The financial services landscape is undergoing a profound transformation, and at the heart of this change lies the digital lending revolution. Once defined by lengthy paperwork, traditional banking silos, and restricted access, lending is today being reshapedintoafaster,smarter,andmoreinclusiveecosystem.Theriseof digital-firstmodelshasnotonlyredefinedcustomerexpectationsbutalso unlocked opportunities for underserved markets, bridging critical gaps betweeninnovationandinclusion.

Thisedition, Top 10 Digital Lending Visionaries Redefining Finance,isa tributetotheleaderswhoareattheforefrontofthistransformation.They are not just adopting technology—they are reimagining the way credit works, applying data intelligence, automation, and artificial intelligence to create lending experiences that are seamless, transparent, and customer-centric. From building robust platforms that accelerate loan approvals in minutes, to deploying machine learning for better risk assessment, these visionaries are setting new benchmarks in agility, security,andscalability.

What sets them apart is their ability to marry technological innovation withhumaninsight.Indoingso,theyaredrivingfinancialempowerment across diverse geographies and demographics—whether it’s enabling small businesses with instant access to working capital, or providing individuals with fairer and more tailored credit options. Their impact extends beyond profitability; it speaks to the larger vision of financial inclusion,resilience,andgrowthinanincreasinglydigitaleconomy.

Asyoureadthroughtheirstories,youwillfindnarrativesofperseverance, disruption, and foresight. These leaders remind us that lending is no longer about gatekeeping it is about unlocking possibilities and enabling dreams. The future of finance belongs to those who dare to innovate responsibly, and the digital lending pioneers featured in this issueareexemplarymodelsofthatethos.

We are delighted to present this special edition, celebrating the changemakerswhoarenotonlyredefininglendingbutalsorewritingtherulesof financeitself.Theirjourneysinspireconfidenceinafinancialfuturethatis faster,fairer,andmoreinclusiveforall.

Relationship Banking in the Digital Age: How Rewrote the Script

Managing

Art

Business

Business

Digital

Co-designer

Marketing

Bo Chen Founder Company Zeitro zeitro.com

Bryce Bradley Founder and CEO

Rosegate rosegate.com

Chris Mo�e Founder and CEO

Simplist simplist.com

Gary Boyadjian Founder & CEO Mortgage Panda pandamortgages.co.nz

Lala Ames Founder CoreLogic cotality.com

Marc Laird Chairman and Co-founder

Cornerstone Capital Bank cornerstonecapital.com

Ma� Corcoran Founder and CEO Pavaso pavaso.com

Randy McIn�re CEO HomeLend Mortgage homelend.net

Bo leads Zeitro in delivering forward-thinking products and services that drive efficiency, growth, and impact.

With extensive exper�se in strategic leadership, business development, and opera�onal excellence, Bryce leads Rosegate in crea�ng forward-thinking products and services that drive growth, efficiency, and measurable impact.

Chris leads Simplist in delivering streamlined, effec�ve, and impac�ul products and services that empower clients and drive business growth.

With extensive exper�se in mortgage advisory, financial planning, and customer-focused solu�ons, Gary leads his team in delivering tailored mortgage op�ons, expert guidance, and excep�onal service.

Known for her strategic vision and industry exper�se, Lala contributes to CoreLogic’s mission of delivering accurate, ac�onable, and innova�ve data solu�ons.

With extensive experience in banking, finance, and strategic leadership, Marc has played a pivotal role in shaping the bank’s vision and growth.

Ma� leads Pavaso in delivering secure, efficient, and paperless transac�on solu�ons that enhance the experience for lenders, �tle companies, and homebuyers.

Randy leads his team in providing personalized guidance, compe��ve mortgage op�ons, and seamless loan processing.

Rocky Foroutan Founder LenderHomePage lenderhomepage.com

Rocky leads the company in providing innova�ve tools and solu�ons that drive growth, efficiency, and client engagement.

Roman Gaponov CEO Django Stars djangostars.com

With extensive experience in technology innova�on, product development, and team leadership, Roman leads Django Stars in delivering high-quality, scalable, and tailored so�ware solu�ons for clients worldwide.

Marc Laird Chairman and Co-founder Cornerstone Capital Bank

Thesanctuarywasquietexceptfortherustleofhymnal pages. Marc Laird sat with his wife Ann and their children,settlinginforSundayworship.Asthechoir filed in, their voices rose in harmony: "Jesus is the Cornerstone..."

In that moment, surrounded by his church family, Marc felt something stir deep within. He had spent a decade climbing the corporate ladder, watching as transactions were prioritizedovertrustandprofitsoverpeople.Leaningoverto Ann, Marc whispered words that would echo through decades, "Cornerstone will be the name of the mortgage companyIstartsomeday."

Justfouryearslater,in1988,Marcfoundhimselfstandingon the precipice of the worst housing downturn since the Great Depression.While competitors shuttered offices and laid off employeesbythethousands,Marcmadeamovethatseemed almostreckless:heopenedanewmortgagecompany Where otherssawdevastation,Marcspottedanopportunitytobuilda different kind of mortgage company—one rooted in trust, relationships,andlong-termvalue.

In a world of corporate greed and impersonal transactions, Marcenvisionedacompanywhereservantleadershipwasn't abuzzwordbutapractice.Whereclosingloansontimewasa sacred promise. Where every client interaction was filtered throughthelensof"HowwouldIwanttobetreatedifIwerein theirshoes?"

That vision, born in a moment of worship, became CornerstoneHomeLending,now . CornerstoneCapitalBank Withjustahandfulofteammembersandabeliefthatservice andintegritycouldbepowerfuldifferentiators,Marclaidthe foundation for what would become one of America's most respectedfinancialinstitutions.

ALeapFueledbyPurpose

Marc's path to entrepreneurship began in public accounting, wherehehonedhisskillsasaCPAbeforejoiningagrowing mortgagefirmin1978asChiefFinancialOfficer.Hequickly rose through the ranks, eventually overseeing the Retail Lending Division and the Real Estate Owned (REO) Division.

ButwhenthecompanywasacquiredbyMutualofNewYork (MONY)in1986,thecultureshifteddramatically.Itwasclear the environment no longer aligned with Marc’s values or

“

In 1984, while my wife and kids were at church, the choir entered singing "Jesus is the Cornerstone." I was deeply moved and whispered to my wife, Ann, “Cornerstone will be the name of the mortgage company I start someday.”

visionformeaningfulimpact.InFebruary1988,Marctooka leap of faith and stepped away from a secure job to launch Cornerstone,alongsidehistrustedcolleagueJudyBelanger.

"Itwasrisky,"Marcadmits."Butitwasalsotherighttimeto create something lasting—something that could weather downturnsbecauseitwasbuiltonvalues,notjustprofits."

The timing, while daunting, turned out to be strategic. As many companies slashed costs and closed branches,

Cornerstonewasabletoattracttop-tiertalent—professionals looking for stability, significance, and a mission worth believingin.

“We weren’t trying to be the biggest,” Marc says. “We were tryingtobethebest.Oneloanatatime,onerelationshipata time.” From day one, Cornerstone focused on closing loans ontime,everytime—apromisethatwouldbecomepartofits identity The company also prioritized empathy and excellence, which became magnets for like-minded team membersandclientsalike.

“

Achieving success or a financial target has never been my goal. I’d rather focus on being significant to my family and the people we have the opportunity to serve, not only in their lives and careers but also for eternity. That would be my definition of a life well-lived.”

TheGoldenRuleGoestoWork

Marc’s leadership philosophy was forged by his blue-collar upbringing. His father, a pipefitter, taught him the value of hard work. His mother instilled in him the power of the GoldenRule:dountoothersasyouwouldhavethemdounto you. That ethos of servant leadership still shapes Cornerstone’sculturetoday.

As Chairman and Co-founder, Marc firmly believes that Cornerstone'sgreatestassetisn'titstechnology,itscapital,or even its market share—it's its people. From the company's inception, he has cultivated a culture where team members feelgenuinelyseen,heard,andvalued.

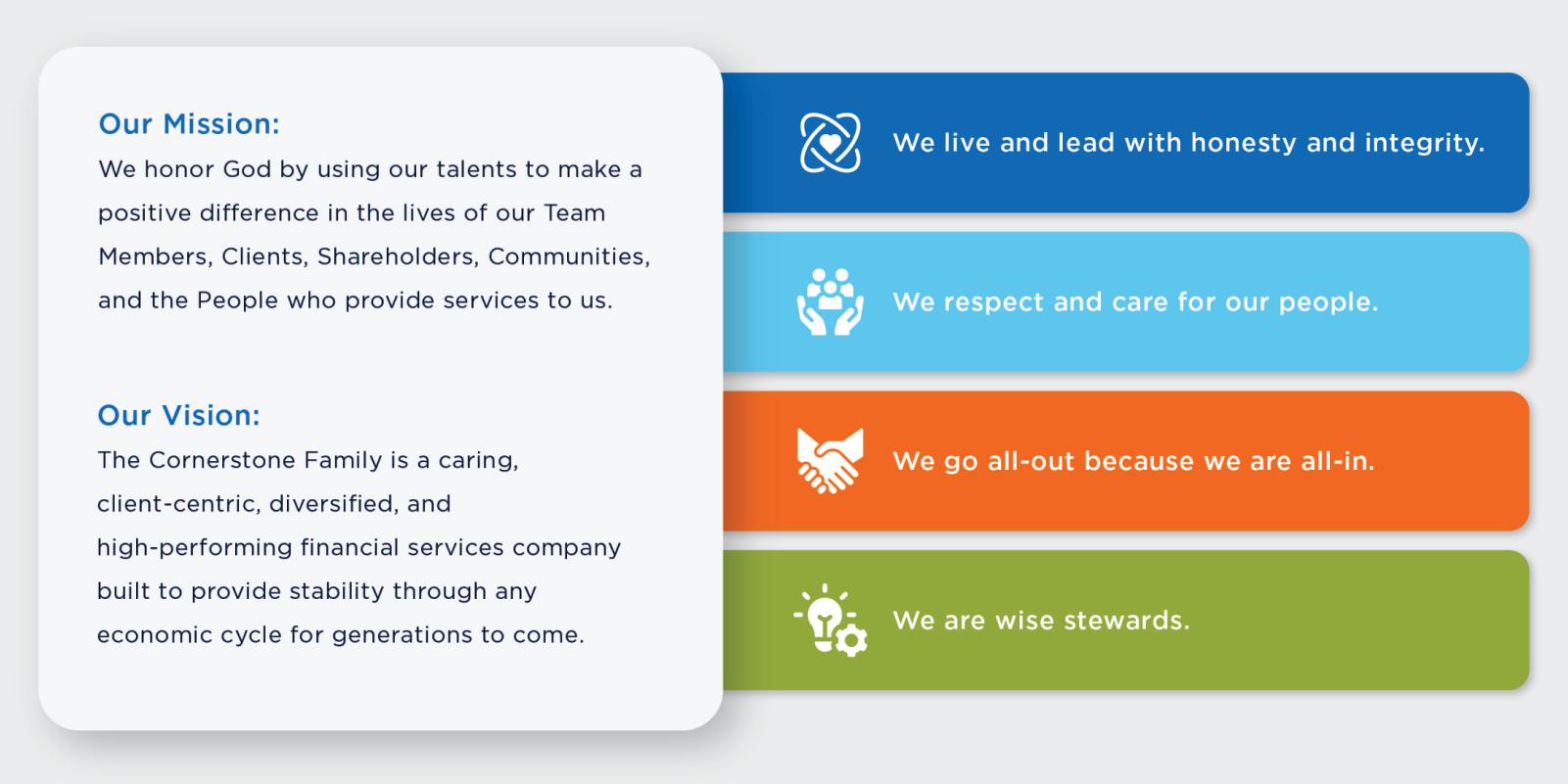

Cornerstone's Mission, Vision, and Convictions Statement transcends typical corporate documentation. It serves as the organization's moral compass Every hiring decision, leadership development session, and client interaction is groundedintheseprinciples.

"We exclusively recruit Team Members who align with our convictions,” Marc emphasizes. “And we make sure they’re not just memorized but lived out in every interaction, every day."

While culture forms the bedrock, innovation fuels Cornerstone’s continued growth Marc understands that financial services must constantly evolve to meet market demandsandchangingclientneeds.That’swhyCornerstone is deeply committed to blending high-tech capabilities with high-touchexperiences.

“Technology is essential, but trust is irreplaceable,” Marc says.“Weusethebesttoolstomakeprocessesfasterandmore efficient,butit’sourpeoplewhobuildrelationshipsthatlast.” ThishybridapproachhasallowedCornerstonetostaynimble and competitive in an industry increasingly dominated by impersonal,automatedfinancialinstitutions.

As Cornerstone expanded, it never lost sight of its core mission:toserve.Thiscommitmentledtoanaturalexpansion beyond mortgage lending into banking, insurance, and financial services—always with the same unwavering focus onexceptionalclientcareandethicaloperations.

Earlyinthecompany'sdevelopment,Marcandhisleadership teammadeastrategicdecision:Cornerstonewouldn’trelyon traditionaladvertisingmethods.Instead,theywouldlettheir clients do the talking. "Satisfied clients are our referral sources," he explains. "If we serve them well, they’ll spread theword.Andtheyhave—over500,000times."

This organic, relationship-driven growth has become one of Cornerstone's most significant competitive advantages. Clients return not simply for competitive rates but because they trust Cornerstone to prioritize their long-term financial well-being.

OneofthemostdistinctiveaspectsofCornerstone’sjourney isitsownershipmodel.Sinceitsfounding,10percentofthe company’s stock has been owned by a small group of team members. Recently, Cornerstone launched an Employee StockOwnershipPlan(ESOP)tograntallteammembers a stakeintheownershipofthecompany

“We believe in creating an ownership mindset,” Marc says. “WhenTeamMembersfeellikeowners,theythink

“

Over 500,000 satisfied clients are our referral sources.

Cornerstone Capital Bank does not advertise its services using TV, radio, or social media ads.”

differently Their work is more meaningful They lead, innovate,andinvestinourcompany’sfuture.”

This decision reflects a fundamental belief that the most successfulorganizationsaren'tmerelymanagedfromthetop down—they're built from the inside out, with every team memberhavingameaningfulstakeincollectiveachievement.

Amajor turning point in Cornerstone’s evolution came with the 2022 acquisition of The Roscoe State Bank and the transformation of Cornerstone Home Lending into CornerstoneCapitalBank.Themovewaspartofalong-term strategythathadbeenintheworksfornearlyadecade.

Marc and his family had quietly invested in two community banks to learn the inner workings of banking They recognizedthatbecomingabankwouldallowCornerstoneto offermorefinancialservicestoitsclients,significantlyreduce its cost of funds, allow for portfolio lending, reduce dependence on external credit lines, and achieve greater liquidityandfinancialstability

Under the leadership of banking veteran Scott Almy, now Cornerstone's President and CEO, the team navigated the complex regulatory landscape. The result: Cornerstone CapitalBankwasborn,currentlythemosthighlycapitalized newbankinTexashistory.“Thisisn’taboutbeingabankfor thesakeofit,”Marcnotes.“It’saboutservingourclients

better, securing our future, and offering more integrated financialsolutions.”

I love my family and the opportunity to serve Cornerstone. Working with Cornerstone adds so much value to people, and that’s what I love to do as a person.” “

In an industry marked by cycles, Marc has consistently emphasized preparedness. “We’ve been planning for this downturnforover10years,”hesays.

Bybuildingadiversified,high-performingfinancialservices company with strong liquidity, Cornerstone has positioned itself to thrive not just survive through economic volatility The bank adds a diversity of asset classes, lowers costs,andboostsresilience,whilethehomelendingdivision remains agile and client-focused with strong financial performancewhenhomeaffordabilityexpandsduringfalling andlowerinterestratecycles

“Cornerstone’s diversified financial services model operates successfully during any interest rate cycle,” Marc asserts.

“We’ve built a structure designed to be successful through anyeconomicenvironment."

BuildingPeople,NotJustProfits

For Marc, leadership isn’t about control It’s about stewardship. Helping team members, clients, and others succeed,grow,andbuildlegaciesoftheirownhasbeenoneof themostrewardingpartsofhiscareer.“Cornerstoneismore than business,” he says. “It’s about making a difference in people’s lives—our clients, our communities, and our Team Members.”

Many of those team members have spent decades at Cornerstone, building careers, buying homes, and watching their children grow. That loyalty speaks volumes about the cultureCornerstone’sleadershipteamhavecreated.

WhatdefinessuccessforMarc?It’smuchmorethanfinancial metrics—it’simpact.

“Imeasuresuccessbythetrustwe’veearned,theliveswe’ve touched,andtheteamwe’vebuilt,”hereflects.“Westartedin one room. Now, we serve over 500,000 clients That means something.” Looking ahead, Marc envisions Cornerstone becomingthenation’sstandardforintegrityandexcellencein financialservices.Hewantsthecompanytoberecognizednot only for closing loans on time, competitive rates and innovativedigitaltoolsbutforhowitmakespeoplefeel.

“We’rejustgettingstarted,”hesays.“Therearemorepeople to serve, more legacies to help build, and more ways to redefine what it means to be a purpose-driven financial institution.”

Evennow,decadesin,Marcremainsenergizedandoptimistic about the road ahead. He continues to show up, engage in meaningfulwork,andinvestinthefutureofeverypersonwho walksthroughCornerstone’sdoors.

Hesumsitupwithclarity:

“Every day is a precious gift from God. True success to me isn’t about titles or earnings—it’s about significance. It’s abouthowmanyliveswecanimpactforthebetter.That’sthe legacyIwanttoleavebehind.”

“

Since the inception of Cornerstone in 1988, 10 percent of Cornerstone’s stock continues to be owned by Team Members; the rest is owned by my family. There are no outside shareholders.”

Today, Cornerstone stands as a testament to what’s possible whentrustisthefoundation,servantleadershipistheculture, and innovation is guided by purpose and heart. With 1,400 dedicated team members and assets exceeding $2.4 billion, Cornerstoneismorethanasuccessstory;Cornerstoneoffersa model for how faith-driven leadership can create lasting change, not just in financial outcomes but in the lives it touches.

The financial services industry is experiencing a technologicalwaveofinnovationatanunprecedented rate. Previously, lending was hindered by timeconsuming documentation, limited access to eligibility criteria, and inflexible processes. Now, the industry is undergoingadramatictransformation.Thenextgenerationof lending products is at the center of this transformation, poweredbyartificialintelligence,real-timedata,cloud-native systems, and embedded finance ecosystems, which are reinventing the credit assessment, giveaway, and managementglobally.Theseinventionspromisetooffermore individualized, faster, and inclusive lending experiences to bothinstitutionsandborrowers.

In the past, lending has been dependent on standard credit models, voluminous documentation, and centralized decisioning.Ontheonehand,thiswayprovidedsomecontrol and risk management; on the other, it left out many individuals and businesses that would not fit into traditional schemes. Digital transformation is currently breaking down these obstacles, creating increased and more versatile credit assessmentandservice.

AI and machine learning in underwriting are one of the features of the current generation of next-gen lending solutions. These tools analyze the massive data, allowing them to assist in delivering details about the conduct of the borrowers,loanquality,andpotentialrisks.Withaparadigm shifttoalternativesourcesdatainsteadofconventionalcredit scoring, lenders will gain additional information regarding theirborrowersinrealtime.

This smart automation will assist in lowering the cost of operationsandthedegreeofhuman-drivenbiasparticipating in the decision-making process. Meanwhile, it increases consistency, transparency, and the speed of the lending lifecycle.Borrowerswillenjoyfasterapprovalandtheirown specialloanservice,andlenderscantakeadvantageofmore dependableconsumerpredictivemodels.

EmbeddedFinanceandSeamlessAccess

The other most important feature of next-gen lending solutionsistheincreasedinfluenceofembeddedfinance.This model enables the lending capabilities to be incorporated directly in non-financial platforms (ex: e-commerce sites, apps, service platforms) where consumers can make use of creditaspartoftheirdailyactivity

This seamless integration makes it convenient and easier to borrow when the time comes, as users find it easy to avail financing services. It also provides an opportunity to businesses to provide customized credit to its customers withoutneedingtocreatealendinginfrastructure.Withsuch accessibility, the consumption and delivery of credit is changingradically

Modern lending platforms are increasinglycloud-nativeand more flexible, scalable and secure. With the help of cloud infrastructure, financial institutions are now able to successfully deploy, update and scale its services. It is also fully integrable with APIs, data analytics, and even thirdparty services. Such flexibility is critical when the financial environmentisrapidlychanging.Futureproductsinlending

must be malleable so that changes in the regulatory environment, market forces and customer demands are addressed.Cloudtechnologyhelpstoachievethisflexibility, promoting greater data governance and cybersecurity policies.

One thing that defines the next-gen lending solutions is that they can increase financial inclusion. Conventional lending productstendtoexcludepeoplewhohaveinsufficientcredit history, non-standard sources of income, and jobs. The new methods have enabled borrowers to be assessed in a more holistic manner, relying upon a far greater number of data points that accurately reflect their financial behavioral patterns and reliability This customization is not just about the improvement of access but also allows the lender to provideacustomizedproductthatfitstheneedsandsituations of the borrower. These innovations benefit the lending ecosystem with more equitable and easier to use loan structures,butalsothroughfeaturessuchasdynamicpricing.

Themovementtonext-genlendingsolutionsisnotsimplya trend, but a structural shift in the financial services sector. Using the capabilities of AI, embedded finance, cloud infrastructure,andreal-timedata,thesesolutionsareenabling a more effective, inclusive, and customer-friendly lending process.

Though there are responsibilities associated with this innovation.Whathappenstothelendingwillnotonlydepend on the technology capability but also on the ethical frameworks, as well as the regulatory measures that accompany it. Banks that adopt this novel paradigm and do notoverlookitsissueswillbeinasuperiorsituationtotakethe forefrontinamoredigitaleconomy

Next-genlendingsolutionscanbeseenastheroadmapaswell asthedrivingforcebehindamoreinclusive,agile,andsmart financial future as the lending industry undergoes an evolution.

The creator economy (as freelancers, gig workers, influencers, and digital content creators shape new career opportunities) has exploded, and as a result, therehasbeenanincreaseddesireforflexibleandaccessible financing. The customary banks, which are based on fixed underwritingmodels,tendtobeunequippedtoaccommodate such new workforces. Fintech lenders are up to the task, providing custom credit products that respond to the circumstancesofthenewworldofwork.

Traditional credit rating is based on a steady job and past creditbehavior,factorsthatmostcreatorsandgigworkersdo not qualify for This disruption is being fueled by fintech lending platforms utilizing alternative data: earnings on the gig platforms, social media activity, telecom spend, utility bills and even psychometric data For example, new companies such as Tala, KarmaLife, and Lenddo are measuring creditworthiness based on behavioral and realtime financial metrics, rather than traditional credit scores. This strategy expands financial access to include a wider workforce,oftenallowingthemaccesstomicroloansorcredit linesthathadpreviouslybeenunavailable.

Earningsofcreatorsandfreelancerscanvary Fintechlending solutions are intervening with income-smoothing mechanisms like Earned Wage Access (EWA) platforms. Thesefacilitateaccesstoearnedincomebeforestandardpay cycles for smooth cash flow In addition to access to funds, platforms have introduced invoices, budgets, expense, tax planning, and retirement capabilities, which add financial transparencyandordertoaremoteemployee.

EmbeddedFinance:SeamlessIntegrationwithPlatforms

Embeddedfinanceisbecomingrevolutionary Itenablessuch financialproductsascredit,insurance,orinstantpaymentsto

bedeployeddirectlytotheplatformspeoplearealreadyusing. Forexample:

• Themodalitytodayseescreditoradvancesagainstfuture income and enhances the financial inclusion of the underbankedfreelancers.

• They facilitated immediate payout through virtual or physical card payment, wealth or tax management functions embedded in apps, which makes financial managementsimpler,andengagementisenhanced.

This facilitation provides seamless access to financial services- delivers the services to where the creators are and whentheyrequirethem.

AI enables broader, more sophisticated lending decisions withaquickerresponsetime.Withreal-timedataACHalbio AI-enabled underwriting dynamically analyzes behavioral, transaction, and platform data to provide a more precise measure of risk than operating within a legacy system. Examples of this include Accumn in India, which is revolutionizingretaillendingandapplyingAI-enabledsmart underwriting, simplifying real-time credit decisions, and enhancingriskscoring.

Global&LocalFintechPioneers

Around the globe, fintech lending is evolving to meet local workforceneeds:

• KarmaLifehasbeenprovidinginstantcreditlinestothe gig and blue-collar workers in India with minimal paperwork.

• Open banking is seen in the UK and EU, where fintech can scale across financial data across many sources to buildcustomproductssuchasmortgagesandinsurance, aswellasloanproductsforfreelancercustomers.

Although fintech lending can go a long way to enhance access,concernsstillexist,especiallywithregardtofairness in algorithmic decision making. The studies on AI-based lending emphasize the dangers of representation bias, in which models trained on largely approved applicants can discriminateagainstlow-socioeconomicborrowers.

Gender bias is another issue identified in one study: even whenthebuildingofthealgorithmdoesnotexplicitlytarget gendernorms,itcanstillresultinitbeingbiasedtowardsmen, even though women tend to make better borrowers. To be mosteffectiveinservingcreatorandgigworkforces,fintech platformsneednotonlytoinnovatebutalsotomakesurethat theircreditmodelsareinclusiveandfair.

Fintech lending is becoming a key enabler of powering new models of the workforce and the creator economy. Using alternativedata,AI,embeddedfinance,andinclusivedesign, lenders are transforming access to credit and financial services.

Tosustainthismomentum,severalstepsareessential:

• Ethical AI and transparency: Incorporate equity in algorithmsandlending.

• PartnershipswithplatformsandB2Bplayers:Partner with the gig platforms to provide financial literacy and fintechtoolstocreators.

• Regulatorysupport:Promotepoliciesthatcangenerate a balance between consumer protection and innovation, e.g., in facilitating information sharing, permitting liberal onboarding practices, and permitting open bank models.

The advent of fintech lending is transforming the way in which creators, freelancing workers, and people within the gig economy can secure credit and finance their personal needs. These innovators are not only replacing traditional systems by opening gaps but also creating a more inclusive road towards financial empowerment using data, AI, and embedded financial tools Though there are problems concerningbiasandfairnessthatstillexist,thepossibilitiesof democratizing credit and empowering the new workforce cannotbeoverstated,aslongasinnovationcanberesponsible andadaptive.

For Subscrip�on: www.insightssuccessmagazine.com

www.x.com/insightssuccess