OAKWORTH CApITAL BANK.

After the largest capital raise in Alabama’s history at the time, we officially opened our doors to thepubliconMarch31,2008.Overtheyears,ourreputationhassteadilygrownasweaimtoset the standard for safety and soundness. In 2016, we expanded our markets in Alabama, adding a South Alabama office in Mobile. In 2020, we expanded to the state ofTennessee, opening a MiddleTennesseeofficeinBrentwood.Andmostrecently,in2023,weopenedourdoorsinthe CentralCarolinas.

In November 2022, Oakworth began trading on the OTCQX Best Market under the trading symbolOAKC,enablingamoreelevatedtradingexperienceforourshareholders.Allmanaging directorsandthemajorityofourassociatesdirectlyownsharesofthecompany.Webelievethis instillsastrongbusiness-ownermentalitythroughoutthecompany.

In addition to your client team, our bank’s leadership team consists of experienced and wellversedindividuals,allowingustoofferawiderangeofCommercialandPrivateBanking, Wealth ManagementandAdvisoryServices.Ourcorevaluesandoverallmissionarebuildingblocksfor thelong-termsuccessofourclients,associates,shareholdersandcommunities.

Learn more about our team in South Alabama: https://oakworth.com/our-team/mobile-office/

OurclientsconsistentlysharethatwhatmakesOakworth unique is our people, the high level of personalized service, and the fact that we consistently aim to make our clients’ financial lives easier. Many organizations have great people, but our professionals aim to organize around the client with the express purpose of providing consistent and distinctive service. South Alabama is a vibrant, thriving market and we enjoy being able to extend that level of service here and continuetohelppeoplesucceed.Ourgoalistobecome an iconic brand in financial services, set apart by our client-centeredapproach.

As we grow throughout our markets, we look for great leaders and associates who believe in our core purpose and share our core values (Golden Rule, Character, Innovative & Creative Spirit, Professionalism and Work Ethic).Next,welook at a few fundamental characteristics within markets: critical mass for our targeted approach; markets that are receptive to our approach; markets that are dominated by larger super-regional and regional financial institutionsandmarketswithlike-minded talent andcompanies.Wecontinuetofindallofthese elementsforsuccessinSouthAlabama!

One of Oakworth’s core values is Innovative & CreativeSpirit. South Alabama embodies a spirit that fuels its dynamic growth and economic success. This market is home to industry leaders in aerospace, maritime, healthcare, logistics & transportation, technology and other commercial enterprises. We are confident our approach to providing expertise and capital will support growth for professionals, business owners and their families and contribute to the continued overall success in SouthAlabama.

ScottB.Reed Chief Executive Officer & Chairman of the Board

This group of talented professionals has demonstrated leadership in the business community and have a vested interest in helping their communities, businesses and families succeed. They represent a multitude of industries and exemplify our core purpose and values.

Thomas Benton

President

Marine and Industrial Supply

Patrick Chapman President

Gulf Coast Organics, Inc.

Michael Delaney Partner

Delaney Property Group

Peter D’Olive President Felder Services, LLC

Stephen J. Hand

U.S. Army Corps of Engineers Owner, Hand Enterprises

Sandy Myers Managing Director & Owner ASF, Inc.

Mike Rogers President Rogers & Willard, Inc.

Jonathan Rudolph Owner & President

Rudolph Development Group, Inc.

Marietta Urquhart

Commercial Real Estate Agent

White-Spunner Realty, Inc.

Tal Vickers

President & Dealer Principal Springhill Automotive Group

Dr. Charles Wilson

Orthopaedic Surgery Specialist

The Orthopaedic Group

Fully versed in the financial complexities of personal, commercial, industrial and professional businesses, our Client Advisors are prepared to deliver our services with an unwavering desire to exceed expectations. We first meet with you to understand your unique needs and goals for the future, and then coordinate a multidisciplinary team of financial professionals to create a tailored strategy. We understand that personal assets are often inextricably intertwined with business assets. By bringing our substantial experience to bear, we offer unique integrated solutions to manage both corporate and personal financial growth.

Deposit Services

Commercial

• Checking

• Money Market

• Savings

• Certificate of Deposit

Personal

• Checking

• Money Market

• Savings

• Ind ividual Retirement

• Certificate of Deposit

• Mobile Deposit

• Mobile Wallet

• SecurLOCK Equip Mobile App

Commercial

• Working Capital Lines of Credit

• SBA Lending

• Equipment Financing and Leasing

• Ow ner-Occupied Real Estate

• Investment Property Personal

• Lines of Credit

• Home Equity Lines/Loans

• Construction Loans

• Margin Loans/Lines

• Zelle Lending Services

Treasury Management

• Sweep Accounts

• Online Banking/Bill Payment

• Debit Cards

• ACH/Direct Deposit

• Zero-Balance Accounts

• Positive Pay

• Wire Services

• Remote Deposit

• Travel Cards

• Gift Cards

• Lock Box Services

• Corporate Credit Cards

Complex financial situations often require sophisticated solutions. Our hallmark is taking both a broad view and a deep dive to help manage wealth and trust needs today— and for generations to come.

Our experienced staff of fiduciary professionals provides comprehensive trust and estate administration services. These can include: assisting with generational wealth transfers, providing invoice management strategies, coordinating the activities of other trusted advisors, overseeing governing documents, managing unique assets, and a host of other services we designed to make your financial life easier.

• Full discretionary trustee services

• Directed trust services

• Investment Management

• Oversight of governing documents

• Invoice management strategies

• Asset preservation for future generations

• Fiduciary tax return filing

• Cl ient advisor coordination

• Real estate management held in trust

• Overseeing probate and will administration

• Valuing and collecting estate assets

• Mana ging jointly held property, life insurance, and retirement accounts

• Paying debts, funeral costs, and taxes

• Hand ling income, estate, and capital gains tax matters

• Preparing and filing estate tax returns with post-mortem planning

• Coordinating with accountants on final and fiduciary tax returns

• Preparing detailed estate and fiduciary accounting

• Transferring assets to beneficiaries

• Executing complex estate plans

• Providing tax details to beneficiaries

• Timberland

• Mineral interests

• Closely held businesses

• LLCs

• Commercial property

Managing both the broad view and the complexities of your wealth management needs is our hallmark. Our holistic approach allows us to manage assets not just for today, but for generations.

We aim to address your evolving wealth needs by offering tailored solutions, a comprehensive view of your financial landscape and advanced digital tools. Our goal is to enhance the client experience and help you achieve your financial goals. Oakworth Asset Management offers a comprehensive range of financial planning services – from wealth management and retirement planning to philanthropic strategies, risk assessment and generational planning.

We take a personalized approach to financial planning; our goal is to help you navigate the intricacies of the marketplace, investment opportunities and wealth management.

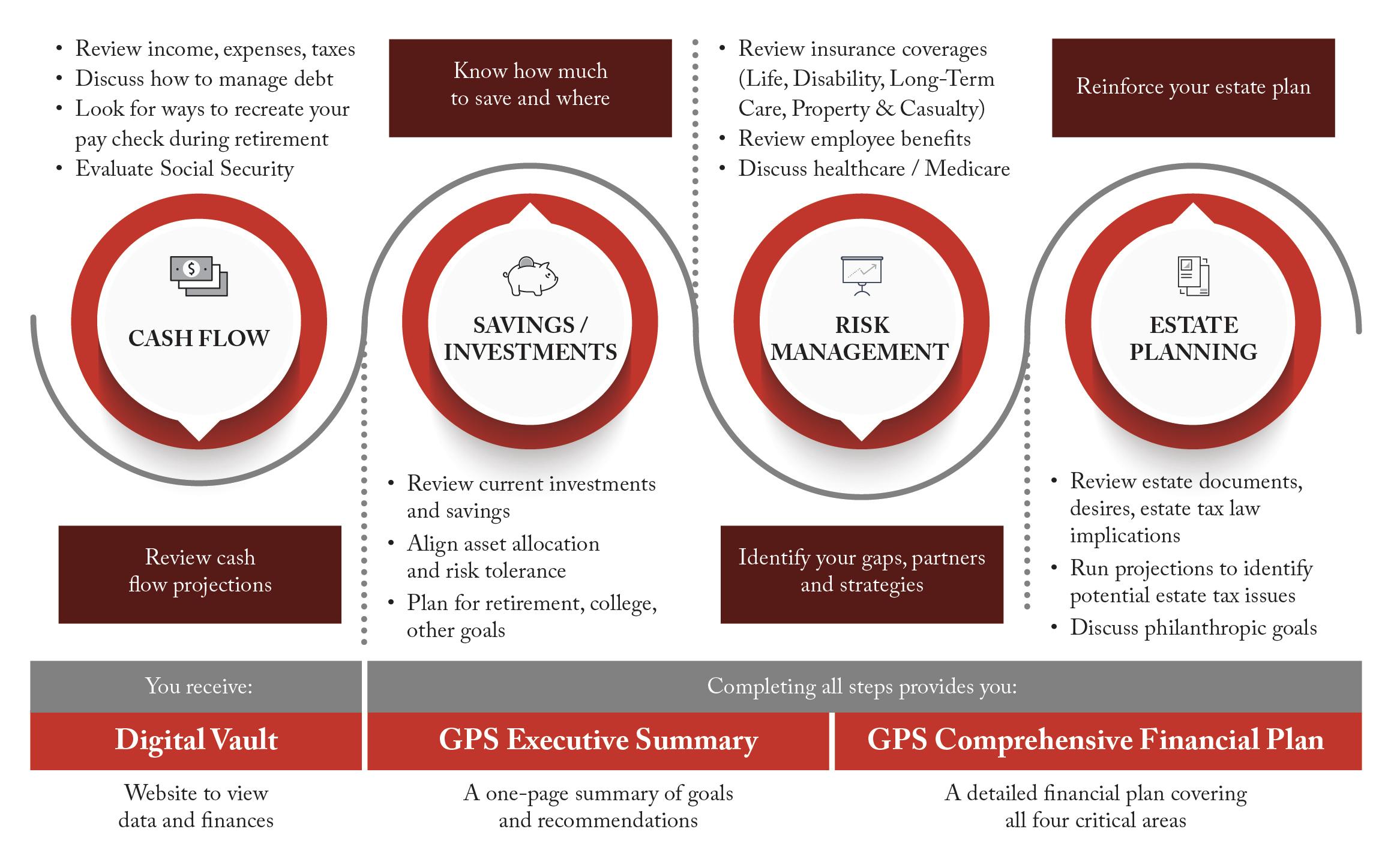

There are critical issues that determine our clients financial success. By building a customized wealth management strategy around your unique needs, we are positioned to effectively address these issues. Together, we will help you achieve financial security by growing and protecting your wealth, making a positive impact and planning for the future. Guided Planning Solutions Estate Planning

Build Your Financial Foundation

GPS is well-positioned to navigate the journey ahead with an organized planning strategy focused on four critical areas:

We believe the most critical decision in investing is asset allocation—specifically, how much to invest in stocks versus other assets. Historically, stocks perform well when the economy grows. As such, our investment strategy hinges on our macroeconomic forecast. To guide our approach, we evaluate economic direction, key sectors and the outlook for corporate profitability. Since economic downturns typically follow financial panics, which are rare, we generally maintain a market-weight or overweight in stocks relative to fixed income, assuming all other factors remain equal.

the

$1.8$2.4

unaudited, as of June 30, 2025

We have a vision to become the iconic brand in financial services. When comparing ourselves to iconic brands such as Ritz Carlton, Starbucks and Chick-Fil-A, we compare favorably in client service.

We believe communication is the key to successful client relationships. While sharing useful information is beneficial, regardless of source, we believe in the value proposition of developing and having our own experts and ideas. By generating our own market commentaries, economic newsletters, topical subject analysis and serials, and even conversational podcasts and videos, our clients know we are using our knowledge, creativity and expertise to help them succeed.

Scan our QR code for all of our content or to subscribe to our publications.

In this weekly podcast, Chief Economist John Norris and Portfolio Manager Sam Clement exchange perspectives on the driving factors influencing our economy. Trading Perspectives can be found on Apple Podcasts, Spotify, Google Play, YouTube, and all other major podcast outlets.

Started over 20 years ago, Common Cents is a weekly blog written by Chief Economist John Norris detailing and explaining the events that impact our economy. John distills the latest information, attempting to make it easy to understand how these events affect daily life.

This print and digital magazine is designed to provide education and unique insight into specific factors that are currently driving the economy. Each quarterly issue includes an economic overview as well as updates on the equity and bond markets, asset allocation and relevant economical issues.

“OUR CONTINUED EXPANSION IN SOUTH ALABAMA REPRESENTS OAKWORTH’S DEDICATION TO PROVIDING PERSONALIZED, HIGH-QUALITY FINANCIAL SERVICES. OUR TEAM IS FOCUSED ON DEVELOPING SOLUTIONS THAT ARE CUSTOMIZED TO OUR CLIENTS’ INDIVIDUAL AND BUSINESS NEEDS, IN ORDER TO SIMPLIFY THEIR FINANCIAL LIVES. WE ARE PROUD TO BE A TRUSTED PARTNER AND ADVISOR IN THIS COMMUNITY, HELPING OUR CLIENTS ACHIEVE THEIR FINANCIAL GOALS WITH CONFIDENCE.”

-LEE HAMMONS MANAGING DIRECTOR, MARKET LEAD

Managing Director, Market Leader

Office: 251.375.7809

Email: lee.hammons@oakworth.com

Mr. Hammons is responsible for developing private and commercial banking relationships for Oakworth Capital Bank, while also ensuring the delivery of the Oakworth approach in South Alabama. He joined Oakworth in April of 2016, bringing over 20 years of experience in the financial industry. Mr. Hammons’ experience includes 10 years with Regions Bank, where he served as Senior Vice President and Manager of Private Banking, followed by Market President and Commercial Banking Manager for Synovus Bank. Mr. Hammons received his undergraduate degree in English from the University of South Alabama and his graduate degree from the Graduate School of Banking at Louisiana State University. He is a current member of the Board of Trustees for the Dauphin Island Sea Lab Foundation and serves on the University of South Alabama – Melton Center for Entrepreneurship and Innovation Advisory Board. He formerly served on the Board of Jags Impact (South Alabama NIL cooperative), is past president of Mobile Touchdown Club (2015-2016) and a former Chair of the Board for St. Luke’s Episcopal School. Mr. Hammons was recognized as the 2006 ABA Under 40 Banker of the Year in the state of Alabama and is a graduate of the 2006 class of Leadership Mobile.

Managing Director Wealth Management Team Lead

Office: 251.375.7802

Email: john.hensley@oakworth.com

Mr. Hensley is the Wealth Team Lead for Oakworth Capital Bank in South Alabama. Mr. Hensley began his career in 1997 with Bank of America (formerly NationsBank) in Charlotte, NC. He then spent 6 years with Synovus Family Asset Management in Columbus, GA, serving as a Family Office Advisor for ultra-affluent families throughout the Synovus footprint. He moved to Mobile in 2003 to work in Wealth Management for Regions Financial Corporation. He served as manager of this group prior to joining BankTrust Financial Group, which was acquired by Trustmark National Bank, serving as Trust and Wealth Management Regional Manager for the Gulf Coast. He currently serves on the Board of the Mobile Touchdown Club and the First Light Community of Mobile (formerly L’Arche of Mobile). He is a past President of the Estate Planning Council of Mobile, and is a 2009 graduate of Leadership Mobile.

Managing Director, Chief Equity Strategist

Office: 251.375.7819

Email: david.mcgrath@oakworth.com

Mr. McGrath is responsible for developing and managing wealth management relationships in South Alabama for Oakworth Capital Bank. He is also a member of Oakworth Capital’s Investment Strategy Committee and serves as Chief Equity Strategist. Mr. McGrath has 29 years of experience in asset management. Prior to joining Oakworth Capital, he spent 19 years at Regions Bank in various capacities including management of three proprietary mutual funds with assets of over $1.2 billion. David is active with Big Brothers Big Sisters of South Alabama.

Associate Managing Director Wealth Management

Office: 251.375.7822

Email: scott.heggeman@oakworth.com

Mr. Heggeman serves as an Associate Managing Director in Wealth Management for Oakworth. He joins Oakworth with over 30 years of experience in the financial services industry. Mr. Heggeman spent the last 18 years with Regions and served in several roles including Manager for the Institutional Trust Services group in South Alabama and Florida panhandle, Relationship Consultant for Endowments and Foundations group clients, and the Sales Strategist for the ITS group. Previously, he received the Accredited Investment Fiduciary and Certified Retirement Services Professional designation. Currently, Mr. Heggeman is serving as a Trustee for the Seaman’s Foundation and an Advisory Committee member for the Dauphin Island Sea Lab Foundation.

Office: 251.375.7824

Email: lee.banks@oakworth.com

In addition to working in banking, Mr. Banks served as a logistics officer on active duty in the U.S. Army for over five years and was a member of the Army National Guard for four years. His experience spans 18 years in banking and wealth management with AmSouth/Regions Bank and Trustmark National Bank. Mr. Banks is a graduate of Leadership Mobile, is a member of the Senior Bowl Committee and a member of the Mobile Estate Planning Council. He and his family are active at Saint Luke’s Episcopal School in Mobile.

Treasury Management Specialist

Office: 251.375.7818

Email: jaye.patterson@oakworth.com

Mrs. Patterson is responsible for developing and expanding client relationship with Oakworth Capital Bank. She joined Oakworth Capital in January 2018, bringing over 24 years of banking experience. Mrs. Pattersons’ experience includes 21 years with Regions Bank, where she served as Assistant Vice-President and Branch Manager. Most recently she served as Assistant Vice-President and Private Banking officer of Servis 1st Bank. Mrs. Patterson received her undergraduate degree in Finance from the University of South Alabama. She is also a graduate of the Alabama School of Banking. She is currently a Board Trustee for St. Luke’s Episcopal School, is active with Junior Achievement of Mobile and is an ambassador of Impact100 Mobile. She has been involved with United Way Women’s Initiative, Back Pack for Kids, United Way Loan Executive, Big Brother Big Sister, Habitat for Humanity and Past Treasury for Girl Scouts of Southern Alabama.

Office: 251.375.7806

Email: wade.gordon@oakworth.com

Mr. Gordon is responsible for developing and advising private banking and wealth clients for Oakworth. His career began with Trustmark (BankTrust), working his way to becoming a Branch Manager then serving as a Trust Services Officer before joining Oakworth in 2015. His primary focus is developing relationships and managing financial services for professionals, corporate executives, and their families as well as small to mid-size professional firms, medical practices, and non-profit organizations. He is currently a member of the Downtown Rotary Club of Mobile and a vestry member of St. Paul’s Episcopal Church. He is involved with Big Brothers Bigs Sisters of the Central Gulf Coast as a Mentor, the Mobile Chapter of Alabama Wildlife Federation and JH Outback Mobile.

Senior Credit Analyst

Office: 251.375.7820

Email: chris.roberts@oakworth.com

Mr. Roberts joined the Oakworth team in 2019, already a knowledgeable financial professional with years of experience assessing borrowing risk and determining the most beneficial solutions for both lender and client.

Prior to 2019, he held senior positions at 22nd State Bank in Alabama (Vice President of Commercial Lending); The First (formerly Bay Bank) (Vice President and Business Banker); and Hancock Bank (Vice President and Business Banker). His collaborative approach to problem-solving and his attention to detail make him an asset to Oakworth and our clients, and strategically align him with our core purpose of helping people succeed.

He and his wife, Lori, are the lucky owners of three beloved dogs. Mr. Roberts is a member of Ashland Place United Methodist. Outside of the office, Mr. Roberts enjoys spending time in the outdoors.

Office: 251.375.7811

Email: jeremy.roberts@oakworth.com

Mr. Roberts is responsible for developing and managing a diversified portfolio of commercial and private banking clients for Oakworth Capital Bank. He has over 24 years of banking experience with Regions Bank and Synovus Bank, having served in various leadership capacities. He graduated from Southeast College of Technology with a degree in Business Administration before receiving his M.B.A. from Columbia Southern University. Mr. Roberts is an active within the Mobile community and is an active member of the Lions Club, Big Brothers Big Sisters and serves in may capacities at Oak Park Church. He was recognized in Mobile Bay Monthly as Top 40 under 40 in 2017 and is a former Loan Executive for the United Way.

Oakworth Asset Management, LLC (“Oakworth Asset Management”) is a registered investment adviser that is owned by Oakworth Capital Bank Inc. (“Oakworth Capital Bank,” or together with Oakworth Asset Management, “Oakworth”), Member FDIC. This piece describes the services of Oakworth, but please note that there are two separate entities that provide different services. All investment adviser services including investment management and financial planning are provided by Oakworth Asset Management. Because of the ownership relationship and possible involvement by Oakworth Asset Management associates with Oakworth Capital Bank, there exists a conflict of interest to the extent that either party (Oakworth Asset Management or Oakworth Capital Bank) recommends the services of the other. For additional information about Oakworth Asset Management, including its services and fees, send for the firm’s disclosure brochure using the contact information contained herein or visit advisorinfo.sec.gov.

This communication contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should not be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. Investing involves risk of loss including loss of principal. Past investment performance is not a guarantee or predictor of future investment performance.