Guide to Giving

Welcome

Welcome to New Canaan Country School, where an active, joyful learning environment is at the heart of all we do. Thank you for choosing to be part of our NCCS community. Your family’s involvement — through participation, volunteering, and philanthropy — strengthens our community and models the values we instill in our students.

A Community of Support

Philanthropy at NCCS is rooted in our commitment to our mission: We create an active, joyful learning environment where children are challenged to think deeply, question confidently, and act generously so that they may lead lives of impact and purpose.

Like most independent schools, tuition alone does not cover the full cost of educating each child. Our sole sources of income are tuition, charitable giving, income from invested reserves, and proceeds from special activities and events, so we must raise additional funds beyond tuition to balance the budget and ensure our financial stability.

This guide highlights the importance of the Annual Fund and underscores the significant impact that all contributions have on our students’ educational experiences. I welcome you to be in touch with our Advancement Team to discuss further.

Aaron Cooper, Head of School

Annual Fund

The Annual Fund is our top philanthropic priority and the primary way community members — parents, alumni, grandparents, faculty, staff, and friends — support and enhance everyday operations at NCCS each year.

Annual Fund gifts help keep tuition increases modest while enriching every aspect of a Country School education, including: innovative teaching, engaging curriculum, financial aid, faculty development, arts, athletics, financial sustainability, technology, and campus maintenance.

Each contribution, whether $50 or $50,000, is used where needed most each fiscal year — between July 1 and June 30. Early participation in the fall or on Giving Day provides critical momentum, helping us plan effectively and confidently throughout the year.

Our Annual Fund helps close the $7,500 per-student gap between tuition income and the actual cost of an NCCS education.

Funding the Cost of a Country

School Education

Leadership Giving Circles

Alumni Leadership Giving Circles Alumni Leadership Circle: $1,000 and

and up

Beyond the Annual Fund

While the Annual Fund supports our operating expenses, capital campaign, endowment, and planned or legacy gifts support specific initiatives or projects that accomplish our school’s long-term strategic goals.

Capital Campaign

NCCS, like most independent schools, relies on capital campaigns and major gift fundraising to build new facilities, renovate existing spaces, and purchase additional land or properties for faculty housing. The Board of Trustees votes to initiate a capital campaign, and members of the community are asked to support the effort. Capital campaign gifts are often multi-year commitments, and pledges may be paid over three to five years.

The Boldly Forward capital campaign, which concluded in 2022, raised $25 million, funding the Susan Haigh Carver ’51 Dining Hall and Commons, as well as the Athletics and Wellness Center.

We are now in the beginning stages of our next campaign, which will enhance our outdoor learning spaces and significantly grow our endowment. Gifts to both the Annual Fund and strategic initiatives over the next five years will support this comprehensive campaign, and the entire community will be invited to be part of this exciting collective investment in our school’s future.

Scan for the latest about our Capital Campaign.

Endowment

Country School’s endowment is a significant investment portfolio that helps ensure our long-term financial strength and supports our mission for generations to come. Much like a savings account for the future, it generates annual income while the principal remains intact in perpetuity, providing a stable source of funding year after year.

As of June 30, 2025, the school’s endowment totaled $65.3 million, with more than 50 funds supporting a range of priorities across school life.

Consistent with peer schools, Country School draws approximately four percent annually from the endowment to support operating expenses in alignment with each fund’s purpose. This thoughtful approach allows the school to sustain excellence in programming, launch strategic initiatives, and respond to challenges with flexibility and confidence.

Newly endowed funds may be established with a gift of $100,000 or more, and are often structured as a multi-year pledge. Donors may also direct gifts of any amount to existing funds that reflect their interests and the school’s evolving needs.

Scan to see the full list of Endowed Funds.

Planned Giving

In 1996, the Board of Trustees established the Welles Society, named after the school’s first Headmaster, Henry H. Welles, to recognize and honor those individuals — more than 65 to date — who have made special provisions in their estate plans to support the school.

Planned gifts, also known as legacy gifts, are often deferred and might include naming the school as a beneficiary in your will. This form of giving can offer donors significant tax and income benefits while ensuring a vibrant future for NCCS.

Albert Perry Scholarship Fund

Over the last two years, Country School received three planned gifts totaling nearly $5 million.

Scan to learn more about Planned Giving.

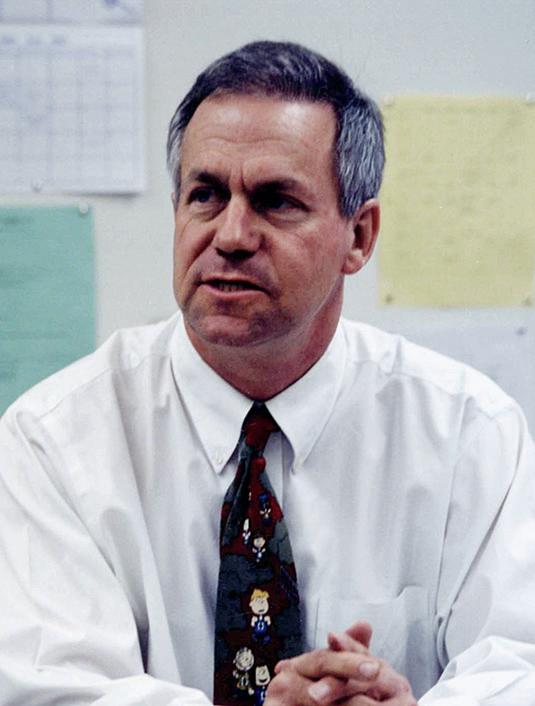

“Mr P” started his teaching career at NCCS in 1982 and taught in the Upper School for 21 years before retiring in 2003. In 2022, he established the Albert Perry Scholarship Fund to expand access to NCCS for students who could not otherwise attend. Since then, more than 100 members of our community have supported the fund in his honor.

Scan to read more about Mr. P, his generosity, and his lead gift totalling $3 million from his estate to our new campaign.

Giving FAQs

Why should I give to the Annual Fund?

The Annual Fund is essential to our daily operations, supporting faculty, curriculum, financial aid, arts, athletics, and more. Your gift helps bridge the gap between tuition and the actual cost of an NCCS education. Gifts to the Annual Fund are 100% tax-deductible.

How much should I give?

Every gift matters. We ask all families to make NCCS a philanthropic priority and give at a level that is personally significant and best matches your capacity to give. The average annual fund gift from school families is $4,000, and leadership giving starts at $7,500, the per-student gap between tuition income and the true cost of an NCCS education.

Why not raise tuition to cover 100% of the operating budget?

Keeping tuition lower than the full cost of education allows independent schools to remain accessible to a broader range of families. Philanthropy helps us maintain excellence without placing the full burden on tuition.

Does my gift make a difference?

Yes! Every contribution, no matter the size, directly impacts your child, their classmates, and every teacher. Collectively, your gifts fund the experiences that define a Country School education.

Do gifts to Horizons support NCCS?

Since its founding in 1964, Horizons has been an integral and special part of NCCS. Because of its unique mission, Horizons fundraises for its operating budget separately, and gifts to Horizons do not count towards the NCCS Annual Fund.

Ways to Give

Whether you are considering your first gift or looking to deepen your impact, we are here to help you find ways to give that fit your needs.

• Gifts Online: Use major credit cards, Apple Pay, PayPal, or Venmo.

• Gifts by Check: Checks payable to New Canaan Country School may be mailed to:

New Canaan Country School 635 Frogtown Road

New Canaan, CT 06840

• Gifts of Securities: Please alert a member of the Advancement Team in advance of making a gift of DTC-eligible stock or securities, and use the following contact information for the transfer.

Bank name: Oppenheimer & Co. Inc.

DTC Number: 0571

Credit Account: G42-0024262 New Canaan Country School, Inc.

Phone: (203) 975-2006

• Wire Transfers: To electronically transfer funds, please contact our team for wire instructions.

• Donor-Advised Funds (DAF): Support NCCS and receive favorable tax benefits by donating via a DAF. To learn more about DAFs, please visit our website.

• Matching Gifts: Company matching can double your gift to NCCS. Please visit our website under Ways to Give for our matching gift database. Our Tax ID Number is 06-0646765.

Our Advancement Team

We look forward to speaking with you.

Holly Donaldson Casella ’04 Director of Advancement (203) 801-5687 • hcasella@countryschool.net

Diane Briggs Associate Director of Advancement & Director of Annual Giving (203) 801-5619 • dbriggs@countryschool.net

Lexi Cimmino Director of Alumni Affairs & Advancement Events (203) 801-5633 • lcimmino@countryschool.net

Nanette Gantz Advancement Database Administrator (203) 801-5600 • ngantz@countryschool.net

Alissa Golden Director of Campaign Stewardship & Planned Giving (203) 801-5695 • agolden@countryschool.net

Brooke Cavanaugh Reed ’01 Advancement & Alumni Associate (203) 801-5637 • breed@countryschool.net

635 Frogtown Road New Canaan, CT 06840 (203) 801-5600 countryschool.net/give

Scan or visit our website to make a gift today!