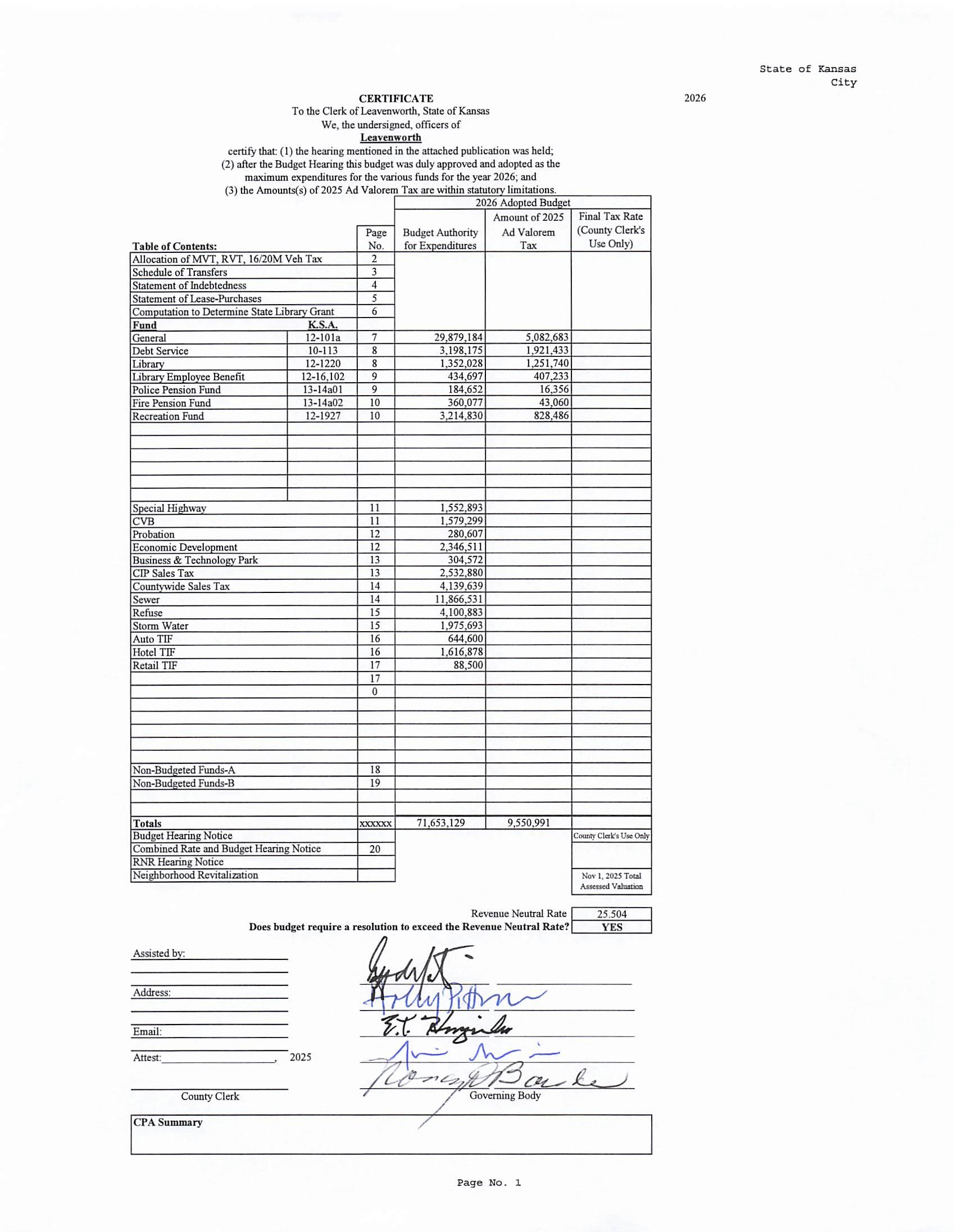

2026

Proposed Annual Operating Budget & 2026 2030 Capital Improvement Plan

2026

Proposed Annual Operating Budget & 2026 2030 Capital Improvement Plan

List of Elected and Appointed Officials

October 14, 2025

The ongoing mission of the City Government of Leavenworth, Kansas is to protect and maintain the health, safety, and general welfare of the Leavenworth community. All representatives of the Leavenworth city government will carry out this mission on a daily basis within the parameters of all fiscal resources available and in a fair and equitable manner for all individuals who live in, work in, conduct commerce in, and visit the City of Leavenworth.

From: Roberta Beier, Finance Director, City of Leavenworth

Date: October 14, 2025

Subject: Updatesto 2026BudgetTransmi al Le er

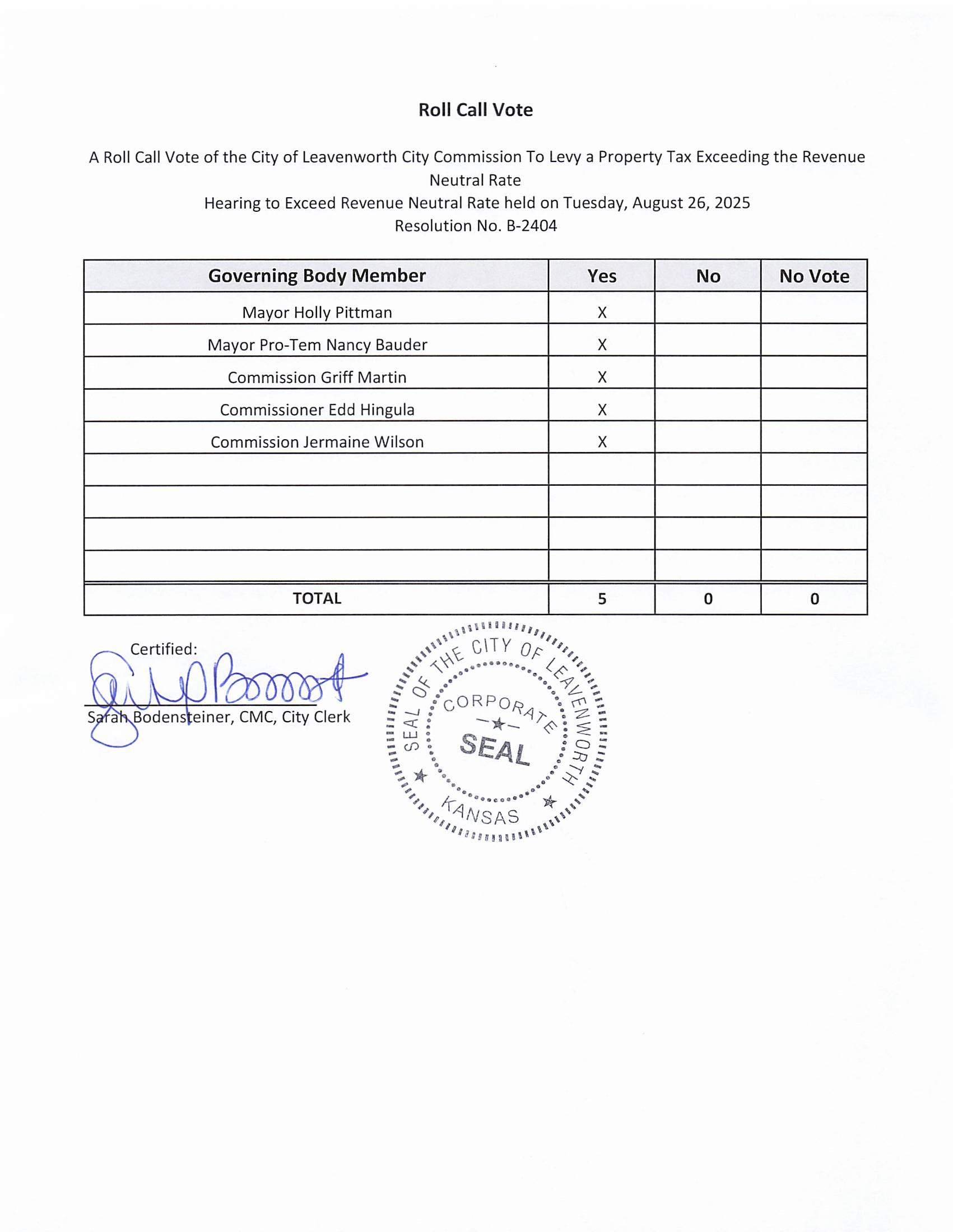

On June 30, 2025, the City Manager and I submi ed theProposed2026 Opera ng Budget and 2026–2030Capital Improvements Programto the City Commission, alongwith the following transmi al le er. Subsequentto delivering the proposedbudgettothe City Commission, the City received addi onal informa onthatresulted in changes beingmade to the proposed budget. An updated budget was submi ed and approved by the City Commission on August26, 2025.

The purposeof this Memorandum for Recordis toprovide an overviewofthe changes made to the budget. It shouldbe readinconjunc onwith the following transmi alle er. Thechanges are summarizedbelow:

In September,2025, theCityreceived its 2026health insurancerenewal rates which were approximately 25%lower than the 2025 health insurancerates.The2026 rates provided asavings of approximately$1,000,000 for the 2026 budget. This savings in health insurance allowed the City to:

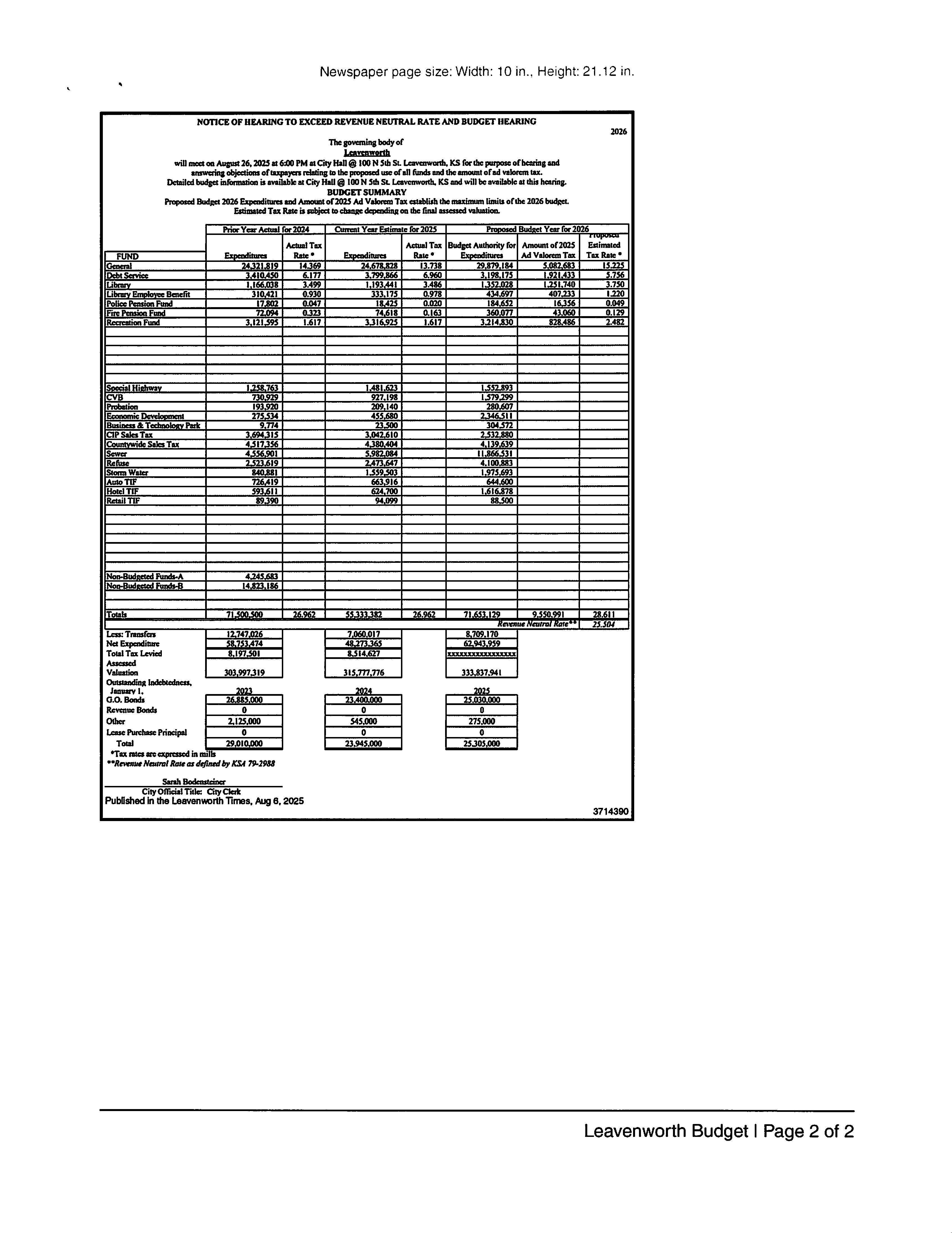

o Lower the amountof advalorem tax neededto supportthe 2026 budgetfrom $9,963,805 (proposed budget) to $9,551,437 (approved budget). Beloware updated tablesthatillustrate the 2026advaloremtax levy and2026mill levy. The originaltablesappear on pagexi ofthe transmi al le er:

o Give raisesto employees, effec ve January 1, 2026 as follows:

1.5% to the following posi ons

Police Chief

Fire Chief

PublicWorks Director

FinanceDirector

2.0% to all other DepartmentHeads

2.75% tothe restof the staff

o Increase theDecember31, 2026budgeted reserves in the GeneralFund from $5,292,893 (22.06%ofannual expenses)to $5,374,827(22.75%of annual expenses)

The projectedDecember 31,2025, cashbalance in the GrantMatching Capital Projects Fundwas updatedto $245,901, reducing the 2026 budgeted transferfrom the General Fundto the GrantMatching CapitalProjects Fund from $1,066,678 to $820,777.

Total City-wide budgeted expenses increased from $61,987,800to $64,849,332. This is primarilydue to the expenditureof cashreservesin thecapitalprojects funds to cover projected encumbrancesas of December 31, 2025.

o Specifically, budgeted expensesin the Enterpriseand SpecialRevenue funds increased from $5,155,420 (proposed2026budget) to $6,934,960 (approved 2026budget) – primarilydue to the ming of thecomple onofcapitalprojects.

The updated table forbudgeted expendituresforthese funds isbelow. The original table appears onpage viiiofthe transmi al le er.

**Note: The CIPSales Tax and the Countywide Sales Tax Fundsaresetup to collectlocal andcountywide salesanduse taxanddisburse thosefunds to variousotherfunds based on previously established City ordinances; therefore, the fundsdonot have anybudgetedexpensesother thantransfersto other funds.

The above changes are in referenceto thetransmi al le er datedJune 30, 2025, which begins on thefollowing page.

Roberta Beier FinanceDirector

June 30, 2025

Mayor and City Commission

City of Leavenworth

Leavenworth, Kansas

Dear Mayor and Commissioners:

The City of Leavenworth Management Team is pleased to present the 2026 Operating Budget and 20262030 Capital Improvements Program (CIP). The two budget processes were combined in 2019 to provide the Commission and residents of Leavenworth with a clearer and more comprehensive view of total City resources and expenditures. The change also reflects the interconnectivity between the budgets. The budget is one of the most important documents the City prepares in a given year and efforts have been made to produce a document that is an effective communications tool, policy document, historical record, financial plan, and operations guide for the City.

The 2026 Operating Budget is balanced, as required by law, and builds on the City’s goal to provide highquality services while maintaining sound financial standing. The budget contains revenue and expenses for all City funds and includes a "pass-through" levy as mandated by the Library Ordinance.

The 2026 Operating Budget was crafted in an environment of declining local sales tax revenue while countywide sales tax revenue, local use tax revenue and countywide sales tax revenue continued their upward trend. At the same time, the local economy continues to face historic levels of inflation, commodity/service/utility price increases and wage pressures. This budget attempts to address the upward trends of price increases for many services and commodities while aligning to the City Commission’s strategic priorities and goals.

Following several years of post-pandemic volatility and rising costs, the development of the 2026 Operating Budget reflects a deliberate effort to stabilize the City’s financial position without overreliance on reserves. Simultaneously, the City faces uncertainty regarding high interest rates and continued inflation in construction costs and the labor market, as well as continued inflationary pressures in critical operating expenses such as insurance premiums, employee healthcare, wage demands, and fuel costs. The City prioritized core services and long-term sustainability, with the budget strategically and prudently addressing these rising expenditures and uncertain revenue trends, while remaining firmly aligned with the City Commission’s established strategic priorities and objectives. Factors that provided constraints to the 2026 Operating Budget include:

RevenueEnvironment: The 2026 budget reflects growth in the City’s assessed property valuation, with an increase of 5.72%, generating approximately $1,178,600 in additional property tax revenue within the General Fund through a 2.787 mill levy increase. While this increase is essential to maintain existing service levels, the City remains sensitive to the impact on taxpayers, especially as residents concurrently face rising utility rates and increases from other tax districts.

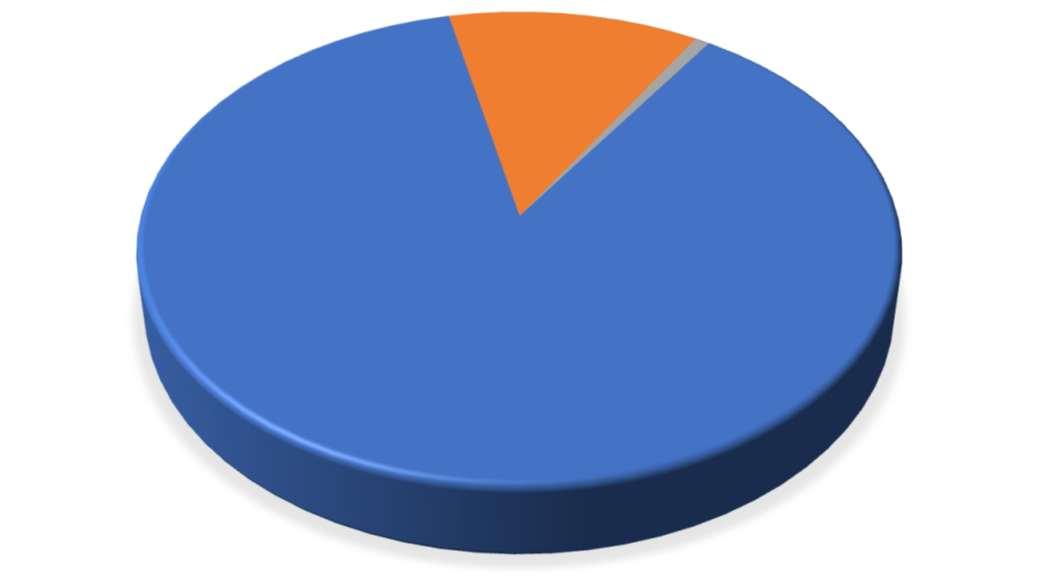

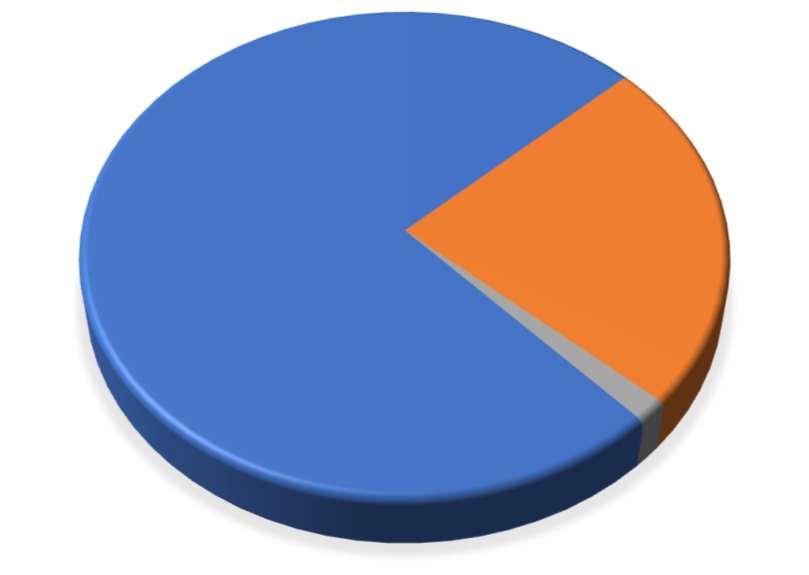

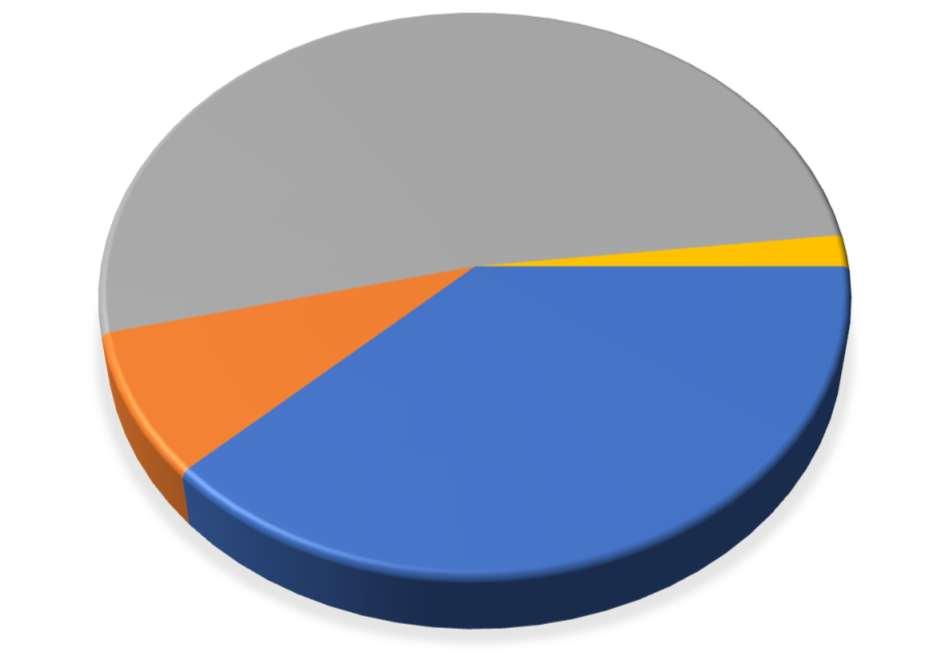

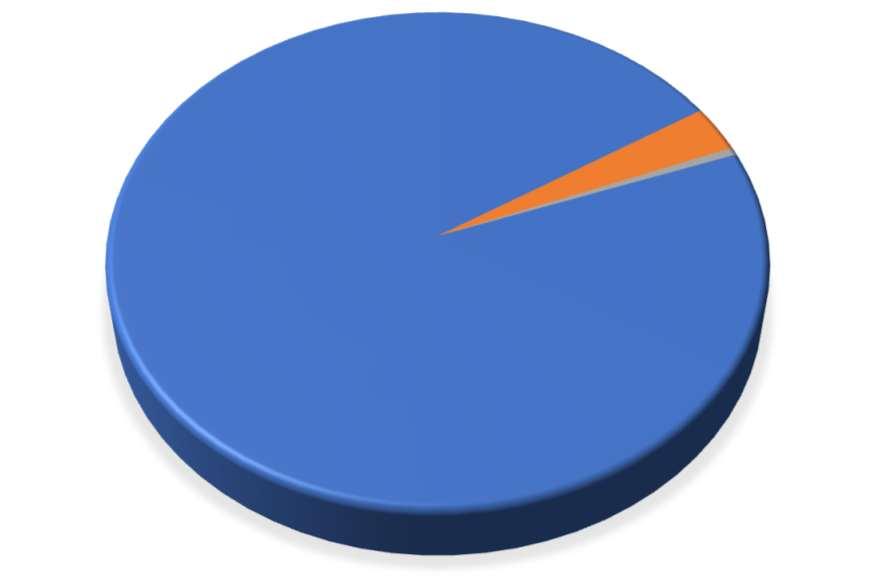

ReservesandFiscalStability: The City places great importance on maintaining healthy General Fund reserves, targeting a minimum of 16% and a preferred level of 30% of annual operating expenses. In order to maintain the City’s excellent bond rating of Aa2, it’s important to keep a reasonable reserve position. Higher bond ratings allow for lower interest rates when borrowing funds for capital projects. Recent years have seen a decrease in reserves as the City completed one-time projects and strategically used reserves to achieve revenue neutral budgeting. As of December 31, 2024, reserves stood at 32.7% of operating expenses, but the proposed budget results in a decrease in reserves to 22.1% as of December 31, 2026. This strategic use of reserves has allowed the City to maintain high-quality services amid revenue volatility, but continued reserve depletion is not sustainable. Accordingly, the 2026 budget has prioritized stabilizing these reserves, reflecting the City’s proactive approach to long-term financial health.

InflationaryandCostPressures: The 2026 budget development process confronted numerous external cost pressures, significantly affecting planned expenditures. Notably, the City’s health insurance expenses rose sharply, increasing by $467,000 (14%) in 2024, with an additional increase of $593,00 (16%) anticipated for 2025. The City is also facing a nationwide inflation of goods, services, equipment, and labor that provide additional constraints on our ability to provide a high level of services. Substantial increases such as these, combined with uncertainties surrounding federal employment at critical local employers such as the VA, correctional facilities, and Fort Leavenworth, underscore the need for budgetary prudence.

OperationalAdjustmentsandCostControlMeasures: In response to these financial challenges, City leadership undertook comprehensive cost-saving measures to maximize efficiencies and avoid unnecessary taxpayer burden. The 2026 Budget includes targeted initiatives such as:

o Made adjustments to the fleet lease program to reduce costs, including downsizing vehicles and selling those with low level of use.

o Strategic staff reductions through attrition without layoffs, maintaining workforce stability while controlling personnel costs.

o Across-the-board reductions in overtime expenses: 10% for most City departments and a targeted 5% reduction for Public Safety.

o No scheduled raises or wage increases for City personnel in 2026, following recent increases to improve wage competitiveness.

In addition to revenue and expense forecasting and management, the Management Team continues to pay close attention to State Legislature-generated budget measures that, if passed into law, would require a fundamental shift in City budgeting. In the 2025 legislative session, those measures included:

Astate-imposedcapofa3%propertytaxincrease: Included, but not passed in the 2025 state legislative cycle, was language that would cap property tax increases. The last bill that was discussed during the legislative session provided for a 3% cap to proposed property tax increases

levied by local municipalities. This measure did not pass, however, there are increasing calls and efforts to address local property tax in the state legislature, which we will continue to monitor.

The last-minute nature of State tax legislation results in unpredictability for local governments. The Leavenworth City Commission is the appropriate body to make taxing decisions for the businesses it represents and the residents who select its composition every two years. Staff will continue to watch for and fight any efforts to limit the City’s home rule authority.

The 2026 Operating Budget is a representative example of the measures taken by the current and past City Commissions in financial management and prudent taxation to deliver services at the local level. The 2026 Operating Budget reflects these past efforts and careful planning, but it also presents a new, goaloriented approach to the City’s division of resources and service delivery. In March of 2025, the City Commission met with staff and developed a list of six goals that you would like to see addressed in the 2026 budget and beyond. Those goals, and the objectives we’ve identified to address them, are outlined below:

1.TakeanhonestapproachtorevenuegenerationintheCity

• Staff has provided a revised, more conservative estimate for sales tax collection through the year 2026 based on recent trends.

• Reduction of spending in key areas- Staff believes all available cuts have been made prior to recommending revenue increases.

• Staff has worked with Enterprise to reduce the City’s annual vehicle fleet lease payment from approximately $750,000 in 2025 to approximately $506,000 in 2026.

• Three vacant staff positions have been closed for re-hire.

• The budget team met with department heads to address their budgets at the lineitem level: every line has been examined to ensure maximum cost savings.

• Reduction of overtime by 10% in every department except public safety (5%).

• No budgeted increases to wages and salaries for City personnel.

• Adjusting enterprise fees to meet the current and future demands of user-based services.

2.EvaluateFutureofSolidWasteServices

• This particular goal is addressed later in this letter, but staff worked closely with the City Commission to evaluate potential options for the future of solid waste in Leavenworth, and have budgeted according to the Commission’s consensus.

3.EvaluateFutureofWastewaterServices

• In June of 2025 the City Commission approved a $370,000 extension to the City’s wastewater treatment plant master plan, that will evaluate options for the construction of a new wastewater treatment plant at the existing site. The plan will also identify existing infrastructure that is slated for replacement in the current CIP that will not be needed in a new facility; this infrastructure will be removed from the CIP, and the funds put aside for future down payment on a new plant.

4.EstablishPrioritiesforEconomicDevelopmentPartners

• Staff is working directly with the City Commission during this budget cycle to see that the future of Leavenworth’s relationship with its economic development partners is moving in the direction the Commission envisions.

5.LookintodigitizationofCity-wideoffices/services

• In 2025 the City adopted the Bonfire software that will be used for all procurement projects moving forward. This is a digital software that allows contractors across the country to view and bid on any proposals the City puts out.

• The Parks and Recreation Department is transitioning to using RecDesk, a digital registration and reservation software, for all recreation programs.

• Staff has included a budget for procuring a business licensing software to streamline the City’s interactions and registrations with local businesses.

• Staff will be transitioning to Microsoft Office365 and Microsoft Teams, allowing for greater digital and remote internal collaboration.

6.IncreasedcommunicationfromtheCitytothepublic

• The City will soon be partnering with Leavenworth County to use its already operational opt-in Texting service, Alert Sense. Residents that opt-in to this service will be sent regular texts, emails, app alerts, or phone calls notifying them of events, emergencies, or general up-to date information going on in the City.

• Staff is exploring new ways to reach younger residents by creating social media accounts, such as TikTok and Instagram, that will provide City-related content and information that pertains directly to them.

The 2026 Operating Budget is a clear representation of strategic financial measures implemented by the current and past City Commissioners, underscoring disciplined fiscal management and prudent stewardship of public funds. By carefully evaluating expense growth, strategically managing reserve levels, and making thoughtful investments, the City is positioned to continue delivering high-quality municipal services despite the challenging financial environment.

In light of this uncertain landscape, the 2026 budget was crafted with a disciplined approach to spending, reaffirming that the Leavenworth City Commission is best positioned to make responsive, responsible financial decisions for its residents and businesses. The budget reflects the Commission’s commitment to long-term stability by limiting new spending, prioritizing core services, and avoiding structural imbalances that could weaken the City’s financial position. As a result, the 2026 budget includes several key investments and considerations that:

ConsiderSolidWasteServicesImprovementandConsolidation: Responding to increased service demands and operational efficiency goals, the budget incorporates the initial phases of a new solid waste consolidation strategy. This involves immediate investment in an additional refuse truck to enhance waste collection in 2026; the planned construction of a consolidation station at the former landfill site; and the development of a master plan for a potential, fullservice transfer station in the future if or when the need arises. This phased approach aims to improve operational efficiency, employee safety, and service reliability for residents.

LeveragetheDedicatedGrantMatchingFund: Recognizing the significant benefit of leveraging external funding opportunities, the City will utilize $1,066,678 from the General Fund in 2026 to meet required local match obligations for approximately $4,016,000 in external grant-supported projects. Beginning in 2027, grant matching requirements will be met through City Sales Tax or Countywide Sales Tax revenues, providing a sustainable long-term funding strategy.

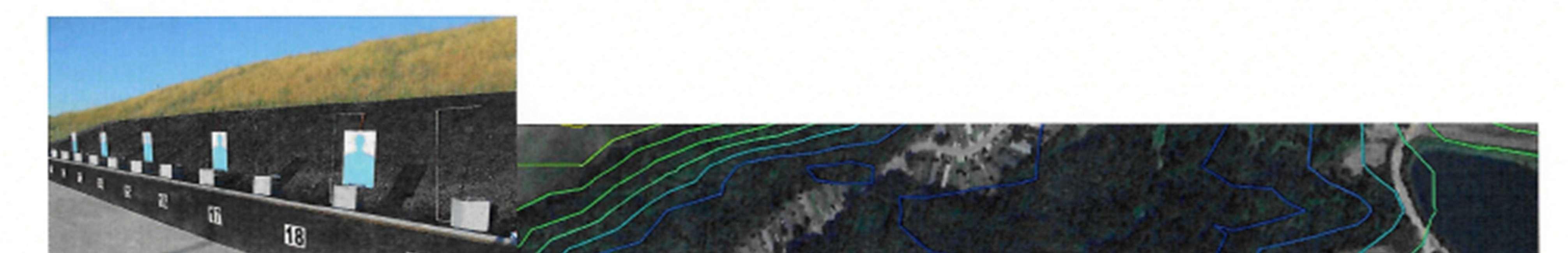

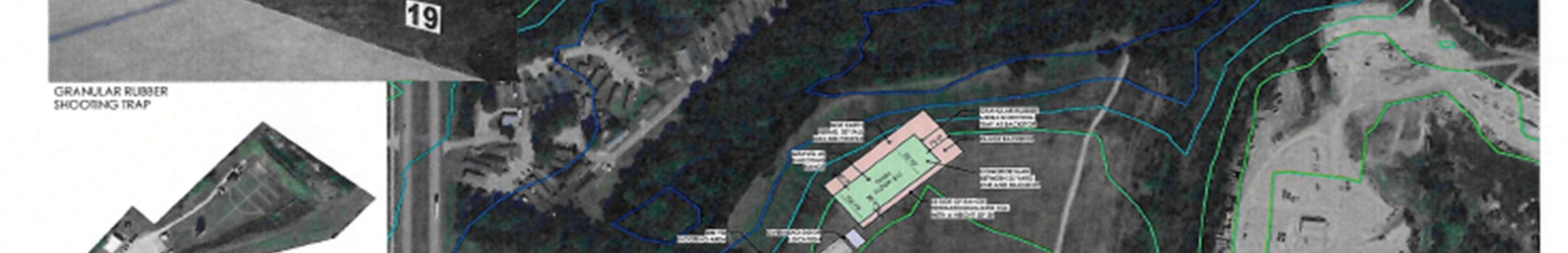

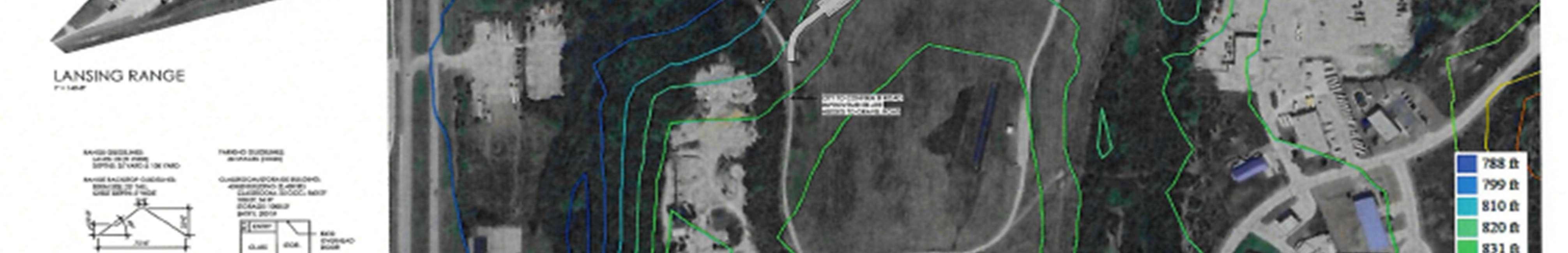

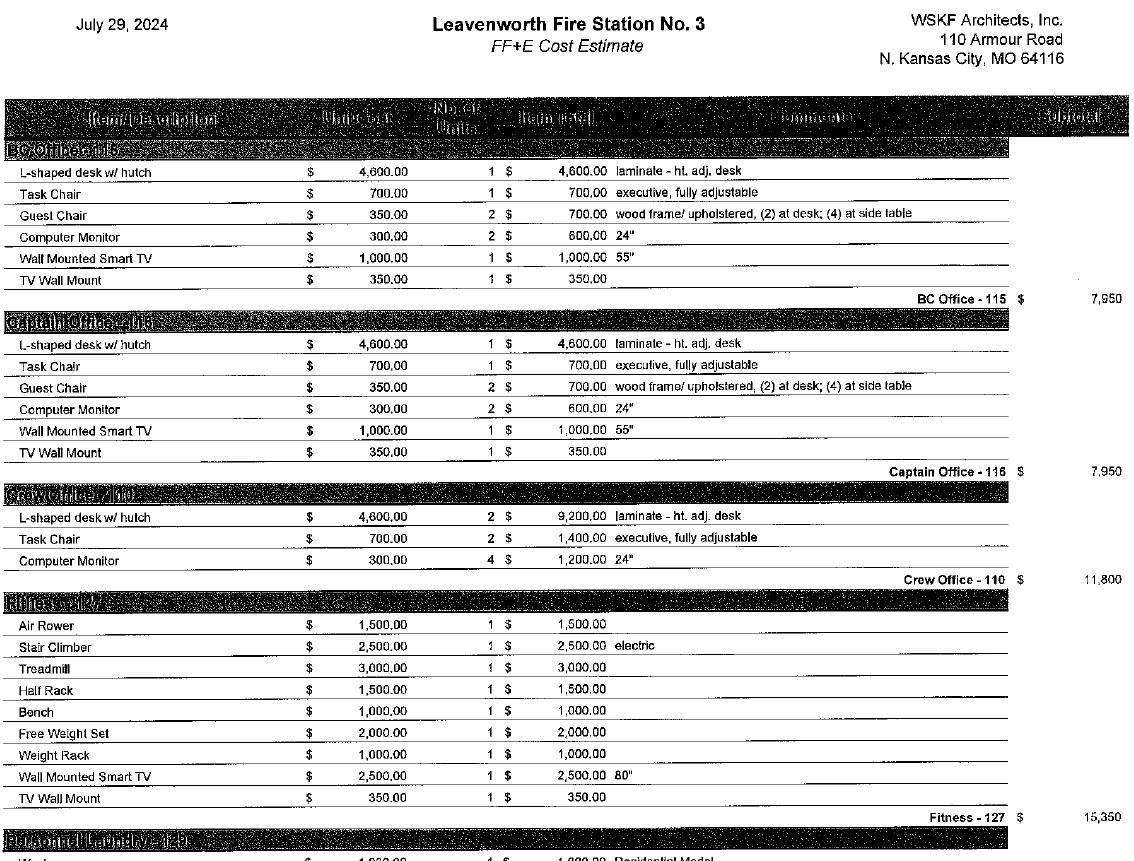

ReduceandManageDebtObligations: The City continues its disciplined approach to debt management initiated in previous years. While bonds totaling $4,885,000 were issued in 2024 for Fire Station #3, the 2026 budget reflects debt service that is $308,000 lower than 2024 debt service and $698,000 lower than 2025 debt service. If the City continues its prudent pay-as-you

go strategy for CIP projects, all general obligation debt will be retired by 2036. This ongoing commitment to debt reduction ensures greater financial flexibility for future budgets.

DigitalizeandEnhanceCommunication: The budget prioritizes modernizing service delivery and enhancing transparency through targeted technology investments. In 2025, key initiatives included implementing digital platforms such as Bonfire for procurement and RecDesk for recreational service management. In 2026 the City is implementing Office 365 for operational efficiency and to improve cybersecurity. Additionally, to foster greater resident engagement, the City is rolling out new communication channels, including an “AlertSense” opt-in texting service and expanding social media outreach through platforms such as Instagram and TikTok.

AdjustWastewaterInfrastructureInvestments: When the master plan for an updated wastewater treatment plan is complete, it will be evaluated by staff and presented to the City Commission. If the decision is made to build a new plant in the existing location, any improvements in the 2026 CIP that will not be used in a future plant will be removed from the CIP.

Based on Commission direction and actions aimed at managing expenses responsibly and restoring appropriate reserve levels while ensuring essential service delivery and strategic investments in infrastructure, the 2026 Operating Budget includes a proposed increase of the City-supported mill levy of 2.377 mills, reflecting the need to maintain fiscal stability in response to sales tax shortfalls and rising operational costs. Despite the increase, the City remains sensitive to the cumulative impact on residents, especially in the context of rising private utility rates and other taxing jurisdiction’s adjustments.

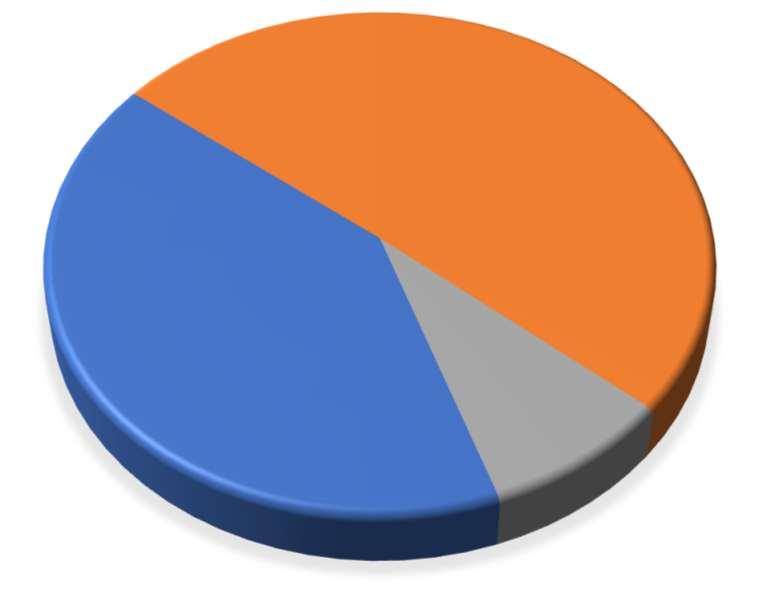

Looking forward, the Budget Team continues to be concerned by the City’s substantial reliance on sales tax revenue as a significant component of general fund revenues, recognizing the dependency as a key vulnerability to broader economic conditions. As stated in its most recent evaluation, Moody’s Investor Service specifically notes, “The City’s reliance on economically sensitive sales tax revenue is a credit challenge.”

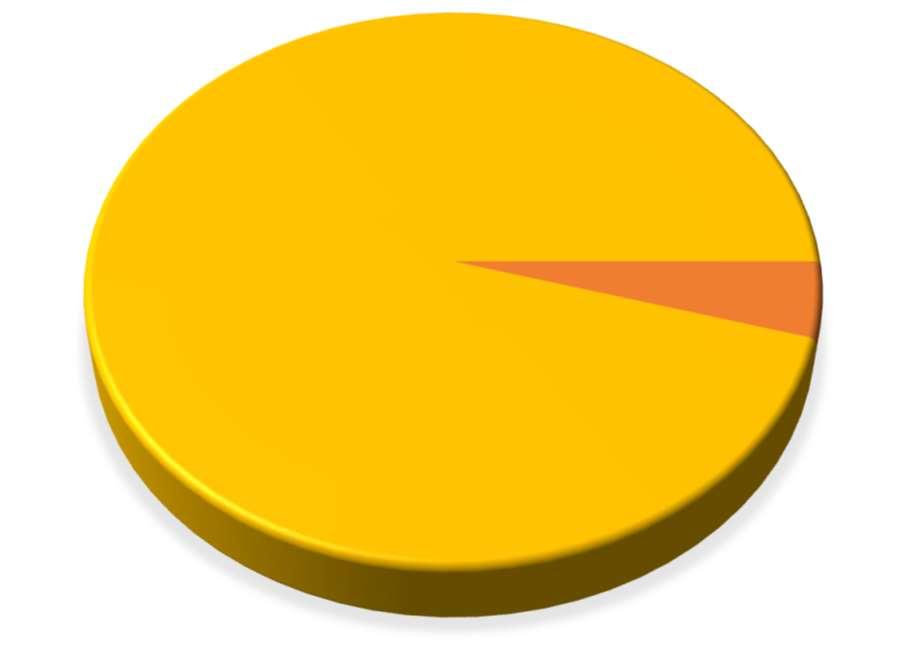

Sales tax is inherently more volatile than property tax and tends to fluctuate with changes in consumer spending. A portion of the City’s sales tax revenue is tied to a one percent countywide sales tax, which is set to expire in 2035. The allocation formula for distributing this revenue includes a property tax component. As the City’s share of the total county property tax collections declines relative to other municipalities, the City’s portion of countywide sales tax revenue will also decrease.

If sales tax revenue continues to underperform expectations and the City maintains a flat mill levy, future budgets may require difficult decisions, including potential reductions in service levels. However, the Budget Team remains cautiously optimistic that future residential, commercial, and industrial growth will gradually expand the City’s property tax base, helping to strengthen long-term revenue without further increasing the burden on existing homeowners and businesses. These efforts directly support Commission goals to expand housing opportunities, attract private investment, and ensure future tax growth benefits all residents equitably.

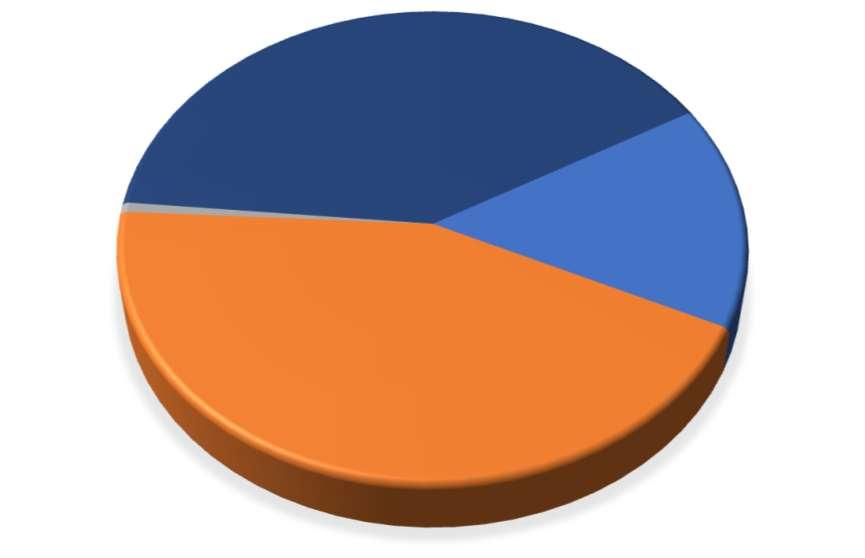

The 2026 Operating Budget totals $61,987,800 across all funds and reflects a disciplined and strategically targeted approach to managing both short- and long-term financial needs. The budget maintains core municipal service levels, invests in key infrastructure and workforce-related initiatives,

and ensures responsible use of taxpayer resources in light of economic volatility and constrained revenues.

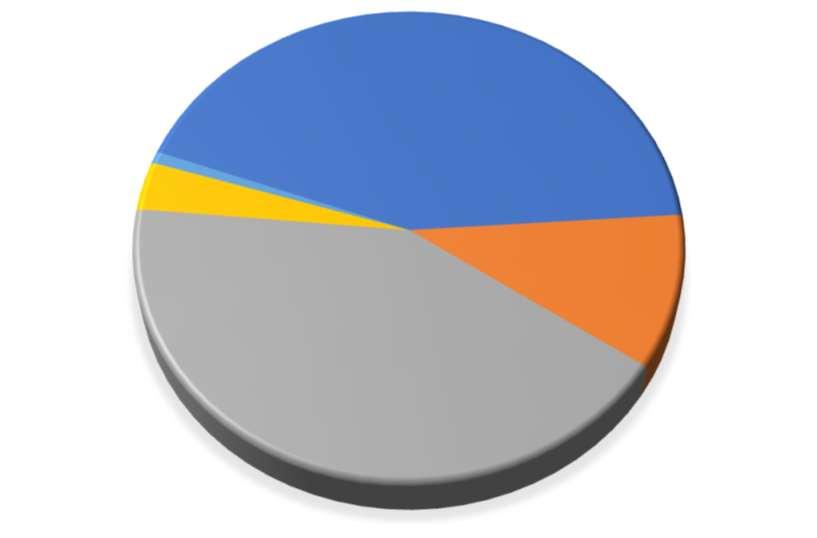

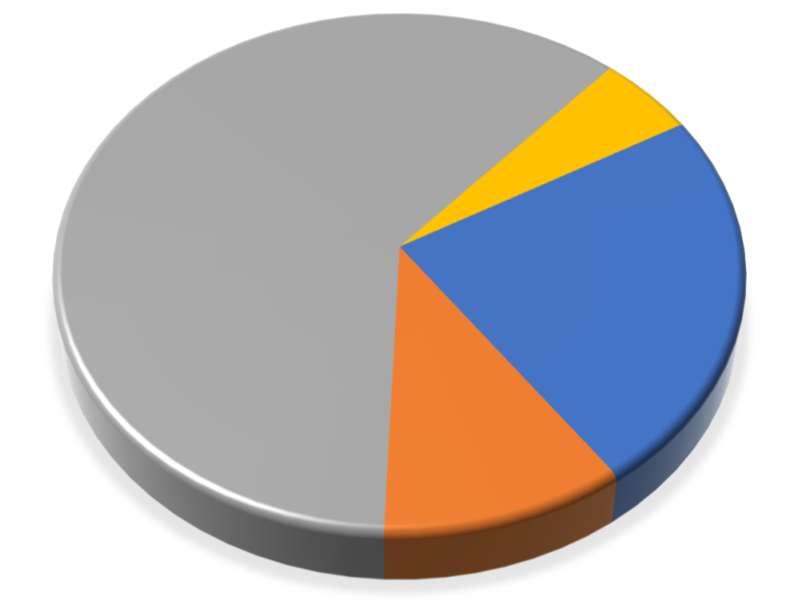

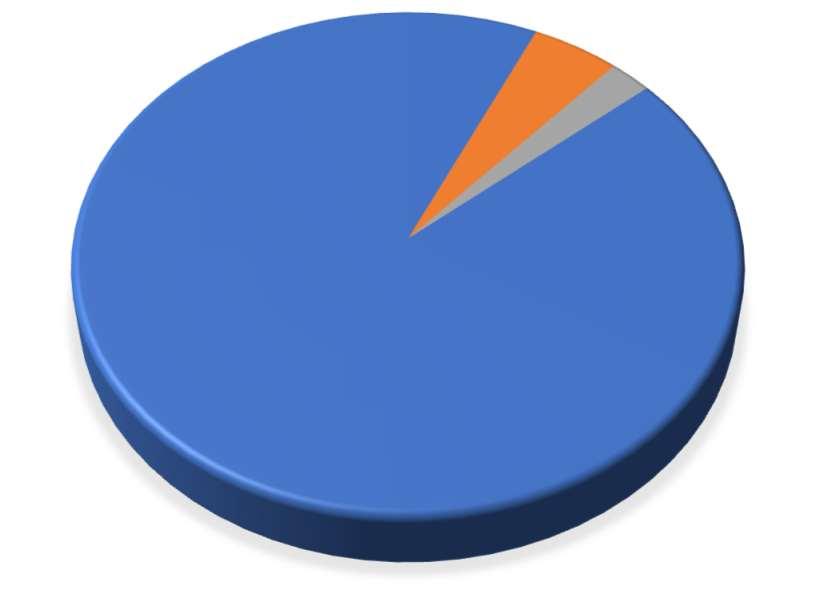

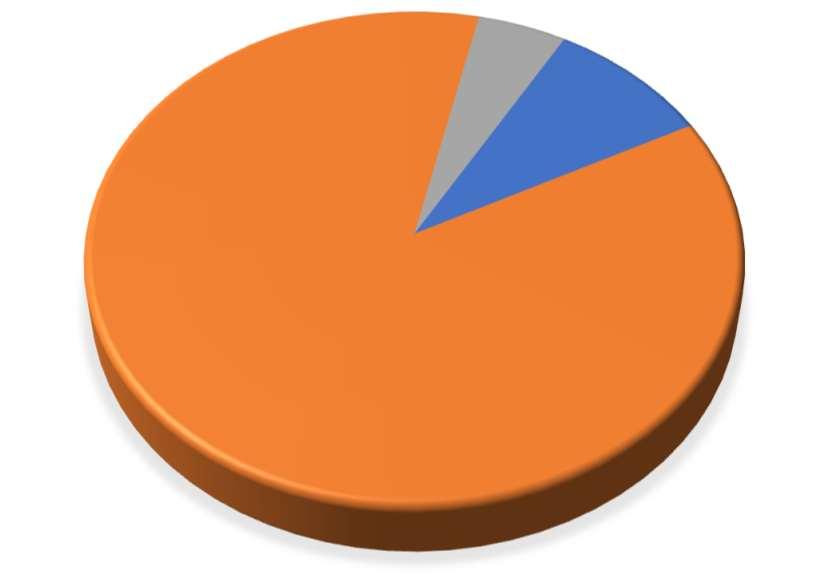

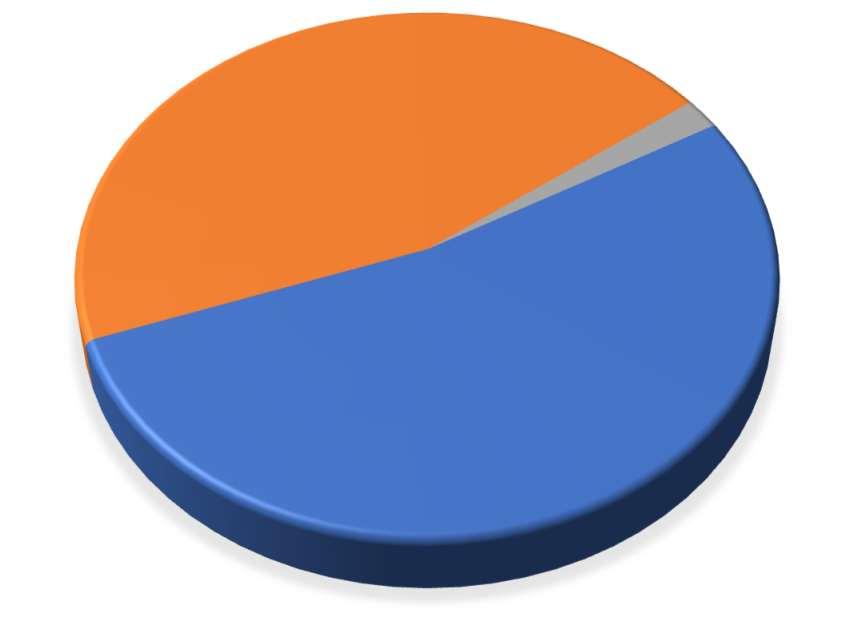

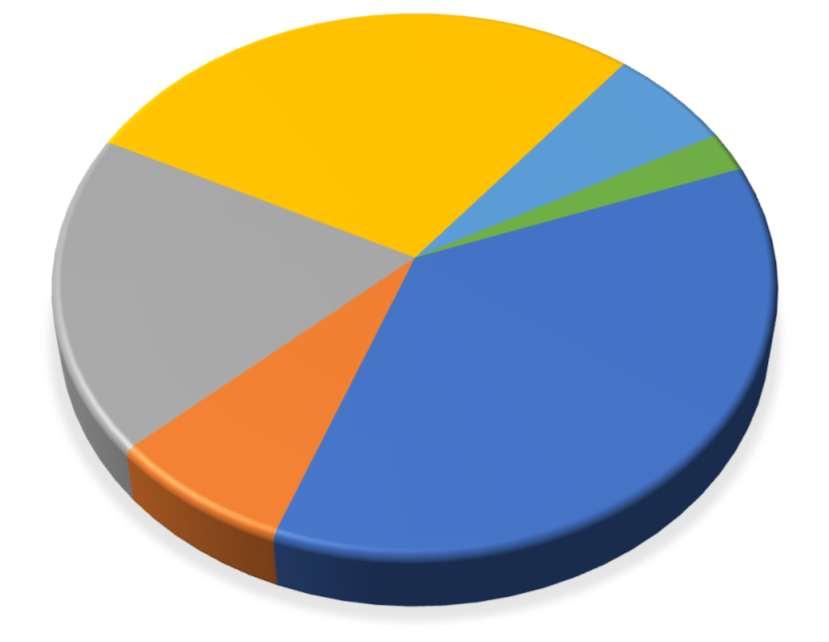

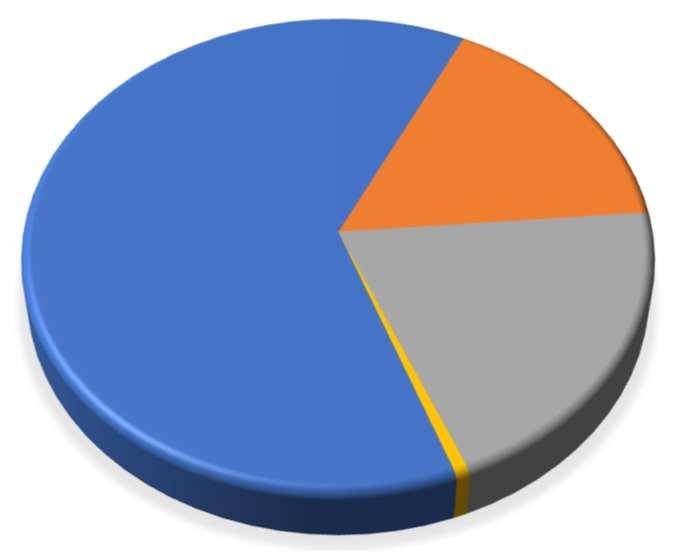

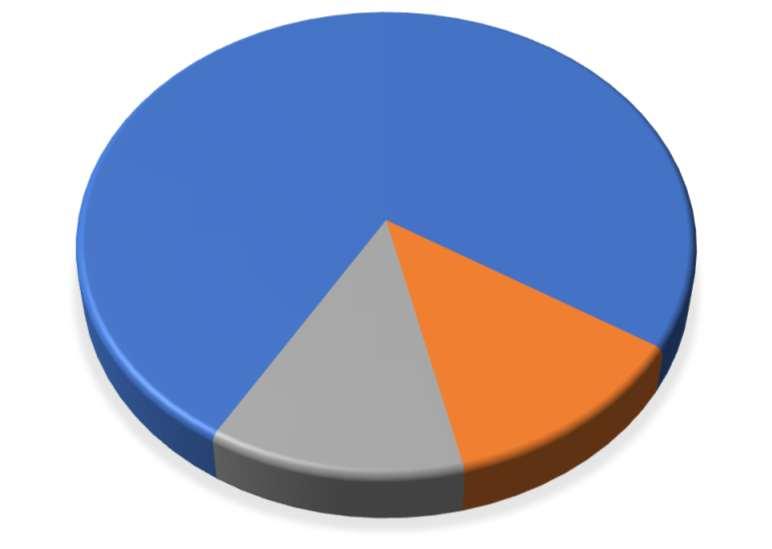

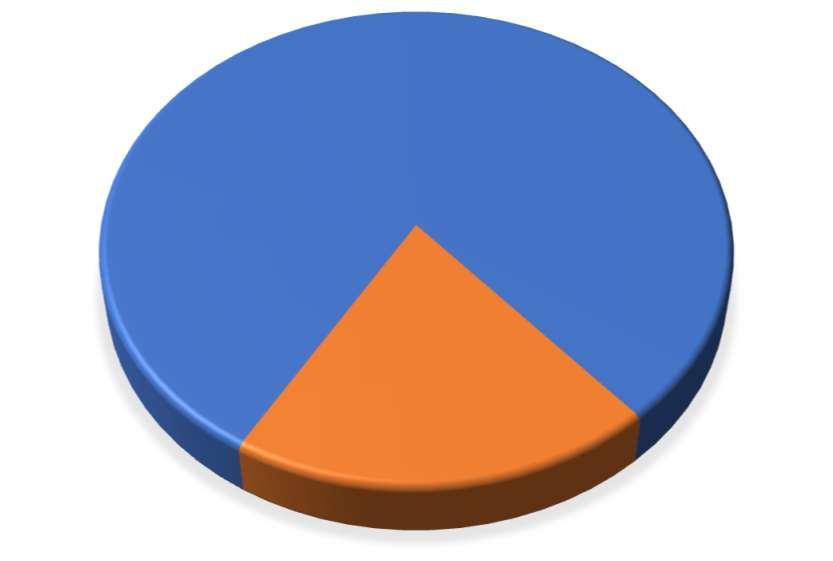

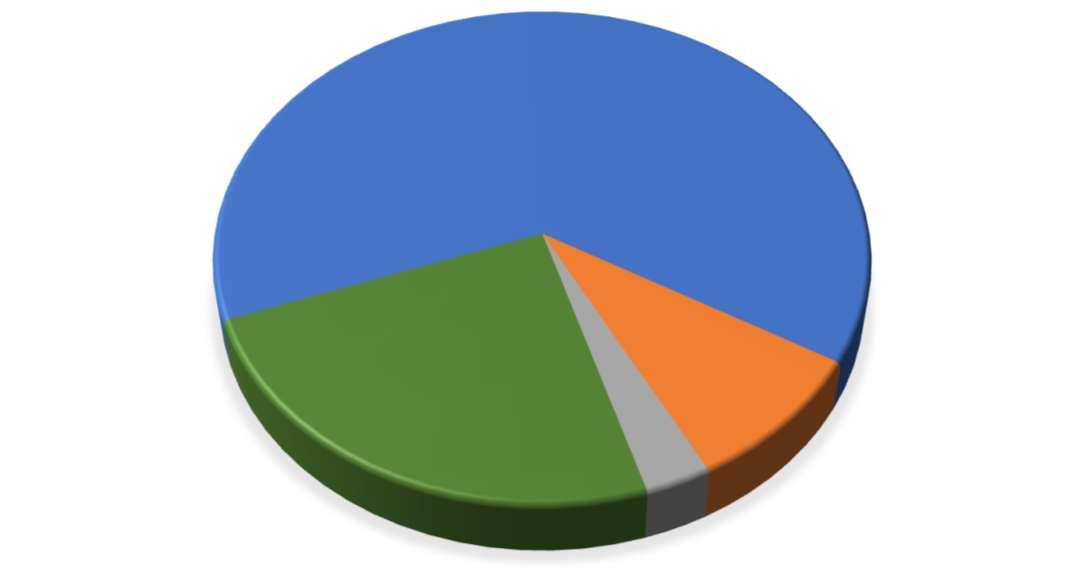

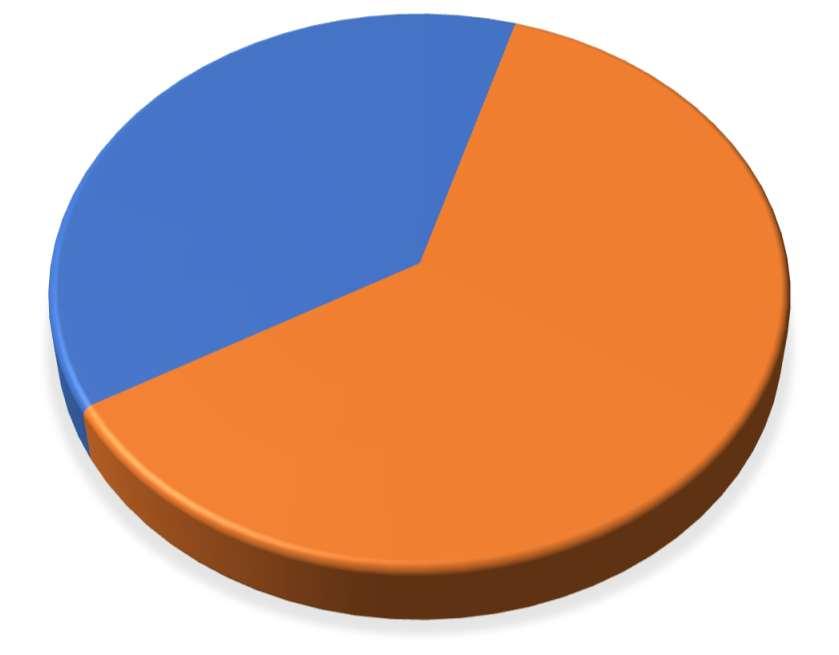

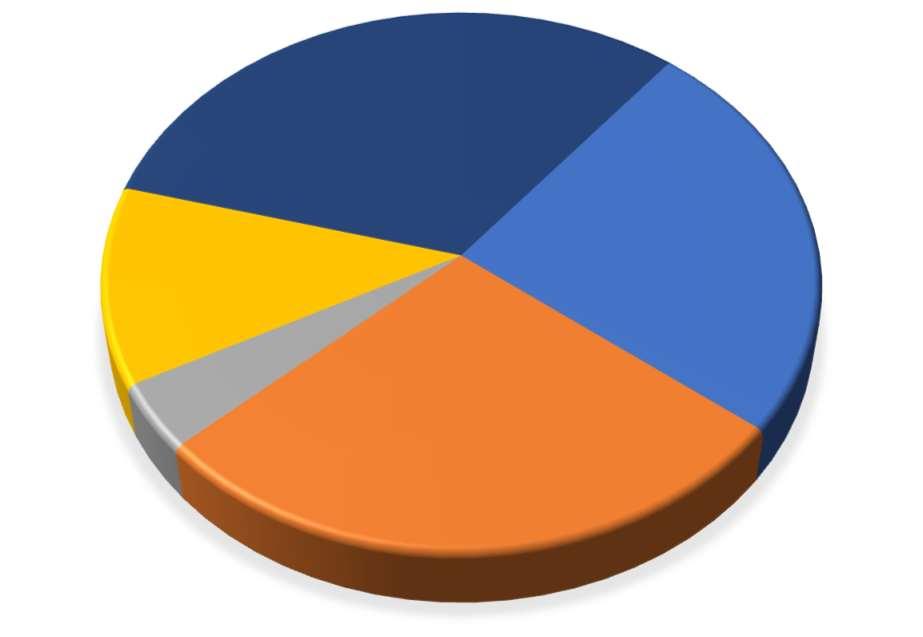

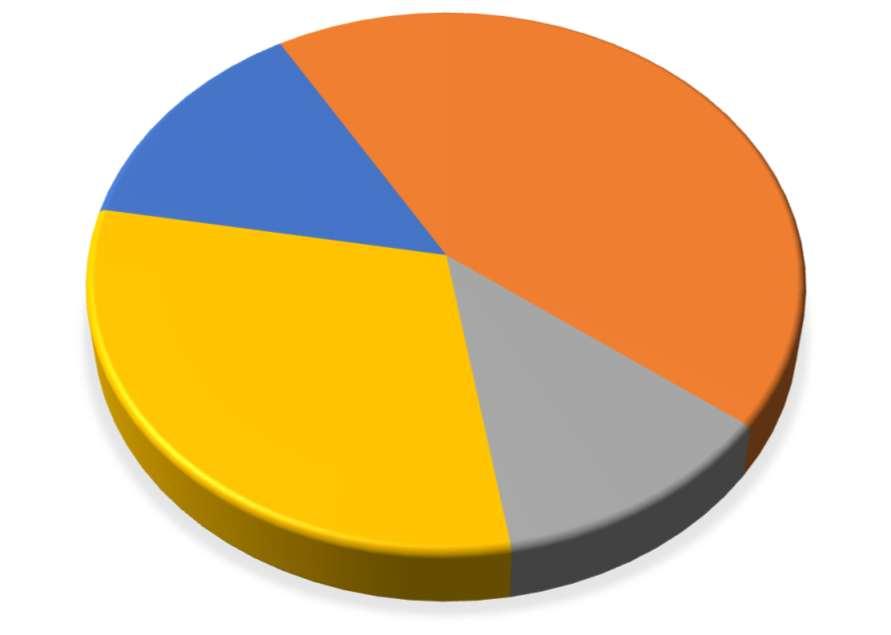

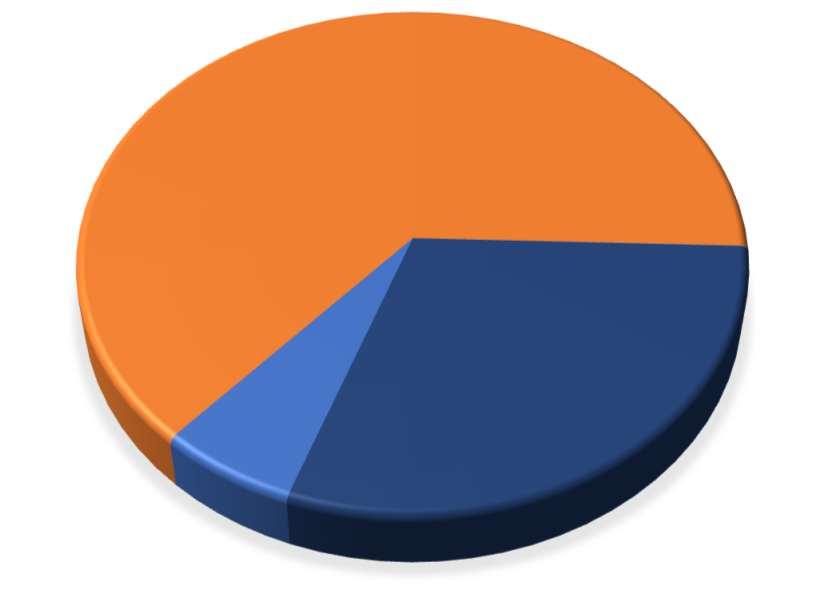

The General Fund serves as the City’s primary operating fund, supporting essential services including Police, Fire, Public Works, and Planning and Administration. The primary revenue streams that support the General Fund budget are: 1) Sales and Use Taxes; 2) Property Taxes; 3) Charges for Services; 4) Fines and Forfeitures; and 5) Franchise Fees. Fluctuations in these revenue streams affect how the City is able to pay for and maintain core services.

The City experienced an increase in assessed valuation, rising from $315,777,776 in 2024 to an estimated $333,837,941 in 2025, or 5.72%. At the proposed City mill levy of 24.876, this increase will generate approximately $1,178,605 in additional property tax revenue for the General Fund. While this marks a reversal from prior years of decreasing mill levies, it is necessary to sustain existing service levels in light of reduced sales tax performance and escalating operational costs.

Total sales tax revenue is projected to decrease 2.18% from 2025 budgeted sales tax collections. This is a reversal of a multi-year trend where the City experienced year-over-year sales tax increases as the result of a strong post-pandemic economic recovery. The volatility of sales tax, particularly amid broader economic uncertainty and inflation, has reaffirmed the City’s strategy to rely more heavily on stable property tax growth for core service funding.

Franchise fees in the General Fund are budgeted to increase by only 1.5% over 2024 actual franchise fee collections and 0.06% over 2025 budgeted franchise fees. Franchise fees are dependent on the weather and are, therefore; difficult to predict.

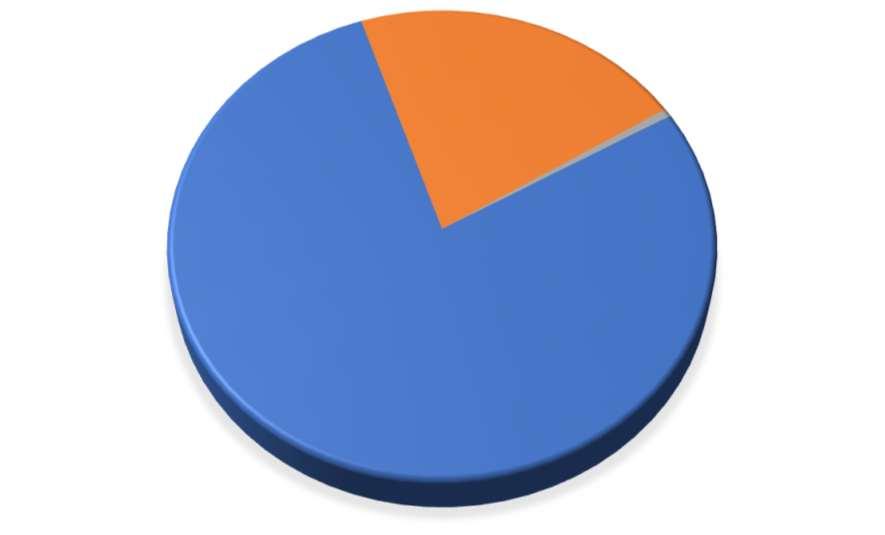

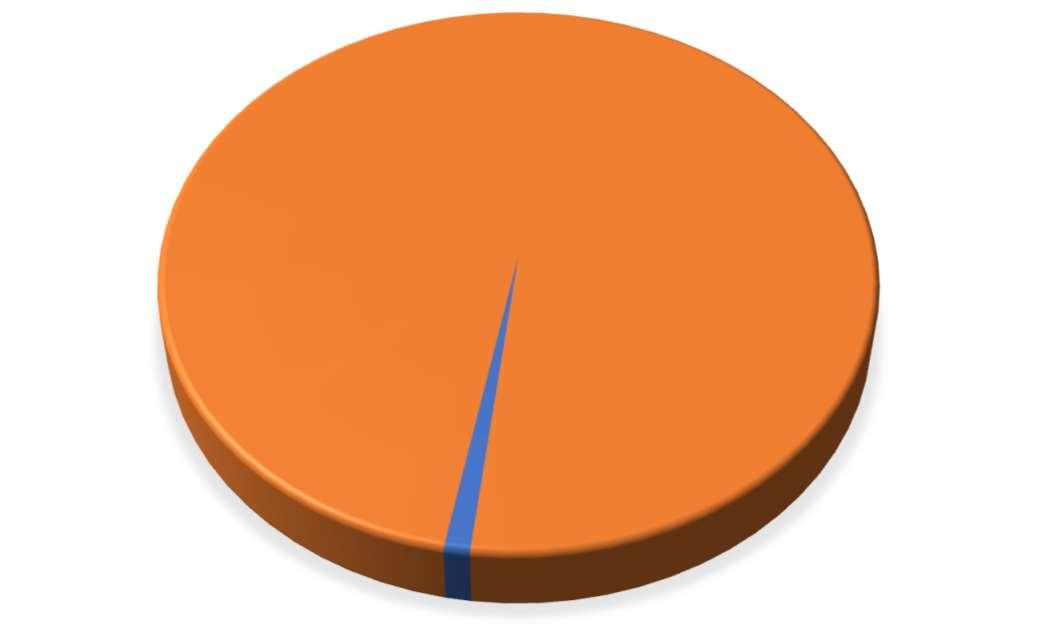

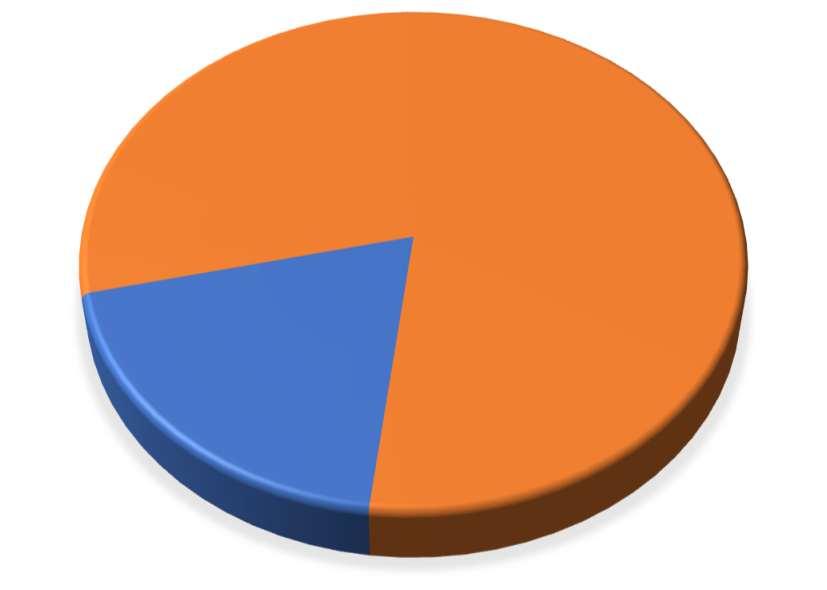

The 2026 Budget projects an ending General Fund Reserve of $5,292,893, with budgeted operating expenses of $23,998,477; therefore, the budgeted General Fund reserves as of December 31, 2026 is 22.06% of annual expenditures. This marks a deliberate effort by the City to minimize the drawdown of reserves. While the reserve is below the City’s preferred 30% target, this allocation reflects a disciplined and proactive approach that maintains the City’s fiscal resilience and will help support the City’s historically strong bond rating.

The City saw substantial increases in insurance premiums across key areas. Health insurance premiums rose by 21.7% in 2024 and by another 9% in 2025; resulting in a 32.7% increase over a two-year period. Health insurance premiums in 2025 are projected to be $598,000 more than they were in 2024. Property insurance increased by $23.8% in 2024 and another 34.6% in 2025 for a total increase in premiums of 66.6% or $302,000 between 2023 and 2025. These inflationary pressures significantly impact the City’s operating costs and necessitate tough decisions to preserve service delivery without overextending reserves.

Following wage increases implemented in 2024 (ranging from 5% to 15%) and a subsequent 3.5% adjustment in 2025, the City has budgeted no wage increases for 2026. However, the City continues to fund all existing personnel levels, ensuring continuity of services despite labor market pressures and rising personnel costs. To control escalating labor costs, the 2026 Budget implements strategic overtime reductions of 10% across most departments, and 5% in Public Safety, which balances operational needs with cost containment.

In 2022 the City partnered with Enterprise Fleet Management and began transitioning to a leased fleet of passenger vehicles and pick-up trucks. The original financial model for the lease arrangement netted the gain from vehicle sales against the lease expense, resulting in a projected

lower annual spend for vehicles. This model was not effective due to the supply issues caused by the COVID pandemic and, therefore; the net cost of leasing vehicles was projected to be approximately $300,000 (66%) higher than budget in 2025. After careful analysis, the City decided to eliminate several vehicles from its fleet and downsize most of the rest of the leased vehicles to reduce the overall cost of the program.

Other budgets included

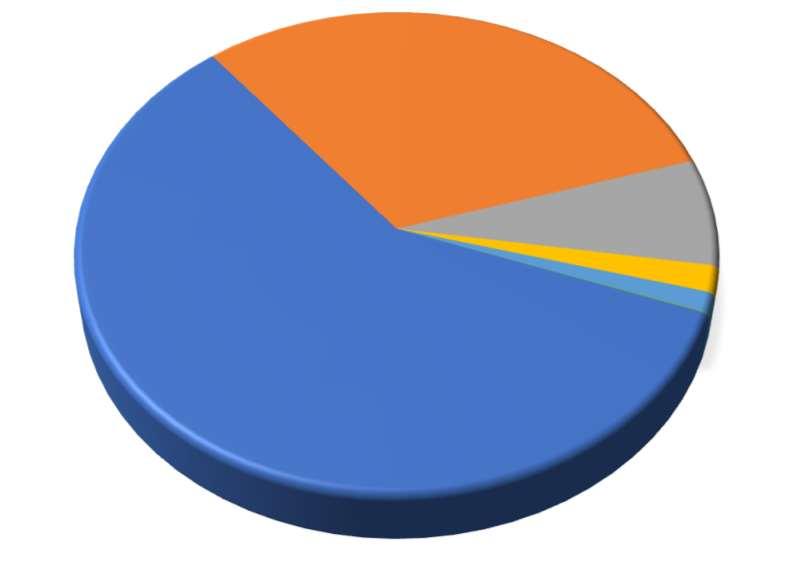

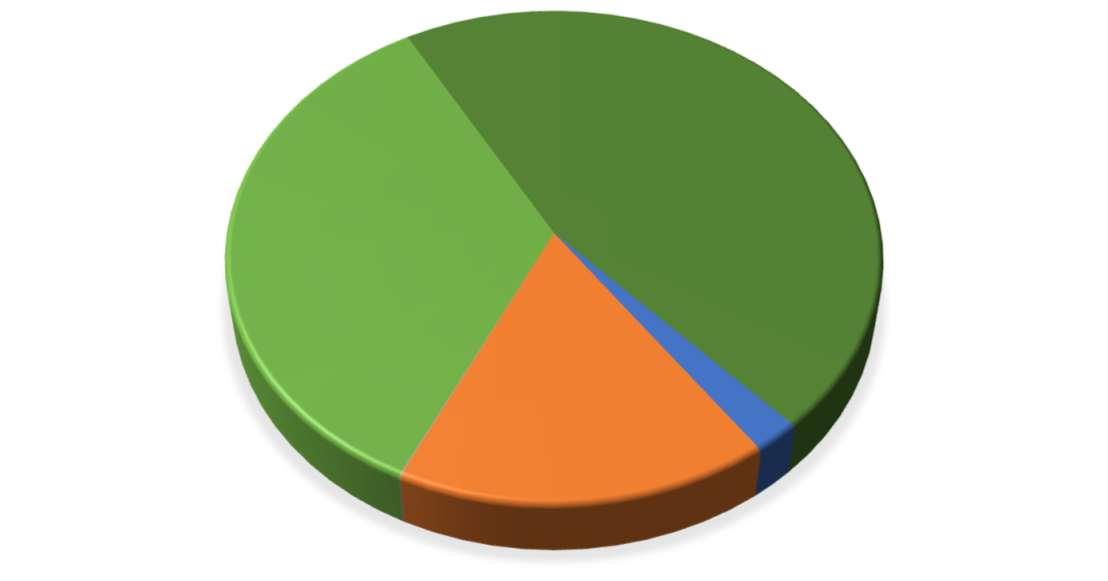

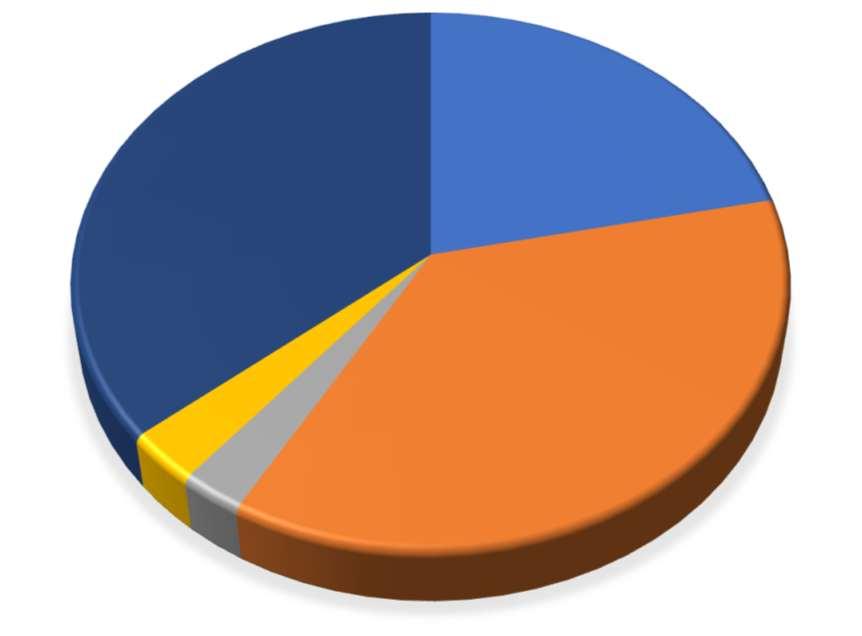

It is useful to consider the rest of the 2026 budget document as consisting of budgets from the four following types of funds: Library Funds, Federal Grant Funds, Enterprise and Special Revenue Funds not supported by ad valorem taxes, and funds that receive support from ad valorem taxes.

The Library Ordinance establishes a mill rate not to exceed 3.75 mills to support Library operations. For 2026, the Library’s submitted budget includes an increase of 0.264 mills for operations, and a 0.243 mill increase for Library Employee Benefits for a total mill increase of 0.507 generating an additional $249,972. The total Library levy will generate approximately $1,659,288.

The City continues to receive annual federal grants for Planters II, the Section 8 Voucher Choice Program, and the Community Development Block Grant (CDBG) initiatives. These programs serve critical housing and community development needs for Leavenworth residents.

The 2026 Planters II budgeted expenses increase by $19,005 (2.3%) over the 2025 approved budget, reflecting a stable budget.

The 2026 Voucher Choice Fund budgeted expenses increase by $101,865 (3.9%). This is largely due to adding an additional staff member for training to replace a member that is retiring. The voucher payments increase based on the level of federal funding the program receives each year. The financial condition of the Voucher Choice Fund is stable.

The 2026 Community Development Block Grant budgeted expenses increase by $22,276 (6.4%) over 2025. Of that total budget, $73,812 may be used for administrative purposes; the balance or $295,248, is used for a variety of community projects in accordance with CDBG guidelines.

The following funds derive their financial support from sources other than ad valorem taxes. Expense budget levels for these funds are generally dependent upon the availability of revenue generated through the pursuit of the fund's activity. For example, the Sewer Fund expense budget is dependent upon funds generated from the sale of sewer services.

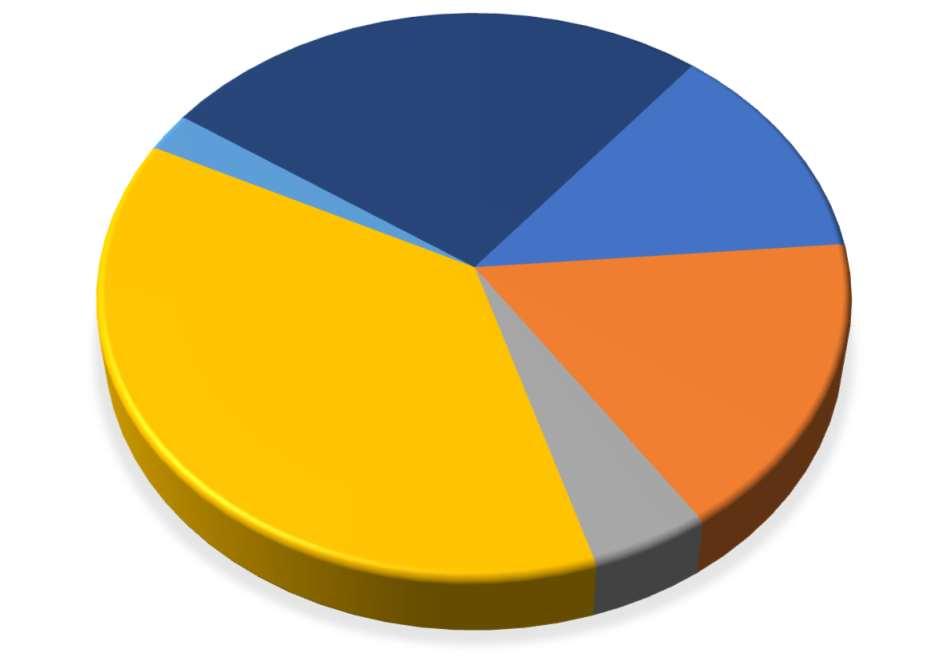

The 2026 budgeted expenses for this group of funds increases $5,155,420 or 23.0% over 2025, to $27,565,632 This significant increase in the non-tax funds budgets is largely attributed to a $2.9 million increase in the combined Capital Project Funds and a $2.0 million in Sewer Fund, also due to an increase in capital project expenditures.

(NetofBudgetedReservesandTransferstoOtherFunds) 2025 Adopted 2026 Proposed

CVB Fund

Probation Fund

Streets Fund

Economic Development Fund

Capital Projects Fund

Streets Capital Projects Fund

CIP Sales Tax Fund**

$740,043 $948,965

$211,109 $219,765

$1,651,142 $1,580,675

$455,695 $448,193

$2,569,871 $2,113,999

$3,135,403 $3,709,000

Countywide Sales Tax Fund** $0 $0

Grant Matching Capital Projects Fund

Sewer Fund

Refuse Fund

Storm Water Capital Projects Fund

Auto TIF Fund

Hotel TIF Fund

Retail TIF Fund

$1,145,780 $4,015,780

$6,792,435 $8,796,564

$2,534,631 $2,812,166

$1,559,503 $1,562,725

$820,000 $644,600

$559,600 $624,700

$195,000 $88,500

Total $22,410,212 $27,565,632

The Convention and Visitors Bureau (CVB) Fund was established in 2014 to account for Transient Guest Tax (TGT) revenue collected on overnight stays. With the addition of several new hotels, revenues grew substantially. After the hotels were built, revenue continued to grow due to increases in room rates and occupancy. In June and July of 2026, Kansas City is hosting matches for the FIFA World Cup. The City expects an increase in occupancy rates during those two months, but the 2026 budget does not include an increase in TGT revenue because those months generally see high occupancy rates due to annual military moves and seasonal travel. 2026 CVB expenses are budgeted to increase by 28.2% or $208,992 over the 2025 approved budget, reflecting expenditures designed to increase tourism during the World Cup event. The 2026 budget maintains reserves of $640,334 (67.48% of 2026 expenses). It is important to maintain reserves in the CVB fund because economic downturns significantly impact tourism-related businesses and the collection of TGT. Reserves are kept available in order to be able to pay staff and maintain marketing efforts during future economic downturns.

The Probation Fund’s 2026 budgeted expenditures remain stable with a slight increase of 4.1% of $8,657.

The Street Fund’s 2026 budgeted expenditures decrease from $1,651,142 to $1,580,675 (4.3%), due to a reduction in overtime and a decrease in the amount of salt being purchased as a result of pre-treating streets with brine.

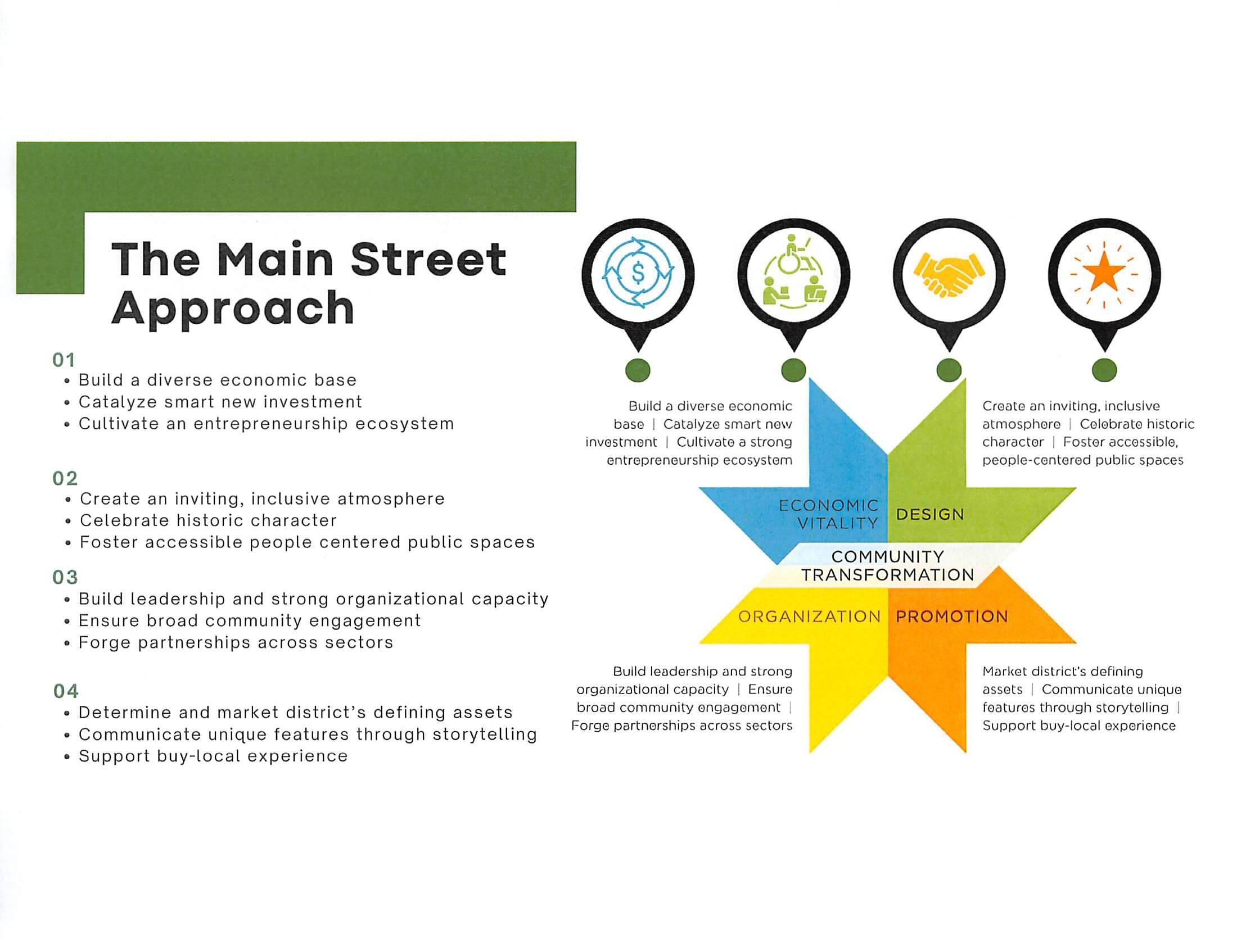

The Economic Development Fund’s budgeted expenses decrease by $7,502 (-1-6%). Revenue in this fund fluctuates because it is based on the collection of countywide sales tax. Yearly allocations for the Main Street, LCDC, and the RideLV Transit Programs account for approximately 49% of annual expenditures. Unspent funds contribute to the reserves which are used for economic development projects and incentives. In 2025, $800,000 from the Economic Development was budgeted to support Wilson Avenue road work for business expansion. The majority of the expenditure for that project will actually occur in 2026.

**The CIP Sales Tax and the Countywide Sales Tax Funds are set up to collect local and countywide sales and use tax and disburse those funds to various other funds based on previously established City ordinances; therefore, the funds do not have any budgeted expenses other than transfers to other funds. The primary recipients of transfers from the sales tax funds are the Recreation Fund, the Debt Service Fund, the Capital Projects Fund, and the Streets Capital Projects Fund. Local sales tax is budgeted to decrease by 5.6% (-$148,786) compared to the 2025 budget and and countywide sales tax is budgeted to increase 1.3% ($44,266) from the 2025 budget.

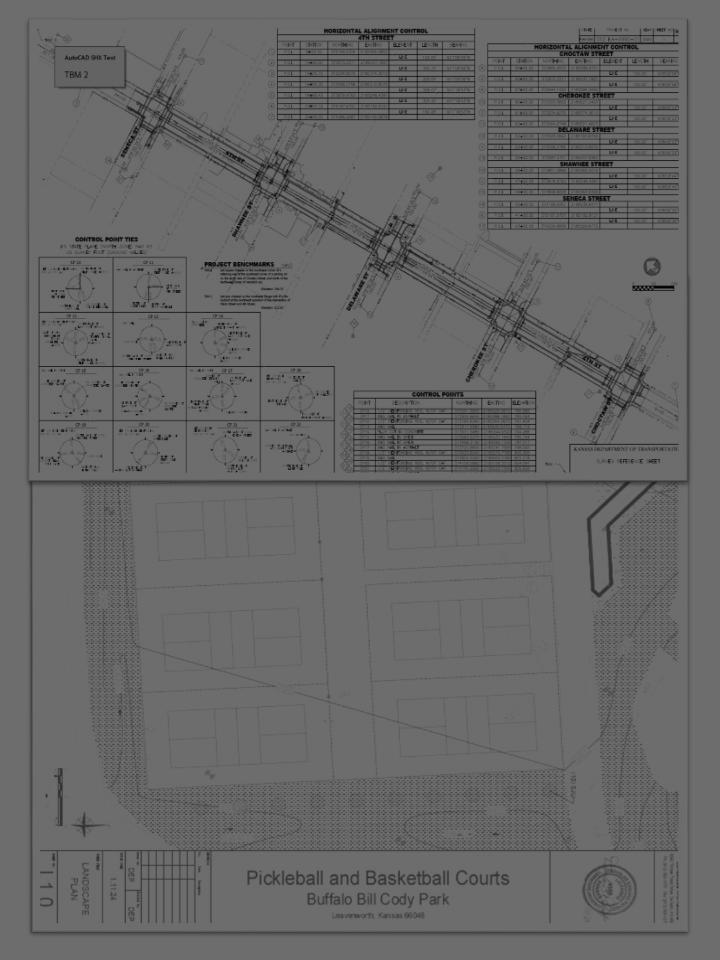

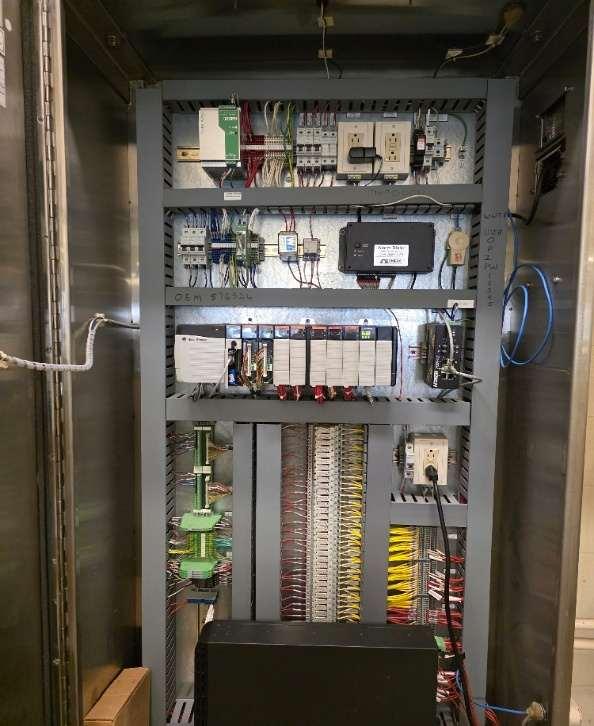

Expenditures in the Capital Projects Fund are budgeted to decrease by $455,872 (-17.7%) due to fewer projects being scheduled in 2026 than in 2025. The attached 2026 – 2030 CIP Budget provides a detailed listing of the projects that are budgeted to be completed in 2026. The highlights include $853,000 for the vehicle replacement program,$372,000 in IT infrastructure equipment, $195,000 in street equipment, $270,000 in Riverfront Community Center improvements and repairs, and an additional $128,000 in parks equipment.

The Streets Capital Projects Fund is budgeted to increase by $573,597 (18.3%) to $3,709,000. This is due to the completion of the Wilson Avenue project being budgeted in 2026.

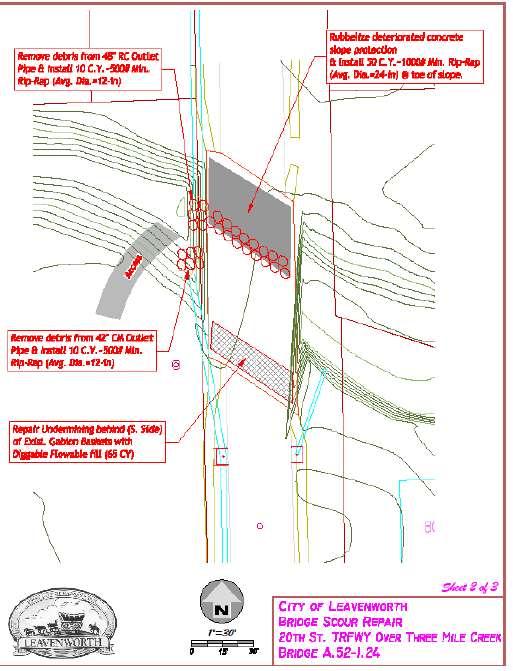

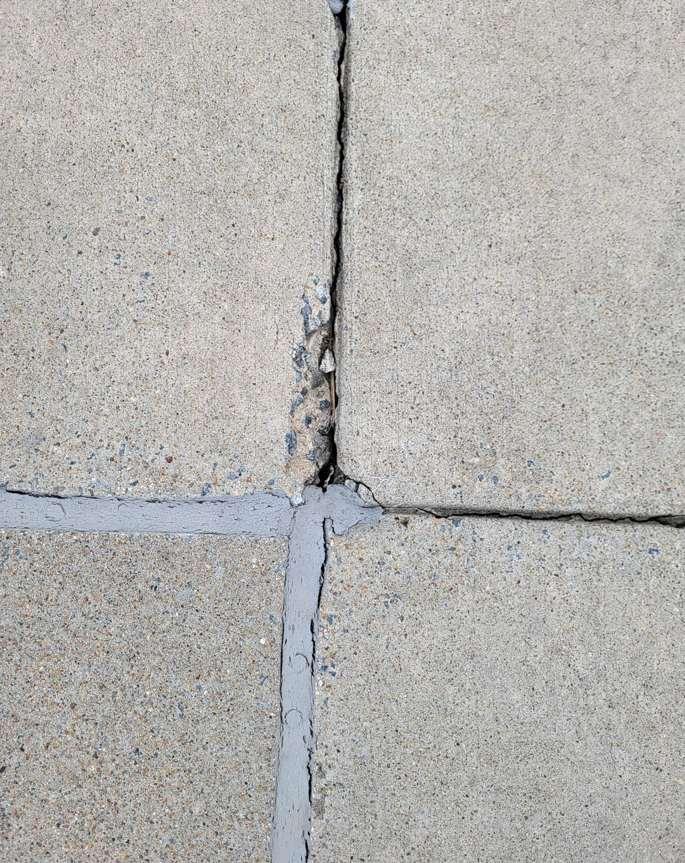

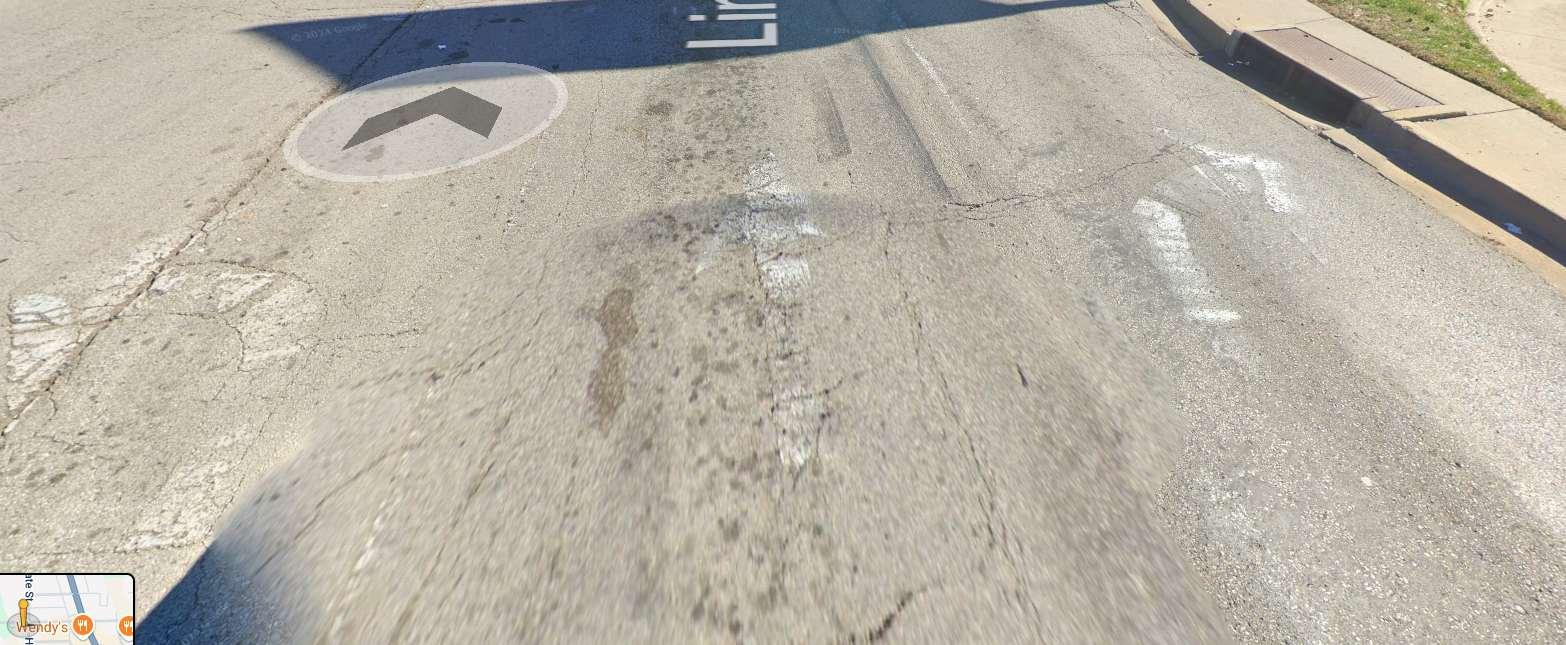

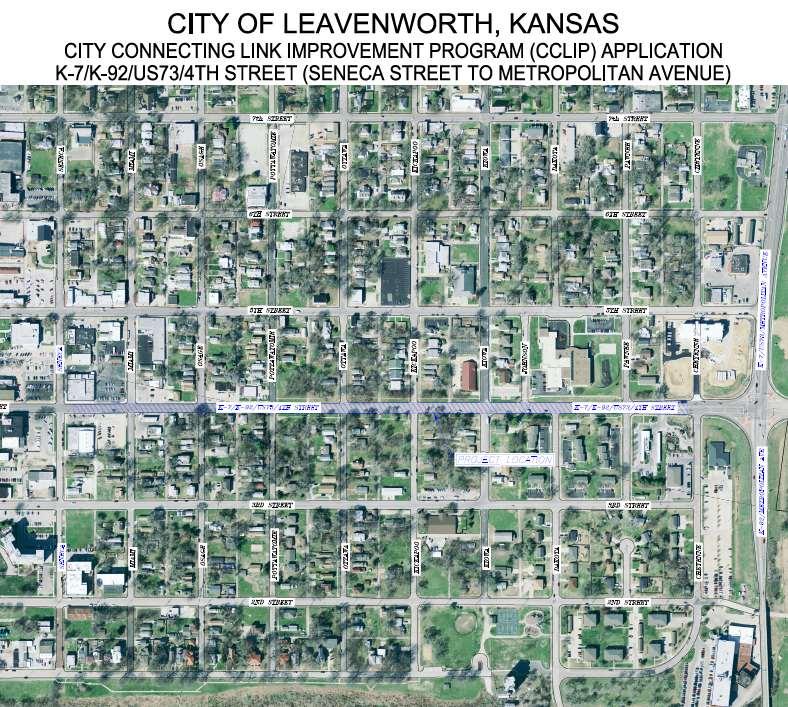

The Grant Matching Capital Projects Fund was first established in 2024 to track capital projects primarily funded through state and federal grants that require a City cost share. In 2026, the fund’s proposed budget increases by $2,870,000 (250.5%). This significant increase is driven by several high-impact infrastructure projects, including improvements to the 10th and Limit Intersection, Vilas Street, Downtown ADA Intersection, and the Airport taxiway and apron pavement seal. A total of $2,949,102 in grant revenue is budgeted in 2026, with an additional $1,066,678 transferred from the General Fund to meet local match requirements, ensure the City remains competitive in securing external funding. Future transfers will come from the CIP and Countywide Sales Tax Funds.

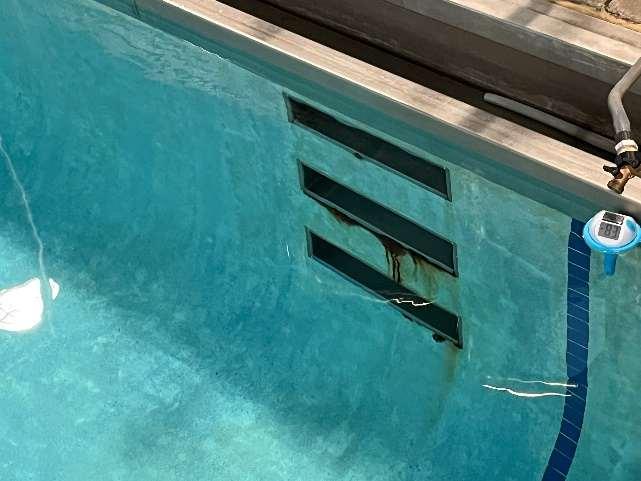

The 2026 Sewer Fund budget increased from $6,792,435 to $8,796,564 (29.5%). The primary driver of the increased budget is in capital outlay which includes $500,000 for manhole and sewer line repairs and $3,750,000 for replacement and repairs of equipment at the treatment plant. Sewer utility rates are budgeted to increase by 3% in 2026 to cover the rising costs of operations and repairs to the aging facility.

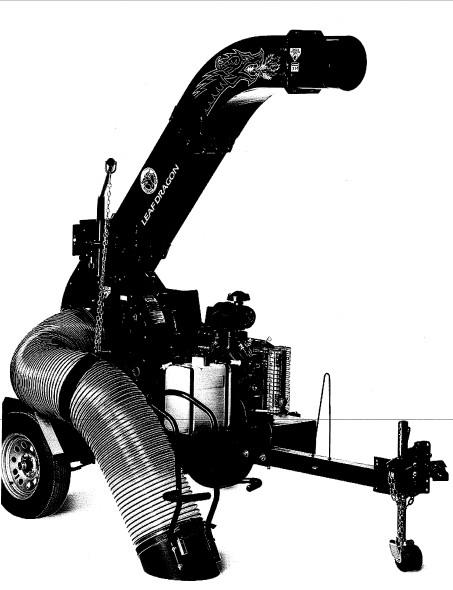

The 2026 Refuse Fund budget increases by $277,535 (10.9%) to $2,812,166. The increase is due to the purchase of an additional refuse truck, bringing the fleet from six to seven vehicles. The Refuse Fund’s 2026 budget reflects the City Commission’s consensus provided during the June 17, 2025, study session to explore the potential of developing a non-public-facing solid waste consolidation site by 2027. This approach balances short-term capacity needs with long-term infrastructure planning. In the near term, the budget includes funding for another collection truck, as mentioned above. Planning efforts remain conceptual for the construction of the consolidation site at the former City landfill site with an estimated capital cost of $1,290,000 and an annual debt repayment of an estimated $109,655 per year for 20 years. Long-term, the City will continue exploring the feasibility of a full-service transfer station, although this transition would likely be far into the future. This phased strategy helps stabilize operational costs, reduce future landfill-related expenses and uncertainties, and extend the useful life of the existing fleet of refuse trucks.

The Storm Water Capital Projects Fund is budgeted to increase by $3,222 or less than 1%. The revenue source for this fund is the Storm Water Impact Fee that is paid annually by all residents and businesses. That revenue is used to repair and rebuild the City’s aging stormwater infrastructure.

The Auto, Hotel and TIF Funds expenses are budgeted to decrease by a total of $256,800, reflecting actual 2024 collections and expenditures.

The 2026 Bond and Interest Fund budget is supported by ad valorem taxes and transfers from the CIP and Countywide Sales Tax Funds. The 2026 mill levy for the Bond and Interest Fund is budgeted to decrease by 1.204 mills, because debt service is decreasing as general obligation bonds are paid off. 2026 budgeted expenses decrease by $697,588 (-18.4%). The decrease has two components. The first is a $275,000 decrease in temporary note payments. The temporary note payment in the 2025 budget was the final payment on a 3-year temp note that funded parks projects. The second component is a $422,588 decrease in bond principal and interest payments as the City’s debt is decreasing. The Bond and Interest Fund is budgeted to finish the year with a $95,841 reserve.

The Recreation Fund is supported by ad valorem taxes, transfers from the CIP Sales Tax Fund, and fees for service. The 2026 mill levy for the Recreation Fund is budgeted to increase by 0.798 mills. As the Bond and Interest Fund requires less ad valorem tax to support debt service, the mill will be shifted to the Recreation Fund so that the Recreation Fund will be less reliant on transfers from the CIP Sales Tax Fund. The Recreation Fund’s budgeted expenses decrease by 2.6% to $3,203,012 in 2026, reflecting small decreases in hours of operation for some amenities and other cost saving measures.

The Police and Fire Pension Funds are supported by ad valorem taxes. The pension plans were closed when the City joined KPERS, therefore there will be no new members in these plans. There are currently three retirees between the two funds and the amount of ad valorem tax levied for these funds is based on an actuarial analysis performed at the end of each year. The mill levies for these two funds, combined, is budgeted to be flat in 2026.

Based upon information recently received from the County Clerk, the City of Leavenworth experienced an increase in assessed valuation from $315,777,776 in 2024 to $333,837,941 in 2023. This is a 5.72% increase in assessed valuation. Tax abated properties, such as the NRA, decreased from $3,971,027 to $3,722,384, increasing the net increase in assessed value, not including tax abated properties to 5.87%.

x

The following table illustrates the 2026 ad valorem tax levy (prior to the delinquency rate calculation) required by each City Fund.

The table below illustrates the 2026 mill levy rate for each City Fund requiring ad valorem tax support given the assessed valuation data provided by the County Clerk.

The Capital Improvements Plan outlines a $39 million investment over 5 years to maintain and enhance the City’s infrastructure and service delivery across utilities, facilities, transportation, parks, and technology. The CIP is supported by two primary revenue sources: 1) ¼ of the City’s local sales tax, and 2) The City’s portion of the countywide sales tax, The CIP also includes information for enterprise funds (Sewer, Refuse, and Storm Water), which are funded through user fees and a storm water impact fee.

The CIP budget is allocated across a range of pay-as-you go projects, including upgrades to existing City buildings, construction of new facilities, equipment purchases, operating transfers, and critical infrastructure improvements. Projects are prioritized through direction from the City Commission and

xi

staff evaluation of how operational needs are impacted by the condition of the City’s equipment, buildings, and infrastructure. These investments align with the Commission’s focus on maintaining core infrastructure, investing in public safety, and enhancing quality of life through deliberate, future-oriented planning. While the CIP represents a five-year outlook, it is reviewed and updated annually to maintain flexibility and responsiveness to emerging needs. The goal of the 2026-2030 CIP is to align available resources with the City’s highest-priority needs while ensuring transparency and accountability to taxpayers.

Staff’s primary approach to the 2026-2030 CIP is to maintain the City’s existing infrastructure. A number of new facilities have been constructed in the last few years, especially in the City’s parks and service centers. As such, staff has redirected necessary resources to ensure that the new facilities stay at peak operating condition and to provide much needed repairs and replacement to the remainder of the City’s aging infrastructure. Staff hopes to maintain the City’s current infrastructure and equipment, while planning for future development and expansion that would necessitate upgrades to existing systems. The 2026 – 2030 CIP plan is provided as part of the overall budget document.

The recommended 2026 Operating Budget and 2026-2030 Capital Improvement Program(CIP) reflect an optimistic, yet cautious approach to the fluctuations in the local, state and federal economies. The recommended budget makes responsible use of reserve levels and only requests the absolute minimum mill levy increase necessary to continue the services at the level expected by the City Commission and the Leavenworth residents and businesses. As mentioned above, local governments are subject to mandates from other levels of government that can dramatically impact the shape and composition of budgeting and tax structures without regard for local governments’ ability to provide service at levels expected by residents and businesses.

The recommended budget proposes to invest in the City’s infrastructure and employee development and workforce stabilization while working to replace and modernize existing City infrastructure and equipment. The 2026 Operating Budget also closely aligns with the City Commission’s stated goals, and staff has made an effort to ensure the Commission’s priorities are clearly reflected in both the 2026 Operating Budget and 2026-2030 CIP. As with any budget process, certain areas were selected for enhancements, while others remained unchanged. We hope the proposed budget matches the goals and expectations of the residents of Leavenworth and the City Commission.

The City’s budget process is a year-round team effort that includes the entire management team and staff at all levels throughout the City. We appreciate the support of the staff in the preparation and presentation of the City Manager’s recommended 2026 Operating Budget and 2026-2030 CIP and we look forward to reviewing its contents with the City Commission.

Sincerely,

Scott Peterson

Roberta Beier City Manager Finance Director

The City of Leavenworth, Kansas is located on the west bank of the Missouri River in the Dissected Till Plains region of North America’s Central Lowlands on land that was originally inhabited by the tribes of the Delaware, Kansa, and Osage peoples. Four small tributaries of the Missouri River flow eastward through the city, Quarry Creek, Corral Creek, Three Mile Creek, and Five Mile Creek. The City’s water source comes from the Missouri River.

Leavenworth is 28 miles northwest of Kansas City, Missouri, 45 miles northeast of Topeka, Kansas, 145 miles south-southeast of Omaha, Nebraska, and 165 miles northeast of Wichita, Kansas, at the intersection of US Route 73 and Kansas Highway 92. The City has a population of 37,370 and covers an area of approximately 24.7 square miles.

Fort Leavenworth, built in 1827, was originally named Cantonment Leavenworth by Colonel Henry Leavenworth. For several decades, the fort played an important role in keeping the peace between the various Native tribes and the settlers moving west. Many Leavenworth city streets are named after local Native tribes.

While Fort Leavenworth was separate from the city until annexation in 1977, the two are interdependent on each other and their histories are inextricably intertwined. The City provides additional housing, shopping, recreational, and cultural amenities that are not available on post. In addition to the military personnel, the Fort provides employment for over 4,500 civilian employees and contractors.

Fort Leavenworth is home to the United States Army Combined Arms Center; the U.S. Army Command and General Staff College; National Simulation Center and the Army Corrections Complex. Leavenworth is home to the University of Saint Mary, the Dwight D. Eisenhower Veterans Affairs Medical Center, and the Leavenworth Federal Penitentiary.

Leavenworth has a small town, historic atmosphere with access to the amenities of a larger city. In addition to the large federal presence and large private employers, such as Hallmark Cards, the Leavenworth community is home to many smaller, family-owned businesses. The 28-blocks of downtown Historic Leavenworth still contains many of the buildings that were present in the early 1900's. Vintage homes are scattered throughout the community.

The City, which grew south of and in support of the fort, was established in 1854 and was incorporated by the first Kansas territorial legislature in 1855. The City was the first city incorporated in the Kansas Territory, hence its motto: “First City of Kansas.” American history identifies Leavenworth for its key role as a supply base for settlers going west. The City was home to freight companies, meat packers, provisioners, stove makers, and furniture manufacturers. As the city grew, factories and businesses flourished and stately homes were built to house the families whose wealth grew as the city grew. Leavenworth was the industrial center of Kansas and of the west. The city has a historic wayside walking and driving tour commemorating the notable events and locations in the community.

Leavenworth also became known as a refuge for African-American slaves fleeing the slave state of Missouri, with the help of Abolitionists. In the years preceding the Civil War, Leavenworth frequently had physical confrontations between anti- and pro-slavery factions.

In April 1858, the Leavenworth Constitution was adopted for the State of Kansas in Leavenworth. The constitution was never officially recognized by the federal government, but was consideredthe most radical constitution drafted for the new westernterritories because it included freed African-Americans as citizens.

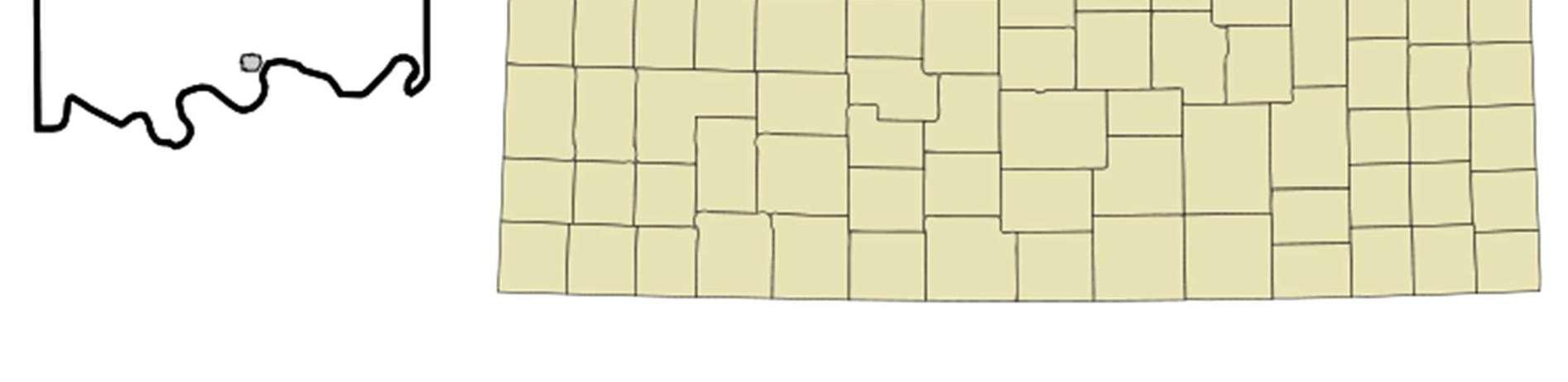

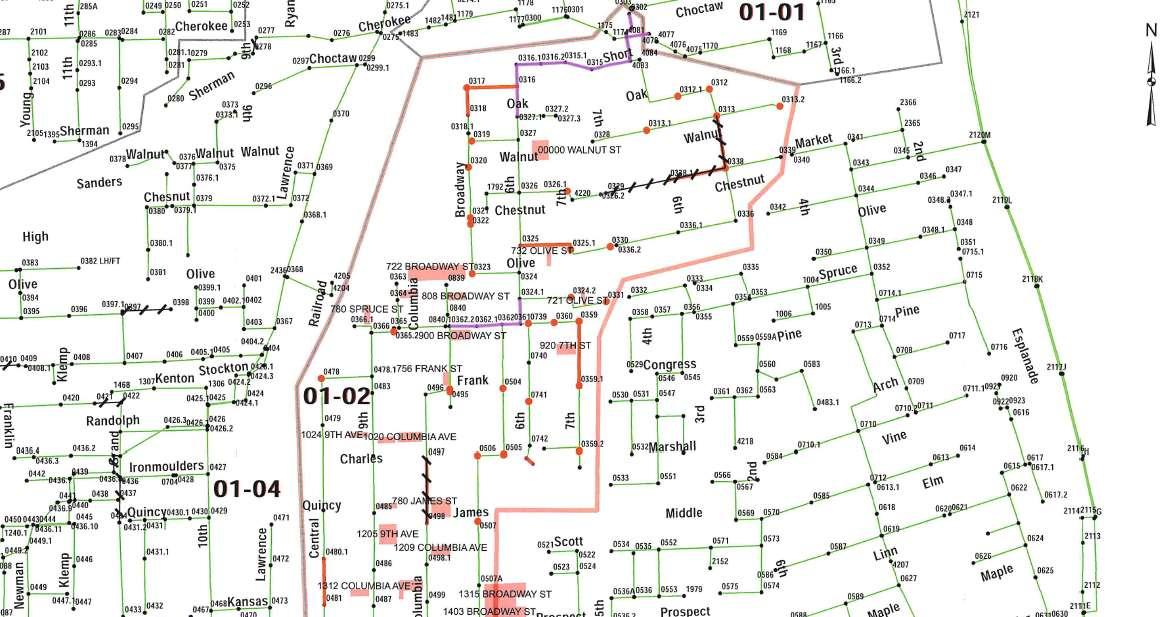

The following map shows the Location of Leavenworth County in Kansas and the City of Leavenworth within Leavenworth County.

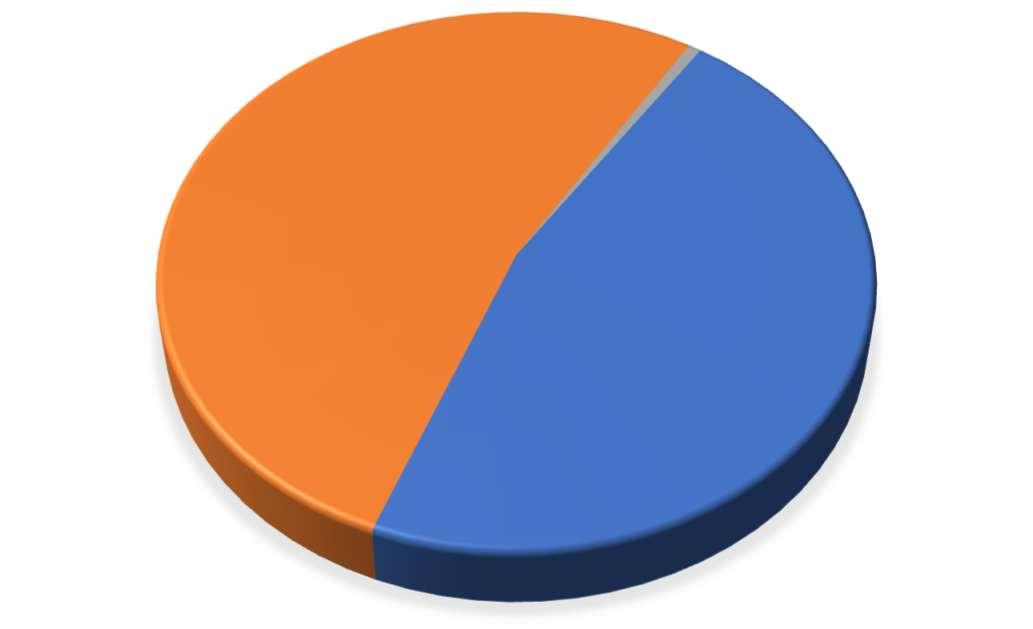

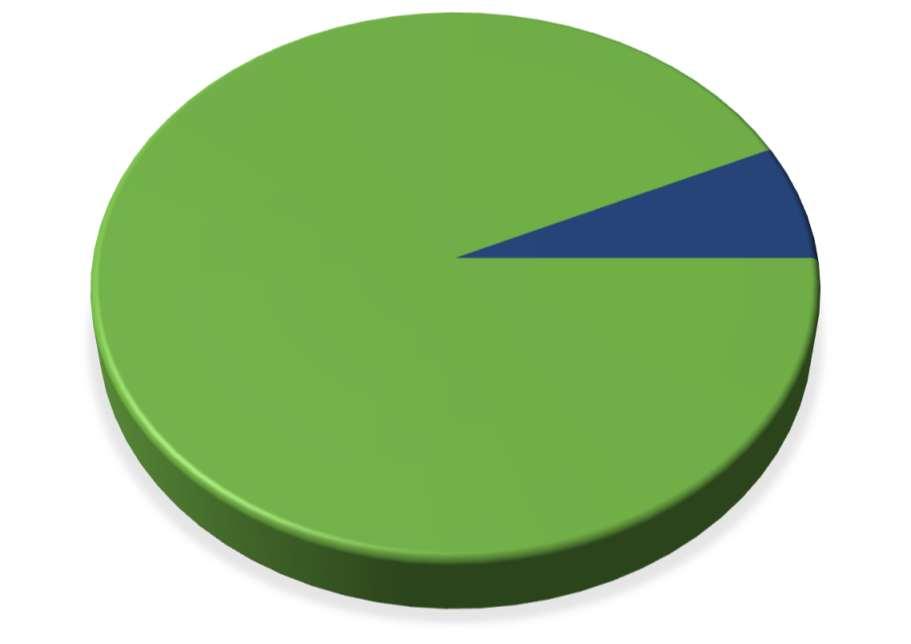

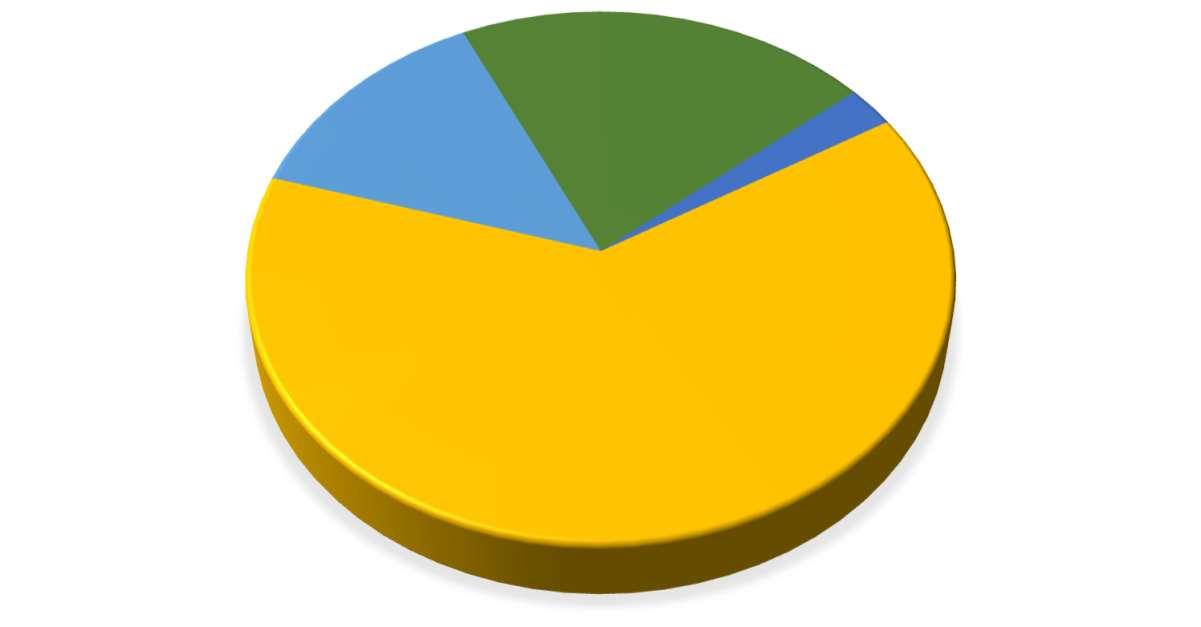

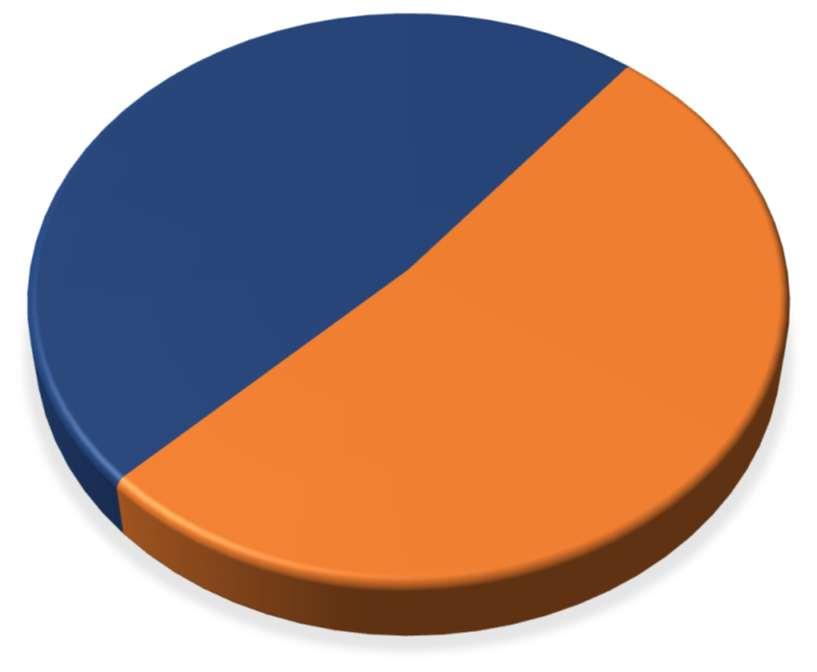

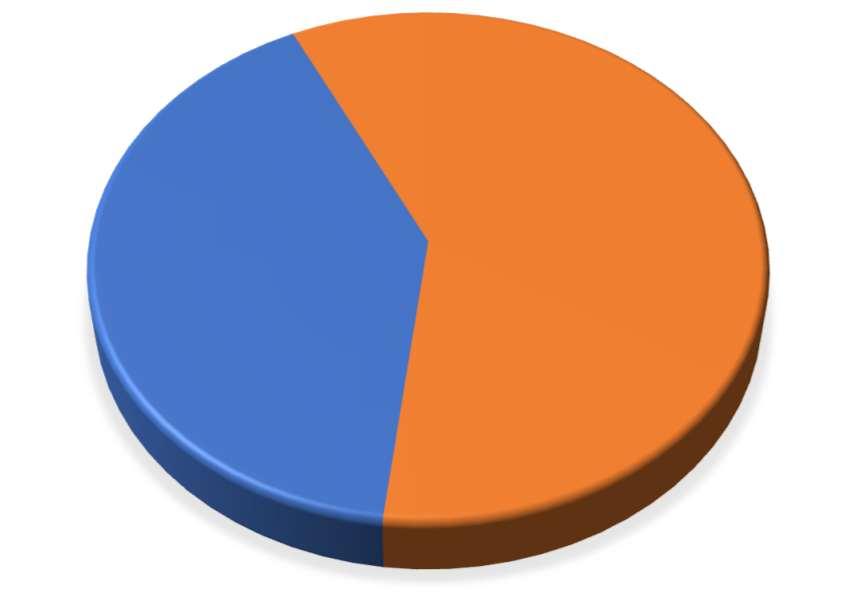

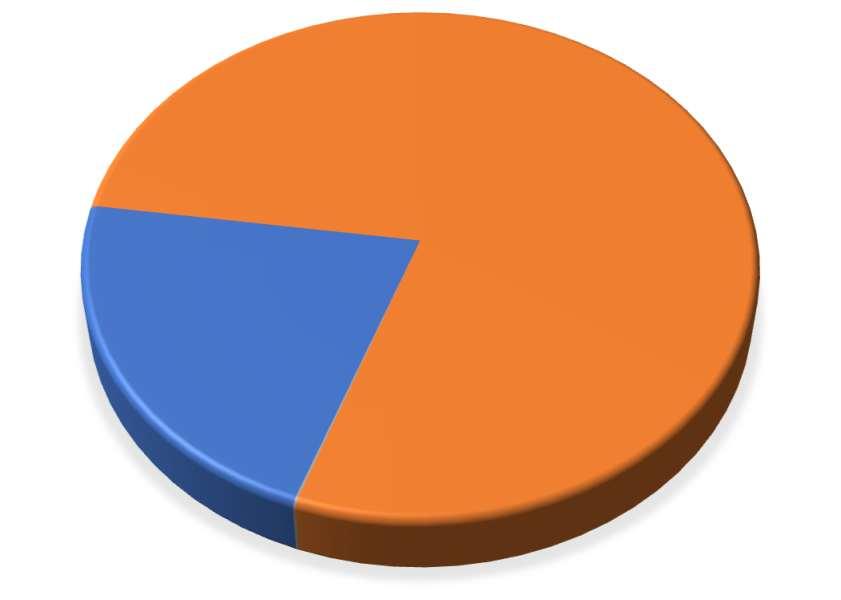

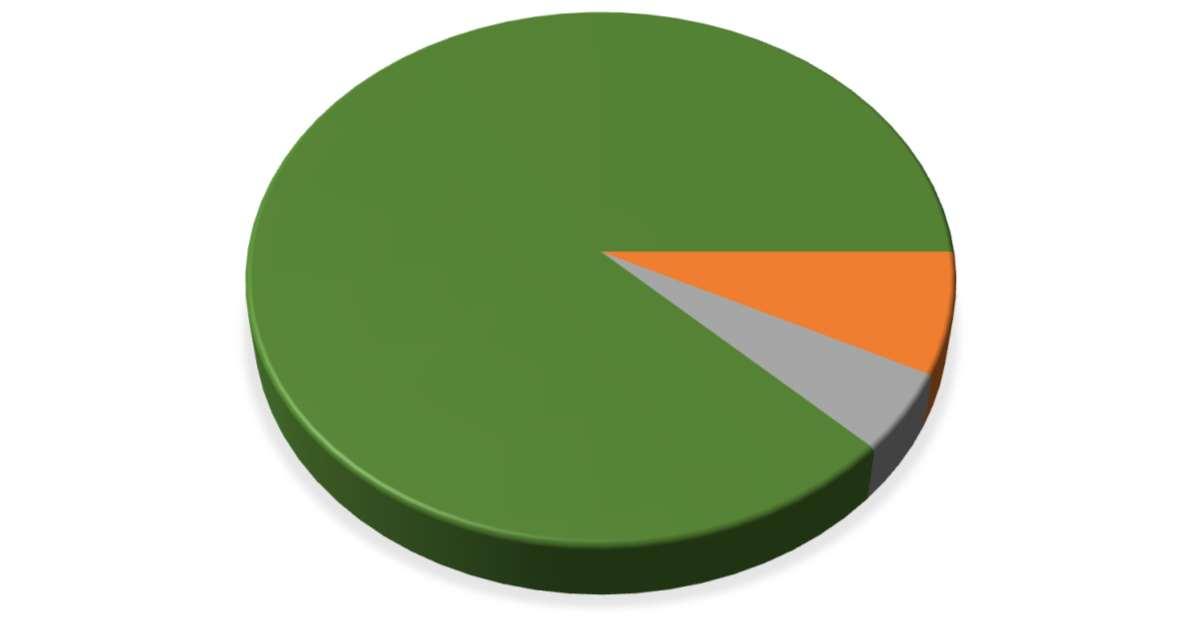

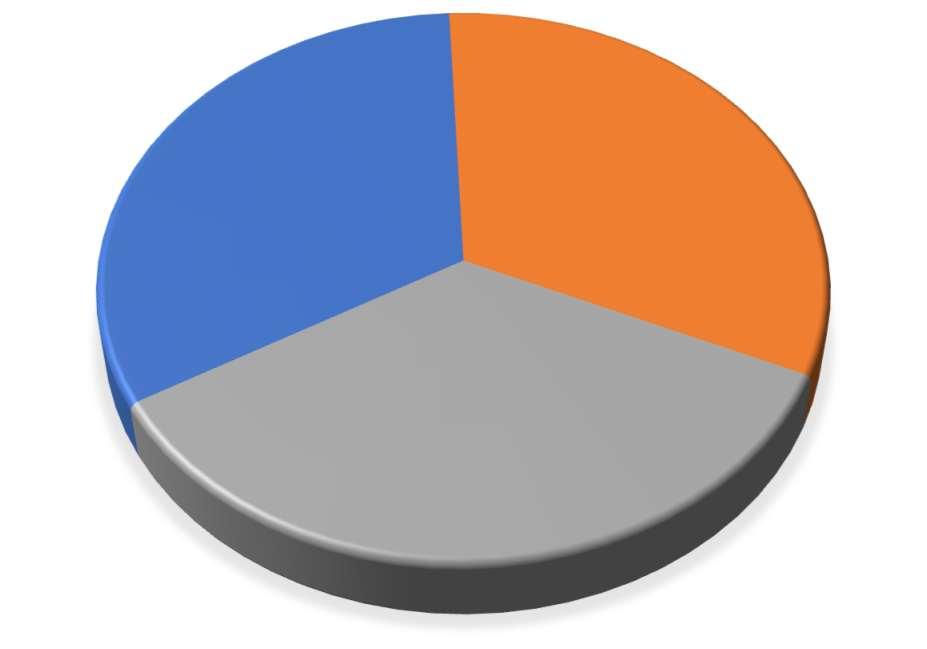

The City of Leavenworth is made up of 16 zoning districts. These zoning districts can be divided into three groups: residential, commercial, and industrial. The residential group is made up of all parcels zoned for the intent of use for habitable dwellings. The commercial group is all parcels zoned with the intent to operate a business for profit. An industrial group is a group made up of zoned areas for industrial uses. Land use in Leavenworth is 76.6% residential, 6.9% commercial, and 9.29% industrial. Leavenworth has several federal and state entities that make up a portion of the land within city limits; these entities are not included in any of the three groups since they are considered government properties and are therefore tax-exempt.

As mentioned earlier, the City has a strong federal presence, which includes Fort Leavenworth, home to the U.S. Army Combined Arms Center and the U.S. Army Command and General Staff College, School of Military Studies, the Center for Army Leadership, the Combat Studies Institute, the Combined Arms Directorate, the Center for Army Lessons Learned (CALL), and the Mission Command Center of Excellence (MCCoE).

The Fort has been continuously occupied by the U.S. Army since its inception in 1827. The original purpose of the fort was to protect settlers on the Santa Fe Trail. The fort also played a key role in both the Mexican and Civil Wars. In 1854, it was the temporary capital of the Kansas Territory. There are two national cemeteries located in Leavenworth. One of these, the Fort Leavenworth National Cemetery, is located on the Fort. Today, Fort Leavenworth is a major economic driver of the community. Providing roughly 15,000 military, civilian, and Department of Defense jobs, an average daily post population of 21,420, and an estimated $1.5 billion economic impact to the city and the region.

In addition to Fort Leavenworth, the U.S. Department of Veteran’s affairs operates the Dwight D. Eisenhower Veterans Affairs Medical Center. The other national cemetery, the Leavenworth National Cemetery, is located on these grounds behind the Veteran’s Affairs Medical Center.

There are several prisons located in Leavenworth and the immediate surrounding area. The United States Federal Penitentiary was built in 1903, along with its satellite prison camp, and the Federal Bureau of Prisons operates both. The Federal Bureau of Prisons has renamed the former United States Penitentiary and is currently constructing a new $461 million Federal Correctional Institution in Leavenworth. The United States Disciplinary Barracks, which is located on the fort and is the military’s only maximum-security facility, and the Midwest Joint Regional Correctional Facility are both military facilities. The Kansas Department of Corrections operates the Lansing Correctional Facility located in Lansing, Kansas, a neighboring city.

These facilities provide strong financial stability to the City.

Three public school districts provide educational servicesto local citizens. Unified School District (USD) 207 is on Fort Leavenworth and has three elementary schools and one junior high school. The USD 207 high school students attend USD 453, the City of Leavenworth’s school district. USD 453 operates four elementary schools, one intermediate school, one middle school, Leavenworth Virtual School (LVS), an Educational Center, and Leavenworth High School. Leavenworth High School boasts the very first Junior Reserve Officer Training Corps (JROTC) in the country. Leavenworth Virtual School is an internet-based school for kindergarten through eighth grade students. Children living in the City’s southernmost areas are included in the Lansing USD 469 School District.

There are also two private schools in Leavenworth, Xavier Elementary school for students in pre-kindergarten through eighth grade and St. Paul Lutheran School for students in pre-kindergarten through eighth grade.

The University of Saint Mary is a four-year private Catholic university located in Leavenworth. Other higher education opportunities in Leavenworth include a Kansas City Kansas Community College satellite campus and a University of Kansas satellite campus.

(Ages 25 and

Bureau

Leavenworth is a prime middle-class community with a sound business base in the Kansas City Metropolitan area. The cost of living in Leavenworth is 90.1% of the national average.

Economic activity in Leavenworth during the past year included:

Construction continued on the new, $461 million federal prison to replace the 126 year-old facility; the new facility will be state of the art, offer increased security and services for physical and mental well- being for prisoners

Site visits from businesses interested in the shovel-ready, 82-acre Business and Technology Park

Infill residential development increased housing options

City celebrated three years of partnership with RideLV, the on-demand micro transit system providing public transportation within City limits

Distribution of dozens of Small Business Economic Development Grants to new and existing businesses to make building and façade improvements

Steady participation in the City-hosted Annual Business Symposium to connect current and future business owners with the resources to help them succeed and grow.

Continued outreach regarding the City’s Neighborhood Revitalization Area (NRA) tax rebate program to stimulate investment into properties within the NRA boundaries

Leavenworth is a legally constituted city of the First Class and the county seat of Leavenworth County.

The City is empowered to levy a property tax on both real and personal properties located within its boundaries. It is also empowered by state statute to extend its corporate limits by annexation, which occurs periodically when deemed appropriate by the governing body.

Since 1969 the City has operated under the commission-manager form of government. Policymaking and legislative authority are vested in the City Commission, which consists of five commissioners elected at large on a non-partisan basis by the general population. The commission elections are held every two years. Three of the commissioners are elected at each election. The two highest vote totals receive a four-year term and the third highest vote total receives a two-year term. The Commissioner with the highest vote total will become mayor in the following year and the commissioner with the second highest vote total will become mayor the year after that.

In comparison to the federal government, the City Commission performs the legislative function; the Municipal Court performs the judicial function; and the City Manager and city staff perform the executive function.

The Commission is responsible for passing ordinances, adopting the annual budget and capital improvement program, appointing committees, and hiring the City Manager. The City Manager is responsible for carrying out the policies and ordinances of the City Commission, overseeing the day-to-day operations of the City, and appointing the heads of the City’s departments.

The City’s financial reporting entity includes all the funds of the primary government (the City of Leavenworth) and of its component unit - the Public Library. A component unit is a legally separate entity for which the primary government is financially accountable.

The City provides a full range of services, including:

Public safety: police and fire protection, animal control, and parking enforcement.

Public Works: sewer, refuse, storm water management, building inspection, airport, and the construction and maintenance of streets, storm water, bridges, and other infrastructure.

Housing and urban development: code enforcement, rental coordinator, and a range of housing and community development programs supported by federal grants.

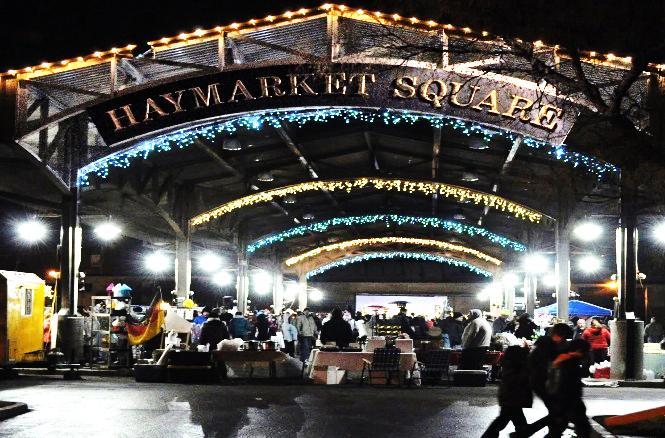

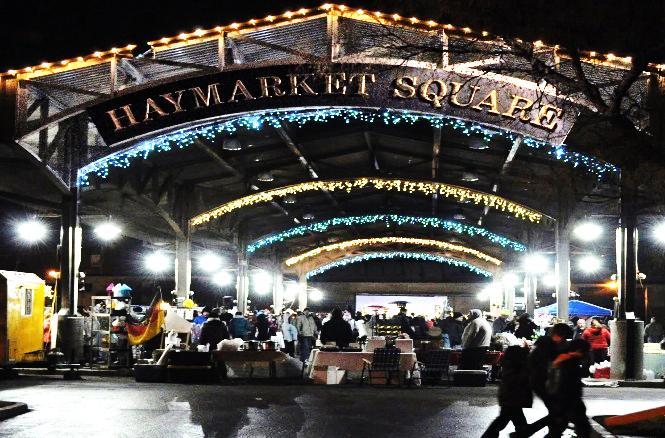

Culture and recreation: parks, recreation, library, community center, aquatic center, farmers market, and performing arts.

Community and economic development: planning and zoning and economic development activities.

General government: Commission, City Manager, Legal,Municipal Court, Contingency, Airport, Civil Defense, City Clerk, Human Resources, Finance, General Revenue (Gen Gov’t), and Information Technology

Spectrum TV Channel 2 is the channel the City uses to broadcast live Commission meetings and other City related public announcements from other governmental agencies and school districts.

The Leavenworth Times is the city’s daily newspaper and is published by Cherry Road Media. Fort Leavenworth publishes a weekly newspaper through the U.S. Army that covers local military and community news.

In addition to print and broadcast media, the City publishes news and updates through their webpage (https://www.leavenworthks.gov) and social media sites.

Area medical facilities provide a full range of services including general health care, preventive health care, dental and vision care, behavioral and counseling services, dialysis, long-term care facilities, hospice care, rehabilitative care, and surgical care. These facilities provide in excess of 1,260 jobs.

In addition to medical facilities for the civilian population, the Dwight D. Eisenhower Veteran’s Affairs Medical Center is located in Leavenworth City limits. There is also a medical care facility located on the Fort.

Currently, there are seven banks in Leavenworth with thirteen locations. The following summary of deposit report is as of March 2025, the most recent data available:

Source: FDIC Bank Ratings

Leavenworth’s location in the Kansas City metropolitan area is advantageous for commercial transportation. A massive logistics hub, the intermodal park in Edgerton, Kansas, (just south of Kansas City) connects railway shipments, trucking shipments, and inland port access to ocean shipping.

The Kansas City International (KCI) airport is located twenty minutes from Leavenworth, and as of April 2023, boasts a brand-new terminal with increased services and amenities. In addition, the City of Leavenworth has

a joint-use agreement with the Department of the Army for the use of Sherman Army Airfield located on post. The airfield is approximately one-mile north of the city and, while it is a military airfield, civilian access is unlimited.

Located at the intersection of U.S. Highway 73, Kansas Highway 92, and Kansas Highway 7, Leavenworth is within easy access to U.S. Interstates 70, 435, and 35. Interstate highway 29 and State highway 45 are within a few minutes of the City on the Missouri side of the river.

In conjunction with the Guidance Center and the Kansas City Area Transit Authority (KCATA), the City began an app-based transportationsystem that allows residents to get to medical offices, grocery stores, and places of work within City limits. RideLV MicroTransit, began in April 2023 and provides on-demand transportation upon request for a flat, affordable $2 rate.

Culture

The City of Leavenworth enjoys a multi-cultural and religious diversity due to its military and international military heritage.

The Leavenworth Parks and Recreation Department maintains a system of more than twenty-five parks, an aquatic center, and the Riverfront Community Center. The community center offers an indoor cardio facility, an indoor pool, a gymnasium, and an excellent event venue. New in 2023 is a popular Splash Pad with water features located at Hawthorn Park.

The LeavenworthPublicLibrary offers many programs suchas meeting rooms,technology services, elementary and teen gaming, and interlibrary loan programs, in addition to specialty programs for children, teens, adults, and seniors.

The River City Community Players provides year-round plays and musicals at the Performing Arts Center.

Camp Leavenworth is the City’s annual festival held in September and attended by up to 10,000 residents and guests. The two-day event features live music, local craft vendors, food vendors, and family-friendly activities.

The City is home to several museums such as:

The Richard Allen Cultural Center featuring items and artifacts from African-American pioneers and members of the military and collections of 1870-1920 photos from the Mary Everhard Collection.

C.W. Parker Carousel Museum offers three complete carousels that can be ridden and unique carousel horses.

National Fred Harvey Museum which is dedicated to the famous American entrepreneur credited with creating the world’s first chain of restaurants and hotels in association with the Atchison, Topeka, & Santa Fe railroad.

First City Museum showcases many different collections and displays of Leavenworth history.

The Carroll Mansion Museum is an 1880’s Victorian house featuring elaborate handcrafted woodwork, stained glass, and antiques from the early 20th century.

Fort Leavenworth Frontier Army Museum boasts a largecollection of 19th century military artifacts.

Leavenworth has an historic shopping district that includes artisan shops, antique shops, art galleries, bakeries, book stores, pottery shops, restaurants, a farmers’ market, and many other points of interest. There is a variety of international cuisine offered in local restaurants.

In addition to the many cultural and recreational opportunities in Leavenworth, its proximity to the Kansas City metropolitan area enhances the City’s quality of life. There are many professional sports venues, such as baseball, football, soccer, hockey, and racing. Kansas City also boasts several museums, art galleries, performing arts venues, restaurants, shopping, farmers market, micro-breweries, and of course, the zoo.

U.S. Decennial Census and worldpopulationreview.com

andelevation.maplogs.com

City of Leavenworth, Kansas

The City of Leavenworth abides by Kansas budget law which requires municipali es to prepare an annual budget form that includes the informa on required by Kansas budget law and discloses complete informa on as to the financial condi on of the municipality. The state provides budget workbooks that must be completed by all municipali es over a certain size. The City’s 2026 Kansas Budget Workbook is included in Appendix D.

The Governmental Accoun ng Standards Board (GASB) establishes the accoun ng rules that municipali es must follow These rules require the City to use a fund accoun ng system Fund accoun ng systems establish separate funds, each with its own budget, that accounts for financial ac vity by revenue source and/or purpose. The City has several different types of funds including General, Debt Service, Special Revenue, Capital Project, Enterprise, Pension and Custodial Funds. A municipality can have only one General Fund, but may have mul ple funds of the other types. The following are brief descrip ons of each type of fund.

General Fund: Main opera ng fund used to account for and report all financial resources and expenditures not accounted for and reported in another fund.

Special revenue funds: Used to account for and report the proceeds of specific revenue sources that are restricted or commi ed to expenditures for specified purposes other than debt service or capital projects.

Capital projects funds: Used to account for and report financial resources that are restricted, commi ed, or assigned to expenditures for capital outlays, including the acquisi on or construc on of facili es, construc on of infrastructure, and acquisi on of equipment.

Debt service funds: Used to account for and report financial resources that are restricted, commi ed or assigned to expenditures for principal and interest.

Enterprise funds: Used to report any ac vity for which the fee that is charged to external users covers the cost for goods and services provided by that fund.

Fiduciary funds: Fiduciary funds account for revenues that are collected and held on behalf of others and are not available for use in support of the City’s ac vi es. The City budgets for the following types of fiduciary funds:

Pension funds: The City has a Fire Pension Fund and a Police Pension Fund that hold resources in trust for members and their dependents.

Agency funds: Used to report resources held by the City in a custodial capacity. The City Budgets for the following agency funds:

o Leavenworth Public Library (Library Fund)

o Library Employee Benefit Fund

o Tax Increments Funds (Auto TIF Fund, Hotel TIF Fund, and Retail TIF Fund)

The Kansas Budget Form is divided into three sec ons: budgeted funds that include an ad valorem tax levy, budgeted funds that do not include an ad valorem tax levy, and unbudgeted funds. While Kansas

budget law includes several statutes that specify types of funds that are not required to be budgeted, the City budgets all funds for planning and internal control purposes.

The following City of Leavenworth 2026 Budget discussion follows the sequence of the 2026 Kansas Budget Form. The next page is an overview of Leavenworth’s City-wide 2026 budget, by fund. Following the City-wide 2026 Budget overview, there is a sec on for each fund. Those sec ons include a brief descrip on, including purpose, of each fund and the budget for each fund, broken down by division.

2026 Budget Overview - General Fund

Description:TheGeneralFundistheCity'smainoperatingfund.MostoftheCity'smainfunctionsareintheGeneralFundincludingPublicSafety (PoliceandFireDepartments),PublicWorks(Permitting,Engineering,andInspections),andtheCity'sAdministrativeFunctions(CityCommission, CityManager'sOffice,CityClerk'sOffice,MunicipalCourt,HR,Finance,CodesEnforcement,Planning,andInformationTechnology).

Note:TheCashBalanceCarryForwardof$6,656,589representsthe estimatedGeneralReservesintheGeneralFundasof12/31/2025. TheCityhasaBudgetaryReservePolicywiththepurposeof establishingaframeworktoprovidequalityserviceswhilemaintaining financialstability.TheBudgetaryReservePolicyrequiresminimum GeneralReservesequalto16%ofannualexpendituresandatargeted GeneralReservesequalto30%ofannualexpenditures.TheCash BalanceCarryForwardfor2026is27.08%of2026budgetedGeneralNote:TheGeneralRevenueDivisionexpendituresof$6,249,062 include$5,37,4827inGeneralReserveswhichis22.75%of2026 budgetedGeneralFundexpenditures.Italsoincludesan$52,958 transfertotheStreets&AlleyMaintenanceFundtocoverthatfund's budgeteddeficitandan$820,777transfertotheGrantMatching CapitalProjectsFundtocovertheCity'sportionof2026projectsthat arepartiallyfundedwithgrantrevenue.

CityofLeavenworth,Kansas

2026AdoptedBudget

GeneralFundOverview

Budgetassumptions

1.5.72%increaseinassessedvalues,1.486millincrease=$744,212additionaladvaloremtaxinGeneralFund

2.3.05%decreasein2025Citysalestax,thenincrease2%in2026 3.0%raises

4.15%decreaseinhealthinsurance

5.PoliceOfficerssalariesinclude4budgetedvacancies

6.FireDepartmentsalariesinclude1budgetedvacancy

7.Overtimereduced10%exceptforpublicsafetyovertime,whichisdecreased5%

8.SecretaryinFireDepartmentwillwork50%forFireDepartment,50%foranotherdepartment

City of Leavenworth, Kansas

General Fund

2026Budget:CityCommissionExpendituresbyType

GeneralFund:CityCommissionDivision

Description:TheCityCommissionisthegoverningbodyfortheCityofLeavenworth.Itiscomprisedoffive(5)commissioners,electedatlarge.TheMayorandMayorProTemarecommissionersthatareselected toserveinthesepositionsbecausetheyreceivedthehighestnumberofvotesinthepreviouselectioncycle.

Mission:ThemissionoftheCityCommissionisto,throughitpoliciesanddecisions,improvethequalityoflifeforresidentsoftheCityandtobetterpositiontheCityforeconomicdevelopment.

2026 Approved Budget

City of Leavenworth, Kansas

General Fund Adopted Budget

January 1, 2024 - December 31, 2024

Description:TheCityManagerisappointedby,andservesatthepleasureof,theCityCommission.AstheCity’schiefexecutiveofficer,theCityManagerandtheirstaffareresponsibleforthedaytoday administrationoftheCity.TheCityManagerisresponsibleforthecreationandsubmissionoftheannualbudget.

City Manager Division

Mission:ThemissionoftheCityManager’sOfficeistosupporttheCityCommissioninformulatingandimplementingpoliciesthatprovideresponsive,effectiveandfiscallyresponsibleservicesforresidentsof

CITY ADMIN Notes Expenditures

full-time employees: City Manager (1), Assistant City Manager (0.4), Assistant to the City Manager (1), Public Information Officer (1). 2024 included a partial year vacancy for City Manager. 2025 projection includes a partial year vacancy for Assistant to the City Manager.

In 2024 the Police Chief was Interim City Manager. The specialty assignment pay is the stipend paid while they filled this position.

City of Leavenworth, Kansas

GeneralFund:CityAdministration/CityManager'sOffice

General Fund Adopted Budget

January 1, 2024 - December 31, 2024

Description:TheCityManagerisappointedby,andservesatthepleasureof,theCityCommission.AstheCity’schiefexecutiveofficer,theCityManagerandtheirstaffareresponsibleforthedaytoday administrationoftheCity.TheCityManagerisresponsibleforthecreationandsubmissionoftheannualbudget.

City Manager Division CITY ADMIN

Mission:ThemissionoftheCityManager’sOfficeistosupporttheCityCommissioninformulatingandimplementingpoliciesthatprovideresponsive,effectiveandfiscallyresponsibleservicesforresidentsof

Approved Budget City Manager's Office

Notes $7,115 CivicPlus website hosting fee plus 2026 ADA module for federal DOJ compliance. This line also includes SESAC Music Performance license $1,217, ASCAP $434, staff photos, and other professional services.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Notes:TheAssistantManager(ACM)isallocatedbetweenthefollowingdivisions:CityManager(40%),EconomicDevelopment(40%),andCVB(20%).The AssistanttotheCityManagerpositionisprojectedtobevacantfor25%of2025.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Notes:TheCityAttorneyisacontractposition,whichispaidbasedonservicesprovided.Theonlypersonnelrelatedexpenseforthispositionsisworkers compensationinsurance.

Actuals for 2021, 2022, and 2023 were $483,290, $483,527, and $401,301, respectively. Revenues have decreased yearly since 2017. Factors include number of citations written due to understaffed traffic unit and unpaid fees/fines.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

City of Leavenworth, Kansas

computer mice, webcams, small UPS's

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

City of Leavenworth, Kansas

Description:TheOfficeoftheCityClerkisdedicatedtoprovidingtimely,accurateinformationandexcellentservicetothepublic,Citystaff,andtheCityCommissionwhilemaintainingfullcompliancewithlocaland

issuesCitylicensesandpermits.TheCityClerk'sofficeisalsoresponsibleforpreparinganddistributingtheagendasandminutesforCityCommissionstudysessions,worksessions,andCityCommissionmeetings.

GeneralFund:CityClerk'sOffice

Description:TheOfficeoftheCityClerkisdedicatedtoprovidingtimely,accurateinformationandexcellentservicetothepublic,Citystaff,andtheCityCommissionwhilemaintainingfullcompliancewithlocaland statelaws.TheCityClerk'sstaffisresponsibleforefficientrecordkeepinginaccordancewithlocalandstatelawsandinamannerthatfosterspublictrustandaccountability.TheCityClerk'sofficemonitorsand issuesCitylicensesandpermits.TheCityClerk'sofficeisalsoresponsibleforpreparinganddistributingtheagendasandminutesforCityCommissionstudysessions,worksessions,andCityCommissionmeetings.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Notes:The2024Actualincludesvacancies.

City of Leavenworth, Kansas

Description:TheHRDepartmentisresponsiblefortheimplementation,revision,andoversightoftheclassification,compensation,benefitsadministration,employeerecruitmentandselection,laborrelations,risk management,training,andrecordsretentionprograms.ThedepartmentalsodevelopsandupdatestheCity'spersonnelmanual,performanceevaluationsystem,andemployeerecognitionprograms.TheHR DepartmentalsoservesasanadvisortoCommitteesandBoards.

2026Approved

3 full-time employees: HR Director (1), HR Deputy Director (1), HR Admin Specialist (1). 2026 is lower than 2024 because a long-term employee retired and was replaced with a lower-cost employee.

GeneralFund:HumanResources(HR)Department

Description:TheHRDepartmentisresponsiblefortheimplementation,revision,andoversightoftheclassification,compensation,benefitsadministration,employeerecruitmentandselection,laborrelations,risk management,training,andrecordsretentionprograms.ThedepartmentalsodevelopsandupdatestheCity'spersonnelmanual,performanceevaluationsystem,andemployeerecognitionprograms.TheHR DepartmentalsoservesasanadvisortoCommitteesandBoards.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

City of Leavenworth, Kansas General Fund

2026 Approved Budget

GeneralFund:FinanceDepartment

Description:TheCityofLeavenworthiscommittedtotheprudentuseofpublicmoney.TheFinanceDepartment'sprimaryresponsibilityisfulfillingthiscommitment.TheemployeesoftheFinanceDepartmentare accountableforallaspectsoftheCity'sfinancialmanagementwiththeexceptionofpropertytaxadministration,whichisconductedthroughthecollaborativeeffortsofthecountyappraiser,countyclerk,and countytreasurer.InadditiontotheFinanceDepartment,theFinanceDirectorhasdirectoversightovertheGeneralRevenueandCity-WideDivisions,whicharebothaccountedforwithintheGeneralFund.The FinanceDirectorhasoversightoveradditionaldivisionsthatarenotpartoftheGeneralFund,whichwillbediscussedlaterinthispresentation.

GeneralFund:FinanceDepartment

Description:TheCityofLeavenworthiscommittedtotheprudentuseofpublicmoney.TheFinanceDepartment'sprimaryresponsibilityisfulfillingthiscommitment.TheemployeesoftheFinanceDepartmentare accountableforallaspectsoftheCity'sfinancialmanagementwiththeexceptionofpropertytaxadministration,whichisconductedthroughthecollaborativeeffortsofthecountyappraiser,countyclerk,and countytreasurer.InadditiontotheFinanceDepartment,theFinanceDirectorhasdirectoversightovertheGeneralRevenueandCity-WideDivisions,whicharebothaccountedforwithintheGeneralFund.The FinanceDirectorhasoversightoveradditionaldivisionsthatarenotpartoftheGeneralFund,whichwillbediscussedlaterinthispresentation.

Description:TheCity-WideDivisionprovidesallocationsfortheCity'sportionofretirees'healthinsurancepremiumexpenditures.ItisalsothedivisioninwhichtheCity'screditcardrevenueshareandcreditcard feesarerecorded.TheCity-WideDivisiondoesnothaveanyemployees.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

City of Leavenworth, Kansas

General

2026 Approved Budget

Expenditures

GeneralFund:PoliceDepartment/AdministrativeDivision

Description:ThePoliceDepartmentischargedwithupholdingthelawsoftheCityofLeavenworthandtheStateofKansas,andthetenetsoftheConstitutionandwilldosowithintegrityandhonesty.Everyonethe PoliceDepartmentcomesincontactwithwillbetreatedwithcompassionandrespectwithoutbias.ThePoliceDepartmentwillbeaccountableforitsactionsandacknowledgeitsmistakes.ThePoliceDepartmentis comprisedofthefollowingdivisions:PoliceAdministration,Dispatch,PoliceOperations,AnimalControl,andParking.TheAdministrativeDivisionincludesthePoliceChiefandhisstaff,includingtheDeputyPolice Chief,aLieutenant,aSergeant,administrativestaff,anEvidenceCustodian,aRecordsSupervisorandClerk,andtwoITSpecialists.

13 full-time employees: Police Chief (1), Deputy Police Chief (1), Lieutenant (1), Sergeant (1), Secretary (1), Admin Specialist (1), Evidence Custodian (1), Records Supervisor (1), Records Clerk (3), IT Specialist (2) Police

GeneralFund:PoliceDepartment/AdministrativeDivision

Description:ThePoliceDepartmentischargedwithupholdingthelawsoftheCityofLeavenworthandtheStateofKansas,andthetenetsoftheConstitutionandwilldosowithintegrityandhonesty.Everyonethe PoliceDepartmentcomesincontactwithwillbetreatedwithcompassionandrespectwithoutbias.ThePoliceDepartmentwillbeaccountableforitsactionsandacknowledgeitsmistakes.ThePoliceDepartmentis comprisedofthefollowingdivisions:PoliceAdministration,Dispatch,PoliceOperations,AnimalControl,andParking.TheAdministrativeDivisionincludesthePoliceChiefandhisstaff,includingtheDeputyPolice Chief,aLieutenant,aSergeant,administrativestaff,anEvidenceCustodian,aRecordsSupervisorandClerk,andtwoITSpecialists.

Lease payments for in-car and body worn cameras. This is new in 2026. We currently own equipment and use the vendors proprietary software for storage, etc. Data has been lost on a couple of occasions.

GeneralFund:PoliceDepartment/AdministrativeDivision

Description:ThePoliceDepartmentischargedwithupholdingthelawsoftheCityofLeavenworthandtheStateofKansas,andthetenetsoftheConstitutionandwilldosowithintegrityandhonesty.Everyonethe PoliceDepartmentcomesincontactwithwillbetreatedwithcompassionandrespectwithoutbias.ThePoliceDepartmentwillbeaccountableforitsactionsandacknowledgeitsmistakes.ThePoliceDepartmentis comprisedofthefollowingdivisions:PoliceAdministration,Dispatch,PoliceOperations,AnimalControl,andParking.TheAdministrativeDivisionincludesthePoliceChiefandhisstaff,includingtheDeputyPolice Chief,aLieutenant,aSergeant,administrativestaff,anEvidenceCustodian,aRecordsSupervisorandClerk,andtwoITSpecialists.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Description:ThePoliceDepartment'sDispatchCallCenterisinasharedfacilitywithLeavenworthCounty'sDispatchCallCenter,locatedintheLeavenworthCountyJusticeCenter.TheCityhasten(10)fulltime TelecomSpecialists.TheCityreceivesfundsfromtheKansas911CoordinatingCouncilwhichtheCitytransferstotheCountytohelpsupportthesharedDispatchCallCenter.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Notes:The2023actualsincludedanequivalentofonevacancy.The2024and2025budgetsincludeten(10)Dispatcherpositionsfilledfortheentireyear.

GeneralFund:PoliceDepartment/OperationsDivision

Description:

Police Department - Operations

2026Approved

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Description:AnimalControlisresponsibleforenforcingcityordinancesregardinganimalsincludingtheleashlaw,vaccinationandlicensingrequirements,andcheckingonneglectedorabusedanimals.Animal ControlOfficerscanissuecitationsforviolationsinthesecases.Theyalsopickuplooseanimalsandinjuredanimalswithnoidentifiableowner.LeavenworthAnimalControlfacilitatestheadoptionofunclaimed animalsfromtheAnimalControlShelter.LeavenworthAnimalControlstronglyurgespetownerstospayorneutertheirpets.AnimalControlpromotesresponsiblepetownershipthrougheducationeffortsand advocacy.

GeneralFund:PoliceDepartment/AnimalControlDivision

Description:AnimalControlisresponsibleforenforcingcityordinancesregardinganimalsincludingtheleashlaw,vaccinationandlicensingrequirements,andcheckingonneglectedorabusedanimals.Animal ControlOfficerscanissuecitationsforviolationsinthesecases.Theyalsopickuplooseanimalsandinjuredanimalswithnoidentifiableowner.LeavenworthAnimalControlfacilitatestheadoptionofunclaimed animalsfromtheAnimalControlShelter.LeavenworthAnimalControlstronglyurgespetownerstospayorneutertheirpets.AnimalControlpromotesresponsiblepetownershipthrougheducationeffortsand advocacy.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

City of Leavenworth, Kansas

2026 Approved Budget

Description:TheFireDepartmentprovidesfirepreventiontraining,firesuppressionandfireprotectionservices,searchandrescueoperations,medicalservices,andinspectionprograms.TheFireDepartmentalso respondstoenvironmentalemergenciesandotherthreatstohealth,safety,life,andproperty.TheFireDepartmentiscomprisedofthefollowingdivisions:FireAdministration,FireSuppression,andFire Prevention.TheFireAdministrationDivisionhasthreefulltimeemployees:TheFireChief,DeputyFireChief,andFireSecretary.TheLeavenworthFireDepartmenthasthreefirestations.TheFireAdministrative DivisionislocatedinFireStation#1.

GeneralFund:FireDepartment/FireAdministrationDivision

Description:TheFireDepartmentprovidesfirepreventiontraining,firesuppressionandfireprotectionservices,searchandrescueoperations,medicalservices,andinspectionprograms.TheFireDepartmentalso respondstoenvironmentalemergenciesandotherthreatstohealth,safety,life,andproperty.TheFireDepartmentiscomprisedofthefollowingdivisions:FireAdministration,FireSuppression,andFire Prevention.TheFireAdministrationDivisionhasthreefulltimeemployees:TheFireChief,DeputyFireChief,andFireSecretary.TheLeavenworthFireDepartmenthasthreefirestations.TheFireAdministrative DivisionislocatedinFireStation#1.

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

Staffing Summary (FTEs and Salaries, Taxes & Benefits), by Fund and by Division 2024 Actual, 2025 Adopted Budget, 2025 Projection, and 2026 Adopted Budget

City of Leavenworth, Kansas

2026 Approved Budget

5.75 full-time employees: Public Works (PW) Director (1), Deputy PW Director (1), Engineering Techs (2), GIS Coordinator (0.5), GIS Technician (0.25) and Admin Clerk (0.5). 2025 Projection includes Admin Clerk going to 0.5 FTE for 75% of the year.

GeneralFund:PublicWorks