From kiosk to back of ce, protect every dollar with Glory’s smart automation.

Still using smart safes? It’s time to upgrade.

Glory cash recyclers automate the full cash cycle—accepting, validating, storing, and dispensing—giving your team instant access to cash and reducing armored pickups.

Kiosk: Validate cash instantly and boost check averages. Drive-thru: Boost speed of service and eliminate manual handling risks. Back offi ce: Automate reconciliation and cut shrinkage.

Glory’s Closed Loop Cash Automation keeps cash secure. And with the option for provisional credit, your cash starts working before it leaves the store.

Built for QSRs. Ready for what’s next. Read our e-book to learn more.

Franchisee Amol Kohli shares his future plans after purchasing restaurant group BRIX Holdings.

The chicken wing market is full of competing players.

The New Haven–style concept is finding expansion opportunities nationwide.

The

shares his journey to founding Compton's Sandwich Shop in NYC.

How Restaurants Are Turning Missed Loyalty Into Captured Revenue Loyalty members visit more often and spend more per check, according to Klaviyo’s 2025 Restaurant Consumer Trends Report.

SPONSORED BY KLAVIYO

SmartChain p. 43

Thought Leadership with the Biggest Names in Packaging Solutions

A closer look at how top brands are solving today’s toughest packaging challenges through innovation, efficiency, and sustainability.

KEY PLAYERS:

Packaging that Performs, Even Under Pressure

Accurate Box p. 46

Anchor Packaging p. 48

Continental Cup p. 50

Fuling USA p. 50

Huhtamaki p. 52

Inline Plastics p. 54

This Restaurant Metric Predicts Growth Better Than Sales Data New data reveals restaurants with just a four-point bump in guest satisfaction see 14x stronger revenue growth.

SPONSORED BY TATTLE

2025’s Fastest Growing Drink Trend Gen Z is driving demand, prioritizing functional and energized beverages.

SPONSORED BY MONIN TRENDING The All-Day Menu Secret You Already Have in Your Kitchen

A new report shows how operators can do more with less without sacrificing creativity.

71 Percent of Operators Facing Labor Shortages Are Rethinking Frozen Beverages A low-touch beverage program eliminates prep, reduces training, and drives $14K in

SPONSORED BY F’REAL BY RICH’S

EDITORIAL

VICE PRESIDENT EDITORIALFOOD, RETAIL, & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

QSR EDITOR Ben Coley bcoley@wtwhmedia.com

FSR EDITOR Callie Evergreen cevergreen@wtwhmedia.com

ASSOCIATE EDITOR Sam Danley sdanley@wtwhmedia.com

ASSOCIATE EDITOR Satyne Doner sdoner@wthwmedia.com

SENIOR VICE PRESIDENT AUDIENCE GROWTH Greg Sanders gsanders@wtwhmedia.com

CONTENT STUDIO

VICE PRESIDENT, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Abby Winterburn awinterburn@wtwhmedia.com

ART & PRODUCTION

SENIOR ART DIRECTOR Tory Bartelt tbartelt@wtwhmedia.com

FSR ART DIRECTOR Erica Naftolowitz enaftolowitz@wtwhmedia.com

SALES & BUSINESS DEVELOPMENT

SVP, FOOD, RETAIL, HOSPITALITY SALES AND ACCOUNT MANAGEMENT Matt Waddell mwaddell@wtwhmedia.com 312-961-6840 VICE PRESIDENT, BUSINESS DEVELOPMENT Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES DIRECTOR Edward Richards erichards@wtwhmedia.com 216-956-6636

NATIONAL SALES DIRECTOR Amber Dobsovic adobsovic@wtwhmedia.com 757-637-8673

NATIONAL SALES MANAGER Guy Norcott gnorcott@wtwhmedia.com 854-200-5864

CUSTOMER SERVICE REPRESENTATIVE Tracy Doubts tdoubts@wtwhmedia.com 919-945-0704

CUSTOMER SERVICE REPRESENTATIVE Brandy Pinion bpinion@wtwhmedia.com 662-234-5481, EXT 127 FOUNDER Webb C. Howell

ADMINISTRATION

919-945-0704 / www.qsrmagazine.com/subscribe QSR is provided without charge upon request to individuals residing in

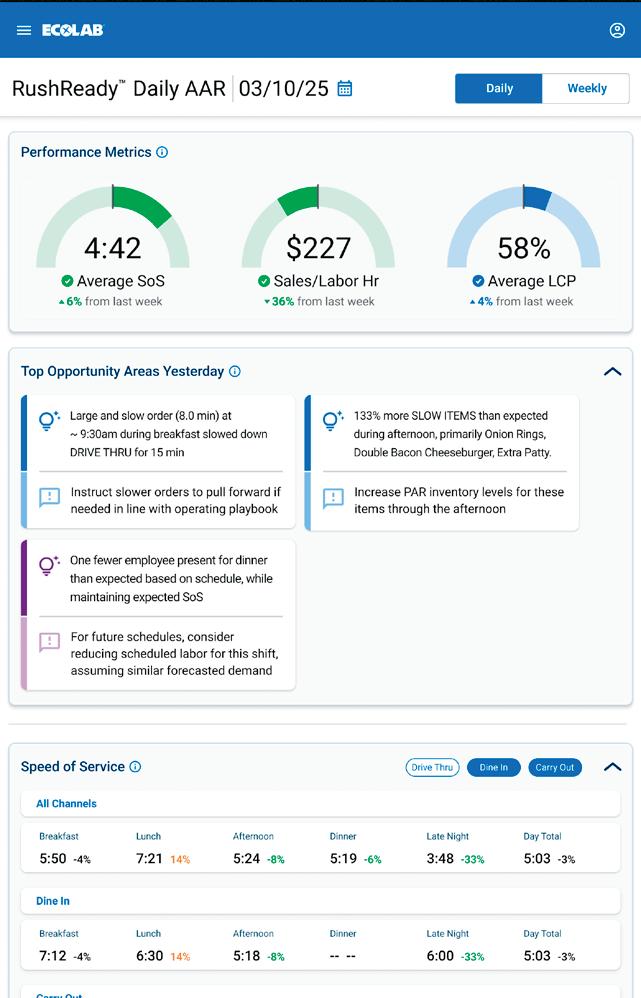

FOOD SAFETY

90% MORE SOIL REMOVED* compared to manual only process*

LABOR SAVINGS

WATER SAVINGS

REPURPOSE 2 HOURS OR MORE labor per day*** vs. traditional dump/fill machine

6,400 GALLONS OF WATER SAVED PER YEAR**

Designed specifically for QSR applications, the XL has a higher wash chamber, 50% faster cycle time, faster dry time, and delivers productivity and food safety at a lower total cost.

Contact your Ecolab Representative or call 800.529.5458 TODAY !

are four brands discounting their menus long-term.

The value wars are going as strong as ever. Some brands are adamant about not discounting their menu. But not everybody.

I want to take time to highlight four notable brands that decided to lower menu prices in the face of an inflationary consumer environment.

The first is McDonald’s. Already offering a $5 Meal Deal and the McValue platform, the brand doubled down with the nationwide return of Extra Value Meals, which cut the prices of certain combo meals. The lineup features eight breakfast, lunch, and dinner options, including the Big Mac, Quarter Pounder, McCrispy Sandwich, and multiple breakfast sandwiches. Customers can purchase a $5 Sausage McMuffin with Egg meal or an $8 Big Mac meal—both offering notable savings compared to ordering items individually.

Jack in the Box is ramping up value offers as well. On October 1, the chain increased cup sizes by 25 percent and lowered prices across menu boards, with 61 percent of combo meals priced under $10 in most markets. Additional deals rolled out, including $5 Smashed Jack burgers during Burger Week and 2-for$3 Monster Tacos—both back in September—as well as seasonal promotions like Jackmas daily deals coming up in December. The chain also introduced an AI-powered “DealQuest” gamified experience on its app.

Smaller companies are joining the fight too.

&pizza positioned itself as a valuedriven outlier in the pizza segment by rolling back prices to pre-COVID levels and simplifying its menu. Under the new structure, “Basics” pies start at $10,

and “Hits” specialty or build-your-own pizzas are priced at $12, with unlimited toppings included. Other items, such as knots, cookies, and sodas, also saw price reductions. The initiative follows the launch of a $7 lunch combo and comes as the 40-unit brand prepares to franchise for the first time. CEO Mike Burns said the moves are a long-term commitment to affordability rather than a limited-time promotion.

The same is true of Happy Joe’s, a Midwestern pizza chain. The company is taking a long-term approach to value by permanently lowering prices on its two best-selling pizzas. The brand reduced its Large Cheese Pizza from $21.99 to $15.99 and its signature Large Taco Pizza from $29.99 to $24.99. Leadership said the plan is not a limited-time promotion but a strategic realignment geared toward strengthening guest loyalty. CEO and chief happiness officer Tom Sacco added that the decision is meant to support customers who’ve weathered rising prices in recent years.

These examples illustrate a broader trend in the restaurant industry. Operators are making choices to prioritize affordability, simplify menus, and reinforce customer loyalty. In an era of rising prices and cautious spending, these brands demonstrate that long-term commitment to value can strengthen relationships with guests while differentiating themselves in a crowded marketplace. Providing real, sustainable value is no longer optional—it’s central to winning and keeping customers.

Ben Coley, Editor

How the biggest names in the industry handle their cash.

Running a busy restaurant, you know that every detail matters—from nailing lunch rush and customer satisfaction to keeping costs in check. Top brands in the industry face the same challenges, and many have found a smart solution with SafePoint® by Loomis.

They rely on SafePoint® for the accuracy, speed, and reliability needed to handle high volumes of cash without the usual headaches. It’s a smart business decision: less time spent on manual counting, fewer discrepancies at the end of the day, and even faster access to funds. It’s a solution that works for those at the top, and it can work for you too.

JOLLIBEE LAUNCHED A NEW COLLABORATION with rising global girl group KATSEYE. The partnership introduced the KATSEYE Special Korean BBQ Chicken Sandwich and Fried Chicken.

The brand is showcasing its culinary creativity through these new items. The Korean BBQ sauce—a blend of soy glaze and gochujang—delivers a sweet, savory, and spicy flavor profile that pairs with Jollibee’s signature chicken. The sandwich version features a toasted brioche bun layered with cucumber, red onion, and cilantro for freshness, while the bone-in fried chicken option highlights the same sauce.

KATSEYE, fresh off its 2025 MTV VMA win, brings star power and cultural influence to the collaboration, embodying the playful, expressive spirit Jollibee hopes fans will embrace under the campaign theme, “Bee Saucy.”

This rollout followed a Jollibee x KATSEYE merch drop in August, which sold out in under three hours.

Restaurants today face high labor costs, food inflation, and increasing operational complexity. To understand how operators use technology, 7shifts surveyed 521 restaurant professionals across all segments. The results revealed four distinct stages of tech adoaption , ranging from paper-based processes to fully integrated systems. Each stage comes with its own challenges, benefits, and prevalence within the industry.

• Operations are run with paper schedules, whiteboards, sticky notes, and gut instinct.

• Owners and managers rely heavily on personal knowledge and face-to-face communication.

• This approach works well for small, stable teams but quickly becomes a bottleneck when scaling.

SURVEY DATA:

• 47% still use paper schedules or whiteboards.

• 55% rely on in-person conversations for shift updates.

• 50% manage inventory with manual counts and paper lists.

• 32% track time with paper timesheets or logs.

• 25% primarily make decisions based on experience and daily observations.

• First step into digital adoption, but typically with generic tools like Excel, Google Sheets, or group texts.

• Systems are siloed, requiring duplicate manual work.

• Operators digitize their most painful processes first—such as moving schedules from paper to spreadsheets.

SURVEY DATA:

• 57% use group texts (iMessage, WhatsApp, Facebook Messenger) for team communication.

• 56% use POS systems for time tracking, but without integration.

• 32% manage inventory with spreadsheets.

• 23% handle time-off requests through text or email.

• Most have only a basic website and rely on third-party apps for online ordering.

THIS IS HOW WE’VE ALWAYS DONE IT.”

I USE SOFTWARE, BUT THE APPS DON’T TALK TO EACH OTHER.”

I’M STARTING TO CONNECT THE DOTS.”

ONE SOURCE OF TRUTH.”

• Operators invest in restaurantspecific software.

• Core systems (POS, scheduling, payroll) start connecting for smoother data flow.

• Efficiency gains are significant— saving hours per week and enabling data-driven decisions.

• Still, some operators face challenges when adapting to more powerful systems.

SURVEY DATA:

• 32% use dedicated team communication apps.

• 27% report facing integration challenges between systems.

• 21% leverage advanced POS reporting for decision-making.

• Many adopt customer-facing tech like QR codes and basic online ordering.

• Fully connected ecosystem with automation across payroll, scheduling, inventory, and communication.

• Operators gain time to focus on innovation, guest experience, and strategic growth.

• Technology enhances, rather than replaces, intuition and hospitality expertise.

SURVEY DATA:

• 33% have most systems connected with minimal manual work.

• 28% have fully automated payroll data transfers.

• 36% use automated tip pooling.

• 36% monitor labor costs in real-time.

• 16% operate a highly integrated system with live data flow across platforms.

• Operators can experiment with AI tools, predictive analytics, and advanced customer engagement.

BY SAM DANLEY

Few products have fueled quick-service growth like wings lately. Just look at Popeyes.

After back-to-back LTO hits in 2023—including its biggest launch since 2019’s viral chicken sandwich—the chain locked in a five-flavor wing lineup as a permanent menu item later that same year. Just a few months into 2024, it had already become the country’s No. 3 quick-service wing provider, a clear sign of how quickly guests rallied around the product.

Popeyes wants to bring even more guests on board in 2025 by giving its wings a fresh start. Reintroduced this summer, the lineup now begins with a mild marinated base seasoned with the brand’s signature Louisiana spice blend.

“When we launched our wings in 2023, our guests loved the bold heat, but they also told us they wanted more variety,” says Amy Alarcon, VP of culinary at Popeyes. “Our previous wings were marinated with ghost pepper, which was great for those who craved heat, but not perfect for everyone. With our new wings,

we wanted to build a heat scale that could satisfy everyone, from the heat seekers to those who prefer a gentler kick.”

The team spent a lot of time fine-tuning the new mild base to ensure it performed across every flavor, whether sauced or dry rubbed, she adds. Starting with a milder yet flavorful foundation, the recipes were reworked so sauces and dry rubs could layer and build in intensity. This approach allowed the brand to deliver the heat fans expect while also offering a spectrum of new flavor possibilities. Returning favorites like Signature Hot, Sweet ‘N Spicy, and Honey BBQ were joined by four new dry rubs: Ghost Pepper, Lemon Pepper, Garlic Parm, and Buffalo.

“Wings have become a staple in the QSR space, but what we’re seeing now is a shift toward more customization and flavor diversity,” Alarcon says. “Consumers want more than just heat. They’re looking for interesting textures, bold combinations, and options they can’t get anywhere else.”

In a crowded segment, standing out with a distinct wing experi-

ence is no small task. Rising consumer demand for wings—and chicken overall—has been met with an equally sharp increase in players fighting for attention in recent years.

Wing Zone’s chief development and growth officer David Bloom describes today’s wing category as “uber competitive,” dominated by a clear number one in Wingstop with no close second. Beyond that, he notes there are “quite a few regional players” and “a whole host of virtual brands” vying for their share of the market. That packed field makes it both more important and more difficult for brands to stand out.

The category’s competitiveness accelerated during the COVID-19 pandemic, when delivery surged and wings proved especially well-suited for the channel. Once seen as a party food tied to beer and sports, wings became a more frequent, center-of-the-plate meal. At the same time, the broader chicken category expanded as tenders and chicken sandwiches proliferated across both emerging and established brands. Add in the runaway success of Wingstop, which showed the power of an off-premises-focused model built on digital and takeout, and the wing space quickly filled with new entrants.

So, how are brands approaching a category defined on one side by Wingstop’s breakneck growth and on the other by a flood of competitors, from wing-focused startups to established chains adding wings as a secondary offering?

For Wing Zone, the strategy is doubling down on its longheld strengths. Bloom says the 34-year-old chain is leveraging strong name recognition and digital expertise, with over half of sales coming through digital channels and roughly three-quarters consumed off-premises. Building on that foundation, a key growth focus is expansion through virtual kitchens.

The strategy leverages partnerships with restaurants that have underused kitchen capacity. These are often national chains—like IHOP or Denny’s—that run 24-hour operations and see heavy volume at peak times but slower demand during other periods.

Bloom says the operational requirements for adding Wing Zone as a virtual brand are minimal. Operators typically just need to add a small saucing station and bring in some additional product.

“You’re able to optimize your existing overhead and build additional revenue, so it’s very attractive with a low barrier of entry from an operator standpoint,” he says. “We have name awareness and we have a lot of expertise in the digital world with so much of our sales being off-premises already, so it’s just a natural fit for us.”

Zooming out and looking ahead, Bloom expects the next few years will bring big shifts in the overall wing segment.

“At some point there’s going to be a period of consolidation,” he says. “I think we’re going to see some of the under capitalized brands either be acquired or go away. We’re going to see some fallout from some of the smaller brands because it’s become so competitive.”

For those aiming to endure, the challenge will be carving out and maintaining a point of differentiation. Doubling down on flavor and continually introducing new sauces and rubs is one way to keep the menu fresh and on trend.

That’s the strategy Atomic Wings CEO Zak Omar is embracing as his New York-based franchise looks to grow its national footprint. He says the brand is seeing more demand for innovation, with customers increasingly engaged in discussions around new and unique wing offerings.

Atomic Wings takes a systematic approach to launching new flavors. This year it prioritized a steady rollout of LTOs, carefully tracking customer feedback and reviews to identify which flavors resonate most. One recent standout was the Korean BBQ flavor, which the brand developed after allowing guests to vote on which new flavor they wanted to see added to the menu.

“I think in this day and age, you have to innovate and you have to be creative,” Omar says. “That’s why we’ve made it a point of emphasis to put out a new flavor every 60 days.”

This constant iteration of flavors is familiar territory for Omar. He recalls sitting in his father’s food truck as a kid and experimenting with leftover chicken nuggets, mixing sauces like ketchup, hot sauce, mayonnaise, and tartar sauce to create new flavors.

That same spirit of experimentation and customization continues to shape Atomic Wings’ approach, and the brand is finding fresh ways to bring that philosophy to life for its fans going forward. Its recently-opened flagship location in downtown Brooklyn features a “Flavor Station” where customers are encouraged to craft their own wing experiences. Guests can order wings in a traditional flavor and then choose from a variety of sauces and dry rubs to drizzle or sprinkle on top.

Omar says this setup lets customers be “the boss of your own sauce” by mixing and matching to their personal tastes.

“A lot of our consumers really want that customization,” he says. “They want that uniqueness of flavor. They want that boldness. And the great thing about wings is that you can dress them up with different sauces and rubs and really add your own flavor to them.”

The New Haven pizza concept eyes aggressive growth in Florida and a handful of other markets.

BY BEN COLEY

FOUNDER: Nicholas Joseph Laudano (CEO)

HEADQUARTERS: Wellington, Florida

YEAR STARTED: 2022

ANNUAL SALES: $10 million

TOTAL UNITS: 5

AH-BEETZ PIZZA, CUT FROM THE NEW HAVEN PIZZA cloth, had its viral moment in March 2023.

Dave Portnoy—founder of Barstool Sports and One Bite, a media company popularized by his series of pizza reviews across the country—came to try some food..

Florida, about 45 minutes away—drove to the 1,000-square-foot shop in Delray Beach to personally make a pie for Portnoy.

The rating? An 8.4 out of 10.

“I believe it was a great score for sure,” says Laudano, a New Haven native who grew up on the New Haven pizza style.

taking a train from Miami.

“We’re the best pizza outside of New Haven,” Laudano says.

Ah-Beetz—a name trademarked 10 years ago—is the phonetic pronunciation of “apizza,” the term for the style of pizza coming out of New Haven, Connecticut. The pizza is known for having a thin, crispy, chewy, and charred crust, traditionally cooked in coal-fired ovens at high temperatures.

Ah-Beetz’s Plain apizza features tomato sauce, pecorino romano cheese, olive oil, and oregano.

As of late August, the chain had Floridabased corporate locations in Delray Beach, West Palm Beach, Royal Palm Beach, and North Palm Beach. In Delray Beach, AhBeetz moved from its 1,000-square-foot location to a nearby 3,000-square-foot flagship restaurant venue, opening in April.

The first iteration opened in 2016 in New Haven as a build-your-own concept, similar to what other fast-casual pizza companies were doing at the time. But the restaurant closed in two years after finding difficulties with the down-the-line ordering process.

“What we found out in the pizza business is that the concept really tends to do better as a one course meal… So when you go into like a two or three course salad, wings, and then a pizza—that build-your-own didn’t work,” Laudano says.

FRANCHISED UNITS: Dozens in development [CONTINUED

Although the restaurant was closed when he initially visited, founder Nick Laudano— who at the time was originally in Wellington,

The store was successful prior to Portnoy’s rating, producing about $1 million per year, but Laudano estimates the viral moment increased annual revenue by roughly 20 percent. The clientele also expanded from the New England vacationers/transplants aged 55 and above to a younger demographic (men interested in sports and gambling and women influencers). A huge influx of college students began arriving from nearby Florida Atlantic University and others driving from Naples or

In 2022, Laudano moved the Ah-Beetz brand down to Florida, where he’s lived for almost 20 years. Although apizza is famous thousands of miles away from the Sunshine State, customers in the area were familiar with the pizza format due to Boca Raton’s Nick’s New Haven Pizzeria and Bar, a 5,000-square-foot full-service restaurant Laudano owned for more than a decade. The area is also a travel destination for Northeast residents.

“It’s been a success

/ BY BEN COLEY

ON A BRIGHT, SUNNY EVENING IN AUGUST, SG Ellison, CEO of franchisee organization Diversified Restaurant Group (DRG), walks into the company’s Taco Bell Cantina on the Las Vegas Strip, proud of what his team has built.

The restaurant is 9 years old, but it’s still unlike anything the Mexican giant has seen before. To this day, it is the highest-grossing store in Taco Bell’s system, earning around $8 million per year.

“It’s Willy Wonka,” says Ellison, as he points to colorful tubes filled with bubbles seemingly sprouting out of the restaurant’s digital menu boards toward the ceiling.

In true Las Vegas fashion, the upstairs doubles as a wedding chapel, where couples can get married with as little as four hours’ notice. The location—using an outside vendor to help gather officiants and a bouquet

made from numerous sauce packets—hosts more than 200 weddings per year. The option to be joined in holy matrimony draws the most passionate fans, who in some cases appear in Taco Bell gear or dress up as a taco or burrito.

Even when no wedding is occurring, the 24/7 venue is the ultimate party vibe. A DJ booth is available for when the store wants to fill the air with loud, energetic music. Up above, there’s a large monitor with 16 TV screens for guests’ viewing pleasure. Like other Cantinas, the restaurant serves alcohol, which accounts for about 50 percent of sales in Las Vegas. Customers can walk up to the counter and see their beer automatically filled from the bottom up. Or they can order a Twisted Freeze, mixing a frozen drink with the alcohol of their choice, in a cup that’s a yard in length.

It’s a destination and a taste of the Las Vegas environment that’s drawn showgirls and the Las Vegas Raiders cheerleading team. It’s where customers hold their holiday parties and bachelorette festivities. People plan their vacation to the city around visiting the famed location.

DRG, which franchises roughly 360 Taco Bell and Arby’s units across Nevada, Northern California, Southern California, Alaska, and Kansas City and is QSR magazine’s 2025 Franchisee of the Year, is no stranger to pushing the envelope and transcending the typical idea of what a restaurant should be. The franchisee is not only responsible for the wondrous Las Vegas restaurant, but also eight other themed Cantinas, the introduction of beverage spinoff Live Mas Cafe, digitally forward Go Mobile restaurants, AI ordering at the drive-thru, EV charging stations, and Arby’s only food truck.

That’s the type of culture Ellison wanted from the start.

“A lot of times we get conservative with wanting to spend money as operators and that’s rightfully so,” Ellison says. “... On occasion in areas where you think you can push, spending more money typically can result in better results, and that’s not just in assets, but that’s in people, that’s in technology.”

DRG didn’t begin with born-and-bred restaurateurs. The company’s origin dates back to 1992 when real estate guru and serial entrepreneur David Grieve started A&C Ventures, which invests in sale-leaseback deals. Over the years, he’s worked with companies like Payless, Rite-Aid, Men’s Wearhouse, and Eckerd. A&C eventually began keeping a lot of the properties instead of selling them off and started major ownership partnerships—friends, family, and associates that have become investors in not only the real estate company but also DRG. The real estate business is now a $1 billion portfolio with about 150 properties divided between apartments, retail, and some industrial.

“We’ve never gone out to look for money,” says Grieve, who serves as chairman of DRG. “Money has come to us through all of those partners. We’re kind of unique in the private-equity world in that we do our own private equity, and it’s all people that we know… In any given deal, our group will put up about one-third of the equity and raise the rest from our partners. It’s been an amazing model because they all get to share in our suc-

cess in the restaurant business.”

In 2006, Grieve’s adventures in real estate led him to Ellison, who was representing CVS Pharmacy in a transaction in Albuquerque, New Mexico. Ellison, without any restaurant experience either, went to school for engineering before dipping into real estate and development.

“I sat down with SG at the airport, and we hit it off,” Grieve recalls. “I knew he was tough and I was tough, and we liked each other.”

A few years later, after they had become friends, Grieve instructed Ellison that if he wasn’t going to come work for him, he needed to strike out on his own. Later down the line, Ellison formed First Street Development with Grieve and Panda Express cofounder Andrew Cherng as lead investment partners, proving his own entrepreneurial merit.

The first restaurant opportunity, in 2012, happened near the same time. Grieve and Ellison created a partnership to provide equity to former Taco Bell executives Brian Cox and Mark Reed to acquire 29 company-owned restaurants. The investment is also when the Doritos Locos Taco debuted, which brought hoards

of customers back into Taco Bell restaurants.

“I ended up watching that deal over the first year, and said, boy this is an amazing business with Taco Bell. I think we could be really successful and make this thing much bigger,” Grieve says.

The former Taco Bell restaurateurs just wanted to keep their 29 stores. Meanwhile, Grieve foresaw the footprint turning into 300 stores, or even 500. So Grieve and Ellison bought themselves out of the deal, and looked to start their own partnership with Taco Bell.

The first acquisition happened in 2014 when DRG looked to Northern California and acquired 72 Taco Bell restaurants in the Bay Area and then 13 outlets in Napa and Sonoma. In 2015, it followed that up with 63 more Taco Bell units in Nevada. Across 2017 and 2018, the company moved east and purchased nearly 60 locations in the Kansas City market before returning to the West Coast in 2021 and adding 75 Taco Bells in Southern California—its largest acquisition to this day. DRG then purchased 25 outlets in San Diego in 2023.

“I just felt like the Taco Bell business is so unique and the brand is so cool and it’s just an iconic brand that has been rel-

evant for years and years and years, and they do a great job of staying relevant, which is really exciting to me,” Grieve says. “So it was partly the people’s business. Obviously, the financial part of Taco Bell is incredible. It’s not an easy business to break into. They are very picky about who their franchisees are, and I think we proved ourselves by being a great partner when we partnered with the [former Taco Bell executives]. And [Taco Bell] welcomed us with open arms.”

In between those Taco Bell moves, DRG lived up to its “diversified” name by buying Arby’s restaurants in California, Nevada, and Alaska.

The company paired its M&A moves with some of the most active innovation among any franchisee in the country.

Once DRG bought the Northern California restaurants, it searched for expansion sites. It found one at the bottom of a condominium building, which previously housed The Melt, a grilled cheese concept. It was across the street from Oracle

Park, the home of MLB’s San Francisco Giants, and had favorable lease terms.

Ellison and the corporate leadership team collaboratively developed the “Cantina” identity, an elevated version of the typical Taco Bell store that also sold alcohol. This was the second-ever Taco Bell Cantina to open. The first was in Chicago, which debuted just prior to the San Francisco location.

The following year, when DRG bought Nevada, the first thing it wanted to do was bring a flagship Cantina to the Las Vegas Strip. The team was surprised that a Taco Bell wasn’t there already, but was told by the previous franchisee that it was too expensive to operate.

Ellison felt differently. Having built four CVS drugstores in the area and dealing with high rents and land prices, he knew the business was there to match it.

“Even though it feels really expensive as a percentage of total income, it was in line with anything else you would do in a suburban market,” Ellison says. “And CVS used to pay their rent on the Strip by just selling water and sunglasses. They sold so much water and sunglasses that everything else was just gravy.”

DRG knew that if it built the Las Vegas Cantina correctly, it would work. The company gave Taco Bell

The one in Downtown Los Angeles—which attracts a lot of walk-ins and delivery customers, but not as much alcohol—is inspired by music, with encased guitars displayed on a wall, and the city’s eclectic vibe, with a stained glass window showcasing a taco. It is less than a mile away from Crypto.com Arena, home of the NBA’s Los Angeles Lakers, WNBA’s Los Angeles Sparks, and NHL’s Los Angeles Kings.

There’s also the Taco Bell in Pacifica, California, that sits on stilts across from the beach. In 2019, DRG decided to transform the restaurant into a Cantina and what Ellison describes as an “elevated tiki bar” atmosphere. Recently, the company converted the fireplace into an indoor/outdoor bar. The location is on pace to earn around $8 million this year and challenge the Las Vegas Cantina as the highest grossing store in the system. It’s already the most searched Taco Bell in the world.

designers the example of the flagship M&M shop down the street, which has every type of flavor imaginable. It’s a destination for M&M connoisseurs, and DRG wanted the same for its Las Vegas restaurant.

“We wanted the drinks flowing from the sky and built all of these amazing features in the building, including the wedding chapel… It’s just been a wildly successful Taco Bell Cantina flagship, and it launched the idea of Cantina in a bigger way,” Ellison says. “Even though a couple had been opened, this one really took it to the next level.”

Now, DRG has nine Cantinas, each with its own personality.

“I remember [ Grieve ] and I were standing on the deck and on the beach and said this is the place we should be able to have a taco and a Corona,” Ellison says. “... The brand worked with us. They helped us financially with some of the marketing things they could do because it was all risky because it hadn’t been done before.”

The 10th Cantina is planned for San Francisco. It will have a nautical theme and be an homage to the wharf industry.

In 2022, DRG once again proved its diverse nature by opening a digitally driven Go Mobile restaurant with two drive-thrus in Las Vegas—the first of its nature on the West Coast. One side is dedicated to delivery drivers and mobile pickup orders.

There were already a handful of Taco Bell restaurants in the trade area, but at the time, Ellison and his team saw an opportunity to offset some of the delivery rush being felt at nearby high-volume locations.

“ [ It ] made for a better experience with the delivery drivers because there was always this challenge with delivery drivers at fast-food restaurants. Do I stop and get out of the car and go inside to the dining room, or do I get in the drive-thru stack and wait? And so we made it purposeful that here’s your own stack, here’s your own way to get through,” Ellison says.

In the same year, DRG became the first Taco Bell franchisee to open EV charging stations, a solar carport, and electric battery storage, at a unit in San Francisco. And more recently, the franchisee began testing automated voice ordering at the drivethru for Taco Bell. The technology is active in 10 of DRG’s

restaurants throughout different markets.

“I don’t think you can be afraid to fail if you are in innovation, and I think we’ve learned from that and now we’re much more confident when we approach tests or we think about things out of the box and when someone brings something to us,” says COO Todd Kelly. “I think our teams in the field are looking for, ‘Hey, what’s next?’ Instead of, ‘Oh my goodness, what are we doing now?’”

DRG’s innovation covers Arby’s as well. When the company first bought into the sandwich giant, Ellison and his team viewed it “as a recognizable brand with a differentiated format that we think has a lot of room for growth.” The issue was that customer trial wasn’t as high. DRG set out to fix that.

For example, in Las Vegas, DRG operates Arby’s only food truck, offering a full menu of roast beef, chicken, burgers, sides, beverages, and dessert. The 35-foot-long vehicle—decorated with an Arby’s poker chip, the phrase “Viva Las Arby’s,” and LED bulbs reminding customers of the Vegas nightlife—has its own website and is available for a variety of events, such as weddings, holiday parties, school lunches, and fundraisers.

In terms of product innovation, DRG was responsible for connecting Arby’s with actors Anthony Anderson and Cedric The Entertainer, who launched new lifestyle brand AC Barbeque. In the spring, the celebrities and the brand worked together to create the Quarter Pound Pulled Pork and Brisket BBQ sandwiches, which were available alongside Cedric’s Sweet Bussin Brown Sugar Sauce and Anthony’s Spicy Chipotle Smoke Sauce.

Jason Dunn, principal operator of Arby’s and senior VP of restaurant excellence, lists three priorities for Arby’s: bringing forth menu innovation, deploying new technology, and attracting a younger consumer. DRG tested a value-engineered prototype for the brand and is also piloting a new catering program on behalf of Arby’s—individual boxes with sandwiches, chips, and a cookie.

DRG’s impact cannot be denied. When the franchisee entered Alaska and added Arby’s units, it doubled the sales volume in the market, according to Ellison.

Before Taco Bell’s new beverage spinoff—Live Mas Cafe—came to life, Ellison thought through what a Mexican-inspired coffee brand would look like.

He spent a lot of time in Mexico City and Southern California learning about local Mexican cafes that had authentic beverages and used spices not often implemented in the states.

Ellison’s Nana Rosa would put cinnamon and vanilla in her coffees and make different types of Mexican treats, and those memories resonated with him.

Ellison worked with David Zimmerman, his branding partner and friend, to come up with an innovative concept. It was more exploratory than anything else.

The idea was placed on the shelf, until Ellison chatted with Taco Bell CEO Sean Tresvant around the time of the Super Bowl in 2024. He asked Ellison how Taco Bell could break through on drinks and grow the platform.

“I shared with him some of my ideas from the year prior of what I’ve been working on,” Ellison says. “And it was his idea to say, ‘OK, well, why don’t we do that inside the four walls of Taco Bell? How can we take what you started with, but expand it into Taco Bell? Nobody does Mexican-inspired better than Taco Bell. You have a bunch of restaurants. It could be meaningful for the system and the brand. What would it take for you to see this idea through from a Taco Bell lens?’”

Taco Bell provided financial support for research and development and a small team that helped with product and operations—workers who were willing to take leaps and risks. Ellison was able to bring in Zimmerman for creative support as well.

Additionally, Ellison and Zimmerman worked closely with Liz Matthews, Taco Bell’s global chief food innovation officer, and Taco Bell U.S. CMO Taylor Montgomery to bring the beverage brand to life. Matthews and her culinary team created new products while Montgomery helped lay out the ethos of Taco Bell and how to weave the sub-brand together with the parent. Ellison calls it “being radically different, but authentically Taco Bell.”

The group landed on a brand that’s lighter in color (a purplish, lavender shade ) and has softer tones to “bring a little different energy into the four walls,” Ellison says, particularly for the morning daypart.

Live Mas Cafe sprinted toward the finish line. The idea really kicked into gear around late March 2024, and DRG began

renovating a $3 million Taco Bell in Chula Vista, California, in September. Just a couple of months later, the brand opened within the Taco Bell restaurant.

“That’s the other part—you have to have a little crazy in you to do some of these things because you’re taking a really great restaurant that’s making money and you’re going to blow it up,” Ellison says.

The workers were soon labeled as “bellristas,” who offered differentiated drinks like chillers, agua frescas, specialty coffees, and dirty sodas, along with Taco Bell’s typical food menu.

Going forward, 30 additional Live Mas Cafes will open. DRG will debut 15 in Southern California and Taco Bell corporate will open 15 in Texas.

The one exception is that a Live Mas Cafe kiosk will be built across from the Taco Bell Cantina in Las Vegas.

“Having been able to experience Las Vegas and touch hundreds of thousands of visitors from all over the country and world, that’s a way to build brand equity rapidly,” says Ellison, on why he wants to bring the beverage brand to Las Vegas. “To the point where when they go back to their markets, Ohio or the Southeast, the Northeast or wherever, they’re like, ‘Oh, I was at this Live Mas Cafe, Taco Bell flagship Cantina, and it’s really great and someday hopefully I get one.’”

eight years and worked at Arby’s and large Burger King franchisee GPS Hospitality.

Each market is led by vice presidents. And below them are plenty of other restaurateurs. For instance, in Southern California, there are 20 above-restaurant leaders covering 100-plus stores. Employees also use a mobile app to communicate, connect, and keep up with what’s going on at the Support Center and other markets, like key announcements, birthdays, promotions, or special community grants.

“We have a lot of things that come out of the Support Center, whether it’s ideas or thought process or executing the brand mission, but the key is that we have the right leader in each individual market that runs that market that really owns the people, owns the process, owns everything that we’re trying to execute in each market,” Kelly says. “Whether it’s in Southern California, Northern California, Alaska, and Kansas City, especially in our satellite markets where we don’t have those state pieces, you got to have the right leader in there, and at times we’ve struggled with that in the past where we thought we could do it right with just executing out of [the Support Center], but we realized in order to hit our growth model you just got to have the right person.”

When it comes to culture, while most organizations develop

Additional Live Mas Cafes will either live inside a Taco Bell like the Chula Vista version, be a standalone store with its own distinctive Taco Bell food menu, or exist as a beverage line at a regular Taco Bell restaurant.

DRG’s expansion plans are backed by sophisticated infrastructure. Ellison and Grieve aren’t natural food and beverage operators, but they did hire executives with extensive quick-service backgrounds.

It starts with the operations team based out of DRG’s Las Vegas–based Support Center. Dunn, who’s been with the brand for six years, spent nearly 11 years at Arby’s and six years with Krystal before joining DRG. Kelly, a 10-year veteran, worked at Arby’s, Yum! Brands, and Five Guys. There’s also chief restaurant officer Tom Douglas, who’s been under DRG’s banner for

values to follow, Kelly believes DRG took the opposite approach. The leadership team looked at who they were, what they do, and how they live, and created a culture around it. DRG’s main purpose is to positively impact its team members and the communities it serves by doing the right thing, being authentic, innovating, having fun, and winning together.

“We don’t try to put up a front,” Kelly says. “We’re not fake. We’re not political. We’re not red tape. We’re just who we are. We don’t try to make people mold into what we want them to be. We try to help people be good at who they are and what they do. And sometimes it’s hard for us because we all have come from an ops background. We all come from a driven background, but we’re all learning more. Let people just be good at who they are. Give them the freedom, trust that they’re making the right decisions, and just have fun with it and enjoy what we’re doing.”

Dunn says DRG helps people “tap into their potential that they didn’t even know they had within themselves through creating those opportunities.” On its website, the company lays out

a clear pathway for Taco Bell and Arby’s employees to work their way up from team member to director of operations. Employees have access to comprehensive benefits along that journey, like a 401(k), tuition assistance, and DRG Cares, a 501(c)(3) set up to help workers in times of crisis.

DRG uses these brand standards as guardrails for implementing operations. Teaching workers how to make tacos or roast beef sandwiches is a basic part, but the people side of the business and soft skills training is crucial, according to Douglas. The executive gave an example of one vice president who teaches newly promoted workers about financial planning and how to set goals to climb out of debt.

“I’d like to define what we do as a people-first culture. As I said for years when I got here, it has nothing to do with the product we serve,” Douglas says. “Tacos and roast beef is our business, but it’s really about the people and how we deliver upon that. So when you think about people first, you have to put yourself in their situation and understand where they’re coming from. And one of the exciting things with being here going on eight years here, we were growing so fast, we were acquiring all these different companies and you had a bunch of different cultures and it was really about coming in and showing them

that we care for you.”

Hospitality is one of Taco Bell’s biggest priorities. The brand ranked as the fastest drive-thru, by total time, for the fifth straight year, according to the QSR Drive-Thru Report, but now the focus is on how to deliver a consistent one-on-one experience with the guest from the time they pull into the parking lot until they pick up their order and depart. And for third-party deliveries, making sure the Taco Bell culture extends to customers’ homes.

“The push right now is really on that ‘hosBELLtality’ piece and how we tie the great product quality, the speed, with being friendly and being the friendliest in the community,” Douglas says. “So that’s the push that the brand’s going through, and we do a lot of unique things that we’ve been doing for years to try to bring that piece in, but that’s the brand’s push right now is that hospitality.”

In the same vein, DRG prides itself on community involvement.

The company raises money through its Round Up program

and gives away several Live Más Scholarships to college students. Internally, DRG launched a Women’s Leadership Network to uplift women in the foodservice industry. The group also has special relationships with the Boys and Girls Clubs, Big Brothers Big Sisters, and Junior Achievement.

“I think the one piece that makes us people-centric is our ability to connect within our communities as well as with our teams,” Dunn says. “…We have several people within the organization that are part of different organizations and charities that they’re giving and investing back their time within their communities, which create those long-term connections, which I think makes us definitely different from other organizations because we encourage that. And I think it’s our way to connect with the community and really live out our purpose.”

On a national level, Taco Bell is one of the highest-performing brands in the fast-food segment.

As of early August, the chain hadn’t had a single week of negative sales throughout 2025, and continued to take share from fellow fast-food and fast-casual brands. Among the top public restaurant chains, Taco Bell is the only one to never have a negative quarterly same-store sales result in the past five years.

Tresvant says Ellison and the DRG team are an integral part of the Mexican chain’s success.

“Strong operations start with great leadership, a commitment to people, and a deep respect for the brand—those qualities shine through in how SG Ellison and his team run the DRG business,” Tresvant says. “SG combines operational rigor with an innovative spirit, always looking for ways to elevate the Taco Bell experience. That balance not only drives DRG’s success but also helps raise the bar across our system. When one franchise partner delivers at that level, it inspires everyone to keep pushing for excellence and chasing greatness together.”

Arby’s is more of a turnaround story. The company earned $4.325 billion in U.S. systemwide sales in 2025, down from $4.617 billion in 2024. Arby’s overall domestic unit count also decreased by 50 restaurants across 2023 and 2024.

The brand recognizes DRG as a major part of retelling its story and getting back in front of customers. The franchisee has a leadership presence on the Arby’s Franchise Association and the Operations Council.

“As a trusted test partner, DRG has helped pilot a wide range of innovations, from new products and equipment to procedures and design elements,” says Arby’s brand president David Graves.

As for DRG’s future, expansion into other restaurant concepts—or outside of the restaurant industry completely—is a real possibility. Ellison says the company is hoping to grow with “high-quality businesses that are growth-oriented and that have something the consumer responds to in a positive way.”

Whatever it may be, Ellison is happy to try something new. He always has been.

“Innovation equals fun,” Ellison says.

Ben Coley is the editor of QSR. He can be reached at bcoley@wtwhmedia.com

/

BY QSR STAFF

QSR’s Best Brands to Work For shows how restaurants are redefining what it means to support, reward, and grow their people.

The restaurant business has always relied on the energy and dedication of its teams. Increasingly, companies are putting structure and resources behind that idea, with benefits, recognition programs, career pathways, and community efforts designed to keep employees engaged for the long term. QSR’s Best Brands to Work For spotlights 18 companies that illustrate how people strategies have become key to success.

This year’s group includes national names with deep reach. Each demonstrates how large systems can incorporate advancement opportunities, financial support, and recognition across thousands of employees. Fast-growing players showcase how expansion is paired with training platforms, distinctive cultures, and employee programs that keep teams connected to the brand’s trajectory. Smaller and regional concepts highlight the impact of local hiring, flexible scheduling, personal recognition, and family-style gatherings that strengthen bonds between teams and communities. Together, the 18 honorees show how restaurants across the spectrum—from legacy brands to newcomers—are developing approaches that combine benefits, growth, and connection. These programs and practices reflect an industry where people strategies are as critical as menu innovation or store design.

insurance and supplemental options available. Paid time off, sick leave, and flexible scheduling are offered, and the company operates on a one-shift-perday model so staff can keep evenings free. Hourly employees receive a 50 percent meal discount, managers eat at no cost, and each restaurant has a $2,000 yearly budget for team appreciation activities.

Training and advancement play a central role. Employees take part in one-on-one training, cross-training, and hospitality classes, with additional coursework available through a digital learning management system. Leadership development is built into the structure, and more than half of the salaried leadership team has been promoted from within since 2021. Some

managers have advanced into corporate positions, boosting the pathway for internal growth.

Team recognition extends beyond day-to-day praise. Stores compete in upselling contests tied to new promotions, with winners receiving catered meals or Amazon gift cards. The annual “Biscuit Con” gathering honors managers for performance in areas like sales, guest service, and retention. A $100 referral bonus rewards employees who bring new hires into the company.

Communication is treated as an ongoing exchange rather than a oneway channel. Actionline, a third-party feedback tool, allows employees to submit concerns, ideas, or recognition anonymously. Suggestions are

jury duty, and military service, along with holiday pay for seven major days. Financial support extends to tuition reimbursement of up to $3,300 annually for graduate study, adoption assistance, and an Employee Assistance Program through LifeConnect. Associates and their spouses also receive a 50 percent discount on Donatos products.

Recognition and celebration are key to the associate experience. Milestone anniversaries, retirements, and awards for top-performing managers and stores are honored, while gatherings also mark product launches and fundraising efforts such as Pelotonia, where the team raised more than $100,000 for cancer research in 2025.

Career development is another hallmark. Many leaders began as store associates, and it’s not uncommon for employees to build careers spanning decades. CEO Kevin King’s four-part strategy prioritizes people alongside innovation, brand relevance, and sustainable growth, with a focus on training, recognition, and advancement opportunities for both corporate staff and franchise partners.

Donatos also invests in communities. Through the Promise Family Fund, associates facing hardships receive financial help, while volunteer initiatives target housing, hunger, and health. Associates are encouraged to support local schools, charities, and events, emphasizing the company’s mission “to serve you the best pizza and make your day a little better.”

LOCATIONS: 87

la Madeleine is committed to creating warm, welcoming spaces where guests can share delicious food, build connections, and celebrate the French joie de vivre. That same spirit of care extends to its people. Employees receive generous paid time off, competitive medical and dental coverage, a 401(k) plan with company match, and discounts

on gym memberships and wellness programs. To further support wellbeing, the brand invests in counseling services and personalized financial wellness resources.

The Dallas Support Center serves as the hub of la Madeleine’s culture, home to a passionate team that lives the purpose: “We spark joy every day.” Corporate team members regularly work café shifts to stay close to the guest experience, while also giving back to the community through food bank service and local volunteerism. A vibrant culture thrives here, with hybrid work schedules, a free Friday afternoon each week, and playful traditions like the annual cornhole tournament, March Madness shootout, and office Olympics.

The brand is equally proud of its café teams, where loyalty runs deep. More than one-third of general managers began as hourly employees, and the average manager tenure is 7.4 years—well above the industry norm.

la Madeleine also leads its category in hourly retention, thanks in part to annual listening sessions that give field team members a voice in shaping the company’s future. Recognition from Black Box Intelligence’s Heart of the Workplace and the Greater Dallas Business Ethics Award underscores this people-first culture.

CEO John Dillon, who joined the brand earlier this year, captured it best: “I’m honored to be part of this legacy brand, energized by the passion and enthusiasm that will carry us forward and continue to spark joy in the lives of others.”

Portillo’s has built a reputation in which team members can thrive professionally and personally. Flexible schedules allow part-time and full-time employees to balance work with other pursuits, while free meals, competitive pay, performance bonuses, and daily pay options enhance the daily experience. General managers and market managers have access to stock grants, an Employee Stock Purchase Plan, and paid leave programs, while corporate, restaurant, and plant teams enjoy comprehensive benefits, including health insurance, 401(k) options, parental leave, and wellness programs that now include mental health support and diabetes and hypertension coverage.

culture, this fund reinforces the idea that the Tribe looks out for its own. Another unique perk is the brand’s willingness to cover the cost of Velvet Taco tattoos, a symbolic nod to the company’s celebration of loyalty and authenticity.

Guided by four values—Be Relentless, Stand Together, Be a Rebel, and Kick Ass & Take Names—Velvet Taco maintains a culture where creativity, curiosity, and unconventional thinking are encouraged. Employees are urged to challenge norms, collaborate, and bring bold energy to their daily roles.

Career development is a major theme, with the company emphasizing internal promotion and creating paths to leadership. Rapid expansion, including international growth, provides additional opportunities for advancement across multiple functions. Team members also influence the guest experience through menu innovation, contributing ideas to the Weekly Taco Feature and participating in Tacopalooza, a contest where

employees compete to have their creations featured.

LOCATIONS: 338

Chicken defines its culture through bold recognition and lifechanging rewards. When the brand partnered with Roark Capital, every support center employee, store manager, and assistant manager received a bonus roughly equal to a year’s salary. Nearly 20 individuals became millionaires, a decision leadership viewed as a direct investment in the people who helped grow the brand. The transaction was also a reflection of CEO Bill Phelps’ and the brand’s founders’ higher-purpose goal of transforming people’s lives. Many employees have used their bonuses to take life-changing steps—buying their first homes, investing in businesses, saving for retirement, and even starting families.

Outside of milestone events, Dave’s routinely surprises employees with retreats and conventions in distinctive locations—from Hawaii to Monte Carlo, Bourbon Street to the Versace Mansion—meant to celebrate success and strengthen team bonds.

The brand offers financial and lifestyle benefits designed to support employees well beyond the restaurant. These include competitive wages, incentive programs, a 401(k) with immediate vesting and Safe Harbor Match, company-sponsored life insurance, auto and gym reimbursements, and stipends for cell and internet use. Support Center staff receive free daily

lunches, unlimited snacks, and summer half-day Fridays.

Personal growth is addressed as actively as financial well-being. The annual Think Bigger Conference combines workshops and leadership training for restaurant and corporate employees, encouraging them to map out ambitious futures—whether inside or outside of Dave’s. Education assistance covers the cost of relevant coursework, removing barriers to skill development.

Equally important are the quieter moments of care. The company has paid off a home for an employee battling a serious illness and covered medical expenses for procedures not included in insurance plans. These gestures reinforce a belief that taking care of people must be both public and personal.

The overall result is an organization where employees feel recognized, supported, and driven to give their best. Dave’s Hot Chicken demonstrates through tangible action that its growth is inseparable from the people behind it.

LOCATIONS: 447

Potbelly puts people at the center of its strategy through a mix of benefits, growth opportunities, and cultural practices that emphasize inclusion and positivity. Employees have access to a wide range of insurance plans— medical, dental, vision, disability, life, and voluntary coverage—along with a 401(k) match of 50 cents per dollar up

prepare employees at every level to grow into bigger roles.

Training begins with two weeks for hourly staff, covering every station in the Shack. Managers receive up to eight weeks of preparation that blends technical and leadership skills. More advanced opportunities include Shift Up, an 18-week path for hourly team members to step into salaried roles, and Lead to Succeed, which supports newly promoted managers. In 2024, the company promoted more than 3,450 people across its system, while retaining every graduate of Shift Up.

Benefits mirror this emphasis on investment. Eligible employees receive medical, dental, and vision coverage, company-paid life and disability insurance, parental leave, and access to mental health support from day one. Financial stability is supported through a 401(k) with company match,

performance-based bonuses, equity opportunities for general managers, and regular merit reviews. Lifestyle perks include discounted meals, national partner discounts on travel and hotels, and Shack-branded gear.

Shake Shack’s charitable arm, the HUG Fund, is funded by team members and has distributed more than $440,000 in grants to over 220 colleagues in crisis. Externally, the company advances its mission to “Stand for Something Good” by sourcing responsibly, contributing to community causes, and creating opportunities for employees to volunteer. Recognition has followed: a 100 percent score on Human Rights Cam-

paign’s Corporate Equality Index, inclusion on Forbes’ Best Employers for Diversity, and a place on Newsweek’s America’s Greatest Workplaces.

Penn Station East Coast Subs has combined four decades of brand tradition with a consistent commitment to people. Since 2014, the company has fully funded the National Down Syndrome Adoption Network, contributing more than $2 million and supporting events through tournaments and local fundraisers. This long-term partnership underscores a philosophy that success is measured not only in sandwiches sold but in communities strengthened.

Inside the organization, growth is built into the system. With 99 percent of its restaurants franchise-owned, Penn Station has fostered a culture where summer employees can eventually become franchisees. Many have followed that path, including the company’s own president, who began as a summer intern before rising to top leadership. To expand those opportunities, Penn Station introduced its Managing Owner/Operator Program, opening pathways for motivated team members to move from the shop floor to store ownership.

Training has been transformed through My Penn Path, a proprietary digital platform created entirely in-house and recognized by Training Magazine. Combining gamification with learner-centered tools, it stream-

lines onboarding, improves knowledge retention, and provides franchisees with consistent resources. The platform not only raises performance standards but also anchors the brand’s culture of development and opportunity.

Employees benefit from a system that prizes entrepreneurship and career progression. The “people-first” philosophy runs through training, recognition, and the franchise structure itself, which is designed to open doors for those with ambition. At every stage, team members are shown that growth is possible.

Beans & Brews Coffeehouse has a history of growth from within. Many of its leaders and franchise owners began as baristas, store managers, or entrylevel assistants before moving into senior positions, including vice president roles. Long tenure is common, with employees staying five, ten, even twenty years. That pattern of loyalty reflects the culture the company has nurtured since opening in Salt Lake City in 1993.

The brand now operates 89 locations across five states. Despite its expansion, it retains a family-oriented atmosphere where recognition and celebration are a regular part of life. Monthly gatherings recognize both professional accomplishments and personal milestones—marriages, anniversaries, and new family members. Annual system-wide meetings are less conference, more reunion, where achievements are marked alongside games, shared meals, and charitable efforts. At its most recent event, a Cold Brew Relay and lighthearted pie tosses helped raise $1,000 for CORE, an organization that supports restaurant workers and their families in crisis.

Perks extend beyond standard benefits. Employees receive a pound of

coffee every week, $50 in gift cards each month, access to a full kitchen in the training center, and use of an onsite gym. These gestures underline the company’s commitment to wellness, connection, and enjoyment at work.

The past year brought record store openings, expansion into new markets, and the launch of new beverage platforms, all celebrated at the first official “family reunion.” Associates and franchisees joined around a vision to “rejuvenate the world with coffee and mountain vibes,” guided by core values that have defined the company since its founding.

Beans & Brews shows that growth and culture can evolve side by side. Its focus on recognition, unique perks, and career pathways has created a brand where people stay, succeed, and celebrate together.

Marco’s Pizza runs on a simple idea: people first, mission always. Most employees work for franchisees, where benefits can include healthcare, continuing education, profit-sharing, and even paths to ownership. Incentives vary by operator—bonuses, recognition programs, and flexible schedules are common. The franchisor supports this structure with training, development, and leadership pipelines that reach across the system.

Education is a core focus. Marco’s University offers foundational training. MULE and MILE leadership pro-

grams prepare managers for greater responsibility. A partnership with Bellevue University opens doors to further study. On monthly systemwide calls, three General Manager All-Stars are recognized, bringing visibility and reward to high performers.

Growth is everywhere in the brand’s design. Franchisee tools like the We’re Golden platform help embed culture in stores. Coaching materials, service training, and feedback loops are part of the package. The goal is consistent: empower store teams, reinforce hospitality, and build workplaces rooted in respect. By 2025, 700 teams are expected to be trained on this model.

Support goes deeper than development. The Slice of Support fund provides financial aid when employees face hardships—covering losses from disasters or helping families in crisis. The Marco’s Pizza Foundation expands that reach, addressing hunger prevention, workforce development, entrepreneurship, and education. Partnerships with groups like Junior Achievement USA connect employees and communities to bigger opportunities.

The brand positions itself as more than a stepping-stone job. It offers advancement for those who want careers, flexibility for those balancing responsibilities, and respect for all who contribute. From the kitchen line to corporate offices, Marco’s tells its people they are seen, heard, and valued.

Packaging is more than just a vessel to carry a meal. It’s an essential part of the restaurant experience. It preserves food integrity, carries the brand’s story, and increasingly reflects commitments to sustainability and convenience. QSR magazine and the Foodservice Packaging Institute are once again proud to present the annual Foodservice Packaging Awards, shining a spotlight on the designers, manufacturers, and restaurant leaders who elevate packaging into an art form. This year’s honorees represent the best in creativity and functionality.

Friendly’s franchisee Amol Kohli has big plans after purchasing BRIX Holdings.

BY BEN COLEY

Amol Kohli began working at Friendly’s when he was 15 years old. It wasn’t a monumental decision at the time. He was in high school, and like many kids his age, he entered the restaurant business. However, nearly 20 years later, looking back at the move, Kohli believes it changed his life forever.

Without that first job, he would’ve never become a franchisee— operating as Legacy Brands International—and grown his portfolio to over 30 Friendly’s restaurants across the East Coast. Kohli also would’ve never made the decision to buy BRIX Holdings, the chain’s parent company, which also owns Clean Juice, Orange Leaf, Red Mango, Smoothie Factory + Kitchen, Souper Salad, and Humble Donut Co.

“I got my start in a business and I felt that I could do better. A lot of frustrations, a lot of setbacks, a lot of challenges,” Kohli says. “I just kept trying my best, despite having failures. But then somewhere along the line, you’re like, well, you feel like you know it a little bit better. And so you start to get in a groove and when the opportunity came to acquire the franchisor and the parent, I felt like I was ready.”

Over the years, Kohli has been part of, or advised on, several acquisitions. One of the most unique things about purchasing BRIX was he already knew the entire leadership team. He had worked with many of them for years. Kohli understood how they operated, their culture, their strengths, and even their pressure points. That familiarity made evaluating the transaction much clearer, and it created a sense of harmony from the start.

The brands themselves were also a big draw. While many of them are regional, they’ve already proven they can succeed outside of their core markets. They cover different sectors—some better-for-you concepts, others like Friendly’s that are family dining—but none of them are overly complex to run. For example, Friendly’s doesn’t serve alcohol and doesn’t have gaming, so it’s lower regulation and easier to staff.

Another attractive point was durability. Friendly’s has been around for 90 years. Additionally, Kohli believes the other concepts have scalability built into their DNA.

“They also are not significantly capital expenditure intensive,” Kohli says. “We don’t have these 5,000- or 6,000-square-foot behemoths that require two acres and 200 [parking spaces]. I know we can go inline, we can go endcap, we can go nontraditional. We’ve already demonstrated we’re in several airports. We’re in arenas. We have locations for Red Mango in Puerto Rico. So there is proof of concept for the brand, which is important, and there’s whitespace to grow in what I call developable areas.”

BRIX will have continuity. Kohli will step in as chairman and maintain his role as a Friendly’s franchisee, and Sherif Mityas will remain CEO. The brand will also stay headquartered in Dallas. And existing BRIX ownership, including its majority member, JAMCO, chose to continue their involvement with BRIX and will be investors in Legacy Brands International.

Kohli intends to be a franchisee-focused franchisor. To him, growth isn’t about volume—it’s about doing things the right way. His approach will be grounded in fairness, empathy, and discipline.

“We are not here to just collect fees and roll and run. That is not what we’re going to do,” Kohli says. “We are here to establish real businesses for real Americans and investors

from the day we opened,” Laudano says. “And then there’s the training and teaching people what it is and how we cook it and what we deliver and the culture of it. But we definitely, being in Delray Beach, Boca Raton, and West Palm, had a little jumpstart of people that knew New Haven.”

At the time of publishing, two franchise restaurants were scheduled to open in Marietta, Georgia, and Port St. Lucie, Florida. Both franchisees committed to a four-store development agreement—one unit in years one and two, and then two stores in the third year. Another franchise market is Orlando, where the franchisee committed to 10 restaurants. Larger operator agreements have also been orchestrated. In California, Ah-Beetz will be part of a 40-unit licensing deal while a master franchisee in Massachusetts will oversee 20 restaurants.

The goal right now is 250 locations over the next five years.

Ah-Beetz developed a suburban and urban prototype. Urban units will be anywhere from 900 to 1,300 square feet, which would be mostly to-go and include possibly three or four tables, and cost around $250,000 to $400,000 in startup costs. The suburban version is what Laudano calls the “true pizza joint” where there’s dine-in service. That runs from 1,300 square feet to 2,200 square feet and should seat between 40 and 65 customers.

Laudano believes the best ratio in a market is one suburban store for every five urban units, with the suburban restaurant acting as a flagship since it has a bigger menu and serves alcohol. The franchisees in Georgia, Port St. Lucie, and Orlando will begin growth with a suburban location.

The pizza chain founder is proud of the board of directors he’s built to lead Ah-Beetz into the future. The chairman is Jimmy Greco, who has experience leading big brands like Tijuana Flats, Sbarro, Newk’s Eatery, and Bruegger’s Bagels. There’s also Steve Sager, who’s been in the franchise business for multiple decades and signed into Subway in the early 1990s, and Glenn Cybulski, an award-winning executive chef and certified Italian pizzaiolo. The rest of the board has varied experience in finance, real estate, and development.

to build a network, and we want to pick the right operator with the right motivation. We are not just here to plow and grow. We want to grow the right way, and this is coming from a guy who’s paid royalties his entire life. There hasn’t been a week where I haven’t paid royalties since I was probably 22 years old, maybe 23. So I know what it’s like to be on both sides.”

Kohli wants to grow organically and inorganically by making selective acquisitions. He says the market right now is presenting opportunities, and when the right brands come along that fit BRIX’s profile, he and his team will look closely. The company won’t be only interested in brands that are “hitting it out of the gate.” The more important part, to Kohli, is whether there’s room for growth and whether the category is saturated.

In terms of organic growth, BRIX is seeing momentum. Existing franchisees are stepping up and many deals are in the process of being signed.

Ben Coley is the editor of QSR. He can be reached at bcoley@wtwhmedia.com

e best packaging solutions today are solving real business problems, from labor savings to brand storytelling.

Quick-service restaurants are navigating a pivotal moment in packaging. Takeout and delivery have reshaped how meals are consumed. Guests expect food to arrive fresh, intact, and presented with purpose—and they want the packaging to reflect their values around sustainability and quality. Meanwhile, operators are balancing inflation, labor shortages, supply chain volatility, and an evolving patchwork of regulations.

The most successful brands now see packaging as more than just a functional necessity. It’s a strategic tool—one that protects food, reinforces brand identity, and creates operational e ciencies. From tamper-evident features to stackable designs that streamline back-of-house workflows, packaging can make or break the customer experience.

But smart packaging starts with smart partnerships. Whether it’s navigating material bans, optimizing inventory, or meeting new sustainability benchmarks, the right suppliers are helping operators adapt quickly and consistently. In the following insights, leading packaging experts share how quick-service restaurants can turn one of their biggest challenges into a long-term advantage.

Executive Vice President of Sales and Marketing

What are the biggest challenges for quick-service restaurants with packaging today?

Sustainability remains the number one challenge. Customers expect recyclable or compostable packaging, but delivering on that promise— while also keeping food protected and costs manageable—isn’t easy. As takeout and delivery continue to surge, packaging has to do more: it must hold up in transit, maintain freshness, prevent spills, and remain operationally e cient.

How are these challenges impacting the industry?

Quick-service restaurants now have to view packaging as a strategic asset rather than just a functional item. It plays a major role in brand perception and customer satisfaction. Operators seeking lower upfront costs sometimes turn to overseas suppliers, but that can introduce delays, tari s, and quality control issues—ultimately undermining the very e ciencies they were hoping to gain.

What mistakes do operators make with packaging?

Many focus solely on price. But when packaging fails in transit or clashes with the brand image, the fallout can cost far more than the initial savings. Another common misstep is treating each packaging component—bags,

wraps, trays—as standalone items, instead of designing them to work cohesively in function and branding.

What key tasks are being enhanced through packaging?

Packaging has become a key part of the brand experience. As many quick-service restaurants undergo rebranding, packaging is where visual identity comes to life. On the operational side, well-designed packaging that’s easy to stack, transport, and assemble helps reduce labor and streamline the back-of-house workflow.

Why is partnering with a trusted brand more crucial now than ever?

The landscape is shifting

fast—regulations, materials, consumer expectations, and supply chains are all evolving. A trusted packaging partner brings both innovation and stability. When last-minute changes happen, such as rushed graphic updates or forecast shifts, that partner can ensure a smooth, responsive rollout.

Director of Marketing and Custom

What are the biggest challenges for quick-service restaurants with packaging solutions today?

Quick-service restaurants face rising labor and supply chain costs, but the real challenge is the shift in consumer expectations. Diners today have more food-to-go experiences and choices than ever and know that meals can arrive hot, fresh, and intact. Their

standards are higher—and their tolerance for bad occasions is lower. In this environment, packaging performance is investment in repeat business.

How are these challenges impacting the industry?

Rising costs may tempt operators to seek savings in packaging, but that creates real risk. Just as no one would cut corners on the dine-in experience, leading operators recognize that packaging plays the same role outside their restaurants. It’s the only thing between their food and customers— and in a world where reviews spread instantly, prioritizing performance is

essential to protecting your brand.

What mistakes do operators make with packaging solutions?

A common mistake is choosing packaging that doesn’t align with what customers value most: leak prevention, temperature retention, and presentation. Cheaper options may save pennies but risk the significantly larger investments in food, labor, and customer acquisition.

What key tasks are being enhanced through packaging solutions?

Most importantly, saving labor and reducing costs by creating operational e ciencies. Containers designed for saucing food eliminate extra bowls and cleanup. New single-piece baseand-lid designs simplify training and cut storage needs. These smart solutions streamline operations while freeing up sta and resources for what matters

PROTECT FRESH-MADE TASTE LONGER

By holding dressing and sauces separate

STOP COSTLY COMPS

Lid reminds staff to include toppings

SAVE LABOR, SPEED UP PREP

Makes it easy to add different toppings per order

most: profitably serving more customers.

Why is partnering with a trusted brand more crucial now than ever?