FLORIDA’S HOUSING MARKET

Inventories Normalizing, Sales Slowing, and Prices Easing

The July 2025 single-family home report released by Florida Realtors shows a market for existing housing with a rising level of inventories, closing the shortage that was responsible for sparking rapid price appreciation during 2021–2023. The median price has been pushed to $152,200 above the peak price of the housing bubble in June 2006. The median sales price for single-family homes decreased slightly more than $7,000 from July 2024, year-over-year, and now stands at $410,000—a year-over-year price appreciation of -1.7%. Price depreciation in the townhome/condominium market continues, with a decrease in the median sales price of $20,000 year-over-year, registering at $295,000 in July of this year. This price change represents a 6.3% decrease in median prices year-over-year.

Inventories of single-family homes in July are up from 4.4 months of supply a year ago to 5.4 months of supply this year. This indicates an inventory balance that is slightly skewed in favor of the sellers in the single-family market, according to the Florida Realtors report.1

From July 2024 to July 2025, inventories of condominiums rose from 7.0 months to 9.6 months, indicating that the condo market has fully shifted from a seller’s market to a buyer’s market. There is balance in the existing singlefamily homes market, but condo markets have now fully swung in favor of buyers.

Distressed sales of single-family homes in the form of short sales remain at extremely low levels, showing little impact on higher mortgage rates, prices, and homeowners’ insurance costs. They

1 According to Florida Realtors, the benchmark for a balanced market (favoring neither buyer nor seller) is 5.5 months of inventory. Numbers above that indicate a buyers’ market, numbers below a sellers’ market. Other real estate economists suggest a 6-to-9month inventory as being a balanced market.

have increased from 42 in July 2024 to 47 in July 2025, an increase of 11.9% year-over-year, but at still historically low levels. Foreclosure/REO sales remained steady year-over-year versus July 2024, remaining at 152 in July of this year; the level of foreclosure remains quite low. Traditional sales are down 2.8% year-over-year versus July 2024, as high prices and homeowners’ insurance rates propagate affordability challenges that are partially offset by rising levels of inventories and slightly lower mortgage rates.

Distressed sales of condos in the form of short sales are still at extremely low levels, just 7 in July 2025. Foreclosure/REO sales are down 19.1% from July 2024 and remain at a low level of just 38. Traditional sales of condos are down 11.8% in July 2025 when compared to July 2024.

In July 2025, the percentage of closed sales of single-family homes that were cash transactions stood at 26.2%. For condos, that figure is much higher, as 49.3% of all closings were cash transactions. The condo market’s share of cash transactions increased by 1.2 percentage points year-over-year, while the single-family housing market’s share of cash transactions decreased by 0.2 percentage points. This is occurring amidst a still-tight market for mortgages. 2

Figure 1 depicts the monthly realtor sales of existing single-family homes, as well as the 12-month moving average of these sales. The smoother moving average line evens out the seasonality and other statistical noise inherent in monthly housing market data. Sales had been on a strong upward path over the past post-pandemic, and the 12-month moving average and monthly sales vastly exceeded their peak value during

2 The Mortgage Credit Availability Index (MCAI), put out by the Mortgage Bankers Association, increased by 0.1% to 104.0 in August from July 2025. The increase in the index in May from April indicates that mortgage lending standards loosened slightly. The index is benchmarked to 100 in March 2012. Relative to that month, mortgages in January 2025 were 1.0% less available. In 2006, the value of this same index approached 900 and at the start of 2020, the index was near 185. Despite lower mortgage rates, financing is not available to all comers..

the housing bubble. Over the past two years, the 12-month moving average has sharply declined, but in recent months, it has started to flatten out. This reflects affordability issues easing in the face of slower price appreciation over the past year; a rising inventory of houses for sale; stabilizing homeowners insurance premiums; and lower mortgage rates for those able to get loans. The short-lived COVID-19 plunge in sales during January and May pulled down the moving average in 2020, but the immediate postshutdown rebound was strong, fueled by pent-up demand and then record-low mortgage rates.

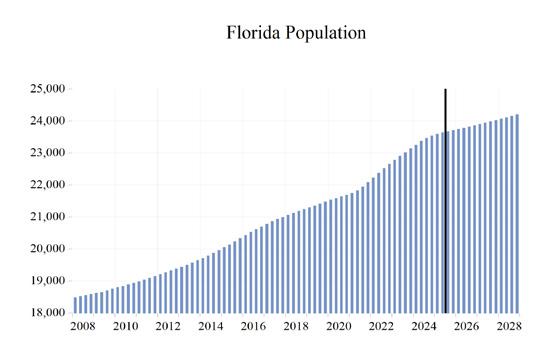

The housing market in Florida is still challenged by the burden of high prices and higher insurance premiums despite somewhat lower mortgage rates. Both economic growth and job growth in Florida are forecasted to slow as the U.S. economy decelerates. More baby boomers continue to reach the end of their working lives, and this bodes well for continued population growth via the immigration of retirees, as well as job seekers, to Florida. We expect sales to remain under pressure, as increases in inventories will help keep downward pressure on prices in an environment with sustained strength in the demographic drivers of housing demand. Housing demand had some relief from higher mortgage rates that had hit near 8.0% at their recent peak, with the possibility of the Federal Reserve Bank resuming interest rate cuts in the final quarter of the year. Also, any relief from recent surges in homeowners’ insurance rates will help support this demand.

Figure 2 displays median sales prices for existing single-family homes. Median sales prices have continued to climb since bottoming out in 2011. The double-digit pace of price increases in 2016 and 2017, which eased in 2018 and 2019,

and resumed in 2020. Over the past year, the 12-month moving average of median sales prices has fallen by $4,061.84.

Low inventories of existing homes for sale and lagging housing starts growth since 2016 contributed to the environment where home prices rose at a rapid pace. This was exacerbated by those who had refinanced mortgages at sub-3.0% levels and were hesitant to sell when current rates were over 7.0%, but they may be adjusting to the new reality of housing finance. The slowing of housing demand will result in a mild slowdown in housing starts. Some softness in the housing market will be a feature of Florida’s economy over the next few years, barring any significant dip in mortgage rates as inventories continue to rise.

This period of unsustainable multi-year price appreciation ended several years ago. The likelihood of an economic slowdown, coupled with relatively higher mortgage rates and rising inventories, has led to a softening of prices. The economic conditions will lead to some price depreciation, but not anything like the 2008-09 collapse in prices.

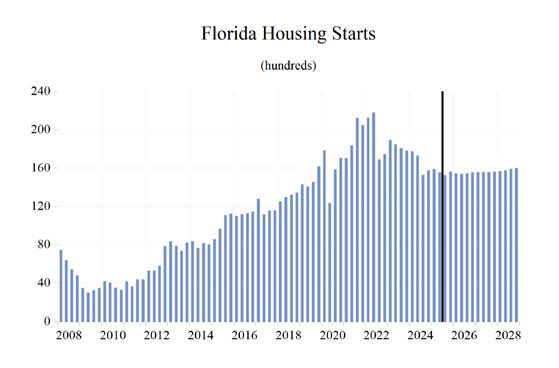

Housing starts in 2028 are expected to increase to nearly 158,500, falling from 183,675 in 2023. Lower interest rates should support this sector of the economy after higher rates had a dampening

Source: Florida Realtors

Figure 1.

Figure 2.

Source: Florida Realtors

effect on home construction activity over the past few years.

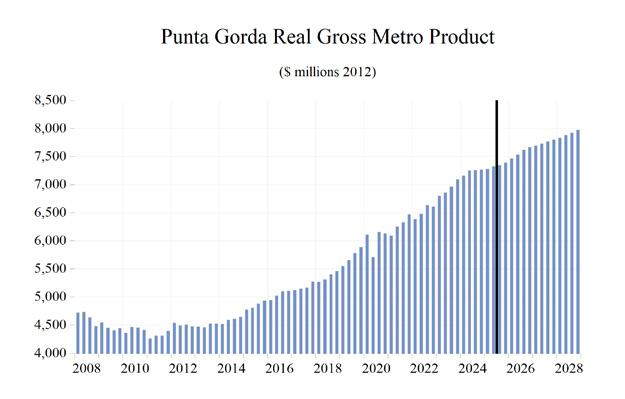

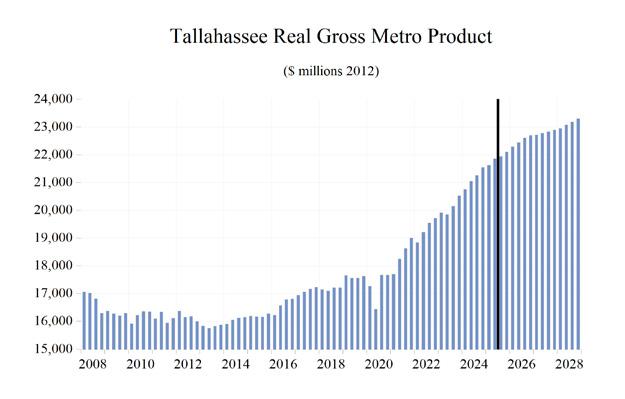

GROSS STATE PRODUCT

COVID restrictions caused a contraction in real Gross State Product (GSP) in 2020 of 1.4% year-over-year. This decline was smaller than both annual declines that occurred during the Great Recession (3.9% in 2008 and 5.5% in 2009). However, the second quarter’s year-overyear decline in 2020 was steeper than any quarter during the Great Recession. Fortunately, the COVID-19 recession, while much deeper than the previous recessions, was very short-lived at just two months. Florida’s decision to avoid heavyhanded and lengthy restrictions on the economy allowed the state to come roaring back in 2021, when growth roared back to 9.4 percent.

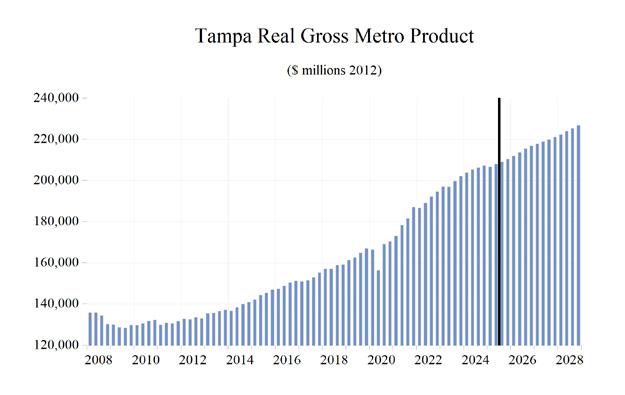

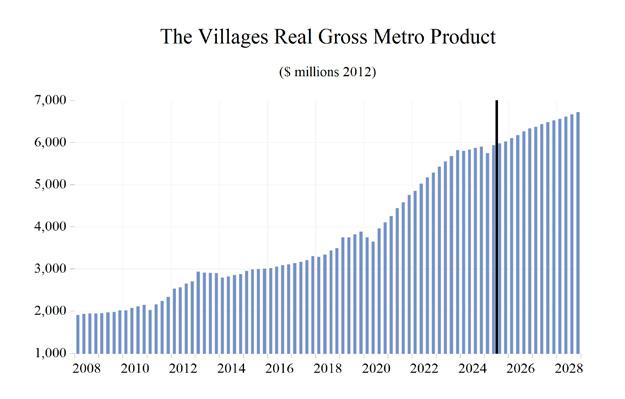

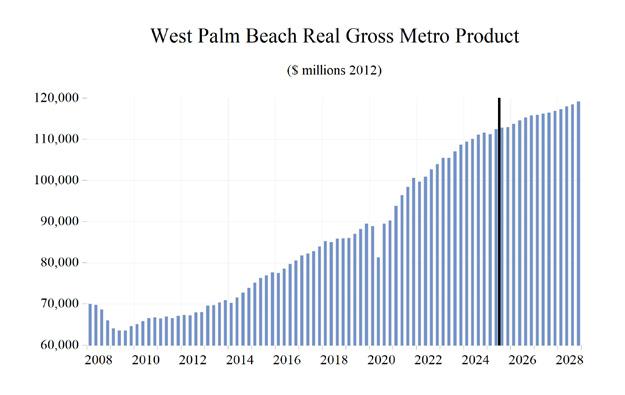

During 2025-2028, Florida’s real GSP is expected to grow by an average of 2.1% annually. This growth will include a 2025 deceleration to 1.9% from 3.6% in 2024. The 2.1% average growth from 2025 through 2028 will be a slower pace for growth compared to the prior four years (when growth averaged 5.8%), and this is due to an anticipated slowdown in the U.S. economy. This projected average rate of growth for Florida’s economy over the 2025-2028 period is higher than

the average of our forecasted real GDP growth for the U.S. economy (1.9%) over the same time frame.

Housing prices have soared since the bottom of the housing crisis. During the crisis, median existing-home prices fell to a low of $122,200 but now stand at $410,000. This price appreciation significantly improved household balance sheets in Florida. With price appreciation to date, Florida has long since recovered the aggregate housing value lost during the housing market collapse and has soared past the once shocking levels at the peak of the housing bubble, but higher mortgage rates and a slowing economy led to a small decline in prices. Fortunately for homeowners, but not for potential buyers, any further price declines will not be anything like the price collapse of 2008-09.

In 2017, Florida’s economy broke the $1-trillion threshold with a nominal (not adjusted for inflation) Gross State Product (GSP) of $1.003 trillion, which increased to $1.29 trillion in 2021. The GSP reached $1.47 trillion in 2022 and hit $1.60 trillion in 2023. We expect Florida’s GSP to rise to $1.79 trillion in 2025, $1.90 trillion in 2026, $1.98 trillion in 2027, and nearly $2.07 trillion in 2028.

Real GSP (adjusted for inflation) exceeded $1.1 trillion in 2021 and will climb to $1.45 trillion in 2028.

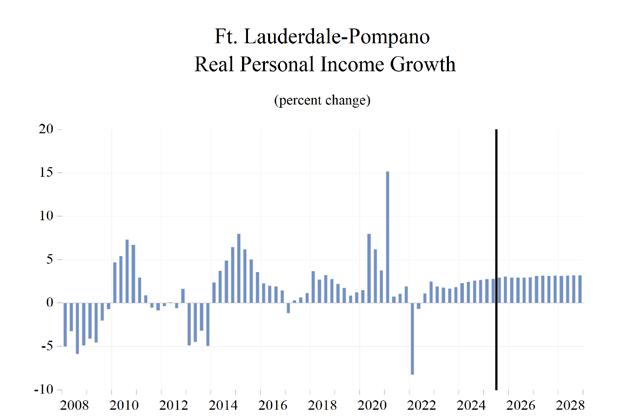

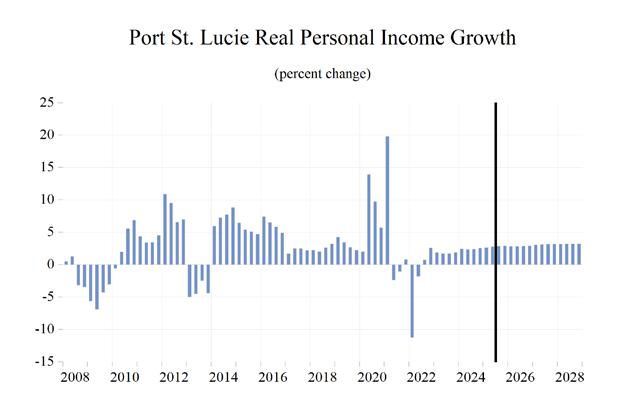

PERSONAL INCOME, RETAIL SALES, AND AUTO SALES

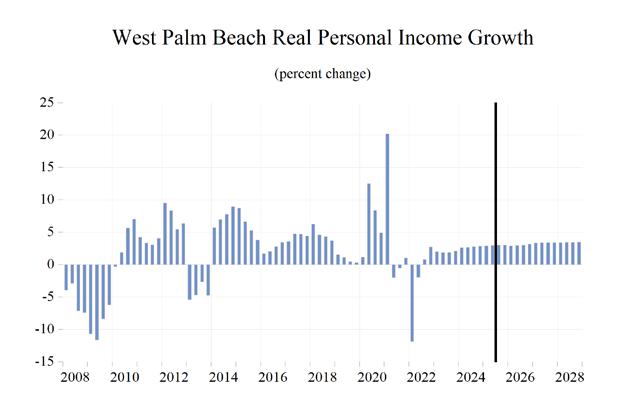

Nominal personal income growth surged to 6.5% (thanks to COVID stimulus and bonus unemployment payments) in 2020 and 11.3% in

2021, amid further federal stimulus spending and tax credits. Nominal personal income will be $2.04 trillion in 2028, marking an increase in personal income of over $1.0 trillion from its Great Recession low point in 2009.

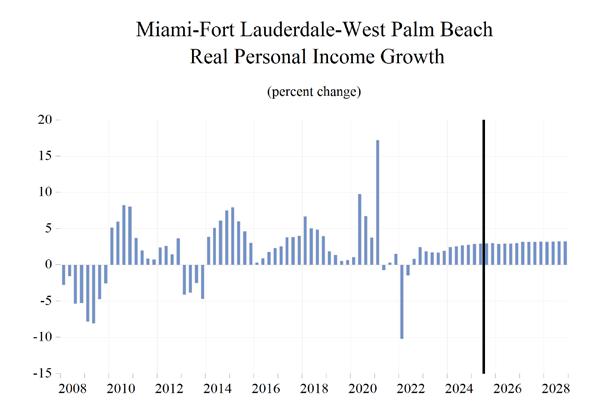

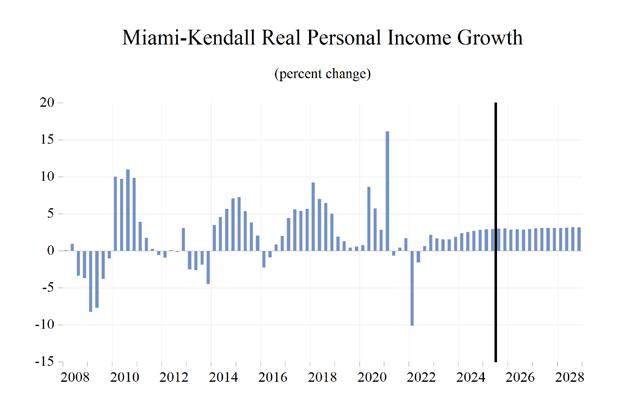

Thanks to rising inflation, real personal income contracted by 1.7% in 2022 but rose by 3.0% in 2023. Growth was 3.3% in 2024 and is expected to be 2.3% in 2025, 3.0% in 2026, 3.7% in 2027, and 3.0% in 2028. Real personal income growth during 2025-2028 will average 3.0% in Florida, weighed down a bit by slower growth in the near term, but still 0.5 percentage points higher than our forecast for the U.S.

Real disposable income growth, because of surging inflation, turned negative at -3.8% in 2022. Average growth in Florida during 2025-2028 will be 3.1% with inflation steadily declining, accompanied by still-solid wage and salary growth supported by Florida’s healthy labor market.

Financial markets experienced a strong rebound from the COVID-19 induced financial downturn, thanks in large part to the Federal Reserve Bank’s resumption of the financial crisis zero-interest-rate policy, quantitative easing, and other federal stimulus programs. The Dow Jones Industrial Average fell to 18,214 in March 2020 but then surged to a new record high of 36,953 in January 2022. The market declined as the Fed commenced its fight against inflation, causing financial markets to decline from those highs to the Dow falling under 34,000. Recently, with the Fed starting to cut interest rates, the market hit a new all-time high above 45,000 but declined significantly in early 2025, with DOGE and tariff uncertainty spooking investors. Once again, the rebound from that contraction has been relatively rapid, as after hitting 36,611 in April, the Dow has recovered to new highs.

Home equity in Florida was slow to recover following the Great Recession. Housing prices have been climbing over the past five years,

and current median prices, though softening somewhat, have greatly exceeded the once heady heights seen during the housing bubble. The housing market did not suffer the pandemic pain that financial markets experienced during the COVID-19 recession, nor will it during any economic slowing in the next few years. Home prices will fall somewhat if this slowdown is worse than anticipated, but to date, large price declines have not materialized in a housing market where inventories are rising, with the Fed resuming interest rate cuts that may result in lower mortgage rates.

Housing may not be as large a driver in the economy over the next few years, as housing starts have dipped from their post-pandemic highs. However, housing will still be an important economic factor as builders work to replenish, albeit at this diminished pace, inventories as Florida’s population continues to grow and the potential for lower mortgage rates supports housing demand.

Retail spending was hurt in the short run by the public health shutdowns and the effective collapse of the tourism industry in Florida from the pandemic response. Retail spending in the first quarter of 2020 contracted by 12.8% at an annual rate, followed by a 6.1% contraction for the second quarter. Spending levels exploded after the short, deep recession and a series of economic lockdowns, fully countering the first half of the year’s plunge, and driving full-year growth into positive territory for the year. In 2021, retail sales grew robustly compared to 2020, rising 17.1% at an annual rate. Sales came back down to Earth from the post-lockdown growth, and after a few quarters of weak growth from an erosion of consumers’ purchasing power from rising inflation and a slowing economy in 2023, solid growth resumed. Growth will average 4.8% during 2025-2028, hitting 3.0% in the final year of our forecast.

Consumers began to purchase light vehicles at a faster pace after the Great Recession ended,

releasing several years of pent-up demand, and continued to do so through 2016, though at a considerably slower pace. The 2020 COVID recession once again caused a contraction of new passenger car and truck registrations of 5.2% year-over-year in the fourth quarter of 2020, versus the fourth quarter of 2019. This contraction was not as sharp or as persistent as the one that took place during the Great Recession. Supply chain disruptions injected chaos into light vehicle markets, and prices for both new and used vehicles soared in the wake of these problems. New cars were selling for thousands above sticker price, and used vehicle inflation at one point hit 40% year-over-year. The rate of vehicle inflation has declined significantly, but prices remain elevated above pre-pandemic levels, and interest rates on auto loans remain high for now. Tariff uncertainty has boosted sales in the near term as consumers try to beat potential tariff-induced price increases.

Pent-up demand and the economic recovery boosted registrations coming out of the COVID-19 recession, and vehicle registration growth in Florida surged in 2021, rising to 11.6%. Registration growth in Florida during 2025-2028 will average 0.2%. Over this period, high auto prices, potentially further impacted by tariffs, will decelerate the growth in the number of new registrations in 2025 to 2.0%. In 2028, Florida’s new passenger car and truck registrations will be slightly over 1.39 million.

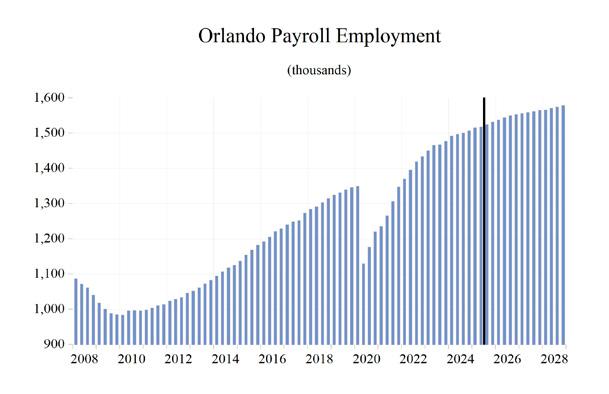

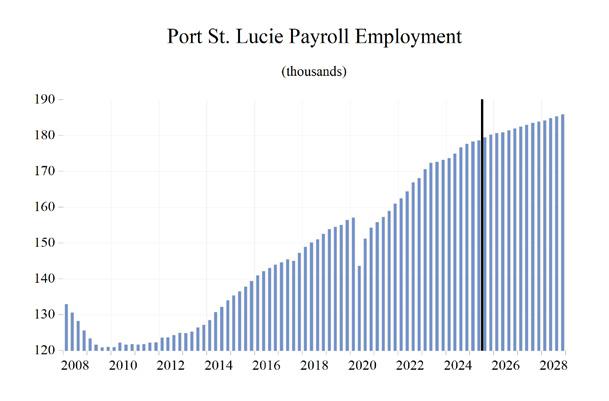

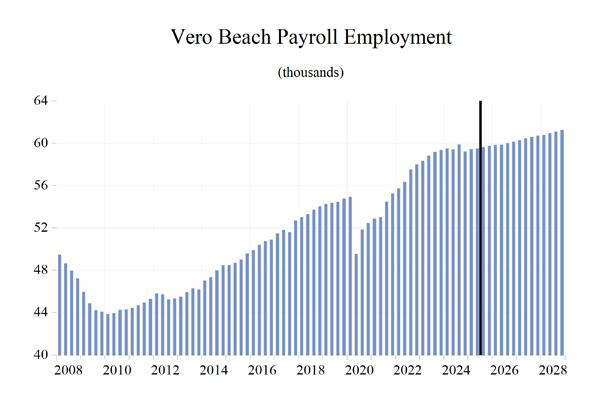

EMPLOYMENT

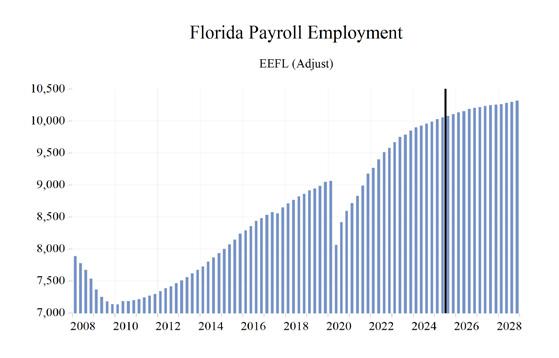

Business payrolls were devastated by COVID-19 lockdowns, as layoffs happened in a massive, but thankfully short-lived, wave. In Florida, total business payrolls surpassed their pre-pandemic levels in late 2021, as Florida ended lockdowns much sooner than most other states. Since then, the strength of Florida’s job market has exceeded that of the national job market, and it will

continue to do so throughout the remainder of our forecast horizon in 2028.

The COVID-19 lockdowns, closures, and travel restrictions were followed by aggressive federal spending and monetary policies to counter the devastating effects of shutting down the economy. These policies added fuel to an economy that was roaring back to life and had a strong impact on the labor market, fueling labor shortages and rapid wage and salary growth.

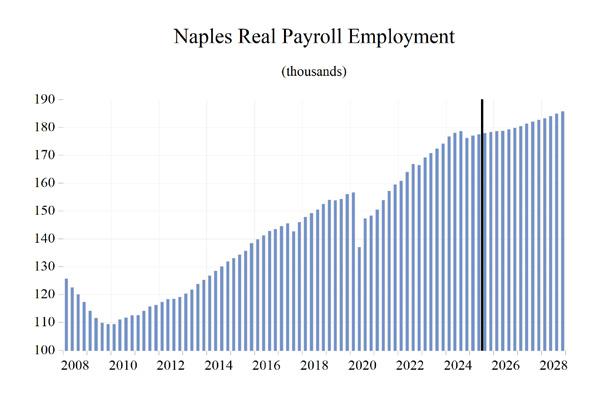

Job growth plummeted in March and April because of lockdowns, contributing to a 4.9% year-over-year contraction in 2020, but Florida’s decision to open the economy and avoid further lockdowns caused job growth to roar back to 4.6% in 2021, accelerating to 5.7% in 2022.

In 2024, the effects of the slowing economy impacted job growth. Total payroll jobs still rose by 3.4% in 2023 and then decelerated to 1.8% growth in 2024 and will further slip to 1.2% in 2025. The deceleration will resume to 1.0% in 2026 and 0.7% in 2027, before easing further to 0.5% in 2028. Florida’s labor market job creation growth will continue to outperform the national economy each year through 2028.

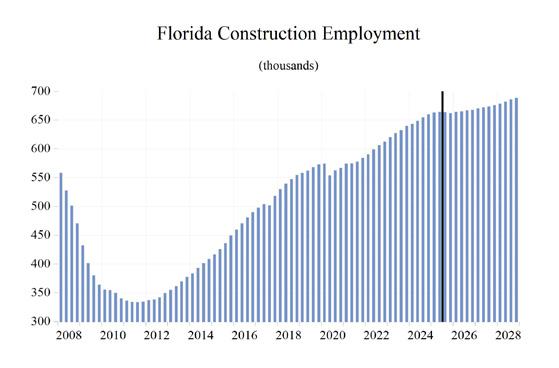

Construction job growth turned slightly negative in 2020 but increased in 2021, with housing starts rising amid depleted inventories and as large-scale public works projects that carried on uninterrupted by COVID. Construction job growth fell to -0.1% in 2020 and then recovered to 2.4% in 2021. Job growth rose further to 4.2% in 2022 and then grew by 4.6% in 2023, and then by 3.4% in 2024. Job growth will slip to 1.8% in 2025 before easing to 0.4% in 2026, rising 1.1% in 2027, and then to 1.6% in 2028. Average annual job growth during 20252028 will be 1.2%. Construction employment will average 683,983 in 2028.

The Professional and Business Services sectors, one of the fastest-growing sectors coming out of the COVID recession, is in for a deceleration as

economic and job growth decelerate. Job growth in this sector is expected to average 0.0% during 2025-2028. Growth in this sector fell to -2.3% in 2020 due to the pandemic and lockdowns. Growth surged to 7.4% in 2021 and then to 8.6% in 2022. It slowed to 2.1% in 2023 and continued to trend lower at 0.2% in 2024. In 2025, growth should be 1.0%; then decelerate to 0.2% in 2026 and contract in 2.2% 2027. Growth resumes at 1.1% in 2028.

The Information sector is a mix of high-tech ventures, including computer programming and software development, but job growth in this sector has for many years been weighed down by the unraveling of traditional print media. Structural and technological changes in the gathering and dissemination of information have decimated the print industry. Sources of growth within the information sector in Florida such as software development, data processing and hosting, wireless telecommunications, and content creation have offset the loss of jobs in traditional print media and publishing. Job growth dropped to -6.2% in 2020, recovered to 5.4% in 2021, and hit 10.3% in 2022—boosted by the roll-out of 5G wireless services. Job growth slowed to 2.1% in 2023 before it slid to -1.2% in 2024. Growth should come in at 0.5% in 2025 and 3.0% in 2026 and then contract by 1.8% in 2027 and 1.6% in 2028. The projected growth rate will average 0.0% during 2025-2028.

The Education and Health Services sector in Florida has been a consistent source of job growth in Florida, even during the worst part of the 2007-2009 Great Recession. However, the pandemic did hit this sector hard, as schools closed and most elective procedures, screenings, and wellness checks were postponed; employment contracted by 2.4% in 2020. The state’s growing population, with a larger share of older residents with a higher demand for health services, has supported growth in this sector and will continue to do so. Job growth will continue, though at a decelerated pace, through the next several years.

During 2025-2028, employment in this sector is expected to continue to expand at an average rate of 2.0 percent.

During 2016-2019, Manufacturing job growth averaged 2.9% in Florida, as trade policies helped level the playing field for U.S. manufacturers. The economic environment for the manufacturing sector is increasingly uncertain as slower economic growth looms for the U.S. and uncertainty in Washington, DC surrounding tariffs and trade deals still hangs over the sector. After job losses of 2.2% in manufacturing in 2020, the economy and manufacturing in Florida came back to life. Job growth accelerated to 2.9% in 2021 and rose by 5.2% in 2022. After that year’s burst, job growth decelerated to 3.2% in 2023 and then slowed to 1.3% in 2024; the sector will once again lose jobs from 2025 through 2028. Average job growth during 2025-2028 will be -1.0 percent.

The State and Local Government sector in Florida has been enjoying higher revenues from increased property values and state sales tax revenues that have exceeded forecasts for several years. As housing prices soared during 202022, property tax revenues rose as well. Though housing price growth has slowed, there will not be a repeat of the local government budget shortfalls after the housing market crashed, which led to job losses in this sector that persisted for six years from 2009 through 2014.

As Florida’s population and economy continue to grow, the demand for state and local government services continues to rise as well. To meet this demand, growth in state and local government employment will be necessary but not to the levels seen during the housing boom, despite the DOGE exercise in Tallahassee.

Average job growth in State and Local Government during 2025-2028 will be 0.8%, after annual growth hit 2.8% in 2023 and slowed to 2.6% in 2024. The slowing economy and softening housing market may eventually put some pressure on both sales and property tax revenue growth,

but this should not result in any severe budgetary issues or layoffs in the sector.

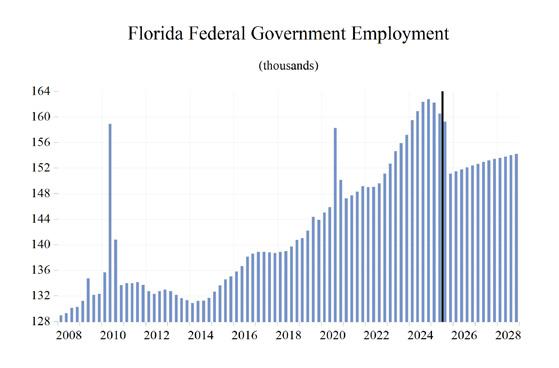

Federal Government employment growth, which was boosted by the decennial census hiring, turned negative in 2021 after the temporary hiring surge during the 2020 census year ended. However, historic deficits, a national debt of over $37.5 trillion, and an increasing debt service burden along with any spending cuts that may stick will become considerable factors going forward and, as job growth in the Federal Government sector in Florida will average -1.2% during 2025-2028.

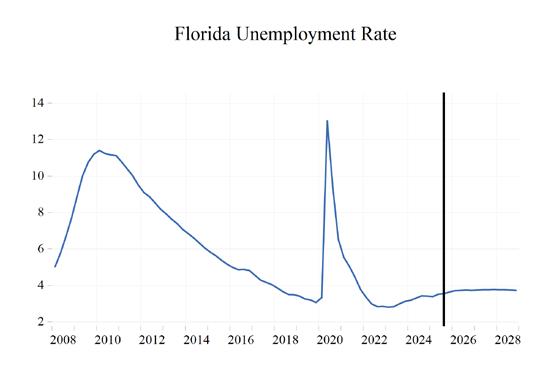

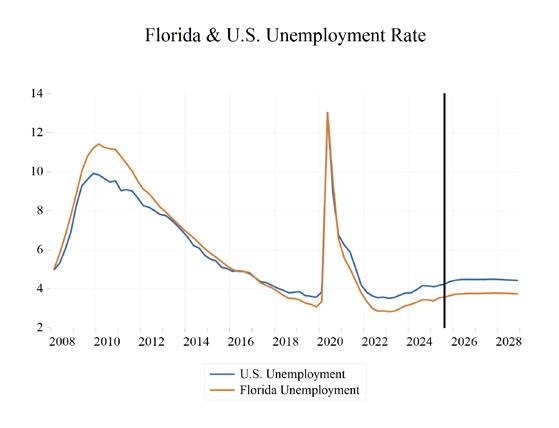

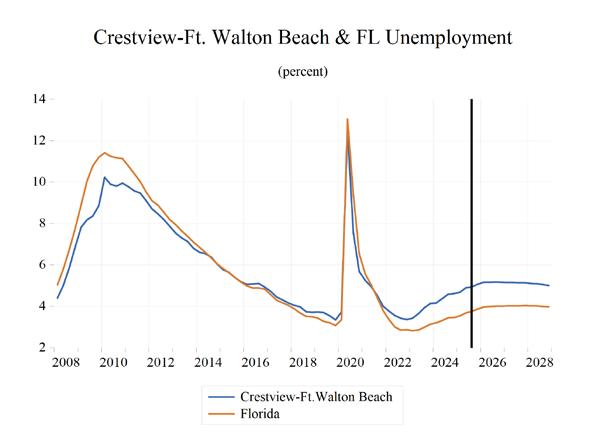

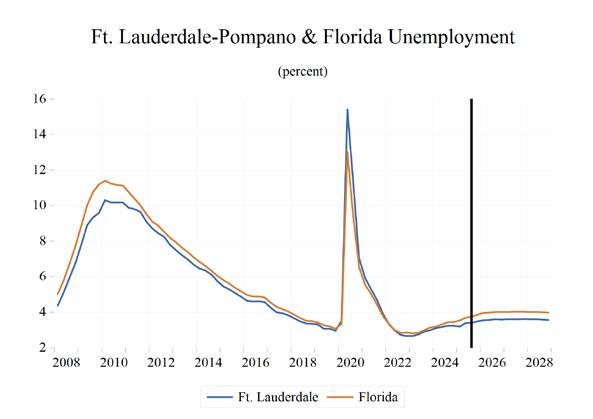

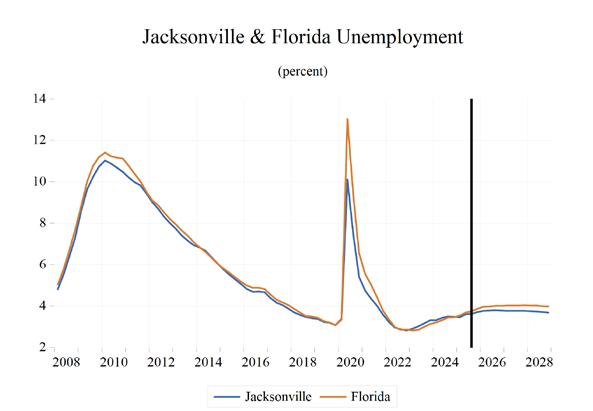

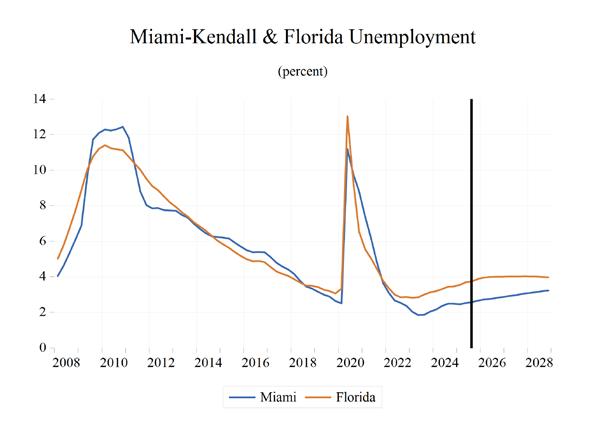

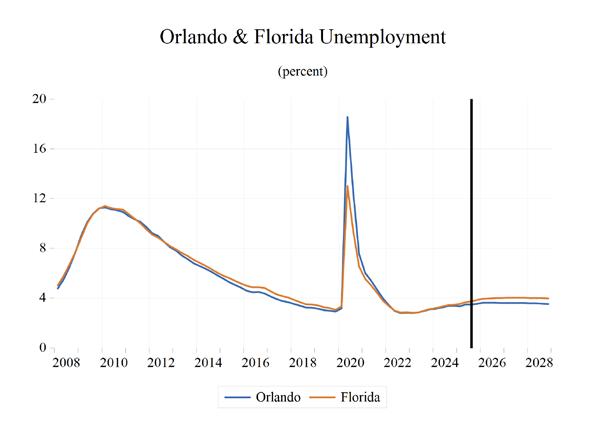

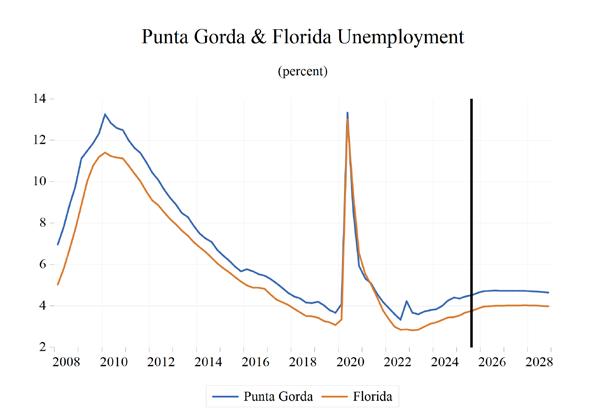

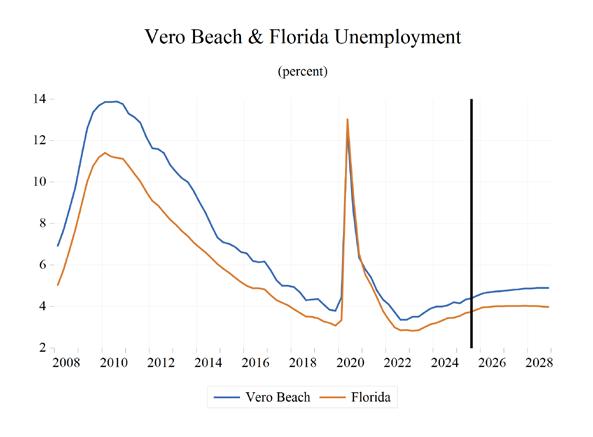

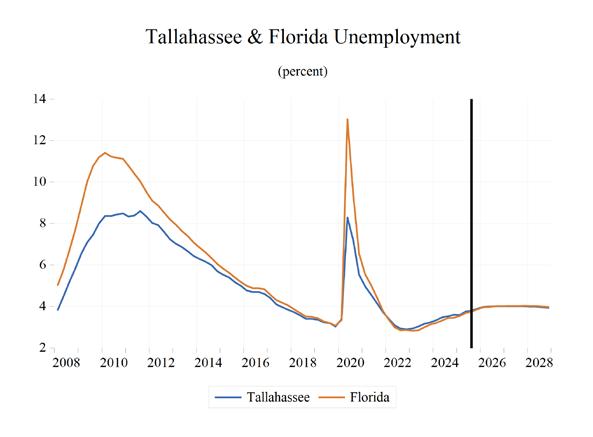

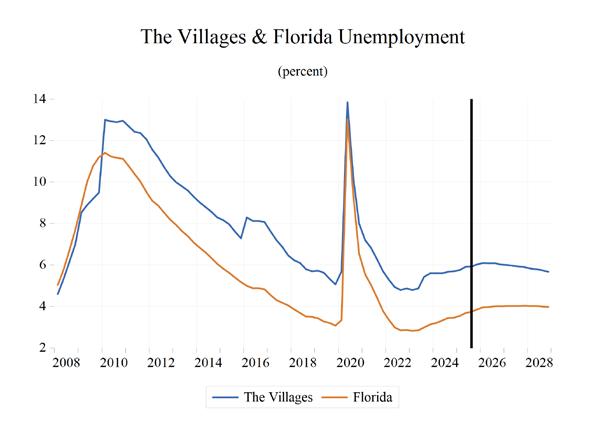

UNEMPLOYMENT

The unemployment rate in Florida has plummeted from its May 2020 peak of 14.2% and stands at 3.8% as of August 2025. When unemployment spiked to 14.2% in May 2020, it was 2.9 percentage points higher than the peak level of unemployment from the Great Recession. This unprecedented spike in unemployment transpired in only three months, while it took two-and-a-half years for the unemployment rate to peak in the Great Recession. The August 2025 unemployment rate is up 0.4 percentage points from a year ago and is 0.4 percentage points lower than the U.S. unemployment rate.

Both nationally and in Florida, the number of workers who are working part-time, but not by choice, and workers marginally attached to the labor force—defined as workers who are not currently employed or seeking employment but express a desire to work, are available for a job, and have searched for work within the past 12 months—which spiked during the public health shutdowns. When adding these groups with discouraged workers—defined as workers who are currently not working and did not look for a job in the four weeks preceding the Bureau of Labor Statistics’ monthly survey of households—to the

headline unemployment figure, U-3, we get the broadest measure of unemployment estimated by the BLS, known as U-6.

Looking at U-6, we see a labor market in Florida that remains the strongest in several decades. U-6 in Florida averaged 7.2% during the third quarter of 2024 through the second quarter of 2025. Meanwhile, the national rate of U-6 averaged 7.8% during the same period. U-6 unemployment in Florida during the second quarter of 2024 through the first quarter of 2025 was 4.9 percentage points below the U-6 rate in 2014, 8.8 percentage points lower than the 16% rate in 2012, and down 12.1 percentage points from its peak average rate of 19.3% in 2010 (the nation’s U-6 averaged 16.7% in 2010). As the national economy slows, these numbers will begin drifting slightly higher in Florida.

An analysis of how U-6 behaves relative to the headline unemployment rate (U-3) continues to provide additional information to fully comprehend the health of the labor market. The gap between these two measures continues to narrow. The average spread between U-6 and U-3 during the third quarter of 2024 through the second quarter of 2025 was hovering at 3.9% at the national level. That gap was 3.6% for the second quarter of 2024 through the first quarter of 2025 in Florida.

Table 1. Annual Summary of the University of Central Florida's Forecast for Florida

Personal Income and GSP

Employment and Labor Force (Household Survey % Change Year Ago)

Nonfarm Employment (Payroll Survey % Change Year Ago)

Population and Migration

Table 2. Quarterly Summary of the University of Central Florida's Forecast for Florida*

Personal Income and GSP

Employment and Labor Force (Household Survey % Change Year Ago)

Nonfarm Employment (Payroll Survey % Change Year Ago)

Population and Migration

Housing Consumer Prices

*Quarterly at an annual rate

Table 3. Employment Quarterly*

Florida Payroll Employment (Thousands)

*Quarterly at an annual rate

Florida Payroll Employment (Thousands)

Billions Current Dollars

FLORIDA NEWS SUMMARIES

Florida’s Small Businesses Victorious in Eliminating the Business Rent Tax

• The Florida Legislature passed HB 7031, permanently eliminating the state business rent tax, with implementation set for October 1, 2025.

• The law also ends collection of the local option sales tax on commercial rent, providing broad relief to small businesses statewide.

• NFIB Florida notes that this change represents a long-sought win for small employers, potentially lowering operating costs and supporting business growth across Florida.

Source: NFIB, June 17, 2025

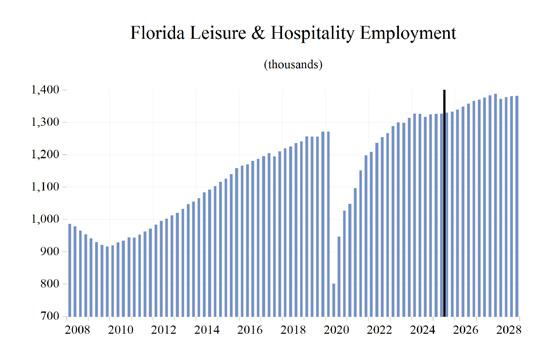

34.4 million people visited Florida in 3 months, breaking tourism record

• Florida set a second-quarter tourism record in 2025, welcoming 34.4 million visitors (31.5 million domestic, 2.3 million international), with Canadian arrivals at 640,000, driving significant airport activity and slight hotel room demand growth.

• Tourism remains a major economic driver, generating substantial tax revenue ($37 billion in 2023), which supports state initiatives like property tax relief and contributes broadly to

Florida’s low-tax environment.

• Benefits are uneven across regions: some coastal and hurricane-affected areas continue to struggle, while reliance on service-sector jobs with stagnant wages limits economic gains for residents despite record visitation.

Source: WPTV, August 22, 2025

T-Mobile Completes $2B Network Expansion in Florida, Covering Entire State with Ultra-Fast 5G Coverage

• T-Mobile completed a $2 billion, multi-year 5G network expansion across Florida, adding or upgrading over 2,600 sites and providing faster speeds, near-universal coverage, and improved reliability for 22 million residents.

• The network upgrades support businesses, smart city initiatives, and emergency response, strengthening economic activity, innovation, and disaster resilience statewide.

• T-Mobile’s expansion also created roughly 220 jobs through new retail stores and funded community programs, including school grants and civic initiatives, supporting workforce development and digital inclusion.

Source: Business Wire, July 2, 2025

Lawmakers add $25M to Job Growth Grant Fund — far below Gov. DeSantis proposal

• The Florida Job Growth Grant Fund is set to receive $25 million in next year’s budget through a Senate “sprinkle list” allocation, one-third of the $75 million originally proposed by Gov. DeSantis.

• The program supports public infrastructure projects with a minimum five-year lifespan and workforce training initiatives at state colleges and technical centers, aimed at helping unemployed or underemployed Floridians.

• Funding requires projects and programs to meet specific criteria, including alignment with CareerSource Florida to ensure broad accessibility and sustainability of skills.

Source: Florida Politics, June 16, 2025

Florida Governor DeSantis Signs Aerospace and Transportation Legislation

• Governor DeSantis signed SB 1516 and SB 1662 to strengthen Florida’s aerospace and transportation sectors, creating the International Aerospace Innovation Fund and updating infrastructure, seaport, airport, and logistics policies.

• The legislation supports workforce development, advanced air mobility (AAM), vertiport construction, and protection of space-designated lands, positioning Florida to attract high-wage jobs, commercial space launches, and global investment.

• Partnerships, including Lockheed Martin and UCF, will expand internships, sponsored research, and executive education in AI, robotics, advanced manufacturing, and hypersonics, reinforcing Florida’s leadership in aerospace innovation and advanced manufacturing.

Source: West Orlando News, June 19, 2025

PROFILES

The Cape Coral MSA consists of Lee County, located on Florida’s southwest coast. This area is known for its extensive network of waterways, with more than 400 miles of canals. Cape Coral has the most extensive canal system of any city in the world and is the largest master-planned community in the U.S.

QUICK FACTS

• Metro population estimate of 860,959 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Lee County population estimate of 792,692 as of 2025 (ACS 5-Year Estimate).

• Civilian labor force of 380,300 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 4.8% as of August 2025, not seasonally adjusted. This amounts to 18,243 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

The studied economic indicators are predicted to show strong levels of growth in the Cape Coral Metropolitan Statistical Area (MSA). Gross Metro Product for the MSA will come in at $43,829.63 million. Real per-capita income is expected to average $56,500, the 11th highest, and the MSA is ranked 6th in personal income growth at 6.1 percent. The average annual wage will grow at an annual rate of 4.2 percent to $74,800. Cape Coral’s population will grow at the 13th highest rate, at an annual rate of 1.3 percent. Employment growth is expected to average 0.9 percent, and Cape Coral will experience a relatively average unemployment rate in the state at 4.0 percent. The Education and Health Services sector will lead the MSA with an average annual growth at 2.5 percent, followed closely by the Financial sector at 1.7 percent. On the other end, the Federal sector will experience the lowest growth, with a contraction of -1.7 percent.

METRO NEWS SUMMARIES

Marriott Opens First StudioRes Ext.-Stay Hotel

• Marriott International has opened the first property in its new midscale extended-stay brand, StudioRes, in Fort Myers, featuring 124 studio-style rooms with kitchens and targeting daily rates around $100.

• The Fort Myers property, operated by Concord Hospitality, is part of a broader plan to develop StudioRes hotels in U.S. submarkets, with Marriott projecting 40 locations open in North America by 2027.

• The launch reflects a broader industry trend, as multiple major hotel chains have recently introduced extended-stay brands to capture demand in a resilient lodging sector.

Source: BusinessTravelNews, June 2, 2025

Bloom to bring affordable housing to essential workers

• Developers and local officials broke ground on Bloom, a 336-unit workforce housing community on Hanson Street in Fort Myers, aimed at essential workers including teachers, first responders, and healthcare staff.

• Over half the units will be reserved for residents earning below 80% of the area median income, with the rest capped for those between 80%–120%, offering substantially lower rents than regional luxury apartments.

• Supported by federal grants, loans, and local tax incentives, the project is expected to improve housing affordability, strengthen workforce stability, and enhance local economic resilience upon completion in 2027.

Source: PineIslandEagle, June 25, 2025

Freedom Fest 2025 returns to Lehigh with Fireworks and Community Celebration

• The Southwest Florida Business Alliance, in partnership with Victory Town Center and Victory Church, will host the fifth annual

Freedom Fest Lehigh Acres on July 4, featuring live music, food vendors, a community vendor village, and fireworks.

• The free event typically draws more than 2,000 attendees, with organizers emphasizing its role in fostering community ties and supporting the local economy.

• Sponsorship from a wide range of local businesses and organizations helps keep the event accessible, while also providing visibility and engagement opportunities for participating vendors.

Source: Lehigh Acres Citizen, July 1, 2025

Fort Myers approves culinary district to shake up downtown area

• Fort Myers approved a $14,500 initiative to establish and promote a downtown culinary district, including a new brand, logo, and social media campaign.

• The project aims to increase foot traffic and highlight local restaurants, with business owners welcoming the potential boost to customer activity.

• City officials emphasized the focus on showcasing the variety of local food and drink options, though the official launch date has not yet been set.

Source: WinkNews, July 23, 2025

Mullet Madness brings fun and business to Fort Myers Beach

• Fort Myers Beach hosted its first “Mullet Madness” event, designed to attract visitors during the off-season with fish-tossing contests, look-alike competitions, and other community activities.

• Local business owners reported strong turnout, ticket sales, and increased foot traffic, noting the event helped bring new energy and customers during a typically slower period.

• Several businesses highlighted the event as part of a broader effort to rebuild community ties and strengthen the local economy following recent challenges.

Source: WinkNews, August 2, 2025

Second hospital for Cape Coral?

• Cape Coral officials are actively pursuing a partnership with HCA Healthcare to build a second full-service hospital, citing it as a priority for city leadership and economic development staff.

• The push comes in response to rapid population growth and resident concerns about long wait times, limited hospital capacity, and the frequent need to transport patients outside the city for critical care.

• Mayor John Gunter noted that the city council, leadership team, and business community are prepared to support HCA throughout planning and construction, though no formal commitment has been made and a timeline is uncertain.

Source: CapeCoral Breeze, August 28, 2025

Long Term Outlook for Cape Coral-Fort Myers, FL

September 2025 Forecast

Personal Income (Billions $)

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

Short Term Outlook for Cape Coral-Fort Myers, FL

September 2025 Forecast

Personal Income (Billions $)

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

PROFILES

The Crestview MSA is comprised of Okaloosa and Walton counties and is located in the northwest corner of the state. Crestview is known as the “Hub City” because of the convergence of Interstate 1, State Road 85, U.S. Highway 90, the Forida Gulf & Atlantic railroad, the Yellow River and Shoal River in or near the city.

QUICK FACTS

• Metro population estimate of 310,149 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Okaloosa County population estimate of 214,281 as of 2023 (ACS 5-Year Estimate).

• Walton County population estimate of 79,846 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 141,100 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 4.2% as of August 2025, not seasonally adjusted. This amounts to 6,074 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

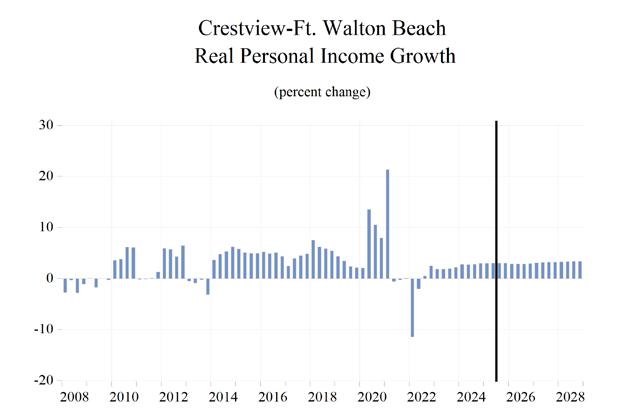

The studied economic indicators are predicted to show average levels of growth in the Crestview Metropolitan Statistical Area (MSA). Gross Metro Product for the MSA will come in at $21,207.8 million. The MSA will experience slightly above average personal income growth of 6.1 percent, and real per capita income will be $63,000. The average annual wage will grow at an annual rate of 4.5 percent to $76,300. Crestview’s population will grow at an annual rate of 0.6 percent.

Employment growth is expected to average 0.6 percent, and Crestview will experience an unemployment rate of 4.0 percent.

The Other Services sector will lead the MSA in average annual growth at 2.0 percent. The Financial sector will follow at 1.7 percent. The Manufacturing Sector will see contractions in growth of -1.1 percent.

METRO NEWS SUMMARIES

Williams International to build $1B aviation engine plant in Florida

• Williams International is investing over $1 billion to build a turbine engine manufacturing campus in Okaloosa County, Florida, creating 336 jobs with an average salary of $69K and beginning construction this month to meet urgent customer demand.

• The three-phase project includes facilities totaling 1 million square feet, with completion dates stretching from 2026 to 2036, and is backed by a $253.7 million Department of Defense contract to boost engine production for missile systems amid rising geopolitical tensions.

• Strategically located near key transportation hubs and military partners, the Florida site complements a parallel $1 billion expansion in Ogden, Utah, where Williams is adding 316 jobs and 100K square feet to meet surging industry growth.

Source: Manufacturing Dive, June 3, 2025

Okaloosa County approves $1.87M study to support Eglin West Gate Redevelopment

• Okaloosa County is advancing redevelopment near Eglin Air Force Base’s West Gate with a newly approved $1.87 million study and extended engineering contract through 2027.

• The Eglin Westside Expansion Plan will be guided by HDR Engineering under Task Order 3, building on prior deliverables from the original 2020 agreement.

• County staff and Eglin officials have jointly approved the scope and cost of the PD&E study, marking a key step in long-term infrastructure planning.

Source: Mid Bay News, July 3, 2025

Okaloosa County to break ground on new Tax Collector’s Office in Crestview

• Okaloosa County will break ground on a new 30,000-square-foot government facility in Crestview on July 21, designed to house the Tax Collector and Property Appraiser offices with room for future administrative expansion.

• The project responds to rapid population growth and rising service demand in north Okaloosa, enabling the relocation of the Tax Collector’s Customer Service Center from Niceville to better serve Crestview-area residents.

• Officials emphasize long-term planning and intergovernmental collaboration, aiming to support countywide growth over the next 40 to 50 years while enhancing service efficiency and customer experience.

Source: Get The Coast, July 16, 2025

A&R Group Expands Hotel Portfolio into Florida’s Panhandle with Acquisition of Fairfield Inn & Suites Destin

• A&R Group has entered the Florida Panhandle market with an $18 million acquisition of Fairfield Inn & Suites Destin, a 100-room hotel located in one of the region’s top tourism corridors.

• The company plans a full renovation of the property starting in late 2025 to meet Marriott’s latest brand standards, backed by a 24-year franchise agreement and positioned for long-term performance in a high-demand leisure market.

• With this strategic move, A&R now operates over 25 hotels across six states, expanding its Southeastern U.S. footprint and reinforcing its commitment to value creation through disciplined investment and operational excellence.

Source: CBS 42 News, July 25, 2025

Okaloosa Commissioners approve Destin, Fort Walton Beach tourism funding plans

• Okaloosa County commissioners approved fiscal year 2026 tourism funding for Destin and Fort Walton Beach, supporting infrastructure and operations through the municipal share of tourist development tax revenues.

• Destin will repay $750K for the Tarpon project and receive $665K for beach and boardwalk maintenance, while Fort Walton Beach secured $575K for golf course renovations and $75K for athletic complex upkeep.

• Additional municipalities are coordinating with county-led efforts or banking their allocations for future projects, with Crestview preparing a proposal and Valparaiso planning to revise and resubmit its application.

Source: Get The Coast, August 7, 2025

City of Fort Walton Beach commits $2 million to ‘Around the Mound’ project design

• Fort Walton Beach will fund $2.025 million of the $2.7 million design cost for the Around the Mound traffic project after missing out on a state transportation grant, with Okaloosa County maintaining its $675K contribution.

• The project aims to expand Highway 98 capacity and support regional traffic flow and military readiness, ranking fourth on the Strategic Intermodal Systems priority list and designated as a Tier 1 SS4A safety initiative.

• City officials plan to pursue alternative funding sources, including SS4A grants and Chamberled efforts, while emphasizing that the funding commitment won’t affect future budgets if the project doesn’t move forward.

Source: Get The Coast, August 14, 2025

Crestview-Ft. Walton Beach-Destin MSA

Long Term Outlook for Crestview-Fort Walton Beach-Destin, FL

September 2025 Forecast

Personal Income (Billions $)

Establishment Employment (Place of Work, Thousands, SA)

Short Term Outlook for Crestview-Fort Walton Beach-Destin, FL

September 2025 Forecast

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

PROFILES

The Deltona–Daytona–Ormond Beach MSA is comprised of Volusia and Flagler Counties. It is located on the east coast of Florida and is notable for special events that occur throughout the year such as Bike Week. It is also home to the NASCAR headquarters and the Daytona International Speedway, which hosts popular races such as the Daytona 500.

QUICK FACTS

• Metro population estimate of 739,516 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Volusia County population estimate of 568,229 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 323,700 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 5.1% as of August 2025, not seasonally adjusted. This amounts to 16,604 unemployed people (FRED, U.S. Bureau of Labor Statistics).

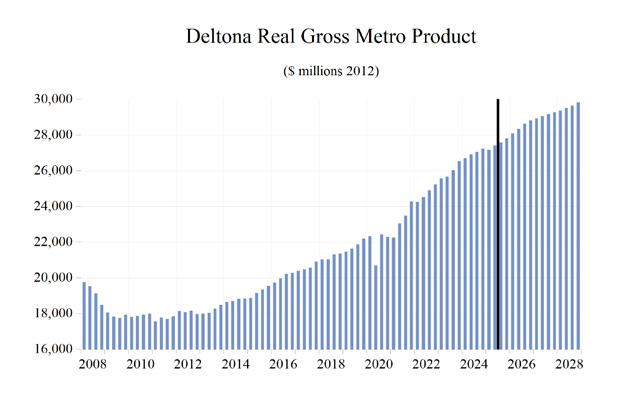

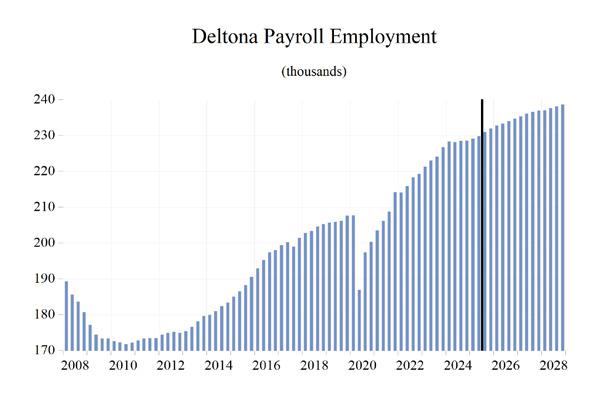

OUTLOOK SUMMARIES

Growth in the economic indicators studied in this forecast is expected to be moderate for the Deltona— Daytona—Ormond Beach Metropolitan Statistical Area (MSA). Gross Metro Product in the Deltona MSA will be $28,663.33 million, placing it 12th in the state for metro output. The average annual wage will grow at a rate of 4.3 percent, driving the average annual real wage to increase to $65,000, which is ranked 22nd in the state. Per capita income levels will come in at $51,000, with average per capita income growth of 4.3 percent annually. Population growth is expected to be 0.4 percent per year.

The Deltona—Daytona—Ormond Beach MSA labor market will experience an average employment growth of 0.4 percent, with an unemployment rate of 4.4 percent.

The Other Services sector will experience the fastest growth rate in this MSA with an annual growth rate of 2.7 percent. The Information sector will follow at 2.6 percent. Deltona will see the largest contraction in growth in the Federal sector at -1.4 percent.

METRO NEWS SUMMARIES

Daytona city government buys oceanfront land for $2.2M hoping to entice new boutique hotel

• Daytona Beach purchased a 0.5-acre oceanfront parcel at 29 S. Ocean Ave. for $2.2 million, below the owner’s asking price of $2.5 million and slightly above its March appraisal of $2.1 million, securing control of key redevelopment parcels.

• Plans include extending the Boardwalk approximately 295 feet from Breakers Oceanfront Park to Harvey Avenue, with $170,237 allocated for design, permitting, and construction administration services to improve pedestrian access and support adjacent commercial development.

• Acquisition and infrastructure improvements are expected to facilitate the construction of a Señor Frog’s restaurant and potentially a boutique hotel, stimulating further private investment and economic growth along Daytona Beach’s southern oceanfront corridor.

Source: The Daytona Beach News-Journal, June 19, 2025

Walmart submits new site plan for Ormond Beach expansion, remodel

• 4,752-square-foot expansion planned to support Walmart’s growing online grocery pickup and delivery services, strengthening digital retail capacity in Ormond Beach.

• Interior upgrades include expanded pharmacy and food offerings, plus technology integration and energy-efficient changes, enhancing operational efficiency and customer service.

• Investment in façade improvements and new branding aligns with Walmart’s modernization strategy, reinforcing the store’s role as a 1521 W. Granada Blvd. economic anchor.

Source: Observer, June 20, 2025

Deltona approves a residential development moratorium despite a new law that restricts the move

• Deltona City Commission approved a residential development moratorium despite state law SB180 restrictions, potentially affecting new projects along Howland Boulevard and near Epic Theaters, creating uncertainty for local real estate investment.

• The city faces possible litigation from Howland Station Condo Developers and may incur significant taxpayer-funded legal costs to defend or appeal the ordinance, impacting municipal budgets and delaying developmentrelated revenue.

• The moratorium is aimed at addressing flooding and stormwater infrastructure issues in new subdivisions, potentially influencing the timing and scale of future residential developments in the city, which could affect local housing supply and property market growth.

Source: Spectrum News, July 1, 2025

Florida Budget includes millions for flood control, roads, arts, more in Volusia, Flagler

• Volusia and Flagler counties received over $137 million for colleges, universities, and school readiness programs, including $64.9 million for Daytona State College, $16.96 million for Bethune-Cookman University, and $5 million for UCF’s Discovery and Innovation Hub, supporting workforce development in healthcare, business, and STEM fields.

• Transportation and stormwater improvements received significant support, including $153.8 million for interstate construction, $71.2 million for resurfacing, and city projects like $3 million for a Port Orange stormwater pond and $2.5 million for Deltona’s recharge well, enhancing economic resilience and growth potential.

• Over $22 million allocated to nonprofits, healthcare, aviation, and manufacturing

initiatives, including $1.5 million for Homes Bring Hope, $1 million for Halifax Health Medical Center EHR consolidation, and $500,000 for Advanced Manufacturing International to strengthen regional workforce pathways.

Source: The Daytona Beach News-Journal, July 2, 2025

SRS Arranges $4.8M Sale of Medical Office Property in Daytona Beach Leased to Florida Health Care Plan

• SRS Real Estate Partners facilitated the ground lease sale of a newly constructed medical office property in Daytona Beach, highlighting continued investment in healthcare real estate.

• The single-tenant building is occupied by Florida Health Care Plan, demonstrating demand for specialized medical office space in the region.

• The property features a corporate guaranteed, absolute triple-net lease, providing long-term revenue stability for investors.

Source: Rebusiness Online, August 1, 2025

Deltona can expect a Culver’s, Chipotle, and Starbucks

• Deltona’s Halifax Crossing Mixed Use Planned Unit Development increased commercial land from 37.31 acres to 58.5 acres, enabling space for multiple new restaurants, markets, and entertainment districts.

• Planned or under-construction businesses along Howland Boulevard include Culver’s, Chipotle, Starbucks, Dairy Queen Grill & Chill, Freshway Meat and Produce, Dutch Bros Coffee, and Wendy’s, signaling strong retail growth in the area.

• The city reduced the minimum commercial parcel size to one acre in the MPUD, supporting greater density and flexibility for future local and national businesses.

Source: Hometown News, August 28, 2025

Deltona - Daytona Beach - Ormond Beach MSA

Long Term Outlook for Deltona-Daytona Beach-Ormond Beach, FL

September 2025 Forecast

Establishment Employment (Place of Work, Thousands,

SA)

Other Economic Indicators

Short Term Outlook for Deltona-Daytona Beach-Ormond Beach, FL

September 2025 Forecast

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

PROFILES

The Broward County MSA, is located in Southeastern Florida. It is estimated to be the second-most populous county in the State of Florida and the 17th most populous county in the United States.

QUICK FACTS

• Metro population estimate of 1,940,907 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Broward County population estimate of 1,946,127 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 1,095,600 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 4.1% as of August 2025, not seasonally adjusted. This amounts to 44,982 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

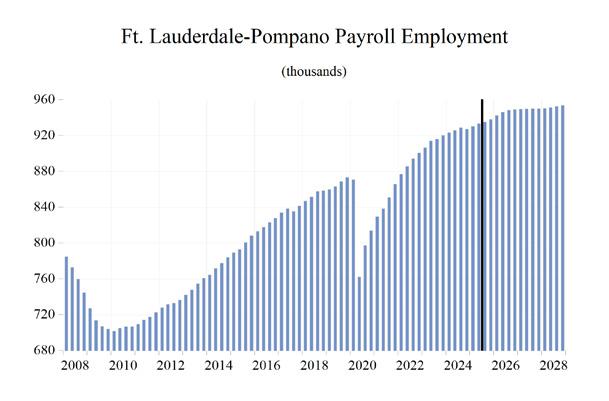

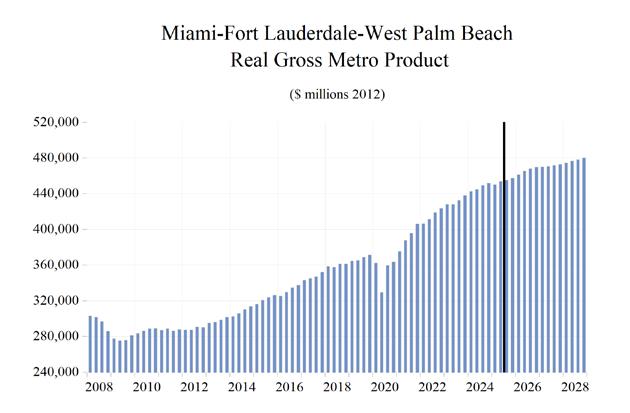

The Fort Lauderdale—Pompano Beach area is expected to show below-average levels of growth in the economic indicators. Personal income is expected to grow an average of 5.3 percent annually, ranking 20th among the MSAs studied. It will experience an average real per capita income level of $55,600, placing it 12th. Average annual wage growth will be 4.4 percent, and the annual wage level is expected to be $87,900, the 4th highest of the studied areas. Fort Lauderdale is expected to average a population growth of 0.2 percent each year, ranking 23rd. The area has the 5th highest Gross Metro Product of the MSAs studied at an average level of $143,872.00 million.

Employment is expected to grow at a rate of 0.7 percent, while unemployment is expected to be 3.6 percent, ranking 22nd.

Fort Lauderdale’s fastest growing sector is expected to be the Other Services sector, which will experience 1.6 percent average annual growth, followed by the

Education and Health Services sector, which will grow at a similar average of 1.5 percent annually. The Federal Government sector will see the largest contraction at -0.4 percent, with Manufacturing also declining at -0.3 percent.

METRO NEWS SUMMARIES

Related Group, Merrimac obtain $160 million construction loan for Waldorf Astoria condo

• Related Group and Merrimac Ventures secured a $160 million construction loan from Bank OZK to advance the 28-story Waldorf Astoria Residences in Pompano Beach, which broke ground in April.

• The project includes 90 Hilton-branded condos, with 70% already pre-sold; units start at $2.6 million, while penthouses are priced between $16 million and $20 million.

• Set for completion in about two years, the development will feature extensive luxury amenities and restaurants, reinforcing Pompano Beach’s positioning as an emerging high-end residential and tourism market.

Source: South Florida Business Journal, June 6, 2025

Spirit adds Fort Lauderdale route to major tourist destination

• Spirit Airlines will begin service at Key West International Airport on November 6, 2025, launching the only nonstop route between Key West (EYW) and Fort Lauderdale (FLL), with four weekly flights expanding to daily service by mid-December.

• The new route connects Key West to Spirit’s largest hub in Fort Lauderdale, offering onestop connections to major U.S. cities including Atlanta, Boston, Chicago, Dallas, Detroit, Houston, New York, and Philadelphia.

• Key West becomes Spirit’s eighth Florida destination, with the service expected to boost regional tourism and provide residents with

a lower-cost alternative to driving or more limited existing air options.

Source: Spirit, July 22, 2025

Blackstone’s UKG opens office in Broward County

• UKG, Blackstone’s largest Florida-based portfolio company, opened a 100,000-squarefoot office in Sunrise, its second South Florida location.

• The office will house over 750 employees, mainly from engineering teams, with amenities including a barista bar and wellness studio.

• The building at 1340 Concord Terrace is an existing structure completed in 1998, owned by an affiliate of Harbor Group International, while UKG’s Weston office continues to host business teams.

Source: South Florida Business Journal, August 1, 2025

Meal delivery service expands in Broward

• Ideal Nutrition leased 1,250 sq. ft. of groundfloor retail at Coasterra Apartments in Fort Lauderdale, opening Aug. 9, expanding the local health-focused food sector and adding visibility for the brand in a growing urban market.

• The lease supports job growth and economic activity, complementing the company’s earlier announcement of 150 new positions at a West Palm Beach distribution center.

• The location in a mixed-use, high-traffic corridor reflects Fort Lauderdale’s ongoing downtown population growth (+16.2% since 2010) and continued transformation into a dense residential and commercial hub.

Source: South Florida Business Journal, August 7, 2025

Law firm buys Broward building, to relocate headquarters

• Law firm Ginnis, Krathen & Zelnick purchased a 7,541-square-foot Fort Lauderdale office building for $5 million, relocating from a leased space as office rents continue to rise across South Florida. Renovations are underway, with move-in expected early next year.

• Retail vacancies increased across MiamiDade, Broward, and Palm Beach counties in Q2 2025, with negative net absorption most pronounced in Broward. Higher rents from leases signed during peak years have led some tenants to relinquish space.

• Industrial vacancies remained stable, with strong leasing activity and significant new supply coming online. Major leases included Amazon in Miami-Dade, Niagara Bottling in Palm Beach, and Lowe’s in Broward, reflecting continued strength in the sector.

Source: South Florida Business Journal, August 10, 2025

$175 million beachfront hotel breaks ground in Broward

• A $175M, 205-room Marriott Autograph Collection hotel broke ground in Fort Lauderdale, adding significant investment and future hospitality capacity to the Broward economy.

• The project is expected to support construction jobs in the short term and generate long-term economic activity through tourism spending, given Fort Lauderdale’s 14M+ annual visitors and $11.4B economic impact.

• Its location on Fort Lauderdale Beach aligns with continued demand for high-end hospitality and dining, reinforcing the region’s positioning as a luxury travel destination.

Source: South Florida Business Journal, August 14, 2025

Long Term Outlook for Fort Lauderdale-Pompano Beach-Deerfield Beach, FL (Division of Miami MSA)

September 2025 Forecast

Personal Income (Billions $)

Establishment Employment

(Place of Work, Thousands, SA)

Other Economic Indicators

Short Term Outlook for Fort Lauderdale-Pompano Beach-Deerfield Beach, FL (Division of Miami MSA)

September 2025 Forecast

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

PROFILES

The Gainesville MSA is comprised of Alachua and Gilchrist counties, and is located in the central north portion of the state. This metro is home to the University of Florida and the Florida Museum of Natural History, the state’s official natural history museum.

QUICK FACTS

• Metro population estimate of 360.81 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Alachua County population estimate of 281,751 as of 2023 (ACS 5-Year Estimate).

• Gilchrist County population estimate of 18,494 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 154,700 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 5.1% as of August 2025, not seasonally adjusted. This amounts to 8,665 unemployed people (FRED, U.S. Bureau of Labor Statistics).

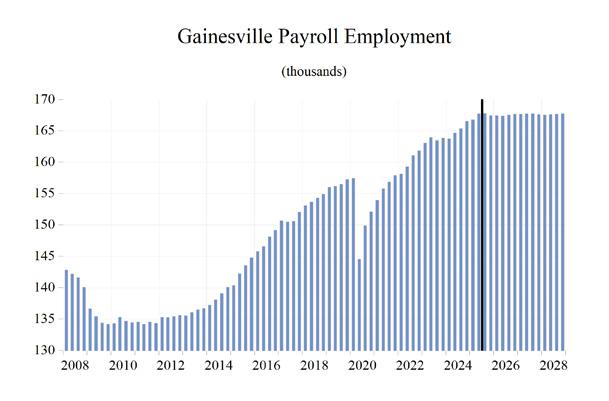

OUTLOOK SUMMARIES

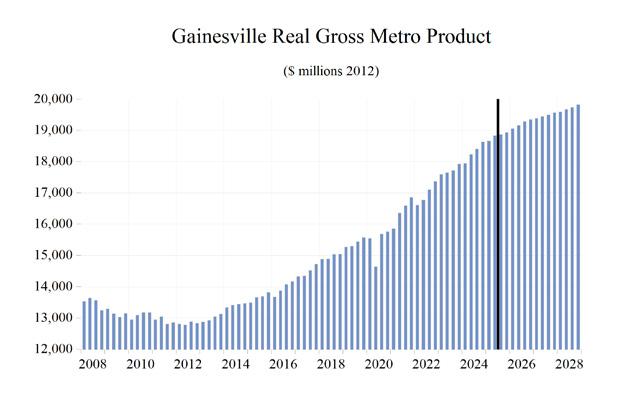

The Gainesville Metropolitan Statistical Area (MSA) will see low levels of growth in the economic indicators studied. Gross Metro Product of $19,307.08 million will place the MSA 18th in the state for metro output. Average annual wage growth of 4.3 percent will help drive the average real annual wage to $72,400. Per capita income will be $48,600, with personal income growth at 5.1 percent. Population growth will be 0.4 percent, ranking Gainesville 24th in the state.

Gainesville will rank 23rd in the state for average annual employment growth at 0.4 percent and will experience an unemployment rate of 4.2 percent. The Financial sector will see the largest annual growth at 2.3 percent. The Information sector will follow with a growth rate of 1.6 percent. The sector experiencing the largest contraction will be the Federal sector, seeing contractions of -1.9 percent.

METRO NEWS SUMMARIES

Gainesville leaders celebrate new roads, hope public investment sparks more development in East Gainesville

• Gainesville officials celebrated the ribbon cutting of a $3.8 million roadway and utility system at the 21-acre Cornerstone site in East Gainesville, marking the second major milestone in the Eastside Health and Economic Development Initiative (EHEDI).

• Gainesville officials celebrated the ribbon cutting of a $3.8 million roadway and utility system at the 21-acre Cornerstone site in East Gainesville, marking the second major milestone in the Eastside Health and Economic Development Initiative (EHEDI).

• City leaders emphasized the project’s role in improving mobility, expanding access to services, and fostering economic growth in a historically underserved area, with future plans including a transit station and mixed-use development.

Source: WCJB ABC 20, July 18, 2025

Gainesville approves business tax increase, 14-story apartment complex

• Gainesville commissioners set a tentative property tax cap of 6.8912 mills and approved a modest 5% business tax hike as they navigate a $9 million budget gap driven by rising staff costs and reduced utility revenues.

• The city’s proposed $156.7 million general fund budget reflects minimal growth and prioritizes pay increases for public safety and unionized staff, following years of cuts and over 120 eliminated positions.

• A 14-story, 240-unit apartment complex near UF’s campus received final approval, with mixed reactions over affordability, limited parking, and zoning changes; 96 units will be reserved for income-based housing under AMI guidelines.

Source: Mainstreet Daily News, July 18, 2025

Officials mark second milestone in east Gainesville transformation project

• Gainesville and Alachua County officials celebrated a major milestone in the Eastside Health and Economic Development Initiative (EHEDI) with a ribbon cutting near UF Health’s new Urgent Care Center, a key anchor for the 21-acre redevelopment site.

• The project includes a new roadway network connecting Southeast Hawthorne Road to Southeast Eighth Avenue and extending Southeast Sixth Avenue to the Gainesville Technology Entrepreneurship Center, with a Regional Transit System station planned for mid-2026.

• Leaders emphasized the initiative’s broader goals of economic empowerment, public-private investment, and improved access to jobs and healthcare in historically underserved east Gainesville, with future amenities like a food hub and park walkway also envisioned.

Source: The Gainesville Sun, July 18, 2025

Gainesville Mayor braces for another DOGEstyle review

• Gainesville Mayor Harvey Ward pledged full cooperation with the state’s audit of city spending, while defending the city’s efficiency and highlighting past efforts to reduce debt and eliminate over 160 staff positions.

• The audit, initiated by Gov. Ron DeSantis and CFO Blaise Ingoglia, targets financial and DEI data and reflects a broader push for ideological oversight in local government operations, with Gainesville and Broward County among the first to be reviewed.

• Amid budget pressures, Gainesville is considering a 7.8% property tax increase to close a $9.8 million gap, while facing transit service cuts due to reduced funding from the University of Florida.

Source: CFO Dive, July 23, 2025

Proposed Gainesville housing development sparks uproar over possible threat to Paynes Prairie

• Maronda Homes has proposed rezoning 73 acres near Paynes Prairie Preserve in Alachua County to build 134 single-family homes, sparking intense opposition from residents concerned about environmental and cultural impacts.

• Locals argue the development threatens wildlife habitat, water resources, and the character of nearby communities like Micanopy, with some calling for the use of city sales tax funds to preserve the land instead.

• While the site lies outside the preserve’s boundaries and is privately owned, critics warn of urban sprawl and precedent-setting risks, urging smart growth and tighter protections as the rezoning process moves forward.

Source: WUFT, August 5, 2025

Gainesville considers complex plan to keep Lot 10 development alive

• Gainesville plans to regain ownership of Lot 10 after the developer missed a four-year construction deadline but may lease it back to AMJ Group under a 30-year agreement to revive a long-delayed downtown residential and commercial project.

• The proposed arrangement would enable tax exemptions for affordable housing under a new state law, with AMJ Group aiming to build 126 units and seeking city support through ConnectFree infrastructure funding and surtaxbacked subsidies.

• City officials stress urgency and financial complexity, with negotiations still pending and construction potentially beginning in June 2026 if all elements align.

Source: Mainstreet Daily News, August 22, 2025

Long Term Outlook for Gainesville, FL September 2025 Forecast

Other Economic Indicators

Short Term Outlook for Gainesville, FL September 2025 Forecast

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

PROFILES

The Homosassa Springs MSA is located in the central northwest portion of the state. Homosassa Springs is a Census designated place in Citrus county and is known for and named after the warm spring located in Homosassa Springs Wildlife State Park which attracts manatees to the area.

QUICK FACTS

• Metro population estimate of 170,174 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Citrus County population estimate of 158,693 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 49,900 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 6.6% as of August 2025, not seasonally adjusted. This amounts to 3,571 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

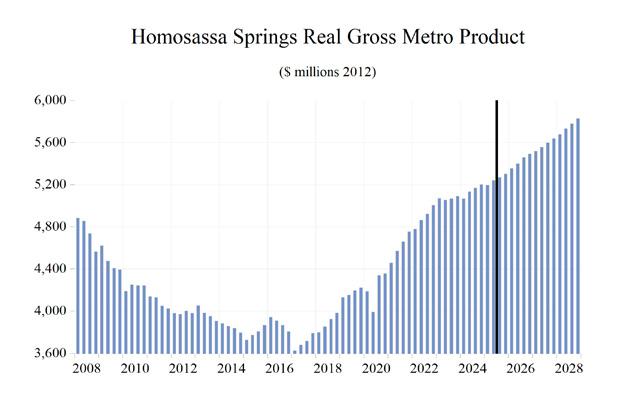

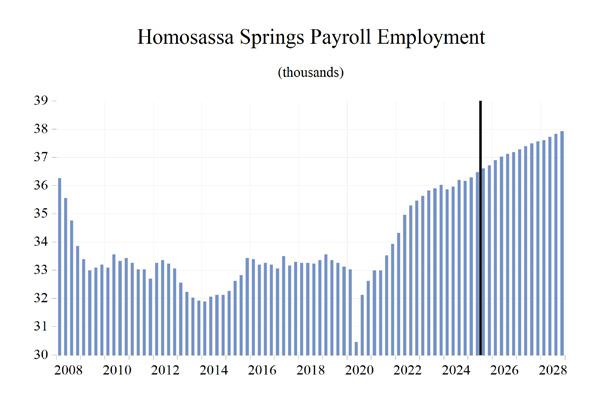

The Homosassa Springs Metropolitan Statistical Area (MSA) is expected to see mixed levels of growth in most of the economic indicators. Homosassa’s expected Gross Metro Product will be $5,504.03 million. Personal income growth of 6 percent (8th highest) will put the MSA’s per capita income level at $43,800, the third lowest in the state. Average annual wage growth of 3.9 percent will push the average real annual wage up to $58,600, the 2nd lowest in the state. Population growth will reach 1.0 percent, ranking 11th compared to other MSAs studied.

Employment growth is expected to average 1.2 percent annually. Homosassa’s unemployment rate will come in at 5.7 percent, the 2nd highest in the state.

The fastest growing sector in the Homosassa Springs MSA will be the Financial sector, which will see an average annual growth rate of 1.8 percent.

The Education and Health services sector will come in second at a growth rate of 1.7 percent. The Manufacturing sector will see the largest contraction in growth, at -0.5 percent.

METRO NEWS SUMMARIES

Drawing companies to Citrus, encouraging startups would be a boon to economy

• The Board of County Commissioners is considering creating an Industrial Development Authority, a move designed to diversify the county’s economy by attracting light industrial and sub-assembly companies that could generate dozens to hundreds of quality local jobs.

• The CORE Business Center, a 501(c)(3) nonprofit, continues to provide free concierge services to startups and expanding businesses in Citrus County, helping streamline registrations, permits, and compliance for hundreds of entrepreneurs annually.

• The Citrus MakerSpace (CMS) offers members free technical training in 3D printing, computer-aided design, and CNC machining, lowering barriers to entry for small businesses and enabling residents to tap into low-cost, high-demand equipment and skills to create new income streams.

Source: Thr Chronicle, June 12, 2025

Nearly all Citrus County projects escape Governor’s veto

• Citrus County projects will receive over $16 million in the 2025–26 state budget, fueling investments in health education, public safety training, and infrastructure that directly support workforce development and long-term economic growth.

• The $1.04 million expansion of Crystal River High School’s Health Careers Academy and $2.5 million for a new public safety training

annex will equip students for in-demand healthcare and emergency response careers, strengthening the region’s skilled labor force.

• Key allocations include $3.5 million for a new fire station at Inverness Airport, supporting the county’s developing business park, and $2.9 million for a multiuse path in Homosassa, both enhancing safety, accessibility, and economic activity.

Source: Florida Politics, June 30, 2025

We’re Losing Another Citrus Slice

• The Shamrock Inn, a Floral City landmark, will close Aug. 2 after a quarter century of operations, marking the end of a longstanding community business.

• On its final day, the Shamrock will donate half of all sales to Floral City Elementary School, reinforcing the business’s legacy of local community support.

• Florida Cracker Kitchen, which previously expanded by acquiring the Riverside Resort in Homosassa, will assume ownership, ensuring the property remains economically active rather than vacant.

Source: Just Wright Citrus, July 21, 2025

Jenkins Auto Group opens new Hyundai location in Homosassa

• Jenkins Auto Group operates more than 20 dealerships across Florida, with the newest addition, Jenkins Hyundai of Homosassa, strategically positioned at 937 S. Suncoast Blvd.

• Jenkins Nissan of Homosassa has relocated to 1785 S. Suncoast Blvd., undergoing renovations to meet Nissan’s NREDI 2.0 standards, ensuring a state-of-the-art facility for Citrus County.

• The opening of the Hyundai dealership and concurrent renovations represent a multimillion-dollar investment in Citrus County, supporting job creation and long-term economic growth in the region.

Source: The Chronicle, August 28, 2025

Homosassa Phase V Septic to Sewer

• Homosassa Phase V represents a major infrastructure project aimed at improving water quality and supporting sustainable economic growth along the Homosassa River.

• With final plans under review, the project is nearing the bidding stage, signaling imminent job creation and contractor opportunities.

• The project is positioned to draw additional federal dollars into Citrus County, multiplying local economic impact while modernizing essential infrastructure.

Source: Citrus County, August 31, 2025

Homosassa Springs MSA Industry Location Quotients

Long Term Outlook for Homosassa Springs, FL September 2025 Forecast

Personal Income (Billions $)

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

Short Term Outlook for Homosassa Springs, FL

September 2025 Forecast

Personal Income (Billions $)

Other Economic Indicators

PROFILES

The Jacksonville MSA is comprised of Baker, Clay, Duval, Nassau, and St. Johns counties. It is located on the northeast coast of Florida and is home to several major U.S. military bases, such as the Jacksonville Naval Air Station, the University of North Florida, and the Jacksonville International Airport.

QUICK FACTS

• Metro population estimate of 1,760,548 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Baker County population estimate of 28,186 as of 2023 (ACS 5-Year Estimate).

• Clay County population estimate of 223,436 as of 2023 (ACS 5-Year Estimate).

• Duval County population estimate of 1,007,189 as of 2023 (ACS 5-Year Estimate).

• Nassau County population estimate of 94,653 as of 2023 (ACS 5-Year Estimate).

• St. Johns County population estimate of 292,243 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 846,700 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 4.6% as of August 2025, not seasonally adjusted. This amounts to 39,389 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

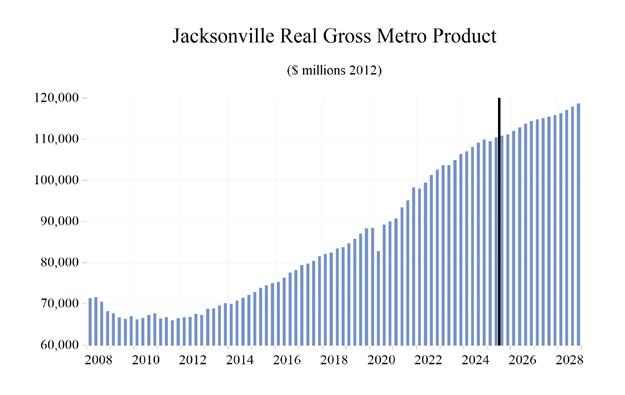

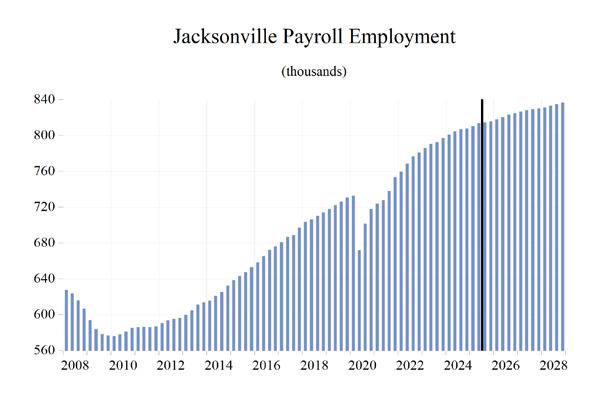

The Jacksonville Metropolitan Statistical Area (MSA) is expected to see above-average growth in most of the economic indicators, relative to the other MSAs studied. Jacksonville’s expected Gross Metro Product will be $114,171.55 million, ranking 7th in the state. Personal income growth of 5.7 percent will put the MSA’s per capita income level at $57.4K. Average annual wage growth of 4.3 percent will push the average real annual wage to $82,900, the 6th highest in the state. Population growth will be 1.1 percent.

Employment growth is expected to average 0.9

percent annually. Jacksonville’s unemployment rate will come in at 3.7 percent.

The fastest growing sector in the Jacksonville MSA will be the Education-Health Services sector, which will see an average annual growth rate of 2.2 percent. The Other Services sector will come in second at a growth rate of 1.8 percent. The Information and Manufacturing sectors will see respective contractions in growth of -1.8 percent, and -0.9 percent, respectively.

METRO NEWS SUMMARIES

Gov. DeSantis announces major deal for aviation company to relocate while at air show in France

• Florida Governor Ron DeSantis announced that Otto Aviation will relocate its global headquarters to Jacksonville’s Cecil Airport, accompanied by the construction of a large manufacturing facility.

• The project includes a $430 million investment and an 850,000-square-foot plant, and is expected to create nearly 400 high-skill, highwage jobs.

• The announcement was made during the Paris Air Show in France as part of Florida’s international trade mission.

Source: Florida Politics, June 16, 2025

University of Florida secures land and capital support for campus in Jacksonville

• The Jacksonville City Council unanimously approved the transfer of ~20 acres in the LaVilla neighborhood to UF and committed $50 million in new funding.

• Combined with state funds and private philanthropy, UF Jacksonville’s total committed funding now stands at $300 million, including support for the Florida Semiconductor Institute.

• UF plans to launch graduate-level degree programs in existing facilities in 2026, with full construction of new buildings beginning thereafter, aiming to align academic offerings with regional workforce needs in business, engineering, health sciences, law, architecture, and applied research.

Source: University of Florida News, June 25, 2025

As it plans Tampa expansion, Brightline highspeed rail seeks $400M in tax-exempt bonds

• Brightline is seeking $400 million in tax exempt private activity bonds to finance the design, construction, and renovation of a highspeed rail line connecting Tampa and Orlando.

• The request goes through the Florida Development Finance Corporation and would avoid direct state funding while still supporting regional expansion.

• The project is expected to boost connectivity and reduce travel time, though Brightline faces financial risk due to existing debt and ongoing bond remarketing.

Source: Creative Loafing Tampa, July 16, 2025

Hard Rock Hotel might be coming to Jacksonville

• A proposal is under consideration to bring a Hard Rock Hotel to downtown Jacksonville.

• The plan suggests that the hotel development could serve as a catalyst for tourism, nightlife, and downtown real estate investment.

• If approved and executed, the project could yield new jobs, increased lodging tax revenues, and broader economic spillovers in hospitality and retail sectors.

Source: First Coast News, July 31, 2025

JLL secures $40.2M construction financing for Ceiba Groupe’s Royal Palms Main Street project

• JLL arranged a $40.2 million construction loan for the Royal Palms Main Street development in Jacksonville, Florida.

• The project will include 227 units that combine multifamily apartments and build to rent townhomes, with completion expected in the first quarter of 2027.

• The site benefits from access to major transportation routes, nearby employment centers, and demand fueled by migration and economic growth in Jacksonville’s Northside.

Source: JLL Newsroom, August 4, 2025

Long Term Outlook for Jacksonville, FL

September 2025 Forecast

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

Short Term Outlook for Jacksonville, FL

Establishment Employment (Place of Work, Thousands, SA)

Other Economic Indicators

PROFILES

The Lakeland–Winter Haven MSA is comprised only of Polk County. It is located in the westerncenter of the state and is heavily agriculturally based, especially in citrus. The MSA is home to Legoland Florida and is also the location of Publix Supermarket headquarters. Each year the Detroit Tigers host spring training at Joker Marchant Stadium. Lakeland is also home to Florida Polytechnic University, one of the newer members of the State University System.

QUICK FACTS

• Metro population estimate of 852,878 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Polk County population estimate of 760,961 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 347,500 in August 2025 (FRED, U.S. Bureau of Labor Statistics).

• An unemployment rate of 4.6% as of August 2025, not seasonally adjusted. This amounts to 19,671 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

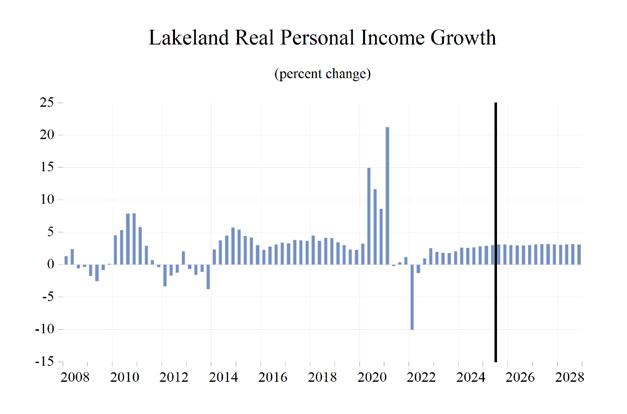

The studied economic indicators are predicted to show mixed levels of growth in the Lakeland Metropolitan Statistical Area (MSA). Gross Metro Product for the MSA will come in at $35,003.93 million. The MSA will experience the highest personal income growth of 6.6 percent, but per capita income will be the lowest in the state at $39,100. The average annual wage will grow at an annual rate of 4.5 percent for an average annual wage of $67,900. Lakeland’s population will grow at an annual rate of 1.9 percent, the 3rd highest in the state.

Employment growth is expected to average 1.2 percent, and Lakeland will experience a moderately high unemployment rate of 4.7 percent compared to the other MSAs.

The Education/Health Services sector will lead the MSA in average annual growth at 2.4 percent. The Other Services sector will follow at 2.2 percent. The Federal sector will see a contraction in growth of -1.7 percent.

METRO NEWS SUMMARIES

Birtcher Anderson & Davis and Belay Investment Group Acquire Heritage Business Center in Lakeland, FL

• Heritage Business Center spans five buildings with 20 suites ranging from 2,500 to 22,000 sq. ft., providing scalable space for growing businesses along the I-4 corridor.

• The property’s current tenant base demonstrates strong demand, with three acres of vacant land available for future development and revenue growth.

• BA&D and Belay Investment Group leverage favorable entry into Central Florida’s light industrial sector, capitalizing on rising construction costs and rental growth potential.

Source: Belay Investment Group News, June 16, 2025

What’s Going on with Lakeland’s Historic Kress Building, Downtown?

• JB Realty Partners’ purchase and redevelopment of the century-old Kress Building reflects a nearly eightfold increase in property value since Polk County’s 1983 purchase.

• Renovations will modernize the interior for Kimley-Horn’s expansion, supporting professional job growth and increasing downtown Lakeland’s business capacity.

• As a historically significant property, the project leverages federal incentives to offset renovation costs, strengthening economic reinvestment in downtown Lakeland.

Source: LKLDNOW, June 26, 2025

‘Corridor of Opportunity’: Here’s Lakeland officials’ vision for remaking Memorial Boulevard

• Memorial Boulevard in Lakeland is identified as a “corridor of opportunity,” with 12 vacant parcels targeted for infill development and potential commercial or mixed-use projects.

• Funded largely by a $75,000 Florida Department of Commerce grant and $11,000 from the CRA, the study outlined 31 action items to guide redevelopment, pedestrian safety, and streetscape enhancements over the next five years.