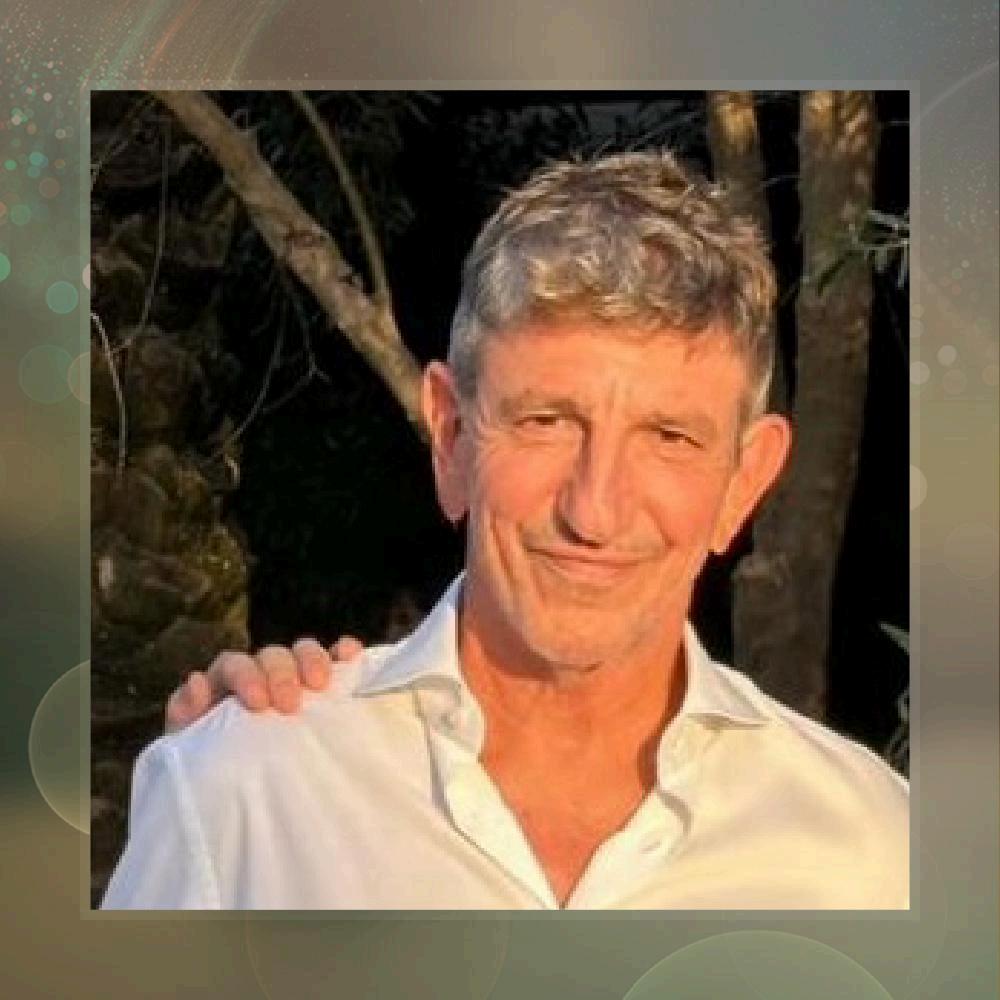

Rami Beracha: Why Smart Money Beats Fast Money Every Time

Rami Beracha emphasizes that every entrepreneur faces the same crossroads eventually – do you bootstrap forever or bring in outside investors? It's tempting to think all money is created equal, but anyone who's been in the startup trenches knows that's complete nonsense The difference between smart money and dumb money can literally make or break your company

Here's what most founders don't realize until it's too late: venture capitalists aren't just walking ATMs with fancy business cards. The good ones are like having a seasoned coach in your corner who's trained champions before They've seen every possible way a startup can go wrong, and more importantly, they know how to course-correct when things go awry.

Picture this scenario: your customer acquisition costs suddenly spike, and you're burning through cash faster than a teenager with their first credit card. A regular investor might panic and start breathing down your neck about expenses But a seasoned VC? They've watched this movie dozens of times. They know whether this is a temporary blip or a sign you need to rethink your go-to-market strategy completely.

The network effect is where things get really interesting. When you partner with the right VC firm, you're not just getting one person's contacts – you're plugging into an entire ecosystem Need a killer CFO who understands SaaS metrics? They've got three recommendations.

Looking for potential acquisition targets or strategic partnerships? Their portfolio companies are already having those conversations.

But here's the kicker that nobody talks about enough: good VCs actually make you a better leader They ask the hard questions you've been avoiding They challenge your assumptions when you're getting too comfortable. They've seen enough train wrecks to spot the warning signs before you drive off a cliff

Sure, the due diligence process can feel like having your financial records audited by the IRS while getting a root canal And yes, giving up equity feels like selling pieces of your soul But

think about it this way – would you rather own 100% of a company that plateaus at mediocre, or 70% of something that could actually change the world?

The startups that truly scale aren't just the ones with the best ideas or the most funding; they are also those that have the right strategy and execution. They're the ones smart enough to surround themselves with people who've already climbed the mountain they're trying to conquer