FOOD & PACKAGING TECHNOLOGY

According to the MarketsandMarkets report, the cocoa and chocolate market is projected to grow from USD 23.69 billion in 2025 to USD 28.24 billion by 2030, at a CAGR of 3.6% from 2025 to 2030

The demand for sweet yet healthy treats is driving the market, with sustainable sourcing, organic formulations, and ethical certifications being prioritized. Cocoa beans of traceable origin, sugar-reduced chocolates, and plant-based options are now the overriding factors distinguishing a manufacturer.

Advancements in technology, such as blockchain-enabled supply chain visibility, AI-based demand forecasting, and automated production systems, are being leveraged to streamline operations and meet compliance requirements. Sustainability continues to be a core focus as companies initiate programs to introduce biodegradable wrappers, recyclable packaging films, and low- emission production processes. E-commerce and direct-to-consumer channels’ availability, particularly in emerging markets, have fast-tracked product reachability. Brands utilize digital channels to engage consumers with personalized offers, such as chocolates that provide additional nutrients or mood-enhancing ingredients.

Factors such as urbanization, rising middle-class incomes, and changing food preferences are expected to drive significant growth in market share in both developed and developing countries. Investments in innovative products, transparent sourcing, and environmentally responsible manufacturing.

Rising demand for functional and premium chocolate offerings

The cocoa and chocolate market is experiencing significant growth due to an increasing demand for premium and functional chocolates. Consumers are

now more inclined to choose products that offer added health benefits, such as high cocoa content, low sugar levels, and plant-based alternatives. Dark chocolate is particularly popular, as it is recognized for its heart health benefits.

In May 2024, Barry Callebaut launched the “Next Generation Cacao” range, which features nutrient-dense formulations designed to meet the demand for wellness-focused chocolates. The growth of the urban middle class and rising disposable incomes in emerging economies are also contributing to increased spending on premium and artisanal chocolates. This trend has been supported by innovations in probiotic and high-protein chocolate variants that cater to health-conscious consumers. Additionally, demand is expected to rise in online and specialty retail formats, as brands strive for functional positioning and transparency in their cocoa sourcing.

Cocoa price volatility affecting manufacturer margins

The primary constraint in the cocoa and chocolate market is the price fluctuation of cocoa beans, which often impacts manufacturers’ cost structures. Geopolitical factors and climate-induced crop failures contribute to these fluctuations, along with supply chain disruptions in producer countries, particularly Côte d’Ivoire and Ghana. In April 2024, it was reported that cocoa prices surged to a 46-year high due to drought conditions and disease outbreaks affecting West African harvests. Consequently, procurement costs have risen for both major companies and mid-tier chocolatiers. As a result, cocoa import-dependent businesses must either raise their prices or risk becoming uncompetitive.

Price instability also hinders the development of long-term sourcing strategies and limits options for creating affordable products. While large corporations can mitigate risk through futures contracts and diversified sourcing, smaller companies often lack such resources. Therefore, cocoa price volatility remains a significant challenge, severely affecting profitability, production planning, and supply chain resilience across the entire value chain.

Ethically sourced and environmentally sustainable chocolate is increasingly being demanded, thus presenting new growth opportunities. Traceability,

deforestation-free sourcing, and fair labor practices are being pressed upon by consumers and regulators. In June 2025, Mondelez International extended its Cocoa Life program into India and Southeast Asia to enhance sustainability and traceability at the farm level. This goes beyond the purely ethical supply bias and is well in line with forthcoming EU due diligence legislation for traceable and sustainable agricultural imports.

On the other hand, technological advancements in digital traceability, including blockchain and QR code packaging, render it possible for brands to be transparent with regard to their supply chain in real time, from bean to bar. These innovations, in turn, bolster brand credibility and consumer trust, especially in the premium segments. The brands investing in verifiable sustainability certifications (such as Rainforest Alliance and Fairtrade) and digital sourcing transparency will undoubtedly take the larger market share. This support around the ethics of supply chains, therefore, opens the gates

According to the MarketsandMarkets report, the global dairy alternatives market is estimated at USD 27.0 billion in 2023 and projected to reach USD 43.6 billion by 2028, growing at a CAGR of 10.1% during the forecast period. The rising demand for plantbased alternatives underscores a global shift toward healthier, more sustainable dietary choices.

In recent years, the global food industry has witnessed a significant shift in consumer preferences, with a growing demand for dairy alternatives. This trend reflects changing consumer attitudes toward health, sustainability, and ethical considerations. As more people seek to reduce or eliminate dairy products from their diets, the market for dairy alternatives has experienced exponential growth. One of the primary drivers behind the surge in demand for dairy alternatives is the increasing focus on health and wellness. Many consumers are becoming more health-conscious and are looking for options that align with their dietary preferences and restrictions. Dairy alternatives, such as almond milk, soy milk, and oat milk, are often perceived as healthier choices due to their lower saturated fat content and absence of cholesterol. Additionally, some dairy-free options are fortified with vitamins and minerals, making them attractive alternatives for those seeking to maintain a balanced diet. Lactose intolerance is another factor

According to the MarketsandMarkets report, the global meat products market is estimated at USD 44.3 billion in 2023 and is projected to reach USD 68.9 billion by 2028, at a CAGR of 9.2% during the forecast period. The global market for meat products is a dynamic and diverse sector within the food industry, covering a range of items such as beef, poultry, pork, lamb, and processed meats. In recent times, there has been a consistent uptrend in the demand for meat products, spurred by various factors, and there are no indications of this trend slowing down.

A primary catalyst for this surge in demand is the continuous growth of the world’s population, particularly in emerging markets. The expanding population, coupled with increasing disposable incomes, has led to a rise in the consumption of meat as a primary source of protein. Urbanization is another influential factor, transforming dietary patterns as more individuals migrate to urban areas, resulting in a preference for processed and convenient meat products to align with busy lifestyles. Global rises in income levels have prompted consumers to seek higher-quality meat products, driving the demand for premium and specialty options, such as organic and grass-fed meat. Shifting consumer preferences towards healthier, protein-rich diets have spurred interest in lean meats and alternatives, including plant- based options such as tofu and plant-based

burgers. Moreover, ethical concerns regarding animal welfare and environmental impact have influenced preferences towards meat products sourced from humanely and sustainably raised animals. A noteworthy example is Cargill, Incorporated (US), which, in collaboration with the China Animal Health and Food Safety Alliance (CAFA), expanded its product range in China by introducing new Sun Valley Raised Without Antibiotics (RWA) chicken products in March 2021.

Additionally, the expansion of the foodservice industry, globalization, and advancements in meat processing and packaging have all contributed to the escalating demand for meat products. The evolving landscape of this market is marked by a broad array of choices, and the industry’s future appears promising, with ongoing innovations and increasing consumer awareness of health and environmental

concerns expected to play pivotal roles in shaping its trajectory. The demand for protein, particularly sourced from animals, has consistently been high due to global meat consumption. This demand for protein from animal meat and products is anticipated to persist in the coming years, showing continued growth. According to the OECD FAO Agricultural Outlook 2021-2030, the global consumption of meat proteins is projected to increase by 14% by 2030. Consequently, the demand for meat and meat products is robust and displays no indications of slowing down in the immediate future.

The trend of urbanization, marked by the increasing migration of individuals from rural to urban areas, has significantly impacted the meat products market. Notably, the convenience associated with processed and pre-packaged meat items plays a crucial role in driving market growth. Urban lifestyles, characterized by fast-paced routines and limited time for traditional food preparation, make these products appealing due to features like pre-cutting, marination, and cooking convenience. Moreover, the compact living spaces and on-the-go lifestyles in urban settings enhance the attractiveness of these products, requiring minimal kitchen equipment and aligning with fast and portable food preferences. The diverse culinary landscape in cities, reflecting various cultures and cuisines, contributes to the demand for processed meats that accommodate multicultural tastes. Additionally, the assurance of food safety and quality addresses concerns of urban consumers who may lack access to fresh and locally sourced meats.

In summary, the convenience offered by processed and pre-packaged meat products is a key driver of market growth in urban areas, meeting the diverse needs and preferences of the urban population.

The surging popularity of veganism is exerting a constraining impact on the meat products market, driven by a confluence of factors such as evolving consumer preferences, heightened concerns for

“In recent years, buzzwords like Big Data, Cloud, AI, and smart sensors have defined digitalisation. ProSweets Cologne 2026 will show how these technologies are transforming automation and quality assurance in the sweets and snacks industry.”

The manufacturers of sweets and snacks are facing a variety of challenges. New packaging lines must be quickly ready to operate so that production schedules can be maintained. At the same time, the output quantities must be achieved stably, and overall system effectiveness must be permanently assured, without malfunctions or down times. This is joined by the necessity to be able to adapt at all times to market requirements and consumer wishes, because, whether fruity, salty, soft or crunchy: variety at the point of sale is increasing –

and not only for the products themselves. From the family pack with a mixed assortment through the practical snack package for on the go to exclusive limited editions, consumers expect a large number of variants and options for personalisation.

The consequence: systems must be retooled more often. Efficiency, high machine availability as well as easy operation are

at the fore for the development of systems. “Called for are highly flexible solutions that allow easy and quick format changes and are subsequently quickly ready to use again. Those who modernise and have no fear of new technologies remain competitive”, says Guido Hentschke, Director of ISM Ingredients and ProSweets Cologne. With their numerous sensors and actuators, the systems in the sweets and snacks industry have long been highly automated, but not consistently data-supported. The producing companies require solutions that prepare enormous quantities of in some cases unused data for process optimisations. These can be found on the Cologne fair grounds. As a first step in the direction of the digital transformation, the technology providers are integrating intelligent sensors into the existing

billion by 2029

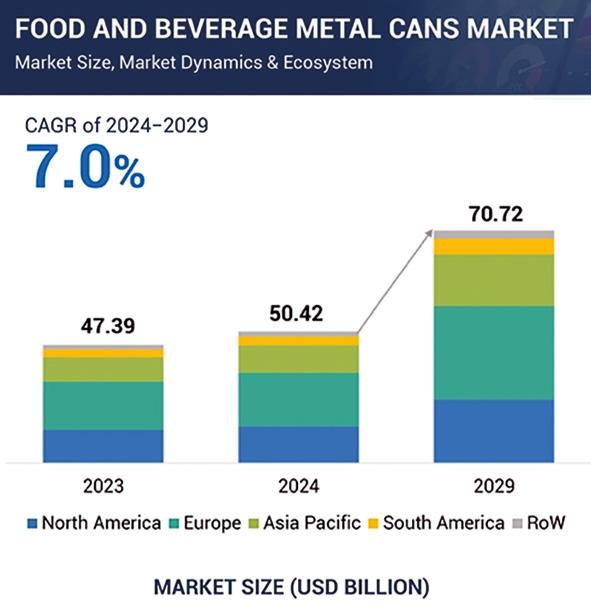

According to the MarketsandMarkets report, the global food and beverage metal cans market is projected to grow from USD 50.42 billion in 2024 to USD 70.72 billion by 2029, registering a CAGR of 7.0% during the forecast period. Metal cans remain a preferred choice for packaging food and beverages due to their ability to preserve appearance, texture, flavor, and nutritional value while ensuring food safety. However, the market faces challenges such as stringent regulations on materials like aluminum and steel and limited infrastructure in emerging regions.

Global food and beverage metal cans market dynamics

Companies are shifting to lightweight, durable food & beverage cans

In the food and beverage industry, companies are increasingly adopting lightweight and durable metal cans, leading to significant growth in the metal can market. This trend is driven by a demand for packaging solutions that provide sustainability, protection, and ease of transportation, all while minimizing environmental impact. Lightweight cans are particularly beneficial as they help reduce transportation costs and carbon emissions, which is crucial for companies striving

The growing use of these packaging options is hindering the expansion of the metal cans market. According to the British Plastics Federation (BPF) in 2020, 1.1 million tons of plastic packaging are recycled annually, with the UK recycling up to 39% of its plastic packaging each year.

The food and beverage metal cans market is driven by demand from food and beverage companies seeking durable, sustainable packaging solutions. Manufacturers produce cans using materials like aluminum and steel, focusing on recyclability and innovation to meet industry standards. Regulatory bodies ensure compliance with safety, quality, and environmental guidelines, while end users, including major beverage and food producers, adopt metal cans for their sustainability benefits. The ecosystem thrives on the growing demand for eco-friendly packaging and the collaboration between manufacturers, regulators, and end users.

The ecosystem analysis of the food and beverage metal cans industry highlights the interconnected roles of various stakeholders. Demandside companies, including Coca-Cola, PepsiCo, and Nestlé, drive the need for packaging solutions. Manufacturers like Ball Corporation, Crown, and Ardagh Group supply the metal cans, ensuring quality and scalability. Regulatory bodies such as FSSAI, ISO, and Aluminum Association maintain safety and environmental and industry standards. End users like Heineken and AB InBev use these cans to package their beverages, aligning with sustainability and market trends. This ecosystem reflects a collaborative effort between demand, production, regulation, and consumption.

The beverage segment is estimated to account for the largest market share

Aluminum cans are widely used to package beverages like soda, beer, and wine. In contrast, metal cans are commonly employed for packaging food items such as vegetables, soups, fruits, pet food,

Meat safety is still at the front line of consumer concern due to the need to control traditional as well as evolving pathogens, such as the ones resistant to antibiotics or preservatives, as well as other food-related stresses. For instance, bacterial pathogens such as Escherichia coliO157:H7 and Salmonellaspp will continue affecting the safety of raw beef, which means that there is a continuous need for advanced antimicrobial solutions, such as active food packaging technologies, which are able to ensure the microbial safety of the packaged beef, while enhancing its shelf life.

The main goal of a Spanish work published in Food Research International journal was the development of an antimicrobial food packaging solution for fresh beef meat, able to be effective without direct contact between package and food, by incorporating food flavourings in polymeric materials. To achieve this, the antimicrobial susceptibility of L. monocytogenes and S. enterica to diacetyl was evaluated. Then, diacetyl was entrapped in active gels through a gelation reaction involving sodium stearate and ethanol. Texture profile analysis was employed to determine the optimal amount of diacetyl that effectively inhibited the growth of Salmonella enterica at 37°C without compromising the mechanical properties of the gel and its handling. Diacetyl release from the active gel and from an active gel blend with porous food-grade cyclodextrin nanosponges (CDNS) was quantified by gas chromatography coupled to a flame ionization detector (GC-FID) at 37°C and 4°C. At 4°C, stearate gels released 0.13 ±0.01 mg per gram of material while the CDNS blends were able to release 0.55 ±0.05 mg per gram of material. In vivo testing of the antimicrobial efficacy of both components (gel and blend), in the form of sachets, was conducted in a packaged fresh beef meat artificially inoculated with Salmonella enterica under refrigerated storage. The blend dis-

played superior efficacy, inhibiting Salmonella by 77 %, on opposite to the gel (33 %). Furthermore, both sachets exhibited a high inhibitory effect (93 to 99 %) against common bacteria found in beef meat such as total viable counts, Pseudomonas spp. and lactic acid bacteria.

The efficacy of these cost-effective and easyto-produce antimicrobial GRAS sachets encourages their application as active food packaging technology, enhancing safety and extending the shelf life of fresh meat products.

A Polish research published in LWT – Food Science and Technology journal focused on assessing the alterations in the quality of pork ham slices packaged using various methods and stored for 28 days under refrigerated conditions (0-4°C).

The meat was packed in modified atmosphere packaging (MAP): MAP80/20 (80 % O2/20 % CO2),

The global end-of-line (EoL) & warehouse packaging automation market is currently experiencing a growth phase, with a compound annual growth rate (CAGR) of 7.9% forecast between 2024 and 2029 according to Interact Analysis. The latest report from the market intelligence specialist – EoL & Warehouse Packaging Automation – predicts the market value will increase from $5.1 billion in 2024 to $7.5 billion in 2029, with the Americas region and warehouse packaging automation anticipated to be significant drivers of growth.

Companies in the Americas and Europe are increasing investment in warehouse packaging automation to combat rising labor costs. Both regions are also seeing growth in end-of-line packaging systems for the manufacturing industry as high wage bills and regulatory pressures

State-of-the-art production robots are, to say the least, extremely capable. The secret behind this outstanding mechanical performance lies in image processing systems that transmit essential product data to packaging robots.

Work literally rolls towards the pick & place robots: conveyor belts often transport thousands of products per minute into production and packaging lines. Which biscuit or chocolate a pick & place robot then picks up and places into a tray, for example, is decided within milliseconds – and right at the beginning of the process.

Scanners are most often located above the conveyor belts to capture key product characteristics, ranging from colour and shape to height. Depending on

the operator’s image recognition requirements, advanced 2D and 3D scanners are available today to meet their specific needs. Both types have interfaces to the robot control system. They exchange the captured product data with the control system via real-time bus systems. Thanks to these, robots continuously receive coordinates at two-millisecond intervals. This allows data from up to 10,000 products to be transferred per minute – an absolute must for reliably processing large quantities in the shortest possible time.

Gerhard Schubert, which has played a leading-edge role in the development of scanner technology over the last forty years, uses its own software to transfer data to the robotics as smoothly as possible via the bus system. “We want to ensure that our image processing systems don’t have to convert the data into robot coordinates before it reaches the robots – and that they remain flexible when modifications are made to the line,” explains Daniel Greb, Head of Image Processing at Gerhard Schubert. For example, a manufacturer may want to integrate a robot with an additional axis into its line so that it can not only pick up products but also swivel them. In this case, the inhouse software enables smooth, seamless communication between the scanner and the robot because it can be quickly reprogrammed. This enables manufacturers to flexibly change the scanners’ inspection radius without having to interrupt production for long periods of time.

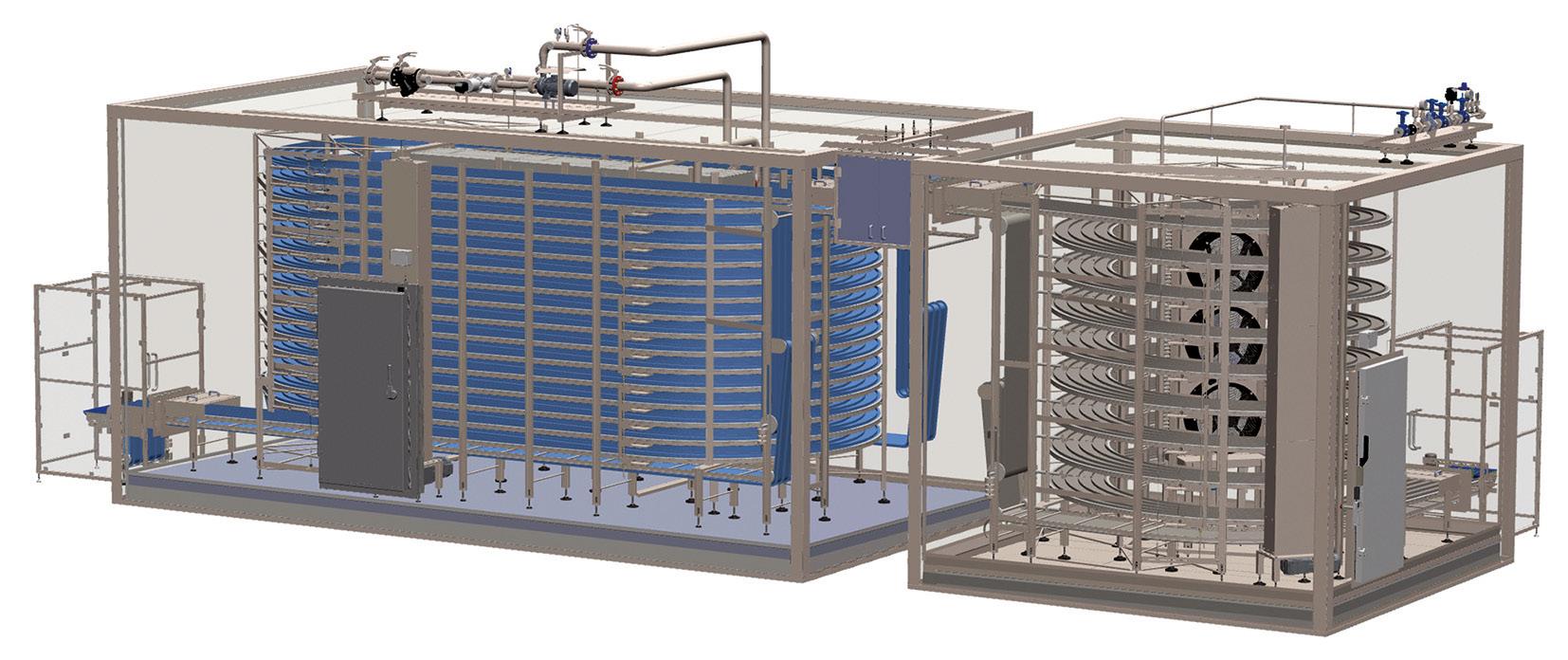

Tailor-made thermal processing lines combining pasteurization and cooling through a fully integrated system, ensuring efficiency, uniformity, and food safety.

With over forty years of experience in designing and manufacturing customized systems for the food industry, SARP is today recognized as a market leader in thermal processing for filled and sealed pouches

The company designs complete lines that integrate pasteurization and cooling in a fully connected system, ensuring precise temperature control, consistent product quality, and optimal energy use.

Under its dedicated business unit Food-ID, SARP develops advanced thermal treatment technologies for post-packaging processes, guaranteeing that products such as sauces, ready meals, dairy, baby food, and pet food maintain their taste, texture, and microbiological safety throughout the entire cycle.

Unlike many standard solutions, SARP systems offer independent treatment zones, integrated heat recovery modules, and modular layouts that adapt

perfectly to any production environment.

Each installation is characterized by hygienic design, easy accessibility for cleaning and maintenance, and spiral or multi-level configurations that deliver high productivity within a compact footprint

More than equipment, SARP provides a process-driven approach: every project is the result of close collaboration with the customer, translating specific production needs into efficient, reliable, and flexible thermal solutions.

Learn more at www.sarp.it

(Sarp - Via Montebelluna di S. Andrea 43 - 31033 Castelfranco Veneto - TV - Italy - Tel. +39 0423 482633 - email: sarp@sarp.it –www.sarp.it)

A rich source of natural color, beetroot (Beta vulgaris L. subsp. vulgaris) extracts and colorants offer deep red color to the dishes and boost their nutritional and antioxidant value.

A Moroccan research extracted beetroot color using Soxhlet, cold press, and ultrasonic methods. After testing the extracts

for yield %, color (L*, a*, and b*), betalains, total polyphenols, and antioxidant activity, the colorant was used to make ice cream. The results of three techniques revealed that the extract obtained from Soxhlet extraction (SE) has more total phenolic content (244.11 mg GAE/100 g), DPPH free radical scavenging activity (23.41%), significantly higher yield (48.05%), and better color results, as compared to the other extraction techniques. However, the contents of betalains (399.47 mg/L) were observed more in the extract obtained from ultrasonic extraction (UE). The extract obtained after the SE technique was further utilized in the ice cream manufacturing to check its acceptability in this product,

compared to the artificial color. Six samples of ice cream were developed having different ratios of beetroot-derived color and artificial color. Control ice cream (T0) contained artificial color, whereas ice cream (T5) was developed by replacing complete artificial color with beetroot-derived color. The other treatments (T1), (T2), (T3), and (T4) contained a combination of both natural and artificial colors with different proportions. Various quality parameters of these ice cream formulations, such as pH, acidity, brix, melting rate, overrun, and specific gravity, were studied.

The result, published in Food Science & Nutrition journal, signified that the addition of beetroot

color did not have a considerable effect on these attributes. The result of color analysis of ice cream suggested that the mean value of L* is higher in T5 (73.16), which only contains 0.1% beetroot color, and is lowest in T0 (65.24), which contains 0.1% artificial color. The addition of natural colorant resulted in a higher L* value. Sensory characteristics including color, mouth coating, flavor, aroma, texture, and overall acceptability of T5 showed more acceptance and significant results as compared to other treatments that contained artificial colors. Therefore, the beetroot-derived natural colorants could be employed to develop nutritional, healthy, and acceptable ice cream.

Grape pomace is a winery by-product with a high biological value that can be valorized in snacks production. A Romanian work aimed to explore the impact of white grape pomace type, seedless (SGPW) and with seeds (GPW) and addition level (1040%) on the chemical, antioxidant, color, texture, and sensory acceptability of maize snacks obtained through extrusion by means of Response Surface Methodology. Furthermore, the optimal addition level for each grape pomace type was selected and the optimal samples were characterized from a molecular point of view.

Mayonnaise is very susceptible to oxidation, due to the high lipid content, therefore the synthetic antioxidants are commonly used in the preparation of this sauce. The green coffee bean is one of the largest natural sources of phenolic compounds with antioxidant activity.

A Brazilian study published in European Journal of Lipid Science and Technology aimed to assess the feasibility of using an aqueous green coffee extract (GCE) as an antioxidant in mayonnaise. Three concentrations of GCE were tested (0.5%, 1.0%, and 1.5%). About 1.5% GCE did not affect the emulsion formation, pH, and textural parameters (p > 0.05). GCE demonstrated a greater delay in peroxide value during

28 days of storage when compared with synthetic agents (p < 0.05). GCE increased the phenolic compounds proportionally to the added concentration, enhancing their antioxidant activity compared to the synthetic agents (p < 0.05). About 0.5%-1.5% of GCE did not affect sensory acceptance (p > 0.05). GCE as an antioxidant for mayonnaise, replacing syn-

Acetoin and diacetyl are aromatic compounds that confer creamy and butter aroma to products such as yogurt and cheese. As such, they can also impart desired sensory properties to plant-based products such as dairy analogues. These compounds are produced by lactic acid bacteria, but few strains can produce amounts high enough to be considered relevant strains for its use as fermentation starters.

Therefore, in a study published in LWT – Food Science

and Technology journal, Spanish Researchers aimed to identify a great acetoin and diacetyl bacteria producer using different

thetic antioxidants, proved viable, especially at a concentration of 1.5%.

In light of consumers’ current interest in natural and functional ingredients, the use of GCE in the production of mayonnaise represents a promising strategy for the food industry, contributing to both oxidative stability and nutritional value of the product.

reported methods. We identified the Lactococcus cremoris strain CNTA 939 as a great producer of these compounds and optimized its production in synthetic medium and in plant-based milk alternatives. In the latter, it was detected that the availability of free amino acids is crucial for allowing good fermentation performance by strain CNTA 939, and it was demonstrated that relevant acetoin and diacetyl titers (115 and 8 mg/L, respectively) can be achieved without adding external supplements.

The content of phenolic compounds can affect the quality of cacao beans (Theobroma cacao L). The variation in the concentration of these compounds is influenced by factors such as cacao variety, fermentation conditions, and temperature, which play a crucial role in the method of bean drying.

In a Colombian study, the analytical method of ultra-performance liquid chromatography (UPLC-DAD-RI) was developed to identify, quantify, and examine variations in the concentrations of catechins (catechin, epicatechin, and epigallocatechin) and

methylxanthines (theobromine and caffeine) by subjecting the beans to controlled temperature fermentation. Three temperature-controlled treatments were used during fermentation on three cacao genotypes (CCN 51, ICS 95, and TCS 01). The average temperature in different treatments was T1: 41.14 ±3.84°C, T2: 42.43 ±4.39°C, and T3: 43.86 ±4.74°C.

The results published in Foods journal demonstrate variations in the concentration of phenolic compounds across the evaluated treatments (T1, T2, and T3). Catechin levels rose from the be-

ginning of fermentation up to day 5, after which they declined by day 6. Conversely, theobromine and caffeine concentrations decreased until day 5, then increased by day 6. A sensory analysis revealed a basic flavor profile (bitter, astringent, and acidic) that was balanced by enhancements in specific attributes, highlighting fruity, citrus, and cacao notes. A significant correlation (p < 0.05) was found between bitterness and the concentrations of epigallocatechin, caffeine, epicatechin, and total phenols. In contrast, a low correlation was observed between bitterness and theobromine and catechin. The astringent profile was directly correlated with epigallocatechin concentration and moderately correlated with theobromine and catechin levels. Acidic flavors showed a moderate correlation with epigallocatechin concentration. The cacao flavor was correlated with catechin and total phenols, while the citrus flavor was linked to total phenol concentration.

Notably, the decrease in phenolic compound concentrations and sensory analysis suggested that the higher fermentation temperatures observed in T3 may enhance the development of a superior flavor quality in cacao.

The ice cream industry generates considerable waste due to stringent quality standards and food safety regulations, creating resource recovery opportunities. This US study aimed to develop an efficient method for recovering high-purity fat from ice cream wastes using ethanol-induced emulsion destabilisation.

Ice cream was treated with varying ethanol concentrations (0%-50% w/w in water) and incubated at different temperatures. Increased ethanol and temperature accelerated the separation

of melted ice cream into phases (transparent liquid, continuous fat and opaque solid). Notably, 25% ethanol facilitated complete fat separation as a highly pure (>93%) phase, with the fat content exceeding 98% on a dry basis. Fat quality remained intact, as neither ethanol nor temperature affected fat hydrolysis or oxidation, based on peroxide value, free fatty acid levels and p-anisidine results.

The recovered fat represented about 50% of the original fat content in the ice cream, reducing

waste and enhancing by-product value. These results were published in the International Journal of Dairy Technology.

The use of new technologies that allow for improving conventional food preservation processes is what the industry has been adopting in recent decades, with high-intensity ultrasound (US) and the application of cryoprotectant agents (cryogels) being those that have become more relevant today.

For this reason, in a Mexican study, cuts of Longissimus thoracis pork frozen in liquid nitrogen with and without waxy starch cryogel and thawed under controlled conditions in water immersion and with US were used, evaluating thermal parameters such as the initial zone and the melting rate of ice crystals and

quality parameters such as pH, water holding capacity (WHC), microstructure, color profile, shear force, and surface changes. It was shown that the addition of cryogel modifies the initial fusion zone, that US-assisted thawing increases the fusion rate, and that both factors influence the quality parameters. However, the main effect on pH is the use of cryogel, unlike WHC, color parameters, and shear force, where the main impact is the thawing method.

These results, published in the International Journal of Food Science, conclude that waxy starch cryogel and the US at 50% thawing have the potential to apply assistance technology in food processing.

Chickpea is a very good source of protein for the development of protein-enriched plant-based ingredients. Chickpea protein isolates are primarily obtained by wet extraction methods such as alkaline or salt extraction. The energy input required for the production of chickpea protein isolates can have an impact on both the environment and processing, thus affecting nutritional quality and human health. Therefore, further research is needed to develop mild processing techniques for the isolation of chickpea proteins.

In a Turkish study, with the aim of developing a more efficient and effective method, chickpea proteins were isolated by ultrasound-assisted extraction and the process parameters were optimised using the Box-Behnken design.

Under the optimal extraction conditions (solid/solvent ratio 13.42 g/100 mL, pH=8.8, extraction time t=10 min, ultrasound amplitude 70 %), the highest extraction yield was obtained, 66.1 % with ultrasound-assisted extraction and 55.1 % with the conventional alkaline method. When comparing the ultrasound-assisted method with the conventional alkaline method, it was found that a higher

protein isolation yield was obtained with a 6-fold shorter processing time and a 29-fold lower energy consumption. Moreover, it was found that the water/oil absorption properties of the protein isolate obtained by the ultrasound-assisted method increased and its foaming properties improved.

This research, published in Food Technology and Biotechnology journal, presents a feasible ultrasound-assisted extraction technique for the isolation of chickpea protein, which can then be used as a versatile ingredient in the food industry.

The objective of this work was to evaluate the effect of mild microwave (MW) treatments (spanning from 31 to 99 J g-1) as an alternative to chemical dipping to prevent post-cutting browning of fresh-cut artichokes. Artichokes (‘Madrigal’) were treated before or after cutting and then wrapped in polyvinyl chloride (PVC) film for 6 days of storage at 5degreeC. Quality parameters were analyzed including gas composition within the package, visual qual-

ity of receptacle and cut bracts (appearance score), color parameters, total phenol content, antioxidant activity and polyphenol

oxidase activity (PPO). MW treatments (applied either on whole, before trimming, or on pretrimmed artichokes) resulted effective in delaying browning and preserving post-cutting quality of fresh-cut artichokes compared to non-treated ones. Some differences were also noticed between the MW-irradiated samples with a slight better performance when treatment was made on the whole artichoke. When coupled