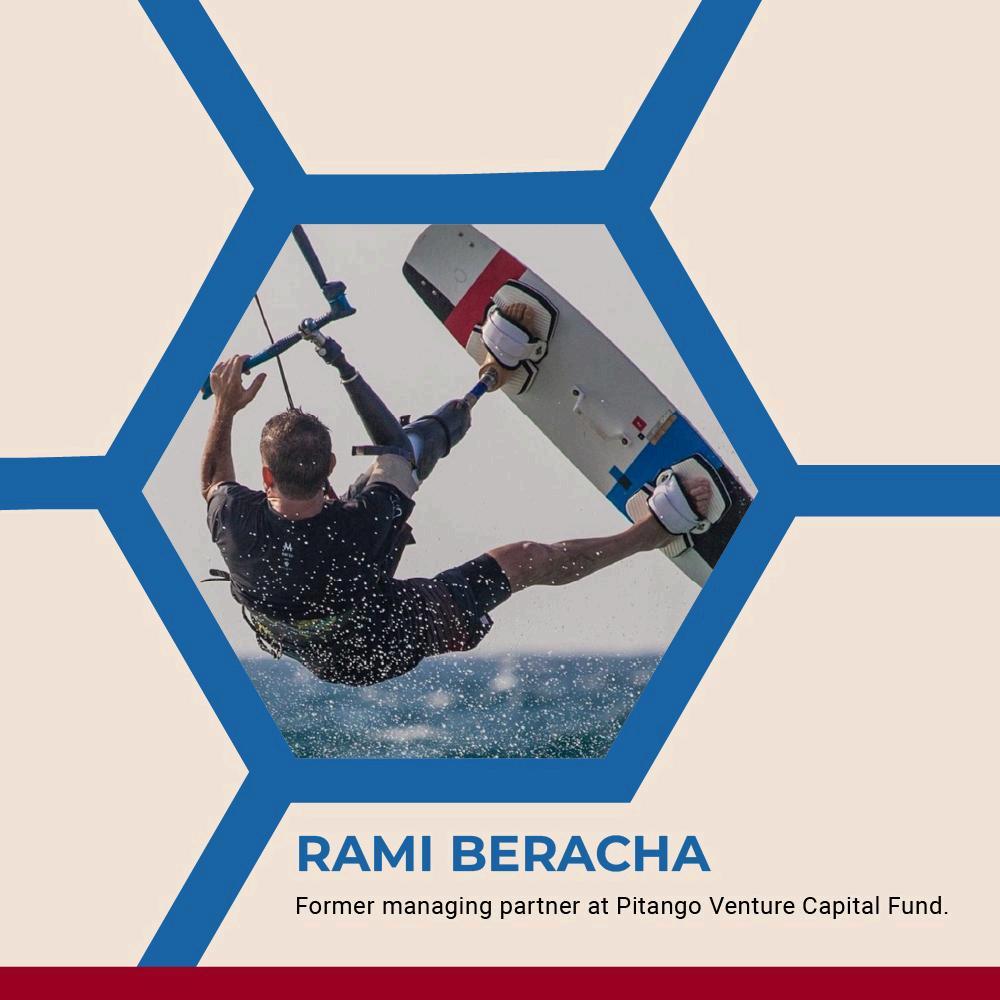

Rami Beracha: Why Smart Startups

Choose Their Investors Like Co-Founders

Rami Beracha emphasizes that most founders approach fundraising in a completely backward manner They're so focused on getting any check that they forget they're essentially choosing business partners who'll influence their company for the next decade It's like proposing marriage to someone because they have a nice car, then wondering why the relationship doesn't work out

The most innovative entrepreneurs I know flip this script entirely They treat fundraising like recruiting co-founders, because that's essentially what's happening. These investors will have a seat at your table during every major decision, from hiring your first VP to navigating acquisition offers. Choose poorly, and you'll spend years fighting with people who fundamentally don't understand your vision.

Here's the reality check: not all money is created equal Getting funded by someone who made their fortune in real estate feels validating, but when you're trying to figure out product-market fit for a SaaS platform, their advice could set you back months. Meanwhile, a VC who's guided three other companies through similar scaling challenges becomes worth their weight in gold

The relationship dynamic matters more than most founders realize. Some investors are hands-off cheerleaders who write checks and disappear until board meetings Others are micromanagers who want to approve every marketing campaign The trick is finding partners whose involvement style actually matches what you need. Early-stage founders often benefit from hands-on guidance, while experienced entrepreneurs might prefer strategic advisors who stay out of the day-to-day operations.

Cultural fit is enormous, too If your startup values move-fast-and-break-things innovation, partnering with risk-averse investors who question every bold move will create constant friction. On the other hand, if you're building in a regulated industry where compliance is crucial, having cowboy investors pushing you to cut corners could be disastrous.

The best VC relationships feel more like having brilliant older siblings who've already made all the expensive mistakes. They'll tell you the truth even when it stings, connect you with the right people at precisely the right moment, and help you see around corners you didn't even know existed.

The proof is in the portfolio Look at a VC's previous investments – not just the unicorns they love bragging about, but the companies that failed and how they handled those situations. Did they support founders through tough times, or did they disappear when things got messy?

Remember, you're not just raising money – you're choosing who gets to influence the next chapter of your story. Pick wisely, because once they're on your cap table, changing your mind gets complicated fast