YEAR 2 | ISSUE NO. 4 | JULY - SEPT 2025

COMPANY FEATURE

Grainpulse Limited

LIVESTOCK FEED

The Rise of Fodder in Africa

SWINE HEALTH

African Swine Fever

PET NUTRITION

Purina Institute’s New Handbook

YEAR 2 | ISSUE NO. 4 | JULY - SEPT 2025

COMPANY FEATURE

Grainpulse Limited

LIVESTOCK FEED

The Rise of Fodder in Africa

SWINE HEALTH

African Swine Fever

PET NUTRITION

Purina Institute’s New Handbook

In late September, leaders and experts from across the continent gathered in Naivasha, Kenya, to begin shaping the Africa Common Position on Sustainable, Resilient, and Nature-Positive Livestock Food Systems. It was the kind of meeting whose implications run deep into the future of African agriculture.

Livestock contributes up to 30% of Africa’s agricultural GDP, and in some countries, as much as 73%. Yet biodiversity, and climate finance remain underrepresented in livestockrelated policies, while weak data systems continue to hinder progress. However, the new framework aims to reposition livestock not only as a source of emissions but as a pathway to solutions that enhance resilience, food security, and sustainable development.

For decades, livestock has been central to rural economies but remained at the margins of national policy. The continental framework aims to change that, providing livestock with a defined role within Africa’s climate, biodiversity, and development agenda. The goal is not simply to cut emissions, but to recognise livestock as a driver of restoration, nutrition, and economic stability.

At the workshop, participants were introduced to LiveSYS, a continental initiative now being piloted in Kenya, Zambia, and Nigeria, with additional insights drawn from Mexico. LiveSYS aims to develop climate-smart livestock systems by promoting resilient and nature-positive practices, enhancing governance, channelling climate finance, and monitoring progress through digital dashboards.

This shift matters. It signals a move from fragmented approaches to coordinated action; from scattered national efforts to a unified continental voice. Strengthening data systems, aligning policy priorities, and mobilising climate finance may sound procedural, but these are the quiet

foundations of long-term resilience.

For the feed sector, such alignment is vital. Feed demand doesn’t grow in isolation but instead follows structure. As livestock systems become more organised, better financed, and more climate-aware, they send clearer signals to the feed industry, shaping where innovation, investment, and capacitybuilding take root. In many ways, this emerging framework is laying the groundwork for the next chapter of Africa’s animal feed story.

At Feed Business MEA, our goal is to remain a steady voice in a fast-moving industry, a place where the science, practice, and people behind feed production receive thoughtful attention. This issue brings together regional perspectives, technical insights, and stories exploring how sustainability and innovation continue to shape the sector’s direction.

Each edition is built on contribution and trust. Our dedicated editors bring you stories from all over the region, our guest contributors share their insights with us, and our partners get a chance to showcase their solutions to the industry.

And to those reading, we’d love to hear from you, too. Tell us what you’re working on, invite us to your events, share the discussions you believe deserve more attention, and contribute your expertise to move the conversation forward. The strength of this magazine lies in the stories it gathers, and there’s always room for more voices at the table.

Warmly,

Wangari Kamau Editor - Feed Business MEA

Superior performance compared to other phytases in the market: delivering greater cost savings to poultry and swine feed industries.

Improves sustainability: driving the science towards inorganic phosphate free diets

IFF’s Scientific Excellence Across Poultry and Swine Feed Solutions.

Market leading thermostability, even under harsh pelleting conditions.

MIDDLE EAST & AFRICA

Year 2 | Issue No. 4 | July-Sept 2025

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Martha Kuria

EDITORS

Wangari Kamau

Nicholas Ng'ang'a

Lydia Khasoa

EXTERNAL CONTRIBUTORS

André Magrini

Saad Gilani

BUSINESS DEVELOPMENT

DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT

ASSOCIATE

Johna Sambai

HEAD OF DESIGN

Clare Ngode

DESIGN

Monica Wachio

ACCOUNTS

Anita Kinyua

PUBLISHED BY: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254 725 34 39 32

Email: info@fwafrica.net Company Website: www.fwafrica.net

Feed Business Middle East & Africa (ISSN 2307-3535) is published 4 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

www.horecamea.com www.healthcaremea.com

VIV MEA

November 25 - 27, 2025

ADNEC Center Abu Dhabi, UAE www.vivmea.nl

Poultry India 2025

November 26 – 27, 2025

Hitex Exhibition Centre, Hyderabad, India www.poultryindia.co.in

35th Annual IAOM MEA Conference & Expo 2025

December 1 – 4, 2025

Jeddah Hilton (Hilton Hall), Jeddah, Saudi Arabia www.iaom-mea.com/Jeddah-2025

Africa Dairy Innovations Summit

February 25 - 27, 2026

Nairobi, Kenya www.africadairysummit.com

VICTAM Asia and Health and Nutrition Asia

March 10 - 12, 2026

BITEC Exhibition Center, Bangkok, Thailand www.victamasia.com

Aquaculture Vietnam 2026

March 11 - 13, 2026

Saigon Exhibition & Convention Center, Ho Chi Minh City, Vietnam www.aquafisheriesexpo.com

World Aquaculture Singapore 2026

June 2 - 5, 2026

Singapore EXPO Convention & Exhibition Centre, Singapore www.was.org/Meeting/Code/WA2026

Middle East Poultry Expo

June 28 - 30, 2026

Riyadh International Convention and Exhibition Center, Saudi Arabia www.mep-expo.com

IDMA 2026

June 25 - 27, 2026

Istanbul Expo Center, Turkey www.idma.com.tr

Middle East Poultry Expo

June 28 - 30, 2026

Riyadh International Convention and Exhibition Center, Saudi Arabia

www.mep-expo.com

BRAZIL – Cargill has made a binding offer to acquire 100% of Mig-Plus, a family-owned Brazilian animal nutrition company, in a move that will strengthen its footprint in Brazil’s livestock sector.

Announced in late July, the proposed deal is pending approval by Brazil’s Administrative Council for Economic Defense (CADE) and other customary closing conditions. Once cleared, Cargill will take full ownership of Mig-Plus’ operations, which include two production facilities and a workforce of about 450 employees.

Founded in 1991 and headquartered in Casca, Rio Grande do Sul, Mig-Plus operates in one of Brazil’s most important swineproducing regions, a strategic advantage for Cargill as it seeks to get closer to producers and expand its service offering. The company manufactures premixes, feed concentrates, and complete feeds for pigs and ruminants.

“We are excited about this acquisition, which will leverage strong synergies between Cargill and Mig-Plus, including shared organisational values and complementary best practices

in production, logistics, and market knowledge,” said Celso Mello, Vice President of Cargill Animal Nutrition & Health in South America.

Both companies highlighted a strong cultural fit and shared commitment to people and performance. “Both companies share a common purpose and values. The care Cargill demonstrates for people gives us confidence throughout this process. Caring for people has always been part of Mig’s legacy,” said Tadeu Migliavacca, CEO of Mig-Plus.

Mig-Plus co-founder Flauri Migliavacca added that the company is confident in the partnership’s benefits for producers and customers across Brazil.

Adriano Marcon, President of Cargill Animal Nutrition & Health, described the deal as “yet another example of Cargill’s confidence in and commitment to growth in the Brazilian market.”

If approved, the acquisition will mark another milestone in Cargill’s ongoing expansion of its animal nutrition business and reinforce its position in Brazil’s highly competitive feed industry.

BURKINA FASO – The government of Burkina Faso has announced the removal of Value Added Tax (VAT) on fish feed in a bid to reduce production costs and stimulate growth in the fisheries and aquaculture sector.

The measure forms part of a broader amendment to the General Tax Code aimed at easing the financial burdens on those engaged in fishing activities.

Officials said the tax exemption will not only lower household food expenses but also create a more attractive environment for private investment in aquaculture.

The initiative aligns with the government’s Agro-Pastoral and Fisheries Offensive 2023–2025 (OPAH), a flagship program designed to boost production in eight key sectors, including fish, poultry, and rice. Through OPAH, authorities aim to achieve self-sufficiency in at least half of the country’s

fish consumption by the end of 2025.

Fish remains a crucial source of dietary protein in Burkina Faso, where domestic production has long fallen short of demand. By reducing feed costs, one of the most significant expenses for fish farmers, the government aims to boost local fish production.

According to the Ministry of Agriculture, Animal Resources, and Fisheries, the OPAH plan is estimated to carry a cost of US$953 million (approximately 592 billion CFA francs). Officials argue that investment in fisheries will strengthen food security and support the livelihoods of rural communities that rely on fishing for income.

The VAT waiver is expected to attract new entrants to the fish feed supply chain, but experts caution that tax relief alone will not be sufficient to meet the country’s ambitious production goals.

Authorities acknowledge that sustained investment in infrastructure, training, and technical support will achieve a lasting impact. The next phase of the OPAH initiative will focus on scaling up fish farms across multiple regions and expanding distribution capacity to achieve nationwide coverage.

With these adjustments, the government hopes that by 2025, at least one in two fish consumed in the country will be sourced locally rather than imported.

AFRICA – The Pirbright Institute, through its Centre for Veterinary Vaccine Innovation and Manufacturing (CVIM), has signed a new agreement with the Global Alliance for Livestock Veterinary Medicines (GALVmed) to advance the development of a Rift Valley fever vaccine intended for low- and middleincome countries.

The initiative will concentrate on African regions where the mosquito-borne disease is endemic, with the aim of providing livestock keepers with an option that avoids the risks associated with existing vaccines.

CVIM will provide the vaccine technology, while GALVmed is responsible for collaborating with a local manufacturing partner to transfer the know-how, conducting safety and efficacy studies, including field trials, and seeking regulatory approval.

The vaccine under development uses a replicationincompetent viral vector, which has already demonstrated safety in pregnant animals, addressing one of the most serious drawbacks of currently available Rift Valley fever vaccines.

At present, licensed vaccines include live-attenuated versions, which can trigger abortion or birth defects if administered during pregnancy, and inactivated formulations, which often require several booster doses and are difficult to roll out quickly during an outbreak.

Rift Valley fever primarily affects sheep, goats, and cattle, but it can also infect humans, making it a significant concern for both animal and public health in affected regions.

In animals, the disease is marked by high mortality in young stock and widespread abortion, outcomes that cause heavy economic losses for farmers and disrupt production chains for milk, meat and trade.

For humans, infection can occur through mosquito bites or contact with tissues from infected animals, with most cases being mild.

Professor Bryan Charleston, Director of The Pirbright Institute, said the agreement with GALVmed represents the transition of a vaccine candidate from research laboratories to commercial development, making it available in affected regions.

Dr Steve Wilson, Director of Research and Development at GALVmed, noted that current Rift Valley fever vaccines remain limited by issues of safety and effectiveness, and the new collaboration aims to provide a safer solution.

By prioritising a vaccine that can be administered to pregnant animals, the partners intend to offer farmers and veterinary services a practical option for reducing livestock deaths, protecting livelihoods and lowering the risk of human infection.

SAUDI ARABIA – First Milling Company (First Mills), one of Saudi Arabia’s leading producers of flour, bran, animal feed, and wheat derivatives, has completed the acquisition of AlManar Feed Company Ltd. in a deal valued at SAR 77 million (US$20.5 million).

The transaction gives First Mills full ownership of AlManar Feed and was financed through Sharia-compliant bank facilities, available cash, and other funding programs. The financial impact will be reflected in First Mills’ third-quarter 2025 consolidated results.

Based in Makkah, Al-Manar Feed Company specialises in high-quality feed for ruminants, poultry, and horses. The acquisition is expected to significantly enhance First Mills’ feed production capacity and strengthen its position in Saudi Arabia’s rapidly growing animal nutrition market.

First Mills said the deal will add around 420 tonnes per day of feed output, increasing its total daily production to 1,320 tonnes. Its newly acquired Al-Manar Feed plant in Jeddah will further contribute 450 tonnes per day, bringing total capacity to 1,350 tonnes daily.

Abdullah Ahmed Al-Shehri, vice chairman of First Mills’ board, described the acquisition as a key milestone in the company’s long-term growth strategy.

“We continue to pursue high-value opportunities for sustainable growth in support of the objectives of Saudi Vision 2030 and to enhance the contribution of local production to achieving food security, while serving our customers, including livestock and poultry breeders, across all regions of the Kingdom,” he said.

CEO Abdullah Abdulaziz Ababtain added that the acquisition will enable First Mills to deliver a broader range of products and strengthen its responsiveness to market needs, reinforcing the company’s long-term competitive position.

First Mills confirmed that all necessary regulatory and commercial approvals, including clearance from the General Authority for Competition, have been obtained, clearing the way for full integration of Al-Manar Feed into its operations.

With Al-Manar now fully integrated, the company anticipates expanding its geographic reach and diversifying its revenue streams in line with its long-term strategy.

KENYA – Quality Meat Packers Limited (QMP), one of Kenya’s leading vertically integrated agribusinesses, has broken ground on its third and largest animal feed plant, marking a significant milestone in its growth strategy and long-standing pursuit of quality.

Privately owned and guided by a family legacy dating back to 1970, QMP said the new plant represents the culmination of years of planning aimed at gaining full control over feed quality and standards.

“This milestone reflects our deep commitment to quality and innovation. For years, we aspired to have complete control over our feed standards, and today, that dream has taken root,” the company said in a statement announcing the milestone.

The facility will supply QMP’s vertically integrated operations, including meat processing, poultry, and livestock farming, while also serving external customers, such as independent farmers and agribusinesses seeking consistent, high-quality feed.

“Our goal is not only to cater to QMP’s own needs but also to evolve into one of the largest feed manufacturing and

trading companies in the region, supplying high-quality feeds to farmers and businesses,” the company noted.

QMP’s investment comes at a time of robust growth in Kenya’s animal feed sector. According to the U.S. Department of Agriculture (USDA), the country’s feed ingredients market is valued at about US$530 million and is projected to grow by 30% by 2027.

Although QMP has not disclosed the financial details of its investment, the new facility positions the company to capitalise on this momentum while reinforcing its reputation for quality and reliability in an increasingly competitive market.

As one of the region’s few vertically integrated agribusinesses, QMP controls the entire value chain, from livestock rearing and feed formulation to processing and distribution, ensuring traceability, consistency, and food safety.

Founded as Hurlingham Butchery in Nairobi in 1970, QMP has since evolved into the operator of Kenya’s largest privately owned meat processing complex, which has been exportcompliant since 1998.

NIGERIA – Premier Feed Mills Co. Ltd., a subsidiary of Flour Mills of Nigeria Plc (FMN), has launched Topfeeds LayerWise, a new poultry feed brand designed to boost productivity, ensure consistent egg yolk color, and promote bird health.

The product was unveiled during launch events in Jos and Kano, attended by industry stakeholders, poultry farmers, distributors, and partners. The company said the milestone underscores FMN’s long-standing commitment to empowering farmers with performance-driven, affordable feed solutions tailored to Nigeria’s agricultural needs.

“Topfeeds LayerWise is a game-changer for poultry farmers, offering a product that ensures optimal performance while maintaining affordability,” said Austin Pam Dalyop, General Manager of Sales and Marketing at Premier Feed Mills, during the launch.

According to the company, Topfeeds LayerWise is formulated with a balanced mix of digestible carbohydrates, proteins, vitamins, minerals, and amino acids to deliver superior egg production and promote bird well-being.

It is designed explicitly for layer birds between 17 and 33 weeks of age and will be distributed through Premier Feed Mills’ dealer and on-farm network across Jos and Kano.

The launch comes as FMN continues to expand its

investments in Nigeria’s agriculture and agro-allied sectors, reinforcing its “Feeding the Nation Every Day” agenda. The company said its focus remains on promoting local content, reducing dependency on imported raw materials, and supporting farmers with sustainable, high-quality solutions.

In a recent statement, Group Chief Executive Officer Boye Olusanya highlighted FMN’s broader role in advancing national development beyond business operations.

“For over six decades, the Group has been a source of livelihood for millions of Nigerian families by providing both direct and indirect employment. And more than any other business in the country, we have guarded our national heritage with trust, ensuring that our activities are sustainable for the country, the environment, and most importantly, for the people,” Olusanya said.

IRAQ – Turkey-based Tiryaki Agro Holding has partnered with the International Finance Corporation (IFC), a member of the World Bank Group, to establish 39 Food and Feed Safety Centres (FFSCs) across 14 Iraqi cities, in a move set to transform the country’s food and feed sector.

The partnership was formalised on September 13, 2025, during IFC Partnerships Day in Iraq, held under the patronage of Prime Minister Mohammed Shia’ al-Sudani, marking IFC’s 20th anniversary of operations in the country.

The initiative will begin with a feasibility study to develop integrated Food and Feed Security Compounds, envisioned as key pillars of Iraq’s food security and agricultural growth. With an initial investment exceeding US$120 million, part of a larger multi-phase plan, the project seeks to modernise the country’s supply chain from farm to market.

The FFSCs will be developed in stages, starting with environmental and social screenings aligned with IFC Performance Standards to ensure sustainability and global compliance. Core elements include soil and water resource assessments, adoption of renewable energy solutions, and construction of modern storage and silo facilities to curb postharvest losses.

Farmer training and capacity-building programs will promote sustainable practices and boost productivity.

“The strong partnership we have established with IFC represents a significant opportunity to responsibly bring Tiryaki Agro’s 60 years of expertise in the agricultural and food supply chain to the region,” said Süleyman Tiryakioğlu, CEO of Tiryaki Agro.

The collaboration builds on Tiryaki Agro’s soy crushing and corn storage facility in Umm Qasr, commissioned in 2024, which now supplies nearly half of Iraq’s feed market and employs 290 workers.

Looking ahead, Tiryaki Agro plans to develop an integrated agricultural and logistics hub in Iraq, encompassing flour, legumes, and rice processing, as well as feed additives and vaccine supply, thereby further embedding sustainable growth into the nation’s food system.

The partnership between Tiryaki Agro and IFC positions Iraq for strengthened food and feed security while driving rural development and regional agricultural integration.

NORWAY – Norway has expanded its national fish feed monitoring programme to include a broader range of contaminants, with the 2024 results revealing generally low levels of harmful substances.

The findings, released in the Norwegian Food Safety Authority’s (NFSA) latest annual report, are crucial for maintaining the integrity of aquaculture feed in one of the world’s leading salmon-producing nations.

Conducted by the Norwegian Institute of Marine Research (HI) on behalf of the NFSA, the 2024 survey analysed 99 fish feeds and 48 feed ingredients, including fishmeal, fish oil, plant meals, insect meal, algae oil, krill meal, and yeast, primarily used in Atlantic salmon production. Samples were tested for heavy metals, pesticides, feed additives, emerging contaminants, microbes, and nutrients.

HI researcher Anne-Katrine Lundebye noted that this year’s programme marked a milestone: “What is new in the 2024 report is that we have included emerging contaminants that have not been analysed in this monitoring program before.”

Among these were brominated flame retardants and chlorinated naphthalenes, industrial chemicals known for environmental persistence. Only one such compound, tribromoanisole, was detected.

“The European Food Safety Authority (EFSA) is requesting more data on bromophenols and chlorinated naphthalenes in food and feed,” Lundebye added.

Heavy metals such as arsenic, mercury, and cadmium were found well below EU limits, though levels were higher in starter feeds, likely due to their greater content of marine ingredients.

Enhanced testing methods revealed the presence of perfluorooctane sulfonamide (FOSA) in 73% of starter feeds and 88% of fishmeal samples. Other PFAS compounds appeared less frequently, and none were detected in insect- or algae-based ingredients.

Traces of cypermethrin and deltamethrin were detected in wheat gluten, while chlorpyrifos was found at minimal levels, likely due to environmental residues.

No traces of the antioxidant ethoxyquin were found, nor were any Salmonella, Listeria, or ruminant proteins detected. However, two corn gluten meal samples contained high levels of the mycotoxin ochratoxin A, prompting continued monitoring.

ANIMAL HEALTH

UGANDA – Northern Uganda has been identified as a hyperendemic hotspot for the pork tapeworm Taenia solium, with a new study finding that nearly one in five pigs in the region are infected.

The research, published in PLOS Neglected Tropical Diseases in August 2025, reported a 17.4% prevalence of porcine cysticercosis, an infection caused by the parasite, raising serious concerns for both animal and human health.

Conducted across the Agago, Kitgum, Lamwo, and Pader districts, the study was led by scientists from the International Livestock Research Institute (ILRI), Makerere University, the University of Edinburgh, the University of Prince Edward Island, and local veterinary offices. It sought to validate geospatial risk maps predicting high-risk zones and identify factors driving the spread of infection.

Taenia solium, often called the pork tapeworm, is a neglected zoonotic parasite that causes taeniasis and cysticercosis in humans and pigs. The infection spreads when humans carrying the tapeworm release eggs through feces, contaminating the environment.

Pigs that roam freely become infected by ingesting contaminated material, while humans risk contracting neurocysticercosis, the form of the disease where cysts lodge in the brain, by consuming the eggs. This severe condition is

the leading cause of adult-onset epilepsy in endemic regions.

With nearly a quarter of households in the study area keeping at least one infected pig, the risk to humans is significant. Poor sanitation, undercooked pork consumption, and inadequate meat inspection further increase exposure.

The researchers warn that without immediate, coordinated interventions, northern Uganda could remain a major reservoir for Taenia solium, undermining both national and global elimination goals.

The World Health Organization (WHO) has listed cysticercosis in its 2021–2030 roadmap for neglected tropical diseases, calling for focused control in hyperendemic zones. The authors of the study recommend a One Health approach that integrates sanitation improvements, better pig husbandry, public education, and treatment for both human and animal hosts.

GLOBAL – The Global Seafood Alliance (GSA) has released a new version of its Best Aquaculture Practices (BAP) Feed Mill Standard, introducing tougher requirements for ingredient sourcing and supply chain transparency across aquaculture feed production.

The revised standard, known as Issue 3.3, will take effect on November 17, 2025, after which all BAP-certified feed mills will be required to comply. GSA said the updates were developed over more than a year of stakeholder consultations “to modernise the standard to meet marketplace expectations.”

The strengthened criteria focus on three critical feed ingredients: fishmeal and fish oil, soy, and palm oil. For marine ingredients, GSA has set new sourcing targets: 90% must come from certified sources by 2028, with full compliance expected by 2031.

Feed mills using soy will need to prepare a sourcing plan by January 1, 2026, outlining how they will transition to using only deforestation- and conversion-free (DCF) soy. While no firm deadline has been set for complete adoption, mills must provide a written commitment and timeline to demonstrate progress.

Palm oil sourcing has also come under stricter oversight, with enhanced traceability checks and tighter verification of oil blends purchased from third-party manufacturers. According to the GSA, these measures are designed to enhance transparency throughout the aquafeed supply chain.

Beyond ingredient sourcing, Issue 3.3 introduces more rigorous documentation requirements to verify the origins of all feed components, especially blended oils. A new glossary of key terms has also been added to ensure consistent interpretation and implementation across regions.

The Global Seafood Alliance, an international nonprofit trade association, has long positioned itself as a global leader in standards for responsible seafood production. Through its BAP certification program, the organisation provides thirdparty assurances for both farmed and wild seafood.

By tightening its feed mill standard, GSA aims to move the aquaculture industry toward greater accountability in ingredient use, aligning with international sustainability and deforestation- free commitments.

AFRICA – Royal De Heus is deepening its investment in Africa’s animal nutrition sector with the launch of a new fish feed plant in Uganda and plans to build a second feed factory in Côte d’Ivoire.

In August, De Heus Animal Nutrition Uganda officially commenced fish feed production at its newly built, state-ofthe-art facility in Njeru, Jinja. The plant, the company’s first dedicated aquafeed facility in Africa, has a production capacity of 50,000 metric tons per year and will serve the fast-growing aquaculture industry across East Africa.

The launch follows a journey that began in June 2023, when construction commenced to achieve operations by mid2025, a goal now met. The first commercial batch of feed rolled off the line in July.

The Njeru facility is designed to create jobs and stimulate local sourcing of key ingredients, such as maize, cassava, and soy, thereby reducing reliance on imports.

The plant also includes an on-site laboratory for quality assurance and leverages De Heus’s global formulation expertise from the Netherlands. Drawing from its advanced operations in Vietnam, the company will tailor high-performance tilapia feed to regional needs.

Best known in Uganda for its Koudijs brand, De Heus plans to gradually transition its aquafeed products under the De Heus name while retaining Koudijs for other livestock segments.

Meanwhile, In West Africa, De Heus announced plans in September to build a new production facility in Korhogo, northern Côte d’Ivoire, its second feed factory in the country. The announcement followed a meeting between Animal Resources Minister Sidi Tiémoko Touré and Paul Bizard, Director of De Heus Côte d’Ivoire.

While details such as capacity and investment cost have not yet been disclosed, the new facility will complement the company’s existing poultry feed plant in Attinguié, near Abidjan, which opened in 2023 with an annual capacity of 120,000 tons.

The developments come as De Heus expands its presence across key African markets, reinforcing its goal of strengthening regional supply chains.

BRAZIL – U.S. agribusiness giant Archer Daniels Midland (ADM) will shut down its pet food manufacturing plant in Tres Corações (TCO), Minas Gerais, marking a significant pullback from Brazil’s pet nutrition sector amid a sweeping global restructuring.

The company confirmed the closure in a statement to Reuters, citing the need to streamline costs and align operations with its long-term strategic priorities. The facility will continue operations for another 90 days, with workers informed of the decision on July 15, according to ADM’s São Paulo-based press officer.

Acquired in 2019, the TCO plant once employed more than 900 people and produced up to 525,000 tons of pet food annually, serving as a cornerstone of ADM’s Latin American pet nutrition business.

“After exploring a wide range of alternatives, we have determined that our Tres Corações facility and related businesses and assets are no longer aligned with our future operational needs,” ADM said in its statement.

Local reports cited by journalist Carlos Sambrana of NeoFeed indicate that ADM had enlisted Barclays earlier this year to sell its Brazilian pet food unit, seeking between R$1 billion (US$172.2 million) and R$1.5 billion (US$258.3 million).

However, sources familiar with the matter said the company was unable to secure a buyer after nearly a year of negotiations.

The closure comes as part of a cost-reduction programme announced in February 2025, under which ADM aims to cut US$500 million to US$750 million over three to five years following its lowest fourth-quarter adjusted profit in six years.

The restructuring plan has already included hundreds of job cuts and tighter scrutiny of ADM’s nutrition division, the smallest of its three business units, which faced an internal accounting investigation in 2024.

Nevertheless, ADM will maintain a foothold in Brazil’s animal nutrition sector through a separate facility in São Paulo state dedicated to feed and animal nutrition products.

SUDAN – The Food and Agriculture Organization of the United Nations (FAO), in partnership with the Government of Sudan, has launched a four-month emergency vaccination campaign to protect 9.4 million livestock from deadly diseases.

Running from October 2025 through January 2026, the campaign coincides with Sudan's worsening food crisis, which has been confirmed as a famine in several areas.

It targets some of the country’s most devastating transboundary and zoonotic diseases, including peste des petits ruminants (PPR), sheep and goat pox (SGP), contagious bovine pleuro-pneumonia (CBPP), African horse sickness (AHS), and anthrax.

Livestock is the backbone of Sudan’s rural economy, providing food, income, and employment to millions of households. The sector also plays a vital role in foreign exchange earnings, with Sudan ranking among the region’s top livestock exporters.

FAO underscored that protecting herds is not only a matter of animal health but also national stability. “This vaccination campaign comes at a critical time as Sudan faces a worsening

food insecurity crisis,” said Hongjie Yang, FAO Representative in Sudan.

According to the latest Integrated Food Security Phase Classification (IPC) analysis, famine has been confirmed in parts of North Darfur and the Western Nuba Mountains. Nearly 24.6 million people are projected to face Crisis or worse (IPC Phase 3 or above) food insecurity levels through May 2025, including 638,000 people in Catastrophe (IPC Phase 5).

To overcome logistical challenges in conflict-hit areas, FAO is piloting cross-border vaccine delivery through Chad for the first time. Working with OCHA and FAO Chad, this approach will enable vaccine transport to Darfur and West Kordofan, where supply chains remain disrupted.

The campaign is supported by a coalition of donors, including the European Union, the Swiss Agency for Development and Cooperation, the Swedish International Development Cooperation Agency, the China International Development Cooperation Agency, and the FAO’s Special Fund for Emergency and Rehabilitation Activities.

From September 10 to 12, 2025, the Nanjing International Expo Center hosted VIV Select China 2025, an impressive showcase of innovation, technology, and international cooperation within the livestock sector. Co-organised by Globus Events and VNU Europe, this year’s edition reaffirmed the exhibition’s reputation as China’s leading livestock industry export platform and a global hub for knowledge exchange.

Bringing together industry leaders, policymakers, innovators, and buyers, the three-day event recorded impressive participation, with 485 exhibitors from over a dozen countries, occupying more than 30,000 square metres of exhibition space. Nearly 17,000 visitors from 108 countries and regions registered, including over 2,300 international attendees and 2,000 conference participants.

Major domestic players, including China Animal Husbandry, Sunhy, Zhejiang Medicine, and Wanhua Chemical, joined leading international brands in presenting cutting-edge livestock technologies and solutions. Exhibitor participation increased by more than 20% compared to the previous edition.

In addition to the bustling trade floor, more than 10 official buying delegations from Southeast Asia, Europe, the Middle East, Africa, and the Americas reinforced the exhibition’s global appeal. The event also featured a comprehensive conference programme, offering insights into smart farming, feed innovation, green technologies, and sustainable production practices.

SHANGHAI TO HOST NEXT EDITION IN 2026

Building on the success of the Nanjing edition, organisers announced that VIV Select China 2026 will take place from August 19 to 21, 2026, at the Shanghai World Expo Exhibition & Convention Center. Themed “Connecting the Globe, Building a One-Stop Livestock Trade Platform,” the move signals a strategic upgrade that leverages Shanghai’s position as a global trade hub.

The Shanghai edition will feature four key highlights shaping the future of livestock production:

• V-AI+ Smart Livestock Zone, spotlighting data-driven innovations in farm management, disease control, and precision feeding.

• Full Industry Chain Coverage, linking feed, animal health, processing, and environmental technologies into an integrated feed-to-food platform.

• Green and Low-Carbon Technologies, advancing China’s “Dual Carbon” goals with solutions such as biogas purification, carbon capture, and energy-efficient systems.

• Expanded International Pavilions, fostering crossborder collaboration and investment, connecting Chinese enterprises with partners from Europe, the U.S., Africa, South America, and Belt & Road regions.

10-12 September, 2025 | Nanjing, China

Do you know your limestone used in your feed formulations?

By Saad Gilani, Technical Sales Manager, Danisco Animal Nutrition & Health

Limestone is routinely added in animal feed, primarily to provide Calcium (Ca) which is required by the animals for bone development and muscle function in poultry and swine alike, and for eggshell quality in case of egg laying hens. Ca when digested in the stomach, can be absorbed in the small intestine. However, it also interacts with other minerals. For example, for bone development and growth it is important that

Ca is absorbed along with phosphorus (P) under the influence of vitamin D. At the same time, the amount of Ca can affect P utilization. Research has shown that higher amounts of Ca can impact P utilization. P requirements in animals are usually met with both organic phosphates - coming from cereals and legumes and their byproducts - and inorganic phosphatesused as di/monocalcium phosphate. Phosphates in cereals/ legumes and their byproducts are usually found either as free P or bound P as phytate. Phytate stores P for the germination of seeds. However, when phytate is ingested by animals, it is not fully digested in the upper gastrointestinal tract, but can be broken down by intestinal alkaline phosphatase. Complication arises when phytate binds with amino acids and minerals like Ca (among other minerals). Ca, depending on how much and how quickly it is released from limestone, can bind with phytate, further complicating the Ca/P utilization. For optimal utilization of phytate it is best that it is hydrolyzed by phytases in the upper gastrointestinal tract as quickly as possible to avoid binding with amino acids and minerals. Hence, it is important to understand your limestone.

This article series is all about the role of limestone in feed formulations: its physical quality, solubility and impact on P utilization within the animals.

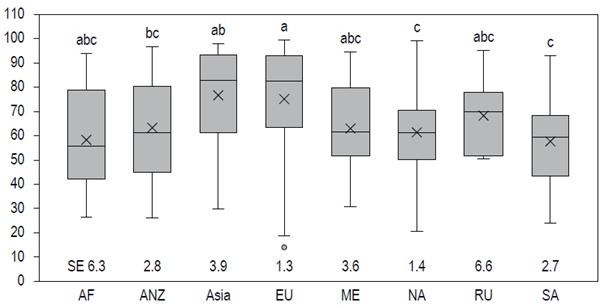

First, let’s try to understand the limestone and its physical quality. As limestone comes from quarries it can vary in its color from pure white to yellowish or black tinge. This may indicate the impurities in limestone and could have impact on chemical composition. Additionally, the particle size of the limestone also varies a lot amongst different samples and regions. One of our research projects investigated more than 600 samples globally to understand the physical/chemical qualities of limestone. Samples were split into either fine type of limestone, which is mainly used for broiler or swine feed, or coarse limestone, that is normally used for layers or breeders’ feed. Starting from the particle size, the average particle size was 288 µm (micrometer) and ranged from 38 – 992 µm for fine type limestone. Coarser limestone average particle size was 1690 µm with a range from 301-3000 µm. This can impact Ca utilization to a certain extent as very fine limestone can be quickly digested and reactive to bind with phytate. Additionally, if particle size is the only challenge, by increasing particle size, it can increase the wear and tear of the feed mills. However, particle size also affects limestone solubility (to be discussed in the next article in this series).

The second and very important part is the chemical composition of the limestone. Generally, it is assumed that limestone contains approximately 40% Ca, which comes from the chemical formula. However, this is not the case, since impurities, particle size, and solubility makes Ca available in the animal’s digestive system differently. Literature suggests there is variation in the total Ca present in limestone. Data from more than 600 samples shows that average Ca content in fine type limestone was 37.8% with a range of 33.3-39.7%. For coarse limestone, average Ca content was 38% with a range of 34.7-40%. There is also variation in total Ca content within the regions as well as wide variation between regions. This could have implications in terms of total supply of Ca in the

diet. Considering the range above, total Ca in animal feed can be below or above the animal requirements. This can further impact absorption and excretion of Ca and P in animals. Simple example, if limestone is used at 1%, typically providing 0.4% total Ca in the diet, above limestone range indicates levels of 0.33% up to 0.39% total Ca in the diet. Additionally, Ca from other ingredients should also be considered for a complete animal diet. Literature suggests that total Ca often is not at the same level as formulated due to many factors like analytical difficulties, Ca coming from ingredients or feed additives, or when limestone is being added as processing aid.

In addition to total Ca in the limestone, it is also important to analyze for other minerals as they can be present as impurities, or their inclusions are added unintentionally. Minerals like Magnesium (Mg), Zinc (Zn), Iron (Fe), Copper (Cu), Manganese (Mn) are needed by animals and are frequently supplemented in the diet. Their oversupply can bind with phytate making P less available to the animal, also leading to bound minerals ending up in the lower intestinal tract, where they can be utilized by pathogens (e.g. Fe being utilized by Campylobacter) or ultimately excreted in the environment which is becoming more and more of a concern. The data from analyzed limestones, show quite big variation of these minerals. For example, Mg average content varied from 0.39 – 1.56%, similarly Iron content varied from 544 – 4463 mg/kg for fine type limestone. For coarser type limestone, the levels for Mg varied from 0.01-2.65% and for Fe, 47-4921 mg/kg.

In conclusion, it is important to know your limestone and its role when formulating diets as it can vary in composition and physical qualities. This variability can impact calcium availability in animal diets, complicating phosphorus utilization and impacting animal health and environmental concerns.

Solubilities and their impact on P utilization will be discussed next in this series.

1. Total Calcium content in limestone samples collected from different regions (AF: Africa, ANZ: Australia and New Zealand, EU: Europe, ME: Middle East, NA: North America, RU: Russia and SA: South America)

BY MARTHA KURIA

rainpulse Limited, a prominent agribusiness based in Bugolobi, Kampala, has become a key player in driving agricultural advancement across East Africa. Initially founded in the early 2000s as Savannah Commodities, the company has evolved into a vertically integrated operation encompassing grain milling, fertiliser blending, coffee processing, and animal feed production. Its animal feed division, launched in 2021, is rapidly gaining traction as a catalyst for Uganda’s livestock sector, delivering high-quality, locally sourced feeds under the Halisi brand. With 28 strategically located distribution hubs, Grainpulse ensures accessibility for smallholder farmers, reinforcing its commitment to sustainable agricultural development and food security.

Under the leadership of Chief Executive Officer Oudtshoorn, Grainpulse is pursuing an ambitious agenda to enhance farmer productivity and market access. “Our goal is to empower

farmers through superior inputs, creating a sustainable cycle from production to consumption, ” Oudtshoorn emphasised. Speaking in an interview with Milling Middle East & Africa, the sister publication to Feed Business Middle East & Africa magazine, the CEO, who had been at the helm at the time of the interview, discussed the company’s holistic approach. Supporting him is Business Development Manager Abaho Karuhanga, whose five-year tenure has been instrumental in expanding the company’s reach.

Grainpulse’s animal feed venture leverages byproducts from its maize milling operations, such as bran and germ from its Jjimu flour brand, to produce nutrient-dense feeds. This integration optimises resource use, reduces costs, and ensures traceability, distinguishing Grainpulse in a market historically reliant on informal, inconsistent feed mixes. The company’s

state-of-the-art feed plant in Buikwe, with a monthly capacity of 2,500 tons, currently operates at partial capacity, reflecting the early-stage growth of Uganda’s commercial feed sector.

“We saw an opportunity to add value to our grain byproducts while meeting the rising demand for quality feeds,” Karuhanga explained.

The ‘Halisi’ brand, meaning “genuine” in Swahili, targets poultry (layers and broilers), pigs, and dairy cattle, delivering tailored formulations that enhance growth rates, egg production, and milk yields. Poultry feeds, the division’s flagship, are designed with high-protein blends to optimise performance, while pig feeds include starter, grower, and finisher variants to support efficient maturation. Dairy cattle feeds incorporate high-fibre components to promote rumen health and milk output. Both fortified and unfortified options cater to diverse farmer needs, balancing performance with affordability.

Quality is the bedrock of Grainpulse’s feed operations. Uganda’s animal feed sector has historically been plagued by aflatoxin contamination, a carcinogenic toxin from improperly stored grains that reduces livestock productivity and poses health risks. To combat this, Grainpulse operates an inhouse laboratory in Mukono, equipped with near-infrared spectroscopy and wet chemistry, rigorously testing all incoming raw materials, primarily locally sourced maize and soybeans, for aflatoxins, nutrient content, and contaminants. “We reject any grain that fails our standards,” Oudtshoorn stated. “Aflatoxins in feed transfer to animal products, undermining both farmer profitability and consumer safety.”

This stringent quality assurance ensures Halisi feeds meet the standards of the Uganda National Bureau of Standards (UNBS) and ISO certifications, positioning Grainpulse as a trusted supplier. By sourcing 100% of its feed inputs locally, except for occasional speciality additives, the company maintains cost competitiveness while supporting Uganda’s

agricultural economy, which contributes over 25% to GDP and employs nearly 70% of rural households.

The transition to commercial feeds in Uganda is fraught with challenges. Many smallholder farmers, rooted in traditional practices, rely on homemade mixes that often lack nutritional balance or harbour toxins. Grainpulse addresses this through extensive extension services, offering free training and demonstration plots to showcase the benefits of Halisi feeds, such as 20-30% faster growth rates and reduced veterinary costs. “Education is critical. Farmers need to see tangible results to adopt new practices,” Karuhanga noted.

Distribution is another hurdle. To ensure last-mile access, Grainpulse has established 28 hubs that serve as both sales points and grain aggregation centres. The company trains local entrepreneurs as “master agents,” who manage these hubs and employ village agents to promote products and provide support. This model not only enhances market penetration but fosters rural entrepreneurship, creating jobs and strengthening community ties.

Working capital constraints present another significant challenge. Farmers often demand cash on delivery for grains, while processing and distribution cycles extend payment timelines. Grainpulse mitigates this through its integrated

model, offering fertilisers on credit and repurchasing harvests to offset costs. This approach builds farmer loyalty, though cultural preferences for low-cost, low-service options persist. “Changing mindsets takes time, but our adoption rates are climbing.”

Sustainability is a core pillar of Grainpulse’s strategy. The company utilises maize cobs and husks as biomass fuel for drying and pelleting, reducing diesel consumption and operational costs. “We’re also exploring organic fertilisers for feed crops to further minimise our environmental footprint,” Oudtshoorn revealed. Partnerships with the International Fund for Agricultural Development (IFAD) have extended feed access to 57 districts, aligning with national goals to enhance food security and rural livelihoods.

Looking beyond Uganda, Grainpulse is eyeing Kenya, a key market for Ugandan poultry products like eggs and meat. Despite non-tariff barriers, such as border delays and high transportation costs, the company has piloted dairy feed exports and plans to scale poultry feed shipments by the fourth quarter of 2025. “We’ve benchmarked Halisi against regional competitors and are confident in its superiority,” Karuhanga stated. Grainpulse advocates for harmonised East African Community (EAC) standards, citing Tanzania’s fertiliserdriven grain export success as a model. “Streamlined trade policies could unlock significant opportunities,” Oudtshoorn added.

With a workforce of 110 full-time employees and 50 casual laborers across all its business sectors, Grainpulse is a vital economic driver in Uganda. Its long-term vision is to lead East Africa in food and nutrition security by increasing fertiliser use to 25 kg per hectare, boosting grain yields, and ensuring a steady supply of quality feed inputs. “Higher yields translate to better feeds, which empower farmers economically,” Oudtshoorn asserted. In just a few years, Grainpulse’s animal feed division has laid a robust foundation for growth. As Grainpulse scales its operations and navigates regional markets, it is poised to redefine animal nutrition, delivering value to both farmers and consumers. FBMEA

BY WANGARI KAMAU

FBMEA: Thank you for honouring our invitation. Briefly tell us who you are, walk us through your research— what does your day-to-day work typically involve?

GETOBAI: Thank you so much for having me. I am the farm manager at Ololo Farm in Nairobi, Kenya and a BSF research enthusiast. My work ranges from running controlled experiments in insect rearing to testing larvae-based feed formulations with poultry and pigs in a regenerative / pasturebased livestock system. I also spend time analysing data, mentoring young researchers, and working with farmers to understand their needs. A significant portion involves promoting on-farm research and demonstrations.

FBMEA: What initially piqued your interest in Black Soldier Fly research, and why have you remained committed to it over the years?

GETOBAI: I was first drawn to BSF because of its potential to solve two major challenges at once: waste management and sustainable feed production. Early on, I saw how larvae could transform organic waste into high-value protein, and that vision of circularity really inspired me. At Ololo, as a small farm with poultry as the main enterprise, our margins of scale depended on our ability to save on feed costs, which make up more than 70% of the total poultry production cost. What has kept me committed is seeing the impact of reducing feed costs for farmers to improving environmental outcomes. It’s both science-driven and deeply practical. Currently on farm, we replace 15-20% of our feed costs per batch with BSF Larvae inclusion and can upcycle a tonne of food waste weekly, mainly from the local market. This “waste” would otherwise be dumped in landfills around Nairobi.

FBMEA: What are some of the most significant discoveries or innovations that have come out of your BSF research?

GETOBAI: One key discovery has been understanding that the integrated model, where BSF production is driven by own farm demand, yields significantly more cost savings, especially at small and medium scale enterprises, is an important one

to note. We’ve also made progress in developing farm-scale systems that can operate reliably under African conditions. These practical innovations from waste-to-feed systems to low-tech rearing methods are what make BSF accessible to more farmers.

FBMEA: From your perspective, how has BSF research transformed the animal feed sector so far, both in Africa and globally?

GETOBAI: Globally, BSF has shifted from a niche idea to a serious alternative protein and enterprise. In Africa, it has opened opportunities for local feed production, reducing dependency on expensive imports like fishmeal and soy. Research has proven that BSF meal can replace a significant

portion of conventional protein sources without compromising animal performance. Many farmers, especially smallholder/ households in Africa and Kenya, have adopted BSF farming and are now integrating the insects in the livestock and crop systems for BSF larvae and frass, respectively.

FBMEA: I first came across you because of your work with The Bug Picture. Please tell us more about your involvement and how initiatives like this are shaping the perception and adoption of insect protein?

GETOBAI: With The Bug Picture, a regenerative agriculture company based in East Africa, I helped demonstrate how BSF can be deployed at scale in community-driven projects, blending science, entrepreneurship, and storytelling to normalise insect protein in mainstream feed and food systems, including in refugee camps. In Kyangwali, Uganda, we integrated pasture-raised chicken farming using movable pens inspired by Ololo Farming Company models with BSF larvae production, achieving remarkable results: healthier chickens with reduced disease and more nutrient-rich eggs, naturally fertilised soils enriched further with BSF frass, and transformative economics where feed costs dropped by 69%, market readiness shortened by two months, and profitability shifted from a baseline loss of -11,294 UGX to an average profit of 30,972 UGX per chicken.

FBMEA: That is pretty impactful. What have been the biggest challenges in advancing BSF research, and how have you managed to overcome them?

GETOBAI: Advancing BSF research comes with its share of challenges, the biggest being the need to grow and evolve step by step, slowly shaping a viable business model through continuous learning, adapting, and even failing along the way. Another key hurdle has been the lack of data; we learned that measuring is knowing, and knowledge is power, so actively running trials and collecting evidence on what works (and what doesn’t) has been critical for fair assessment and growth. Finally, an important mindset shift has been recognising that larvae are not just an end product but a means to an end. At Ololo, they are the glue that holds a circular system together, producing regenerative outputs such as poultry, pigs, fish, ducks, and vegetables for premium organic markets. Whatever the model, the key is to let the larvae work for you.

FBMEA: Research and commercialisation in insect protein often face funding hurdles. What has your experience been in securing financial support, and what advice would you give to upcoming researchers or entrepreneurs in this space?

GETOBAI: Funding is indeed a major challenge, especially in early-stage research. I’ve learned that it takes persistence and the ability to communicate the value of BSF beyond just science, as a business case, an environmental solution, and a community opportunity. My advice: start small, prove impact, and build partnerships with both local stakeholders and global

funders.

FBMEA: Looking at Africa specifically, where do you see the biggest opportunities for scaling BSF in the feed industry, and what role do you hope to personally play in shaping that future?

GETOBAI: The largest opportunity lies in integrating BSF into existing farming systems. Poultry, pig, and aquaculture sectors are growing rapidly, and BSF can supply cost-effective protein for them. There’s also a major opportunity in organic waste management, especially for urban centres.

In the next decade, I see BSF becoming a mainstream protein ingredient, not just an alternative. Large-scale operations will supply commercial feed mills, while decentralised systems will empower smallholder farmers. We’ll also see stronger policies and standards guiding the industry.

I want to continue bridging research and practice, generating knowledge while also ensuring it reaches farmers and entrepreneurs. My goal is to help make BSF a cornerstone of Africa’s sustainable feed sector, while mentoring the next generation of scientists.

FBMEA: What advice would you give to the next generation of scientists and innovators who want to explore insect protein?

GETOBAI: Stay curious but also stay practical. This field requires individuals who can effectively combine solid scientific principles with real-world applications. Don’t be discouraged by setbacks; every challenge is a chance to innovate. And most importantly, collaborate; this is not a journey to walk alone. Whatever the model, the key is to let the larvae work for you.

FBMEA: On a lighter note, what has been the most pleasantly surprising thing to happen because of your career in BSF research?

GETOBAI: Thanks to the BSF and the research work I have been working on. Last year (2024), I was recognised on stage at the Leaders’ Summit in New York by the United Nations Global Compact as one of twelve Global SDG Pioneers. This global award came after I was recognised as an SDG pioneer in Kenya, representing the SME sector. This award has opened up opportunities for collaboration and partnerships, including speaking engagements in global forums and the chance to work with agro-pastoralists in Kenya's southern rangelands to help build climate resilience.

FBMEA: Congratulations on that recognition, and cheers to many more to come. Now, finally, do you have any closing remarks?

GETOBAI: Thank you very much. I’d just say that BSF is not a silver bullet, but it’s a powerful tool in the toolbox for building resilient food systems. I hope more people, from researchers to policymakers, will see its potential and invest in scaling it responsibly. FBMEA

BY ANDRÉ MAGRINI CHIEF REVENUE OFFICER, OGI SYSTEMS*

The unexpected failure of a critical asset is the single greatest threat to margins and supply chain stability in the modern milling operation. When a component, say, a bearing in a key conveyor or a high-wear part in an extruder, fails, the ripple effect is immediate chaos and a loss of production control. The true competitive edge today belongs to the leader who can turn this operational threat into a source of predictable performance by mastering Predictive Maintenance (PreMa).

PreMa is no longer optional; it is the definitive strategy for moving operations from reactive firefighting to proactive industrial foresight. It centres on deploying AI-driven intelligence across the entire facility, ensuring that every asset, from the primary hammer mills to essential handling equipment, is continuously monitored and understood.

The challenge of downtime isn't isolated to just the most expensive machinery. Simple bottlenecks on a conveyor belt or a failure in an industrial motor can halt an entire line. The new standard for PreMa demands universal coverage,

achieved through integrated, smart sensor technology that tracks:

• Mechanical Stress: Real-time analysis of vibration and heat (temperature spikes) in rolling elements (bearings) and gearboxes to detect minor anomalies that precede catastrophic failure.

• Operational Load: Monitoring of motor and driver runhours to calculate component fatigue precisely and accurately forecast remaining useful life.

• Process Flow: Tracking process variables to ensure the overall system operates within normal parameters, defined by a constant stream of learning data2. This diagnostic capability relies on sophisticated Machine Learning (ML) models that calculate a Compound Anomaly Index (CAI), learning the "normal" state of every asset and flagging deviations the moment they appear.

A common organisational problem arises when multiple advanced monitoring tools and legacy systems operate in

isolation, scattering critical data across disconnected platforms. This fragmentation leads to delayed reporting and prevents leaders from forming a single, coherent view of operational risk.

• To address this challenge, leading global companies are implementing an integrated architecture that serves as a system conductor to coordinate these diverse data sources.

• The Problem: Fragmented data from multiple monitoring tools and infrastructure creates a reporting delay, sometimes taking days to aggregate and analyse operational insights.

• The Solution: An organisation's technical partner deploys a unified dashboard and central data platform that forces data standardisation and aggregates insights from all disparate systems. This central view provides a complete blueprint for the facility’s health.

• The Impact: This cohesive approach yields powerful and swift results. For one company leveraging this model, the time required for accurate, real-time reporting was drastically reduced from three days to just 15 minutes. This speed gives maintenance teams the clarity needed to act proactively.

The true value of modern PreMa lies in predictive power, achieved through the deployment of Agentic AI. These next-generation systems extend intelligence beyond simply identifying a risk, enabling strategic foresight and giving leaders control over future outcomes.

• Scenario Generation: Agentic AI uses the constant stream of high-fidelity data (vibration, temperature) to run

millions of hypothetical failure scenarios. This allows the system to predict not only when a part might fail, but what the cascading impact would be on the entire production schedule.

• Autonomous Optimisation: By simulating various outcomes, Agentic AI can recommend the precise next best action, whether that's scheduling a pre-emptive repair immediately or intelligently extending the maintenance window based on real-time risk calculations.

The ability to command this unified, intelligent system gives leaders the ultimate peace of mind. It allows them (the Hero of the operation) to transform the villain of unexpected downtime into a predictable, manageable line item, securing long-term operational resilience.

The shift toward intelligent operations marks the final evolution of manufacturing excellence. By embracing Predictive Maintenance, Machine Learning, and Agentic AI today, leaders are doing more than simply reducing costs; they are investing in the core predictability and resilience of their business for years to come. This data-driven foresight transforms the hidden risks of component failure into manageable events, guaranteeing maximum uptime and operational efficiency. The tangible return on investment isn't just measured in avoided breakdowns, but in the sustained competitive edge achieved when your entire facility operates with unmatched precision and clarity. The technology is here to secure that smarter, more profitable future—the time to implement this strategy is now. FBMEA

*Before joining OGI Systems, Magrini was a director for North America at AGI, a company in the agribusiness sector.

BY WANGARI KAMAU

When the rains fail in Africa, the images that often make headlines are of emaciated cattle, goats, and sheep; livestock that otherwise represent food and livelihoods for millions of households. Behind those images lies a central truth that the survival and productivity of livestock are inseparable from the availability of fodder. For decades, fodder has been treated as a footnote, overshadowed by cereals, cash crops, and the booming market for commercially processed feeds. However, that is beginning to change. Across the continent, governments, investors, and development partners are now treating fodder as a sector with the power to stabilise rural economies, strengthen food security, and unlock new investment opportunities.

Fodder refers to any plant material grown or deliberately harvested to feed livestock. It spans a wide range of sources, from napier grass, legumes like clover and lucerne, cereal plants like maize and sorghum, fodder shrubs like calliandra and leucaena, and even hydroponic sprouts of barley or maize. Each type offers a unique balance of energy, protein, and

adaptability to local conditions.

For farmers, steady access to nutritious fodder translates into higher milk yields, better meat quality, improved fertility, and reduced reliance on costly commercial concentrates. At national levels, strong fodder systems ease pressure on overstretched grazing lands, enrich soils through nitrogenfixing legumes, and help stabilise rural economies where livestock remain central to livelihoods.

The sticking point has always been seasonality. Across much of Africa, the rainy season brings abundance, while the dry months usher in scarcity. Conservation practices such as haymaking or ensiling chopped green fodder can bridge this gap, enabling farmers to store feed for leaner times. Yet adoption has lagged, held back by knowledge gaps, poor infrastructure, and limited investment. That landscape is beginning to change. Across the continent, renewed efforts are putting fodder at the heart of livestock strategies. Here are three case examples that highlight this shift.

Kenya’s livestock sector is at the heart of its rural economy, contributing nearly 12% of GDP and supporting over 10 million

households. Yet the industry has been crippled repeatedly by severe feed shortages. The 2021–2022 drought alone resulted in the estimated loss of 2.5 million animals in the arid and semiarid lands (ASALs), erasing billions of shillings in household wealth. For years, the country's fodder supply has lagged far behind demand, resulting in a national deficit of nearly 30 million metric tonnes annually, equivalent to US$4.5 billion in unrealised feed value.

Recognising the scale of this crisis, Kenya is doubling down on fodder as a strategic sector worthy of investment. This mindset was evident at the inaugural Kenya Fodder and Forage Conservation Investors’ Forum (KEFFCIA) held in August 2025, which brought together government leaders, development partners, cooperatives, and private investors. The forum culminated in the launch of two major initiatives: the Cooperative Fodder Fund (CFF) and the Sustainable ASAL Fodder Economy (SAFE) project.

The Cooperative Fodder Fund (CFF) is designed as a revolving financial facility that channels capital directly to farmer cooperatives and community-based organisations. Backed initially with KES 1.6 billion (about US$12 million), the fund will help producer groups invest in seeds, conservation equipment, and storage infrastructure such as silos and hay barns. Its structure reflects a lesson from decades of development work in Kenya: smallholders rarely access commercial credit on favourable terms, but cooperatives can pool resources, manage risk collectively, and achieve economies of scale.

Complementing this is the Sustainable ASAL Fodder Economy (SAFE) project, valued at KES 1 billion (about US$8 million), which focuses specifically on building resilience in the drought-prone northern and eastern regions. SAFE is targeting the expansion of fodder reserves, the establishment of feed banks, and the promotion of drought-tolerant species, such as Sudan grass, sorghum, and fodder shrubs like calliandra. A key innovation under SAFE is the integration of early warning systems, enabling countries to trigger feed production and conservation before droughts reach crisis levels.

Together, these initiatives represent a structural shift as Kenya embeds fodder into its national economic planning. The government has signalled that fodder will be treated as a standalone enterprise within livestock development, one that can attract private capital, generate rural jobs, and reduce dependence on costly emergency feed relief.

As the AU-IBAR Director, Dr. Huyam Salih, remarked at the forum: “If we fix feed, we will have fixed food and we will have secured the future of our livestock sector, our economy and our people.”

Elsewhere, Rwanda has taken an approach that integrates fodder into climate resilience, as is exemplified by the Transforming Eastern Province through Adaptation (TREPA) project, which is financed by the Green Climate Fund and

FODDER HAS BEEN TREATED AS A FOOTNOTE, OVERSHADOWED BY CEREALS, CASH CROPS, AND THE MARKET FOR PROCESSED FEEDS. HOWEVER, THAT IS BEGINNING TO CHANGE

implemented by the IUCN in partnership with CIFOR-ICRAF, World Vision, the Rwanda Forestry Authority, and Cordaid. The US$49.6 million TREPA project aims to restore 60,000 hectares of degraded land while improving the livelihoods of more than 600,000 people. Fodder production is central to this effort. The project promotes drought-resilient grasses and legumes such as Brachiaria, Chloris gayana, and Desmodium, alongside the establishment of community fodder banks and seed distribution networks. By ensuring year-round feed availability, TREPA reduces pressure on natural pastures, stabilises soils, and enhances milk yields across smallholder farms.

Meanwhile, another critical initiative is Rwanda’s implementation of hydroponic fodder technology under the Rwanda Dairy Development Project (RDDP) – Phase 2. This system promotes the cultivation of fodder without soil, utilising up to 90% less water than conventional methods and requiring a minimal land area. It has proven especially valuable in areas facing land scarcity and recurrent droughts. Beyond conserving natural resources, hydroponics reduces deforestation pressures, cuts the carbon footprint by lowering feed transport needs, and limits reliance on synthetic fertilisers.

With Africa’s largest livestock herd: over 70 million cattle, 42 million sheep, and 52.5 million goats, Ethiopia has long been described as a “sleeping giant” of animal agriculture. Yet productivity continues to lag, primarily because of chronic feed shortages. National feed balance studies indicate deficits of approximately 9% in dry matter, 45% in metabolizable energy, and 42% in crude protein, gaps that leave farmers struggling to maintain healthy, productive animals throughout the year.

In 2025, the Ministry of Agriculture, in collaboration with the International Livestock Research Institute (ILRI), launched the Ethiopian Livestock and Fisheries Investment Handbook to facilitate the mobilisation of private capital into the sector. The guide highlights fodder and feed production as a priority investment area, with opportunities ranging from commercial hay and silage production to feed processing and packaging, improved forage seed systems, and mechanised feed development using irrigation and climate-smart technologies.

To encourage investors, the government has paired the handbook with a suite of incentives that include tax holidays,

duty-free import of equipment and inputs, streamlined financing through movable collateral registries, and access to land allocated by regional authorities. This investor-friendly posture is consistent with Ethiopia’s 10-year agricultural transformation plan, which positions livestock modernisation at the heart of national food security and rural development.

On the ground, regional governments are beginning to align with this vision. Oromia, for instance, earmarked 600,000 hectares for forage production in 2024, with tens of thousands of bales already banked for emergency use in drought-prone areas. Such measures signal that fodder is no longer seen as a peripheral activity but as a cornerstone of Ethiopia’s livestock future, one that can both close critical feed gaps and generate profitable opportunities for local and international agribusiness.

On a continental level, the Resilient African Feed and Fodder Systems (RAFFS) project, led by the African Union-InterAfrican Bureau for Animal Resources (AU-IBAR) with support from the Bill

& Melinda Gates Foundation, deserves a mention in this article.

Launched in late 2022, RAFFS is a threeyear initiative designed to respond to the “Triple C” crises: COVID-19, climate shocks, and the war in Ukraine, which have disrupted feed supply chains and exposed deep vulnerabilities. The project is collaborating with African Union Member States and Regional Economic Communities in IGAD, ECOWAS, and ECCAS to foster systemic resilience through enhanced data and analytics, innovative solutions, and crosssectoral partnerships.

The stakes are high. Livestock already contributes nearly a quarter of Africa’s agricultural GDP and sustains millions of households, with women making up the majority of those employed in the sector. By placing feed and fodder at the centre of agricultural transformation, RAFFS is reframing the sector as a strategic priority for the continent’s future. If successfully implemented, it will not only cushion the sector from shocks but also catalyse longterm investment and innovation.

FBMEA

BY WANGARI KAMAU

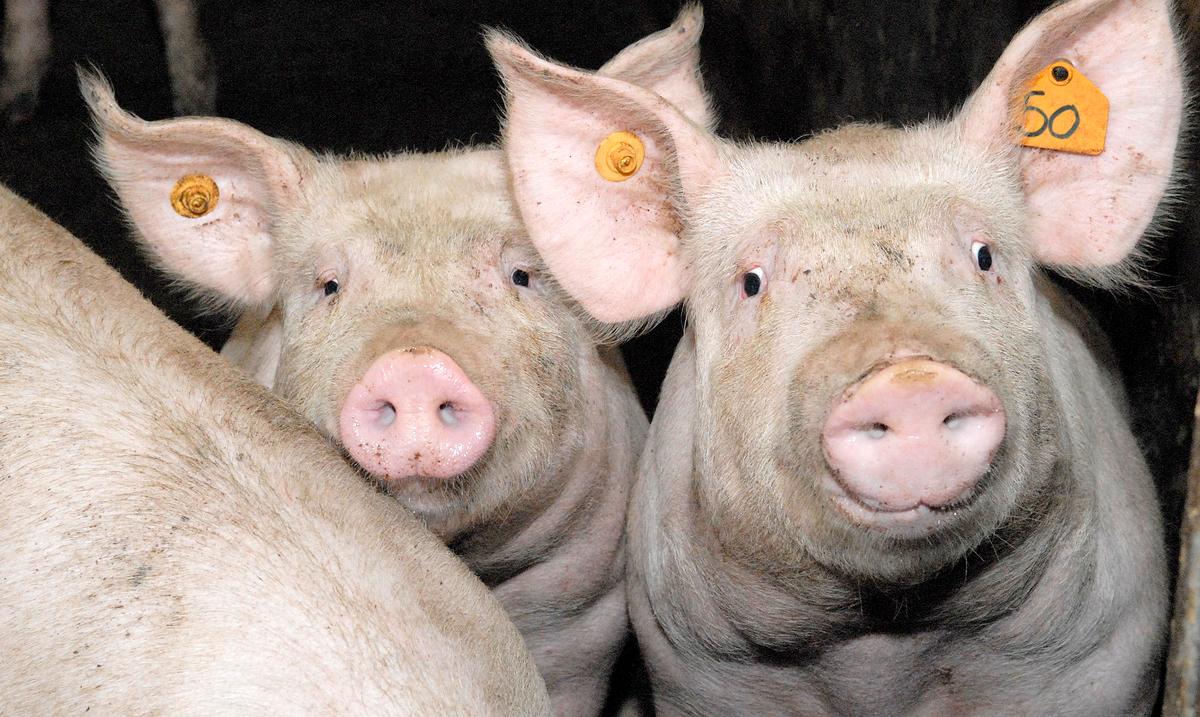

The pork industry commands vast economic significance, with the global pig farming market valued at US$210.76 billion in 2024, according to The Business Research Company, and projected to reach US$277.09 billion by 2029. This growth is primarily driven by rising meat consumption and the increasing global demand for pork products as people’s disposable incomes increase.

Yet, the industry’s progress remains shadowed by African swine fever (ASF), a highly contagious and often fatal disease for which no globally approved commercial vaccine exists. In 2025, ASF once again took centre stage, as new studies highlighted the limits of existing vaccine candidates and the World Organisation for Animal Health (WOAH) adopted a global vaccine standard for the disease.

Since January 2022, outbreaks have resulted in the loss of more than 2 million pigs globally, affecting about 68 countries, according to the latest situation report by WOAH. The virus, which can wipe out nearly 100% of infected animals, has disrupted pork supplies, destabilised markets, and undermined livelihoods. For smallholder farmers in low- and middle-income

countries, many of whom raise pigs in backyard systems, the disease is particularly devastating.

Amid this backdrop, researchers at the U.S. Department of Agriculture’s (USDA) Plum Island Animal Disease Center in New York, working with the International Livestock Research Institute (ILRI) in Nairobi, set out to test a promising vaccine candidate. Their findings highlight both progress and new challenges.

The live-attenuated vaccine candidate, ASFV-G-ΔI177L, was tested against a range of ASF virus strains collected across Africa. When pigs were vaccinated and exposed to the same strain used to develop the vaccine, the results were encouraging: vaccinated pigs remained healthy while unvaccinated animals succumbed quickly. Against a strain isolated in Ghana, about 80% of vaccinated pigs survived.

But the story changed with other strains. Against genetically distinct variants from Malawi, Kenya, South Africa, and Uganda, the vaccine offered no protection, despite generating strong immune responses.

These results point to a stark reality: ASF viruses are too genetically diverse for a single vaccine to offer universal protection. Current classification methods, which rely on analysing a single gene (p72), proved inadequate. In fact, two viruses with identical p72 sequences behaved very differently when tested against the vaccine.

To overcome this hurdle, USDA scientists have developed a new classification approach that examines the virus’s full set of protein-coding genes. This method, they argue, offers a more precise way to match vaccines with regional virus types.

“Although much further corroborative experimental work is needed, the classification developed will likely be the only available rational approach for deciding vaccination procedures to control and manage ASFV outbreaks,” explained Manuel Borca, USDA scientist.

ILRI’s Senior Scientist, Anna Lacasta, echoed this view: “This research reinforces the need to rethink our ASF vaccine strategies. A one-size-fits-all solution is unlikely. We need targeted vaccines aligned with the regional virus biotypes to maximise protection and control outbreaks. There is need to support the development and licensing of vaccines based on circulating ASFV biotypes.”

The findings, although sobering, represent a crucial step toward developing ASF vaccines that are effective in the field.

Just weeks before the USDA–ILRI research was published, another significant milestone was reached in Paris. At its 92nd General Session in June 2025, the World Organisation for Animal Health adopted its first international vaccine standard for ASF.

“This new standard marks a critical step forward in securing animal health,” said Emmanuelle Soubeyran, Director General of WOAH. “I am convinced that progress is within our grasp.

With sustained research and innovation, the development and use of high-quality, effective vaccines, alongside proven disease control strategies, can greatly reduce the toll ASF takes on communities and ecosystems.”

The standard outlines minimum requirements for vaccine safety, efficacy, and quality. It stresses that vaccines must:

• reduce disease severity and prevent transmission,

• provide effective immunity without causing harmful side effects, and

• align with the specific ASF strain circulating in a region, to avoid creating new, more dangerous variants through genetic recombination.