THE CINEMA EXPERIENCE: How premium formats are driving global box office.

AUSTRALIAN FILMS: We examine strategies to get local films theatrical cut through.

DISTRIBUTION: Studios and independents give their insights into the market.

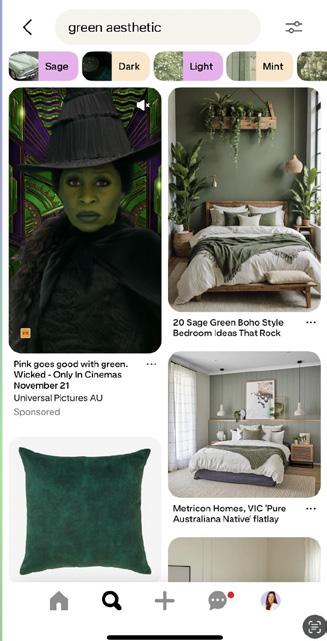

MARKETING: From TikTok to Pinterest, what’s the best way to reach under 35s?

INNOVATION: Leaders predict the future of F&B and cinema tech.

The Cinema Association Australasia is delighted to welcome delegates to the 78th Australian International Movie Convention (AIMC) Powered by Vista Group. Our association’s members contribute over 90 per cent of Australia and New Zealand’s box office, and the opportunity to meet, network, share ideas, get enthused about the slates of our studio partners, and collaborate with our trade partners and the filmmaking community remains vital as we continue to drive box office growth regionally.

The new AIMC team have been working to further enhance the AIMC experience by addressing your 2024 feedback. You will find that this year’s AIMC has more breaks, enhanced F&B and events, more keynotes, whilst capturing the same spirit of camaraderie and love for the cinema experience that the AIMC has become synonymous with.

Global box office this year will exceed A$50 billion, and locally we expect to end the year above the A$1 billion mark in Australia and $NZ170 million in New Zealand. There is global evidence that well-made, well marketed content, backed by exceptional cinema experiences, drives attendance and box office to the industry’s mutual benefit. Dips in box office continue to be directly correlated with a reduction in the amount of content released, so a steady stream of diverse, compelling and well promoted content released across the full calendar year is needed to increase frequency and box office.

Our association’s members continue to invest heavily in the cinema experience, and countless examples continue to surface evidencing the love audiences have for cinema. The industry is aligning around the value of longer windows, studios like Paramount Pictures are committing to increasing their film output (the studio plans to raise annual output from eight this year to 15 movies “very quickly”), streamers are dedicating sizable production budgets to films that release exclusively in cinemas first (14 films from Amazon MGM Studios in 2026), and the industry is well placed for the exciting next chapter of growth.

We can therefore be optimistic for what lies ahead given:

• Five of the top eight films in Australian

history have been released in the last four years.

• Cinema remains Australia’s most popular cultural venue or event (ABS)

• In the past 20 years (2004 – 2023), the Australian box office has exceeded $20.1 billion, creating jobs (~55,000 in 2021 as estimated by the ABS)

• Australian cinema ticket prices are one of the lowest globally from an affordability perspective, and this affordability sees Australia as a top ten international box office market globally, enjoying one of the highest box offices per capita globally. Without question, Australia and New Zealand have the most passionate, talented, committed and respected exhibitors and distributors globally. Whilst box office will increase this year, with more collaboration, we should expect more. As a highly respected country within our global industry, we can innovate and test opportunities more frequently, and the AIMC provides an ideal opportunity to discuss and debate these opportunities and agree on industry wide strategies that can be tested through 2026 and beyond.

We are incredibly appreciative of all the industry partners that support the AIMC, including the passionate distribution community, and our major sponsors the MPDAA, Vista Group, Asahi Beverages, Christie, the HOYTS Group, Screen Australia, Screen Queensland, the Gold Coast Film Commission and the City of Gold Coast.

A huge personal thank you also to the talented and hardworking AIMC team that has passionately curated this week’s event, taking over from the irreplaceable Sonia Deakin. Kerry Westwood, Rachel McGowan, Bec Pini, Rob Crawford and Tim Laven have all consistently delivered above and beyond any expectation, and I remain incredibly appreciative of the time, enthusiasm and passion that this team inject into the AIMC, ensuring that the event remains the leading Southern Hemisphere celebration of cinemagoing.

Welcome and please enjoy the 78th Australian International Movie Convention Powered by Vista Group!

#cinemaforever

Cameron Mitchell

Cinema Association Australasia - Executive Director

ALL ROADS LEAD to the Gold Coast as we celebrate the 78th Australian International Movie Convention.

Hosting this convention underscores our city’s ongoing support to the screen industry. For the past 30 years, we have partnered with other levels of government and the private sector to foster creativity and support the immense talent which exists across Australia and overseas.

Right now, there’s a lot happening with the City this year announcing a new creative industries precinct planned for Miami. The landmark project is set to become a centre for postproduction and visual effects. It will integrate this exciting industry into the local community, introducing a new neighbourhood hub for Gold Coasters. When open, the Miami Arts Depot will build on our industry training and logistics support for filmmakers.

We were also shortlisted as one of five destinations in the City of Film category at the Global Production Awards 2025 in Cannes, putting the spotlight on the Gold Coast.

As Mayor, I welcome delegates to the coast and look forward to hearing of the success of your convention as we work together to deliver excellence.

Tom Tate Mayor

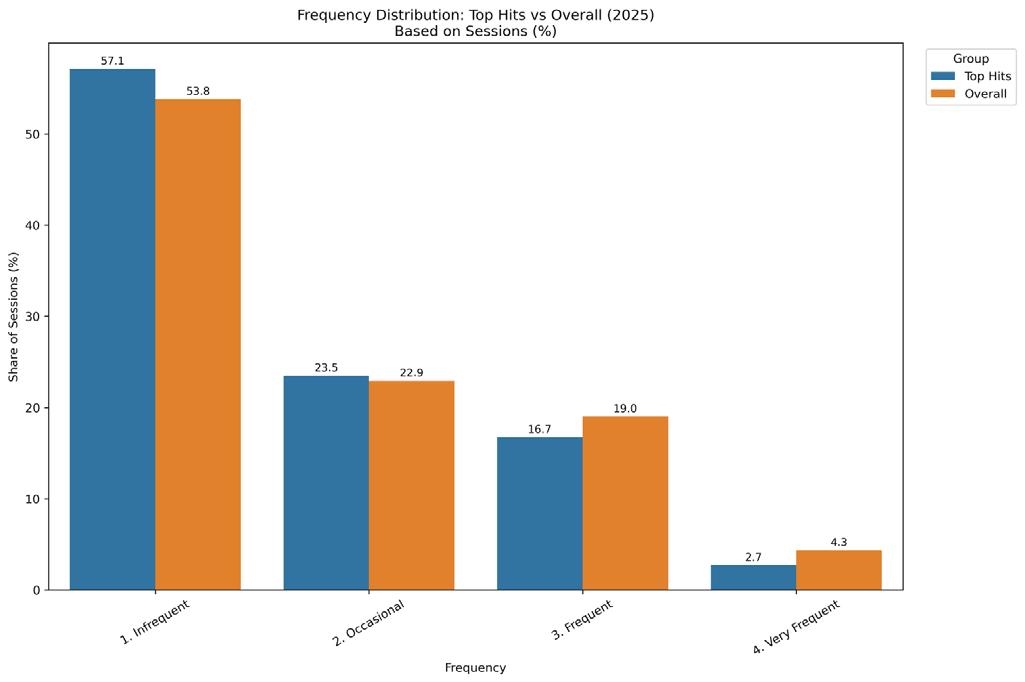

These snapshots, based on anonymised ticketing and loyalty program data from Movio, show how Australians are heading to cinemas. Among the top 10 films of the year through July (by total sessions rather than box office rankings), family outings, blockbuster franchises and repeat visits stand out.

Admissions Distribution

TOP TITLES IN 2025 APPEALED MORE TO INFREQUENT MOVIEGOERS

Top-performing films in 2025 saw a higher proportion of group ticket purchases, particularly in the 3–4 ticket range (+5.0pp) and 5+ range (+1.7pp)

In contrast, sessions involving singleticket purchases were underrepresented by –4.5pp, suggesting that leading films may have motivated more social or groupbased visits

While 2-ticket purchases also dipped slightly (–2.1pp), the overall pattern points to top hits being experienced more frequently as shared outings, possibly among families, friends, or small groups.

TOP FILMS IN 2025 SKEWED TOWARD

Infrequent/Occasional moviegoers made up a greater share of visits for top-performing films, while frequent visitors were slightly underrepresented.

Top-performing titles saw higher shares of larger-ticket purchases, suggesting stronger appeal for group or social outings.

Top-performing titles saw higher shares of larger-ticket purchases, suggesting stronger appeal for group or social outings.

ON MIDLIFE AUDIENCES (35-54) DRIVING SESSIONS:

“That audience double dips… they go for themselves for things like F1 and Mission, but that’s also the parental age that’s going to take the kids to Lilo and Dragon.”

MATTHEW LIEBMANN, VISTA GROUP CHIEF PRODUCT, INNOVATION AND MARKETING OFFICER

‘A Minecraft Movie’ is the highest grossing film of 2025 so far in Australia. (Photo

•Skewed slightly male overall (50.2%).

•Family films like Lilo & Stitch (66% female) and How To Train Your Dragon (60% female) pulled in mums with kids.

•Action/franchise titles like Superman (34% female) and Mission: Impossible – The Final Reckoning (39% female) tilted male.

•The male skew suggests the top 10 slate may have lacked strong “grown-up” female-skewing hits or broadly compelling family tentpoles.

•Audiences aged 35–54 were more prominent among topperforming films, while engagement among the oldest and youngest segments remained below average.

•Families: A Minecraft Movie, Lilo & Stitch, How to Train Your Dragon, Sonic The Hedgehog 3 all saw high shares of 3+ ticket sessions – reflecting family outings.

•Franchises: Jurassic World: Rebirth and Mission: Impossible – The Final Reckoning drove strong multi-ticket engagement, a sign of both familiarity and event-scale draw

•Takeaway: To drive larger party sizes or repeat visits, films benefit either from being kid and family friendly, or from offering a familiar, large-scale cinematic experience that audiences rally around.

“I would say that’s a supply issue, not a demand issue.”

DISTINCT AUDIENCE PROFILES EMERGE BY SESSION FREQUENCY

INFREQUENT MOVIEGOERS (<2 SESSIONS )

•54% of all sessions

•54% female skew

•Majority aged 22-44 (44%)

•Most likely to attend in pairs (50% were 2 ticket admissions)

VERY FREQUENT MOVIEGOERS (12+ SESSIONS)

•4.3% of all sessions

•66% male skew

•Older: 45+ make up nearly half

•Most likely to attend alone (58% were 1 ticket admissions)

ON VERY FREQUENT MOVIEGOERS:

“There’s a sort of fanboy mentality… They’re there for the previews, they’re there for the opening night. [But] even over the opening weekend, let alone the life of the film, the audience morphs to be more female and older.”

•Action films led the pack, making up 40.3% of sessions in the top hits (vs. 23.5% overall), a +16.8pp over-index.

•Family films (+11.2pp), Science Fiction (+7.9pp), and Fantasy (+6.3pp) also overperformed in the top 10.

•Meanwhile, genres like drama, horror, animation, and romance were not represented at all among the top titles from Jan to Jul, despite having a solid presence in the overall 2025 landscape.

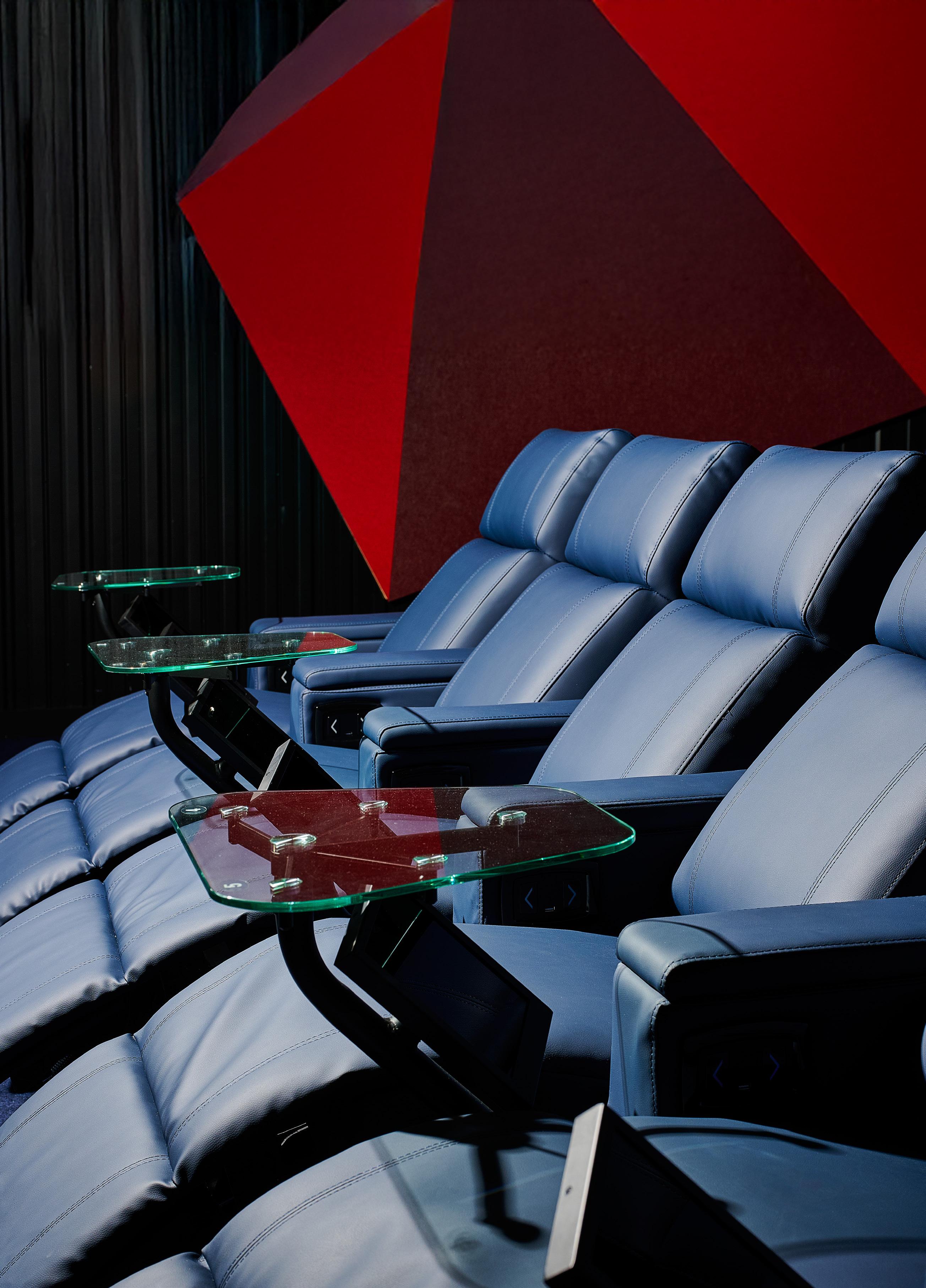

Exhibitors are doubling down on comfort, dining, spectacle and social experiences in order to give audiences reasons to leave the couch and head to the cinema. Jackie Keast reports.

Even as the box office continues to stabilise after years of disruption, Australia’s exhibitors are investing heavily in the next evolution of the cinema experience.

Premium formats such as IMAX, ScreenX, 4DX and D-BOX are expanding fast and driving significant box office returns – IMAX alone will have 10 sites across Australia by the end of the year, up from just two locations two years ago. At the same time, an uptick in out-ofthe-box event screenings and special programming are offering audiences more reasons to head to cinemas.

Event Cinemas currently sees around 50 per cent of its total box office derived from premium formats, from IMAX to the long-established VMax and Gold Class. For blockbuster titles like Mission: Impossible – The Final Reckoning or Superman, that number can surge even higher to around 65 per cent.

IMAX Sydney – operated by Event’s parent company EVT – ranks fifth globally despite having up to half the capacity of its top competitors, thanks in part to a custom seating layout, while Event’s ScreenX theatre in Campbelltown ranked third in gross revenue across the APAC region during its first 12 months.

Given the huge returns, EVT Group CEO Jane Hastings says it will naturally invest more in premium formats. It’s partnered with IMAX for a further four screens around the country, and has deals with CJ 4DPLEX for more ScreenX and 4DX theatres.

Exhibitors argue cinemas are increasingly becoming a destination for more than just films.

She argues the trend towards premium formats aligns with how cinemagoers now see moviegoing: as a valuable, elevated, social experience that complements, rather than competes with, watching at home. At Event, customers are spending more per visit, satisfaction scores are at record highs, and attendance remains strong when the right films are playing.

“Customers want choice at the cinema, and we ensure there is an experience for everyone – those that appreciate the original experience and those that prefer premium,” she says.

Hoyts Group CEO and president Damian Keogh agrees cinemagoing has become more ‘occasion-led’ since the pandemic, fuelling the growth in premium formats. The exhibitor has seen Xtremescreen and Lux admissions up 10 per cent year-on-year, D-BOX continues to grow, it’s opening two ScreenX theatres and five IMAX screens, and is experimenting with Samsung Onyx LED screens at Entertainment Quarter and Highpoint.

“When people go out, they want to experience something that is significantly better than what they can get at home,” he says.

“They want the different experiences, like ScreenX or D-BOX. And there’s still a lot who like the ‘business class’-type experience; dine in cinemas, being served food and drink while sitting on comfortable recliner chairs. “

Premium formats aren’t just for the majors either. Dendy Icon Group CEO Sharon Strickland says the independent chain’s IMAX Canberra screen, which opened last October, has had a spillover effect on its premium lounges.

“It’s brought people into our cinema who are then choosing our premium experience as well; if they can’t get into IMAX, they’ll go to premium,” she says.

Cinema Association Australasia executive director Cameron Mitchell predicts 20-25 per cent of each location will be devoted to premium offerings in the future. He observes the first sessions to sell out now are now typically in such formats, with the best seats within those auditoriums, like recliners, booked first.

While major exhibitors often use dynamic pricing for loyalty club members in PLFs, Mitchell argues price is almost “irrelevant” if the content and experience is right. Customers will even drive past nearby cinemas closer if it means they can see a film in their preferred format

“Exhibitors are telling me their premium concepts are at record levels,” he says.

“If anything, what’s struggling to keep up is the stock standard, generic experience, and that’s the challenge for the industry moving forward.”

In Mitchell’s view, exceptional screen and sound are now the bare minimum. It’s F&B, bars, lounges, hangout areas and other entertainment experiences that will define cinemas into the future. He points to Korea, where CGV calls its venues ‘cultureplexes’.

“Cinemas are becoming more of a destination, not just for cinema but for socialising,” he says.

Keogh agrees people are prepared to pay more for a better experience, noting there is a “flight to quality” across all out-ofhome experiences, from restaurants to sporting events.

However, while premium formats helped Hoyts increase its market share to 27.2 per cent in the first half of this year, the CEO admits there is serious capital investment involved in upgrading. Hoyts was lucky that it renovated most of its circuit prior to the pandemic, allowing it to cherry pick sites for PLFs

and other upgrades to see good return on investment.

“The challenge for all cinema operators, is that because the box office hasn’t recovered to pre-pandemic levels, and we’ve had that hiccup with the actors’ and writers’ strikes, is that from a business perspective, it’s been very challenging to commit additional capital,” Keogh says.

“We’ve been working very closely with our landlords – and in certain cases, had contributions from landlords – to assist in creating these extra experiences, because they can see the benefit in extra admits coming to their shopping centres, and the attraction of strong brands like IMAX.”

For independents, Strickland says you must be choosy about where and how to upgrade, but the added revenue from one upgrade should help bankroll the next.

It’s a point echoed by Independent Cinemas Australia CEO Brett Rosengarten, who says cinemas with smaller budgets don’t necessarily need to think large screens: “You don’t have to spend millions of dollars to offer a premium out-of-home experience.” F&B offerings can usually be improved without significant capital outlay, while some ICA members have had success with converting just the front row of auditoriums to recliners – a strategy also applied by Event Cinemas with its Daybed seating in select locations.

“We’ve got to be adapting and reinvesting in our cinemas. It’s a tough time to do it, because there was so much lost revenue both during COVID and the strikes,” Rosengarten says.

“We need to stay relevant as a major out-of-home entertainment experience... [if] people come back once or twice more, that’s what drives exponential growth.”

It’s a point echoed by Mitchell, who says replacing a 200-seat theatre with

100 recliners costs roughly the same as installing 200 new regular seats. A more comfortable chair will then likely improve the guest experience; they’d be willing to pay more and return more often.

“It’s no longer about who’s got the biggest capacity. It’s about who has the best experience.”

With the Hollywood strikes disrupting the content pipeline, many exhibitors have leant into creative events, festivals and special screening programs – again offering experiences that can’t be replicated in home.

At Dendy Powerhouse, an outdoor cinema in Brisbane, dog-friendly screenings on Sundays are just one such example of the experimentation underway (and yes, there are dog treats at the candy bar). The unique venue, which opened around 18 months ago, features a large screen set on shipping containers, a shipping container candy bar, festoon lighting and QR-code F&B ordering. Outcomes can be weather dependent, but retros, Q&As, and themed events have proved popular.

Across the broader Dendy circuit, film festivals, Q&As and interactive sessions – like its ‘Off Script’ events, which are singalong screenings – are also helping to draw crowds, and often younger audiences.

“People are just looking for something different,” says Strickland.

For an added revenue stream, Event Cinemas has hired cinemas out for conferences and corporate events, and with fewer releases in the market, has leant on alternative content and foreign language films, particularly Indian cinema, with success.

For the first time ever, the Australian production, distribution and exhibition sectors have come together in a joint research initiative that aims to understand the Australian public’s motivation for cinemagoing. The hope it will develop insights that will increase the frequency of cinema attendance in a time of rapid change.

Led by Dr Ruari Elkington and Dr Tess Van Hemert from QUT’s Digital Media Research Centre, the project brings together partners Screen Australia, Cinema Association Australasia, Independent Cinemas Australia, the Motion Picture Distributors Association of Australia and the Australian Independent Distributors Association.

While the results are still forthcoming, the research compares the results of two surveys of cinemagoers – one group are loyalty club members of multiple cinemas (CAA and ICA members) and the other, cinemagoers surveyed in-person by fieldwork researchers as ‘exit surveys’ upon leaving a cinema screening. Survey participants were asked to rate the factors they considered when making decisions around cinemagoing. With over 8,000 respondents, the data sets will provide insights across two groups who could be positioned as ‘more engaged’ (loyalty club members) and potentially ‘more casual’ (patrons exiting a screening who may not be loyalty club members).

“We program content to meet the demand of our local communities, and our communities are becoming more diverse,” Hasting says.

“In some locations these releases can outperform Hollywood titles.”

Yet while the impact of the strikes has prompted a lot of innovation, Hasting says: “There is still no replacement for what a great blockbuster movie can deliver commercially.”

“Hearing the upbeat announcements from the studios on an improving film supply is certainly great news.”

In the same vein, cinemas’ investment in cutting edge auditoriums will be for naught if there is not a range quality films appealing to all audience segments, Hasting says.

“After all, customers don’t come to a cinema to look at a blank screen.”

Hastings is the former chair of the Global Cinema Federation, which during her tenure conducted a survey of 68,000 moviegoers in 15 markets. Released in March, the research found the primary obstacle to cinema attendance was a lack of appealing films. Price was far less of a factor; 72 per cent thought cinema was good value for money.

The exec observes that as a result of the writers strike, in FY2024-25, among the top 50 films (which made up 75 per cent of GBO), there were only two comedies, five female-targeted films and one film aimed at older audiences.

“We had a good range of family and action/adventure films, even though our customers want more, and these audiences responded well,” she says.

“So, let’s be clear, you can invest in creating an amazing customer experience, but the primary admissions driver is having a film on the big screen that a customer wants to see.

“Of course, when you have a good film, it is the exhibitor’s role to ensure the experience is the best it can be.”

IMAX’s ambitious Australian expansion is well underway, with 10 theatres to be operating by end of year. IMAX chief sales officer Giovanni Dolci talks to Jackie Keast about how it’s tackling the market.

When IMAX Sydney reopened in October 2023, CEO Rich Gelfond announced plans for around 40 IMAX screens across Australia within the next few years.

It was a bold target: until then, Melbourne had been the country’s sole IMAX for some time.

IMAX chief sales officer Giovanni Dolci recalls people laughing at the ambitiousness of the plan. Yet two years on, IMAX already has four theatres in Australia, with six more to open by year’s end – just in time for Avatar: Fire and Ash.

From January to August this year, Australia’s IMAX sites generated $11 million, with the country ranking among the top 10 markets globally.

IMAX Sydney and IMAX Melbourne are among the most successful sites in the world, with Sydney in the top five and Melbourne in the top 15 – nothing to sniff at for a company with 1,800 theatres. Both were also among the 10 highest-grossing locations last year, while Australia led the world in per-screen-average at $4.5 million.

With these standalone sites already performing at the top level, Dolci says

•Global box office (Jan-Jun 2025): 3.6% BO share (with <1% of screens).

•IMAX drove 2025 hits: IMAX generated >20% of global opening weekend box office for Sinners, Mission Impossible – The Final Reckoning, F1: The Movie. This has only happened for five other titles in history.

proving the model in converted sites was the next step. He is “very happy” with how Dendy Canberra and Event Cinemas Pacific Fair – both opened late 2024 –are performing.

“The two operators, both Dendy and Event, did an extraordinary job ensuring that this was not a conversion of shortcuts,” he says.

This year has proved a “real turning point” in IMAX’s continued expansion, Dolci says, signing multiple deals. Village will open a theatre at Fountain Gate; Event has confirmed four more auditoriums, the first of which will open by the end of this year, and Hoyts is on board for five screens, including Chadstone, Melbourne Central, Blacktown and Carousel.

“What we see now is the brand has an incredible cachet,” says Dolci.

“The fact we went from one theatre to four, and we’re now going to 10, tells you that audiences are extremely attentive to the quality of experience.”

Ultimately, IMAX’s aim is to be in all of Australia’s major cities, though in places like Brisbane, it’s still searching for the right location.

As the rollout continues, most sites will be upgrades of existing cinemas, though standalone locations are possible if viable. Locations must make commercial and technical sense; if an upgrade, auditoriums with shorter throws are preferred, since “long, tunnel-like” rooms reduce immersion.

In its second quarter results, IMAX reported its global box office had climbed 41 per cent year on year to $281 million. It has a strong content slate ahead, from Christopher Nolan’s The Odyssey and Avatar: Fire and Ash to Dune:

Part Three and Avengers: Doomsday.

Dolci admits the calendar is only getting more crowded, with studios jostling for release slots years out.

However, he’s keen to stress “IMAX is not just a Hollywood format”. Local language content made up 20 per cent of IMAX’s global box office last year. Anime Demon Slayer: Infinity Castle became the highest-grossing IMAX release ever in Japan and set records across several Southeast Asian markets.

On the back of that kind of success, Dolci says the company “would love to do something with an Australian filmmaker.” While there have been a couple of early inquiries, nothing is firm yet, but he points to Australia’s “incredible history of filmmaking” as fertile ground for future opportunities.

“Ten years ago, there was the misconception often that IMAX was only about big action superhero movies. That concept has definitely evolved. We’ve proven that IMAX is a canvas for a wide array of titles and content, and that’s good because it allows exhibitors to tailor their programming strategy to what their audiences want and what they stand for,” he says.

With another 30 theatres on the horizon, Dolci says Australia is already a “real success story.”

“It could be frustrating if we were opening a small number of locations and it didn’t work that well, or if we didn’t have the backing of cinema operators. Importantly, I’ve got to admit there are instances like that.

“It’s really heartwarming to see a market where everybody’s rooting for it and backing the format.”

The future of cinema might just be immersive. CJ 4DPLEX

Americas CEO Don Savant talks to Jackie Keast about the rise of ScreenX and 4DX.

By the end of this year, the footprint of ScreenX theatres in Australia will have doubled, with more screens on the way.

ScreenX – designed by Korea’s CJ 4DPLEX, who also spearheaded the 4DX motion-theatre technology –presents films with expanded, dual-sided, 270° screens projected on the walls of a theatre.

While both ScreenX and 4DX have been around for years, each format has grown markedly since the pandemic, with North American grosses up 47 per cent in the first half of 2025 versus 2024.

CJ 4DPLEX CEO Americas Don Savant says the reason for its success is simple: “What we focus on is differentiating the cinema experience from the home.”

Relatively new in Australia, ScreenX debuted at Event Cinemas Robina in 2023, followed by Campbelltown. EVT has since signed a deal for a further six theatres across Australia, New Zealand and Germany. Alongside, Event operates seven 4DX auditoriums across Australia; it just opened Australasia’s largest theatre earlier this month at Marion in Adelaide.

Hoyts is also set to get into the ScreenX game, opening its first auditorium at Melbourne Central this month, with a further theatre to open at Blacktown in Sydney by end of year.

For EVT CEO Jane Hastings, ScreenX numbers “speak for themselves”.

“ScreenX delivers stronger occupancies on higher yields and customers will travel to enjoy the ScreenX experience,” she tells IF.

“Campbelltown’s ScreenX was the third highest ranking ScreenX in the entire APAC region for its first 12 months, with Twisters putting Campbelltown ScreenX in the top 10 grossing ScreenX auditoriums worldwide.

“It is truly unique and immersive.”

According to Savant, ScreenX’s first true hit was 2018’s Bohemian Rhapsody, which showcased the format’s power

through its transitions between the intimacy of Freddie Mercury’s parents’ apartment and the panoramic immersion of Wembley Stadium. Its post-pandemic growth has been driven by actively engaging studios and talent, “explaining what ScreenX can do for them, so that they can use it as a tool for their artistic vision.”

Joseph Kosinski embraced the format, shooting Top Gun: Maverick with 180° cameras on the planes’ wings and repeating the approach on F1: The Movie with cameras on the cars. Similarly, he personally oversaw each film’s 4DX motion sequences.

“When you watched Top Gun in ScreenX, you saw footage that no other PLF had because it was outside of the main frame,” Savant says.

“It’s really up to the director to when they utilise the screen ‘wings’, but we are now increasing the time to over 60 minutes per film. If you looked at How to Train Your Dragon or Jurassic, we’re 80 minutes+ on each of those films.”

Savant notes that the goal isn’t to fill the side screens constantly, but to use them strategically. “In some interior scenes... the side walls should be black, because you want your attention fully focused on the main screen. But as things open up, that’s where it gives us the opportunity to add image outside of the main screen.”

If a film isn’t shot using 180° cameras, the ScreenX team will take B-roll, and via its in-house VFX company, create footage that can run on the ‘side wing’ screens.

“All of it is passed by the studio, the producers, the director, the editor… it’s their creative vision. It’s their decision, not ours. We’re there to support and execute,” Savant says.

Each year, CJ 4DPLEX handles about 25 Hollywood films for ScreenX, plus Korean, Japanese, and Chinese titles, and is now branching into Indian and French projects. In 4DX, the slate usually has 40-45

Hollywood films a year, plus local content.

“Local content is driving the cinema business, and so we want to be there to support it,” Savant says.

“We’d love to do Australian films. As long as it has scope and it’s something that we can help them release internationally, I think it’d be a benefit for both.”

As a supplement to its main slate, CJ 4DPLEX is also filming concerts for ScreenX but releasing them to other PLF formats such as VMax. Historically this has been K-pop and J-pop concerts, but the company has recently shot concerts for Kygo and Linkin Park, as well as Christina Aguilera and Paris Hilton documentaries that feature music.

To bring these experiences to audiences, the company works closely with exhibitors to install screens. ScreenX requires a roughly 15-metre-wide flat screen, while 4DX, Savant notes, can transform under-utilised mid-size auditoriums into high-revenue, immersive venues attracting 8-30-year-olds.

“We’re getting them off the phone, getting them off of streaming and gaming, and into the theatre, giving them something really exciting,” he says.

As ScreenX and 4DX continue to expand globally, CJ 4DPLEX is betting that immersion – not just bigger screens – will be the key to sustaining box office growth.

“That’s really the beauty of it,” Savants says. “That’s why the directors are getting so excited about what it does and how it differentiates.”

Distributors reflect on the highs and lows of the past year, preview what’s next, and outline how they’re navigating today’s market.

MIKE BAARD, MANAGING DIRECTOR, UNIVERSAL PICTURES INTERNATIONAL AUSTRALASIA

What’s fuelling box office growth, and what challenges are still shaping the market?

Audiences recognise the impact of seeing a major event film on the biggest screen possible and are gravitating to those experiences. We are seeing “the big films” getting bigger, to use that turn of phrase. We are seeing this trend in many markets around the world. It suggests that every film must be an “event” for someone; just offering a generic film is not going to be sufficient to justify a visit to cinemas.

The challenges are not unique to cinema: the increased cost of living, less discretionary leisure time, more competition for the leisure dollar. Cinema remains a highly cost-effective out of home entertainment option. Our industry needs to continue to promote our benefits and how strong our value for money proposition is.

What titles this year have you been particularly pleased with, and what drove their success?

Our goal with our biggest brands is to drive cultural ubiquity that fuels interest and urgency creating unmissable events for audiences. That was the case with several of our highest grossing films (A Minecraft Movie; F1: The Movie and Superman for Warner Bros; Jurassic World: Rebirth and How To Train Your Dragon for Universal).

We’ve also been strategic in cultivating fandom within genres. We’ve had enormous success with horror (Sinners, Weapons, The Conjuring: Last

Rites, Final Destination: Bloodlines, Nosferatu) and curating for upscale audiences (The Brutalist, Black Bag, The Phoenician Scheme).

What films are you most excited by on your upcoming slate?

We are heading into what we hope will be a very successful two years for the Universal slate, anchored by our animation studios bring new instalments of some of the most successful franchises (The Super Mario Galaxy Movie, Minions 3, Shrek 5) along with the live action adaptation of How to Train Your Dragon 2. We have the next films from Christopher Nolan and Steven Spielberg as well as the much-anticipated Michael Jackson biopic, Michael.

For Warner Bros. the upcoming slate will see DC returning with Supergirl and Man of Tomorrow, and the first animated title from WB’s new division, The Cat in the Hat Dune Part Three from Denis Villeneuve will be a huge event for his fans and we are excited to see the next collaboration between Margot Robbie and Emerald Fennell with their reimaging of Wuthering Heights

The Global Cinema Federation survey found the primary obstacle to cinema attendance worldwide was a lack of appealing films. What are your reflections on this?

It’s very helpful to have research to guide the decision on what to put into production. I can understand the concerns for the volume of films. No studio has

released more theatrical films since the beginning of the decade than Universal, and we have around 15 films a year from Warner Bros., so the studios we represent are doing their best to deliver the breadth of titles the market requires. It is encouraging to see Amazon MGM Studios committing to a full slate of films which will help increase the volume of releases. However, it’s more than just a volume game – it’s about creating films audiences genuinely want to see, and ensuring that the cinema environment is a place they will leave their homes for. I am very confident that the cinema experience in ANZ is world-class and commend many exhibitors who continue to invest in creating amazing cinema experiences for audiences.

At CinemaCon this year, US exhibitors called for a 45-day theatrical window. What is your current approach in ANZ? It varies from film to film, there is no standard window across the entirety of the slate.

In December 2025, movie-goers will return to the colourful and mystical world of Pandora as Avatar: Fire and Ash releases in cinemas But are you ready to give your audiences an unforgettable experience?

With 3D enjoying a renaissance, there’s never been a better time to upgrade your screen! Whether you ’ ve recently upgraded your projection system moving to laser, in need of more peak brightness for ageing xenonbased projection or simply in need of a new screen, there’s never been a better time to buy yours

At Harkness we have a range of 2D and 3D screen surfaces designed to help you create a premium viewing experience for your audiences

Ahead of Avatar: Fire and Ash, check how your auditorium is performing with the all-new HSG Labs Checker, the lowcost brightness and audio checking device

Suitable for use with all types of projection including xenon, phosphor RB and RGB laser

www harkness-screens com

sales@harkness-screens com

JOSH BRIGHAM, GENERAL MANAGER, STUDIO, ANZ; KYLIE WATSON-WHEELER, SENIOR VICE PRESIDENT AND MANAGING DIRECTOR, ANZ

What’s fuelling box office growth, and what challenges are still shaping the market?

JB: Big blockbusters are bringing the biggest audiences locally. What’s most pleasing to see is that cinemagoers are seeking out special eventised screenings or sessions that elevate their movie watching experience. We saw huge success recently with our eventised Tron: Ares sessions at IMAX and our themed previews for Springsteen: Deliver Me From Nowhere. We will continue showcasing the power of the big screen and attracting cinemagoers in this way.

The shortened windows to PVOD remain a challenge for our industry to grapple with. It’s particularly impactful for smaller releases that may be marketed as ‘express from cinema’, which can have the effect of dampening the urgency and momentum a film needs to fuel a theatrical release.

What titles this year have you been particularly pleased with, and what drove their success?

KWW: Disney’s live action Lilo & Stitch is the only Hollywood film to achieve $US1 billion at the global box office in the 2025 calendar year. We’ve had four billion-dollar films in the last two years. Driving this success were incredible campaigns. We had a little fun with Stitch and created some mayhem in market befitting of his character. Moana 2 (another billion-dollar hit) and Mufasa: The Lion King were also huge successes and had sustained campaigns throughout last summer. We know audiences will love Zootopia 2, and of course, Avatar: Fire and Ash will finish the year and continue the Avatar cultural phenomenon. We’re pleased to see the strong Marvel brand affinity continue to draw in local audiences with three films delivering around $50 million in Australia this year.

What films are you most excited by on your upcoming slate?

JB: We have an exciting finish to the year with Avatar: Fire and Ash. James Cameron and the Lightstorm team have made the film for the big screen and it’s simply unmissable. In 3D! Zootopia 2 is the highly anticipated sequel to the original that took in more than $US1 billion globally and $31 million in Australia. Looking to 2026, the hits keep on coming, with Toy Story 5, The Mandalorian and Grogu, The Devil Wears Prada 2, live action Moana, and Avengers: Doomsday Don’t make me pick a favourite! We can’t wait to screen Searchlight’s Rental Family at AIMC this year, which is a perfect showcase of the strength of the studio’s line up for the next 18 months, with supporting those films remaining a key focus for us.

How important is the ANZ market to your global strategy? How do you currently tailor releases or marketing for local audiences?

KWW: Australia and New Zealand are important markets for The Walt Disney Company. We have deep local expertise in studios distribution and marketing. We review all films and tailor our release plan to work according to the market dynamics which we understand, such as holiday patterns and cultural nuances. It’s not always possible but we consider every date. Our marketing campaigns always have a local and loved approach to tap into the cultural zeitgeist. We take great care to ensure every campaign is tailored to our Aussie audiences. Bringing big-name Hollywood talent to our shores for our film launches helps us to create a deeper, more meaningful connection with local audiences. We certainly saw this with Fantastic Four: First Steps and Freakier Friday

What initiatives are you pursuing to strengthen partnerships with local exhibitors? How do you see the role of exhibitors in driving awareness and engagement for your films?

JB: The partnerships we have with local exhibitors are crucial to our collective success. Trailering is something we remain focused on as an important way to showcase our upcoming releases to drive audience awareness and engagement. We must prioritise trailering over advertising in the preshow. We also want to push creative boundaries to bring audiences into the cinema for the first time, as the big screen experience is a one of a kind. We can also deepen and extend the ways we work together to reach audiences – for example, by better leveraging databases and social channels together.

At CinemaCon this year, US exhibitors called for a 45-day theatrical window. What is your current approach in ANZ?

JB: Recently Disney has seen huge success with longer windows for our blockbusters, including Inside Out 2, Deadpool & Wolverine, Moana 2 and live action Lilo & Stitch. These are all $US1 billion movies and had 100-day windows to Disney+, where they continued to deliver for audiences.

BRIAN PRITCHETT, VICE PRESIDENT AND MANAGING DIRECTOR AUSTRALASIA

What’s fuelling box office growth, and what challenges are still shaping the market?

People are gradually rebuilding the habit of going to the movies after the pandemic, and that’s being fuelled by a strong mix of original content and well-established franchises. These titles are reigniting interest and giving audiences a reason to return. However, my biggest concern remains the younger demographic – many of them are losing the cinemagoing frequency.

As an industry, we need to do a better job of crafting compelling narratives that resonate with audiences and encourage more frequent cinema visits.

The rising cost of living is another challenge. With so many content options available – many of which are more affordable than a trip to the cinema –audiences are making tough choices, especially during financially strained times. We’re also still working to rebuild the volume of theatrical releases to prepandemic levels.

The recovery has been slower than hoped, but I’m confident we’ll get there by giving audiences great stories that drive them out to theatres, and offering something for everyone.

Now more than ever, collaboration across the industry is essential. We need

to leverage reliable data sources to gain deeper insights into audience behaviour and preferences. That’s how we’ll continue to deliver real value to our customers.

What films are you most excited by on your upcoming slate?

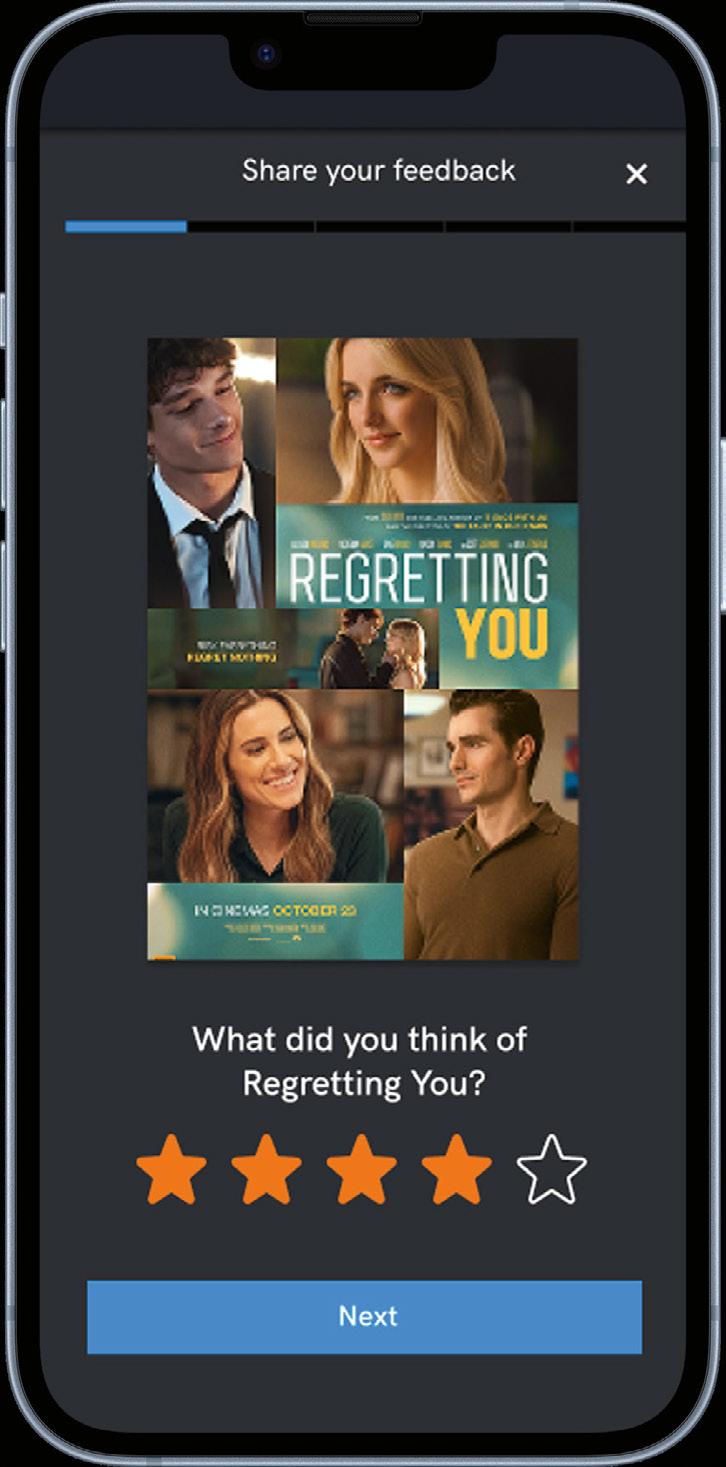

I’m really excited about Regretting You, which is set to release in October. It’s tailor-made for our female audience, which is one of the most frequent cinemagoing segments in ANZ. The film is based on the work of Colleen Hoover, who also wrote It Ends With Us, and it’s directed by the same filmmaker behind The Fault in Our Stars. It’s a powerful, emotional story that I believe will really connect. Running Man is another one I’m personally thrilled about. It’s directed by Edgar Wright – one of my favourite directors – and stars Glen Powell, who’s having a phenomenal moment. It’s a high-energy action thriller with a compelling story and cast, and it’s coming in November.

And of course, we have The Spongebob Movie: Search For Squarepants arriving on Boxing Day. I genuinely believe this is the funniest and most entertaining entry in the franchise yet. It’s a film that will delight families and every generation that’s grown up with our beloved Sponge and his best mate Patrick.

How important is the ANZ market in your global strategy?

ANZ is a critically important market for us. Depending on the title, this region can rank in the top five international markets. We consistently overperform with comedies, family films, and dramas. It’s a market with one of the highest cinema attendance frequencies globally, and I love seeing families filling cinemas during school holidays. Young kids are the next generation of moviegoers, and it’s vital we continue to nurture that.

Even horror, which historically hasn’t been as strong in Australia, is gaining momentum. And the female audience here is incredibly engaged – they attend frequently and drive performance for many titles. That’s why we always aim to include elements in our marketing that appeal to women and couples, helping us broaden the reach and impact of our campaigns.

STEPHEN BASIL-JONES, EXECUTIVE VICE PRESIDENT AND MANAGING DIRECTOR, SONY PICTURES RELEASING ANZ

What’s fuelling box office growth, and what challenges are still shaping the market?

Box office growth fluctuates depending on content. Audiences are fragmented and films need to both appeal to an audience and be deemed worthy of the theatrical occasion. When the right film hits the right audience and delivers for them, the box office will surge, as we’ve seen it do on multiple occasions this year. One of the key challenges of the market is the flipside – when a film does not appeal to or deliver to that audience; the box office doesn’t deliver. The oft-quoted –there is no ceiling, and there is no floor.

The industry still faces challenges from streaming, piracy, consumer confusion over windows, and the multiple entertainment choices available to the consumer. Franchise/IP-driven titles continue to drive box office, but growth is being fuelled by event titles that have cultural currency which help bring in younger and wider audiences.

What films are you most excited by on your upcoming slate?

We are excited about our eclectic range of upcoming titles, including the locally-filmed action/comedy/adventure Anaconda, releasing on Boxing Day,

starring Jack Black and Paul Rudd, two comic geniuses and just perfect for the Australian market in summer. Also opening in the Christmas window is a wonderful British film, The Choral, starring Ralph Fiennes. We are looking forward to the next chapter in the 28 DAYS franchise, 28 Years Later: The Bone Temple, releasing in January on the back of the extremely well received and commercially successful 28 Years Later. Swinging into cinemas next July is the much-anticipated blockbuster Spider-Man: Brand New Day. We’re also incredibly fortunate to have our slate bolstered by some outstanding film product from Amazon MGM, a distribution pact recently announced which also includes the very high-profile film Project Hail Mary, starring Ryan Gosling and releasing in March.

The Global Cinema Federation survey found the primary obstacle to cinema attendance worldwide was a lack of appealing films. More than half of

respondents also said they wanted to see more comedy. What are your reflections on this?

We need strong, elevated comedy back on the big screen, with marketing campaigns that feel like cultural events, and to remind audiences that laughing together in a cinema is a best-shared experience. The GCF survey demonstrated that there is audience desire for this much-loved genre on the big screen – particularly in Australia where we have historically dramatically over-indexed on comedy box office. We are looking forward to bringing the hilarious Anaconda to cinemas on Boxing Day – and to more tentpole comedies on the slate.

How important is the ANZ market in your global strategy? How do you currently tailor releases or marketing for local audiences?

We are a strong, mature cinemagoing market, with the highest per capita cinemagoing rate in the world. At Sony

we are often a top 5 market theatrically. We have an important voice at the table in what movies get made, how we feel they will fare in Australia, and how they are marketed locally for strongest audience appeal. Where we need more executional nuance in our key marketing materials than a domestic or an international approach, we will work with the studio to ensure we are marketing a film as we need to. We also work closely with the studio, local media and exhibitors, for talent and content-creator content that is bespoke to our market and audience.

At CinemaCon this year, US exhibitors called for a 45-day theatrical window. What is your current approach in ANZ? Sony continues to be a strong supporter of the theatrical experience. Like all distributors, we need to be smart about how we communicate to audiences, so they are not confused about how quickly films are available on ancillary platforms.

What’s fuelling box office growth, and what challenges are still shaping the market?

A strong Q2 heavy on tentpole titles really propelled the local box office after a sluggish start, specifically blockbuster studio titles like Minecraft, Lilo & Stitch, Jurassic World Rebirth and How to Train Your Dragon. There’s plenty of talk at the moment around ‘eventising’ a film’s theatrical release and those large-scale films certainly succeeded in achieving that. But challenges remain at the lower end of the theatrical scale, where cut through can feel even harder to achieve right now and the continuing cost of living pressures mean that moviegoing audiences are becoming even more selective about what they choose to watch in cinemas and how they value content.

What titles this year have you been particularly pleased with, and what drove their success?

From a Roadshow perspective we

were thrilled with the results our team achieved on Conclave ($8.76m). Early WOM screenings, a prime January release date that captured the awards buzz the film was garnering, and of course a little real life Vatican drama helped. We saw some great success on smaller prestige dramas Small Things Like These and Widow Clicquot. Again, setting these films up with early WOM preview screenings, tactical partnerships and strong noncompetitive release corridors really helped drive the outcomes on these titles. Outside of our own slate, with an eye on the overall health of the industry, I was really pleased to see titles such as Sinners, Tinā, We Live in Time and Materialists capture audience’s attention and deliver strong results.

What films are you most excited by in your current slate?

I was fortunate enough to attend the premiere of David Michôd’s Christy at TIFF in September and the audience

response throughout that screening was electric. The obvious discussion point is Sydney Sweeney’s standout performance as pioneering female boxer Christy Martin, but beyond that it’s such an inspirational story and a real crowd pleaser – by the end of the film the whole auditorium was clapping and cheering Christy on. Roadshow have partnered up with Kismet on this release and we couldn’t be more excited to be bring it to cinemas in January. I would be remiss not to also mention our upcoming local production Addition, which sees Roadshow once more working together with our friends at Made Up Stories. It’s a delightful romantic drama starring Teresa Palmer and Joe Dempsie and everyone at Roadshow feels very passionately about sharing this with local audiences from January 29.

PAUL WIEGARD, CEO AND CO-FOUNDER

What’s fuelling box office growth, and what challenges are still shaping the market?

Two areas of growth that are of interest: i) the expansion of IMAX locations and ii) the resurgence of major local film festivals, which saw a 20 per cent plus increase in attendance compared to 2024. IMAX is delivering on the promise of providing a big screen ‘experience’ and festivals are a vital platform for independent films, allowing us to build awareness and generate marketing momentum for

wider national releases. A key challenge for both exhibition and distribution is the difficulty of reversing negative public sentiment or igniting greater interest in a film that underperforms initially. Once a film loses momentum, the decline can be alarmingly rapid.

What titles this year have you been particularly pleased with, and what drove their success?

FY25 proved to be a banner year for Madman, with strong slate consistency driving success. We’re incredibly proud of our eight Academy Award-nominated films, including The Substance, The Apprentice, Flow, Memoir of a Snail, Sing Sing, and Porcelain War. Several titles, such as Flow, The Penguin Lessons, Kneecap, Becoming Led Zeppelin and The Substance, exceeded $1 million at the ANZ box office. Tinā was the standout, generating $10 million, resonating deeply with the Pasifika community and beyond. The film sung a song that audiences wanted to hear.

What films are you most excited by in your current slate?

I’d happily wax lyrical about every one of the films currently slated for FY26 release. Focusing on four films that represent our portfolio approach:

• Sentimental Value: Joachim Trier’s film, winner of the Grand Jury Prize at Cannes Film Festival is an intimate and moving exploration of family, memories, and the healing power of art. A Boxing Day release.

• Nuremberg: A stunning performance by Russell Crowe, immersing himself in the role as the duplicitous Hermann Göring.

• Pike River: Three-time Emmy nominee Melanie Lynskey and acclaimed NZ actress Robyn Malcolm star as Anna Osborne and Sonya Rockhouse; two ordinary women who lost their loved ones in the 2010 Pike River Mine explosion, and become leading voices in the families’ fight for truth and accountability.

• Crowded House: Mischievous, funny, clever and talented. This cinematically intimate feature-length documentary dives deep into the Crowded House journey. Directed by Richard Lowenstein (Mystify).

ELIZABETH TROTMAN, CEO

What’s fuelling box office growth, and what challenges are still shaping the market?

Film is driving this growth, with strong performance from Demon Slayer, Weapons, F1 etc. The challenges still facing the market are cost of living pressures as consumers consider where best to spend their discretionary dollar. I think we will see a further lift as interest rates come down further.

What titles this year have you been particularly pleased with, and what drove their success?

We are delighted with our $17.8 million result for Paddington in Peru. This was a huge lift on the previous two and shows you the work we have done building the franchise in the marketplace. I think also that because Paddington 2 was such a great film, this helped drive the growth for no. 3.

What films are you most excited by in your current slate?

I’m excited by the release of Kangaroo

This film has been in development and production for over ten years and is our first local production. We are thrilled with how well the film has turned out, audiences are responding well to it, and it is now the tenth highest grossing local Australian film to release in Germany.

The Global Cinema Federation survey found the primary obstacle to cinema attendance worldwide was a lack of appealing films. More than half of respondents also said they wanted to see more comedy. What are your reflections on this?

Comedy can be a tricky genre as it can be harder to make people laugh than

it can to get them jumping out of their seat with horror. I also think comedy requires bigger stars to work theatrically, than a lower budget horror needs to be commercial. And of course, the action genre delivers great commercial results through the home entertainment and TV windows if it works theatrically.

In a market still dominated by major releases and evolving audience habits, how are you ensuring smaller and independent films get visibility and engagement in cinemas?

As the audience is shifting more to online platforms, we have benefitted from reduced free-to-air TV advertising costs. Furthermore, our films complement the American franchises e.g. quality British drama like We Live in Time or entertaining local comedy like Kangaroo!

What is your current approach to the release window in ANZ?

Films are expensive, so we need to protect our windows as much as possible. But if a film under performs at the box office, we do occasionally need to react to that and shorten the window.

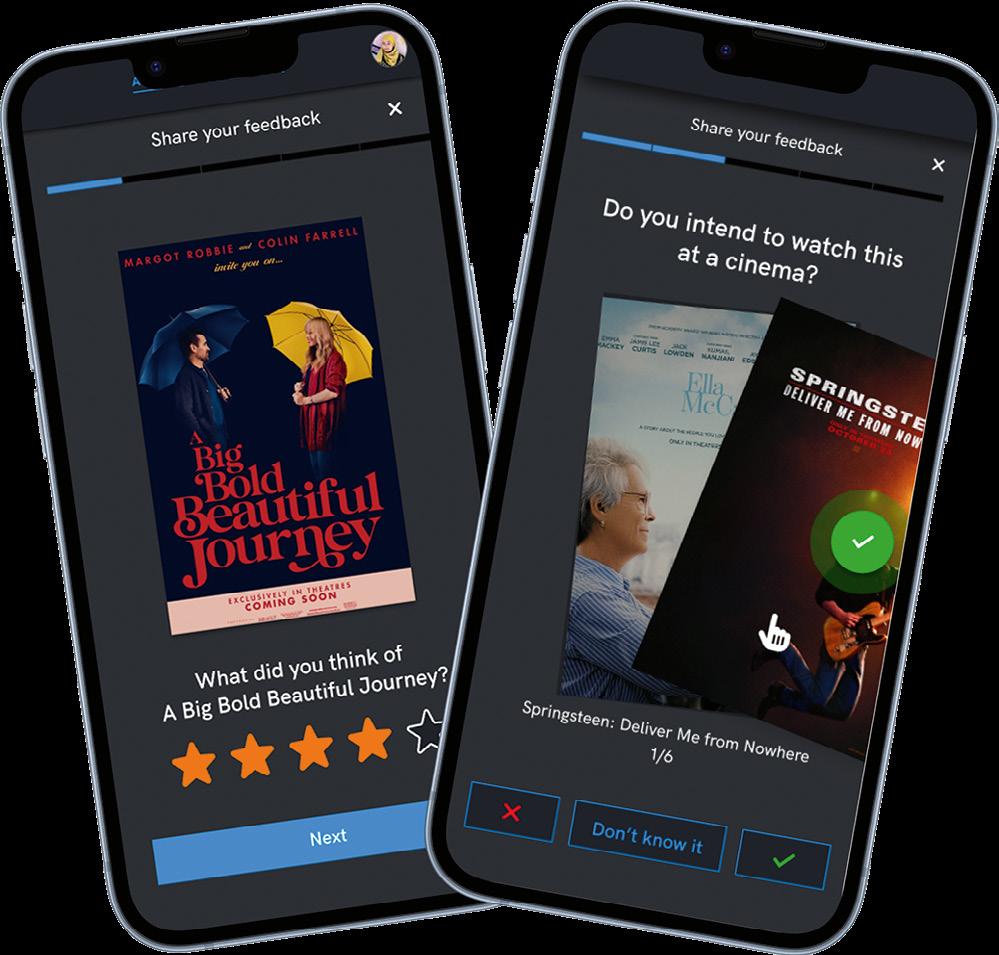

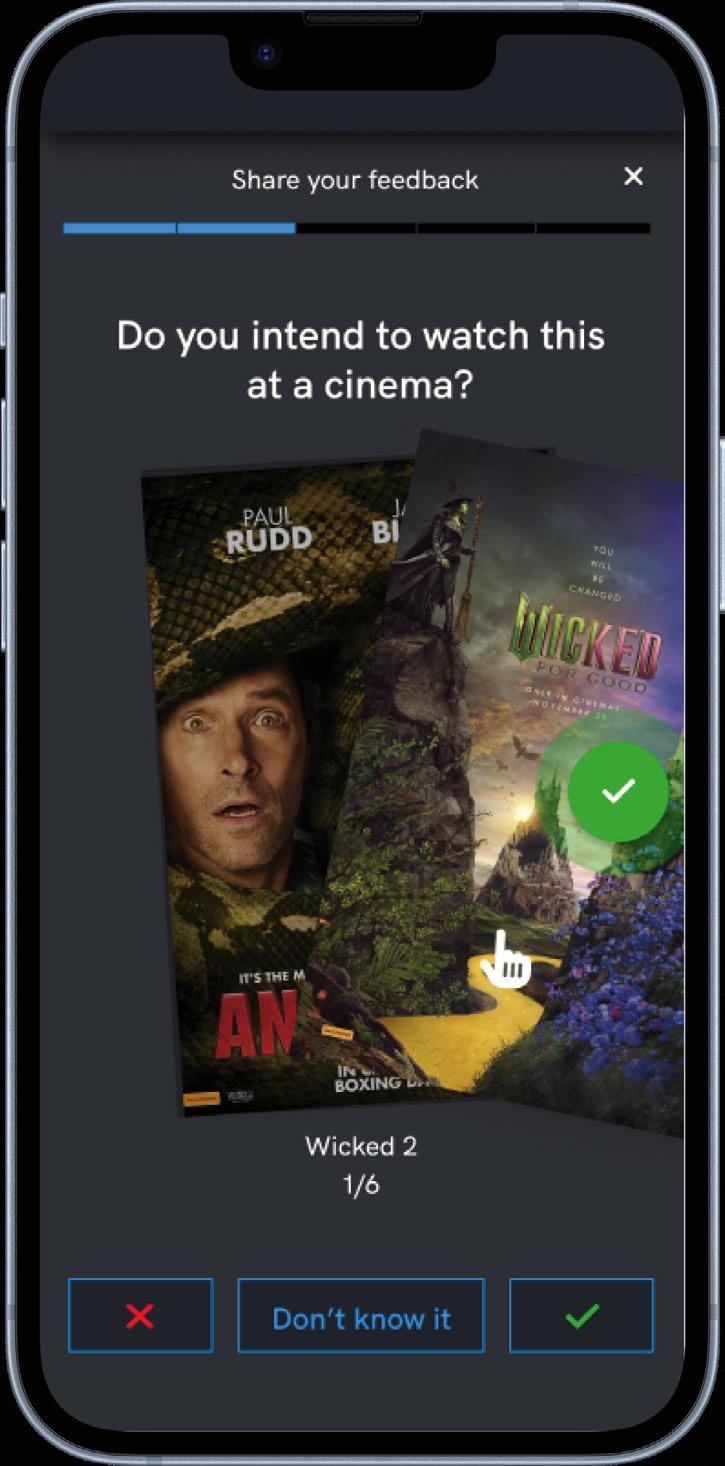

From box office to candy bar receipts, cinemas know how audiences behave. Now Vista Group’s React wants to show cinemas how they feel. Matthew Liebmann, chief product, innovation and marketing officer, gives Jackie Keast the rundown on its latest pulse survey tool, designed to capture audience sentiment.

Cinemas have long tracked tickets sold and popcorn purchased. What’s harder to measure is how audiences feel as they walk out: Did the film land? Was the experience worth it? And what do they want to see next?

That’s a gap Vista Group hopes to solve with React, the company’s latest pulse survey tool. The idea: If exhibitors understand how audiences feel, it’ll lead to smarter programming, marketing, and operational decisions.

“For about 30 years, Vista has captured data as almost a byproduct of the things we do,” chief product, innovation and marketing officer Matthew Liebmann says.

“For example, we sell a ticket or a popcorn, we get transactional information. If we sign people up and help facilitate loyalty programs, we’re getting demographic and behavioural information.

“But we sat there and said, ‘This is data that happens inadvertently as we do something else. Are there data points that are critical to exhibitors we’re not capturing at the moment?

“What we noticed we were missing is moviegoer sentiment; what did they think of the visit and the movie they’ve just enjoyed, and what is their intent in terms of what they want to go and see next?

“That’s where the React pulse

survey came from, as a means of getting attitudinal and intentional data to supplement the transactional, behavioural and demographic data we already have.”

React has two components, the first around movies, and the second around experience.

Customers will be asked what they thought of the film they just saw, rated on a five-point scale. Then, in a riff on Tinder, they swipe left or right on a series of posters for upcoming titles to indicate whether they’d watch them in-cinema. While the questions are fixed, the posters presented are bespoke to a cinema’s own programming.

Posters will also be individualised to a customer’s profile; in Reset, Vista will draw on Movio, its long-running data and campaign analytics arm, which uses AI to predict what different audiences are most likely to enjoy. For instance, a parent who just watched a kids film might see family-friendly options alongside recommendations tailored to their own habits, like a rom-com for date night.

Exhibitors can customise the second half of the survey to focus on questions of cleanliness, courtesy, the quality of food and beverage, and an overall net promoter/CSAT score. Moviegoers can also enter free text responses, which Vista will enter into AI and distill into trends. React will automatically trigger postvisit, with prompts via email or through Vista’s “living ticket”, a digital pass that updates throughout a customer’s visit and can nudge them to rate their experience on the way out.

Liebmann says React is intentionally short and gamified, focusing only on what moviegoers thought of the film they saw and what they want to watch next

(with other demographic data already captured through loyalty programs or online ticketing). By keeping it visual and simple – swiping on posters and rating films – completion rates in prototypes hit 95 per cent.

The data collected will feed all of Vista’s other products, and Liebmann predicts when cross-referenced with loyalty and profile data, exhibitors will have unprecedented insight into customer segments for marketing. For instance, cinemas could pinpoint high-value patrons who had a poor experience and target them with personalised offers.

In terms of programming, the survey presents a mix of upcoming films, from imminent releases to those further out, giving exhibitors a sense of audience interest over time. Liebmann says this data could inform conversations with distributors, highlighting films with high potential but low local engagement.

“Our forecasting and targeting won’t be just based on what you saw as a moviegoer, but what you saw and enjoyed,” he says.

For Liebmann, the promise of React isn’t just the data it collects, but how it can inform every part of a cinema’s operations. He sees it as part of a bigger shift in how cinemas think about the audience experience.

“Eventually, our objective is to make the end of the current visit the beginning of the next.”

React will officially launch in Australia at AIMC, and be available to Vista Cloud clients via the Digital Enablement capability. Expanded features, including customisable operational questions, are planned for release in the first half of 2026.

Ahead of AIMC, some of the industry’s most prominent female leaders reflect on their careers and the changes they’ve seen.

NATALIE MILLER EXECUTIVE DIRECTOR, SHARMILL FILMS; JOINT EXECUTIVE DIRECTOR, CINEMA NOVA; DIRECTOR FOMO CINEMAS

When did you start in the industry and in what role?

My way into the industry was the stepping stones from a BA from Melbourne University, a first job where I trained as a publicist and a journalist on a grocery trade paper, then the next job in public relations at ABC TV. I had leave at the time as I became pregnant (the rules in those times). They did me a favour; I started my own PR business, and was fortunate to be asked to do the PR for the Melbourne Film Festival, which I did for 17 years. It all went on from there. During that time, I started Sharmill Films and bought Luis Buñuel’s The Exterminating Angel as my first film as a distributor and thereafter so many great films from great directors. The rest is history. Going into exhibition with the single-screen Longford Cinema, I later partnered with Barry Peak to found Cinema Nova, took a share in what is now Palace Nova in Adelaide, and most recently became involved with Fomo Cinemas.

What has been the biggest change since you started?

The industry is so different today. For exhibition, the advent of the streamers was a major change, though people thought this when TV came in and when videos were all the go. In distribution, I believe there are less arthouse films made by the likes of Fellini, Truffaut, Bergman, Buñuel etc, and genres such as action and horror are now prevalent.

What is your best AIMC memory?

I have too many good memories of AIMC. So hard to pick one. Maybe in the good old days sitting in the lounge at the ANA hotel till four in the morning with colleagues having a good time… no early starts. However, in recent years the memories of a world class packed convention with colleagues remain indelibly in my mind.

NICE

ICON FILM DISTRIBUTION

HEAD OF DEVELOPMENT

When did you start in the industry and in what role? 2016, as a script analyst.

What advice would you give your younger self?

Be open to every possibility –sometimes the best path forward is the one that you didn’t expect at first.

What has been the biggest change since you started?

The biggest change has been the way technology has reshaped storytelling – from the rise of streaming platforms to advances in digital production. It’s opened up incredible opportunities for diverse voices, but it’s also redefining how films are made and seen.

What tips would you give to those entering the industry?

Curiosity and adaptability are key. The fact that something’s been done the same way forever doesn’t mean it can’t be reimagined.

What do you love about cinema? I love sitting in a dark room with strangers feeding off each other’s emotional energy.

What is your best AIMC memory? I am looking forward to creating some memories at AIMC 2025 – it will be my first time attending!

DENDY ICON GROUP CEO

When did you start in the industry and in what role?

In 2006, when I joined Hoyts as the group financial controller.

What has been the biggest change since you started?

In my opinion, there has been two significant changes: The transformation from 35mm to digital prints and the change in consumer behaviours. People now seek unique experiences when they go to the movies, leading cinemas to be more innovative to stay relevant and competitive.

What tips would you give to those entering the industry?

The industry is constantly evolving with technology and consumer preferences. Be open to learning and adapting to new trends and innovation Networking and building relationships is important –attend industry events, join professional organisations and engage with colleagues. And most importantly, have a love of cinema.

What is your best AIMC memory?

IMAX CEO Rich Gelfond’s presentation at the 2023 AIMC. The presentation was so compelling that it prompted Dendy to become the first independent cinema circuit in Australia to introduce an IMAX screen. And of course, the annual Hoyts CTG Teppanyaki dinner that is always a wonderful evening every year.

SCREEN AUSTRALIA CEO

When did you start in the industry and in what role?

My first role in media was writing copy and announcing over the credits of ABC TV programs, live. Not only did I get to experience an amazing array of Australian television in my 20s, I’ll sometimes revert back to that voice behind the microphone to dampen the nerves of public speaking.

What advice would you give your younger self?

Don’t be afraid to back yourself or express your opinion respectfully, even if you feel you may be challenged. Remain curious, honest, bold... and see where that takes you.

What has been the biggest change since you started?

The impact of technology, in every aspect of our lives, from the immediacy of communication to seismic industry change within the ‘user-centric era of media’ (quoting Evan Shapiro).

What tips would you give to those entering the industry?

Always be open to learning something new, even if it sits outside your area of focus. Look beyond the obstacles you’ll encounter on the path to expressing your creativity; there have never been more opportunities to tell stories than there are right now!

What do you love about cinema?

I feel privileged to be able to work closely with Australian film creators and distributors. The shared community experience of sitting in a cinema, immersing myself in a story or world on a large screen is nothing short of magical, and it wouldn’t happen without them.

What is your best AIMC memory?

Having only returned to Australia last year, I’m looking forward to AIMC memories to come.

STUDIOCANAL ANZ CEO

When did you start in the industry and in what role?

Age 19, working at a single screen complex in Takapuna, New Zealand, during my university years. Then my first career job was at Disney, working on Lion King and Toy Story.

What advice would you give your younger self?

Study digital technology and keep across changes in this field.

What has been the biggest change since you started?

The roll out of SVOD and the disruption to the traditional windows as a consequence.

What tips would you give to those entering the industry?

Think about where the area of growth is so you can shape your career accordingly.

What do you love about cinema?

I love being transported to another world for a few hours and not having the distraction of my phone or household chores.

What is your best AIMC memory?

Studiocanal was very proud to present our first production last year, Kangaroo.

WEIRANDERSON FILMS, FOUNDER

When did you start in the industry and in what role?

Following a career as a corporate lawyer I joined AUSTAR in 2002 and was group director of corporate development, which covered a lot of ground including our content relationships and programming strategy. Involvement with content creators led me to start investing in feature films. Eventually I set up WeirAnderson Films so that I could become more personally involved in development and production.

What has been the biggest change since you started?

The launch of broadband and the proliferation of streaming services has empowered audiences with so much choice and ease of access that their viewing behaviour has changed, leading to huge changes in the economics and the power relationships in the film industry. Producers, distributors and exhibitors need to work together collectively to ensure we can continue to engage audiences so that we can all thrive in the new world order.

This year, the Natalie Miller Fellowship will give out two grants for the first time, with the recipients to be announced at AIMC.

The $10,000 grants are designed to recognise, nurture and empower the next generation of female leaders to achieve outstanding success at the top of their fields. It helps to fund professional development through attachments, internships, secondments and travel.

Established in 2011, the fellowship honours the unique contribution of screen industry pioneer Natalie Miller.

Previous recipients include: Katrine Elliott, Genevieve Grieves, Dr Sian Mitchell, Bridgette Graham, Pauline Clague, Anna Kaplan, Miriam Katsambis, Kristy Matheson, Sasha Close, Courtney Botfield, Rebecca Hammond, Harriet Pike and Rachel Okine.

UNIVERSAL PICTURES ANZ DIRECTOR OF MARKETING

When did you start in the industry and in what role?

I began my career as a publicist with the UIP marketing team, working on Universal, Paramount and MGM releases. It was my first step into the world of film, and I was beyond excited. I could hardly believe I was being paid to watch movies and work alongside “movie stars”. It was literally my ‘dream job’ and still feels that way today. What started as a pinch-me moment has become a lifelong passion and career that I feel grateful for every single day.

What has been the biggest change since you started?

My goodness, where do I start? The industry has transformed in almost every way. From the digital revolution in how films are delivered to cinemas, to the sophistication and ambition of today’s marketing, the pace of change has been extraordinary. Social media can now propel a film’s box office overnight, and the globalisation of release dates means most films launch simultaneously with the US, creating truly worldwide cultural moments.

On the exhibition side, local cinemas have reinvented themselves, no longer just theatres, but entertainment destinations, offering some of the best cinema experiences in the world. And yet, with all this innovation, one thing remains the same: the magic that happens when the lights go down, and we share a story together in a darkened cinema.

What is your best AIMC memory?

My first will always stand out: seeing The Sixth Sense before the world had discovered it. We were all sworn to secrecy about the ending and only later did I realise we were among the first to witness a moment that would become iconic in cinema history.

CINEMA ASSOCIATION AUSTRALASIA, AIMC OPERATIONS DIRECTOR

When did you start in the industry and in what role?

I grew up in the cinema industry! I started working at my local cinema when I was in high school, popping corn, scooping ice cream and selling tickets. When I finished university, I was offered a role in a management cadet program and from that point, knew that cinema was where I wanted to be. I developed my career through various operational management roles and moved into senior executive human resources roles. About 15 years ago I explored opportunities as a consultant to the industry and have been successfully working in that space since.

What has been the biggest change since you started?

The shift in how audiences experience cinema has been the most significant change. From the introduction of digital projection to the rise of streaming, the industry has had to evolve constantly. What hasn’t changed, though, is the magic of people coming together to share stories on the big screen; that collective experience is timeless.

What tips would you give to those entering the industry?

Be curious, be adaptable, and never underestimate the importance of people. Cinema is about creating experiences, and that relies on teamwork, creativity, and customer connection. Learn as much as you can, stay open to change, and always keep the audience at the heart of what you do.

MOTION PICTURE DISTRIBUTORS

ASSOCIATION OF AUSTRALIA EXECUTIVE

DIRECTOR, AUSTRALIAN CINEMA

PIONEERS NATIONAL PRESIDENT

When did you start in the industry and in what role?

After studying theatre and cinema in South Africa, my first job in Australia was as a production assistant on a furniture commercial. Ah, the glamour! Things got a little better after that with research and co-ordinator roles, and then production manager and producer roles on an incredible range of films and docos. From being chased by a rogue bull elephant in Kenya to landing the space shuttle’s flight simulator, I had an amazing career in production. In the 2000s I worked at the Australian Film Commission, supporting the development and production of feature films, documentaries, short films and online projects. Then in 2011 I joined the Motion Picture Distributors Association, representing the major film distributors in Australia and here I still am! For ten of these years, I held the commensurate role of executive director of Creative Content Australia, helping to raise awareness about the value of screen content and the impact of piracy.

What has been the biggest change since you started?

Pretty much EVERYTHING has changed since I started! Most importantly, what hasn’t changed is the need to tell great stories with emotional heart and intelligence to a targeted (and wellunderstood) audience on a platform appropriate to the story and the audience.

What do you love about cinema?

That feeling of turning off the phone, settling into a great recliner and, along with a room full of strangers, giving myself completely to the story.

Dr Ruari Elkington, chief investigator at QUT Digital Media Research Centre, and Olga Aleksan, Christie senior regional sales manager, cinema, explore how the Australian cinema industry has stayed resilient through the turbulence of the last five years.

Resilience is the capacity to recover from adversity and continue looking to the future with optimism and determination, even in the face of significant challenges.

Resilience, like persistence, grit or determination, is a quality many people aspire to but often find difficult to fully understand. In ‘How Resilience Works’ (Harvard Business Review, 2002), Diane Coutu identifies three pillars of resilience: accepting reality, improvising, and finding meaning.

The Australian cinema industry has engaged with these principles repeatedly, not only to weather disruption, but to drive technological development and industry growth.

Unwillingness to confront the reality of challenging circumstances is a very human response. Understandably, we may find ourselves avoiding hard realities and confronting truths about our industry. Yet those who do confront those realities, have a far better chance of overcoming obstacles. This applies equally to people and organisations.

The reality for cinemagoing in 2025 is that there has never been more entertainment, leisure and culture options competing for audience time, attention and money. While that can be framed as a problem for cinema, it also points to a reality where cinema is given the opportunity to define the out-of-home entertainment offering – not in competition, but in contrast and collaboration. The Australian cinema industry’s resilience in an increasingly VUCA (Volatile, Uncertain, Complex, and

Ambiguous) world lies in recognising limited audience attention alongside the unique, meaningful experiences cinema can offer.

From 2020 onwards, Christie took a clear-eyed view of the market and anticipated what was to come. During this period, sales of home-entertainment systems rose sharply, and the company foresaw the technological challenges that would follow. As expected, retailers now promote 8K displays, HDR, variable refresh rates, and screens up to 116 inches. At the same time, while the home-entertainment industry received an unprecedented boost, the cinema industry faced a very challenging period that limited its ability to invest in new technological solutions. Rather than denying or downplaying these trends, Christie recognised them for what they were and set clear goals for research and development (R&D) to be ready to meet them head-on.

Embracing reality with clarity and courage naturally leads to the second pillar: improvisation. Improvisation is not simply ‘thinking outside the box’. In practice, it means moving quickly within constraints and making the most of existing assets.

Recognising rising audience expectations for image quality, Christie has directed R&D towards solutions that differentiate cinemas while respecting financial realities. Among the products released recently, a key discovery was that tighter software integration enables precise control of RGB laser diodes. From that base, Variable Dynamic Range

(VDR), an advanced software application for RGB projectors, began as a bold idea and is now progressing towards deployment. VDR is designed to deepen blacks, lift sequential contrast, and enhance colour – particularly at nearblack levels. Importantly, it was Christie’s cultural willingness to resource and support improvisation, the classic ‘yes, and’ attitude, that enabled this technical innovation to occur.

During the same period, cinemas were engaged in constant innovation to respond to the reality of business challenges. As mandated closures and social isolation measures took hold, cinemas leaned into new initiatives, from rapidly scaling up bespoke streaming services, to social media tours of bioboxes, to Uber Eats popcorn and choc tops, and new social media campaigns. These reminded audiences of the resilience of the industry and the vital role of cinemagoing to Australian society; a reminder of what cinemagoing meant as it was taken away so abruptly by COVID restrictions. Cinema workers and leaders immediately pivoted to innovation – just as the industry has done over a century of challenge and opportunity.

This spirit of adaptation was not only about surviving – it was also about holding on to something deeper. In turbulent periods, resilient organisations and people continue to draw strength from the third pillar: meaning.

Meaning, underpinned by purpose and embedded core values, keeps individuals and organisations looking ahead with hope, even in crisis. Psychiatrist and

“The real ‘meaning’ Australian audiences derive from cinemagoing extends far beyond just ‘watching a movie’. Watching a movie can be easily done at home. Cinemagoing is an entirely specific context of meaningmaking for audiences where social, emotional and experiential elements combine to elevate an experience.”