Your brand can reach up to 250,000+ trade customers across 6 national publications. Download

Your brand can reach up to 250,000+ trade customers across 6 national publications. Download

Welcome to the October edition of National Liquor News – an issue that captures the passion, resilience and innovation that continue to define our industry.

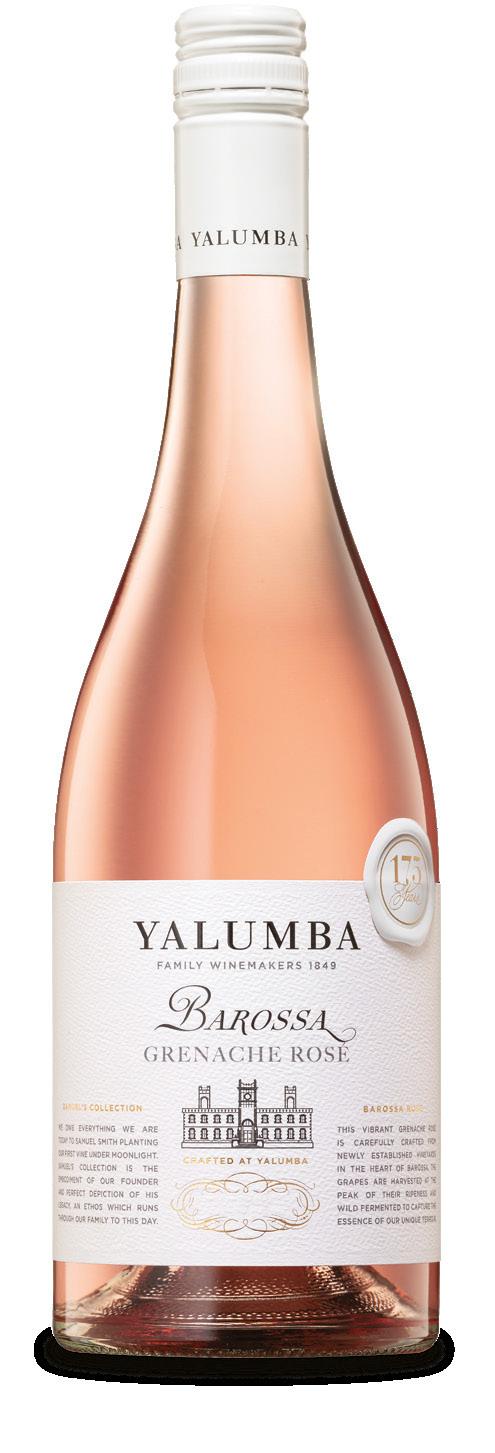

At the heart of this edition is our Rosé Buyer’s Guide, a celebration of one of the most dynamic and fast-growing wine categories. With hundreds of entries and an exceptional line-up of gold medal winners, the guide is an invaluable resource for retailers heading into peak rosé season.

We also spotlight three of the biggest industry gatherings of the year. The Independent Liquor Group marked its 50th anniversary with a study tour across Barcelona and Lisbon, blending cultural discovery with record-breaking trading results that underscored the strength of the cooperative model. On the Gold Coast, Independent Brands Australia revealed its bold ‘Family Founded’ campaign at its annual conference, uniting more than 550 members, suppliers and staff behind a powerful

cross-pillar message. And in Perth, Thirsty Camel Victoria hosted its largest forum to date, with more than 260 members and suppliers coming together under the theme of ‘Next Level’, unveiling rebate increases, loyalty program upgrades and new digital tools to sharpen in-store execution.

Rounding out this issue are inspiring stories from retailers like Ben Duval at Carwyn Cellars in our Retail Unfiltered series, and a new direction for Good Pair Days, which has taken its personalised model into bricks-and-mortar.

As always, a big thank you to all our contributors, readers and industry partners.

Cheers, Deb

Deb Jackson, Managing Editor 02 8586 6156 djackson@intermedia.com.au

FOOD & BEVERAGE

Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Senior Journalist: Molly Nicholas mnicholas@intermedia.com.au

Journalist: Sienna Martyn smartyn@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Webb-Smith kea@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST) 2yrs (22 issues)for

Saving

(33

for $147.00 (inc

– Saving 30% To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

2025

10 Cover story: Ampersand drives growth with bold innovation

12 Retail unfiltered with: Ben Duval, Carwyn Cellars

14 Store Profile: Good Pair Days opens first retail store

30 News: The latest liquor industry news for retailers around Australia

34 Marketplace: Brand news and promotions

Industry Focused

16 Independent Liquor Group: Celebrating 50 years in Barcelona and Lisbon

22 Independent Brands Australia: IBA to unleash the power of independents

26 Thirsty Camel Victoria: Thirsty Camel Forum takes members to the Next Level

32 Paramount Liquor: Delivers biggest conference yet

44

Retail Drinks: Retail Drinks Industry Summit and Awards 2025

45 DrinkWise: Campaigns promote safer, respectful drinking

46 Activate Group: Formatting the industry

47 Strikeforce: The difference between being seen and being sold

48 New Zealand Winegrowers: New Zealand Wine forum embraces change

49 Wine Australia: State of the Grapes reveals wine trends

50 Leasing: Major shake-up in Queensland commercial leasing

51 Training: Filling the gaps

52 NielsenIQ: Rules of liquor innovation

54

Changing Rank: BrightSide announces recent placements

56 RTD: The category that won’t stand still

72 Summer Beers Marketplace: The season’s freshest pours

75 Trade Buyer’s Guide: Spotlight on Rosé

Independent retailers gain a premium partner as Ampersand Projects delivers innovation, loyalty and super smooth vodka excellence.

In just seven years, Ampersand Projects has evolved from a single standout release into one of Australia’s top independent spirits brands. The business has built a loyal following and delivered consistent results for retailers through its bold product development, premium positioning, and ability to connect with health-conscious, experience-driven consumers.

Proudly 100 per cent Australian-owned and part of the Casella Family Brands group, Ampersand has carved out a clear identity in the ready-to-drink (RTD) and spirits category. Its commercial success offers independent liquor retailers a significant opportunity, thanks to strong consumer demand and a reputation for innovation that larger competitors often struggle to match.

At the heart of the brand is its signature vodka, which underpins both RTD and standalone spirits offerings. Available in a premium 500ml glass bottle at 37.5 per cent ABV, the vodka delivers a smooth taste profile that has resonated with consumers seeking approachable yet highquality options at an attractive price point under $40.

Founder Alex Bottomley explains it’s a formula that has resonated strongly with consumers and remained central to the brand’s growth.

“Staying true to our taste profile with

our super smooth vodka has been key. We’ve adapted our flavours to suit trends with drinkers, but the vodka itself is hard to beat – especially our 500ml bottle, which is proving to be a standout with customers.”

This focus on consistency and quality has provided the foundation for extending into a diverse RTD range, with formats spanning four per cent, six per cent and nine per cent ABV alongside cocktail flavours, gin, and whisky.

Ampersand’s reputation as a market leader comes from a willingness to experiment and deliver excitement to both shoppers and retailers. From higher ABV RTDs that align with consumer demand to creative packaging solutions, the company has consistently pushed the boundaries of the category.

One standout innovation is the Vodka & Raspberry Lemonade six per cent RTD, perfectly suited to independent retail shelves where discovery and differentiation drive sales. The launch of an eight-pack format

with a free bonus bucket hat inside reinforces Ampersand’s point of difference, turning each purchase into a ready-made experience.

“We pride ourselves on being bold and doing things a bit different – putting the actual GWP inside the pack is one example of how we set ourselves apart,” says Bottomley.

With every product being low calorie, no sugar and gluten-free, Ampersand also caters directly to the growing better-foryou movement. Consumers trading up to premium options are finding appeal in its portfolio, while retailers benefit from the margins and volumes delivered by a brand aligned with modern drinking occasions.

“As an Australian-owned business, we take pride in staying close to our consumers and independent retailers. Our independence gives us the freedom to innovate quickly and bring exciting products to market quicker than our global competitors,” Bottomley adds.

For independent liquor retailers, Ampersand represents a chance to stand out with a trusted, in-demand brand. By ranging Ampersand, retailers can capitalise on its strong following, commercial performance, and innovation pipeline – while also supporting a proudly local success story.

To explore the full range, visit the Ampersand website or contact your Casella Family Brands sales representative to discuss ranging opportunities. ■

Carwyn Cellars’ Ben Duval champions tradition, innovation and community, shaping Melbourne’s independent liquor scene with passion.

Retail unfiltered dives behind the counter to uncover the real people of Australia’s liquor retail industry.

Here we meet Ben Duval of Carwyn Cellars, long-time champion of independent beer and a familiar face in Melbourne’s craft community.

Known for his easy-going nature and deep knowledge of traditional beer styles, Duval has helped steer Carwyn Cellars through some of its toughest years while maintaining its reputation as one of the country’s leading independent retailers.

Carwyn Cellars was opened in 2007, when Ben and Nicole Carwyn purchased a run-of-the-mill bottle shop and set about reshaping it into something unique. Three years later, Duval joined the business and was quickly immersed in its growing focus on craft and independent producers.

“Back then we were 100 metres down the road from the current site – I have fond memories of the vintage green carpet tiles and selling lots of beer without lactose,” he recalls.

From student job to lifelong beer passion Duval’s appetite for drinks began in his student days, when he worked at Booze Brothers in North Adelaide.

“For the time, they had a great selection of beers – mostly Belgian and English – and I would take a different beer home at the end of every shift. By the time I left that job, I had a true passion for traditional beer styles,” he says.

That love for tradition continues to shape his palate and his retail philosophy today, guiding the way he selects products, champions classic styles, and balances innovation with the timeless favourites that customers keep coming back for.

“Traditional beer styles have seen a huge renaissance, which is awesome. I think they offer great value, but also consistency… how undeniably delicious is a well-brewed ESB or a Czech Pilsner!”

Carwyn Cellars has earned a reputation as one of the most dynamic independent retailers in the country, something Duval credits to a philosophy of

buying what excites him and Ben Carwyn.

“It’s just full of interesting and diverse booze. Ben (Carwyn) and I split the buying, and we simply buy what we like. That means tasting a lot of great booze – but somebody has got to do it! I’d say Carwyn doesn’t feel overly curated or staged though either –it has a comfortable feeling to it, which is welcoming to absolutely anybody, no matter their walk of life or their preference of tipple.”

That sense of inclusivity extends beyond the shelves. In 2020, when Covid forced the cancellation of their flagship street festival, Carwyn Cellars turned the setback into one of its most memorable achievements.

“We had organised 11 of the world’s best breweries to fly in for the event and to collaborate with a local brewery. Thanks to Covid arriving first, we had to cancel two weeks out – we had brewers in transit and airfreighted beer already landed. Not wanting to waste our hard work, we changed to a virtual festival and our community massively got behind us. We sold out the 3,600 mixed festival beer packs and it’s safe to say the virtual festival was one of the highlights of lockdown for many people,” says Duval.

Looking ahead, Duval sees flavour experimentation as a defining trend, one that’s reshaping not only beer but also the broader spirits and RTD categories, as producers and consumers alike search for new ways to experience familiar drinks.

“Every brewer in the country right now seems to be playing with terpenes. This has allowed brewers to really dial in and enhance specific flavours. It’s a real game changer and not something that is likely to go away soon,” he explains.

Technology also plays a pivotal role in Carwyn Cellars’ future, shaping everything from how customers discover new products online to the systems that keep the store running smoothly behind the scenes.

Duval says: “Being so online focused, technology and data are king. We recently rebuilt our website and changed over our systems in the interest of staying ahead of the digital curve.”

The past five years have not been without challenge for Carwyn Cellars, which experienced a change of

ownership, a period of voluntary administration, and eventually a return to its original owners.

“I’ve had to take on new responsibilities and above all I just tried to keep a cool head through it all,” Duval says. “We managed to keep the same team together through it all, which is testament to the culture of what we have built and the awesome people who work here. All in all, the business is back in safe hands, and we are well positioned to get back to what we do best and explore more exciting booze adventures.”

Asked what he would change about liquor retail in Australia, Duval points straight to tax, highlighting how high excise and duties on beer and spirits have driven prices up and shifted many products into a luxury spending category.

“Beer and spirits cop the rough end of the stick, and it’s caused prices to rise to a point that for many, these drinks now fall into the luxury spending category and consumers are choosing alternatives,” he says.

Away from Carwyn Cellars, Duval is a keen golfer with a rather unusual prize story, having twice claimed the closest-to-the-pin title at the Moon Dog trade golf day and walking away with a haul most beer lovers could only dream of.

“I took out the Moon Dog trade golf day closest to the pin competition, twice, and won 100 free kegs of beer!”

And when it’s time to wind down, he doesn’t stray far from the classics, preferring a beer that delivers balance, refreshment and a sense of timeless tradition over anything too experimental.

“I’m going to go with The Albert Czech Pilsner from Tassie – full flavoured, spicy, bitter and as refreshing as any drink in the world.”

For Duval, the heart of Carwyn Cellars has always been about people – the team, the producers, and the community of customers who share a love of great drinks. Through challenges, innovation, and a relentless curiosity for flavour, he has helped build a store that is as welcoming as it is adventurous.

With a renewed sense of stability and a finger on the pulse of emerging trends, Duval and Carwyn Cellars are well placed to continue shaping Melbourne’s independent liquor scene for years to come. ■

“[Carwyn Cellars] is just full of interesting and diverse booze… it has a comfortable feeling to it, which is welcoming to absolutely anybody, no matter their walk of life or their preference of tipple.”

Blurring online and offline, Good Pair Days has debuted a hybrid wine bar and retail space in Surry Hills, writes Deb Jackson.

Good Pair Days has taken a significant step forward in its journey to reinvent the way people discover and enjoy wine, officially opening its first bricks-and-mortar wine bar and bottle shop on Sydney’s Crown Street. Since its launch, the business has built its reputation as a digital-first retailer with a unique proposition: using technology and data to deliver personalised wine recommendations based on individual taste profiles. Customers complete a palate quiz, rate wines they receive, and in turn, the platform uses this data to refine future selections. Over time, members not only receive wines they’re more likely to enjoy but are also encouraged to experiment with new varietals through challenges, badges, and rewards. This gamified approach to discovery has been central to Good Pair Days’ appeal and growth.

According to Co-founder and CEO Tom Walenkamp, the move into physical retail is about expanding this philosophy beyond the screen.

“We never saw ourselves as a pure online retailer,” he told National Liquor News. “We saw ourselves as a retailer, full stop. Customers do want that personal interaction. They want to taste before buying, get out of the house, experience something and have fun. We wanted to meet them where they wanted to be.”

The new store, located on Crown Street in Surry Hills, is designed to deliver the same personalised discovery process in real life. Existing members can scan a QR code or ask staff to pull up their profile, instantly accessing the same tailored recommendations they would see online. Wines tasted at the bar can be logged against their account, badges can be awarded for in-store activity, and reward points redeemed on the spot.

“We’ve built the tech so wines you try instore can be added to your account in real time,” Walenkamp explained. “It’s really the best of both worlds – digital personalisation alongside face-to-face interaction with our wine associates.”

Translating the online model into a physical experience

For those encountering Good Pair Days for the first time, the experience begins just as it would online: by taking the palate quiz. Staff can guide newcomers through the process, or customers can do it themselves on their phones. Recommendations are then drawn from the range available in-store, and staff can turn those into a wine flight or tasting.

It’s a seamless extension of the brand’s core promise: helping customers find wines that genuinely suit their tastes, while still encouraging exploration.

According to Walenkamp, the choice of location for Good Pair Days’ first physical store was also data-led.

“Surry Hills and Darlinghurst are our highest concentration of members in Sydney, which means in Australia, really,” he said. “We wanted to be convenient for current members to try new wines and experiences in-store.”

At the same time, Crown Street provides

brand visibility to a wider audience, acting as what Walenkamp calls a “billboard for the brand” while remaining profitable in its own right. He added that rather than increasing spend on traditional top-of-funnel marketing channels like outdoor and radio, the business saw greater long-term value in investing that money into a physical space that directly serves members.

Inside, the venue blends wine bar and retail formats, with seating for around 50 people and capacity for up to 85 including outdoor areas. Members enjoy significant benefits: discounted pricing by the glass, no corkage fees when drinking takeaway bottles onpremise, and access to a program of tastings, meetthe-maker nights, and education sessions.

“For every wine by the glass we have a member and non-member price,” Walenkamp said. “If you buy a bottle from the shop, there’s no corkage, so you’re paying retail prices to drink on-premise – which is pretty unheard of in any wine bar. And if you’re not a member, you can join on the spot and get the benefits straight away.”

The space also represents a new kind of stage for suppliers. Good Pair Days plans to host regular events where winemakers present their wines directly to customers, building connections between producers and the engaged Good Pair Days community.

“We want the winemakers to be in-store, talking about their products and telling their stories. They’re the people behind the wines, and that’s the interesting part,” Walenkamp said.

Transitioning from e-commerce to physical retail has not been without its challenges. Staffing has been one of the steepest learning curves, particularly finding people with both wine knowledge and the right hospitality skills to fit the hybrid wine bar and retail model. Venue Manager Tim Sturt, whose background spans both hospitality and retail, has been key to bridging this gap. At the same time, integrating store staff into the company’s digital-first communication culture has required careful onboarding.

“Most of our team works remotely and uses Slack and Notion daily,” Walenkamp said. “Retail staff are more used to face-to-face communication, so we’ve had to invest more into onboarding and blending both worlds.”

While the store is still in its early days, the long-

term ambition is clear. If successful, the format will be rolled out in other Australian cities and even internationally, with the UK a likely next step given it now accounts for half of the company’s business.

Walenkamp believes the store represents more than just an additional sales channel – it’s a way of deepening relationships with members while introducing the brand to a new audience in an experiential way.

“Some feedback we had early on was, ‘You can’t be both a wine bar and a bottle shop.’ But we looked to adjacent industries, like Mecca in beauty, and saw how they’ve tied experiential retail, education, loyalty and personalisation together,” he said. “We think that makes a lot of sense for wine too.”

With its first physical store, Good Pair Days is betting that the future of retail lies in seamlessly blending the convenience of digital with the engagement of in-person experiences. For a business built on personalisation, it’s a natural extension – and one that may well set a new benchmark for how online-first liquor businesses think about physical retail. ■

“Customers do want that personal interaction. They want to taste before buying, get out of the house, experience something and have fun. We wanted to meet them where they wanted to be.”

Tom Walenkamp

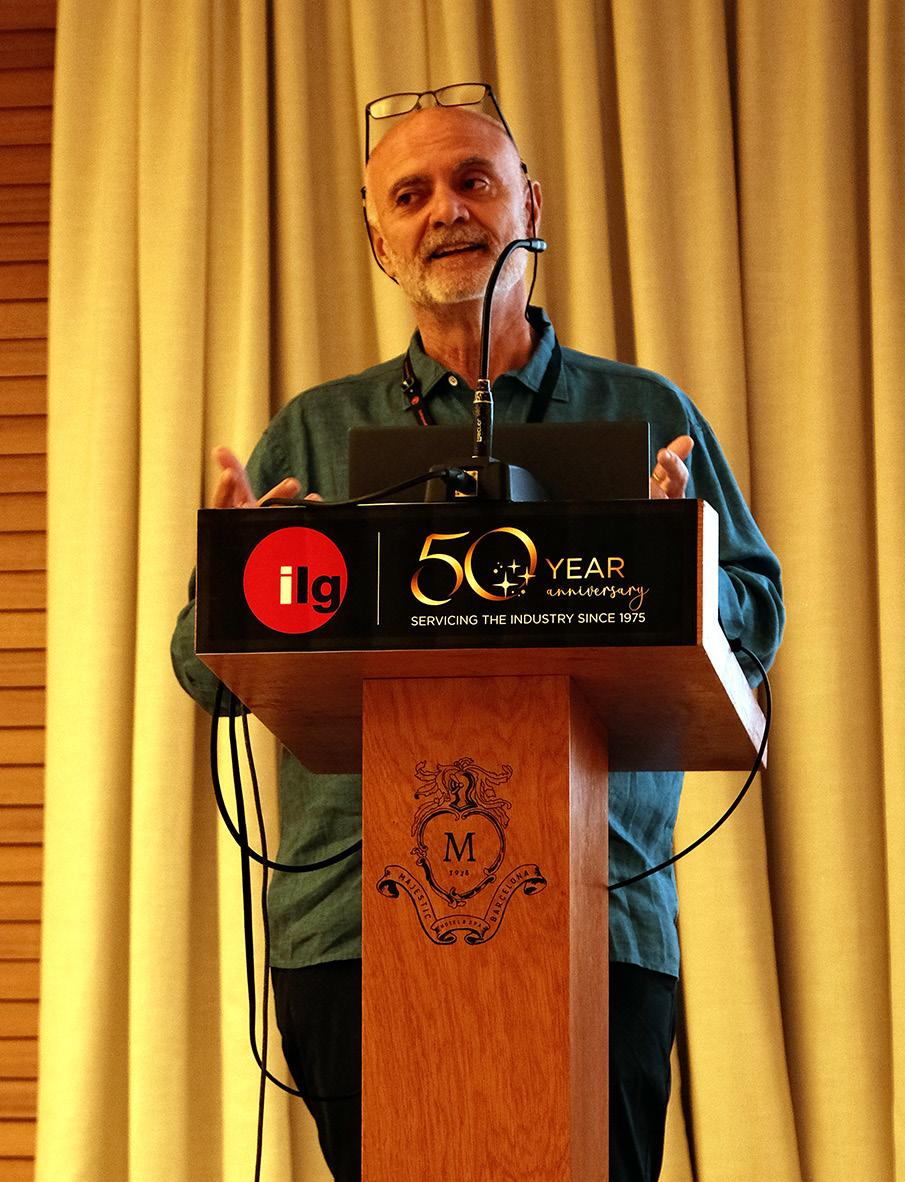

Delegates embraced connection, collaboration and celebration as ILG’s anniversary trip blended business sessions with cultural discovery.

The Independent Liquor Group (ILG) marked its 50th anniversary year with a study tour that spanned Barcelona and Lisbon, bringing together members, suppliers, and partners in a celebration of both business strength and the enduring bonds of the ILG family.

From the very first morning in Barcelona, it was clear this was no ordinary conference. Delegates were greeted by ILG CEO Paul Esposito at the Majestic Hotel, the base for the first stage of the trip. He described the event as “an annual reunion” – a chance for familiar faces and first-timers to share in the cooperative spirit that has defined ILG across five decades.

“It seems like yesterday we last got together,” he said warmly. “For those of you joining your first ILG trip – it won’t be your last.”

Esposito spoke to the heart of the ILG identity: a group built on community, trust, and collaboration.

“It’s been a good year for ILG, and it’s great to

have everyone together here to mark this milestone,” he said. “The next few days are about connection, collaboration and celebration.”

Beyond the camaraderie, there was serious business to share. ILG reported sales of $530.1 million in FY25 – a record-breaking result achieved despite difficult trading conditions and heightened acquisition activity in Queensland.

“We didn’t lose any business because of anything we did wrong – it was largely down to acquisitions, particularly the activity of a large, listed group in Queensland,” Esposito explained. “That represented around $20 million worth of business, but we’ve already started to rebuild.”

The figures reflected resilience and agility. More than 5.4 million cases moved through ILG’s warehouses in the past year, including 1.7 million

cases of beer, 1.3 million of RTDs, and 1.2 million of wine. Service levels held strong at more than 97 per cent despite labour shortages, while banners such as Fleet Street, Super Cellars, and Bottler all delivered growth against the backdrop of the major chains’ downturns.

Esposito pointed to new product development as the key to the future, saying: “Please embrace it, because that’s where the growth is.”

He also highlighted ILG’s investments in e-commerce, loyalty programs, and a new Queensland hub at Swanbank, all aimed at setting members up for long-term success.

Trading Manager Tony Oliverio added detail during his update in Barcelona, noting ILG’s outperformance in wine and spirits.

“Across the board we’ve seen really

“It’s been a good year for ILG, and it’s great to have everyone together here to mark this milestone.”

Paul Esposito

pleasing results, but what’s most important is that ILG has outperformed the market in almost every category,” he said.

Wine stood out with 22.7 per cent growth compared to 5.8 per cent for the wider market. Spirits also surged, with tequila, whisky and vodka driving double-digit growth. RTDs and premium beer maintained strong momentum, while innovation remained central to category strategy.

“The numbers show that we’re not just keeping pace with the market – we’re leading

in key categories like wine and spirits,” Oliverio said.

For members, these figures underscored what they already knew: ILG’s cooperative structure continues to deliver, even in challenging times.

Discovering Barcelona together

If the mornings belonged to business, the afternoons and evenings were devoted to discovery. Day two began with a breakfast briefing before delegates stepped out into

Barcelona. The group ascended Montjuïc for sweeping harbour views, strolled along Paseo de Gracia to marvel at Gaudí’s architecture, and paused at the Mirador de Torre Glòries Observation Deck, where the city stretched in every direction.

The evening brought everyone back to the Majestic Hotel for Happy Hour – a relaxed opportunity to swap stories and deepen connections.

As Esposito promised: “By the end of this trip, everyone will know everyone.”

On day three, delegates enjoyed free time to explore Barcelona at their own pace. Some joined guided tours of the Gothic Quarter and Picasso Museum, while others wandered the city’s bustling streets. That night, the group reconvened at Can Travi Nou, a 17th-century Catalan farmhouse. Surrounded by rustic stone walls and shaded gardens, members shared traditional Spanish dishes, toasts and laughter – the essence of the ILG family spirit.

Day four offered another unforgettable highlight: a pilgrimage to Montserrat. Delegates visited the Santa Maria Monastery and the famed Black Madonna, then climbed aboard the mountain railway to absorb the dramatic Catalan landscape.

In the afternoon, the mood shifted from the spiritual to the celebratory as the group toured Codorníu, Spain’s oldest winery. Wandering through 33 kilometres of underground cellars before enjoying a cava tasting, ILG members were immersed in the history and craft of the Penedès region. Lunch followed outdoors at Torre de Codorníu, where long tables of delegates ate, drank and conversed in the sunshine – a scene that perfectly captured the cooperative’s sense of community.

“Across the board we’ve seen really pleasing results, but what’s most important is that ILG has outperformed the market in almost every category.”

Tony Oliverio

“In 1975, ILG was born out of the vision of a few gentlemen. Today we own more than $100 million in assets and continue to grow stronger together as a cooperative.”

Paul Esposito

Lisbon’s charm and culture

From Barcelona, the group travelled west to Portugal for the second leg of the anniversary journey. Lisbon welcomed them with an authentic Portuguese dinner, setting the stage for more discovery and connection.

The following day brought a lively tuk tuk tour through the city’s winding streets. Delegates paused at Miradouro da Senhora do Monte to admire sweeping views, wound through the historic Alfama district, and ended the morning at Parque Eduardo VII before enjoying a Portuguese lunch.

The excursion continued with a trip to Sintra, where members toured the National Palace – a reminder of Portugal’s rich cultural history – and then on to Cabo da Roca, Europe’s westernmost point. The day ended in Cascais, where delegates relaxed by the sea, another reminder that the ILG family knows how to balance business with pleasure.

Free time in Lisbon allowed delegates to explore at their own pace, before the Study Tour drew to a close with a gala dinner. Laughter and stories flowed as members celebrated the friendships forged, the business insights shared, and the history written across ILG’s 50 years.

“The numbers show that we’re not just keeping pace with the market – we’re leading in key categories like wine and spirits.”

Tony Oliverio

For many attendees, the Study Tour was about more than travel or even trading updates. It was about the people – the community that continues to define ILG.

Esposito reminded delegates of the group’s humble beginnings, saying: “In 1975, ILG was born out of the vision of a few gentlemen. Today we own more than $100 million in assets and continue to grow stronger together as a cooperative.”

That sense of shared ownership, of collective strength, is what binds ILG members and suppliers. From breakfast briefings to winery lunches, from business panels to tuk tuk rides, every moment of the tour was designed to reinforce connection.

Oliverio captured this sentiment when he credited ILG’s results to collaboration: “That’s a credit to the support of our members, our supplier partners, and the sales team who’ve helped deliver the programs on the ground.”

The study tour closed with a sense of optimism. ILG has weathered challenges, posted record sales, and celebrated 50 years with style and substance. But the cooperative’s gaze is firmly on the future.

Investments in e-commerce, loyalty programs, and new product development signal a group that is adapting to changing consumer behaviours. The Swanbank hub in Queensland will provide new efficiencies, while category strategies continue to focus on affordability, innovation, and premiumisation where it makes sense.

Esposito summed up the trip early on by saying: “The next few days are about connection, collaboration and celebration.” For members and suppliers who journeyed through Barcelona and Lisbon together, those words became a lived experience – and a promise of more to come.

ILG will continue its milestone celebrations with the 50th anniversary Family Reunion, taking place in October in Sydney.

As ILG enters its next chapter, it does so with the confidence of a group that has grown stronger together over 50 years – and the shared commitment to ensure the next 50 are even more remarkable. ■

This year marks a golden milestone—50 years of ILG. From our humble beginnings to becoming Australia’s largest liquor co-operative, our journey has always been about empowering our members and shaping the future of the liquor industry.

Every member, partner, and team member has been a cornerstone of our success, and we reflect with immense gratitude on the trust and loyalty that has fuelled our growth.

Independent Brands Australia brought members, suppliers and staff together on the Gold Coast recently for its annual conference, unveiling a bold new cross-pillar plan, writes Andy Young.

At the start of September, Independent Brands Australia (IBA) hosted its annual Trade Workshop on the Gold Coast, drawing more than 550 members, suppliers and staff. Over three days, attendees explored IBA’s performance, engaged with suppliers at an impressive trade show, and celebrated excellence at the IBA Five Star Awards and gala dinner.

Metcash Liquor CEO Kylie Wallbridge opened proceedings with a welcome that set the tone for a week focused on resilience, growth and optimism.

“This is an opportunity for us to recognise that Independents are leading the liquor industry, reflect on why and then double down on it – we can celebrate the achievements of the IBA network,” she said

Wallbridge acknowledged that the past 12 months have not been easy for retailers or consumers. But she highlighted that Metcash’s three core divisions –liquor, food and hardware – all achieved value growth.

“It was a challenging year with difficult conditions at times and the shoppers who are coming into your stores are feeling it too,” she said. “So, we consider it a fantastic result that as a business our independent networks delivered growth.”

Her message was clear: independents have held their ground and are well positioned to keep building market share.

“I think that’s something to take a lot of confidence from,” she told delegates. “Ultimately it’s the work that you and your teams are doing in your stores and your premises every day that is making this possible.”

Despite post-pandemic slowdowns, Wallbridge stressed the independents’ resilience.

“There’s still plenty of opportunities for us to grow in the liquor space, but retail is the heart of what we do. The fantastic thing, and we should absolutely celebrate this in all of our stores, in all of our venues, is that the independents have continued to grow share every year for the last four years.

“For us to grow, it means you’re serving your shoppers and your customers better than anybody else in the market.”

That confidence forms the foundation of Metcash’s new cross-pillar campaign, ‘Family Founded’, announced at the conference and now live across liquor, food and hardware stores. Backed by a major Metcash investment, it aims to celebrate the family of

“Independents have continued to grow share every year for the last four years.”

Kylie Wallbridge

family founded retailers – whether family-founded, family-owned or family-built, and all the unique benefits they provide local shoppers.

The flagship in-store competition – Big Family, Big Prizes – gives shoppers who spend $25 or more in participating stores the chance to win a share of instant and major prizes. Prizes include travel experiences ranging from a Great Northern Kakadu Adventure to a Heineken Singapore racing experience.

More than just an in-store promo, ‘Family Founded’ seeks to resonate with consumers who are increasingly motivated by authenticity, local and community connection.

Clare Adamiak, IBA’s Head of Shopper, Brand and Digital, explained: “This is about momentum. Like we’ve said before, we are stronger together. This campaign is designed to live well beyond launch, creating recognition and loyalty for our network of independent, family-founded stores year after year.”

Taking the message nationwide

The promotion spans more than 3,000 stores and is supported by a significant advertising investment across TV, radio, digital and social media. At its heart is what IBA calls “a game-changing media partnership with Nine”.

Adamiak told delegates: “Nine Radio and Nine Media partners will broadcast this campaign across their channels. Our retailers will be heard across the country on what it is like to be family founded, what it is like to shop independent and share with their shoppers that they can win big.”

In-store, new digital screens will be rolled out to create theatre for shoppers and target communications in real time.

“This campaign is built on partnerships that extend across brands in liquor, food and hardware,” Adamiak added. “Let’s show the market the true power of independence.”

The conference was also a chance to spotlight outstanding performance through the 2025 Five Star Awards, recognising the best people, suppliers and stores throughout the network

The Supplier of the Year awards were split between small and large, with Sazerac named Small Supplier of the Year, and Craig Payens, IBA National Retail

Merchandise Manager said: “Sazerac exemplifies what it means to be dynamic and a committed partner. Whether it’s through innovative merchandising solutions or agility through NPD, Sazerac has proven that great partnerships are built on trust, responsiveness and shared ambition.

The Large Supplier of the Year Award went to Lion, for delivering “a standout performance with IBA, driven by strategic alignment, category insights, strong execution and impressive in-trained engagement. Their ability to bring compelling activity to life and support IBA’s goals has been a real impact for a matter to most, with our members and in the market”, Payens continued.

Adrian Ricci, General Manager – IBA Retail, announced National Business Development Manager of the Year as Ben Lysaght.

In accepting, Lysaght said: “Massive appreciations

“This campaign is designed to live well beyond launch, creating recognition and loyalty for our network.”

Clare Adamiak

to the Queensland team, from the BDMs to the staff in the support office and the Promotions Coordinators. We constantly believe the mantra that we’re all one team; we all work towards a common goal. This is amazing, thank you.”

The Rising Star Award went to Holly Roberts of Cellarbrations Shoreline, Tasmania, Ricci said: “Holly shows exceptional creativity, dedication and deep commitment to the community engagement. Holly has consistently demonstrated a willingness to go over and above beyond bringing innovative ideas to life. Congratulations Holly, a well-deserved award.”

Store Manager of the Year was awarded to Todd Kelly of Cellarbrations Superstore, Aussie World, Queensland. Kelly reflected: “Most of the words spoken here have been about family and team and you really have transcended more than business partners for me, you really are my family, and I can’t thank you enough.”

The National Retailer Award, recognising both performance and spirit, went to Cellarbrations Somerset in Tasmania.

Goodstone Group Operations Manager Mark Cadle said: “This is the most wonderful award to win. Olivia you’re a star, I always thought you were a star and you’ve proved it. Thank you very much.”

Beyond awards and activations, the 2025 IBA Trade Workshop reinforced the strength of the independent retail network. Sessions examined evolving consumer trends, digital engagement, supplier collaboration and the long-term strategy of competing with scale against national chains.

The mood throughout was one of optimism. While the industry faces headwinds – from tightening household budgets to cost-ofliving pressures – independents are framing these challenges as opportunities. Consumer habits are becoming increasingly focused on local, quality and service.

That positions family-founded independents to drive a fundamental shift in Australian shopping habits – one grounded in trust, loyalty and the enduring importance of family.

For IBA and its members, the conference marked more than an annual catch-up. It was a line in the sand – a commitment to harness momentum, invest in new platforms, and continue carving out a growing share of the liquor market.

The message from the Gold Coast was unmistakable: independents are not just surviving – they are thriving, united by a common purpose and ready to take their story national. ■

Congratulations to our winning retailers, suppliers and IBA teams!

Championing Successful Independents

Perth hosts record-breaking Victorian Thirsty Camel Forum as members and suppliers unite to raise the bar in retail execution.

Thirsty Camel’s 2025 Forum, held in Perth from 17–21 August, lived up to its theme of ‘Next Level’, bringing together more than 260 Victorian members and suppliers – the biggest turnout in the event’s history.

The five-day program combined serious business discussions with memorable networking and social occasions, underscoring Thirsty Camel’s ongoing drive to innovate while empowering members to deliver stronger results in-store.

Thirsty Camel Victoria’s General Manager, Adrian Moelands said of the event: “This Forum was about setting the bar higher and now it’s time to deliver. We’re backing our members with increased rebates, investing in digital ticketing to make price changes instant, and sharpening our focus on in-store execution. Clean, consistent, well-run stores are where the wins are made, and we’re committed to giving our network the tools and incentives to make that happen.”

To further strengthen member margins, Thirsty Camel announced the roll out of significant rebate increases across key categories. Wine rebates will rise by 25 per cent, while Spirits, RTD and Cider will see a 15 per cent uplift. These increases ensure that

Thirsty Camel members are better rewarded for their compliance and commitment – putting more money back into their businesses and reinforcing Thirsty Camel’s position as the network that invests in its own.

The record attendance in Perth spoke volumes about the strength of the Thirsty Camel network and the appetite among members to sharpen their competitive edge. The Forum provided a unique opportunity to step away from day-to-day trading pressures, take stock of the business’s evolution, and explore new ways to engage customers more effectively.

Business sessions were complemented by a supplier expo at Optus Stadium, where the latest products, initiatives, and promotional tools were showcased. Social highlights included a lively Fremantle pub crawl, a special guest appearance from cricket legend Adam Gilchrist at Optus Stadium to introduce his new tequila, El Arquero, and a spectacular gala dinner at Sandalford Winery in the Swan Valley.

Thirsty Camel has spent recent years building a suite of innovative programs – from its flagship Hump Club loyalty initiative, through to Top Drops, e-commerce platforms, and the Camel Academy

“This Forum was about setting the bar higher and now it’s time to deliver.”

Adrian Moelands

training system. The ‘Next Level’ theme reflected the group’s desire for members to now focus on execution: improving a little bit every day, lifting staff engagement, and embedding best practices consistently across stores.

As members were reminded during the sessions, innovation means little unless it is backed by strong execution in-store. Clean, tidy, well-run venues with engaged teams will ultimately be those that extract the full benefit from Thirsty Camel’s evolving tools.

A key highlight of the Forum was the presentation on Hump Club V3, delivered by Thirsty Camel’s Loyalty & Digital Marketing Manager, Rachel Brown. The program has been a cornerstone of the brand for 15 years, but its latest evolution is setting new benchmarks for customer engagement and profitability.

Brown explained that the move to version three was essential to deepen customer relationships and outpace competitors.

“Loyal customers are more profitable than non-loyal ones,” she told delegates. “They spend 67 per cent more, have a 306 per cent higher lifetime value, and are much less price sensitive. That’s why building loyalty is central to everything we do.”

The numbers spoke for themselves. In the past 12 months alone, Hump Club delivered 85 per cent revenue growth, 70 per cent transaction growth, and 38 per cent membership growth, compared to the prior year. Customers enrolled in Hump Club also spend on average, $19 more per transaction than non-loyalty customers.

The rollout of V3 has already shown strong traction, with average basket sizes rising sharply among those redeeming multiple offers. Brown urged members to make Hump Club a daily habit in-store.

“None of the innovation matters unless your staff buy in,” she said. “If you’re at a 15 per cent tag rate, aim for 30. If you’re already at 30, aim for 50. This is how we take loyalty to the next level.”

At the gala dinner, awards were presented to recognise standout store performance, with the Portland Hotel taking home Best Hump Club Store of the Year, Commercial Hotel Yarram winning Highest Tag Rate, Thirsty Camel Echuca West securing Most Completed In-Store Sign Ups, and Grandview Hotel being named Most Improved Store.

Alongside Hump Club, Thirsty Camel unveiled two major new initiatives designed to improve retail execution.

The first tackled the longstanding challenge of Hotspot execution. While these high-visibility product displays are powerful sales drivers, some members have hesitated to use them due to theft concerns. To address this, Thirsty Camel introduced a new lockable retail unit that allows high-value stock to be showcased safely and consistently across the network.

Large Format Store of the Year: Thirsty Camel Portland

Medium Format Store of the Year: Rubicon Hotel

Small Format Store of the Year: Settlers Tavern

Supplier of the Year: LION

Outstanding Achievement Award: Pernod Ricard

Member Recognition Award: John Payne

Best Hump Club Store: Portland Hotel

Highest Tag Rate: Commercial Hotel Yarram

Most Sign Ups: Thirsty Camel Echuca West

Most Improved Store: Grandview Hotel

“Loyal customers are more profitable than nonloyal ones. They spend 67 per cent more, have a 306 per cent higher lifetime value, and are much less price sensitive.

That’s why building loyalty is central to everything we do.”

Rachel Brown

The second innovation was Digital Ticketing, offering members a faster, smarter, and more environmentally friendly way to manage pricing and promotions. Digital ticketing will allow stores to update prices in minutes, run late-week specials or knock-off drink offers, and improve compliance across the board. By co-investing in this system, Thirsty Camel is equipping its members with the tools to respond to shopper trends in real time.

A major highlight of the Perth Forum was the keynote address from Bastien Treptel of Ironclad ID, who spoke about the role of artificial intelligence in shaping the future of retail and hospitality.

Treptel’s presentation offered members an eyeopening look at how AI is already transforming consumer behaviour, operations, and data-driven decision making, and how independent retailers can harness these tools to remain competitive.

His message reinforced the Forum’s theme: the future belongs to those willing to level up, adopt new technologies, and continuously adapt.

Beyond the business agenda, the Forum emphasised the strength of Thirsty Camel’s culture. From supplier showcases to the Fremantle pub crawl and the gala dinner at Sandalford Winery, the program provided ample opportunity for networking, collaboration, and celebration.

The Forum also provided space to celebrate resilience in what has been a challenging trading environment. Members were reminded that Thirsty

Camel remains the third-largest independent retail brand nationally and continues to punch above its weight thanks to its distinctive, upbeat positioning and engaged network.

Looking ahead, the Forum made it clear that the building blocks for success – loyalty programs, digital tools, training, and supplier partnerships – are firmly in place. The task now is to ensure consistent execution, with every store aiming to raise its standards just a little more each day.

As Brown summarised in her Hump Club presentation: “Our job is to make your life easier and your business better by adding value. But we need you to buy in. Leveling up isn’t optional – it’s the only way forward.”

With record attendance, an ambitious agenda, and a clear message of continuous improvement, Thirsty Camel’s 2025 Forum set the tone for a new era of execution excellence. If Perth was about taking things to the “Next Level,” the momentum now rests with members to carry that spirit back into their stores — and turn innovation into results. ■

Endeavour Group has announced the appointment of Jeanette Fenske as Managing Director of BWS, bringing more than three decades of retail expertise to the role.

Fenske has 35 years’ experience in retail, including senior leadership roles with South Africa’s Clicks Group and Woolworths Group in Australia. She is currently Director of Stores at Woolworths Supermarkets, overseeing 130,000 team members across 1,100 stores nationwide.

Endeavour Group Interim CEO Kate Beattie welcomed the appointment, saying: “I am delighted Jeanette is joining Endeavour Group to manage our market-leading BWS business. She is a seasoned retail operator who joined Woolworths almost 10 years ago as Assistant State General Manager, before being promoted to lead the eCommerce Online Operations and Last Mile business in Woolies X.”

Fenske takes over from Scott Davidson, who will step down as BWS Managing Director at the end of November after more than five years in the role.

New Zealand’s largest spirits producer, Scapegrace Distilling Co., is turning up the heat on the Australian market, after introducing a dedicated local sales team and taking its distribution in-house.

The move is designed to give the brand more control and flexibility, while deepening relationships with retailers and venue operators across the country.

Best known for its award-winning portfolio of gin, vodka, single malt whisky and RTDs, Scapegrace is crafted in New Zealand’s Central Otago region – a location that has fast become as famous for world-class spirits as it is for Pinot Noir.

The brand recently unveiled its new $27m state-of-the-art distillery on the shores of Lake Dunstan, a striking home that will allow it to scale production across its full range.

Co-founder Daniel McLaughlin said: “Australia is a key market for Scapegrace. There are natural synergies between New Zealand and Australia when it comes to taste, culture, and drinking occasions, and we know there’s the opportunity for us to strengthen our offering there.

“We’ll be putting a greater focus on Australia with increased investment in retail, on-premise, and brand building. Bringing distribution in-house will also give us more control and the ability to scale quickly.”

Scapegrace already holds a strong track record on the awards circuit. In 2025, its Vanguard Single Malt struck gold at the World Whisky Awards, while Anthem Single Malt earned gold at the IWSC. Its London Dry Gin has previously been crowned World’s Best at the International Wine & Spirits Competition.

McLaughlin said it’s the New Zealand environment that sets their spirits apart.

“We’re proud to represent the best of New Zealand distilling with our team using glacial water, locally grown ingredients, and a unique climate on the 45th Parallel – conditions that are ideal for ageing whisky with exceptional depth of flavour,” he said.

“We have a strong existing footprint in Australia, and we’re excited to deepen relationships with retailers and customers, and to expand the reach of our award-winning spirits.”

Lion has announced it has become a certified B Corporation, supporting the company’s long-term commitment as a force for good.

While some Lion brands, including Stone & Wood, have previously gained a B Corp certification, this certification is for the entire business and means each Lion brand can say it is produced by a certified B Corporation.

Lion Group CEO, Sam Fischer, says: “We are delighted to be recognised as a Certified B Corporation across Lion as a whole. Being a force for good has always been part of Lion’s DNA, but B Corp Certification has given us a framework to go even further.

“For almost two centuries, we’ve believed in making a strong contribution to our communities and managing Lion for the longterm, and this certification supports that commitment for the years to come.

“B Corp Certification provides independent verification of Lion’s commitment to measuring success not just in profit, but in the positive impact we create together with our partners.”

Lion has achieved B Corp certification after scoring 80.6 on the B Impact Assessment, surpassing the 80-point threshold required and well above the global median score of 50.9 for standard businesses.

As part of the certification process, Lion also amended its constitution to formally embed a commitment for directors to consider the long-term impact of business decisions on employees, suppliers, customers, communities and the environment.

Fischer added: “When our trade partners choose to work with Lion, our B Corp Certification is further evidence that they’re partnering with a business that places people, planet, purpose, and profit on equal footing.”

To celebrate the launch of Hard Rated Alcoholic Orange 4.5 per cent, Thirsty Camel and Hard Rated offered free spray tans to Melburnians bold enough to match the new RTD’s colour.

For one day only, customers who spent more than $5 at Thirsty Camel Harp of Erin Hotel scored a free spray tan between 12pm and 4pm.

Lisa O’Donovan, Thirsty Camel’s National Marketing Manager, said the stunt was a bold way to grab attention.

“We’re so excited to celebrate the long-awaited launch of Hard Rated Orange. It’s bold, it’s bright, and it’s guaranteed to get people talking.”

Sarah Wilcox, Asahi’s Head of RTDs and Cider, added: “Thirsty Camel has been a perfect partner to launch Hard Rated Orange with. They understand how to have fun, push boundaries, and bring bold new drinks to life.”

Collingwood defender and brand spokesperson Oleg Markov also joined in, celebrating with a spray tan.

Paramount Liquor’s 2025 Queenstown conference united leaders and partners to focus on agility, innovation, and growth.

Paramount Liquor has successfully delivered its largest conference to date, uniting more than 150 internal leaders and supplier partners in Queenstown, New Zealand, for three days of collaboration, insight and innovation.

This year’s theme, Faster Smarter Together, reflected Paramount’s commitment to agility, data-led intelligence and strong partnerships as the foundations for growth across the hospitality sector.

The program featured a mix of keynote speakers, interactive workshops and direct engagement with Paramount’s leadership. Entrepreneur Naomi Simson opened the conference with an inspiring keynote on building trust, creating value and thriving in times of change. Attendees were also given a forward-looking view of the on-premise landscape, with BDA Marketing sharing insights into current trends and the opportunities emerging on the horizon.

Paramount’s leadership team joined supplier partners for a candid Q&A session, offering transparency around strategy, challenges and opportunities. Workshops were also held to give sales teams and suppliers practical tools to strengthen relationships, build loyalty and accelerate performance.

The conference placed strong emphasis on partnerships in action, with leading brands including Altus Brands, Amber Beverages, Asahi Beverages, Brown-Forman, Fever-Tree, Möet-Hennessy, Pernod Ricard, Lion, Treasury Premium Brands, William Grant & Sons, Vanguard Luxury Brands, Red Bull, Vinarchy, Samuel Smith & Negociants, Robert Oatley Wines, Bacardi-Martini Australia, Diageo, Campari and Sazerac supporting the program through activations and collaborations.

For Paramount Liquor CEO Nathan Rowe, this spirit of collaboration summed up the conference’s intent.

“Faster, smarter, together is how we partner with suppliers and venues to drive the next era of growth. We want to be the disrupter, not the disrupted. This year’s conference proved the power of agility and collaboration, delivering new insights, stronger partnerships, and a clear path forward for the industry.”

As the conference closed, the focus was firmly on what comes next. With agility, intelligence and strong partnerships at the centre of its approach, Paramount Liquor and its partners left Queenstown with fresh ideas, renewed connections and a shared commitment to supporting hospitality venues in a changing market. ■

“We want to be the disrupter, not the disrupted.”

As a certified B Corp, we balance people, planet, purpose and profit. It’s our public commitment to do the right thing for the long-term, with our people, communities, and planet at heart. We’re committed to ongoing accountability, unlocking new ideas, and continuing our journey towards a more positive future. Learn more about our commitments and progress: www.lionco.com/force-for-good

Vinarchy has officially taken over full distribution of its wine portfolio acquired from Pernod Ricard, including Jacob’s Creek, Stoneleigh, Church Road and Campo Viejo. The transition, effective 1 September 2025, follows the May merger of Accolade Wines and Pernod Ricard Winemakers that created Vinarchy, now one of the world’s largest dedicated wine companies.

These brands can now be ordered directly through Vinarchy in Australia and New Zealand, supported by new local teams, including a commercial division in New Zealand under General Manager Kiri Hyde.

Andrew Clarke, Managing Director, Australia and New Zealand at Vinarchy, said: “This is a major milestone for Vinarchy, enabling us to work more closely with our trade partners. We are excited to deliver a stronger wine focus and offer for our customers and consumers.”

Vinarchy will continue to partner with Hancocks in New Zealand for the legacy Accolade portfolio, including Grant Burge, Mud House and Jam Shed.

Distributor: Vinarchy

ThunderDonk, the bold new flavoured whisky, is set to turn heads in Australia with breakthrough flavours, global recognition, and a name consumers won’t forget.

Bringing something fresh and exciting to one of the fastestgrowing categories in spirits, ThunderDonk stands apart with its independent spirit and bold personality. Built to inject new energy into the whisky aisle and create fresh opportunities for the trade, it’s a brand designed to excite consumers and cut through the clutter.

Available in two expressions – Spiced Maple and Salted Caramel – ThunderDonk is full-flavoured and versatile, made to be enjoyed neat, as a chilled shot, or in cocktails.

Co-founder Daniel McLaughlin said ThunderDonk is about more than just liquid innovation.

“We wanted to bring a fresh sense of energy into flavoured whisky – a brand with a strong identity and a collective culture.”

Salted Caramel offers indulgence with rich caramel, a hit of sea salt, and soft vanilla – smooth, decadent, bold. Spiced Maple delivers rich maple sweetness, warming spice, and toasted oak – bold, warming, maple-rich. Both have already been globally recognised, including a gold medal at the International Drinks Awards, proving that bold flavour and worldclass quality can go hand in hand.

McLaughlin added: “ThunderDonk is unapologetic. It’s bold, modern, and impossible to ignore – a breakthrough brand in an emerging category that excites consumers, brings new people into the category, and stands out in every bar and bottle-shop.”

Let’s Donk.

Distributor: ALM and Paramount Liquor

Forget what you thought you knew about spritz season. Hoxton London Spritz is rewriting the rules with a bold, botanical twist on the Italian aperitivo, born from its founder Gerry Calabrese’s heritage and sharpened with the edge of East London.

Crafted with fennel, lemon, cherry, raspberry and more. It’s layered, drier, and cleaner than the syrupy orange spritz consumers sipped five summers ago. Built on real fruit and natural flavours, this is a spritz for a new generation that is stylish, effortless, and low ABV, so consumers can enjoy it round after round.

At home, it’s the new go-to for garden hangs and barbecues; just pour over ice, top with Prosecco and garnish. At the bar, it’s the serve that turns heads, vibrant in the glass, crisp on the palate, and made to spark conversation.

London Spritz is more than a drink. It’s a flavour-first attitude. A statement. A reminder to #ownyourflavour wherever the summer takes you.

Distributor: In a Glass Group

Jim Beam is expanding its Australian portfolio with three new releases, targeting the growing demand for premium Bourbon and flavour-led RTDs.

Leading the charge is the return of Jim Beam Black, relaunched with a bold new look. Aged for seven years in virgin oak barrels, it offers a smoother, richer Bourbon profile, layered with oak, vanilla, and golden caramel notes – cementing its place in the premium Bourbon segment.

Alongside this, the Jim Beam RTD range is broadening with two flavour innovations: Jim Beam & Vanilla Cola and Jim Beam & Ginger Beer. Both blend the smooth taste of Jim Beam White Bourbon with distinctive flavour twists, developed to meet consumer appetite for variety and refreshment in the RTD space.

These launches reflect Jim Beam’s ongoing commitment to diversifying its portfolio in Australia, while ensuring Bourbon enthusiasts have more ways to enjoy the brand – whether in a premium pour or a flavourful, ready-to-drink option.

Available nationally from September 2025, the new releases are set to strengthen Jim Beam’s market-leading presence in both Bourbon and RTDs.

Distributor: Suntory Oceania

Australia’s number one Prosecco producer, Brown Brothers, is turning up the sparkle this season with two bold new releases: the Prosecco Yuzu Lemon Spritz, and the Orange Prosecco Spritz.

The Yuzu Lemon Spritz blends crisp Prosecco with the aromatic zing of Japanese yuzu – zesty, refreshing, and just a little bit extra. Meanwhile, the Orange Prosecco Spritz brings a juicy citrus twist to your glass, balancing sweetness and sparkle in all the right ways.

Available in stylish 750ml bottles and convenient 250ml cans, both spritzes are made for summer sipping – whether it’s festive hosting, park picnics, or spontaneous catchups.

With cocktail-inspired flavours, spritz-style ease, and grab-and-go formats, these are your ultimate warm-weather plus-ones. Vibrant, flavour-forward, and effortlessly chic, they’re here to elevate every moment. Because honestly? Life’s better with a little sparkle.

Available now at leading liquor retailers and brownbrothers.com.au.

Distributor: Brown Family Wine Group

De Kuyper Royal Distillers is bringing Archers, its premium peach liqueur, to Australia in October, marking the next stage of its global expansion. Already the number one peach liqueur in the UK, the brand sees Australia as a high-potential market, with cocktails accounting for 20 per cent of alcohol consumption and 3.17 million regular cocktail drinkers.

Leo Evers, CEO of De Kuyper, said: “Given the cultural connections between Britain and Australia, combined with Australians’ strong appreciation for cocktails, makes this an incredibly promising market for us.”

Archers will be distributed locally by William Grant & Sons Australia, long-time partner of De Kuyper in the UK.

Lucien Heusy, Chief Commercial Officer of De Kuyper, added: “Having William Grant & Sons Australia by our side gives us tremendous confidence. Their expertise in both markets makes them the perfect partner.”

With its subtle ripe peach flavour and balanced sweetness, Archers is ideal for refreshing serves like Archers Lemonade, or as a key ingredient in cocktails such as Sex on the Beach, which ranked among Australia’s Top 10 cocktails in 2024.

Archers will roll out through select independents and wholesale channels, supported by PR, social media and onpremise activations.

Distributor: William Grant & Sons

FELLR launches its cult favourite into spirits with Watermelon Vodka

Australia’s largest independent light RTD brand, FELLR, is shaking up the spirits world with the launch of its debut full-strength spirit: FELLR Watermelon Vodka.

Since launching in 2020, FELLR has become a cult favourite for its all-natural flavours, low-calorie but full-flavour taste, and celebration of Aussie culture. In just five years, the brand has expanded from 30 stores to over 5,000 nationwide, selling more than four million drinks annually, and recently won World’s Best Premix at the 2025 World Premix Awards in London.

Now, Co-founders Andy Skora and Will Morgan are taking on the bottled spirits market. While global giants have shifted from spirits to RTDs, FELLR is reversing the trend – bringing its iconic Watermelon flavour into a five-times distilled, twice charcoalfiltered Watermelon Vodka. Light, crisp, and versatile, it’s perfect for vodka sodas, cocktails or simply on ice – proving Aussie innovation can stand up to global spirits giants.

“It’s a hugely exciting next phase for FELLR,” says Morgan. “We’ve always had ambitions to move into spirits, and with our Gen Z and Millennials consumers looking for fresh, great-tasting, simple-serve options, the timing is perfect.”

FELLR Watermelon Vodka is launching 8 October nationwide and is available now in all major wholesalers for those independents looking to support a local Aussie spirits start up.

Distributor: FELLR

The Glendronach, one of Scotland’s oldest licensed distilleries, has unveiled the first expression in its ultra-premium core range to debut the refreshed visual identity following the landmark 2024 restaging.

While the packaging reflects the brand’s elevated new look, the whisky itself remains unchanged – a minimum of 21 years in the finest Oloroso and Pedro Ximénez sherry casks from Andalucía. Bottled at 48 per cent ABV and presented with natural cask-imparted colour, The Glendronach Aged 21 Years is renowned for its depth, richness, and Highland character.

Rachel Barrie, Master Blender at The Glendronach, described the release as “an elegant and sublime expression, defined by its exceptional balance and depth.” She noted aromas of “ripe autumn fruits, blackberries, and red plums” with a palate revealing “layers of fine sherry and bitter chocolate sauce over nutmeg and ginger-baked Victoria plum pudding.”

The launch follows a creative brand campaign by Scottish photographer and director Rankin, aligning the design evolution with the distillery’s near 200-year heritage. Later this year, new 30 and 40-Year-Old expressions will complete the ultra-premium collection.

The Glendronach Aged 21 Years will be available in Australia from August 2025.

Distributor: Brown-Forman

Cupitt’s Estate unveils bold new Signature Range

Cupitt’s Estate is redefining South Coast winemaking with six new signature varietals: Vermentino, Arneis, Fiano, Montepulciano, Sangiovese and Nebbiolo. The release signals a generational shift and positions the region as a hub for distinctive, climate-appropriate wines.

Head Winemaker Wally Cupitt said the varieties were chosen not for trend, but because “they make sense for our coastal way of life. They’re fresh, textural, food-friendly, and perfectly suited to the kind of dishes we serve at the restaurant here at Cupitt’s Estate”.

Strategic Partnerships Manager Libby Cupitt, recently appointed President of the Shoalhaven Coast Wine Association, added: “We believe the future of Australian wine is growing right now in the vineyards of Hilltops, Tumbarumba and Canberra.”

The Signature Range joins the Classic and Festive collections, reflecting a refreshed brand direction for the family-run estate.

Distributor: Direct

Hellyers Road Oloroso de Jerez 10 Year Old may indeed be the oldest fully matured Oloroso cask whisky by any Australian distillery.

This fine Tasmanian single malt was aged for 10 years in very old 250 litre Oloroso casks from Jerez (Spain), delivering the complexity and sustained finish on the palate that can only be achieved with long-term, full-size, cask maturation.

This Oloroso de Jerez 10 Year Old release is a small batch marriage of carefully selected casks from Hellyers Road’s remarkable bond store of more than 6,500 fullsized maturation casks – the finest bond store of aged whisky in Australia.

“Reaping the rewards of 10 years of patience we invite you to savour this sweet and savoury dram, a melange of flavours to delight the senses, you will not be disappointed,” said Fiona Coutts, Head Distiller.

Distributor: Hellyers Road Distillery

DMG Fine Wine has secured exclusive distribution for Hunter Valley’s Krinklewood Estate, a leading certified organic and biodynamic producer known for wines such as Francesca Rosé, Wild Shiraz and Estate Chardonnay.

“We’re proud to welcome Krinklewood Estate to our growing portfolio of organic and biodynamic wines and spirits from around the world,” said William Dong, Managing Director of DMG Fine Wine. “Our DMG portfolio is selective by design.”

Krinklewood owner Oscar Martin said: “This partnership is about more than distribution – it’s about shared values and a belief in doing things the right way.”

The addition strengthens DMG’s line-up of certified organic producers alongside Handpicked Wines, House of Arras and Moutai.

Distributor: DMG Fine Wine

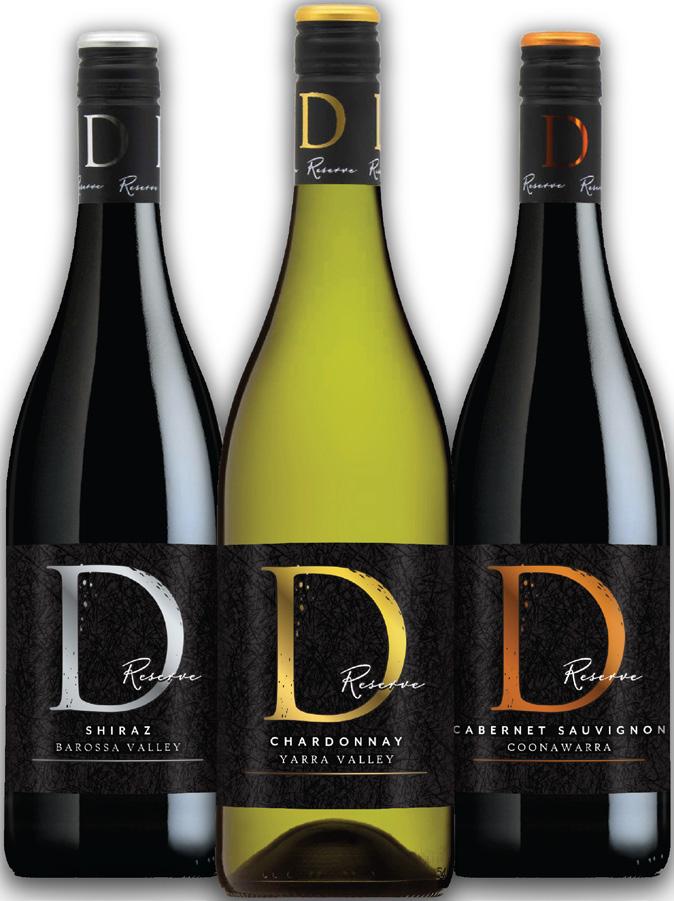

Dee Vine Estate has unveiled refreshed packaging for its D Reserve range, designed to reinforce its premium positioning.

Michael Farah, National Sales Manager, said: “The refresh was driven by a desire to better align the packaging with the quality and prestige of the wines inside the bottle… The updated look draws on luxury cues and refined detailing to signal to customers – both visually and tactilely – that D Reserve is a wine of exceptional character.”

The redesign features textured, uncoated labels, black and charcoal tones with metallic foiling, embossed lettering, and a matte capsule with metallic accents.

The update spans Barossa Shiraz, Coonawarra Cabernet, and Yarra Valley Chardonnay, with the wines remaining true to their award-winning blends.

The refreshed range launched in July through fine wine retailers and select on-premise venues.

Distributor: Dee Vine Estate

Bird in Hand debuts 2025 Tasmanian Sparkling

Bird in Hand has released its 2025 Tasmanian Sparkling, expanding the winery’s Tasmanian Series following the recent launches of Nouveau Pinot Noir, Reserve Pinot Noir and Riesling. Crafted from Pinot Noir and Chardonnay grown at the Tamar Valley vineyard near Rowella, the sparkling showcases coolclimate purity and precision.

“Tasmania offers the ideal conditions for sparkling wine –pristine fruit, natural acidity and incredible site expression,” said Bird in Hand Senior Winemaker Sarah Burvill. “The 2025 Sparkling captures all of those characteristics – it’s vibrant and precise, and layered with finesse. We aimed for a style that is bright and fresh, and perfectly celebratory.”

With production limited to 1,600 dozen, the release highlights Bird in Hand’s growing Tasmanian footprint, including its upcoming hospitality venue at the Royal Tasmanian Botanical Gardens in Hobart.

Distributor: Bird in Hand

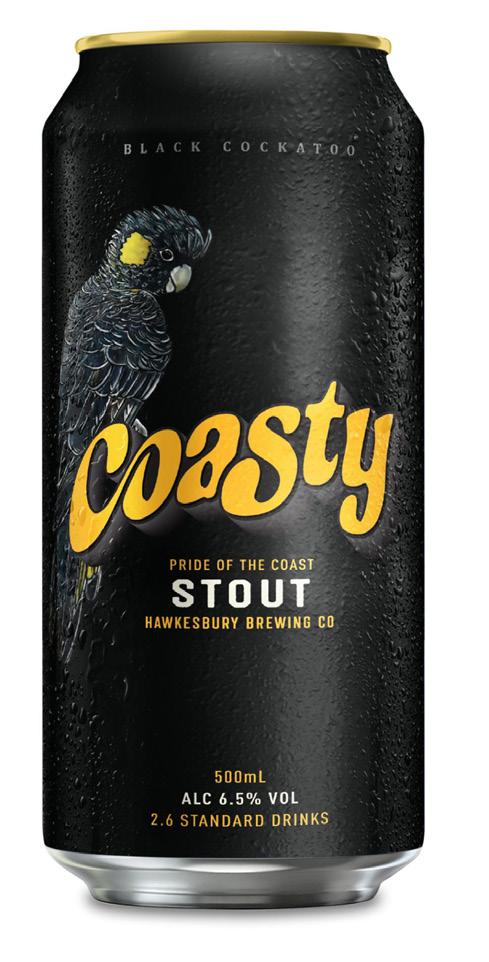

Hawkesbury Brewing Co has unveiled Coasty, a refreshed brand identity inspired by the pace, people, and places of Australia’s coastline. The new look will unify the brewer’s full range, from lagers and stouts to ready-todrink premixes, under one style.

Leading the rollout is Coasty Stout, the award-winning traditional stout, now with a bold new look. The recipe remains unchanged, delivering smooth, full-bodied flavours with chocolate, coffee, and toasted malt notes.

“Hawkesbury Brewing Co is evolving, and the Coasty range marks the next chapter in our story,” said Marketing Director Joanna Lynsky-Smith. “It’s our way of celebrating the communities that have always supported us.”

National Sales Director Mitchell Elmes added: “The flavours you know and love haven’t changed. What’s changed is how we’re showing up in market – with a stronger foundation to grow awareness, expand distribution, and connect with more drinkers.”

Coasty Stout is now available nationally in 500ml cans and 650ml longnecks.

Distributor: ALM and Direct

Maker’s Mark has unveiled Star Hill Farm Whisky, the distillery’s first new mashbill in over 70 years and its first wheat whisky. The limited release celebrates regenerative agriculture, using wheat grown to enhance soil health, flavour and sustainability.

Rob Samuels, eighth-generation whisky maker and Managing Director, said: “We are proud to share Star Hill Farm Whisky with the world – a 10-year journey to unlock nature’s depth of flavour… it will expand our platform to advance regenerative agriculture beyond our business.”

The 2025 release combines two mashbills – one with 70 per cent soft red winter wheat and 30 per cent malted barley, the other 100 per cent malted soft red winter wheat – blended and bottled uncut at cask strength (57.35 per cent ABV).

Master Distiller Dr. Blake Layfield said: “This release is a complex yet balanced blend… The nose captivates with notes of buttery caramel, golden raisins and gingerbread.”

Distributor: Suntory Oceania

Award-winning South Australian winery Maxwell Wines has acquired McLaren Vale producer Fox Creek Wines, aiming to preserve the brand’s legacy while injecting fresh energy into its future. The Fox Creek Cellar Door site will close and is subject to a separate sale.

Jeremy Maxwell, General Manager of Maxwell Wines, said: “This isn’t just about expanding our portfolio – it’s about preserving the future of McLaren Vale… Fox Creek Wines is a brand with deep roots here, and we’re proud to help ensure it remains in McLaren Vale hands.”

Once a Langton’s Classified winery and named among the Langton’s Top 100, Fox Creek Wines holds a significant place in South Australian winemaking.

“Maxwell is taking a long-term view… we are committed to preserving the essence of what made Fox Creek exceptional while investing in renewed energy,” Maxwell said.

KPMG’s Tim Mableson, who oversaw the sale, said: “Maxwell brings a strong pedigree… their vision, commitment and deep ties to the local community will provide the ideal platform for Fox Creek Wines to flourish.” Fox Creek Wines continues to trade online at www.foxcreekwines.com.au

Premium UK spirit brand AU Vodka has officially launched in Australia, bringing its globally recognised, gold bottled vodkas Down Under.

Founded in Wales in 2015, AU Vodka has rapidly grown into one of the UK’s topselling vodka brands, known for its luxurious branding and high-quality liquid. The gold packaging pays tribute to the periodic symbol for gold – Au (atomic number 79) –symbolising purity and perfection.

The Australian release features AU Vodka’s award-winning 700ml core range, including AU Original (Masters Medal, Spirits Business), Green Watermelon (Gold), and Black Grape, Blue Raspberry, and Fruit Punch (Silver).

With a strong following among Gen Z and millennial consumers, AU Vodka has built its reputation through bold flavour innovation, strong social media presence, and visibility in nightlife venues.

The brand also plans to enter Australia’s booming RTD category, with a peach-flavoured ready-to-drink offering set to launch soon.

AU Vodka is now available nationally via selected retail and on-premise partners, offering Australian venues and retailers access to a high-velocity brand with strong international credentials and proven consumer demand.

Distributor: CoLab Group

Brown Brothers launches limited-edition Moscato

Brown Brothers has unveiled its latest limited-edition release – Moscato Lush Lychee. The vibrant new wine signals a shift from dessert-inspired styles towards refreshing, fruit-forward experiences.

Crafted with notes of ripe lychee and tropical spice, Moscato Lush Lychee is clean, fresh, and perfectly balanced. Best served chilled, it’s designed to be enjoyed young and vibrant, whether paired with melon and ice cream or spicy seafood dumplings.

The release follows the success of previous successful launches including Strawberries & Cream, White Chocolate & Raspberry Ripple, and Mango Swirl. In consumer testing, 46 per cent of Brown Brothers’ Meta respondents chose lychee as their preferred next flavour, with the winemakers’ sensory panel ranking it the strongest expression to date.

With the global lychee market expected to reach USD $8.8 billion by 2028, the launch highlights the brand’s strategy to redefine fruity wine as modern, premium, and fun. Moscato Lush Lychee is set to appeal to adventurous drinkers, boosting category relevance and delivering a flavourful new option for spring and summer.

Distributor: Brown Family Wine Group

Global packaging leader SIG has partnered with leading Australian wineries to debut the country’s first recycle-ready bag-in-box wine pack, manufactured at its Adelaide facility.

Made from SIG Terra RecShield, the monomaterial film replaces conventional aluminiumbased films, meaning every component – bag, tap, and carton – is now recycle-ready. The packaging meets the Australian 2025 National Packaging Targets and APCO’s Sustainable Packaging Guidelines, with the Australian Recycling Label advising consumers to “Check Locally” for kerbside or drop-off recycling.

The pack’s performance has been validated through shelf-life tests and transport trials with Hill-Smith Family Estates, Vinarchy, De Bortoli Wines and Calabria Family Wines. It also features Australia’s first locally made wine tap designed for easier detection in recycling facilities.

Carmen Houston, ANZ Head of Marketing & Sustainability at SIG, said: “SIG has been at the forefront of bag-in-box packaging globally… we are bringing a recycle-ready solution to market that fits Australian recycling infrastructure while maintaining wine quality through the supply chain.”

Hill-Smith’s Jason Spiteri said: “We’re pleased to continue that legacy of innovation with this Australian-first, recycle-ready bag-in-box packaging from SIG.”

Zero Hour is a new non-alcoholic Prosecco designed for celebrating without sacrificing tomorrow. Made from Australian grapes, it retains the flavour and sparkle of traditional Prosecco, with alcohol gently removed using advanced de-alcoholisation to preserve texture and character. At no more than 0.5 per cent ABV – similar to fruit juice – it’s a lighter choice for consumers and the planet.

Kate Lawton, Head of Product Development at Joval Wines, said: “We only wanted to release a non-alcoholic Prosecco if it was genuinely good, as there are too many zero-alc wines on the market that fall flat.”

The launch follows non-alcoholic wine volumes rising nearly 60 per cent in two years.

Distributor: Joval Family Wines

El Toro has launched El Toro Coconut Tequila, blending bold agave character with creamy coconut. Built on the El Toro Clásico base, the release is designed to appeal to curious drinkers while maintaining the authenticity bartenders and retailers expect.

“Coconut Tequila is designed to lower the barrier of entry for curious drinkers while still delivering the tequila character bartenders and retailers are looking for,” said Eloise Penny, Brand Manager at Vok Beverages.

The new expression lands as Australia cements itself as the world’s fourth-largest tequila market by revenue, with volumes forecast to rise another 4.36 per cent in 2025.

Versatile and premium in style, it’s equally suited to cocktails, sipping neat or pouring over ice. Tasting notes highlight creamy, tropical, toasted aromas with a smooth, refreshing palate where velvety coconut meets vibrant agave, lifted by citrus and gentle warmth – a release primed for Australia’s ongoing tequila boom.

Distributor: Vok Beverages