressure for Hong Kong to build new facilities.”

Generally, the global waste-toenergy market is expected to reach $740.69m (US$95.19m) by 2035, garnering a compound annual growth rate of 7.2%.

According to Market Research Future, Asia Pacific is the fastestgrowing market due to rapid urbanisation and government investment in waste management. China, Japan, and South Korea are

expanding their capacity to combat landfill shortages and air pollution.

“With rising waste volumes, evolving technologies, and strong regional policy support, waste-toenergy is set to play a pivotal role in creating a cleaner, more sustainable energy future. As advancements continue, the sector will not only help reduce environmental pressures but also contribute meaningfully to global energy security,” Market Research Future said.

Iu said incinerators in the Greater Bay Area could process all of Hong Kong’s waste, which reached 3.97 million tonnes in 2023, according to a report by the Environmental Protection Department published in October 2024.

The Zhuhai Environmental Biomass Thermal Power Project in Guangdong province, operational since November 2016, is one of the available incineration facilities. Its first and second phases can handle 3,000 tonnes of waste daily, according to SUS Environment, a

waste-to-energy service provider based in Shanghai.

Waste-to-energy facilities are key to Hong Kong's push for more sustainable waste management. It has set a zero landfill target in 10 years.

The $31.12b (US$4b) Integrated Waste Management Facilities Phase 1 (I·PARK1), the city’s first wasteto-energy incinerator built on an artificial island off Shek Kwu Chau, is about to be finished this year.

It comes eight years after its design-build-operate contract was awarded to the Keppel Seghers Hong Kong Ltd. and Zhen Hua Engineering Co. Ltd. group.

Second facility

Hong Kong plans to build the I·PARK2, its second waste-to-energy plant in the middle-ash lagoon at Tsang Tsui, Tuen Mun.

The government has invited tenders for the design, construction, and operation of I·PARK2, which isn't expected to start operating until 2030.

I·PARK1 was designed to process 3,000 tonnes of municipal solid waste per day, generating electricity from waste heat to power about 100,000 households. I·PARK2 is expected to double the capacity of I·PARK1.

Hong Kong hopes to approve the budget for the construction of its second integrated waste management facility by next year.

This was announced by Chief Executive John Lee during his 2025 Policy Address.“To expand our wasteto-energy capacity, the Government will seek funding approval from the LegCo next year for the construction of I·PARK2,” the official said.

Meanwhile, I·PARK1 will progressively begin operation by the end of this year, he said.

Shipeng Zhang, an assistant professor at The Hong Kong Polytechnic University’s Department of Civil and Environmental Engineering, said incinerators, which number about 700 in China, are key to hitting Hong Kong’s zero-waste goal.

“Until that [I·PARK1] is running, let’s utilise the full potential of municipal solid waste in Hong Kong,” he told the magazine.

The $4b I·PARK1 is Hong Kong's first waste-to-energy energy incinerator (Photo from Carbon Neutrality and Sustainable Development)

Lawrence Iu

Shipeng Zhang

FINANCIAL INSIGHT: PRIVATE EQUITY

Distressed assets lure PE back to HK

Investors eye Pan-Asian deals to minimise exposure to US trade risks.

MARKETS & INVESTING

Private equity fund managers are ramping up investment in Hong Kong, seizing opportunities in real estate and diversifying into healthcare, consumer goods, and technology, as falling valuations and an improving capital market reset the deal landscape.

“Most Hong Kong-based PE firms are eyeing real estate,” Ka-chun Wong, Hong Kong bureau chief at Mergermarket, told Hong Kong Business in an exclusive interview. A significant drop in property prices has created a good entry point for private equity.”

Prices in Hong Kong’s commercial property market have dropped steeply. Grade A office prices have fallen 51% from their peak, with some mortgagee sales slumping almost 60%, according to Thomas Chak, head of capital markets and investment services at Colliers International (Hong Kong) Ltd. Retail and industrial asset prices have fallen 39% and 32%, respectively.

The correction has left the market “very stuck,” according to Timothy Loh, managing partner at law firm Timothy Loh LLP. He added that private equity firms have stepped in as “vulture buyers,” helping distressed developers and providing capital relief for banks.

In February, Gaw Capital Partners injected $758m in equity and a $500m senior unsecured note into CSI Properties Ltd., which had been posting losses.

The Hong Kong–based real estate private equity firm is also raising a $15.6b (US$2b) fund to back private credit and equity investments in tier-1 and tier-2 cities across the Asia-Pacific region including Hong Kong, Reuters reported in May.

Thomas Crasti, M&A advisory partner at PwC Hong Kong, said other areas are drawing private equity interest,

particularly healthcare and business services. Wong noted that multinationals have been divesting parts of their consumer portfolios. Hong Kong startups in the sector are gaining traction with private investors, according to Tracxn Technologies Chairperson Neha Singh.

Technology is also rising on investor radars. Ben Jelloun, managing partner at GCCVest Partners, cited artificial intelligence (AI) and robotics as focus sectors, pointing to Chinese AI company DeepSeek as a catalyst in attracting fresh capital back to Asia.

Andrew Lam, managing director of assurance at BDO Ltd., said information technology and biotechnology in the Greater Bay Area remain especially attractive.

Crasti expects private equity firms to continue expanding beyond Greater China, pursuing Pan-Asian investments to diversify and minimise exposure to US trade risks. In January, Pacific Alliance Group acquired a majority stake in Indian pharmaceutical packaging company Pravesha Industries, illustrating this trend.

Still, some investors are keeping an eye on Chinese companies with global ambitions.

“We are continuously trying to identify leading mature companies, dominant locally but with high potential for growth globally,” Jelloun told Hong Kong Business. Singh noted that Hong Kong investors “prioritise international expansion and innovation.”

Market sentiment has improved with Hong Kong’s stronger capital markets. Lower interest rates, abundant funds, and an upbeat investor outlook are expected to support deal activity, Lam said.

Crasti told Hong Kong Business that signs of recovery in China should further lift sentiment.

Ka-Chun Wong

Timothy Loh

Thomas Crasti

Bargain hunters revive property market

Transaction value soared 65% year on year to $9.1b in the first half.

Offices accounted for 76% of all real-estate investments in the second quarter

End-user demand is fuelling the property sector, as falling prices and fresh government measures spur activity across office, hotel, residential, and retail assets.

Investors acquiring properties for their own use—whether as offices, student housing, or luxury residences—are driving activity that analysts say will accelerate once interest rates ease.

“Commercial activity continues to be primarily driven by end-user demand, as recent price corrections have renewed interest amongst buyers seeking to secure long-term office and retail premises,” Thomas Chak, head of capital markets and investment services at Colliers Hong Kong, told Hong Kong Business.

As of 25 August, commercial realestate transaction volume had reached $27b, or about 60% of last year’s total, he said in an exclusive interview.

Grade A office prices have slumped 51% from their peak, with some mortgagee sales plunging nearly 60%. Retail and industrial prices have dropped 39% and 32%.

“Amongst these sectors, office properties have experienced the most

significant adjustment and are now trading at deep discounts,” Chak said. “Once interest rates begin to ease, leasing and investment demand are expected to improve substantially.”

The office sector has emerged as the biggest beneficiary of renewed enduser interest. Transaction value soared 65% year-on-year to $9.1b in the first half, according to Colliers.

Cushman & Wakefield, said offices accounted for 76% of all real-estate investments in the second quarter, with total investment sales climbing 92% quarter-on-quarter to $9.7b.

Driving that increase was the Hong Kong Exchanges and Clearing’s $6.3b acquisition of floors at One Exchange Square in Central for its permanent headquarters.

CBRE Group, Inc. highlighted other major transactions, including entrepreneur Mike Cai Wensheng’s $650m en bloc purchase at Park Aura and Hongxingyang Ltd.’s $230m acquisition at 9 Queen’s Road Central.

Tom Ko, executive director and head of capital markets at Cushman & Wakefield Hong Kong, said anticipated US rate cuts would unlock further office demand.

Lower US interest rates could generate demand especially amongst end-users, he added.

Beyond traditional leasing, Hong Kong’s office sector is being reshaped by the “Hostels in the City” scheme, introduced in July by the Development Bureau and Education Bureau, which allows offices to be converted into student housing.

Colliers projects demand for student beds to reach 120,000 by 2028, far outstripping the 48,000 supply, about 3,500 of which are from student hostels.

Chak said well-located Grade B offices are now priced attractively enough to yield stable returns after conversion. Ko added that Kowloon, Tsim Sha Tsui, Jordan, and Mong Kok are prime areas because they are near universities, whilst Sheung Wan could serve Hong Kong University students.

Hannah Jeong, executive director and head of valuation and advisory services for Hong Kong at CBRE, said conversion projects need not be adjacent to schools. Proximity to rail stations is sufficient since students are willing to travel “a little bit more.”

Student accommodation often generates steady rental income, usually 5% or higher compared with what the property cost to buy, said Oscar Chan, JLL Hong Kong’s head of capital markets.

Compared with offices, Jeong said converting hotels into student housing is faster and far less costly than converting office buildings.

Hotel-to-student housing conversions usually take four to six months and cost about 5% to 10% of the hotel’s original value, according to Cushman & Wakefield. Ko said hotel unit prices are down 50% to 60% from their peak.

Jeong said buyers usually target distressed hotels or those with low rents and high vacancies. Converting such properties could generate rental yields of 4% to 6%. Buyers are often universities or other education institutions, she added, noting that they account for a significant share of end-user demand in Hong Kong.

Chak said the education sector accounted for 10% of property deals in the first half. Government-related

Tom Ko

Thomas Chak

sectors, which include bodies such as the stock exchange, airport authority, and several educational institutions, accounted for 42%.

He said the growing demand for student accommodation is driven by Hong Kong’s rising appeal to mainland Chinese and international students.

Chak noted that the government recently raised the nonlocal student quota to 40% from 20%, a move that is intensifying housing needs.

Hotel transaction values advanced 83% year-on-year to $2.8b in the first half, he added.

Cushman & Wakefield reported two big hotel deals during the period. HKIA Accommodation Ltd. snapped up the Winland 800 Hotel in Tsing Yi for $765m, whilst Nanyang Commercial Bank acquired Hotel COZi Harbour View in Kwun Tong for $1.87b.

Key drivers of demand

Mainland Chinese investors are emerging as key drivers of demand in Hong Kong, not only for student accommodation but also for luxury homes, Chan said. “We saw strong demand from mainland Chinese buyers, driven by Hong Kong’s stable market and high-end lifestyle appeal,” he said in a separate interview. He added that cheaper financing since April and the Federal Reserve’s likely September rate cut could further lift sentiment in the luxury residential market.

Mortgage interest rates are holding at 2.5% to 2.7%, a range Jeong described as a healthy buffer, particularly as residential property is considered a less risky asset type.

Jeong said mainland buyers favour Hong Kong luxury homes since low developer risk guarantees reliable delivery of purchased units.

“In Mainland China, during the residential market crunch, a number of developers either defaulted or were unable to deliver their projects during the construction period,” she told Hong Kong Business

“From the perspective of mainland investor-buyers, Hong Kong developers are very prudent and committed to delivering what they promise,” she continued.

Jeong added that since the Hong Kong dollar is pegged to the US dollar, buying property in Hong Kong is, in effect, like investing in US dollars rather than in renminbi. If prices climb and the US dollar strengthens, buyers gain twice, making Hong Kong apartments especially attractive to

Chinese investors, she said.

About 50% of luxury residential buyers in Hong Kong are mainland Chinese, Jeong said. Location-wise, Kai Tak and Wong Chuk Hang are emerging as the preferred districts for luxury residential developments.

She added that buyers prefer apartments over houses because these are typically overseen by experienced property operators.

As a result, even units exceeding $100m have attracted strong interest from mainland buyers, boosting apartment sales, Jeong said. Their preference for new units has translated into higher first-hand sales across the residential market, now representing roughly a third of transactions.

Retail revival

In the commercial space, hotels and retail assets continue to drive transaction volumes. The retail vacancy rate fell to 7.1% in the first half, pushing rents up 0.9% quarteron-quarter, according to CBRE data. Food and beverage groups leased 134,000 square feet, their strongest take-up since 2009.

From the perspective of mainland investor-buyers, Hong Kong developers are very prudent and committed to delivering what they promise

In the second half, three retail deals took place—one was Perfect Smart Ltd.’s $119m acquisition of Unit C1 at King Fai Building, whilst the other two were purchases made by churches.

Retail remains undervalued, Chan said, citing prime-location shops with fixed leases of as long as 10 years that can provide yields above 5%.

“Prime retail with stable tenancies can offer a good return.” Jeong noted that retail yields typically range from

Oscar Chan

Hannah Jeong

Nanyang Commercial Bank acquired Hotel COZi Harbour View in Kwun Tong for $1.87b

Retail vacancy rate fell to 7.1% in the first half, pushing rents up 0.9% quarter-on-quarter

5% to 7%, depending on tenant quality and stability.

Street shops are particularly attractive, offering good rent and the potential for high yields. “Investors were keen to look at these because they were amongst the most heavily adjusted asset types in 2024,” she added.

She expects stronger transaction volumes in the second half, supported by an improving stock market.

“The IPO market has been very active, thanks to government support. And normally, when the stock market recovers, the property market follows a similar pattern,” she told the magazine.

Chak said stronger IPO and fundraising activities in Hong Kong would create a “wealth effect” that is likely to drive robust investment in the property market. He added that a government programme to let applicants invest a portion of their funds in property would also support the market.

The head of capital markets and investment services said 911 applicants had been approved under the scheme as of April, translating into estimated inflows of more than $37b.

Jeong said Hong Kong’s revised re-domiciliation rules, which allow overseas companies to shift their legal base to the city, are expected to boost business activity and investor confidence in the property sector.

She added that the Northern Metropolis project is likely to create more opportunities in residential real estate, especially with strong government backing. The large-scale development along Hong Kong’s border with Shenzhen aims to deliver about 350,000 new housing units.

Hong Kong’s hostel conversion scheme seen reviving office sector

ANormally, when the stock market recovers, the property market follows a similar pattern

government scheme allowing commercial buildings to be converted into student hostels is expected to breathe new life into Hong Kong’s struggling office market, where prices and rents have been falling since last year.

“Owners of existing underperforming Grade B or C office buildings will see an opportunity to give those buildings a new lease on life,” Shaman Chellaram, senior director at property consultancy Colliers, told Hong Kong Business in an exclusive interview.

“No additional procedures will be required for converting existing commercial properties. This could save them about six to nine months,” the senior director continued.

In the last quarter of 2024, prices of Grade B and C offices fell 20%, whilst rents dropped more than 5%, according to data from the Rating and Valuation Department.

Rents and capital values continued to decline across almost all commercial property segments in the first quarter this year, according to Jones Lang LaSalle, Inc.

The office sector’s vacancy rate had risen to 13.7% by the end of March, with rents slipping 1.3% quarter-on-quarter.

Launched on 21 July by the Development Bureau and Education Bureau, the Hostels in the City Scheme allows buildings on land zoned as commercial to be converted into student hostels. Industrial buildings are excluded.

The programme classifies student hostels as nondomestic buildings, letting them have more floor space than standard residential projects.

“We can now preserve those spaces such as parking lots or other commercial zones and convert them into game zone, activity room and study room,” said Gary Chan, assistant marketing manager at Y.X., one of Hong Kong’s biggest student accommodation providers.

Y.X. bought a 25-storey office tower in Hung Hom together with its fund partner AEW for $1.65b in 2022 and converted it into a 600-bed student hostel.

Chellaram noted that third-party investors have been increasingly drawn to the student accommodation sector. “It not only gives them land appreciation but also provides a de-risked cashflow as students would pay rents in advance,” he told the magazine.

The number of University Grants Committee-funded students surpassed 100,000 in the 2024-2025 academic year, up 8.1% from 2020 to 2021. As of 2024, Hong Kong’s higher education institutions had enrolled over 333,600 students across various programmes.

Prices of Grade B and C offices fell 20% in end-2024

HOTELS & TOURISM

The Northern Metropolis project is likely to create more residential real estate opportunities

Street shops offer good rent and the potential for high yields

REAL ESTATE LUMINARIES

Most notable real estate agents under 40

In search of the most notable real estate agents under 40, Hong Kong Business reached out to more than 35 property firms. After rigorously reviewing submissions from the firms, five women and 15 men have made it to the final cut.

Agents on this year’s list come from CBRE, Colliers, Cushman & Wakefield, Knight Frank, JLL, OKAY.com, and Savills. Leading the pack are Colliers and CBRE, with five representatives each. The youngest on the list is from Savills.

Realtors in the office market took the lead, taking seven spots in the list.

This year’s honourees are million and billion sellers and have handled big clients such as Hong Kong Exchanges and Clearing Limited (HKEX), ANZ Bank, Prudential, Y36, Mazars, Oriental Watch, Cinda International Holdings Ltd.,Vizz Digital Group, Chiaphua Industries Ltd, and FTI Consulting.

Notable deals completed by this year’s honourees feature the sale of Goldin Financial Global Centre and Cheung Kei Center, with the latter fetching $2.65b from Hong Kong Metropolitan University—the biggest commercial property deal of 2024.

Here are this year’s honourees, arranged from youngest to oldest.

Thomas is a real estate professional who has played a significant role in deals exceeding $2.5b over the past two years. His expertise lies in the acquisition and disposal of high-value investment properties, including retail, hotels, en-bloc composites, car parks, residential properties, and school premises. His notable transactions include the Urbanwood Hung Hom Hotel, the Commercial Accommodation and Public Vehicle Park at Alto Residences, and a house lot at 19 Kent Road. Beyond transacting deals, he mentors future surveyors through active participation in the Committee of the HKIS Young Surveyors Group.

Harry advises clients in financial services, asset management, consumer and pharmaceutical goods, and public relations, with mandates from Mainland China, wider Asia, and Europe. Last year, he successfully negotiated leases for Oriental Watch for a combined 20,000 sq. ft. and orchestrated a comprehensive lease extension for Mazars’ 20,000 sq. ft. in Wan Chai. His portfolio includes transactions for lease renewals, relocations, and expansions, including the relocation of a mainland enterprise to K11 Victoria Dockside in Tsim Sha Tsui. In 2024, Harry generated $4.5m revenue across 20 transactions.

Michael provides strategic advice on acquisitions, disposals, and pricing, with a focus on navigating investment opportunities for investors and high-net-worth individuals. Michael has been involved in multiple high-ticket transactions totalling over $2.5b. Amongst them is the SL Ginza (formerly Golden Wheel Plaza) commercial building in Tin Hau. He also worked on the pioneering Y36 receivership sale of an en-bloc multi-unit residential building in Hung Hom, which was acquired by a student accommodation operator. This year, he was involved in the Queen's Road Centre transaction.

Nino specialises in cross-border real estate strategy for enterprises from Mainland China. He provides services including land acquisition, development feasibility, investment optimisation, and commercial leasing and purchasing. Nino works with mainland government bodies, central state-owned enterprises, and state-owned enterprises to help them expand in Hong Kong. In 2025, he led the relocation of Cinda International's headquarters from Cosco Tower to Central Plaza and helped the Jiangsu Provincial Government establish its Innovation and Technology Centre at Cyberport.

Wilson is an experienced real estate professional focused on the acquisition and disposal of investment properties. As an associate director, he has demonstrated resilience and strategic acumen. In 2025, he successfully brokered a commercial portfolio on Hong Kong Island and a basket of residential units and parking spaces on Robinson Road, Mid-Levels. Before his capital markets career, Wilson helped launch a 1-million sq ft retail complex in Guangzhou and built a strong track record in international property brokerage. His diverse background provides a holistic market perspective and a high-value client base.

1 Thomas Ng 24, Savills

2 Harry Wong 25, Colliers

3 Michael Ip 27, Colliers

4 Nino Huang 29, Colliers

5 Wilson Cheung 29, Knight Frank

REAL ESTATE LUMINARIES

Dave is a dedicated real estate professional at Savills Hong Kong, specialising in agricultural and brownfield land transactions. In the last three years, he has successfully brokered over 200,000 sq.ft. of agricultural lands. His notable transactions include 37 Cumberland Road and DD85 Lot 612 S.G. He has also concluded a diverse range of deals, including residential development land, retail malls, and industrial properties. Dave excels at identifying market trends, using data-driven insights and innovative strategies to provide tailored solutions. His expertise in complex deals makes him a trusted specialist in the challenging real estate sector.

9

Flora has been a specialist in large-cap investment transactions at Savills Investment CEO Office since 2018, playing a pivotal role in deals totalling nearly $8.5b. She has expertise in managing receivership asset sales, including a portfolio of elderly care centres under receivership. Amongst her notable achievements are her contributions to the Goldin Financial Global Centre and the Cheung Kei Center, two of Savills Hong Kong’s largest office projects in recent years. She also managed the sale and acquisition of elderly care centres under receivership. Her analytical mindset allows her to provide insights into market trends and investment opportunities.

7

Jarrod is an innovative leader in the Tenant Advisory Group at Cushman & Wakefield. He transacts over 25 assignments annually for local and multinational occupiers, including strategic renewals, lease restructures, and relocation projects. He also leads the Alternative Investment Services platform, offering insight for occupiers in the sector and the Greater Central submarket. In 2025, his notable assignments included representing a North American insurance firm with 310,000 sq ft of lease negotiations and an international bank occupying 50,000 sq ft. He is passionate about delivering tailored solutions that align with each client’s long-term goals.

10

Tony is an Associate Director on the Industrial & Logistics Leasing team. Specialising in tenant representation, he's known for his market knowledge and strategic thinking, delivering end-to-end real estate solutions to help clients streamline operations and achieve long-term savings. He successfully closed seven deals with Cainiao Supply Chain, totalling over 250,000 sq ft. Another standout transaction involved advising a client on leasing two floors of China Resources Sha Tin Warehouse in Fo Tan, totalling 67,396 sq ft. His portfolio includes transactions with third-party logistics firms, high-tech electronics manufacturers, self-storage operators, and G/F warehouses.

8

Honlia is a dedicated professional in JLL's Office Leasing Advisory team. With a decade at JLL, she has advised on over 250 deals, including new lettings, renewals, lease restructures, and rent reviews. Notable achievements include securing two office floors for the English School Foundation, advising a major French bank in its long-term leasing strategy, and assisting an insurance client with lease restructures. She has also negotiated signage agreements in Great Eagle Centre and shaped leasing strategies for The Hong Kong Club Building and Infinitus Plaza. Honlia is committed to delivering thoughtful solutions for Hong Kong's evolving office market.

11

Evan is an Associate Director in CBRE's Industrial & Logistics team. He has eight years of experience in the industrial and warehouse market, providing strategic market planning and consultancy services to both local and multinational corporations. Evan's expertise covers leasing, renewals, and strata-title sales. He has handled leasing transactions for various government departments, totalling over 270,000 sq ft. Notable achievements include leasing 113,362 sq ft of warehouse space for Chaiphua, and, as landlord representative, securing tenants from the logistics, aviation, and pharmaceutical sectors totalling 103,194 sq ft in just eight months.

6 Dave Yeung 29, Savills

Jarrod Mongston 33, Cushman & Wakefield

Honlia Mok 33, JLL

Flora Mak 33, Savills

Tony Leung 33, CBRE

Evan Chau 35, CBRE

REAL ESTATE LUMINARIES

Kelvin specialises in tenant representation across various asset types, including office, retail, industrial, residential, and hospitality properties. With nearly a decade of experience, he is a trusted adviser to tenants in Hong Kong's commercial property sector. He focuses on guiding clients from emerging sectors like technology, co-living, and digital marketing. His notable achievements include the en bloc lease of 129 Temple Street to Linko Concept, an 8,966 sq. ft. transaction in the co-living sector for student accommodation. He also successfully relocated Vizz Group from an industrial building to a full-floor tenancy at KOHO in Kwun Tong, a 16,151 sq. ft. space.