Readiness to borrow

Picking the right season, not just the right seed

Picking the right season, not just the right seed

Special features

20 Allica Bank: A quiet transformation

NACFB: Readiness to borrow

Colenko: Complexity introduces time

NACFB: And the winners are…

48 ART Business Loans: Lost in the shuffle

iwoca: At the turning point

TRIVER: Bridging the festive cash flow gap

Metro Bank: The ‘forgotten middle’

Roma Finance: From stopgap to strategy Opinion & commentary 60 Rural & Business Specialists (R&BS): Cultivating success

Hilco Real Estate: The broker’s advantage

Coventry & Warwickshire Reinvestment Trust: Championing the regions 66 Somo: Beyond the deal

68 GB Bank: Further afield

70 Triodos Bank: Five things brokers should know about ethical lending

72 Five minutes with: Playter’s Jamie Beaumont From problem-solver to coach Andrea O’Brien on Haydock, brokers, and why creating space for others matters most

Kieran Jones Editor & Feature Writer Kieran.Jones@nacfb.org.uk

Jenny Barrett Communications Consultant Jenny.Barrett@nacfb.org.uk

Laura Mills Communications Manager Laura.Mills@nacfb.org.uk

Sophie Olejnik

Digital Marketing Executive Sophie.Olejnik@nacfb.org.uk

Amber Jane Roye

Graphic Designer Amber-Jane.Roye@nacfb.org.uk

Samantha Scales

Graphic Designer Samantha.Scales@nacfb.org.uk

Magazine Advertising 0207 101 0359 magazine@nacfb.org.uk

Jim Higginbotham Chief Executive Officer

NACFB

You catch us in a reflective mood. My first twelve months as CEO have seen significant developments for both the Association and the market we serve, and as the year closes, it feels right to pause and take stock.

As I flick through this final edition of Commercial Broker for the year, I’m struck by how strongly it captures that same spirit of reflection. It brings together an array of perspectives from across our community – brokers, lenders, and strategic stakeholders – each offering up-to-the-minute insight into the issues shaping SME finance. The result is a publication that not only reports on the sector, but also seeks to give it a collective voice.

Our cover feature explores the concept of readiness to borrow and reminds us that timing, preparation, and judgment often matter more than product alone. In a market still adjusting to higher rates and tighter conditions, brokers are proving their value by guiding clients towards finance that supports growth rather than strain.

We also share really encouraging news from the NACFB Mutual. By leaning into one of the true benefits of mutuality, we have been able to return money directly to the pockets of Members who hold PI cover through the Association. At a time when costs remain under pressure, this is a tangible example of collective strength working for the good of each firm.

And, of course, this issue celebrates the winners and highly commended firms from last month’s Commercial Broker Awards Their achievements are a reminder that excellence continues to shine across our industry, even in demanding conditions.

Looking ahead, our roster for 2026 is ambitious, and it builds on the strong platform created this year. Thank you for your continued support throughout 2025 – it has made my first year in post both rewarding and energising. I look forward to what we can achieve together in the year ahead.

Delay kills opportunity. And that’s why we’re here. Reward is the original alternative business lender. We collaborate with enterprising businesspeople who need timely decisions that set their plans in motion. rewardfunding.co.uk

The NACFB Mutual, now in its third year of trading, has confirmed it will deliver its first round of loyalty-based fee reductions to qualifying Members upon renewal. This benefit, built into the very design of the Mutual, ensures that surpluses are returned directly to Members.

Qualifying Members will see a 15% loyalty rebate applied at their next renewal, reflecting contributions made during the Mutual’s first trading cycle (the initial period of cover for those who joined at launch). To be eligible, brokers must have held cover from the outset of that cycle, have renewed continuously since, and have made no claims or notified any circumstances that could give rise to a claim. The rebate will be netted off at renewal rather than paid separately, ensuring the benefit is felt immediately in reduced renewal costs.

This marks the first phase of a core commitment built into the Mutual from the outset: that any trading surpluses should be shared fairly among its Members. The first phase of that benefit

is now being realised. This approach ensures that the advantages of mutuality – fairness, transparency, and Member ownership – are felt directly by those who supported the Mutual from the outset and who continue to renew their cover.

Alongside this development, the underlying insurer backing the Mutual has recently been upgraded to an A-rated provider, First Underwriting Limited, giving Members added comfort and long-term peace of mind.

Launched to tackle the escalating cost of PI insurance, the NACFB Mutual has consistently delivered meaningful savings. Members have seen up to 30% reductions on first-year renewal contributions compared with other providers. Today, four in five NACFB Members are now covered by the Mutual – a testament to its effectiveness and growing reputation across the broker community.

Unlike conventional insurers, the Mutual also has the flexibility to respond to circumstances outside standard policy wordings, reflecting the day-to-day realities faced by both property-focused

and business and asset finance brokers.

Chair of the NACFB Mutual, Adrian Coles, commented: “The Mutual was founded on the principle that Members should share directly in its success. This first round of loyalty-based reductions marks a significant step in delivering on that promise. Coupled with the security of an A-rated insurance backer, the Mutual continues to set the benchmark for fair, reliable, and Member-focused cover.”

Martin Richards, a director at Tower Insurance Brokers, the team that manages the NACFB Mutual, said: “The Mutual was built on fairness and transparency. Rebates are linked to Members’ original contributions and reviewed annually by the board, so while not guaranteed each year, they ensure that whenever conditions allow, Members directly share in the success of the Mutual.”

The NACFB Mutual remains open to all qualifying broker firms within the Association. Member firms with upcoming PI renewals are encouraged to visit nacfb.org/mutual

We’re a specialist business bank focused on commercial and buy-to-let mortgages for experienced property landlords, investors and British SMEs. Meet our Business Development Team

Andre Parcian Head of Business Development North East, Midlands & Wales

Mark Dobson Head of Business Development South & London

Ian Tudor Regional Development Manager South and South West

Sue Young Regional Development Manager South East

Jane Hand

Regional Development Manager North East

07741 140338 andre.parcian@redwoodbank.co.uk

07920 585222

mark.dobson@redwoodbank.co.uk

07443 966050

ian.tudor@redwoodbank.co.uk

07789 587633 sue.young@redwoodbank.co.uk

07879 174887

jane.hand@redwoodbank.co.uk

Read our latest product guide here

From smarter criteria, expert support and cash back rewards, we’re helping landlords go further.

READ ABOUT HOW REDWOOD SUPPORTS AND DELIVERS FOR OUR CUSTOMERS.

When a client belonging to award-winning brokers B2B Finance wanted to refinance a development loan they had used to upgrade a block of flats worth more than £1.2m, the brokerage firm turned to Redwood Bank and its solicitors, Knights, to handle the complex deal.

Properties involved: 11 remaining flats in Wrexham worth £1.22m (originally 24 flats, half already sold).

Legal challenge: Properties held on two defective leasehold titles; client also owned the freehold.

Solution:

Redwood Bank and solicitors Knights resolved title and lease issues.

Knights acted as dual rep solicitor for efficiency

Loan details: £934,065 loan, 76.5% LTV, 20-year interest-only term.

Purpose: Deal qualified for Green Cashback Reward due to EPC ratings of C.

Redwood Bank is one of our most trusted lending partners, with a clear understanding of the needs of experienced property investors. Their specialist approach and ability to handle complex cases really set them apart.

Rebecca Jones, B2B Finance

Let Redwood help YOU with your specialist lending needs.

Seven key policy moves that could unlock growth for SMEs – and new opportunities for brokers

Dave Furnival Head of Broker NatWest

The sight of the Chancellor’s red despatch box at this time of year brings with it a mix of anticipation and concern – and for brokers, Rachel Reeves’ upcoming Budget could be especially significant.

Despite a black hole in the country’s finances that’s estimated to hover around the £40 billion mark, she has promised an “investment-first” approach, and if she gets it right, there’s real potential to give small and medium-sized enterprises (SMEs) the oxygen they need to grow. This could boost confidence of SMEs up and down the country to invest in their futures and mean more opportunities for UK brokers and finance professionals.

Laying out one of the central themes of her autumn Budget recently, Chancellor Reeves said the Government would aim to improve the productive capacity of the economy, allocate higher investment into infrastructure, and redefine planning rules.

“If renewal is our mission and productivity is our challenge, then investment and reform are our tools,” she said, setting a determined tone.

So, if investment and growth are the goals, what would a broker’s Budget wish list look like? Here are a few practical moves the Chancellor could make.

1. Enhance capital allowances with a focus on SMEs

In her last Budget, the Chancellor maintained the Government’s full expensing scheme to encourage capital expenditure by larger companies. Broadening its scope to make full expensing more widely available and offering allowances for investments in productivity-enhancing equipment, could drive a wave of borrowing and leasing activity amongst SMEs.

2. Smarter tax reliefs for growth businesses

Extending or enhancing reliefs for R&D, digital investment, or energy efficiency could free up capital for SMEs to expand.

For brokers, that could translate into a larger pool of businesses seeking advice and finance packages.

One of the biggest headaches for SMEs is late payment. The Chancellor could strengthen the Fair Payment Code or enforce tighter standards on big corporations to settle invoices quickly. This would improve cash flow in the SME sector, making small businesses more “finance ready,” boosting demand for broker-arranged funding solutions.

Brokers and their clients spend too much time navigating red tape. A targeted review of financial promotions rules or reporting requirements for smaller brokerages could help them focus less on box-ticking and more on serving customers.

Extending tax incentives for investment zones or offering specific grants for regional SME hubs could spread growth across the country. That creates new networks for brokers to tap into, ensuring finance flows to where it’s most needed.

Business rates are set to rise in April 2026 for premises with rateable values over £500,000. Although this increase is primarily aimed at large distribution warehouses used by online retailers, it is also likely to affect bricks-and-mortar retail, hospitality, and leisure (RHL) businesses with similarly valued premises. Freezing business rates at current levels for these businesses could give them much-needed breathing space to reinvest.

The Chancellor will be walking a tightrope in her Budget speech – balancing fiscal responsibility with the need to kick-start growth. For brokers, the priorities of strengthening SMEs, making capital more accessible, and improving efficiency in the system would be outcomes we could all get behind.

Want to talk to us about how we could support you? Email us on brokerteam@natwest.com

From funding growth initiatives to investment in capital equipment or infrastructure, our Unsecured Business Loans can help SMEs to boost growth and move their businesses forwards.

Highlights:

• Loans from £25k – £250k

• 1 – 5 year terms

• No arrangement fee (£200 doc fee applies)

• Simple, online application process

• Assisted auto-decisioning for more challenging or complex deals

• Same day pay-outs*

*Once approved, where all required info is received by 12pm.

Interested in working with us? Get in touch

FOR INTERMEDIARIES ONLY

The Treasury is reconsidering a proposed increase in landfill tax following significant backlash from industry leaders. The plans, which aimed to eliminate exemptions and reduce rates, were revealed unexpectedly, causing anger among sectors like housebuilding and construction. Currently set at £126.15 per tonne, the tax could see costs for large housebuilders rise dramatically. One industry source noted: “They are still trying to get a grip on the impact and implications of the reforms.”

FCA finds insurers short-changing drivers

The Financial Conduct Authority (FCA) has identified that around 270,000 drivers are owed £200 million in compensation due to insurers undervaluing vehicles during claims for theft or write-offs. The FCA’s review prompted insurers to amend their claims processes. So far, £129 million has been paid to nearly 150,000 customers. Sarah Pritchard, FCA’s deputy chief executive, said: “We’ll step in when consumers aren’t getting fair value – and we are pleased to see that the practices which led to some unfair payouts have already changed.”

Landlords dismiss tax hike suggestions

The National Residential Landlords Association (NRLA) has rejected the Joseph Rowntree Foundation’s (JRF) analysis suggesting that tax hikes on the private rented sector have aided first-time buyers. The JRF report claims that reforms since 2016 have led to 1.1 million more households owning homes. However, NRLA chief executive, Ben Beadle, stated: “The idea that higher taxes are good for renters is simply not correct.” He warned that further tax increases would dampen investment and push rents higher. The JRF supports closing tax loopholes for landlords to promote homeownership.

Reeves tells investors she wants to ‘take out more regulators’

The Chancellor has announced plans to reduce the number of regulators in the UK to stimulate economic growth. Speaking at the British Private Equity & Venture Capital Association summit, Rachel Reeves said: “I want to take out more regulators; there’s still too many.” She highlighted recent actions, including the dismissal of the Competition and Markets Authority chair and constraints on the Financial Ombudsman Service.

The Prudential Regulation Authority (PRA) has proposed significant regulatory cuts to ease the banking sector’s operational burdens. The plan includes eliminating 37 overlapping reporting templates, which could save banks approximately £26 million annually. The regulator said the changes would not compromise its “primary objective” of ensuring the safety and soundness of firms.

UK economy falters with 50,000 job losses

The latest flash PMI from S&P Global has warned that growth in the UK’s private sector had slowed to its weakest level in the three months to September as higher business costs led to “subdued” demand and further job cuts. Manufacturing output has dropped to a six-month low, while the service sector struggles with constrained spending. Some 50,000 job losses were also reported in the three-month period. Chris Williamson, chief business economist at S&P Global Market Intelligence, said: “Alarm bells should be ringing that the economy is faltering.” Despite these issues, the PMI index remains above 50, indicating modest growth.

The Organisation of Economic Co-operation and Development (OECD) has increased its forecast slightly for UK growth this year from 1.3% to 1.4%, but predicts a fall again to 1% next year, unchanged from previous forecasts. Inflation in the UK is expected to hit 3.5%, up from its previous estimate of 3.1%, falling to 2.7% in 2026. Chancellor Rachel Reeves responded saying the figures “confirm that the British economy is stronger than forecast.” But Shadow Chancellor Sir Mel Stride said the OECD confirmed “what hard-working families already feel - under Labour, Britain is in a high tax, high inflation, low growth doom loop.”

We have a specialist understanding of the following key sectors: Community Faith Healthcare Social Housing Reliance Bank wins

Reliance Bank prioritise business lending to organisations that deliver positive social impact in the UK.

We outperform high street banks for customer satisfaction

Reliance Bank have been awarded FIRST place overall in the 2025 Charity Finance Banking Survey!

Reliance Bank also achieved first place in the following categories:

Helping good people do great things with

Reliance Bank has been at the forefront of socially responsible banking since 1890, when we were founded as the bank for The Salvation Army.

We provide:

Loans for refinancing

Loans for business acquisition

Loans for property purchase

Loans for refurbishment

Loans for business expansion

A commitment to the broker market and SME lending

Brian Cartwright Head of Broker BPCE Equipment Solutions

BPCE Equipment Solutions has built its reputation in the UK market, over the last 27 years, by forging strong partnerships – especially with brokers.

I’m excited to lead the next phase of our growth in the UK, ensuring our broker partners are fully supported and empowered to deliver value to their clients

Our longevity and resilience through difficult economic times are integral to who we are and our support of our partners. As we continue to expand our footprint in the UK, we remain committed to the markets we serve and to supporting SMEs across all sectors through meaningful relationships and tailored funding solutions.

Our success is driven by the strategic leadership of our UK executive team and the deep industry expertise within our business. We’re proud to offer brokers the support they need for every type of transaction.

A key part of our service model is access to our commercially minded expert teams who work closely with brokers to structure deals that benefit all parties, especially where those deals are more complex. Fast, transparent decision-making and hands-on support throughout the deal lifecycle are central to how we operate.

As the newly appointed head of broker, I bring years of experience in the broker market and a deep understanding of the challenges brokers face. I’m excited to lead the next phase

We actively listen to broker feedback to refine our product suite and credit appetite, to ensure brokers have the tools they need to deliver fast, effective, and client-focused funding solutions

of our growth in the UK, ensuring our broker partners are fully supported and empowered to deliver value to their clients.

Following our recent acquisition by Groupe BPCE, we’re ready to be part of their ambition to become Europe’s leading provider of equipment lease financing. This milestone opens new opportunities for us to expand our asset finance lending in the UK.

We’re investing in systems and people to strengthen our reach across diverse sectors, with broker-led growth forming a key part of our strategy in the years ahead.

The broker-lender relationship: Evolving with purpose

The broker market is evolving, with a growing emphasis on collaboration, transparency, and shared values. Successful partnerships today go beyond pricing – they’re built on trust and responsiveness.

We actively listen to broker feedback to refine our product suite and credit appetite, to ensure brokers have the tools they need to deliver fast, effective, and client-focused funding.

We believe there’s a real opportunity to bridge the funding gap with flexible asset finance terms that give businesses the confidence to move forward. We value our relationships with brokers and consider our real value is in providing the right solutions that help brokers invest and grow.

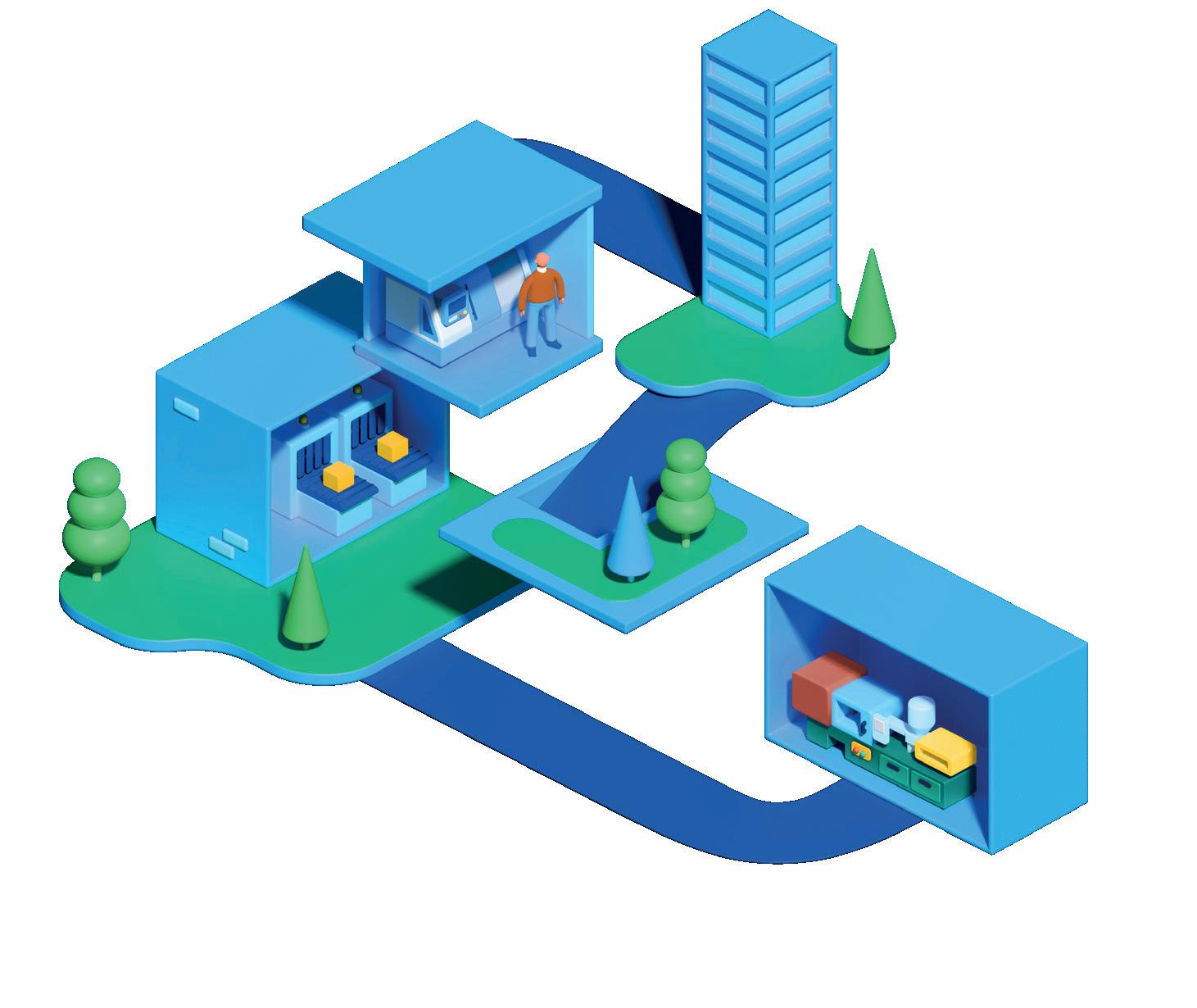

A typical deal: From proposal to drawdown

Speed, clarity, and communication are at the heart of our process. A typical deal begins with a broker submitting a proposal via our portal or account manager. Our team assesses the opportunity and delivers a credit decision –often within four to 48 hours, depending on complexity.

Once approved, our operations and documentation teams work closely with brokers to finalise paperwork, verify assets, and complete due diligence. Drawdown is typically completed within 24 hours, ensuring a smooth and professional experience for clients.

The UK SME sector remains a vital engine of economic growth – despite facing challenges such as interest rates, inflationary pressures, and political uncertainty which continue to weigh on confidence. Yet, despite these headwinds, many businesses are still investing in equipment to modernise operations, and boost productivity, and they need reliable funding partners to do so.

At BPCE Equipment Solutions, we’re committed to being that kind of lender – relationship driven, service-focused, and ready to support the growth and success of the broker community.

Our hope is that lenders, brokers, and trade bodies like the NACFB continue working together to support SMEs with access to fair, responsible, and innovative funding.

The role of the broker has never been more important. As demand for tailored asset finance grows, so does the need for trusted lenders who act quickly, think commercially, and treat brokers as true partners.

Speed, clarity, and communication are at the heart of our process

Sarah Cunningham Head of Compliance NACFB

Acommon refrain from NACFB Members is that the FCA simply doesn’t understand credit broking. That perception has often been reinforced by the kind of data the regulator collected in the past. Through the old GABRIEL returns, the information submitted was considered rudimentary at best and some viewed it did little to reflect the real nuances of a broker’s work.

In a bid to change that, and to make better assessments of whether firms are using their permissions appropriately, the FCA has sought to improve the way it gathers information. The introduction of a new consumer credit return is their attempt to do just that – collecting clearer, more relevant data that should, in theory, help the regulator gain a sharper picture of the sector.

Whether this shift genuinely leads to a deeper understanding of credit broking remains to be seen. But what is clear is that it marks a step in the right direction, with the regulator wanting to learn and understand more about credit broking. So, what exactly will the changes look like – and, crucially, what do brokers need to do about them?

The new consumer credit return will apply to firms with permissions for credit broking, debt adjusting, debt counselling, or credit information services. It introduces five universal sections – permissions, business model, marketing, revenue, and sales staff – followed by tailored questions depending on the permissions you hold. This ‘branching logic’ should keep the return more relevant to your business model.

The new return also replaces some of the existing data items. For example, CCR004 (Debt Management Firms) and CCR005 (Client Money & Assets) have been retired, with CCR009 introduced in their place. The idea is to reduce duplication and simplify what firms need to submit. In total, the prototype was reduced by almost a third after direct feedback from the NACFB, meaning brokers will face fewer questions and less duplication than first proposed.

So, what do the changes mean in practice? The answer will depend on whether you operate as an independent firm or as a principal with appointed representatives (ARs).

Independent firms will need to complete the new return directly via RegData, ensuring they report accurately against their own

Anyone who has spoken to me this year will know that a common source of confusion is knowing what is a regulated, exempt, or unregulated transaction

Make sure you also understand your deals, and know which transactions fall within regulated, exempt, or unregulated categories, as this will directly affect what you report

permissions. For many smaller firms, this will mean collating data manually or from spreadsheets – which can be time-consuming, but the questions should now be simpler to match to business activity.

Principal firms with ARs carry added responsibility. Principals must report not only their own activity but also that of their AR network. The FCA has published a series of flow diagrams to clarify this process, but in practice, it means principals will need reliable reporting systems from their ARs to avoid inconsistencies.

Anyone who has spoken to me this year will know that a common source of confusion is knowing what is a regulated, exempt, or unregulated transaction. This distinction matters because it determines both how you handle the agreement and what you submit for your reg data submission.

Lending of less than £25,000 with a business purpose is regulated by the Consumer Credit Act when it is provided to a regulated customer (individuals, sole traders, partnerships of two or three people, or unincorporated associations that do not include a corporate body and is not a partnership).

For the business exemption to apply to a regulated customer, three conditions must all be met: the loan must be for more than £25,000, the funds must be used wholly or mainly for business purposes, and the business exemption declaration within the finance agreement must be signed. Only when all three conditions are satisfied does the deal become exempt. At the point a broker introduces a customer to a lender, the customer is still treated as regulated.

Limited companies, LLPs, and partnerships of four or more people are treated as non-regulated customers and therefore fall outside the scope of the Consumer Credit Act.

It’s important to remember that your FCA submissions need to include regulated and exempt deals. Just because

an exempt deal is signed up on non-regulated paper doesn’t mean it shouldn’t be submitted. The FCA also wants you to include proposed deals that have been declined.

For most NACFB Members, the practical steps are straightforward. Begin by checking your permissions – only firms with the relevant credit permissions will need to complete the new return. Review how you currently collect data: if you rely on manual spreadsheets, consider whether that will remain sustainable. Make sure you also understand your deals, and know which transactions fall within regulated, exempt, or unregulated categories, as this will directly affect what you report.

The new consumer credit return now applies to all firms with

permissions for credit broking, debt adjusting, debt counselling, or credit information services. If your reporting period ended after May 2025, you will already be required to complete the new return. Others will encounter it as their current cycle closes. Submissions continue to be made via RegData, but the FCA has indicated it may look to better align reporting cycles in future. The NACFB will seek to provide guidance and templates to support Members in adapting and continue to work closely with the FCA regarding these returns.

The Association will continue to monitor how the new return is implemented, challenge inconsistencies, and press for fair treatment of brokers. With the right preparation, and with the NACFB compliance team on hand to help, Members can approach the new return with confidence rather than concern.

the future, rather than being shaped by it

From shifting customer expectations to the latest in digital transformation, the asset finance landscape is evolving fast. To unpack what this means for brokers and lenders, we put questions to Jason Hurwitz, Sales Director Europe at NETSOL Technologies – who shares his views on where the sector is heading.

Brokers are under more pressure than ever to get commission disclosure right. What makes this such a challenging area in practice?

The industry was upended and went through a painful period of adapting to full commission disclosure post the High Court ruling in October. As is too often the case, businesses rush to remain on the right side of compliance and legal requirements, but positive customer experience falls down the priority list. It’s now not uncommon for a borrower to be in receipt of three or more disclosure documents through the journey of taking on finance, with varying language and terms. Part of this may be inevitable as the shape of a deal, particularly more complex lending cases, can change materially through the course of accessing funding. In more simple cases, this repeated disclosure could do the very opposite of its designed intention, risking creating more ambiguity and damaging confidence.

If disclosures are handled poorly, what are the risks for brokers?

When disclosures are mishandled –whether through omission, ambiguity or delay, the consequences can be

severe. Beyond reputational damage and regulatory penalties, brokers face the risk of deals being unwound or challenged retrospectively, undermining both trust and profitability. At NETSOL, we believe technology must play a central role in de-risking this process. Automated, auditable disclosure not only ensures compliance, but also strengthens borrower (and lender) confidence – something the industry cannot afford to overlook.

How does the Supreme Court’s decision on commission practices impact on the operational and compliance needs of brokers and asset finance companies, and how is NETSOL positioned to support them?

The Supreme Court’s decision offers some relief to lenders and brokers, but it also reinforces the need for more rigorous and demonstrable compliance and documentation practices. Even though many historic claims may now fall away, the spotlight remains firmly on commission transparency –especially as the FCA prepares a redress scheme for excessive discretionary arrangements. What is clear is that without a tech supported customer journey with an audit trail, brokers and lenders will find they experience material disruption and distraction to business growth activities in having to manually gather data and documentation to evidence fair and compliant practices.

At NETSOL, we’re uniquely positioned to support this shift. Our solutions are designed with built-in compliance controls, customisable customer

Jason Hurwitz Sales Director Europe NETSOL Technologies

journeys, commission visibility and real-time audit trails. This ensures our clients can avoid material business disruption, adapt quickly to regulatory expectations in hours, while strengthening trust with partners and customers alike.

In light of the ruling, what specific features or capabilities in NETSOL’s platform can help brokers and lenders futureproof their businesses?

NETSOL’s origination platform is highly adaptable and flexible, allowing brokers and lenders to customise their workflows to tailor to today’s unique needs and regulatory demands of different customer segments, all in one platform. Our clients can continue to tailor customer journeys at speed to ensure they respond quickly to market changes and fast-evolving compliance requirements, futureproofing their operations.

Our solutions and partnership ensure both lenders and brokers need never stand still or be stuck in one solution that is inflexible and hard to adapt. We unlock business agility for our clients, along with reducing risk.

Following the previous Court of Appeal ruling on commission disclosure, our innovative portals for lenders and brokers ensured compliance for Haydock Finance with zero disruptions to their operations. These compliance system changes were delivered in record time – just 36 hours. We enabled clear disclosure documentation to be sent to customers with one click, seamless integration into existing processes, and, as mentioned, no operational disruptions.

There’s an understandable scepticism among brokers currently about AI. For all the hype and bluster, it may not always be clear how AI is positively impacting the broker or borrower experience. For many, it may feel like quite the opposite.

Indeed, a recent survey of Allica’s broker panel revealed that over half of commercial mortgage and bridging brokers feel that technology, including AI, has either had no notable impact or even had a negative impact on the speed or efficiency of processing applications.

With 51% reporting a positive experience, asset finance brokers appear to have had a slightly better experience of technology’s impact, but this was still only a narrow majority.

I can understand this scepticism. When it comes to interacting with banks, many people’s practical experiences of AI don’t extend beyond a rather frustrating chatbot whose only mission seems to be to stand between you and someone who can actually help.

But at banks like Allica, there is in fact a quiet transformation taking place behind the scenes, which warrants unpacking.

I often hear stories about banks cutting down on the human element of their service as they look to reduce overheads. This is often because their people are the simplest cost to cut, as their legacy back office is simply too embedded to change.

At Allica, we do things the other way around. We understand how much brokers and businesses value a real person interaction.

So, we have remained committed to giving our brokers the real human support of their business development manager. And instead, we invest heavily in automating everything that sits behind that human interaction. Making our people more effective, decisions faster, and providing a smoother experience overall for the broker and their client.

The saying goes that: “If it has ‘AI’ in the name, it’s probably not real AI. Real AI is the stuff you don’t notice.”

And this is exactly my experience here at Allica. Our market-leading tech team has implemented AI tools into our processes in ways that may not be apparent to the end user – our broker community and their clients – but are transforming the overall experience. I’ll outline a few ways that’s already happening at Allica now.

Our current commercial mortgage application processing time is around just two days, while asset finance is four hours. Far beyond the industry average. Turnaround times like this help our brokers meet tight deadlines and service clients promptly.

We understand how much brokers and businesses value a real person interaction

From automating decisions, to speeding up underwriting, to improved communication and greater transparency, AI means commercial finance will be a different beast just a few years from now

AI is a big reason for this efficiency. Our underwriters use AI to read documents and process unstructured data, cutting down processing times by as much as 75%. This then means we have more time to spend assessing the nuanced risks in an application and better tailor our offers to your clients.

Preventing ‘ping-pong’ applications

We’re working on an AI system that checks applications when they’re submitted in real-time for missing information. This will alert the broker instantly about what we need, saving a back and forth with our team, and streamlining the process overall.

decisions (to a point)

Our automated decisioning for asset finance is one of the clearest examples I can give of AI improving service delivery.

Our machine learning system assesses applications in real-time, automatically approving, referring or declining them based on creditworthiness, affordability and policy. This means that decisions that previously took 24 hours have become just one minute, giving welcome certainty to brokers and their clients as quickly as we can. After all, a fast no is always more helpful than a long maybe.

Importantly, we only automate decisions where it’s black and white. Anything nuanced still goes to a real underwriter. We also only currently run this system on relatively low value assets (<£50,000). We expect to roll this out to six- or seven-figure applications after further testing and fine-tuning.

In a world where many banks are putting up technological barriers between them and their brokers and customers, Allica is doing things the other way around.

The possibilities for transforming the lending experience – and supporting an even greater number of businesses as a result –go far beyond my imagination. From automating decisions, to speeding up underwriting, to improved communication and greater transparency, AI means commercial finance will be a different beast just a few years from now. And I am delighted that, as the UK’s fastest-growing fintech, Allica is at the vanguard of this movement.

But I know that whatever avenues Allica does go down, the human relationship that we know our brokers value will always be a core component.

Picking the right season, not just the right seed

Kieran Jones Head of Communications & Advocacy NACFB

FIn a market that prizes speed, the ability to slow down at the right moments is what makes you fast overall

armers don’t harvest because they own a combine. They harvest because the crop is ready. Try a week too soon and you leave yield in the field. Leave it too long and wind, rain, or pests do the damage for you. In a sense, commercial borrowing works the same way. The tools matter, but timing decides the outcome. In the post-pandemic market, where rates are higher and for many cash buffers are thinner, the brokers who win are the ones who read the season, not just the product sheet. They are the ones that help clients avoid a ‘now or never’ mentality, prepare for ‘not yet’ and move at the moment when debt genuinely supports progress rather than smothering it.

The headline numbers tell you why this matters. The UK now counts more than 5.6 million registered businesses, with record new formations in 2023 and again in 2024. Challenger banks and fintechs have widened routes to capital. Yet approvals for day-to-day finance still trail pre-2020 levels. That gap, is in large part, down to readiness. It shows up when directors ask for speed whilst their filings are late, when bank statements broadcast strain, when personal credit jars with the business case, or when a startup wants a facility before it can show a steady pulse in the numbers. Sometimes it takes discipline and longer term thinking as an intermediary to work with a customer and help them on their journey to readiness. The easy route can be to follow the path of least resistance and offer a quick fix, but

if that fix doesn’t meet the real needs of the customer or creates unnecessary strain on the business then trust in the intermediary is eroded. The very best brokers build solid solution-based relationships as opposed to unstable loan stacks.

So,

Readiness is not just a buzzword. In essence, it’s the alignment of three things at a point in time: a clear purpose for the money, numbers that prove the business can carry the debt, and people whose conduct supports the story. Purpose stops you selling a fast fix to a slow problem. Numbers – in filed accounts, clean bank statements, stable gross margin, believable forecasts –turn hope into evidence. The personal element, including the director’s own credit, now carries greater weight than many owners expect. Lenders price behaviour because it predicts resilience when trading gets choppy.

Readiness is also not the same as access. A firm can find offers and still not be ready to accept one without regret three months later. It is also not a moral judgement on a founder or a team. It’s a judgement on today and that distinction matters. Owners who hear ‘not yet’ with a clearly defined solution and pathway return. Owners who hear a vague ‘no’ often disappear and join the ranks of permanent non-borrowers.

Many brokers see a version of the same early stage request each week. A new retailer or online brand feels the tug of demand and wants inventory finance three months after launch. The story is encouraging, but the evidence is thin. There’s no pattern across seasons. The director’s personal file may be thin rather than bad, which still trips risk appetite. A facility at this point is likely to be expensive and brittle. It turns a promising business into a borrower who checks the bank app every hour and sleeps with a knot in their stomach. Step back and six to nine months of clean trading, on-time filings, direct debits that prevent missed payments, and a simple cash rhythm transform the same request. Suddenly a revolving line mapped to receivables makes sense. Same business. Same lender universe. Just a different season.

The same early mistake shows up in sectors with lumpy revenue too. Contractors reach for quick cash products to bridge gaps between milestones before they’ve proved how the calendar really flows. A single project delay then collides with daily or weekly repayments. An account that never comes to rest looks risky to every funder who sees it. Here again, the ‘not yet’ discipline buys

time to match tenor to cycle and to build acceptance gates for new work that protect margin. The eventual facility is cheaper and less stressful because it fits how cash actually arrives.

At the other end of the scale, you’re likely to meet businesses that wait until pressure is obvious, then ask for a single injection to reset. Maybe trading has been slow, and they have wages to pay or a one-off payment to a supplier becomes due. There are many fast, friction free options available to receive a short-term cash injection which when used correctly can be just the help that’s needed. However, too often these options are not thought through, are more expensive than expected and can end up acting like a tourniquet. It stops the bleeding, then starves the limb. Serviceability becomes challenging and what was a short-term fix turns into a long-term problem. Such a problem is compounded when similar solutions are sought to ease serviceability. The loans stack up, leverage increases, and growth is stifled.

This is where brokers have a responsibility to truly understand their customers’ business and financing needs. Where understanding the investment plans, the working capital cycle and the seasonality of the business can help recommend the most appropriate debt structure. Often restructuring pre-existing loans into more appropriate debt solutions, reducing serviceability burdens and creating a strong long-term foundation for growth.

None of this pays off if brokers act like a product rep. Finance professionals right across the NACFB membership sit in the only seat that sees both the owner’s ambition and the lender caution. Use this position of privilege wisely. Guide your customer through the various stages of financial maturity and the associated debt solutions that become available at each

Owners who experience a thoughtful ‘not yet’ with dates, milestones, and a review point come back

stage. Help them tell their story in a way that is both compelling and transparent to a lender.

Taking this relationship-based long-term approach creates real equity with and for customers and lenders alike. Owners who experience a thoughtful ‘not yet’ with dates, milestones, and a review point come back. Lenders who meet you through files that are clean and stories that are honest remember you. Reciprocity grows. Your pipeline improves because referrals track toward prepared businesses. Your reputation with credit teams strengthens because you don’t flood them with noise. In a market that prizes speed, the ability to slow down at the right moments is what makes you fast overall.

Reading the file like a lender

Journalists talk about ‘writing to length’, brokers need ‘reading to risk’. The file tells you if the season is right in plain cues. On-time filings signal discipline. Bank statements show the heart rate: credits, seasonality, concentration risk, rejected payments. Management accounts show whether margin holds when volumes change. Forecasts matter only if they tether to the drivers you can point at – orders, recurring revenue, confirmed contracts, or footfall that justifies a staffing plan.

Then there’s the director’s personal file. Treat it as a business variable, not a private footnote. Small changes – clearing minor balances, fixing outdated addresses, putting all regular bills on direct debit can all help. Owners rarely know that. You do. Tell them, give them a checklist, and set a date to review. You are not being paternalistic. You are closing the loop between behaviour and price.

Timing, shown not told

Real names aren’t needed to make the point, but brokers encounter examples of this tension frequently. Consider this, a young brand with strong engagement but little trading history wants a cash boost for stock. The early offer is costly and unforgiving. You decline with a plan: live bookkeeping, monthly management accounts, a minimum of two clean quarters, and a target date. When you revisit, the facility size is smaller than the original dream but fits the rhythm of receivables and costs less. Timing, not access, changed the answer.

A hospitality group carries legacy support debt and short-term advances stacked during a bad winter. Cash cover fails under a modest stress. Rather than add another layer, you rebuild the weekly cash routine, negotiate with the two biggest creditors, and close during loss-making hours. Ninety days later, the cover

test passes, and a more suitable debt structure that matches the needs of the business cycle can be put in place. The products existed on both days, but the readiness did not.

A contractor leans on quick cash to bridge between milestones and ends up with three repayments a week. You map the debt stack, match tenor to cycle, and add go/no-go rules for low-margin work. A single facility replaces three, the account calms, and the lender relationship becomes a conversation rather than a fire drill. Same tools. Different sequence.

These are timing stories, and they prove an unfashionable point: saying ‘no, not yet’ can be the most commercial thing you do.

If doing the right thing at the right time is going to be the competitive differentiator moving forward you need to make sure you build purpose, affordability and behaviour – the three pillars of readiness – into your firm’s DNA. Do your diligence, understand the business, think what will help now, tomorrow and in the future. Build trust and a lasting relationship. Help your customer pull together the right evidence to support a credit request and start to build that trust with the lenders. After a decline, write a short memo that explains the why, the what next, and the when. Diary the review before you hang up. Then measure what matters. Track how many warm declines return within six months and fund on better terms. Track time-to-yes for prepared files versus rushed files. Share those numbers in your team. Culture follows metrics.

The payoff is practical. Conversations improve. Files move faster. Your team spends less time firefighting and more time guiding. Clients notice and so will lenders, your brokerage will become known not for the size of your database but for the quality of your delivery.

Brokers don’t control all the variables, but they can help guide customers through their path to readiness and beyond. The job isn’t finding the quick fix its more about finding the right solution at the right time and having the confidence to wait and prepare rather than rush and fail. Too early and debt outruns the evidence. Too late and it turns into a tourniquet. Choose the right moment and debt works as a lever. Serve the client and the lender, and you earn repeat business and faster decisions.

That is the harder path to take, a trickier long game. Readiness is a broker’s craft. Timing is your edge. Use both to turn good firms into resilient borrowers, short calls into lasting partnerships, and one completion into a client for years.

Andre Parcian Head of Business Development (Midlands and Wales) Redwood Bank

Specialist lending is still sometimes seen as the place where unusual or difficult deals end up. In reality, what brokers are handling day-to-day shows that these so-called ‘specialist’ scenarios are widespread. Clients with property transfers into companies or trusts or plans to expand through HMOs (houses of multiple occupation) and mixed-use properties are no longer exceptions. They’re becoming a significant part of mainstream business.

Human underwriters can weigh up context, apply judgement and speak directly with brokers about the nuances of a case

That shift means specialist lending isn’t a side-line. It’s a core part of the lending landscape. Take a look at the types of clients brokers are dealing with today. Yes, there are still plenty of ‘vanilla’ cases – straightforward buy-to-lets or commercial loans with clean credit histories. But there’s also been a steady rise in cases that don’t line up neatly with standard criteria.

Examples include landlords transferring properties into limited companies for tax efficiency or trusts being used as part of succession. I’ve also seen people in mid-life careers – teachers, doctors, civil servants – stepping away from their day jobs to build property portfolios instead. None of these scenarios are unusual anymore. But they do create challenges for lenders who rely solely on rigid, rules-based systems.

Mainstream banks absolutely still play an important role. If a client ticks every box, they can often provide the cheapest and quickest solution. But when those boxes aren’t ticked, the high street can be unforgiving.

That’s where specialist lending comes in. What defines this part of the market isn’t a willingness to take reckless risks, but rather an ability to look at cases in the round. Borrower experience, structure and long-term viability often matter as much as a single number on a spreadsheet. For brokers, having that option can be the difference between progressing a deal or seeing it collapse.

One of the distinguishing features of specialist lending is the role of manual underwriting. Some might see that as old-fashioned in today’s world of technology, but in practice it’s often the best way to deal with real-world complexity.

Automated systems are efficient, but they struggle when a case involves moving properties between entities, managing the credit worthiness of multiple applicants or when the asset involved is a large HMO or semi-commercial unit. Human underwriters can weigh up context, apply judgement and speak directly with brokers about the nuances of a case.

That dialogue is hugely valuable. It means brokers aren’t just submitting an application into a black box – they’re part of a conversation.

The specialist sector has also been adjusting to today’s affordability challenges. Across the market, changes to how affordability is assessed have opened the door to deals that might previously have stalled. In some cases, targeted adjustments to cost deductions and the option of higher fee structures for lower interest rates have allowed landlords, particularly those with HMOs and semi-commercial properties, to achieve higher loan-to-value ratios than before. In practice, this can mean a refinancing case releases tens of thousands more in available borrowing, or that a portfolio expansion which looked impossible suddenly becomes viable.

Keeping on top of these shifts can unlock opportunities for clients at a time when margins are tight and yields are under pressure.

Specialist doesn’t mean slow

One misconception that persists is the idea that specialist lenders will take any deal, at any risk, for the right price. A poor-quality case won’t cut the mustard with any lender. All lenders, including specialists, must have robust credit policies. What changes with a specialist is the willingness to look beyond rigid thresholds, the opportunity to have a conversation about the case and to consider the bigger picture.

This is where a broker’s role is vital. The better a deal is articulated, the easier it is for underwriters to make balanced decisions. In that sense, specialist lending is not a shortcut; it’s a partnership.

It’s also important to stress that specialist doesn’t mean slow. Lenders in this space are investing in technology to accelerate early-stage checks and give brokers faster clarity. More sophisticated credit referencing tools, for example, can flag potential hurdles at the very start, saving wasted effort.

Looking ahead, I expect technology to become even more embedded. AI will no doubt streamline parts of the process. But I don’t see human judgement disappearing. If anything, as cases become more complex, the combination of efficient tech and experienced underwriters will be even more critical.

For brokers, the lesson is simple: don’t think of specialist lending as an emergency option. Think of it as part of the core toolkit. Clients today come with diverse backgrounds, ambitions and financial structures. High-street criteria alone can’t cater for that variety. By working closely with specialist lenders, brokers can expand their options, strengthen client relationships and ensure that deals keep moving even when the straightforward route isn’t available.

Understanding the need for fast, and not so fast, bridging finance

Mark Marlow Head of Sales Colenko

Bridging finance has long carried a reputation for speed. Marketed as a swift, flexible alternative to traditional lending, it’s often positioned as the go to solution when time is of the essence. Whether that is for seizing a property auction opportunity, resolving a chain break, or unlocking capital tied up in an asset. But, as the bridging market has matured, so too has its complexity. And for brokers, the reality is this: not all bridging loans are fast.

Today, bridging spans a wide and increasingly nuanced spectrum of products. Some deals still complete in a matter of days. Others, particularly those involving heavy refurbishment, complex corporate structures, or specialist security can take weeks, if not months. The challenge for brokers is clear: how do you manage client expectations in a market where ‘bridging’ no longer guarantees speed?

There’s no doubt that fast bridging still exists and thrives. For the right deal, a straightforward residential purchase with clean title and cooperative vendors, funds can be released in 48 to 72 hours.

In these cases, speed is driven by:

• Simple ownership structures – individual or joint borrowers

• First-charge security on residential or mixed-use property

• Clear exit strategy – such as refinance or resale

• Cooperative third parties – such as vendors, legal teams, valuers

• Experienced borrowers with strong profiles.

As a broker, identifying these opportunities early and working with lenders who specialise in quick completions is key. But they represent just one end of the bridging spectrum.

On the other end are the more complex facilities often described as ‘heavy’ bridging. These may include:

• Development or refurbishment finance – especially where planning permission is involved

• Second-charge or multiple security arrangements

• Corporate borrowers, trusts, or offshore ownership

• Unusual property types or non-standard valuations

• Adverse credit or regulatory concerns.

Heavy bridging resembles structured lending more than the fast-and-flexible solution many clients imagine. Valuations might take a week or more. QS reports, environmental checks or monitoring surveyors may be required. Legal due diligence becomes more involved. Underwriting takes longer, not due to inefficiency, but because the risk profile is fundamentally different.

For brokers, it’s crucial to explain to clients that complexity introduces time. The phrase ‘bridging is fast’ is only true when the deal allows for it.

Several trends have contributed to the diversification of bridging timelines:

• Increased lender competition has led to product innovation, expanding what bridging can cover

• Borrower sophistication has increased – clients are using bridging not just for urgency, but as part of broader investment strategies

• Risk appetite has widened meaning lenders now take on more complex deals that naturally require more due diligence.

In other words, bridging has evolved. It’s no longer a one-size-fits-all emergency loan. It’s a flexible, multi-purpose financial tool, but not always a quick one.

The broker’s role is to navigate this complexity, identifying when bridging can deliver speed and when it demands patience. The more brokers understand about the expanding world of bridging the better equipped they are to pair the right deal with the right lender and to set their clients up for success.

Lancashire Cricket Club at Emirates Old Trafford, Manchester, was brimming with energy on Friday 19th September as it played host to the largest-ever NACFB Commercial Broker Awards.

A record 580 guests from across the industry gathered to celebrate broking excellence, cheering as winners were crowned across 24 coveted categories. This year saw a surge in engagement, with 357 award entries submitted – marking a 22% increase in submissions and a 25% rise in participating NACFB Member firms.

The ceremony was fronted by comedian Jayde Adams, whose sharp wit kept the momentum flowing and the audience entertained. One of the most poignant moments of the afternoon came when Paul Slapa, founder of the NACFB’s 2025 charity partner, The Unbeatable Eva Foundation, shared his deeply personal story. The room was visibly moved, before rallying together for a game of Heads and Tails that raised £4,000 in support of the cause.

Reflecting on his first NACFB Commercial Broker Awards as CEO, Jim Higginbotham said: “These awards not only highlight the very best in broking but also celebrate the firms that are pushing boundaries and helping to shape the future of our industry.

I’m immensely proud that the NACFB sits at the heart of such a thriving community.”

All shortlisted firms, highly commended entries and overall winners were decided upon by combining the insights of an expert judging panel and votes from Patron lenders and Partner suppliers.

The winners and highly commended in each category are:

Asset & Leasing Finance Broker of the Year (1 to 3 brokers)

Winner: Claratus Commercial Finance

Highly commended: Synergi Finance

Sponsor: Ultimate Finance

Asset & Leasing Finance Broker of the Year (4+ brokers)

Winner: Moorgate Finance

Highly commended: Bathgate Business Finance

Sponsor: Haydock Finance

Buy-to-Let Mortgage Broker of the Year (1 to 3 brokers)

Winner: VIBE Finance

Highly commended: Advanced Funding Solutions

Sponsor: Paragon Bank

Buy-to-Let Mortgage Broker of the Year (4+ brokers)

Winner: Aria Finance

Highly commended: SPF Private Finance

Sponsor: Keystone Property Finance

Cashflow Finance Broker of the Year (1 to 3 brokers)

Winner: Synergi Finance

Highly commended: Claratus Commercial Finance

Sponsor: Reward Funding

Cashflow Finance Broker of the Year (4+ brokers)

Winner: Halo Corporate Finance

Highly commended: Leonard Curtis

Sponsor: Funding Circle

Commercial Broker Network of the Year

Winner: Synergy Commercial Finance

Highly commended: Fiducia Commercial Network and Vaughans

Sponsor: YBS Commercial Mortgages

Commercial Mortgage Broker of the Year (1 to 3 brokers)

Winner: Ross

Commercial Finance

Highly commended: Aquilae Capital Advisory

Sponsor: Cambridge & Counties Bank

Commercial Mortgage Broker of the Year (4+ brokers)

Winner: Watts Commercial Finance

Highly commended: Leonard Curtis

Sponsor: Lloyds Bank

Development Finance Broker of the Year (1 to 3 brokers)

Winner: Willow Isle Capital

Highly commended: Positive Commercial Finance

Sponsor: LendInvest

Development Finance Broker of the Year (4+ brokers)

Winner: Real Finance

Highly commended: Arc & Co. Sponsor: LBB

Industry Ambassador of the Year

Winner: Kim McGinley – VIBE Finance

Highly commended: James Murray – James Murrary Finance

Sponsor: HSBC

Industry Specialist of the Year

Winner: Approved Business Finance

Highly commended: Crown Business Finance

Sponsor: Allica Bank

Invoice Finance Broker of the Year (1 to 3 brokers)

Winner: Evolve Business Finance

Highly commended: DMK Finance

Sponsor: HSBC

Invoice Finance Broker of the Year (4+ brokers)

Winner: Leonard Curtis

Highly commended: TSF Finance

Sponsor: Ultimate Finance

Unsung Hero of the Year

Winner: Mickaella Johnson - Tower Leasing

Highly commended: Barbara Curzon

- Watts Commercial Finance

Sponsor: Close Brothers Broker Solutions

Northern Irish Broker of the Year

Winner: RM Commercial Finance

Highly commended: Ross Commercial Finance

Sponsor: NACFB

Scottish Broker of the Year

Winner: Ross Commercial Finance

Highly commended: DMK Finance

Sponsor: Hampshire Trust Bank

Welsh Broker of the Year

Winner: Pure Property Finance

Highly commended: Watts Commercial Finance

Sponsor: Roma Finance

Pioneering Broker of the Year

Winner: Lime Finance Solutions

Highly commended: Clifton Private Finance

Sponsor: NatWest

Rising Star of the Year

Winner: Kevin Calkiewicz – Charles & Dean Finance

Highly commended: George Sanford – VIBE Finance

Sponsor: Shawbrook

Service Excellence

Winner: Watts Commercial Finance

Highly commended: Willow Isle Capital

Sponsor: Aldermore

Short-term Finance Broker of the Year (1 to 3 brokers)

Winner: Advanced Funding Solutions

Highly commended: Plutus Business Finance

Sponsor: Recognise Bank

Short-term Finance Broker of the Year (4+ brokers)

Winner: Arc & Co.

Highly commended: Propp

Sponsor: Market Financial Solutions

We’re one of the UK’s largest independent SME funders and have been providing specialist and adaptable working capital finance for over 40 years. We support businesses with improving cashflow, investing in new equipment or trading internationally through our Invoice Finance, Asset Finance and Foreign Exchange solutions. Awarded NACFB Factoring and Invoice Discounter of the Year 2024, for the second year running, we are a funding partner you and your clients can rely on.

Todd Davison Managing Director Purbeck Insurance Services

The UK Government’s recent investigation into the use of personal guarantees (PGs) for small and medium-sized business loans has brought some clarity about the future of a financing tool that’s often misunderstood by business owners and directors. With a commitment to help businesses better understand PGs, the findings suggest that the benefits outweigh the drawbacks –positioning PGs as a route to finance rather than a barrier.

Our data suggests some businesses are already buying into this message and have become more comfortable in the past year to sign personal guarantees when backed by insurance protection – July 2025 was a record month for us. One notable trend is that in Q2 2025, 16% of loans supported through Purbeck’s Personal Guarantee Insurance were for businesses under two years old – up from just 6% in Q2 2024. The average loan value for these early-stage businesses has also risen sharply, reaching £165,538 in Q2 2025 – a 52.71% increase year-on-year.

But a perception gap about personal guarantees remains. PGs are often seen as a necessary evil to be avoided at all costs, but small businesses must have some ‘skin in the game’ for lenders to take the risk of lending. Without this security there will be no lending. This perception gap is one that commercial brokers are perfectly positioned to fill with their knowledge of the risk mitigation options SMEs have at their disposal.

The recent expansion of the Growth Guarantee Scheme (GGS) is another good move but another opportunity for

misunderstandings when it comes to PGs. We have found that many SMEs mistakenly believe that the government-backed guarantee protects them directly. In reality, the guarantee protects the lender, not the borrower. Business owners are still required to sign personal guarantees for the full extent of the loan and remain liable if the business defaults. It’s vital that business owners understand the implications of signing a personal guarantee. The lender can only claim on the government-backed guarantee after exhausting all avenues –including the personal guarantee – to recover the debt.

Alongside the expansion of the GGS, the Government has announced a new mandatory Code of Conduct for accredited lenders to promote fairness and transparency in the use of PGs. Whether this clears up the common misunderstanding of borrower liability remains to be seen, but it is again an area where NACFB Members can support education and awareness.

Whilst company insolvencies have been falling, Purbeck has noted rising business failures linked to poor acquisition due diligence and the sudden withdrawal of government grants. These trends highlight the importance of risk mitigation when entering PG-backed agreements. Brokers play a vital role in guiding businesses through these complexities. By explaining the pros and cons of PGs and offering solutions like personal guarantee insurance, they can help SMEs pursue growth with confidence.

A perception

Carolyn Asplin Head of Real Estate Lloyds Commercial Banking Intermediaries

The Real Estate Ready Loan is a new lending solution designed for commercial real estate businesses. It reflects our imperative to always listen and act on broker feedback and deliver lending solutions that truly meet what the market needs.

One of the most impactful changes this brings is lowering the minimum loan threshold to £100,000, making our lending proposition more accessible to a wider range of investors.

Whether your clients are expanding their portfolios, or entering the market for the first time, they now have access to interest-only terms – available depending on EPC qualifying criteria – alongside our existing part-amortising and fully-amortising options. This marks the first time these products have been made available at the lower lending threshold and represents an important milestone for brokers seeking tailored solutions for residential-dominant investments.

We’re also matching market standards and paying a 1.5% commission on the loan amount.

While the Real Estate Ready Loan is mainly designed for residential investments, we understand the different needs of today’s property investors. The loan therefore extends to support mixed-use properties and student/HMO accommodations, if at least 70% of the income used to service the loan is derived from residential assets.

This flexibility makes sure our offering stays relevant for clients with diverse portfolios, making it easier to secure financing for properties that blend commercial and residential uses, or for those that cater to the student and shared accommodation markets (our very first sanctioned deal was secured for a mixed-use property – a shop with flats above).

• Interest-only: from 1.15% over base rate (OBR)

• Part-amortising: from 1.28% OBR

• Fully-amortising: from 1.55% OBR

Fixed interest rates are available across all options, and a 2% arrangement fee applies.

Feedback from brokers has been overwhelmingly positive, with the straightforward process, clarity, and efficiency of getting to indicative terms resonating well.

For those clients who end up not meeting the criteria, our business development managers remain on hand to support other opportunities through the usual channels.

To get started with the Real Estate Ready Loan, please contact brokerdirect@lloydsbanking.com and the team can share more details, including a proforma that’s required for all enquiries.

Let’s help your clients make the most of this opportunity.

The UK commercial property market is in a period of change, and with change comes opportunity. For brokers, helping clients navigate shifting demand patterns and regulatory landscapes isn’t just about securing finance; it’s about uncovering hidden value in overlooked or evolving asset classes.

One of the clearest opportunities lies in portfolio diversification. Landlords are increasingly looking beyond traditional buy-to-let models and considering commercial or semi-commercial properties that can offer multiple income streams. A shop with residential flats above, for example, can provide a blend of long-term commercial lease income alongside shorter assured shorthold tenancy (AST) agreements. In some cases, the residential element can be reconfigured into a house of multiple occupation (HMO), maximising yields while spreading risk.

The value doesn’t have to be in the building as it stands today. Change-of-use strategies, such as securing planning permission to convert commercial space into residential, can transform the income profile of an asset. Even where full conversion isn’t the goal, landlords can reposition properties to meet local demand, such as splitting larger retail units into smaller, more affordable spaces for independent occupiers.

Location trends are also shifting in ways that open up new possibilities. Secondary and tertiary high streets, which may once have been overlooked in favour of large retail parks or out-of-town superstores, are enjoying renewed relevance. As hybrid working patterns take root and consumers favour local shopping, demand is rising for well-located ground-floor retail with residential above. This provides a dual benefit for investors: stable commercial tenants serving their community and high-demand residential units in walkable locations.

The office sector is another area where change is creating broker opportunities. While the pandemic prompted a wave of office-to-residential conversions, we’re now seeing a partial

return of demand for high-quality office space as firms encourage teams back into the workplace. This creates a nuanced landscape – in some cases, conversion to residential will still be the optimal route; in others, refurbishing and modernising office stock can deliver strong rental growth.

For brokers, the key is to guide clients through these options with a focus on unlocking untapped potential. That means understanding both the asset’s current income profile and its future possibilities. Financing needs will often extend beyond a straightforward purchase – refurbishment costs, planning applications, and phased redevelopments all require flexible, responsive funding solutions.

At Glenhawk, we’ve seen first-hand how strategic property repositioning can deliver exceptional returns for landlords and developers. The role of the lender is to provide the speed and certainty of funding that allows brokers’ clients to seize opportunities as they arise. Whether that’s acquiring a mixed-use property in an emerging location, converting upper floors into HMOs, or breathing new life into an under-loved high street building.

The UK commercial property market is evolving fast. For borrowers willing to look beyond the obvious, there’s enormous value waiting to be uncovered. The challenge – and the reward –lies in spotting it first.

We’re now seeing a partial return of demand for high-quality office space as firms encourage teams back into the workplace

Gemma Wright

Managing

Director – Sales & Distribution

Reward Funding

Brokers know better than most that no two SME funding journeys are the same. Needs evolve, circumstances change and priorities vary — and often, all of that can happen in the span of a single conversation. Whilst they are aware of this, even the most experienced brokers can turn to familiar lenders, rather than approaching each deal with a new outlook. It can be easy to do so, especially when a client may have an incredibly tight timeline or a complex need.

In fact, findings from the NACFB’s 2024 annual impact report found that a quarter of SMEs who secured funding through a NACFB Member broker ended up with a different product than they first enquired about – proof that initial assumptions often evolve.

We recently had a broker approach us for a straightforward bridging facility, but when we delved into the ‘why’ behind their client’s need, we structured a combined asset and business finance package that unlocked more working capital and provided a longer runway.

This demonstrates the need for brokers to challenge assumptions, take the time to address what their client is truly looking for and consider how a lender might meet those needs. Lenders too, have a duty to ensure that brokers have a clear understanding of their products and processes – including when things change – and in turn, take care to understand the needs of the broker. When these factors are in play, lenders can act decisively, shape the right facility fast and be comfortable that the best outcome is born for both the broker and the client.

By pigeonholing a lender into a narrow category, maybe thinking ‘they only do bridging deals’, or ‘they are just focused on asset finance’, brokers risk missing the nuances that make all the

difference to SMEs when picking out the right lender for the job. Lenders are constantly evolving and diversifying their offerings to reflect an increasingly complex landscape, so what a broker knew 12 months ago when they last approached the lender could be completely different to the current reality.

So how can brokers keep lending solutions dynamic?

The main answer here is to ask clients more questions. Go further than simply asking what they want the loan for. Yes, they may have cash flow issues or growth plans. But then look at the ‘why’. Why now, why those specific aims, why did the issues come about? More often than not, by looking beyond the ‘what’, brokers can open up a lot more solutions.

Alongside this, it is important that brokers revisit their understanding of lenders’ offerings on a regular basis. Taking the time to reconnect with the various lenders and familiarising themselves with current products, processes and services will pay dividends. Brokers may be surprised with what has changed in a relatively short time, especially in the fast, flexible funding space we work in.

Ultimately, a broker’s value lies in more than just sourcing the funding for a client. It is about understanding the landscape, seeing where flexibility lies and challenging initial assumptions. So, if you’re a broker and you want to keep your options wide and your client’s ambitions front and centre, we always recommend that you pick up the phone to a lender before you pick the product.

More often than not, by looking beyond the ‘what’, brokers can open up a lot more solutions

A look at market drivers, risks, and lending solutions

Marc Callaghan Head of Specialist Finance OSB Group

The owner occupier sector is going from strength to strength. According to CoStar data, in Q1 2025, the total volume of commercial property acquired for owner occupation in the UK was £2.8 billion, a significant portion of the overall £8.9 billion invested in UK commercial real estate.

On June 23rd 2025, the UK Government published its 10-year Modern Industrial Strategy aiming to boost business investment and growth in key high-growth potential areas such as advanced manufacturing, digital and technology.

If this is to be successful, then SMEs within owner occupied industrial/ warehouses and offices may need to be the driving force behind it.

June 2025 also heralded the Government’s 10-Year UK Infrastructure Strategy. With £1.35 billion of public funding now available, businesses are gaining confidence; industrial occupational demand improved by 10% during Q2 2025, and it’s hoped that this trend will continue.

Office investment also gained momentum in 2025. The sector accounted for the highest share of UK transaction volumes in H1, at 21%, according to CBRE.

Industry data from CoStar suggests that UK office take-up has risen to a three-year high and the UK office vacancy rate has stabilised (data from Avison Young), helped by a 10-year low in office construction.

In particular, the UK ‘Big Nine’ regional office cities outside of London (Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds, Liverpool, Manchester and Newcastle) has seen collective take-up reach 3.7m sq ft, as highlighted by Avison Young, 6% ahead of the 10-year average.

Driven by a lack of Grade-A space in city centres, occupiers are increasingly looking out of town. Six of the 10 largest deals in H1 2025 were outside the city centre, compared with 2024 where all top 10 deals took place in city centre locations, according to Cushman & Wakefield.

With a limited construction pipeline, Cushman & Wakefield also notes, that this could place upward pressure on rents, enhancing returns and unlocking further investment activity. Improving retail sales could also be aiding retailer performance with average weekly volumes 2.3% higher during Q2 2025 compared with last year.

The owner occupier market continues to face several challenges, including economic uncertainties such as inflation and rising interest rates, which impact affordability and borrowing costs.