THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors - OC Today-Dispatch

Published by OC Today-Dispatch for the Coastal Association of Realtors. Advertising in this publication is limited to members and affiliated members of the Association.

The COASTAL ASSOCIATION OF REALTORS® (CAR) is a trade organization for real estate professionals in Wicomico, Worcester and Somerset Counties on the Eastern Shore of Maryland. Its membership consists of more than 1,000 REALTORs® and affiliate members serving the home-buying and homeselling needs of the public since 1957.

The term REALTOR® is a registered collective membership mark, which may be used only by real estate professionals who are members of the NATIONAL ASSOCIATION OF REALTORS® and subscribe to its strict Code of Ethics.

The COASTAL ASSOCIATION OF REALTORS is located at 314 Franklin Avenue, Suite 106 • Berlin, MD 21811. Phone: 410-641-4409. On the Web: www.coastalrealtor.org

OC TODAY-DISPATCH is the leading newspaper publisher on the Maryland coast, with OC Today-Dispatch publishing weekly on Friday, Bayside Gazette and Ocean City Digest publishing on Thursdays and Real Estate, the Coastal Real Estate Resource publishing key weekends throughout the year. On the Web: www.octodaydispatch.com

Editor......................................................................... Stewart Dobson

Executive Editor................................................................ Steve Green

Account Managers....................... Mary Cooper, Renée Kelly, Terri French

Classifieds/Legals ........................................................ Pamela Green

Art Director....................................................................... Cole Gibson

Senior Page Designer....................................................... Susan Parks

Senior Ad Designer............................................................ Kelly Brown

Publisher..................................................................... Christine Brown

Administrative Asistant.......................................................... Gini Tufts

BERLIN, MD — September 2, 2025 — The Coastal Association of REALTORS® hosted its 6th Annual Golf Tournament at Glen Riddle Golf Club’s Man O’ War course, drawing 105 golfers for a day of fun and fundraising. The event generated more than $14,000 for the Coastal REALTORS® Foundation, which supports nonprofits in Wicomico, Worcester, and Somerset counties. The tournament combined friendly competition with a shared commitment to giving back to the Lower Eastern Shore community.

Provide a Comprehensive Report Detailing Reserve Funding Recommendations to Help Your Condominium, Homeowners Association and/or Marina Make Informed Decisions & Obtain Financial Insights To Protect Your Valuable Assets.

Reserve Studies of Delmarva is led by Eugene Jubber, a certified Reserve Specialist through CAI (Community Association Institute) with a PCAM Designation (Professional Community Association Manager). His goal is to reduce unnecessary and/or unforeseen special assessments. In his 25-plus years' experience, Eugene knows what is important for his clients. Contact Eugene to discuss the Level of Reserve Study that is most appropriate for the goals of your community.

stevegreen.coastallife.com

I will work with you every step of the way sharing my expertise about buying and selling real estate on the shore….just as I helped Anthony and Alison.

"Working with Steve was a pleasure. His deep market knowledge, sharp negotiation skills, and data-driven approach helped us through the procession from listing to settlement. Thanks to his guidance, I was able to meet mytarget return on investment with a smooth, hassle-free transaction. Steve handled everything with a high level of professionalism, grace and integrity — exactly what you want in a trusted partner. I highly recommend his services and will certainly utilize him again.”

ANTHONY W. ON RECENT SALE OF OCEAN BLOCK MID-TOWN CONDO AT 96% OF ORIGINAL LISTING PRICE.

“Steve spent an entire day with me while my husband underwent training at a new job that requires us to relocate to the coast. As soon as we sell our home in Virginia, we will be following up with Steve to help us facilitate the buying process. We look forward to working with him, as he gained my confidence after the first showing. I don’t know many agents who would dedicate an entire day showing me properties. Not even rain could dampen his spirits, while others would view the search day as a waste of time. He has earned our business.”

ALISON L. ON SECURING BUYER AGENT SERVICES FOR AN UPCOMING PURCHASE IN THE COASTAL REGION.

Credit card debt could be compromising the financial security and wellbeing of millions of individuals. According to the Federal Reserve Bank of New York, Americans' total credit card balance in the second quarter of 2023 was more than $1 trillion, and LendingTree reports that the average credit card balances among U.S. cardholders in December 2022 was $7,279.

Average balances are lower but still a concern in Canada, where data from TransUnion® indicates the average cardholder had an outstanding balance of $3,909 as of the first quarter of 2023.

Effective credit utilization is a vital component of long-term financial health. The average credit card balances in both the U.S. and Canada suggest many consumers are putting their financial futures in jeopardy by relying too heavily on credit to fund their lifestyles.

The good news is consumers tend to have a sense of self-awareness regarding their credit usage, as a recent NerdWallet survey of more than 2,000 adult consumers found that 83 percent of respondents acknowledged they overspend.

Recognition of an over-reliance on credit could be a solid first step toward eradicating debt, and consumers who own their homes may consider home equity loans or lines of credit in an effort to

tame their debt once and for all.

The Consumer Financial Protection Bureau notes that a home equity loan allows homeowners to borrow money using the equity in their home as collateral. Equity is the amount a property is currently worth minus the amount currently owed on a mortgage. So if a home is worth $500,000 and homeowners have a mortgage balance of $300,000, then their equity is $200,000.

Bankrate notes that the average interest rate for a home equity loan is typically much lower than the rate on credit cards, so homeowners can theoretically save a lot of money by paying off their credit card debt with a home equity loan.

Though lower interest rates and consolidated debt are two advantages to paying off consumer debt with a home equity loan, this option is risky. Perhaps the biggest risk associated with this approach is the potential of losing a home. Individuals with substantial credit card debt should know that a lack of discipline when using a home equity loan to pay off debt could result in foreclosure. If homeowners cannot make their monthly loan payments on time, they could lose their home. In addition, Bankrate notes that if a home is sold with an outstanding home equity loan balance, that balance must be repaid at once.

By Jacky Mueck Maryland REALTORS® Online

Maryland REALTORS® is urging consumers, policymakers, and industry partners to stay informed as the ongoing federal government shutdown threatens to disrupt critical housing programs across the state.

“Each day the shutdown continues, uncertainty grows for Maryland families trying to buy or sell a home,” said Maryland REALTORS® 2026 President Denise Lewis. “While our industry remains resilient, extended disruption to federal housing programs could delay closings, limit access to flood insurance, and create financial hardship for thousands of households.”

REALTORS® in Maryland and nationwide are advocating for home buyers and sellers, warning federal leaders of the impacts a prolonged shutdown will have on our communities and our economy.

National Flood Insurance Program (NFIP): During a lapse in government funding, the NFIP may be unable to issue new or renewal flood insurance policies. Existing policies will remain active until their expiration dates, and claims will continue to be paid while funds last. NFIP policies can still be transferred from sellers to buyers during a lapse, and most lending regulators have provided flexibility to support transactions. Consumers are encouraged to speak with their REALTOR®

about private market flood insurance options during the shutdown.

U.S. Department of Agriculture (USDA) Loans: Direct and guaranteed loan programs through USDA will be significantly affected. No new direct or guaranteed loans will close during the shutdown, though some pending conditional commitments may be reviewed and processed if possible. Guaranteed loan closings without a previously issued guarantee may proceed at the lender’s risk. Disbursements on existing construction loans may continue to protect USDA’s interests, but rental assistance and loan servicing activities will be extremely limited until the government reopens.

Department of Veterans Affairs (VA) Loans: The VA will continue guaranteeing home loans during a shutdown, allowing lenders to process applications. However, staffing reductions may delay appraisals, approvals, and the issuance of certificates of eligibility. Veterans are advised to consult their lenders for updates on processing times.

Understanding What’s at Stake: A lapse in the NFIP would leave millions of Americans vulnerable during peak hurricane season and disrupt real estate transactions across more than 20,000 communities nationwide.

• Nearly every U.S. county (98%) has experienced a major flood disaster in the past two decades.

• Just one inch of floodwater can cause an average of $25,000 in damage.

• Without NFIP coverage, families must rely on limited federal disaster aid.

• The National Association of REALTORS® estimates that an extended NFIP lapse could impact 1,400 home sales per day nationwide.

Such a disruption would put American homes, businesses, and communities at significant risk and should be avoided.

Impact on Maryland: With 3,190 miles of coastline, Maryland ranks 10th in the nation for total shoreline exposure.

• Estimated number of home sales at risk: 452 per month (15 per day)

• Estimated economic impact: $756 million in lost local income annually

If the Shutdown Lasts Two Weeks: A short-term shutdown would likely cause transaction delays rather than cancellations, with most buyers and sellers in non-flood zones able to close on schedule. However, flood-zone sales could stall temporarily due to NFIP’s lapse, and USDA-backed loans may pause until normal operations resume.

Maryland’s real estate industry could experience a short-term slowdown of approximately 150 home sales statewide, based on historical data—representing several million dollars in deferred local income and economic activity.

If the Shutdown Lasts One Month: A month-long shutdown would

create a backlog in loan approvals, flood insurance issuance, and property closings, particularly in coastal counties.

• Roughly 450 home sales per month could be delayed or lost.

• More households would turn to private flood insurance, often at higher cost.

• Reduced consumer confidence—especially among the state’s large population of federal employees—could dampen housing demand and local spending.

The resulting economic loss could exceed $60–70 million in local income for that month alone.

If the Shutdown Extends Longer: A prolonged shutdown would have cascading effects across Maryland’s housing market and economy.

• NFIP funding could be depleted, delaying claim payments.

• USDA and FHA loan pipelines could freeze.

• Lenders may tighten credit standards or defer closings in flood-prone regions.

• Local governments could see lower transfer-tax and recordation-fee revenues.

An extended lapse could imperil thousands of transactions statewide and cost communities hundreds of millions in local income. Rural and coastal areas would face the most significant challenges.

Homeownership is a goal that many people aspire to. However, a complicated housing market in the United States, marked by high prices and high interest rates, has led the homeownership rate to dip to 65.1 percent in the first quarter of 2025. This decline marked a five-year low, and younger homeowners, particularly those under age 35, have found buying a home particularly challenging, according to the U.S. Census Bureau and the Federal Reserve Economic Data.

Those who have been successful with their homeownership endeavors can benefit from all the help they can get to offset rising costs. The excitement of a new space often comes with a long list of home needs, making housewarming gifts practical and appealing this holiday season. The following are a selection of items that can benefit any new homeowner.

Practical essentials

New homeowners will need to outfit their homes with basic household items. As repairs and remodeling might be the first tasks to tackle, a high-quality tool kit and some key power tools will be invaluable. Additional practical gifts include a fire extinguisher, smart home devices, a sturdy step stool, and painting equipment.

Kitchen gadgets

Plenty of action takes place in the kitchen, and this room often is referred

to as the heart of a home. Upgrading the space with an arsenal of culinary tools is often slow-going for new homeowners. That’s when gifts of a durable coffee maker, a set of mixing bowls, a cutlery set, cast-iron cookware, or stylish serving platters can help get homeowners established.

A new home may seem stark at the outset. Gifts of creature comforts like throw blankets, lush bedding, luxurious soaps, scented candles, accent lighting, low-maintenance houseplants, or a Bluetooth smart speaker can create a welcoming retreat.

New homeowners likely will appreciate a little help by way of services that can take some of the work off of their shoulders. A gift of lawn care or cleaning services will get the property and home looking its best. For the security-minded, gifting security cameras or access to a remote security monitoring service will be thoughtful. Homeowners who have pools or spas may appreciate a maintenance service that helps with cleaning and water balancing.

New homeowners have much on their plates, so well-intentioned holiday gifts can fill in the gaps as they begin life in their new abodes. GG25A205

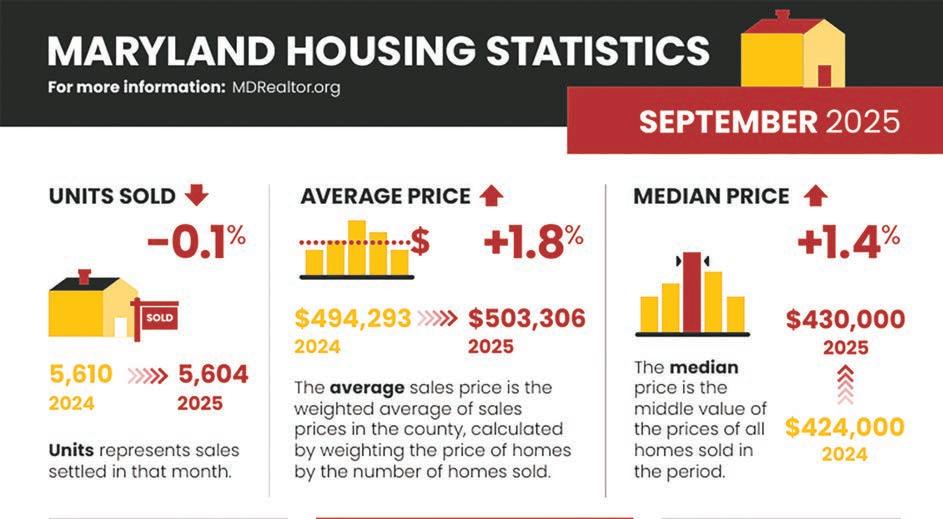

ANNAPOLIS, MD – October 13, 2025 – Maryland’s statewide housing market was virtually unchanged in September, with 5,604 homes sold –just six fewer than September 2024’s 5,610 closings (–0.1%), according to Maryland REALTORS®’ Housing Statistics.

The average sales price rose 1.8% to $503,306, while the median price increased 1.4% to $430,000.

“This is what a market finding balance looks like,” said Denise Lewis, 2026 President of Maryland REALTORS®. “Sales were essentially flat with last year; prices nudged higher—not surging—and buyers had more time and leverage than a year ago. That combination points to a healthier, more sustainable market.”

Days on market lengthened to 17 days, up from 11 in September 2024.

“When homes take longer to sell, it’s a sign that the frenzy has cooled,” Lewis added. “Serious buyers are back in the driver’s seat on timing and negotiations, and sellers who price to the market are still getting to the closing table.”

Meanwhile, in the Delaware and Maryland Coastal region, strong closing figures were seen in September.

Surpassing last month and 16.9% higher than a year ago, there were 824 closed sales on the coast. Worcester and Wicomico counties had particularly strong gains up 42.1% and 37.7%, respectively. Overall closed sales year-to-date are ahead of 2024 by 2.4%.

However, pending sales are lower than last September, down 9.9%. The number of pending sales has stayed below new listings, leading to more in-

ventory at the end of each month. There were 3,494 active listings on the market at the end of September.

Active listings have risen year-over-year since June 2022 but are still just 78% of the number available at the end of September 2019.

More inventory has allowed buyers more time to place contracts. The median days on market was 39 days for homes closed in September, 12 days higher than last year. Price gains are also cooling, with the median price up by just 1.2% in September.

September sales on the Lower Shore and Sussex

County exceeded last year as mortgage rates fell at the end of the summer. Yet many buyers and sellers will remain cautious in the coming months.

The federal government shutdown and general economic uncertainty will impact the second home market. Home sales likely will continue to be relatively slow through the end of the year.

For consumers, Maryland REALTORS® advises realistic pricing for sellers and flexible timelines for buyers, particularly when transactions involve federal verifications, USDA, FHA, VA, or flood-insurance requirements.

There are many reasons homeowners consider adding a room to their current homes. Some outgrow an existing space, while others take up new hobbies or have different needs that were not apparent when purchasing the home. Indeed, a room addition can remedy a host of issues affecting a home.

Those considering adding a room may wonder what is involved in this type of project. According to The Spruce, no home improvement project is more complicated or expensive than building an addition. The National Association of Realtors says building an addition can cost between $90,000 and $270,000, depending on the size and intended purpose of the room. An addition structurally changes a home, which requires the work of professionals whether homeowners plan to build upwards or outwards.

With so much to ponder when considering a home addition, here’s a look at what homeowners can expect of the process.

• Design and planning: Homeowners must determine the purpose behind the addition and how it will integrate with the existing home. A bedroom design likely will be different from a garage addition or family game room.

• Hire an engineer and contractor: An addition changes the footprint of a home.

Greater

Guaranteed

Guild

Habitat

Moly Hilligoss

Karen Cooper

DeChant

P. DeChant

Hawkins Electric

Jordan MacWha

High Tech Home Inspections

Scott Donnelly

House Master Alan Hoffman

Integrity Appraisals

Karen Vara

Tony Hilligross

L Turner Appraisals

LeRoy Turner

Lakeside Title Company

Diana Dovel

Landmark

Colleen Nichols

Marr Appraisals

Homeowners will require professional contractors and structural engineers/architects to properly design the addition and ensure that it will not compromise the existing structure. Detailed architectural plans will be drawn up considering the layout, size and integration with the existing structure. The home may require a new property survey as well.

• Comply with building codes: The project will have to meet with local zoning regulations, building codes and homeowners association rules.

• Timing involved: Adding a room is a major overhaul of a space. It may require months of a home being in upheaval. If the renovations are particularly extensive, homeowners may need to temporarily move out of the space. Electrical, plumbing and HVAC must be considered, and drywall and finishing the interior are some of the last steps to make the room habitable.

• Demolition: Adding a room may involve taking down walls or modifying existing spaces, necessitating hiring a dumpster to remove debris. This is an added consideration and expense. Putting an addition on a home is a complex process that will take time and money. Such a project requires careful planning and consultation with an array of experts.