With a legacy extending over 125 years, Savino Del Bene has developed a strong and steady presence in global logistics and freight forwarding. Established in Florence, Italy, early in the 20th century, the company has grown to operate across more than 60 countries. In South Africa, its offices in Johannesburg, Cape Town, Durban and Port Elizabeth (Gqeberha) leverage the country’s strategic position as a gateway to African trade. The local branch offers comprehensive logistics services, including air, ocean and overland freight forwarding, customs brokerage, bonded warehousing and end-to-end logistics management. This covers warehousing, distribution and handling specialised cargo such as perishables, oversized items and high-value goods.

Savino Del Bene’s expertise touches multiple sectors, from automotive and fashion to food, pharmaceuticals, break-bulk and wine. By combining international reach with in-depth local knowledge, the company supports South African businesses in navigating complex supply chains and expanding their market access across Africa and beyond.

Standard Bank Business and Commercial Banking offers a comprehensive selection of award-winning fleet management solutions designed to optimise fleet efficiency and reduce operational costs for businesses of all sizes.

With a deep understanding of the challenges inherent in managing a vehicle fleet, Standard Bank provides tailored products and services that enhance control, security and savings. At the core of our offering are versatile payment solutions, including the chip-and-PIN Visa Fleet Card and prepaid fleet cards, which streamline fuel, oil, and maintenance purchases while providing real-time transaction monitoring. This detailed oversight can be managed through the advanced Fleet360 platform, an intuitive online portal that offers powerful reporting and data analysis for informed decision-making.

Beyond payments, Standard Bank’s fleet services extend to managed maintenance programmes and full maintenance leasing or rental options, ensuring vehicles remain operational and compliant with safety standards. Value-added services, such as diesel rebates, toll management and fines and vehicle licenses management tools, further empower businesses to run their fleets effectively.

By leveraging its industry expertise and innovative technology, Standard Bank Fleet Management delivers a holistic solution that drives productivity and cost savings, allowing businesses to focus on their core operations.

For more information: www.standardbank.co.za

AGL is a trusted logistics operator in Africa, offering logistics, port, maritime and rail solutions. With 23 000 employees in 50 countries, AGL leverages its developed expertise to provide tailored and innovative services to its African and international clients. AGL’s ambition is to make a lasting contribution to Africa’s transformation. AGL is also present in Haiti, East Timor and Indonesia.

In South Africa, AGL has a long-standing presence through AGL South Africa, BALSA and AGL Terminals, supporting trade and economic growth through sustained investments in infrastructure, technology and port development. This enduring engagement reflects AGL’s commitment to strengthening regional supply chains and contributing to sustainable economic transformation.

Driven by its ambition to make a lasting impact across Africa, AGL continues to expand its capabilities and invest in solutions that connect communities and markets.

For more information: www.savinodelbene.com

For more information: www.aglgroup.com

PUBLISHED BY

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Anthony Sharpe

Content Manager: Raina Julies rainaj@picasso.co.za

Copy Editor: Brenda Bryden

Contributors: Biénne Huisman, Vanessa Rogers, Rodney Weidemann, Lisa Witepski

Content Co-ordinator: Natasha Maneveldt

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Cover Images: Courtesy of Transnet, [metelevan]/123rf.com, [pitinan]/123rf.com, [scharfsinn86]/123rf.com

SALES

Project Manager: Tarin-Lee Watts wattst@arena.africa | +27 87 379 7119 +27 79 504 7729

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Shamiela Brenner

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Online Editor: Stacey Visser vissers@businessmediamags.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer COPYRIGHT: Picasso Headline.

published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

With abundant natural resources, a diversi ed economy, sophisticated nancial and legal frameworks and advanced infrastructure, South Africa remains the economic powerhouse of Africa. However, continuing issues within logistics and supply chains threaten to derail this dominance (in some instances quite literally).

In this inaugural issue of Move, we examine the pain points facing supply chains across South Africa and beyond, along with innovations and solutions that are helping to address these.

We look at how government is responding to the imposition of United States tariffs through its recently launched Export Support Desk, and how the African Continental Free Trade Area aims to boost intra-African trade, which is essential to weather this trade storm and build greater economic resilience across the continent.

Unbundling Transnet has long been seen as necessary to improve our logistics

infrastructure, a move that has been given a shot in the arm by a $1.5-billion development policy loan from the World Bank. Equally encouraging is the opening up of rail infrastructure to private operators, which should help revitalise this critical mode of transport and shift freight volumes off roads. It will take a long time for this to happen, however, which is why improvements need to be made in the short term to make trucking more sustainable, including greater collaboration between all stakeholders.

Such collaboration can be facilitated through a uni ed logistics platform, trialled successfully in India, which we examine to see how applicable it is in the South African context. We also look at last-mile delivery, which is increasingly important for small to medium enterprise development, and the ever-important question of building resilience in supply chains. Because ultimately, economic resilience rests on the strength and effectiveness of our supply chains and logistics infrastructure.

Anthony Sharpe

8 EXPORTS

In response to US tariffs on local exports, government has launched an Export Support Desk for affected industries.

13 TECHNOLOGY

A uni ed logistics platform can improve transparency, enable real-time cargo tracking, reduce logistics costs and promote compliance and innovation.

19 CROSS-BORDER TRADE

How the African Continental Free Trade Area aims to boost intra-African trade, galvanise economies and lift millions out of poverty.

28 LAST-MILE DELIVERY

Last-mile delivery often comprises the most expensive leg of logistics – and the most important.

30 RESILIENCE

How to build supply chain resilience in an uncertain world.

31 PORTS

New cranes at Cape Town Container Terminal are helping to boost productivity.

34 RAIL

The selection of 11 private train operators in South Africa is expected to boost rail volumes, attract private investment and enhance economic growth.

42 SUSTAINABILITY

South Africa’s logistics industry needs to reduce its carbon footprint for the economy to remain competitive.

44 FINANCE

Finance from the World Bank is aiding reforms and the unbundling of Transnet.

In response to the United States’ imposition of exorbitant tariffs on local exports, government has launched an Export Support Desk for affected industries. RODNEY WEIDEMANN examines what it might do for businesses and the economy

South Africa’s Department of Trade, Industry and Competition (dtic) launched an Export Support Desk (ESD) in August 2025 to assist exporters affected by the recent 30 per cent United States’ (US) tariff hike on local products.

According to a dtic spokesperson, the ESD focuses on providing tailored advisory services to exporters on alternative destinations, guidance on market entry processes, insights into compliance requirements and linkages to South African embassies and high commissions abroad.

The department states: “In addition to issues linked to diversi cation and markets, the ESD has also been processing enquiries with regard to updates on negotiations, details on tariffs and implementation and developments on economic response measures. These enquiries are forwarded to the various units and entities in government responsible for the relevant areas for follow-up and responses.”

Tafadzwa Chibanguza, CEO of the Steel and Engineering Industries Federation of Southern

Africa, notes that around eight per cent of the sector’s total exports go to the US, equating to around R32-billion, the loss of which would likely lead to downsizing and job losses. “Our steel, zinc and copper exports have attracted a fty per cent tariff due to these metals being deemed a strategic US industry, which is a really high wall to overcome. The balance of products from this sector, such as pumps and valves, face a thirty per cent tariff.”

The citrus industry employs 140 000 people and exports R1.8-billion in citrus to the United States annually. The new tariffs could make these exports unviable, and hundreds of thousands of cartons may go unsold. Other agricultural products like wine and macadamia nuts also face severe challenges, especially for smallholder farmers.

Source: Deloitte

An additional concern, Chibanguza states, is that these engineering products are typically higher value and unique, in that they are custom-made for their speci c market. This means that if you lose access to that market, you will lose the market for these products entirely, because they are from a production line set up speci cally to service the US. “The other major challenge for us is that there are other nations with a similar basket of products that face lower tariffs, and this relative advantage will have long-term implications for our industry.

In addition, the idea of market diversi cation is not that simple in practice because it takes a long time to achieve. After all, if these markets were already pro table, others would already be exploiting them.”

Mikel Mabasa, CEO at the Automotive Industry Export Council, adds that South Africa’s automotive exports to the US now face material cost disadvantages, raising concerns about pricing competitiveness and pro tability for multinational original equipment manufacturers operating domestically.

“OUR STEEL, ZINC AND COPPER EXPORTS HAVE ATTRACTED A FIFTY PER CENT TARIFF DUE TO THESE METALS BEING DEEMED A STRATEGIC US INDUSTRY.” – TAFADZWA CHIBANGUZA

This is evident in how domestic vehicle exports to the US decreased by 87.4 per cent during the second quarter of 2025 compared to the previous year.

“For South Africa, the primary impact relates to the loss of around twenty- ve thousand vehicles per annum to the US,” says Mabasa. “However, the secondary impact of increased competition for the bulk of vehicle exports to other markets could potentially pose an even bigger risk, as every other country is in a similar position and will be pursuing alternative export markets.

“Diversifying into new markets is not easy for volume exports lost to the US market, as the automotive industry already exported vehicles and components to one hundred and fty- ve markets in 2024.”

The dtic’s Export Support Desk is part of the department’s ve-point strategy of non nancial measures to support vulnerable rms and workers, continues Mabasa. Initiatives are appreciated by the industry in general, but some areas require further clari cation to achieve tangible bene ts for affected businesses. “Ultimately, the idea of the ESD is good, but most businesses will require nancial support measures – tax incentives or means to pay salaries – until such time that alternative export markets can be found.

“Furthermore, the automotive sector, heavily reliant on stable supply chains for components and raw materials, may experience volatility in both costs and availability, necessitating strategic risk management and the diversi cation of supply sources.”

Dr Jacob van Rensburg, head of research and development at the Southern African Association of Freight Forwarders, explains that the ESD can buffer immediate shocks by guiding exporters on compliance, fast-tracking tariff impact assessments and co-ordinating sector-speci c support.

“Government backing through such mechanisms signals a commitment to preserve industrial capacity, particularly as the African Growth and Opportunities Act (AGOA) renewal remains uncertain,” he says. “For the auto, steel and agriculture sectors, ESD assistance means better navigation of customs and standards while also lobbying for exemptions, which the industry hopes the ESD will signi cantly help with. Linking rms to diplomatic channels also supports South Africa’s push for tariff relief and strengthens credibility in upcoming bilateral negotiations with the US Trade Representative.”

“ANY SHIFT AWAY FROM THE US MARKET REQUIRES COMPANIES TO RECONFIGURE THEIR SUPPLY CHAINS, ADJUST LOGISTICS AND FOCUS ON SERVING A BROADER RANGE OF INTERNATIONAL MARKETS.” – OLEBOGENG

RAMATLHODI

However, Dr van Rensburg further notes that there is a caveat to this: shifting international trading patterns is something that does take signi cant time – often years, rather than months. “The ESD should therefore focus on diversifying into the African continental market, as there has been a rise in intra-African trade of up to twenty-two per cent, by some metrics. It should do the same with BRICS and the EU market, while maintaining pressure for the renewal of AGOA. Compliance support, especially around US technical standards, will help to safeguard ongoing trade, while diplomatic linkages are always vital in negotiations.”

The ESD initiative is a key part of South Africa’s efforts to protect its economy, support diversi cation and maintain resilience in a changing global trade environment, suggests Olebogeng Ramatlhodi, indirect tax leader at Deloitte Africa. He points out that the automotive sector, employing around 115 000 people, has been hit hard, with export volumes to the US dropping by 73 per cent in early 2025, and escalating further in the following months.

“The overall tariff burden on automotive goods now stands at fty- ve per cent, making local exports largely uncompetitive,” says Ramatlhodi. The industry has already witnessed 12 company closures and over 4 000 job losses recently, with an additional 30 000 jobs at risk.

“Any shift away from the US market requires companies to recon gure their supply chains, adjust logistics and focus on serving a broader range of international markets. Nonetheless, market diversi cation and regional integration create opportunities for increased local manufacturing and content. For example, a ve per cent increase in local content could add thirty-billion rand in procurement, potentially outstripping the value of lost US exports.”

Ramatlhodi notes that the ESD’s success is contingent on it learning from previous shortcomings, focusing on practical, measured outcomes and truly putting exporters at the centre, especially small and new businesses. “It is still early days, but the truth will be in the success realised by industries in the short to medium term. Trade ow diversi cation is a complex terrain to navigate, and for this to be impactful, government has to be intentional and consistent in the support provided.”

According to consulting firm Deloitte, these are the core functions of the Export Support Desk:

• Market intelligence and updates: regular data on trade policy and developments.

• Alternative market identification: support for finding and accessing new export destinations.

• Market entry guidance: help with market entry strategies and understanding of regulatory requirements.

• Compliance assistance: advice on international standards, certifications and regulatory compliance.

• Diplomatic network assistance: connections to embassies and trade missions, to facilitate new business opportunities.

Follow: Tafadzwa Chibanguza www.linkedin.com/in/tafadzwachibanguza Mikel Mabasa www.linkedin.com/in/mikel-mabasa-628bb76 Dr Jacob van Rensburg www.linkedin.com/in/jacob-van-rensburg-420912119 Olebogeng Ramatlhodi www.linkedin.com/in/olebogeng-ramatlhodi-7740403a

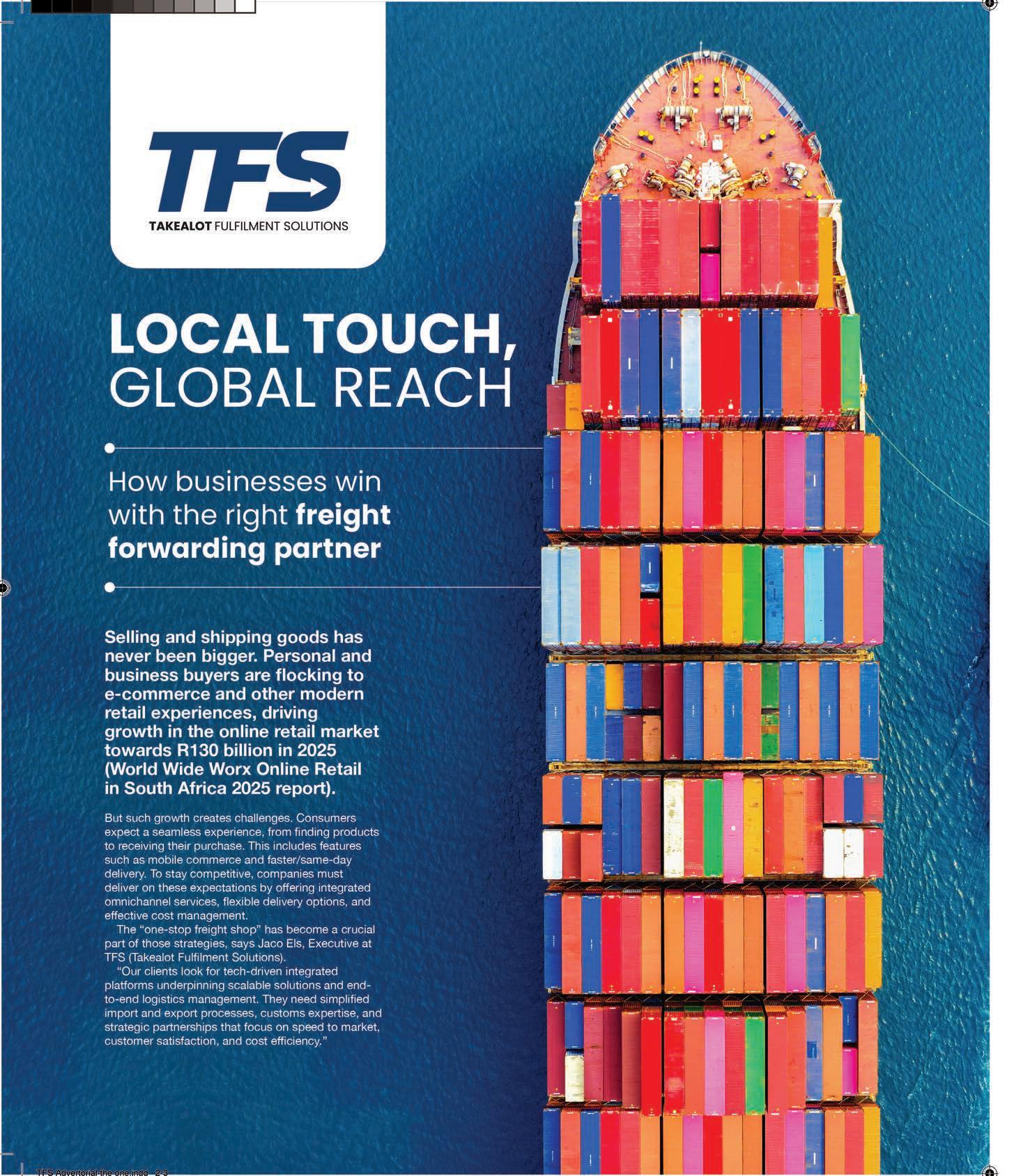

VERNON SINDEN, head of logistics at Investec Business Banking, explains why South African businesses must embrace data-driven logistics

In today’s hyper-connected world, global trade is no longer shielded from economic shocks and political turbulence. What happens in one region ripples quickly across borders, creating complexities that disrupt supply chains and put pressure on business margins.

It’s no surprise then that 94 per cent of companies have reported revenue impacts from supply chain disruptions, according to Electro IQ’s Supply Chain Statistics and Facts (2025). The new reality? Predictability isn’t just a competitive advantage; it’s the currency that drives resilience, growth and customer trust.

According to a World Economic Forum article on supply chains , the widespread adoption of advanced technologies will accelerate the digitalisation of supply chain management and fundamentally reshape how products and services move.

With predictive technology, businesses can prepare more effectively and make sharper decisions – an invaluable advantage in an industry de ned by constant uncertainty. For companies that embrace these tools, the reward is clear: optimisation, ef ciency and agility.

Agility has become the lifeline of modern supply chains. With the logistics sector recently contributing 0.2 per cent points to South Africa’s gross domestic product, as reported in a September government press release, ensuring stability in this space is critical. Predictive technologies, powered

by real-time data on freight rates, vessel movements and demand trends, enable businesses to forecast disruptions, mitigate risks and streamline operations.

International holidays such as Golden Week or Chinese New Year – once notorious for stalling shipments across major routes – can now be managed with foresight. Predictive tools allow companies to plan ahead, reroute cargo or leverage alternative carriers. This is predictability in action, turning uncertainty into opportunity and safeguarding performance in a volatile market.

From fuel price surges to unexpected delays, the nancial toll of disruption is and continues to be unavoidable. Yet businesses with access to the right capital and advisory services can pivot quickly, adjust strategies and minimise losses.

Having access to working capital can afford businesses the exibility to readjust their shipping strategies to avoid delays. However, the most effective partnerships go beyond nancing: they combine risk management, digital tools and tailored payment solutions to give businesses exibility today, and also position them for future growth and the resilience needed tomorrow.

There is no doubt that tomorrow will have disruptions. Disruptions will keep evolving – whether geopolitical, environmental

Vernon Sinden

THE IMPLEMENTATION OF ADVANCED DATA ANALYTICS WILL PROVIDE DEEPER INSIGHTS INTO SUPPLY CHAIN PERFORMANCE, DEMAND FORECASTING AND MARKET TRENDS.

or technological. The only constant is uncertainty. That’s why innovation, underpinned by advanced analytics, must anchor reinvention. The implementation of advanced data analytics will provide deeper insights into supply chain performance, demand forecasting and market trends. By harnessing such deeper insights, businesses can anticipate challenges before they materialise.

Ultimately, those who invest in predictability will do more than survive; they will lead. The digitalisation of supply chains is reshaping how goods move and businesses grow, and companies that embed predictability into their DNA will not only protect against shocks, but also unlock the optimisation the industry has been waiting for.

Predictability is no longer optional; it is the new currency of global trade.

Following the success of India’s unified logistics platform, South Africa should be seeking the benefits a similar implementation can offer, writes RODNEY WEIDEMANN

India’s Uni ed Logistics Interface Platform (ULIP) aims to create a seamless, technology-driven logistics ecosystem by integrating data from government and private sources into a single, application programming interface-based portal.

This should improve supply chain ef ciency and transparency, enable real-time cargo tracking, reduce logistics costs and promote compliance and innovation. The potential impact is clear, raising the question of whether South Africa’s logistics sector could bene t from a similar proposal.

Zak von Gordon, associate director for strategic transformation at Deloitte Africa, says we should be inspired by India’s success. “A local ULIP that integrates logistics systems, data and stakeholders for seamless operations could address fragmented data, inef cient customs, high costs and poor supply chain visibility. This could potentially reduce logistics expenses by ten to twenty per cent annually.”

Dr Jacob van Rensburg, head of research and development at the Southern African Association of Freight Forwarders, adds that the issues handled by a ULIP have been on the radar of trade, transport and logistics professionals for quite some time. “The best examples in our industry currently relate to Maritime Single Windows (MSW) and Port Community Systems (PCS). The former is an

electronic platform that enables the electronic exchange of information required for the arrival, stay and departure of ships in ports. The MSW should harmonise data through standardised, interoperable electronic messages, based on the International Maritime Organisation Compendium on Facilitation and Electronic Business. This should ensure consistent and high-quality data exchange. “The PCS, on the other hand, focuses on the operations and commercial business aspects of port logistics. The PCS has a business-to-business characteristic, while the MSW has a business-to-government characteristic.”

A ULIP could offer many bene ts, says van Rensburg. For one, it would enable the intelligent and secure exchange of information between all stakeholders – public and private –in the extended ports environment. “It can drive productivity, ef ciencies and competitiveness, while improving a port’s digital and transactive attractiveness. Furthermore, when working smoothly, it can connect port users and supply chain participants and allow them to share information ef ciently on a single platform by

LESSONS FROM INDIA’S UNIFIED LOGISTICS INTERFACE PLATFORM

India’s ULIP connects 43 systems from 11 ministries via 129 application programming interfaces (API), handling over 1 billion API transactions since its launch in 2022. Results include:

• 30 per cent fewer shipment delays.

• Cost savings of up to 20 per cent.

• Support for sustainability and emissions reduction.

Source: Deloitte

drawing data from different enterprise resource management systems.”

Von Gordon suggests there would also be enormous integration and ef ciency gains, including through data centralisation, unifying sources for accurate, consistent information and better decision-making. “Real-time processing, meanwhile, can eliminate delays and errors, optimising logistics in dynamic environments, while advanced analytics enable predictive planning and proactive issue resolution.”

Moreover, adds von Gordon, customs should be streamlined thanks to paperless processes and automation, reducing human error and delays. “Meanwhile, it can assist with multimodal transport by integrating road, rail, air and sea data, for optimal route planning and seamless modal shifts.”

Of course, there are challenges in pulling this off in Africa, notably limited transport networks and infrastructure, including digital connectivity, regulatory diversity across the continent and language and payment issues.

“The keys to success, however, would ultimately include robust cybersecurity for the centralised data and market-speci c digital infrastructure and skills,” says von Gordon. “Stakeholder education and phased adoption are also critical, while it requires high-level support and broad engagement between the public and private sectors to drive adoption.”

Ultimately, says von Gordon, a ULIP would offer South Africa the chance to modernise its logistics sector, lower costs and improve global competitiveness. “Success depends on collaboration, infrastructure investment, government leadership and – most crucially –lessons learned from India’s experience that are adapted thoughtfully to Africa’s unique context,” he concludes.

Follow: Zak von Gordon www.linkedin.com/in/zakvongordon Dr Jacob van Rensburg www.linkedin.com/in/jacob-van-rensburg-420912119

The withdrawal of the direct maritime service that connects South Africa to the East Coast of the United States, is forcing exporters to rethink their strategies

With goods now being rerouted via transshipment hubs, exporters face increased lead times, additional handling and higher exposure to risk. For the fruit industry, extended transit windows can affect shelf life and compromise market positioning.

Automotive and manufacturing supply chains that depend on tightly managed schedules are being equally exposed to costly delays and increased storage requirements.

Industry analysts from Investec and the South African Maritime Chamber (MBC) note that the broader implications extend beyond immediate operational hurdles. A reduction in direct connections can trigger a structural rise in costs, erode reliability and ultimately affect South Africa’s attractiveness as a trading partner. Exporters with thin margins are particularly vulnerable, making strategic responses essential.

The withdrawal of this direct service adds layers of complexity to export logistics. Where previously planners could count on predictable times and fewer touchpoints, they must now contend with additional variables. More handoffs increase risk of delay and damage. Congestion at major hubs may lengthen waiting times unpredictably.

In response, exporters are adopting three practical measures to mitigate the impact:

• Rerouting strategically – Identifying alternative hub ports, such as Singapore, Hamburg or Dubai with consistent US connectivity.

•Carrier diversi cation – Working with multiple carriers to spread risk and reduce dependency on any single shipping line or route.

• Risk management – Introducing contingency frameworks to deal with bottlenecks, including emergency storage or alternate transport modes.

While exporters can implement many of these strategies independently, the complexity of rerouting, carrier negotiation and schedule optimisation requires specialist expertise. Savino Del Bene South Africa is playing a key role in supporting clients through this transitional phase by offering tailored solutions focused on minimising disruption.

Addressing these challenges requires not only operational adjustments but also strategic foresight. Exporters supported by savvy logistics partners can position themselves to weather the disruption and capitalise on emerging opportunities.

The company’s approach includes a thorough assessment of the market conditions, an analysis of client-speci c needs and agile operational adjustments. We leverage a broad portfolio of partnerships that gives clients access to a network of alternative shipping corridors. By managing relationships and providing critical market intelligence, we enable exporters to adapt with greater con dence.

The shipping service withdrawal affects more than just logistics operations – it also has signi cant economic and trade implications. Reliable and cost-effective access to global markets is essential for sustaining South Africa’s export growth and maintaining its position in international value chains.

Higher freight costs can translate into reduced price competitiveness, which may lead importers to source wares from alternative markets. In industries where shelf life is closely tied to transit times, the impact can be even more signi cant. Manufacturing sectors dependent on predictable shipments may face risks that ripple through domestic production, affecting jobs and economic output.

The withdrawal of the AMEX service highlights a broader global shift towards more dynamic and unpredictable shipping landscapes. Political developments, port capacity constraints and evolving trade patterns mean no single route or service can be taken for granted. For South African exporters, resilience has moved from an operational concern to a core strategic priority – companies with exible supply chains, diverse carrier relationships and informed risk management will be better equipped in periods of uncertainty.

According to Kobus Maree, managing director of Savino Del Bene South Africa, “Shipping disruptions are not new, but the pace and scale of change we are seeing globally emphasises how critical resilience has become for local exporters. Companies that respond decisively, with forward-looking logistics strategies, will be able to safeguard their competitiveness and retain access to key markets.”

The withdrawal of direct maritime connections to the East Coast of the United States calls for pragmatic adaptation rather than reactive responses. South African exporters must therefore create space for innovation in their supply chain management.

Savino Del Bene South Africa continues to support exporters with actionable solutions, to help them navigate the disruption effectively and maintain smooth market access. In a period marked by change, thoughtful planning and partnerships grounded in expertise remain essential to the country’s export success.

Follow: Savino Del Bene www.linkedin.com/company/savinodelbene/posts/?feedView=all

Intra-African trade has the potential to boost economies and lift millions out of poverty, but faces a host of challenges. ANTHONY SHARPE examines how the African Continental Free Trade Area hopes to solve these

Spanning 30.4 million square kilometres and 54 countries, and home to an estimated 1.5 billion people speaking thousands of languages, Africa is as varied as it is vast. As the continent’s economies diversify beyond the minerals and oil that have historically de ned them – and driven centuries of exploitation –opportunities are growing exponentially, too. Its natural resources remain abundant, while rapid growth in population, urbanisation, consumer spending and digital connectivity are creating dynamic new markets for businesses looking to expand beyond saturated mature markets.

However, the vastness and variety that de ne Africa are re ected in the dif culties facing cross-border trade, including poor infrastructure, limited logistics expertise and security concerns.

Dr Jacob van Rensburg, head of research and development at the South African Association of Freight Forwarders (SAAFF), says that from a freight forwarder’s perspective, the challenges are less about a single bottleneck and more about the interaction of infrastructure, documentation and border processes –along with the overall lack of harmony in the region.

“As far as infrastructure is concerned, many corridors remain underdeveloped or poorly maintained, with road transport costs up to one hundred and seventy- ve per cent higher than in other regions,” says Dr van Rensburg. “Rail is fragmented and ports face congestion, while approximately eighty per cent of cross-border trade in Africa is still via the road modality.”

Intra-continental trade currently accounts for only about 15 per cent of Africa’s total trade, compared to over 60 per cent in Europe and nearly 50 per cent in Asia.

Source: United Nations Conference on Trade and Development Economic Development in Africa Report 2023

differing customs, transport and licensing regimes across the Southern African Development Community (SADC), the Common Market for Eastern and Southern Africa, and the East African Community that create duplication and delays. “We also have legacy systems, the automated system for customs data on different levels of maturity at different customs and a bunch of other transport ‘systems’ in the region, not to mention other government agencies not being on the digital platform.

Dr Jacob van Rensburg

Dr van Rensburg cites documentation and regulatory misalignment issues, including

“Border processes face queues, inconsistent application of rules and overlapping agencies driving dwell times and unpredictability.”

Of cially in effect since the start of 2021, the African Continental Free Trade Area (AfCFTA) is one of the African Union’s agship initiatives. AfCFTA is a trade agreement that creates the world’s largest free trade area by number of

AfCFTA unites 1.4 billion people across 55 African countries, creating the largest free trade area in the world by population.

If fully implemented, AfCFTA could add +$450-billion to Africa’s gross domestic product by 2035.

(Source: World Bank).

The agreement could help lift 30 million people out of extreme poverty and create millions of new jobs across multiple sectors.

Participating states aim to remove tariffs on 97% of tariff lines, which represent at least 90% of import value.

Intra-African trade is 15% of total trade today; experts say it could rise well above 50% under full integration.

“COUNTRIES ARE MAKING COMMITMENTS TO LIBERALISE THEIR TRANSPORT SECTORS. AT THE SAME TIME, WE ARE NEGOTIATING A REGULATORY FRAMEWORK FOR TRANSPORT.” – DR JACOB VAN RENSUBRG

participating countries, including all Africa’s 55 nations except Eritrea, thus far. It is intended to eliminate tariffs on up to 90 per cent of goods, reduce nontariff barriers and allow freer movement of goods, services, investment and ultimately people across the continent.

The AfCFTA Protocol on Trade in Goods has nine annexes, several of which deal with customs and border management matters, including customs co-operation and mutual administrative assistance, elimination of nontariff barriers and trade facilitation, explains Trudi Hartzenberg, executive director of the Trade Law Centre. “For example, quite a number of African customs authorities have authorised economic operator (AEO) schemes, which recognise compliant enterprises and provide bene ts such as expedited clearance of goods. Mutual recognition of AEO schemes could have a multiplier effect, with bene ts for compliant traders both at point of export and import across the continent.”

Dr van Rensburg says that SAAFF, through Business Unity South Africa, is

The World Bank projects that the African Continental Free Trade Area could boost intra-African trade by 52 per cent by 2035, potentially lifting 30 million people out of extreme poverty.

the respective countries – the reality is that there are still signi cant disparities in terms of the harmonisation of the framework.”

While AfCFTA’s primary goal is to boost intra-African trade, Hartzenberg believes it can also provide a shot in the arm to industrialisation. “Only seventeen per cent of Africa’s exports are destined for other African countries (2024 data). Trade transaction costs, including delays at border posts and cumbersome trade processes, remain comparatively high on the continent, while disharmonised regulations and complex rules of origin in some regional trading agreements effectively constitute nontariff barriers, which are much higher than actual tariff barriers on the continent.” Hartzenberg says these erode competitiveness, with the result that it is cheaper and more ef cient to import commodities and goods from other countries. However, the fact that so few countries have developed and diversi ed industrial sectors represents another barrier to greater continental trade. “For this reason, AfCFTA has been adopted as a framework for Africa’s industrialisation to support value addition and diversi cation of productive structures on the continent. In the medium to longer term, this will make a difference, as countries develop their capacity to produce tradeable goods competitively and change how and what they trade among themselves and with global partners.”

Of course, to develop and diversify industrial and commercial capacity, infrastructure

“AfCFTA HAS BEEN ADOPTED AS A FRAMEWORK FOR AFRICA’S INDUSTRIALISATION TO SUPPORT VALUE ADDITION AND DIVERSIFICATION OF PRODUCTIVE STRUCTURES ON THE CONTINENT.” – TRUDI HARTZENBERG

The Southern African Association of Freight Forwarders (SAAFF) recently launched a cross-sectoral consultative initiative. The initiative brings together freight and logistics stakeholders, including the South African Revenue Service, the International Trade Administration Commission of South Africa, the National Regulator for Compulsory Specifications, the South African Health Products Regulatory Authority and the Border Management Authority, along with key government and regulatory bodies.

SAAFF head of research and development Dr Jacob van Rensburg says recent consultations have highlighted three golden threads:

• The need for binding commitments under the African Continental Free Trade Area (AfCFTA), with stakeholders being clear that vague liberalisation pledges are insufficient; time-bound and enforceable schedules are needed.

• Digitalisation is not optional, as interoperability and shared standards are the backbone of efficient logistics.

• The private sector must be included, with forwarders, truckers and small to medium enterprises requiring formal representation in corridor design and regulatory dialogue. “These insights signal a path forward: structured public-private dialogue, phased compliance measures and investment in corridor digitalisation,” says Dr van Rensburg. “Together, these can transform Africa’s logistics system from fragmented to integrated, unlocking the full potential of AfCFTA.”

is needed – and not just in the sense of transport and ports, as digital and energy infrastructure are now equally important.

“Digitalisation is central to making AfCFTA workable,” says Dr van Rensburg. “Without interoperable systems, regulatory commitments won’t translate into real facilitation. However, the different declaration systems in place (and not having the other government agencies on the digital systems) represent a signi cant hindrance.”

On a positive note, Dr van Rensburg says single-window platforms, corridor trip monitoring systems and regional customs interconnectivity platforms are already showing promise. “The private sector has pushed for data-sharing rules, interoperability with existing enterprise resource planning and transport management system platforms, and digital customs clearance to become mandatory under AfCFTA frameworks. In practice, this means less paperwork, greater transparency, and faster cargo release, which are all critical for small and medium enterprises (SMEs).”

Hartzenberg says it has also long been recognised that soft infrastructure, including harmonisation of regulatory frameworks, is essential too, as this applies to all infrastructure. It is important to recall that the AfCFTA is not only a free trade agreement, but also a agship project of the African Union, along with other agship projects, including the Programme of Infrastructure Development for Africa. These projects are closely connected, and the success of AfCFTA is linked to the effective implementation of the others.

Complementing AfCFTA is the Pan-African Payment and Settlement System (PAPPS), developed by the African Export-Import Bank in collaboration with the AfCFTA Secretariat to simplify and speed up trade payments between African countries.

PAPPS is designed to handle payment and settlement in real-time, in domestic currencies, says Hartzenberg. “It requires central banks and the commercial banks of buyers and sellers to be in the system to facilitate payment and settlement, so it may take some time to be fully operational. There are, of course, important regional initiatives, including the

Southern African Development Community real-time gross settlement system, a regional interbank settlement system settling payments in South African rands.”

Hartzenberg says PAPSS could play an important role in supporting SMEs across the continent, reducing transaction costs and time. “Large enterprises may continue to work through the nancial institutions as they do now, denominating transactions in global currencies, since they are also likely to trade globally and need forex for those transactions.”

As of August this year, PAPPS was active across more than 150 commercial banks in 18 countries. CEO Mike Ogbalu expects this gure to grow to 30 by the end of the year, covering 500 million bank accounts.

As the economic powerhouse of the continent, South Africa is expected to be one of the rst-round bene ciaries of AfCFTA. Hartzenberg says evidence of this can be seen in the number of AfCFTA certi cates of origin issued so far.

“South Africa’s diversi ed economic structure and export reach, especially across Southern Africa, are already well established, as it has bene tted from the Southern African Customs Union and SADC free trade areas,” elaborates Hartzenberg. “South Africa’s trade footprint includes not only agricultural and industrial products, but also services. South African enterprises in a range of services sectors, including nancial services, communication, professional, transport, construction and mining services, have for many years already been actively engaged in African markets, not only through the cross-border supply of services, but also the establishment of commercial presence and the temporary presence of services suppliers.”

The Single African Air Transport Market was introduced by the African Union (AU) in 2018 to create a unified African air transport market. To date, 38 out of 55 AU states have signed up, but unfortunately, protectionist policies have made enforcement difficult, while regional co-operation has often been trumped by national interests.

Source: Kenya Association of Air Operators

Hartzenberg adds that South Africa’s wholesale, retail and franchising distribution services, and transport and logistics have been important in providing conduits for consumer goods and agricultural products to reach consumers in other African markets. “It is important to note, however, that other countries are now actively reaching new market opportunities across the continent. Notably, countries in the North African region, including Morocco, Tunisia, Egypt and others, have joined regional economic communities, including the Common Market for Eastern and Southern Africa and the Economic Community of West African States, and are not competing with producers in the Sub-Saharan region.”

Dr van Rensburg believes South African freight forwarders are aware of the opportunities presented by AfCFTA and are, in many respects, ready, although several gaps nevertheless remain. “In terms of expertise, operators must become conversant with the new regulatory frameworks, digital systems and services trade negotiations. There are capacity issues too, with SMEs in particular (which do more than eighty per cent of trade in Africa) struggling to comply with certi cation and sustainability requirements without phased timelines and nancial support. Finally, regarding the policy environment, liberalisation must be matched with binding schedules and safeguards to avoid a rollback of commitments.”

Follow: Dr Jacob van Rensburg www.linkedin.com/in/jacob-van-rensburg-420912119

Trudi Hartzenberg www.linkedin.com/in/trudi-hartzenberg-6b306812

AFRICA GLOBAL LOGISTICS explains why Africa’s supply chain bottleneck isn’t where you think it is

There’s a myth in African logistics that port congestion is primarily a berth problem. Ships anchor at the port limits, and the nger-pointing begins. However, terminal operations experience across the continent reveals a far more subtle and costly reality.

The visible delays at the quayside are symptoms. The actual challenge lies in how ports are designed, operated and integrated into the broader supply chain ecosystem.

Consider what happens when a container ship arrives at a busy African port. The berth might be available. The cranes might be functioning. Yet the container spends four, ve and sometimes six extra days moving through the terminal. Why? Because the real bottleneck isn’t vessel reception; it’s the co-ordination between that berth, the storage capacity, the yard management system and the outbound transport infrastructure.

Most operators measure terminal performance metrics: referring to containers, ship working hours, ship turnaround times, on-time berthing of the vessel, gross crane hours, truck turnaround times and container dwell times all play a part. A terminal can move cargo quickly and still create chaos downstream. Poor yard planning means containers pile up in the wrong container stacks. Inadequate storage capacity forces suboptimal stacking. Unreliable handoff procedures delay truckers and rail operators waiting outside the gate. Each friction point adds costs: to the port operator and, exponentially, to every shipper in the system and the economy.

This reality can play out at any port: a major shipping line frustrated with turnaround times threatens to divert to another port. The port’s management blames congestion. Investigations could reveal something different: a terminal’s operating system isn’t integrated with its yard management software. Container locations are being logged manually, and truckers arriving to collect containers often have to wait hours while staff manually search the yard. The shipping line isn’t suffering from berth delays

PORT

OPERATION AND INTEGRATION INTO THE BROADER LOGISTICS ECOSYSTEM NEED A RETHINK.

but from operational invisibility. The costs to this shipper could run into hundreds of thousands of dollars annually in extended demurrage, storage and haulage fees.

Modern port operations demand more than throughput; they demand systems thinking. Integration, visibility and predictability matter.

At Africa Global Logistics (AGL), this philosophy is being translated into concrete operations across Africa’s port infrastructure. When AGL assumed operations at A-Berth, Duncan Docks in Cape Town earlier this year, it had the opportunity to demonstrate what integrated terminal management looks like in practice. Working alongside Transnet National Ports Authority, FPT Group, and AGL with partner BALSA implemented a model prioritising operational co-ordination and system reliability.

Rather than viewing each function as discrete, operations were designed around the entire journey: from vessel arrival through to container collection. NAVIS Terminal Operating Systems (TOS) create real-time visibility across all operations. Modern handling equipment moves cargo faster and more reliably and predictably, resulting in improved cargo-handling ef ciency, reduced turnaround times and a seamless, modernised experience for port users. TOS gives customers full visibility of operations along the import and export value chains. Business partners have web-based access for pre-advice of containers to TOS to ensure ef cient operations. This approach extends across AGL’s port concession portfolio.

Perhaps most signi cantly, AGL is pioneering green terminal operations that integrate environmental sustainability into operational excellence. Sustainable terminal design –optimised energy consumption, reduced emissions and waste minimisation – improves ef ciency. Greener operations are leaner operations, requiring better systems integration, smarter work ow design and closer co-ordination with customers.

Many African ports still operate in silos. Maritime operations, storage and outbound logistics are managed as separate functions rather than integrated processes. This is expensive: a shipper importing goods through an inef cient port doesn’t just pay higher port charges; they carry additional inventory buffer to compensate for unpredictable delivery windows, maintain larger storage facilities and employ more staff to manage uncertainty. These hidden costs often dwarf the port fees.

The path forward requires a fundamental reframing. Performance metrics should encompass the entire value chain: predictability, system integration, real-time visibility and total cost of ownership, not just tonnes moved.

The continent’s economic transformation depends on supply chains that move cargo reliably, predictably, sustainably and affordably. Port infrastructure design, operation and integration into the broader logistics ecosystem need a rethink.

Follow: Africa Global Logistics www.linkedin.com/company/africagloballogistics

reflects on the evolving role of fleet management

In a world where logistics underpins every trade ow and economic interaction, the discipline of eet management has become more than just a back-of ce function. It is now a core driver of ef ciency, innovation and competitiveness across industries.

Justin Thomas , executive head Standard Bank eet management, and a leading voice in eet and mobility solutions, frames eet management not as a “market”, but as a discipline of cost and risk management. “When people hear ‘ eet management,’ they often think only of telematics,” he explains. “However, in reality, it is a discipline made up of multiple services – fuel and eet cards, consulting, payment providers and technology platforms – all working together to reduce costs, manage risks and unlock value for businesses.”

Traditionally, eet managers were dedicated professionals inside large corporations with hundreds of vehicles. However, in today’s landscape, the picture is more nuanced. “For large eets, the discipline is entrenched,” Thomas notes. “But, in small and medium enterprises (SMEs), you don’t often nd a dedicated eet manager. Instead, the responsibility sits with HR managers, of ce managers or even nance leads – essentially hybrid roles where eet management becomes another part of the daily job.”

This shift reveals both a challenge and an opportunity: awareness. Many SMEs aren’t fully conscious of what they should be monitoring – fuel usage patterns, risk exposure and expense leakages –yet these factors directly impact margins. The opportunity lies in equipping these businesses with accessible, technology-driven solutions that help them manage eets with the same discipline as large corporates.

At its heart, eet management is a balancing act between cost control and risk mitigation. Whether it’s controlling spend on fuel, ensuring compliance with regulations or monitoring driver behaviour, the function directly in uences pro tability. “Fleet management isn’t glamorous, but it’s critical,” Thomas remarks. “It’s about making sure businesses don’t lose money where they shouldn’t, while ensuring safety and compliance. Done right, it can be transformative.”

With trade and logistics becoming increasingly digitised, innovation is powering the next phase of growth. Digital eet cards, real-time analytics and integrated payment platforms are reshaping how businesses track, manage and optimise mobility. These tools not only improve oversight, but also generate the data that enables smarter,

Follow: Justin Thomas www.linkedin.com/in/justin-thomas78

“BUSINESSES DON’T NEED MORE DASHBOARDS. THEY NEED INSIGHTS THAT MAKE THEIR LIVES EASIER – WHETHER THAT’S REDUCING FRAUD, IMPROVING CASH FLOW OR STREAMLINING COMPLIANCE.”

– JUSTIN THOMAS

faster decision-making. For Thomas, this evolution is less about technology for its own sake and more about practical value creation. “Businesses don’t need more dashboards. They need insights that make their lives easier – whether that’s reducing fraud, improving cash ow or streamlining compliance,” he emphasises.

As Africa’s economies grow and regional trade accelerates, eet management will play an outsized role in shaping competitiveness. By professionalising how vehicles, drivers and expenses are managed, companies can unlock ef ciencies that ripple across supply chains – powering trade, lowering costs and driving innovation. The discipline is no longer hidden in the background. It is becoming a strategic lever that determines whether businesses simply move goods or move ahead.

Managing a fleet is easier with a STANDARD BANK FLEET CARD

In today’s high-pressure operating environment, managing a eet is no longer just about fuel and mileage; it is about data, control and nancial discipline.

Standard Bank’s Fleet Card offers many bene ts and facilitates seamless operation.

The Standard Bank Fleet Card brings these priorities together through a secure, intelligent and future-ready payment solution that helps businesses of all sizes manage mobility spend with con dence.

The Standard Bank Fleet Card combines robust chip-and-PIN technology with real-time transaction monitoring to reduce fraud and unauthorised spending. Integrated rules engines prevent over lls, duplicate transactions and out-of-pattern usage, ensuring that every litre purchased is fully accountable.

Through the Fleet360 platform, each cardholder’s transactions are visible instantly, giving businesses live oversight of consumption, cost per kilometre and route-level behaviour. For smaller businesses without a dedicated eet manager, this visibility provides the kind of governance and insight once reserved for large corporates.

Beyond security and reporting, the Standard Bank Fleet Card is engineered for savings. Standard Bank’s negotiated alliances with leading fuel suppliers translate into substantial per-litre discounts. Across its customer base, these collective savings exceed R1-million daily.

The card also supports evolving energy needs: partnerships with charging-network providers are extending its acceptance to electric-vehicle infrastructure, ensuring continued relevance as eets transition to alternative power.

By integrating nancial, operational and technological capabilities, FML enables businesses to focus on their core purpose while Standard Bank manages the machinery that moves it forward. It is a complete mobility solution. One that transforms eet ownership from a burden into a strategic advantage.

TECHNOLOGY WITH REAL-TIME TRANSACTION MONITORING TO REDUCE FRAUD AND UNAUTHORISED SPENDING.

Fleet ownership can be one of a company’s largest xed costs – second only to payroll – yet vehicles themselves rarely represent a core business capability. Standard Bank’s Full Maintenance Leasing (FML) model reimagines eet management as a service, enabling organisations to outsource complexity while retaining complete operational control.

Under this structure, Standard Bank assumes responsibility for the vehicle throughout its life cycle, from procurement and licensing to insurance, tyres, maintenance, roadside assistance and eventual disposal. Businesses lease the vehicles they need on xed terms and predictable costs, freeing up capital and management time for growth activities.

The bank’s national buying power delivers immediate savings at the point of acquisition, while its total-cost-of-ownership analytics optimise running expenses across fuel, parts and service intervals. Fleet360 technology provides a uni ed view of usage, spend and compliance, turning every data point into a decision tool.

Flexibility is built in: vehicles can be replaced or upgraded at contract maturity, ensuring eets remain modern, ef cient and aligned with business requirements. For

specialised sectors, such as refrigerated transport or last-mile delivery, custom con gurations, solar-powered units and alternative-energy options are available.

By integrating nancial, operational and technological capabilities, FML allows businesses to focus on their core purpose while Standard Bank manages the machinery that moves it forward. It is a complete mobility solution. One that transforms eet ownership from a burden into a strategic advantage.

Maintenance costs often represent the hidden drain in eet operations. Standard Bank’s Managed Maintenance solution transforms that challenge into an opportunity for measurable ef ciency through data-driven oversight, supplier optimisation and proactive risk management.

Processing more than R1.4-billion in repair transactions annually across a 40 000-vehicle portfolio, the programme identi es and eliminates unnecessary spend before it occurs. Fleet360 technology consolidates every repair, part and supplier invoice into a single digital environment, allowing clients to benchmark real costs against target cents-per-kilometre performance.

The results are tangible. Continuous monitoring and negotiated supplier rates

FLEET360 TECHNOLOGY CONSOLIDATES EVERY REPAIR, PART AND SUPPLIER INVOICE INTO A SINGLE DIGITAL ENVIRONMENT, ALLOWING CLIENTS TO BENCHMARK REAL COSTS AGAINST TARGET CENTS-PER-KILOMETRE PERFORMANCE.

generate annual client savings estimated between R250-million and R300-million. Predictive analytics highlight early warning signs, such as excessive idling or component wear, so maintenance schedules can be adjusted to prevent costly breakdowns. In one national eet, optimised service intervals reduced engine failures and saved millions of rand in a single year.

Managed Maintenance also integrates essential support services, including licence renewals, nes administration and 24-hour roadside assistance. These add-ons reduce administrative load while ensuring compliance and driver safety.

For smaller organisations without dedicated eet teams, the service introduces professional eet discipline through an accessible, automated platform. For corporates, it delivers scale, transparency and measurable returns. By aligning engineering insight, nancial control and digital intelligence, Standard Bank’s Managed Maintenance converts maintenance from a reactive cost centre into a strategic lever of performance and pro tability.

E-commerce growth has boosted South Africa’s last-mile delivery industry –and this upward trajectory is set to continue, writes

LISA WITEPSKI

The sudden proliferation of smart lockers – now situated in almost every mall – is testimony to the growing demand for last-mile courier service.

According to Parcel and Postal Technology International, there are now more than 1 200 of these lockers throughout the country, with increasing numbers driven by the mushrooming popularity of retailers like Shein, Temu and Yaga.

Ryan Gaines, CEO of City Logistics, which handles last-mile deliveries through its sister company, Fastway Couriers, says an interesting dynamic is at play in the industry. “Our work with e-commerce platforms is de nitely on the up. For example, TFG has experienced a forty- ve per cent increase through its online arm, Bash. However, there’s been a general slowdown in terms of the volume of deliveries to traditional brick-and-mortar shops, correlating with uctuations in the rand’s value.”

Gaines adds that South Africa’s industry is not alone in being forced to keep up with the evolution in e-commerce, but the country has had to grapple with many unique challenges. For example, until around ve years ago, the industry was geared primarily

South Africa’s last-mile delivery market is projected to generate revenue of around R58-billion by 2030.

Source: Grand View Research .

for business-to-business deliveries, but now there is a growing small and medium enterprise presence in the market.

Last-mile delivery is the very last step in the supply chain process. Before this, an item would have been moved from the manufacturer to a warehouse. This “first mile” is followed by the final milestone: ensuring the item is delivered into the hands of the customer from the warehouse.

Although this sounds simple, this stage is where errors are most likely to occur: parcels and packages may be damaged or poor infrastructure may impact delivery times – particularly concerning given growing customer expectations for same-day delivery. In South Africa especially, the last mile may be challenging because of poor road conditions or the accessibility of rural areas and townships.

Source: Merchants Fleet

Linked to this is the new emphasis on previously underserviced areas, which brings about new opportunities. For instance, several entrepreneurs have moved to ll the gap left by courier companies that do not have the resources required to overcome the challenges associated with delivery in townships. As smart logistics operator Pargo notes, these are multifaceted and include “insuf cient mapping for navigation, crime concerns and unreliable geolocation apps”. Pargo has addressed this by introducing Pickup Points, which negate the need for home delivery. Thanks to these centres, the company has been able to service communities in Soweto, Umlazi and Khayelitsha.

City Logistics’ answer has been to create a franchise model, where couriers are recruited to serve the communities in which they live. “This creates community buy-in: people are more likely to support them, while they have an insider’s knowledge of the area,” says Gaines. In this way, the industry is also serving as a catalyst for job creation. Last-mile delivery provider Green Riders states that its strategy is “to recruit unemployed, underprivileged youths (both men and women) and train them, in the areas in which they live, to become professional delivery riders”. The company, which uses e-bikes and e-motorbikes because they are cheaper for riders to operate, has created the Green Riders Academy to help it achieve this goal. By November 2024, the company had created 2 025 jobs.

Meanwhile, in 2024, the Takealot Group announced its intention to recruit 1 000 last-mile delivery drivers to scale its reach into townships.

Gaines predicts that, with their signi cant densities, these underserviced areas will continue to provide the most signi cant areas for the industry’s growth going forward. However, all players should expect stiff competition in the future as giants like Amazon and Takealot up the ante in terms of service.

Follow: Ryan Gaines www.linkedin.com/in/ryan-gaines-5370b217

Ryan Gaines

Since its modest beginnings in 1956 “Old Faithful,” a single truck that carried the company’s rst loads, Cargo Carriers has grown into a trusted and specialised logistics partner serving multiple industries across the region.

Founded by visionary entrepreneur Des Bolton, the business was built on four enduring values: tenacity, integrity, competence and innovation. These principles remain central to its operations today, underpinning every decision and every delivery.

The transport and logistics sector is competitive, high-risk and asset-intensive. Success requires reliability, safety and constant innovation – qualities that have de ned Cargo Carriers for over six decades. From its early work servicing the Free State gold elds to today’s operations –transporting hazardous chemicals, fuels, steel, cementitious products and agriculture, namely, sugar – Cargo Carriers ensures ef ciency, reduced risk and added value for its clients.

Expansion has always been a hallmark of Cargo Carriers, and growth has continued throughout Southern Africa, supported by the company’s ability to diversify into new sectors. Today, Cargo Carriers operates through two focused business entities:

• Cargo Trucking – road freight logistics.

• Cargo Carriers Supply Chain Solutions –warehousing, distribution and supply chain optimisation.

From a single truck to one of Southern Africa’s most respected and specialised logistics partners, CARGO CARRIERS handles and moves goods across the region reliably and safely

Within its trucking division, three industry verticals deliver customised services:

• Chemicals, steel and mining.

• Fuel and powders.

• Agriculture, namely, sugar.

This structure ensures deep technical expertise and sector-speci c solutions. Many clients have partnered with Cargo Carriers for more than 48-plus years, a powerful testament to its reliability and long-term commitment.

For more than three decades, Cargo Carriers has been a leader in the transportation of hazardous chemicals. As a founding signatory to the Responsible Care Programme of the Chemical and Allied Industries Association, the company has set the benchmark for the safe handling and movement of dangerous goods across Southern Africa. Its operations are guided by rigorous compliance standards, including DEKRA accreditation, OHSAS 45001 certi cation and regular external and internal audits. These frameworks ensure not only operational excellence, but also the protection of employees, clients and surrounding communities.

Cargo Carriers’ pursuit of operational optimisation and supply chain innovation has been recognised with multiple Logistics Achiever Awards, including:

• Gold Logistics Achiever Award

• Platinum Award – transformation in the sugar industry,

• Gold Award – supply chain innovation in the apparel industry.

• Gold and Silver Awards – supply chain optimisation and innovation. These accolades con rm the company’s ability to combine strategic insight with practical execution, consistently unlocking value for its clients.

Cargo Carriers has always been a pioneer in applying technology to logistics. From installing its rst computing systems in the 1980s to deploying today’s intelligent telematics, the company has continually evolved to deliver full supply chain visibility and enhanced internal ef ciency.

At the same time, its people remain central to success. Cargo Carriers invests heavily in driver training, skills development and regular health screenings, ensuring a capable and safe workforce.

After more than six decades, Cargo Carriers remains steadfast in its values – tenacity, integrity, competence, innovation and accountability. These principles are not abstract ideals, but practical commitments re ected in the company’s culture, day-to-day operations and enduring client partnerships. Looking ahead, the company’s vision is clear: “To be recognised as the preferred partner in supply chain and logistics solutions and to be rated as the leader in our selected specialised markets.”

South Africa’s supply chains have faced unprecedented pressure – from port congestion and ageing rail infrastructure to power outages and rising security risks. Yet strategic shifts are steadily shaping a more resilient logistics sector.

By VANESSA ROGERS

South Africa’s transport and logistics industry remains a cornerstone of the national economy. In 2025, Eulerpool Research Systems valued gross domestic product from transport alone at R377.3-billion, underscoring its central role in trade and economic activity. The sector spans over 750 000km of roads, about 30 400km of rail, 90 licensed airports and maritime transport that moves 96 per cent of export volumes (Source: news.nwu.ac.za)

Yet, despite its scale and importance, port congestion, rail inef ciencies, power outages and mounting security risks are driving up costs, delaying deliveries and eroding reliability.

South Africa’s ports remain under severe strain. In June 2025, port delays surged by up to 300 per cent compared to pre-pandemic levels, with Cape Town ranking among the hardest-hit global hubs, according to Tradlinks. The congestion has led to extended vessel waiting times, delayed cargo deliveries and ripple effects across industries dependent on just-in-time logistics.

At the same time, rail infrastructure faces persistent challenges. Reuters reports that maintenance backlogs, equipment theft and ageing assets continue to hamper the network. Freight volumes rose from 152 million tonnes in 2023 to 160 million tonnes in 2024, but remain below the 170 million tonnes target. Modest improvements are expected in 2025 as recovery measures take effect.

To ease pressure, the government licensed 11 private operators in 2025 to manage 41 rail lines and 6 logistics corridors.

Despite these interventions, many mining and industrial producers are turning to road transport to bypass rail bottlenecks. This shift drives up costs, worsens congestion and highlights the urgent need for long-term infrastructure investment and strategic planning.

While load shedding has eased for households, rolling blackouts continue to disrupt production, cold chains and transport operations. These power cuts, combined with rising cargo theft, truck hijackings and port vandalism, are driving instability and forcing operators to adjust routes and schedules –often at signi cant cost.

The scale of the problem is stark. In 2023, the Transported Asset Protection Association recorded 41 120 cargo crimes across 36 African countries, with 99 per cent occurring in South Africa. These ranged from truck hijackings to warehouse thefts, costing businesses billions in losses.

Paul Vos, regional managing director of the Chartered Institute of Procurement & Supply (CIPS Southern Africa), says: “South Africa’s supply chains have endured some of the toughest tests in living memory – from port congestion and rail breakdowns to power cuts and security risks. At CIPS, our view is clear: we cannot future-proof against every disruption, but we can build future- t supply chains that are visible, adaptable, inclusive and people-driven.”

Key strategies to achieve this include:

1. Strategic risk management: map the entire network to identify vulnerabilities.

2. Digital visibility: use real-time tracking, predictive analytics and scenario modelling to anticipate risks.

3. Adaptability over efficiency: replace rigid, lowest-cost models with agile systems that allow rerouting, exible contracts and regional trade options.

4. Inclusive partnerships: collaborate with diverse suppliers while aligning

Follow: Paul Vos www.linkedin.com/in/pauljvos Frans Prinsloo www.linkedin.com/in/frans-prinsloo

“RESILIENT SUPPLY CHAINS ARE BUILT BY PEOPLE AS MUCH AS BY SYSTEMS.” – PAUL VOS

environmental, social and governance and broad-based black economic empowerment objectives.

5. Investing in people: equip staff with the skills and agility to make informed decisions under pressure.

“Resilient supply chains are built by people as much as by systems,” Vos adds.

Frans Prinsloo, head of business development and innovation at Lombard Insurance, stresses the importance of insurance in supporting resilience. High-crime areas, extreme weather events and transport incidents have pushed insurers to adapt coverage terms for high-risk commodities.

“By combining strategic risk management with digital visibility and strong insurance partnerships, transport operators can safeguard operations and reduce nancial losses,” Prinsloo explains.

He points to innovative rms such as Route Management Services and AgrigateOne that use real-time data to prevent losses and offer operational foresight. “Data-driven solutions give operators and insurers the insights needed to anticipate risks rather than simply respond to them. By investing in these tools and collaborating closely with clients, insurers can help build supply chains that are not only protected, but also positioned to thrive despite disruption.”

New cranes at Cape Town Container Terminal are helping to boost productivity, but more than just equipment is needed, writes

South Africa’s ports have been in a state of decline for some time, with Cape Town being no exception. This is bad news for agricultural exports, with bottlenecks and delays costing the apple and pear industry alone R1-billion a year, according to Tru-Cape.

However, progress has been made with the launch of 9 of 28 new rubber-tyred gantry cranes with 3D cameras for precision hybrid engines and anti-sway systems enabling them to operate in winds of up to 90km/h. The cranes were acquired as part of a R3.4-billion investment programme in turning the port around, which is crucial to unlock the port’s full capacity, says Dr Juanita Maree, CEO of the South African Association of Freight Forwarders. “Equipment upgrades matter because productivity is closely tied to the alignment of physical assets with terminal design. Although Cape Town Container Terminal (CTCT) was designed to handle 1.4 million twenty-foot equivalent units (TEUs) annually, infrastructure limitations have reduced its capacity to around 1 million.”

Encouragingly, however, Dr Maree says that this investment, combined with changes, such as the introduction of a fourth shift and incentive-based performance monitoring, is beginning to yield measurable results. “Since mid-July, Cape Town Container

ANTHONY SHARPE

Terminal (CTCT) has averaged two thousand three hundred and three TEUs per day – well above the target of one thousand nine hundred and sixty-two and markedly higher than last year’s average of one thousand eight hundred and fty-nine. Export volumes overall are up twenty-four per cent year-on-year, while refrigerated container volumes have grown by thirty-two per cent.”

Theo Pappas, director of investments for Africa at APM Terminals, which forms part of Maersk’s transport and logistics division, says the shipping giant is pleased to see the new equipment in action. “The timing of this roll-out – following the peak reefer season – is ideal, providing operators with a valuable window to familiarise themselves with the machinery ahead of the upcoming grape season.”

While new equipment like the cranes is vital to reinvigorating the port, Dr Maree says that looking at international best practice across ports in the Netherlands, Germany and Thailand, it’s clear that equipment alone is not enough. “Soft infrastructure such as platforms and collaborative governance are equally important.

Cape Town ultimately requires a Port Community Platform that unites stakeholders on a single digital interface for real-time data, planning and transparency.”

Equally important, says Dr Maree, is stakeholder trust and collaboration. “Transnet has already acknowledged the value of customer partnerships. Extending this ethos into a structured governance framework would amplify the bene ts of infrastructure upgrades.”

Pappas says Maersk is encouraged by the announcement of a 10-year strategic partnership between Transnet Port Terminals (TPT) and materials handling equipment provider Liebherr. “This long-term collaboration signals a strong realisation of the need to ensure continued maintenance of the new equipment and, therewith, a commitment to operational excellence and sustainable productivity improvements towards international standards.”

Beyond equipment and digital platforms, bottlenecks at the “edges” of the system need to be dealt with, says Dr Maree. “On the landside, back-ofport facilities such as the Bellville Container Terminal have proven instrumental in acting as a release valve for congestion. The integration of Transnet Freight Rail movements between this terminal and CTCT has eased yard pressure and allowed for smoother stack planning.” She adds that decongesting the port precinct, optimising yard ows and ensuring increased crane capacity translates into higher throughput, all hinge on scaling up these facilities.

“On the waterside, improvements in vessel ows in and out of port limits are equally important,” adds Dr Maree. “The collaboration between Transnet National Ports Authority and TPT in managing arrivals and departures has already yielded ef ciencies, enabling ships to begin operations more quickly once alongside.”

www.linkedin.com/in/juanita-maree

www.linkedin.com/in/theo-pappas-57654964

VIVEN CHAPLIN, director – Corporate and Commercial, and HAAFIZAH KHOTA, senior associate – Corporate and Commercial, at Cliffe Dekker Hofmeyr, write that South Africa’s rail sector has turned a corner with early signs of recovery noted

South Africa’s rail sector is moving from diagnosis to delivery. The challenges are well documented: a shortage of operational trains, ageing infrastructure, widespread theft and vandalism and operational inef ciencies, creating bottlenecks that spill into port. Shifting trade routes, geopolitical instability and environmental concerns add further complexity.

Yet opportunities are emerging as the African Continental Free Trade Area takes effect. The United Nations’ Economic Commission for Africa projects about a 50 per cent increase in intra-African transport demand and a 28 per cent rise in freight demand by 2030, making ef cient movement of people and cargo across the continent critical for economic growth.

In contrast to last year’s audit of constraints, signi cant progress can be reported this Transport Month. The rail network is at the centre of reform. With evolving policy, active industry involvement and increased access to capital, the focus now is on disciplined execution that delivers reliable passenger and cargo services.

The policy direction was set in 2020 under the Economic Reconstruction and Recovery Plan, when government committed to enabling third-party access to the core rail network. The National Rail Policy, followed in 2022 and mapped out the priorities, including the creation of a national Rail Planning Function, tasked to develop an integrated Rail Master

Plan, promotion of third-party access through a Private Sector Participation (PSP) framework, independent economic regulation of rail access and a shift of passenger demand from road to rail.